Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

An Ethereum initial coin offering participant has sold 2,300 ETH, worth about $9.9 million, early Monday morning, onchain data shows.

Onchain data analytics provider Lookonchain reported Monday that the address "0x845…a210c" transferred 2,300 ETH to Kraken, leaving the address with 1,623 ETH remaining.

The Ethereum ICO whale originally received 20,000 ETH for $6,200, which is now valued at around $86 million, according to Lookonchain.

In addition to Monday's transfer, the address made several previous outbound transfers: 250 ETH in December 2024, 1,000 ETH in February 2024, and 3,000 ETH in late November 2023, among others.

Ethereum climbed 1.64% in the past 24 hours to trade above $4,300 at the time of writing, reaching its highest levels since December 2021, according to The Block's Ethereum price page.

The Ethereum ICO, held from July 22 to September 2, 2014, raised about $18.3 million by selling over 60 million ETH tokens at an average price of $0.31 per ETH, with 1 BTC initially buying 2,000 ETH and later 1,337 ETH due to price adjustments.

The funds, equivalent to 31,531 BTC, supported the development of Ethereum, which launched in July 2015 with a total initial supply of 72 million ETH, 83% of which went to ICO investors.

This ICO, accessible globally without investor restrictions, yielded an ROI of more than 12,000-fold for early investors, based on Ethereum's current price.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The corporate race into crypto has just gotten hotter, starting with Bitcoin, then Ethereum, XRP, and now coming down to BNB. Nasdaq-listed company BNC (formerly VAPE) has announced a $160 million purchase of 200k BNB.

This huge purchase makes BNC the largest corporate holder of BNB in the world. Following the news, the BNB price jumped to $819, marking an 8% gain in just a week.

From VAPE to Crypto Power Player

According to Wu Blockchain, Nasdaq-listed BNB Network Company — formerly known as VAPE, has made a bold entry into the Binance ecosystem, spending $160 million to buy 200,000 BNB tokens.

This wasn’t just a casual market buy. The purchase was backed by a $500 million private funding round led by 10X Capital and YZi Labs, signaling strong confidence from heavyweight investors.

Wu Blockchain@WuBlockchainAug 11, 2025Nasdaq-listed company BNC (formerly VAPE) has announced a $160 million purchase of 200k BNB, making it the largest corporate holder of BNB globally. The acquisition was funded through a $500 million private placement led by 10X Capital and YZi Labs. BNC plans to continue…

While many public companies are still experimenting with Bitcoin or Ethereum, BNC has gone straight for a high-stakes bet on BNB, a token deeply tied to the Binance ecosystem.

Plans to Keep Buying

BNC isn’t stopping here. With its warrant structure, it could boost its BNB investment to $1.25 billion, gaining huge influence over corporate holdings. If they follow through, that would put the company in a position of massive influence over BNB’s corporate ownership.

If more corporations follow this path, BNB could move from being primarily an exchange utility token to a recognized strategic asset for big institutions.

Impact on BNB Price

BNB’s market momentum has been undeniable. The token price has climbed 18% over the past month, trading between $750 and $838 in the last week.

Meanwhile, the Relative Strength Index (RSI) is at 65.88, suggesting more room for growth before hitting overbought territory.

However, technical analysis suggests that breaking above $825 could send prices to $850–$875

On the flip side, if resistance holds, prices may drop to $790, with $750 as strong support

In the crypto world, Chainlink and XRP are often discussed side-by-side, but not because they are in direct competition. The two projects simply serve very different purposes.

XRP’s technology is widely used for cross-border payments, especially by banks and payment providers. Chainlink, on the other hand, is less visible to the general public but plays an important role in connecting blockchains with real-world data.

A Viral Debate on X

A recent post on X (formerly Twitter) sparked a discussion between the two communities.

One expert opened up about Chainlink, saying they had “I’ve never seen it work in real life” or met anyone building with it. He argued that developers on the ground know what works better than influencers promoting projects.

Dom | EasyA@dom_kwokAug 10, 2025i have actually seen @ripple’s tech work in real life.

i’ve never seen @chainlink work in real life, nor have i met anyone building with chainlink either.

when you spend every day on the ground with developers you understand what tech works much better than an influencer who’s… https://t.co/0SIbExpvPf

However, another analyst replied, stressing that the two projects serve completely different purposes. XRP, through RippleNet, focuses on fast, low-cost global payments. Chainlink ensures authenticity and data accuracy for blockchains.

They also pointed out that the LINK token is mainly for payments, is not native to Chainlink, and runs on Ethereum as an ERC-20 token. “You can’t compare chain and XRPL, it’s like comparing MS Word with PHOTSHOP,” (sic) Vincent Van Code wrote.

Key Differences Between Chainlink and XRP

In an August 10 video titled “My End Of 2025 ETH Price Prediction (Using AI) — You’re Not Bullish Enough!”, crypto analyst Miles Deutscher said Ethereum’s latest breakout above the “very key level in the $4,000 zone” has shifted the market into what he views as a confirmed, structurally stronger advance toward new all-time highs. “We actually did get a daily close,” he noted, adding that the weekly close above the same region—something Ethereum “hasn’t closed above on the weekly since November 2021”— underscores the significance of the move. In Deutscher’s framework, that close is “confirmation for a much bigger run.”

How High Can Ethereum Go?

Deutscher centered the analysis on a simple question—how high can Ethereum go—and answered it with a blend of technical context and model-driven probabilities. Before invoking AI, he sketched an “eye test” path in which price discovery unfolds “well into this range here between $6,000 to $8,000,” arguing that Ethereum is effectively “playing catch-up” after lagging other top assets that already printed new highs.

He even floated a directional benchmark—“I think the price prediction is going to be $7,000”—before deferring to probability distributions as a more disciplined way to size the upside. To that end, he ran two large-language models on a shared set of inputs, asking for odds of specific price bands by the end of 2025 and then by the end of 2026.

On his telling, the first model’s 2025 peak probabilities favored continuation: roughly a three-in-four chance to revisit the prior high near $4.7k, about sixty-plus percent to clear $5k, around thirty percent to reach $6k, high-single-digits to breach $7.5k, and roughly one percent to tag $10k this year.

Expanding the window through 2026 raised those odds materially, to what he summarized as high confidence in $4.7k–$5k, better-than-even odds for $6k, and about forty percent for $7.5k, with a non-trivial tail—“even here 10k plus it’s giving an 18% probability to.”

Running the same exercise on Grok produced a more aggressive contour. As Deutscher relayed it, Grok’s “base case could very well be $10,000,” with an $8,000–$15,000 band as a plausible cycle-top range.

He quoted the model’s technical guardrails explicitly: “A break above $4,800 signals new all-time high pursuit. Drop below $3,800 could invalidate the bullish thesis.” By contrast, his own trading invalidation skews tighter to trend, cautioning that “if Ethereum drops below the money noodle on the daily, which right now is around like $3,400, I think structurally this could start to invalidate the bullish move at least in the short term,” while “as long as we maintain above $4,000, we are in the pursuit of that prior all-time high.”

Headwinds For Ether

The projection stack rests on a macro-to-micro chain of tailwinds that Deutscher argued now favors Ethereum more directly than in prior cycles. He cited consistently positive ETF flows—“around $17 billion of net inflows into the crypto ETFs over the last 60 days, $11 billion coming in the month of July alone,” with particular traction on the ether side—alongside anticipated retirement-account access to crypto that could unlock what he called a “massive pool of new buyers.”

He framed recent US policy steps as a near-term accelerant for on-chain finance, saying the GENIUS Act clarified treatment for a set of crypto assets and “regulates some of the key stable coins,” thereby widening the aperture for institutional yield strategies and tokenization. In his view, those are specifically Ethereum-centric growth funnels because “Ethereum is the biggest blockchain facilitating asset tokenization and DeFi,” which makes ETH “the number one proxy for anyone looking to get exposure to this narrative.”

Deutscher also paired the flows argument with market-structure observations: stablecoins at fresh highs, price resilience marked by “sell-offs… relatively short-lived,” and a turn in bitcoin dominance that, if it persists, historically precedes broader alt rotation with ETH at the fulcrum.

None of this, he stressed, implies a straight line. Deutscher expects the cycle to oscillate through rotations—bitcoin strength, an ether catch-up, then a higher-beta alt expansion—rather than a single monolithic “altseason.”

He even penciled in a likely second-leg window into 2026, aligning with political and monetary calendar points, while cautioning that “you never know what’s going to happen” and emphasizing the need for clear invalidations.

Still, the directional conclusion is unambiguous: the combination of structural inflows, regulatory clarity around on-chain finance, and Ethereum’s technical regime shift leaves him biasing to the upside. “This would be hard momentum to slow down in the short to mid-term,” he said, adding that the true “FOMO” phase probably begins only once ETH is in price discovery above its $4,800 peak.

At press time, ETH traded at $4,303.

BNC, a subsidiary of CEA Industries, announced Sunday that it purchased 200,000 BNB for $160 million, effectively becoming the largest publicly listed holder of the cryptocurrency. The company purchased through its treasury management subsidiary, BNB Network Company.

Last month, the Nasdaq-listed company announced that it is shifting its primary focus from nicotine vapes to building a BNB treasury, changing its ticker symbol from VAPE to BNC. It recently closed a $500 million private placement to support the treasury strategy, led by 10X Capital and Changpeng Zhao's YZi Labs.

"Deflationary token burns, increasing on-chain activity, and potential catalysts such as a BNB spot ETF make the asset a compelling long-term play," BNC wrote in its press release.

The company said it aims to bring more institutional presence to the BNB ecosystem, which is currently underrepresented in the U.S.

BNC said it will continue buying BNB until the initial treasury capital is depleted, and may opt for additional capital worth $750 million via its warrant structure, potentially acquiring $1.25 billion worth of BNB in total.

The trend of corporate crypto treasuries has expanded beyond Bitcoin and Ether, with companies establishing treasuries based on altcoins such as BNB, XRP, and Solana. Other companies, Nano Labs and Windtree, have recently committed around $500 million to their respective BNB treasuries.

BNB is currently the fourth largest cryptocurrency by market capitalization, and is the native token of BNB Chain, which is the third largest chain by total value locked. The cryptocurrency is up 1% in the past day to trade at $820.5, according to The Block's BNB price page.

According to Google Finance data, CEA Industries closed up 3.7% at $17.10 on the Nasdaq last Friday, up more than 92% since it announced its BNB strategy.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

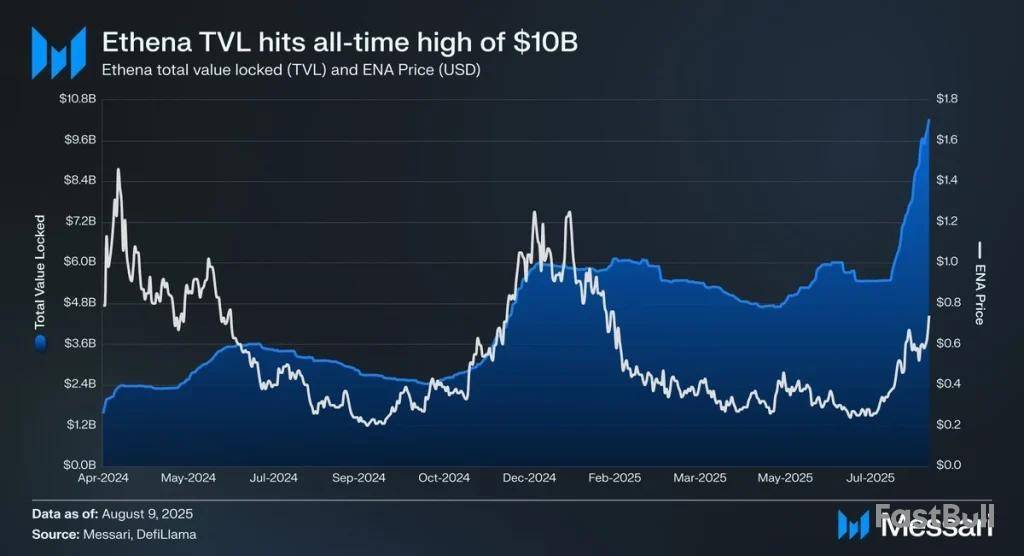

Ethena price has staged a strong 40.03% rally this week, and 11.59% in the last 24 hours, trading at $0.8406. The moonish surge aligns with Ethena’s TVL hitting a record $10 billion, alongside a major milestone for its synthetic dollar, USDe. Which recently became the 3rd largest stablecoin by market capitalization.

Successively, $5M daily ENA buybacks are reducing circulating supply, creating scarcity. Plus, whale addresses holding 100k-1M ENA grew 12% in July, now controlling ~30% of supply. Wondering where the ENA price could head next? Join me as I decode the same in this analysis.

On-Chain Analysis

Ethena’s TVL has reached an all-time high, surpassing $10B as of August 9, 2025, according to Messari. This marks a significant influx of capital into the protocol, reflecting growing investor confidence and adoption of its DeFi products. The TVL rise has tracked closely with ENA’s price recovery from multi-month lows, suggesting that capital inflows may be leading price action.

ENA Price Analysis

ENA’s recent price breakout came on August 10th, when it surged 13.7% from $0.64 to $0.7277, breaking out of a bullish flag pattern. The rally has since extended toward $0.8493, today’s high, with the price currently consolidating around $0.84.

Technical indicators point to strong momentum, the RSI-14 at 74.76 suggests the market is nearing overbought levels, though not yet extreme. This is while the shorter-term RSI-7 at 81.81 indicates high short-term enthusiasm. MACD, on the other hand, has confirmed a bullish crossover with the histogram turning positive at +0.010557.

Talking about price targets, the key upside targets are at $0.8741 at Fibonacci 127.2% and one at $1.02. However, $29.8M worth of ENA moved to exchanges on August 9–10, which could introduce near-term volatility. On the downside, a close below $0.7046 could trigger profit-taking toward lower supports at $0.5638 and $0.4764.

FAQs

Why is the ENA price surging now?Strong TVL growth, USDe’s stablecoin milestone, buybacks, and whale accumulation have boosted ENA’s price.

What are the key levels to watch for the Ethena price?Upside targets are $0.8741 and $1.02; support sits at $0.7046, $0.5638, and $0.4764.

Is ENA overbought?RSI shows it’s approaching overbought territory but still has room for short-term continuation.

The LayerZero Foundation, which backs the cross-blockchain messaging protocol LayerZero, has put forward a proposal to acquire the crypto protocol Stargate for $110 million, which has boosted the tokens tied to both projects.

LayerZero laid out the plan in a post to Stargate’s forum on Sunday, pitching the offer as “designed to accelerate both Stargate and LayerZero, giving Stargate the resources to ship on an aggressive roadmap that expands its prerogative outside of bridging.”

LayerZero would swap the platform’s token, Stargate Finance (STG), for its self-titled token LayerZero (ZRO) at a rate of 1 STG to 0.08634 ZRO, it explained.

Stargate was developed and launched by LayerZero in 2022, and the deal — if approved by Stargate’s community — would see the platform come back under its umbrella.

Stargate allows users to transfer digital assets across blockchains using liquidity pools, which the platform pitches as allowing assets to be transferred natively instead of relying on blockchain bridges — which have a history of being hacked.

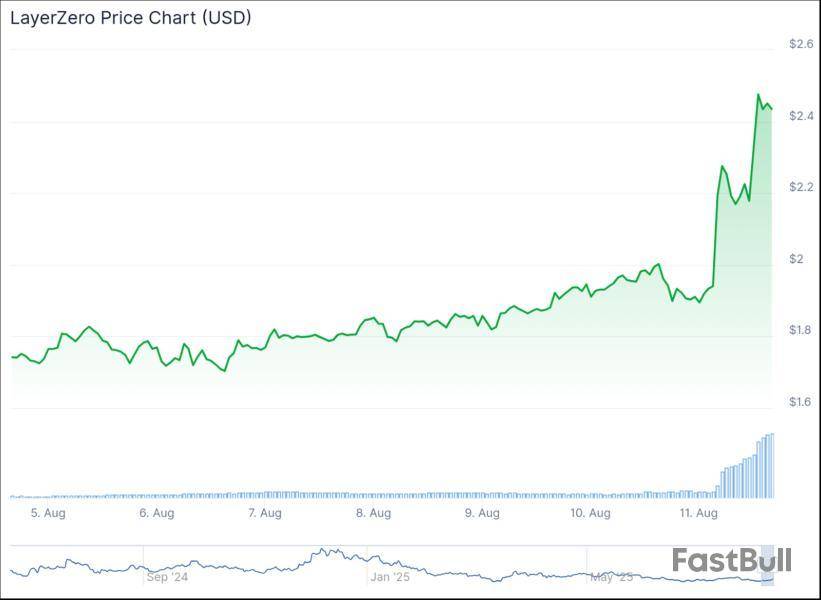

STG, ZRO tokens rise on plan

The tokens tied to the platforms both gained double-digit percentage points on the day on LayerZero’s proposal.

LayerZero’s token has gained over 23% in the past 24 hours to trade at $2.44, making it one of the biggest gainers in the crypto market in the past day, per CoinGecko.

Stargate’s token, meanwhile, saw 24-hour gains of around 16.5% to just over 19 cents, extending its rally over the past week.

Both tokens are down significantly from their peaks, with ZRO down 67% from its December high of $7.47, while STG has fallen over 95% from its mid-2022 peak of $4.14.

LayerZero boss hails plan as “unified direction”

LayerZero co-founder and CEO Bryan Pellegrino posted on X that he wants “to move faster, ship faster.”

He said the proposal would “help Stargate execute on its ambitious roadmap while creating a single stack that anybody integrating within the [LayerZero] ecosystem can adopt.”

He added it would also give STG holders “a more liquid token” and would give the Stargate community “a clear path forward with significantly more resources and a single unified direction.”

STG tokenholders say plan “not attractive at all”

However, the deal saw generally negative feedback from holders of Stargate’s token, with some saying they understand the need for a swap, but the deal pitched is unfair and won’t allow for staking.

“The offers are not attractive at all. They do not offer any advantages to STG holders, and STG’s revenue-sharing system is not available on ZRO. We will only be able to hold on to our tokens,” one Stargate user wrote.

The user added that LayerZero “needs to raise its offer significantly,” while others said the offer was “fundamentally flawed” and agreed the offer should be higher, possibly a 1:1 token swap, due to “the amount of revenue Stargate makes and the potential for the protocol.”

Another user said they saw the need for the swap as “managing two tokens is a pain and causes more distractions than necessary,” while another said it “makes sense to merge” the tokens, but agreed the deal was unfair as it meant STG holders would no longer be able to stake their tokens for rewards.

Stargate said the proposal will be available for comment for the next seven days. The platform’s decentralized autonomous organization, made up of tokenholders, is then set to vote on the deal.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up