Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Xpeng's First Global AI Car Officially Begins Large-Scale Overseas Shipments] On February 2nd, The New XPeng P7+, The World's First AI Car, Officially Began Large-scale Overseas Shipments, Departing From Lianyungang, Jiangsu Province, And Destined For 18 Countries Worldwide. As XPeng Motors' First Model Targeting A Global Market, The 2026 XPeng P7+ Has Been Launched In 36 Countries Globally, And Is Simultaneously Undergoing Localized Production At Its Graz Plant In Austria. Deliveries Are Expected To Begin In 25 European Markets This April

[Bitcoin Surges Above $78,000] February 2nd, According To Htx Market Data, Bitcoin Rebounded And Broke Through $78,000, Currently Trading At $78,005, With A 24-Hour Decrease Narrowed To 1.27%

Spot Silver Recovered More Than $8 Of Its Losses, After Falling Nearly 10%. Spot Gold Narrowed Its Losses To 1.2%, After Falling More Than 3.5%

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum’s validator exit queue has climbed to 671,900 ETH, or roughly $3.1 billion, as withdrawals stack up after the market’s summer rally, according to The Block’s data dashboard.

The surge follows weeks of rising exits that The Block previously flagged when the queue first pushed past 521,000 ETH, worth $1.9 billion at the time, and then the highest since early 2024. Since then, both the size of the queue and the expected processing time have accelerated. Data from validatorqueue.com estimated the wait time at roughly 12 days, up from nine days last month, as withdrawal requests have quickly accumulated since mid-July.

However, the exit size considerably outstrips the entry demand this time. About 105,620 ETH, currently valued at $480 million, is queued to be staked. The previous figure was approximately $1.3 billion or 359,500 ETH, despite Ether trading lower last month.

Why the queue is swelling

Speculators are debating why validators are unstaking ETH en masse. A pseudonymous DeFi analyst who goes by Ignas pointed to several overlapping factors behind the spike.

The expert surmised that unwinding leveraged staking loops may be one reason. Traders who staked to receive liquid staking tokens like stETH and then borrowed against them appear to be deleveraging as funding and borrow costs rose, increasing exit requests.

Ignas also mentioned LST depeg jitters and arbitrage. A softening stETH/ETH ratio could have encouraged network participants to unstake, rotate between stETH and ETH, and harvest basis spreads, which would raise exits while reducing looped exposure. He also noted that Lido, EthFi, and Coinbase appeared among the largest recent sources of unstaked ETH, consistent with a broad de-risking by LST users.

Positioning ahead of potential staking products might be another driver, Ignas said in an X thread. In May, the SEC clarified that staking does not violate federal securities rules, paving the way for funds that invest portions of assets under management into onchain yield contracts. Some stakers may be repositioning in anticipation of U.S. products that could change how institutions access staking yield, the analysts argued.

With prices pushing back toward record territory, it’s also possible some validators are simply locking in gains, even as ETF and corporate-treasury demand absorb incoming supply.

What the exit queue is (and is not)

The exit queue is a throttle on validator withdrawals. When many validators opt to stop validating at once, they enter a line that limits how fast funds become withdrawable and then swept to withdrawal addresses. Crucially, exiting does not mean immediate selling—some ETH may be restaked later, redeployed in DeFi, or held in custody—and sweep timing can add days beyond the queue itself.

This latest spike in exits arrives as ether approaches prior highs and as spot ETH ETFs continue to attract capital, a backdrop that can offset near-term supply from withdrawals. Still, a record-long exit line is usually seen as a clear sign that deleveraging and risk management are back in focus for parts of the staking ecosystem.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

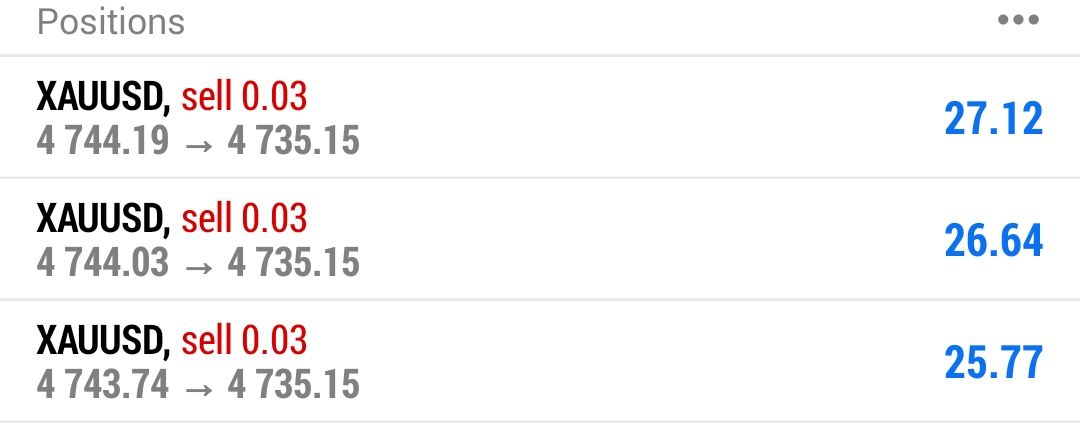

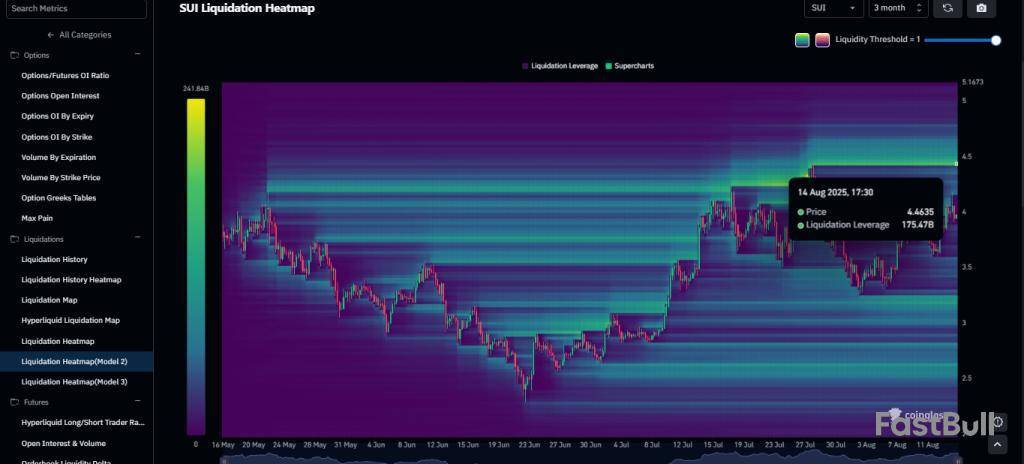

The SUI price has once again approached the $4 resistance zone, after rebounding from August lows. Its recent strength is fueled not only by technical recovery but also by a wave of ecosystem growth, exchange listings, and institutional interest.

SUI Price Chart Signals Strong Resistance Test

Looking at the SUI price chart, the token has made a consistent recovery by building a structure of higher lows from the $2.40 range in June.

At present, the SUI price today is trading near $3.93 after briefly spiking to $4.18. This intraday jump represented a 9% surge, which was largely fueled by the latest breaking news of a new major exchange listing.

Technically, momentum has built strongly, and if bulls successfully break through the $4 ceiling with convincing volume, then the next upside targets appear near $4.46 to $4.50. In this range, nearly 175 billion leveraged positions are present, according to Coinglass data.

In the short term, this cluster could act as a magnet for SUI/USD, and if bulls’ demand increases, then a short squeeze could even open the door for the token to revisit January 2025’s highs.

On the downside, the fact remains that $4 supply has acted very strongly, which has capped SUI’s momentum observed in the past quarter also. If global sell-off sentiment reawakens, then in that case, failure to hold above $4 may result in a pullback toward $3.30 or even $3.00.

DeFi and Institutional Growth Strengthen Fundamentals

Apart from price action, August has been particularly notable for the SUI Network’s DeFi ecosystem. Per the data from the defiLlama platform, the Total value locked (TVL) has surged magnificently and reached an all-time high of $2.29 billion in late July before a slight retracement.

Now, in August, the TVL is inching closer again at $2.21 billion, which is firmly reflecting renewed demand.

Similarly, the Institutional momentum is also building, which is signalling growing trust from established financial players.

For instance, on August 12th, Grayscale unveiled two new products on its official X post, where it mentioned that these products are built exclusively on the SUI blockchain.

Expanding Ecosystem and Exchange Listings

Likewise, Alkimi, the first fully on-chain advertising platform, also posted today on X and announced that it is moving to the SUI Network. This showed that SUI is opening fresh use cases for decentralized ad technology.

Meanwhile, the biggest breaking news of today happened to be the Japanese exchange Bitbank listing news of SUI with a SUI/JPY trading pair. This move is seen as a big one because it is extending the token’s accessibility to one of Asia’s most active trading markets.

The US Securities and Exchange Commission gave regulatory greenlight to another crypto ETF. It accepted the filing for Invesco Galaxy Spot Solana ETF, a proposed exchange-traded fund (ETF) designed to track the spot price of Solana .

SEC Acknowledges Filing for Invesco Galaxy Spot Solana ETF

Invesco Galaxy Solana ETF initially filed an application on June 25, 2025, via Cboe BZX, targeting spot exposure with integrated staking rewards. Unlike Bitcoin or Ethereum ETFs, this fund specifically tracks the spot price of SOL, a leading Layer 1 blockchain known for its speed and scalability.

The acknowledgement initiates the form’s review, including examinations of custody arrangements, market surveillance, and investor protection measures. This comes after the Cboe BZX exchange submitted a Form 19b-4. It proposed a rule change for listing and trading the ETF, which initiates the SEC’s formal review process.

When Will the SEC Approve SOL ETFs?

Currently, multiple institutional and mainstream investors are seeking diversified crypto exposure with SOL. VanEck Trust, 21Shares Core, Bitwise, Grayscale, Canary, Franklin Templeton, Fidelity, REX Shares, and Galaxy Digital have filed for the SOL ETF.

However, the SEC has not approved any SOL ETF applications. The expected time for approval is October 2025. If approved, it will establish Solana as a legitimate mainstream asset in traditional financial markets.

The acknowledgment for Invesco Galaxy Spot Soana ETF is an important procedural milestone that initiates the SEC’s formal review process. Though it does not yet mean the ETF is approved for launch.

What Does This Mean for Invesco Galaxy?

Despite not being officially approved yet, this filing signals a positive development for the company. The collaboration of Invesco and Galaxy Digital aims to capture opportunities in the crypto ETF market, following Bitcoin and Ethereum ETFs prior success.

The formal approval could enhance the companies’ position as a key player in crypto-related investment products. It can also potentially increase investor engagement in Solana through a regulated vehicle.

FAQs

Has the SEC approved the Invesco Galaxy Spot Solana ETF?No, the SEC has only acknowledged the filing, starting the review process.

When could the SEC approve Solana ETFsAnalysts expect potential approval around October 2025, pending review results.

How is this ETF different from Bitcoin or Ethereum ETFs?It offers direct Solana exposure and staking rewards, unlike BTC or ETH ETFs.

A sophisticated cyber operation is quietly infiltrating remote tech jobs worldwide.

Blockchain investigator ZachXBT uncovered a major leak from a DPRK IT worker’s device showing a small team of five managing 30+ fake identities, with government IDs and purchased Upwork/LinkedIn accounts to obtain developer jobs at projects. They also claimed experience at top blockchain companies like Polygon Labs, OpenSea, and Chainlink.

ZachXBT@zachxbtAug 13, 20251/ An unnamed source recently compromised a DPRK IT worker device which provided insights into how a small team of five ITWs operated 30+ fake identities with government IDs and purchased Upwork/LinkedIn accounts to obtain developer jobs at projects. pic.twitter.com/DEMv0GNM79

Inside the DPRK Remote Job Operation

The spreadsheets reveal how DPRK IT workers operated, including weekly reports, expense tracking, and meeting schedules, and include a script used for the fake identity “Henry Zhang.” Their expenses show purchases of SSNs, Upwork and LinkedIn accounts, phone numbers, AI tools, rented computers, and VPNs or proxies.

Leaked Google Drive files, Chrome profiles, and device screenshots revealed that they managed schedules, tasks, and budgets mostly in English. Telegram chats show how they coordinated to land jobs, handle payments, and route salaries through crypto wallets.

One of the key signs pointing to North Korea was their use of Google Translate into Korean during searches, sometimes routed through Russian IP addresses.

Wallet Linked to $680K Favrr Exploit

Notably, one wallet was linked to multiple payments and the $680K Favrr exploit in June 2025, where DPRK ITWs acted as CTO and developers using fraudulent documents. Additional operatives were connected to other projects through this same wallet address.

DPRK IT Workers Flood Remote Jobs

ZachXBT points out that the biggest challenge in stopping DPRK IT workers is poor coordination between companies and security services, along with recruitment teams who often ignore or resist warnings.

These IT workers are not especially sophisticated, but they are persistent, flooding the global job market for remote developer roles and commonly use Payoneer to convert regular payments into crypto.

North Korea’s Crypto Crime Network

North Korea’s cyber theft operations are massive and growing. In January, operatives stole $2.2M, and in June, authorities seized over $7.7M linked to fake remote job schemes.

North Korean hackers are tricking people with fake IT job offers to access cloud systems and steal crypto. Since 2020, these campaigns have targeted major crypto platforms, contributing to massive thefts such as Axie Infinity’s $620M breach, DMM Bitcoin’s $305M hack, and Bybit’s $1.5B heist.

Experts estimate that North Korea has stolen $1.6B in crypto so far in 2025, accounting for 35% of all stolen crypto last year, and they are showing no signs of slowing down.

FAQs

How can I protect my crypto from scammers and fraudulent schemes?To protect your crypto, always verify platforms, use reputable exchanges, enable two-factor authentication (2FA), and be skeptical of “too good to be true” returns or unsolicited offers. Store large amounts in secure hardware wallets, never share private keys, and be wary of phishing links.

What are the common red flags to identify a crypto scam or fake investment platform?Common red flags include promises of guaranteed high returns, pressure tactics to invest quickly, anonymous or unknown project teams, poorly written whitepapers, and demands for crypto payments for services or unexpected fees. Check for inconsistent website details, grammar errors, and lack of customer support numbers.

What tools do these scammers use?Leaks reveal purchases of SSNs, AI tools, VPNs, rented PCs, and crypto wallets to launder salaries—often routing payments via Payoneer-to-crypto conversions.

Bitcoin reached a new all-time high of over $123,700 during early Asian trading hours today, sparking a wave of bullish momentum across the cryptocurrency sector.

Additionally, many experts suggest that further gains may be imminent for BTC. They predict that the largest cryptocurrency could likely continue rising, citing its positive correlation with gold.

What’s Next for Bitcoin? Gold-BTC Correlation Hints at More Gains

Edwards observed that the current gap is similar to the one observed in 2020. At the time, this was succeeded by Bitcoin entering a strong bull run.

Moreover, by 2021, Bitcoin even outperformed gold. Thus, if history repeats, the flagship coin will likely continue its upward momentum beyond its current record peak, reaching new highs.

Similarly, crypto investor Jelle reinforced this narrative. He highlighted that gold typically leads while Bitcoin follows. Jelle predicted that this dynamic could propel Bitcoin toward $150,000, aligning with this historical precedent.

Reasons Why Bitcoin May Continue Surging

It’s worth noting that the expectation for Bitcoin or even gold prices to rise isn’t too far-fetched, especially considering the current market conditions. Charlie Bilello, Chief Market Strategist at Creative Planning, previously revealed that gold and Bitcoin are the top-performing assets in 2025.

“Gold (+29%) and Bitcoin (+25%) are the top-performing major assets so far in 2025,” Bilello stated.

He stressed that gold and Bitcoin have not historically occupied the top two spots in any calendar year, making 2025 a notable outlier. Furthermore, in a detailed thread on X, The Kobeissi Letter explained that BTC and gold are benefiting from many factors.

The market commentator noted that in July 2025, US tariff revenue surged by over 300%, reaching a record $29.6 billion. The Kobeissi Letter projects the revenue to exceed $350 billion annually during President Trump’s term.

Nonetheless, the US deficit also grew by $47 billion (19%) in July, hitting a record $630 billion in government spending. Meanwhile, tariff revenue covered only about 10% of the deficit.

“Despite record tariff revenues, the US spent nearly DOUBLE what it received in July. If we can reduce spending, President Trump’s tariffs could significantly help eliminate the deficit. The gap is simply too big to fill right now,” the post read.

This economic backdrop fuels increased interest in Gold and Bitcoin, as investors seek safe-haven assets amid growing financial instability and inflationary pressures.

“As we have been saying for 12+ months, this is the best possible fundamental backdrop for both Gold and Bitcoin,” The Kobeissi Letter added.

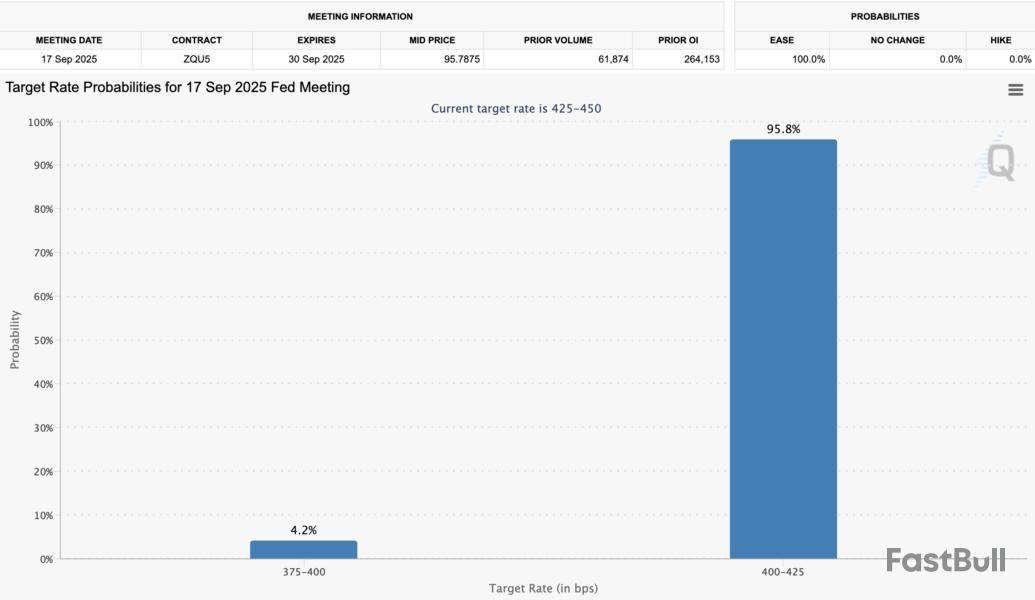

Furthermore, the latest data from the CME FedWatch Tool shows that the odds of the Fed cutting rates in September have surged to 95.8%.

BeInCrypto previously reported that if the Fed slashes interest rates, it could be quite bullish for cryptocurrencies. Thus, the gold-BTC correlation and other supporting macroeconomic factors hint that Bitcoin’s ascent is far from over. The market will be watching closely to see how far the asset will go in the time to come.

After reaching a fresh all-time high earlier this month, XRP’s momentum has slowed, with the price consolidating around $3.23. While the overall crypto market continues to climb, weakening on-chain activity and fresh allegations of market manipulation are giving traders reason to pause.

Many now fear a drop in XRP’s price due to its falling market dominance. But what’s happening?

XRP Network Activity Loses Steam

XRP’s network activity is showing clear signs of strain, with daily active addresses taking a steep hit. Data from XRPscan shows daily active addresses have plunged to just 52,380, while active payments over the past 24 hours have fallen sharply to 835,000.

Meanwhile, the social media buzz is also fading, with XRP’s share of crypto-related discussions dropping to 3.54%, well behind Bitcoin and Ethereum.

Allegations of XRP Price Manipulation

Fueling further price plunge over potential wash trading has emerged after validator operator Grape flagged unusually large transfers, often exceeding 140,000 XRP, between major exchanges like Binance and Bitget.

𝐆𝐫𝐚𝐩𝐞@RealGrapedropAug 12, 2025🧐 XRP Forensics: Price Manipulation in Plain Sight?

If anyone has been following me you probably know I started running an XRPL Validator since July 12, 2025, and what I’m seeing is…shocking.

This isn’t conspiracy talk — I have live transaction data that might prove how the… pic.twitter.com/la5QZglNVd

These movements bear the hallmarks of “wash trading,” a tactic used to artificially boost volume or influence prices. Although such tactics are banned in traditional finance, the crypto market’s looser enforcement could allow them to persist.

Ripple CTO Stresses Strong Fundamentals

Despite short-term concerns, Ripple CTO David Schwartz has highlighted the XRP Ledger’s durability and efficiency, citing its 13-year uptime, low transaction costs, and direct XRP transfers without gas fees.

He also pointed to the surge in tokenized real-world assets on the ledger from $5 million in January to over $118 million by July, a 2,260% jump, as a sign of deepening adoption.

XRP Price Outlook

Looking at the price analysis, technical signals suggest key levels ahead. A daily close above $3.3182 could open the door to $3.477, then the $3.60–$3.68 liquidity zone. Breaking higher may fuel a push toward $3.85 and $4.00.

However, slipping below $3.20 could bring $3.094 into play, with further downside risk toward $3.00.

However, XRP RSI sits at 56.1 still leaves room for a price jump.

FAQs

Why is XRP’s momentum slowing after its all-time high?XRP price is consolidating as network activity drops and market manipulation concerns grow.

What is the XRP price prediction for 2025?Analysts predict XRP could reach $5.05 by end of 2025, fueled by ETF approvals, Ripple’s banking license application, and resolution of SEC lawsuit.

Will XRP hit a new ATH in 2025?Likely—if spot ETFs get approved and Ripple’s banking partnerships expand, XRP could surpass its $3.66 ATH this year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up