Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum is rapidly emerging as the go-to asset for institutions, with a growing number of organizations adding it to their treasuries for its role in DeFi, staking, and Web3.

Could this be the start of Ethereum challenging Bitcoin’s dominance?

69 Entities Hold Over 4M ETH

Data from strategicethreserve shows that 69 entities now control over 4 million ETH, valued at a massive $17.6 billion. That is approximately 3.4% of all Ethereum in existence.

BitMine Immersion Technologies tops the list with about 1.5 million ETH worth $6.6 billion. Sharplink Gaming follows next with around 740,800 ETH worth $3.2 billion. The Ether Machine holds roughly 345,400 ETH, while the Ethereum Foundation manages about 231,600 ETH.

In addition, the ETH ETFs reserve currently holds 6.36 million ETH worth about $27.4 billion, representing 5.26% of the total supply.

ETH Outpaces BTC in Treasury Trading

Analyst Miles Deutscher highlighted a “crazy chart” and notes that ETH is overtaking BTC in Treasury Company trading volume. While ETH is gaining ground, he believes it still has plenty of room to catch up with Bitcoin.

Miles Deutscher@milesdeutscherAug 20, 2025This is a crazy chart.BINANCE:ETHUSDT is now flipping BINANCE:BTCUSDT for Treasury Company trading volume.

Tbh, looking at this image makes me think ETH still has a lot of catchup up to do vs BTC, and is the far less saturated trade. pic.twitter.com/SyAZ3LAKJy

The analyst also recently shared that ETH looks like the better buy than BTC right now, pointing out the following:

He believes ETH will rebound stronger than BTC and even outperform many altcoins, offering a better risk-adjusted return.

Expert Views on ETH Treasury Momentum

Adding to the bullish outlook, Ethereum co-founder Joseph Lubin also told in an interview with CNBC that ETH could overtake BTC in market cap within “the next year or so,” with treasury companies playing a key role in that shift.

But not everyone is convinced by the ETH treasury boom.

Ethereum co-founder Vitalik Buterin noted that although treasury companies can strengthen ETH as an asset, he also warned that heavy leverage could trigger cascading liquidations.

Bitcoin bull Samson Mow has argued that ETH’s recent momentum is largely driven by insiders rotating BTC into ETH, only to eventually dump it back into Bitcoin.

With strong momentum in place, ETH could be on a path to outperform Bitcoin in the near term.

Arthur Hayes is moving from crypto battles to stem cell clinics. The BitMEX co-founder, recently pardoned by U.S. President Donald Trump, has taken a board seat and a major stake in a stem cell company – the same firm where he’s been a patient for more than a year.

“I want to live as long as possible, as healthy as possible,” Hayes said, adding that more countries are beginning to ease rules around stem cell treatments.

The company, currently rebranding, has not been named. Hayes has been traveling to clinics in Mexico and Bangkok for infusions aimed at extending his healthspan.

Crypto Titans Look Beyond Tokens

Hayes isn’t the only one. Some of crypto’s most familiar names are backing biotech and life-extension projects.

For these crypto leaders, extending human life has become just as exciting as building the next blockchain.

Hayes Still Deep in Crypto

Even with his new focus, Hayes hasn’t stepped back from the industry that made him a billionaire. He still invests actively and often shares his market views and experiences with the crypto community, especially on X.

His family office, Maelstrom, funds Bitcoin developers with grants worth up to $250,000 each and has invested in digital asset treasury companies – public firms stockpiling crypto on their balance sheets.

The Trump Factor

Trump’s March pardon cleared Hayes and fellow BitMEX executives of their Bank Secrecy Act convictions. It marked a clean slate for Hayes, who built one of the world’s biggest derivatives exchanges before regulators cracked down.

Since then, Trump himself has embraced crypto, which Hayes sees as validation.

“If you have the president of the empire creating his own memecoin and it’s freely tradable, I think that gives license to other politicians to use memecoins as a way to do campaign finance,” he said.

Hayes also hinted that he’s preparing to release a detailed report on stablecoins, adding another layer to his ongoing influence in the crypto space.

Christopher Perkins 🦅🌎⚓️NYC@perkinscr97Aug 20, 2025Great chat with my fellow @Citi markets alum and absolute crypto OG @CryptoHayes. Always amazing to hear his perspective on macro and markets. Arthur teased a soon to be released report on stablecoins. Oh, we had a chance to get his perspective on DATs, too. Great pod. https://t.co/EViMcIIkjg

Hayes built BitMEX, faced trial, and walked free with a presidential pardon. Now he’s investing in two things that could shape the future: Bitcoin and human longevity.

Bitcoin’s price struggles continued in the past 24 hours as the asset slipped to a three-week low of $112,500 before it staged a recovery to almost $115,000, where it faced another rejection.

Most larger-cap alts stand relatively calm, but BNB managed to surge to a new all-time high, while OKB has stolen the show again with another mindblowing pump.OKB, BNB New ATHs

It seems that the past few days have belonged to digital assets tied to some of the largest cryptocurrency exchanges. BNB, for instance, traded at around $830 yesterday, but it skyrocketed to a new all-time high of just over $880 in hours. Although it has lost some traction since then, BNB is still 3% up on the day, trading close to $860.

The daily award for the biggest gains, though, goes to OKB once again. OKX’s native token has flown by 50% to chart a new record of its own at almost $197 (CoinGecko data). The asset has gained 300% in the past month.

Ethereumhas tapped $4,300 after a 1.25% daily increase, SOL has exceeded $185% after a 2% jump, andDOGEis above $0.22 following a 2.5% pump. LINK is close to $26, whileADAand TRX have posted more modest gains. In contrast, MNT has slumped by over 8% following its recent run.

The total crypto market cap has added around $30 billion since yesterday and is up to $3.950 trillion on CG.BTC Struggles Below $114K

While some altcoins have headed north to new peaks, bitcoin’s price actually continued its recent downfall. The asset reached a new ATH last week, but has lost over ten grand since then. The past 24 hours also saw some declines, as BTC slipped to a three-week low of $112,500 (on Bitstamp).

The bulls managed to react rather well to this price drop and didn’t allow a further breakdown, even though there are a few warning signs. Just the opposite, BTC jumped to almost $115,000, but it was quickly stopped there and pushed south to under $114,000, where it currently sits.

Its dominance over the alts has slumped by 0.5% in a day to 57.4% on CG, while its market cap is at $2.265 trillion.

Chainlink has been trending strongly in the crypto market. The token is up more than 3% in the last 24 hours, and excitement around its future is building fast.

According to data from CoinGlass, open interest in LINK futures has soared to a record $1.5 billion, up nearly 60% since the start of 2025. On-chain data also shows a major spike in activity, with 9,625 new LINK wallets created on August 18, the highest daily figure of 2025, while 9,813 active addresses were transacting just a day earlier.

This is being fueled by institutional adoption. More than 30 financial institutions are now piloting or testing Chainlink-powered solutions, pushing confidence that LINK could be one of the biggest winners of this market cycle.

Three Drivers Behind LINK’s Growth

1. Chainlink Reserves Program

The project recently launched Chainlink Reserves, a system where LINK tokens are purchased on the open market and locked away for years. The funds for these purchases come from both DeFi revenues and enterprise clients like Mastercard. By reducing circulating supply, the reserves act like a vacuum, supporting long-term price growth.

2. Wall Street Integration

The Intercontinental Exchange , parent company of the New York Stock Exchange, has tapped Chainlink to bring foreign exchange (forex) and precious metals data on-chain. This move could be the first step toward broader Wall Street integration, eventually extending into major exchanges like NYSE and NASDAQ.

3. SWIFT Partnership

Chainlink is also working with SWIFT, the global banking communication network used by thousands of financial institutions. Instead of each bank experimenting with different blockchains, SWIFT is adopting Chainlink as a single “abstraction layer.” This allows banks like Citibank, BNP Paribas, and BNY Mellon to connect to blockchain infrastructure using Chainlink as the bridge.

Price Levels and Market Outlook

Immediate resistance sits around $29–31, while support lies near $21–22. If LINK can reclaim $26 and hold, analysts say it could push it higher into lighter liquidity zones.

For the long-term outlook, many are asking: Can LINK reach $100?

BNB price has jumped nearly 14% in the last 30 days and recently touched a new all-time high of $881. While the price is now trading just 2% below that mark, what matters more is how it’s holding firm above key resistance.

In the past 24 hours alone, BNB gained another 3.4%, showing solid buyer interest. Two key on-chain signals suggest this rally may not be a one-off event. Both long-term and mid-term holders are backing this run.

HODLers Are Buying Into Strength — And They’re Not Alone

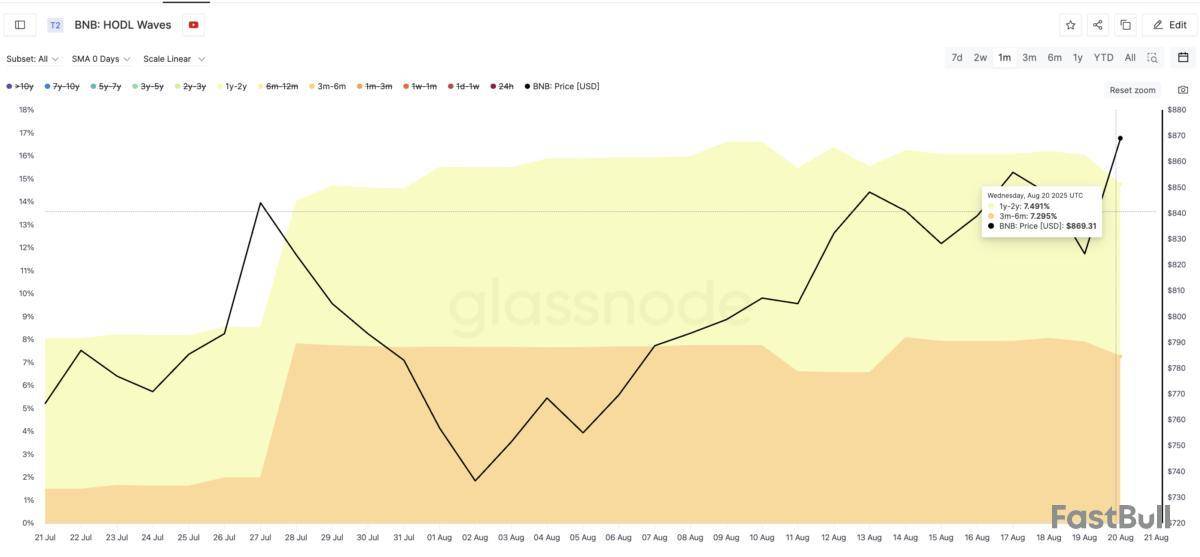

The chart below displays BNB’s HODL waves — a metric that measures the duration investors have held their tokens without selling them. It splits all BNB holders into age bands. The key here is the behavior of two specific groups: long-term holders (1–2 years) and mid-term conviction buyers (3–6 months).

On July 21, the 1–2 year band held just 6.56% of supply. That number has grown to 7.49% as of August 20. Similarly, the 3–6 month cohort rose from 1.5% to 7.3%. These are significant increases, especially when BNB’s price went up during the same time.

This kind of accumulation isn’t happening during a dip. It’s happening during a 14% BNB price rally, meaning these holders aren’t waiting for a pullback. They’re stepping in on strength.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

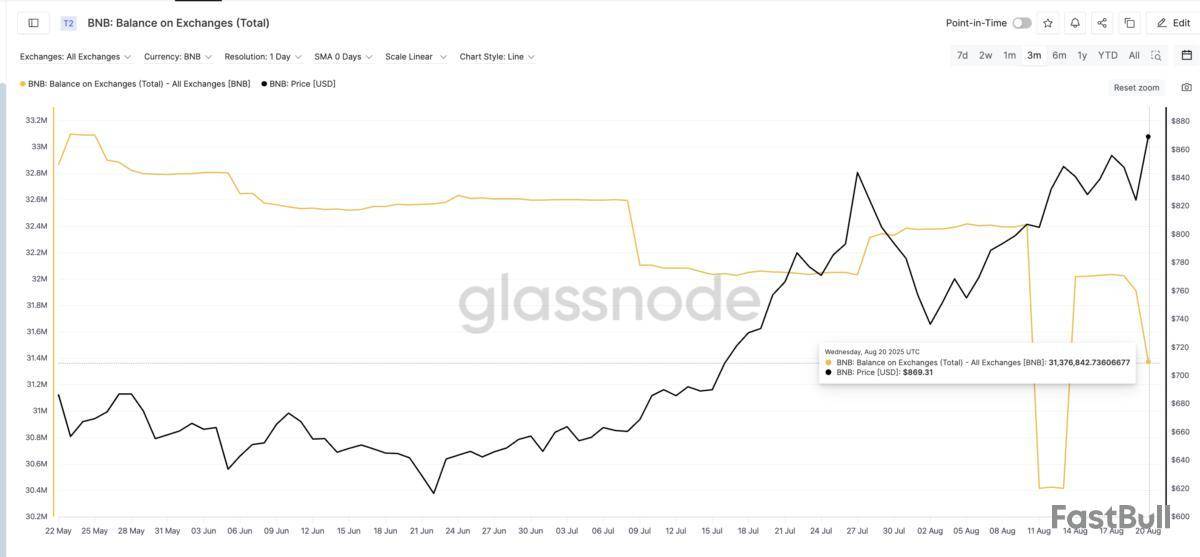

Now look at exchange balances. Between August 19 and 20, BNB’s price jumped from $824 to $869. Over the same period, exchange balances dropped from 31.91 million to 31.38 million BNB — a 530,000 token drop in one day.

That means traders weren’t sending coins in to sell. They were pulling coins out. Combined with rising HODL bands, this is clear: BNB holders expect higher prices.

BNB Price Action Confirms That $881 Was Only the First Barrier

BNB’s price rally hasn’t been random. It’s been following a clear uptrend, with pullbacks respecting Fibonacci retracement levels. The chart shows a trend-based Fib extension plotted from the recent impulse: $730 (start) to $864.95 (peak), retraced down to $812.

Based on that, the 0.5 level — $881 — acted as clear resistance and was tested almost perfectly. This test marked BNB’s all-time high. If this resistance breaks, the next Fib levels at $897 and $920 open up; both would be fresh all-time highs.

But there’s one risk. If the BNB price breaks below $812, the trend structure weakens. The level acted as the key retracement zone, and losing it would shift sentiment. But until then, the setup favors continuation.

By George Glover

Bitcoin was edging lower on Thursday, although other cryptos were picking up gains as investors tried to figure out the Federal Reserve's next move.

The world's largest token was down 0.2% to $113,858 over the past 24 hours, according to data from CoinDesk. It's now trading 9% off the record high it hit last week.

Ethereum was up 2.7%, Solana was up 3.5%, and XRP was up 1.2% over the past 24 hours, per data from the crypto exchange Kraken.

Digital-asset prices have soared this year thanks to a slew of positive regulatory developments, but they have lost some steam over the past week after wholesale inflation data came in a little hotter than expected.

Fed chair Jerome Powell's Friday speech at the Jackson Hole Economic Symposium on Friday is a likely crunch point for cryptos. If Powell signals a flurry of interest-rate cuts are coming, that ought to reignite the rally. When borrowing costs fall, cryptos tend to get a boost because they are more appealing compared with lower-yielding assets such bonds or cash.

There's also a new meme coin for crypto investors to trade. Rapper Kanye West, who now goes by the name Ye, said in a post on X late Wednesday that he was launching a new cryptocurrency called YZY Money, which will trade on the Solana blockchain. The token's launch comes at a time when lawmakers are looking at how to regulate altcoins and questions about its legitimacy will add fuel to the debate.

Write to George Glover at george.glover@dowjones.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up