Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key takeaways:

Ether has rebounded from key parabolic and triangle support levels, reviving the case for a $10,000 breakout.

Historical fractals and RSI recovery mirror past pre-rally setups seen in 2016 and 2020.

Altseason signals and strength against rivals like SOL and XRP boost Ethereum’s potential to outperform.

Ether , Ethereum’s native token, has soared over 44% in just three days to surpass $2,600 on May 11, fueling fresh speculation of a run toward $10,000 in the coming months.

A mix of fractal setups as well as Ether’s potential to outperform its top-ranking rivals, Bitcoin , Solana , and XRP , are serving as some catalysts behind the five-figure price prediction.

ETH's “up band” target is around $10,000

Ether’s long-term price action continues to follow a parabolic curve that has defined its major market cycles since 2015.

As of May 2025, ETH has rebounded from the curve’s lower boundary near $2,100 — a historically significant support zone that has previously triggered major rallies.

If this parabolic trajectory holds, Ethereum’s next move could be toward the upper boundary of the curve, which currently intersects near the $10,000 level.

Supporting this view, analyst MilkyBull Crypto highlights a similar setup on Ethereum’s monthly chart, noting that ETH’s rally to $10,000 “can’t be ruled out technically.”

Combined with RSI recovery from a multi-year support zone near 40, the setup adds further weight to the five-figure price target.

ETH looks set to outperform top crypto rivals

The bullish outlook for Ethereum is gaining traction as analysts anticipate an altcoin season in the coming months.

Chartist Mister Crypto, for instance, argues that altcoins like ETH may rally 40% in a single day amid capital rotation from Bitcoin.

The Altcoin Season Index, which has broken out of a downtrend just below the 29 level, signals a potential shift away from Bitcoin dominance. While still in “Bitcoin Season” territory (below 25), the breakout suggests altcoins like ETH may soon begin to outperform.

Additionally, Ethereum’s top blockchain rival, Solana, is painting a rising wedge pattern against Ether, furthering its potential to decline in the coming weeks.

The same picture can be seen against XRP, suggesting that more capital may flow toward Ethereum from rival altcoins in the coming days or weeks.

Ether symmetrical triangle hints at above $10,000

As of May, Ether is reclaiming the lower trendline of its multi-year symmetrical triangle after a brief breakdown in March, while bouncing off its 200-2W exponential moving average (200-2W EMA; the blue wave) support.

ETH’s rebound confirms a bullish rejection, validating the ongoing consolidation structure.

This setup closely resembles ETH’s past macro consolidations, namely the 2016 bull flag and the 2018–2020 falling wedge, both of which preceded major breakouts to new all-time highs.

A breakout above the current triangle consolidation could follow a similar trajectory, increasing the probability of ETH reaching the $10,000 mark — and even $20,000 if the breakout pans out per the rules of technical analysis.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Ripple is on the verge of breaking above a crucial resistance at the wedge’s upper boundary of $2.5. A successful breakout could trigger a fresh rally toward the $3 threshold.XRP Analysis The Daily Chart

Following an influx of buyers at the key 200-day moving average support near $2.1, XRP has surged toward a decisive resistance area. This critical region includes the upper boundary of the prolonged wedge pattern at $2.5, which poses a robust barrier for buyers. A breakout above this level, followed by a successful pullback, could initiate a bullish rally toward Ripple’s all-time high of $3.4 in the mid-term.

Conversely, a rejection at this resistance would likely lead to a consolidation phase within the wedge, providing the market time to rebuild momentum. Overall, XRP remains confined between the wedge’s upper boundary and the 100-day and 200-day moving averages, awaiting a breakout to define its next major direction.

On the 4-hour timeframe, Ripple’s push toward the $2.5 wedge boundary highlights increasing bullish pressure. However, the price has faced a mild rejection at this level, prompting a retracement to the short-term support zone at $2.3. This area is likely to provide a temporary floor.

XRP currently trades within a narrow range between the $2.3 support and the wedge’s upper boundary. The most probable scenario is a bullish breakout above this structure, which would pave the way for a continuation toward the $3 resistance zone.

Bitcoin kicked off the second week of May with a powerful continuation move, breaking through key resistance levels and climbing to fresh local highs. While the rally has been rapid, and the current technical signals suggest there’s still gas left in the tank, caution is still warranted.The Daily Chart

On the daily timeframe, BTC has pushed decisively above the $100K resistance and is now hovering around the $104K mark. This breakout marks a clear escape from the month-long compression between the rising trendline and the 100 and 200-day moving averages.

The price has reclaimed both the moving averages around the $90K price level, and the RSI is holding above 70, indicating strong momentum. However, it also points to slightly overbought conditions. If the buyers maintain pressure and avoid sharp rejections, a run toward a new all-time high is likely.

Zooming into the 4H chart, the breakout becomes even clearer. BTC exited an ascending channel pattern to the upside, rallying through the previous key supply zone around $98K with almost no resistance. Since then, the asset has been grinding higher in an orderly fashion, supported by the RSI cooling off.

The latest price action shows signs of slowing momentum, but there’s no reversal confirmation yet. A healthy pullback into the $100K–$98K range would be a logical area to look for continuation setups if the buyers remain in control. However, if that level fails, support at $94K could catch the next wave of bids.

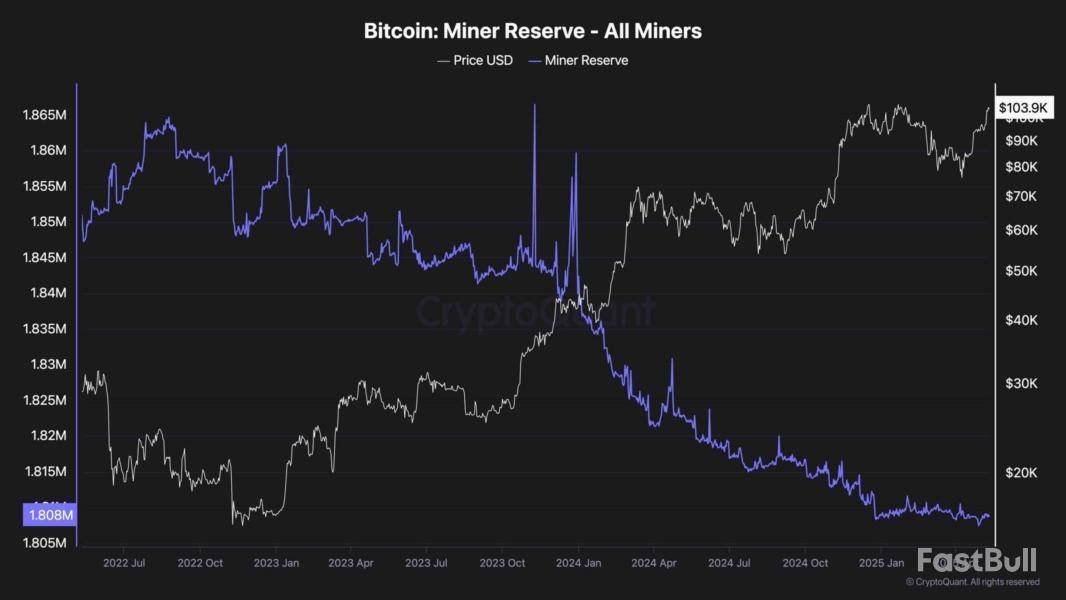

On-chain data reveals a persistent downtrend in the Bitcoin Miner Reserve, which has now dropped to around 1.8M BTC, the lowest in recent years. This suggests that miners are not accumulating, but rather continuing a long-term distribution pattern. Instead of increasing their holdings during this rally, they appear to be gradually offloading BTC, possibly to capitalize on higher prices or manage operational costs post-halving.

While this doesn’t necessarily signal aggressive selling, it does indicate that miners are not contributing to long-term supply tightening at the moment. Their lack of accumulation, in contrast to strong spot buying, reinforces the idea that current demand is being driven by other market participants, such as institutions and retail investors.

The market remains mainly bullish at the end of the week, however, there are some exceptions, according to CoinMarketCap.CoinMarketCap">

The price of XRP has fallen by almost 2% over the last 24 hours.TradingView">

On the hourly chart, the rate of XRP is bearish as it is near the local support of $2.3416. If the daily bar closes around the current prices, the breakout may lead to a test of the $2.32 area.TradingView">

On the bigger time frame, the price of XRP has made a false breakout of yesterday's bar peak of $2.477.

If bulls cannot seize the initiative, the decline may lead to a test of the $2.30 zone next week.TradingView">

From the midterm point of view, neither side is dominating as the price of XRP is far from the key levels. Thus, the volume remains low. In this case, ongoing sideways trading around the current prices is the more likely scenario.

XRP is trading at $2.3694 at press time.

After trading in a relatively quiet range for much of April, Dogecoin has started May on a good note. The meme coin has surged over 33% this week, pushing above the $0.22 level due to a new wave of bullish momentum among retail and institutional traders.

Amid this recovery, technical indicators are flashing a familiar signal that has led to massive price increases for Dogecoin since 2024. The latest analysis from popular crypto chartist Trader Tardigrade has brought attention to a possible inflection point: a bullish MACD crossover on the weekly timeframe.

MACD Signal Returns, Points To Explosive Upside For Dogecoin

Due to its performance since October 2023, the MACD (Moving Average Convergence Divergence) indicator has become a valuable tool for spotting momentum shifts in Dogecoin’s price cycles. It is now flashing bullish once again. The crossover, where the MACD line crosses above the signal line, has coincided with the beginning of powerful uptrends since the current cycle began in Q4 2023.

According to Trader Tardigrade’s chart, the last two confirmed MACD crossovers on the weekly timeframe led to rallies from $0.06 to $0.23 and from $0.086 to $0.48, respectively. Each of these rallies followed a period of deep corrections, conditions similar to what Dogecoin has witnessed since March 2025.

The first MACD crossover in this cycle was in October 2023, which resulted in a 285% rally. The second MACD crossover was in September 2024, which led to an even bigger rally of about 460%, during which Dogecoin surged to multi-year highs of $0.48.

The chart also reveals that these MACD crossovers occurred after a rounded bottom pattern. The current price structure looks like that setup, with a higher low rounded bottom and the blue MACD line about to cross to the upside of the orange line.

This lends strong credence to the notion that Dogecoin could be on the cusp of another rally, particularly as the overall crypto market sentiment is now positive following Bitcoin’s break above $100,000 again.

Eyes On $1: Can MACD Rally Repeat One More Time?

Now that the MACD crossover is almost underway, the obvious question is whether this can cause Dogecoin to finally reach the elusive $1 mark.

The projected $1 target lies on a long-term ascending resistance trendline that guided the $0.23 and $0.48 tops this cycle. If the pattern holds, and Dogecoin’s MACD crossover plays out as it has in the past, the meme coin might be currently at the start of a third impulsive move. The analyst’s chart draws a projected trajectory that extends toward $1 by mid-year, following a path similar to the other rallies.

Achieving the $1 target would require a price surge of about 335% from current levels around $0.23. At the time of writing, Dogecoin is trading at $0.2335, up by 3.4% in the past 24 hours and an intraday high of $0.2569.

Featured image from Unsplash, chart from TradingView

Opinion by: Sean Li, co-founder of Magic Labs

Crypto markets run 24/7. Human traders don’t. As AI agents begin to manage liquidity, optimize yield, and execute trades at all hours, they’re quickly becoming essential infrastructure for decentralized finance’s (DeFi) future. While AI agents are evolving from niche tools for quant traders into mainstream financial operators, they’re rapidly outpacing the wallets meant to secure them.

Advancements in account abstraction and smart contract wallets have emerged, but most DeFi platforms still predominately rely on externally owned account wallets that require manual approvals at every step. Early-stage programmable solutions exist but remain fragmented, costly on layer-1 networks and adopted by only a tiny fraction of users.

As AI agents increasingly operate in DeFi, this infrastructure limitation becomes critical. We need standardized infrastructure that allows for secure, cost-effective automation with verifiable guardrails across multiple blockchain ecosystems.

Automation needs guardrails, not guesswork

The rise of autonomous agents opens new possibilities: hands-free DeFi strategies, real-time portfolio optimization and crosschain arbitrage. Without programmable permissions and onchain visibility, however, delegating control to AI can expose users to catastrophic risk. Malicious bots, hallucinating agents and poorly designed automation can drain wallets before a human notices.

We’ve already seen what happens when agent infrastructure fails. In September 2024, users of the Telegram-based trading bot Banana Gun lost 563 Ether (approximately $1.9 million) through an exploited oracle vulnerability that allowed attackers to intercept messages and gain unauthorized access to user wallets. More recently, attackers breached Aixbt’s dashboard and issued commands to transfer funds directly, resulting in the loss of 55.5 ETH worth over $100,000. These aren’t isolated incidents — they are warning signs of systemic vulnerability in our automation infrastructure.

Legacy wallets can’t support autonomous agents

Despite years of wallet innovation, the architecture remains static mainly: sign a transaction, broadcast it, repeat. Most wallets aren’t built to understand “intent,” verify that automation matches user-defined rules, or restrict activity by time, asset type or strategy.

This rigidity creates an all-or-nothing dynamic: either you maintain manual control and miss out on fast-moving opportunities or you hand over access entirely to opaque third-party systems. For AI-powered DeFi to scale securely as it builds more utility, we need programmable, composable and verifiable infrastructure.

Programmable permissions are the new trust layer

As smart contracts encode logic into DeFi protocols, wallet infrastructure must encode logic into user control. That means enabling session-based permissions, cryptographic verification of agent actions and the ability to revoke access in real-time.

Recent: AI and blockchain — A match made in heaven

With these features in place, users can delegate trading, rebalancing or strategy execution without giving up complete control. This approach doesn’t just mitigate risk — it expands access. Advanced DeFi strategies could become accessible to users without technical knowledge and managed securely by agents operating within verifiable constraints.

Programmable infrastructure makes DeFi scalable

Programmable wallet infrastructure doesn’t just make DeFi safer — it makes it scalable. Fragmentation across chains and protocols has long been a barrier to automated strategies. A universal keystore protocol that syncs permissions across networks can streamline crosschain delegation and open the door for interoperable agent ecosystems.

As institutional interest in DeFi grows, secure automation will be non-negotiable. Most firms won’t allow AI agents to interact with capital without verifiable guardrails. Just as zero-knowledge proofs are becoming essential to privacy and compliance, programmable wallet permissions may become standard for agent-based security.

The future of DeFi

Some may argue that AI can’t be trusted with financial autonomy, but traditional markets have already adopted algorithmic trading and black box automation. DeFi isn’t immune — it’s simply unprepared.

If crypto is to maintain its transparency and user sovereignty principles, it must build infrastructure that keeps AI agents in check. That starts with rebuilding wallets as interfaces and operating systems for the autonomous, multichain economy.

DeFi is on the edge of an automation revolution. The question isn’t whether agents will participate. Whether we give them the rails, they need to act in service of users, not in spite of them.

Opinion by: Sean Li, co-founder of Magic Labs.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Ethereum (ETH) plunged into territory not seen since 2019 before it posted a substantial recovery in the past few days. However, it’s still trading at a steep discount to Bitcoin (BTC).

According to the latest weekly report from on-chain analytics platform CryptoQuant, the ETH/BTC MVRV ratio, which measures market value relative to realized value, has entered “extremely undervalued” territory, a level that in past cycles set the stage for major ETH rebounds.A Discount Amid Growing Headwinds

CryptoQuant’s analysis noted that Ethereum’s deep discounts against BTC have historically signaled prime buying opportunities.

However, it pointed out that the current environment is markedly different, with a series of fundamental headwinds responsible for the undervaluation. These include the unraveling of Ethereum’s once-promising deflationary supply narrative, with the asset’s total supply hitting an all-time high of 120.7 million.

The analytics platform attributed the reversal to March 2024’s Dencun upgrade, which drastically reduced transaction fees and collapsed the ETH burn rate. With fewer tokens being burned, inflationary pressure found its way back into the ETH market.

Further compounding the issue is that on-chain activity has been stagnant for a while. Since 2021, key metrics such as transaction counts and active addresses have dropped, mostly because Layer 2 (L2) networks diverted usage away from the Ethereum mainnet. Even though they have improved scalability, L2s have also diluted demand for base-layer block space, undermining ETH’s utility narrative in the process.

CryptoQuant also noted that institutional interest in the asset has been waning. The amount of staked ETH has reportedly dipped from its November 2024 peak of 35 million to about 34.4 million. ETF holdings have also shed as much as 400,000 ETH since February this year, reflecting weakening investor confidence.

“Bitcoin is benefiting from robust institutional demand, capped supply, and ETF-driven inflows,” read the report, contrasting the fortunes of the two cryptocurrencies.Undervalued but Not Without Risk

Despite the obstacles, ETH staged a sharp rebound towards the end of the week. It shot up to roughly $2,400 on Friday.

Additionally, over the past week, the altcoin soared just above 30%, crushing Bitcoin’s 7.5% climb and vastly outpacing the global crypto market’s 8% gain. The rally coincided with the successfulactivationof the long-awaited Pectra upgrade on May 7, which introduced account abstraction and improved staking mechanics via 11 bundled EIPs. However, its impact may be muted.

Past experiences show that Ethereum’s discount to Bitcoin is often a buying signal. Still, CryptoQuant’s analysis suggests that the returning inflation, weakening demand, and stagnant activity may mean that this could be the first cycle in which ETH’s undervaluation isn’t a springboard but a trap.

“While ETH appears undervalued on a historical basis, its recovery path may be more complex and slower than in prior cycles,” CQ concluded.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up