Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum price started a fresh increase above the $1,800 zone. ETH is now rising and attempting a move above the $1,850 resistance.

Ethereum Price Remains Supported For Gains

Ethereum price remained supported and started a fresh increase above $1,780, like Bitcoin. ETH gained pace for a move above the $1,800 resistance zone.

The bulls were able to push the price above the 50% Fib retracement level of the downward move from the $1,872 swing high to the $1,752 low. Besides, there is a connecting bullish trend line forming with support at $1,810 on the hourly chart of ETH/USD.

Ethereum price is now trading above $1,820 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,840 level and the 76.4% Fib retracement level of the downward move from the $1,872 swing high to the $1,752 low.

The next key resistance is near the $1,850 level. The first major resistance is near the $1,920 level. A clear move above the $1,920 resistance might send the price toward the $1,950 resistance. An upside break above the $1,950 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,000 resistance zone or even $2,050 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,850 resistance, it could start a fresh downside correction. Initial support on the downside is near the $1,825 level. The first major support sits near the $1,810 zone and the trend line.

A clear move below the $1,810 support might push the price toward the $1,780 support. Any more losses might send the price toward the $1,750 support level in the near term. The next key support sits at $1,665.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,810

Major Resistance Level – $1,850

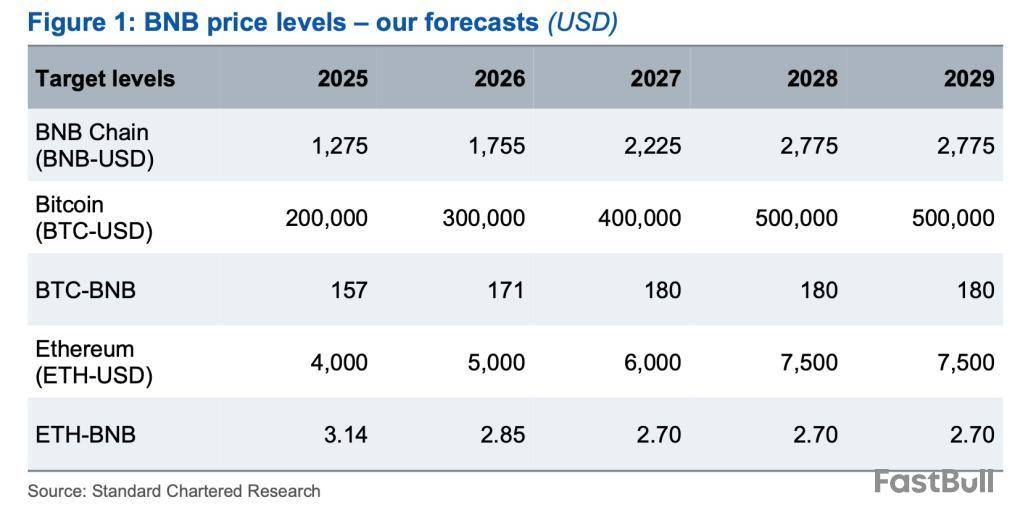

Standard Chartered has initiated formal coverage of Binance’s exchange token, BNB, and set out one of the industry’s most detailed long-term trajectories for the asset. In a research note shared with The Block, Geoffrey Kendrick, the bank’s global head of digital-asset research, argues that the token price could accelerate from roughly $600 today to $1,275 by 2025 and $2,775 by 2028, before “plateauing” through 2029.

BNB Could Spike By 360%

The path implies a gain of more than 360% from current levels and, crucially, situates the token in what Kendrick calls “a benchmark-like role” inside the wider crypto capital structure. “BNB has traded almost exactly in line with an unweighted basket of Bitcoin and Ethereum since May 2021 in terms of both returns and volatility,” Kendrick wrote. “We expect this relationship to continue to hold, driving the price from around $600 currently to $2,775 by end-2028.”

Standard Chartered’s broader outlook is unabashedly bullish on the majors: Bitcoin is projected to reach $200,000 in 2025 and $500,000 in 2028, while Ethereum is pencilled in at $4,000 and $7,500 over the same horizons. When those forecasts are translated into cross-asset ratios, they reveal subtle shifts in market share.

The BTC-BNB ratio—how many BNB one Bitcoin can buy—is expected to tick up from 157 in 2025 to 180 by 2027, then hold steady, implying that Bitcoin’s dollar appreciation is likely to outrun BNB’s. By contrast, the ETH-BNB ratio is seen slipping from 3.14 in 2025 to 2.70 in 2027, signalling that Ethereum may outperform BNB, but more gently than Bitcoin will.

Kendrick acknowledges that BNB “may underperform Bitcoin and Ether both in real terms and as measured by market cap in circulation,” yet he contends that its deflationary tokenomics and deep linkage to the world’s largest centralized exchange “support its long-term value.”

The research note scrutinises BNB Chain’s architecture. Its “proof-of-staked authority” model rotates just 45 validators every 24 hours—a sharp contrast to Ethereum’s million-plus validator set. Kendrick describes BNB Chain as “highly centralised relative to other chains,” adding that its developer activity has “stagnated” since the 2021 DeFi surge and now trails networks such as Avalanche and Ethereum.

Even so, forthcoming technical milestones are expected to expand the ecosystem’s resilience. Kendrick cites the recently completed Pascal hard fork and the looming Maxwell upgrade, due in June, as examples of “incremental but meaningful” incentives for developers.

On the demand side, the token’s fortunes remain tethered to Binance’s trading engine. Holders receive tiered fee discounts calculated on their token balance and 30-day volume—a mechanically enforced use-case that has so far “helped the BNB Chain retain activity even as competition from other ecosystems like Solana grows,” Kendrick notes. PancakeSwap, the dominant decentralised exchange on BNB Chain, amplifies that liquidity loop.

Meanwhile, regular token burns, coupled with the fixed-limit supply, underpin a structural deflation that Standard Chartered says justifies the premium BNB commands on its market-cap-to-GDP valuation screen—currently “rich” by the bank’s preferred metric.

At press time, BNB traded at $605.

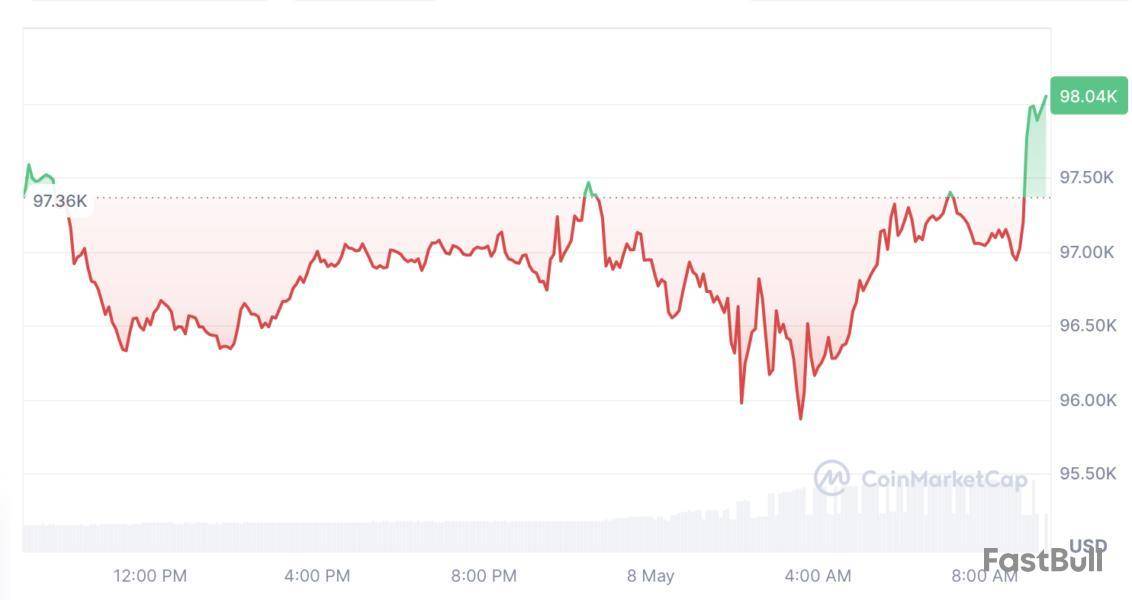

Bitcoin has reclaimed $98,000 for the first time in almost three months after the US Federal Reserve said it would keep interest rates the same for another month.

The Fed’s decision to keep interest rates unchanged comes despite mounting pressure from US President Donald Trump, who just weeks ago threatened to fire Fed chair Jerome Powell for being “too late” in cutting rates.

Fed cites higher unemployment, inflation risk

Powell said on May 7 that the Federal Reserve rate-setting committee held rates in the 4.25% to 4.50% range due to the rising risks of higher unemployment and higher inflation.

He added inflation has “come down a great deal but has been running above our 2% longer objective.” Powell said surveys in households and businesses showed a “sharp decline in sentiment” mainly due to concerns over Trump’s trade policy.

However, Powell said that “despite heightened uncertainty, the economy is still in a solid position.” In the days leading up to the announcement, data from CME Group’s FedWatch Tool indicated that the futures market expected minimal odds of a rate cut.

Powell said the unemployment rate remains low, and the labor market is “at or near maximum employment.” The market expects the Fed to drop the Fed funds rate to 3.6% by the end of 2025.

Bitcoin (BTC) dropped below $97,000 to $95,866 after Powell’s speech, but it shot up to tap $98,000 for the first time since Feb. 21 just hours later.

Bitcoin momentum has been building, with the Crypto Fear & Greed Index returning to “Greed” territory, and spot Bitcoin exchange-traded funds (ETFs) posting inflows of almost $4.41 billion since March 26.

On March 9, network economist Timothy Peterson warned that if the Fed holds off on rate cuts in 2025, it may cause a broader market downturn, potentially dragging Bitcoin back toward $70,000.

Peterson’s forecast came after Powell said in March that “we do not need to be in a hurry and are well-positioned to wait for greater clarity.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Group of Seven leaders may address the escalating threat of North Korea-backed cyberattacks and crypto theft at next month's summit in Canada, Bloomberg reported Wednesday, citing sources familiar with the summit's plans.

Bloomberg's sources reportedly described North Korea's cyber activities as "alarming" due to their role in funding the regime. A White House official previously said that North Korea funds its weapons of mass destruction and ballistic missile programs through crypto heists.

However, the agenda for the June G7 summit has not been finalized, with discussions over other geopolitical situations such as the Ukraine war likely to be prioritized, the sources said.

As digital assets became major payment and investment tools, North Korea launched numerous attacks on crypto firms through state-backed hacker groups, causing significant losses.

February's $1.4 billion hack on Bybit, the largest-ever attach on a centralized exchange, was attributed to a targeted malware attack by North Korea-backed hacker organization Lazarus Group. A large portion of the stolen funds has gone dark, having been quickly moved through crypto mixers and peer-to-peer exchanges.

Other significant crypto heists attributed to North Korean hackers include the $600 million Ronin Bridge exploit, attacks on Harmony's Horizon Bridge, and a breach of the DMM Bitcoin exchange in Japan.

North Korean cyber actors have also taken diversified strategies to siphon away crypto funds, from exploiting vulnerabilities in DeFi protocols and blockchain bridges to deploying sophisticated social engineering campaigns, such as fake job interviews and phishing attacks.

Last month, hackers linked to the Lazarus Group created three shell companies to target crypto developers with malware, according to cybersecurity firm Silent Push. Two out of three companies were registered in the U.S.

The U.S., South Korea, Japan, and other countries have taken action to sanction these cybersecurity attacks; however, such attacks remain rampant. Earlier this month, the U.S. Treasury proposed banning Cambodia's Huione Group from the U.S. financial system for allegedly helping North Korea launder stolen crypto funds.

In 2024, North Korean hackers stole $1.34 billion across 47 incidents, according to Chainalysis, making up 61% of all cryptocurrency theft that year. The blockchain analytics firm stated that hacking methods are becoming more sophisticated, with stolen funds being increasingly difficult to trace.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Arizona has become the second U.S. state to pass a bitcoin reserve bill into law, following in New Hampshire's footsteps earlier this week.

Arizona Governor Katie Hobbs signed House Bill 2749 into law on Wednesday, allowing the establishment of a crypto reserve.

The bill, sponsored by Representative Jeff Weninger, establishes a reserve fund for unclaimed virtual assets that could be tapped for future use pending legislative approval, according to a statement released by Weninger's office. It also allows qualified custodians to stake the reserve assets for rewards or airdrops.

Essentially, it enables the integration of crypto assets into Arizona's unclaimed property framework.

"By preserving unclaimed crypto in its native form and creating a Bitcoin and Digital Assets Reserve tax free, we are modernizing our laws to reflect crypto's position as the future of finance and ensuring Arizonans receive the full market value of their assets," Weninger said.

Hobbs' signing of HB 2749 follows New Hampshire's approval of a strategic bitcoin reserve bill (HB 302) on Tuesday.

New Hampshire’s HB 302, signed by Governor Kelly Ayotte, authorizes the state treasurer to allocate up to 10% of the general fund and other approved funds into investments in precious metals and digital assets with a market capitalization exceeding $500 billion — a criterion currently met only by Bitcoin.

Meanwhile, another Arizona bill, SB 1373, which would create a strategic reserve from seized digital assets, is now awaiting action from Governor Hobbs, who could either sign or veto the bill.

Last week, Hobbs vetoed a separate bill, SB 1025, which would've allowed the state's treasurer and retirement systems to invest up to 10% of their funds in cryptocurrencies such as Bitcoin.

"Arizonans' retirement funds are not the place for the state to try untested investments like virtual currency," Hobbs said in a letter last week explaining the veto.

Beyond New Hampshire and Arizona, multiple states are weighing similar strategic reserve legislation, with North Carolina and Texas emerging as the next most advanced in their efforts, according to data from Bitcoin Laws.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

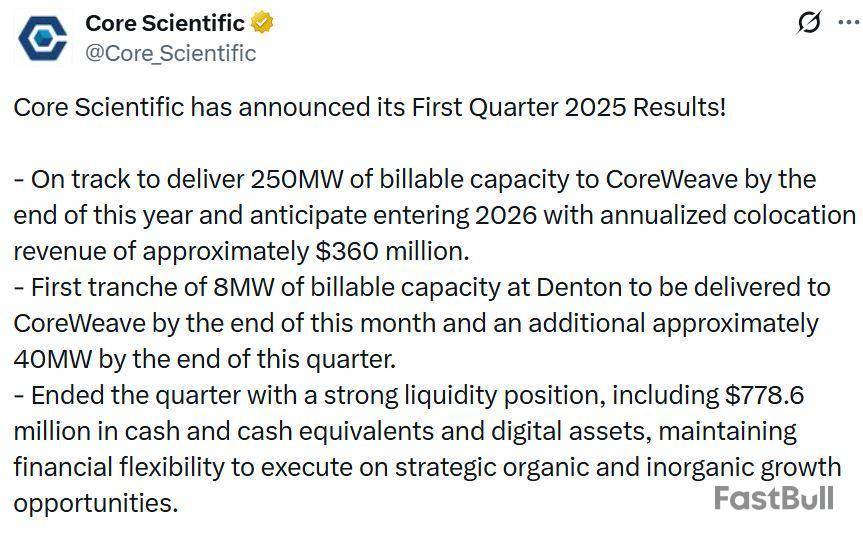

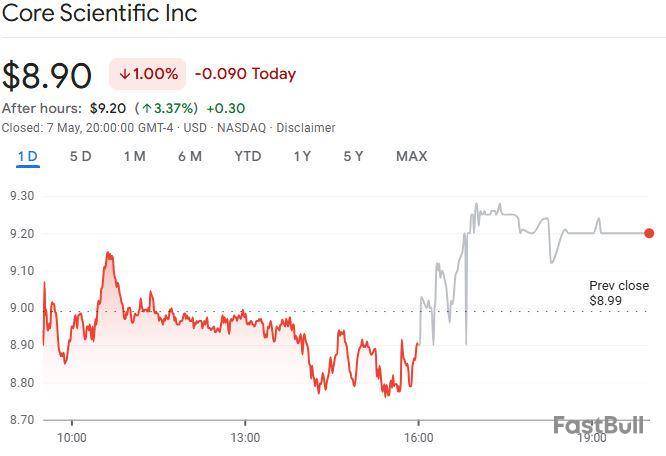

Nasdaq-listed Bitcoin mining firm Core Scientific Inc. posted a net profit of $580 million with its first quarter results, but missed analyst revenue estimates after a drop in its mining profits.

Core Scientific’s Q1 2025 results, shared on May 7, saw it more than double its $210 million net income from the year-ago quarter, while its total revenue reached $79.5 million, missing Zacks analysts' estimates by 8.11%, and falling from its $179.3 million in revenues for Q1 2024.

The firm’s primary source of revenue came from $67.2 million in self-mining revenue, $3.8 million in hosted mining revenue, and $8.6 million in colocation, formerly listed as high-performance computing (HPC) hosting.

Core Scientific said its drop in Bitcoin mined and revenue was due to the halving on April 20, 2024, when mining rewards were cut from 6.25 BTC to 3.125 BTC, and its operational shift to HPC hosting, primarily used for artificial intelligence.

However, the losses were partially offset by a 74% increase in the average price of Bitcoin and a 33% decrease in power costs due to lower rates and usage.

As part of its HPC hosting shift, Core Scientific inked a deal in February with AI startup CoreWeave for a $1.2 billion data center expansion. As a result, Core Scientific anticipates entering 2026 with annualized colocation revenue of $360 million.

Inflection point for miners in AI shift

Core Scientific CEO Adam Sullivan said in a statement that its first quarter was an “inflection point,” as the firm positioned itself at the “center of one of the most important shifts in modern computing,” as the demand for high-performance data infrastructure has accelerated.

Shares in Core Scientific (CORZ) closed May 7 trading down 1%, falling to $8.90, according to Google Finance. However, they jumped over 3% to trade at $9.24 after the bell.

In an August report, asset manager VanEck estimated that if publicly traded Bitcoin mining companies shifted 20% of their energy capacity to AI and HPC by 2027, they could increase additional yearly profits by $13.9 billion over 13 years.

Riot Platforms appointed three new directors to its board in February, one of whom has experience converting Bitcoin mining assets toward HPC.

Hive Digital, Hut 8 and Iris Energy converted part of their operations to HPC and AI last year, and TeraWulf sold its stake in a Bitcoin mining facility for $92 million in October, with the proceeds marked for hosting AI and building HPC data centers.

Bitcoin price started a fresh increase above the $96,500 zone. BTC is rising and might aim for a move toward the $100,000 resistance.

Bitcoin Price Regains Traction

Bitcoin price started a fresh increase from the $93,500 support zone. BTC formed a base and was able to clear the $95,000 resistance zone. The bulls even pushed the price above $96,500.

There was a break above a connecting bearish trend line with resistance at $97,200 on the hourly chart of the BTC/USD pair. The pair spiked above $98,000 and tested $98,300. A high is formed at $98,292 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $95,824 swing low to the $98,292 high.

Bitcoin is now trading above $97,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $98,250 level. The first key resistance is near the $98,500 level.

The next key resistance could be $98,800. A close above the $98,800 resistance might send the price further higher. In the stated case, the price could rise and test the $99,500 resistance level. Any more gains might send the price toward the $100,000 level.

Another Decline In BTC?

If Bitcoin fails to rise above the $98,250 resistance zone, it could start another downside correction. Immediate support on the downside is near the $97,700 level. The first major support is near the $97,000 level and the 50% Fib retracement level of the upward move from the $95,824 swing low to the $98,292 high.

The next support is now near the $96,400 zone. Any more losses might send the price toward the $95,500 support in the near term. The main support sits at $94,200.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $97,000, followed by $96,400.

Major Resistance Levels – $98,250 and $98,800.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up