Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum prices have skyrocketed almost 20% over the past 24 hours to reclaim $2,200 in a two-month high.

ETH tapped $2,234 during Friday morning trading in Asia as it climbed from below $1,900 on Thursday. The asset has now gained 26% over the past fortnight and more than 50% over the past month, recovering from a dump to bear market lows around $1,400.

The big move comes as the long-awaited Pectra update wentlive on mainneton May 7.Ethereum’s Best Day Since 2021

According to CoinGlass, more than $280 million in short ETH positions wereliquidatedover the past 24 hours. It’s Ethereum’s best day since 2021, wrote Bankless on May 9; however, the asset has had several similar spurts of action over the past year.

Between May 20 and 22 last year, ETH surged 23% from $3,070 to just below $3,800, and between November 6 and 10, it pumped almost 30% from $2,400 to over $3,100, so these moves are not unusual.

Analysts are starting to turn bullish with longer-term predictions for ETH now that the asset has bounced off the bottom. ‘MMCrypto’ saw a target of $3,700 should the asset return to the top of this wedge pattern.

ETHEREUM TARGET: $3’700 pic.twitter.com/hNJkh4AajX

— MMCrypto (@MMCrypto) May 9, 2025

Web3 growth manager Cas Abbé commented that Ethereum’s Pectra upgrade has been really successful. Hours after the upgrade, ETH annual inflation dropped from 0.7% to -0.5% as issuance turned deflationary again, he observed.

Also, the daily ETH burn has doubled since the Pectra Upgrade, “which is the reason behind ETH’s pump,” he said before adding:

“We all know that ETH has been underperforming this entire cycle, due to a lack of demand and increasing supply. If ETH burn increases, the supply issue will be resolved, and it will eventually attract demand too. It feels like $3K ETH in Q2 is coming.”

Ethereum’s Pectra Upgrade has been really successful.

Hours after the Pectra Upgrade, ETH annual inflation dropped from 0.7% to -0.53%.

In simple terms, ETH has turned deflationary again.

Also, daily ETH burn has doubled since Pectra Upgrade, which is the reason behind ETH’s… pic.twitter.com/5uOJ4uLPMw

— Cas Abbé (@cas_abbe) May 8, 2025

Stablecoin and Tokenization Gold Rush

The stablecoin and tokenization gold rush is going to usher in a huge wave of net new adoption for crypto over the coming years, said Ethereum educator Anthony Sassano, who added.

“At the center of it all is Ethereum – the home of stablecoins and tokenized real-world assets.”

Ethereumis the industry standard for real-world asset tokenization. According to RWA.xyz, Ethereum has a 58% market share for tokenized assets with almost $7 billion on-chain, excluding stablecoins.

When stablecoins are included, Ethereum is still the industry leader with a 55% RWA market share, followed by Tron with almost 30%, but this is primarily due to Tether.

American fast food outlet Steak ‘n Shake has announced it will begin accepting Bitcoin as payment at all locations starting on May 16.

The firm said on X on May 9 that it was making the cryptocurrency available to more than 100 million customers, adding that “the movement is just beginning,” before signing off as “Steaktoshi.”

The fast food chain initially hinted at accepting Bitcoin in March when it posted “Should Steak ‘n Shake accept Bitcoin?” on social media.

The tweet drew the attention of the crypto community and Bitcoin proponents such as Jack Dorsey, who rapidly replied with a “yes.”

The firm has built momentum since then with Bitcoin-themed marketing, Tesla promotions, and visual hints on its social media feeds.

Related: How to buy food with Bitcoin?

The acceptance of Bitcoin represents a significant development in mainstream crypto adoption, as few restaurant chains have moved beyond limited pilot programs to full-scale payments.

Cointelegraph reached out to Stake ‘n Shake for more details but did not get an immediate response.

Crypto for fast food

Stake ‘n Shake will join a growing number of fast food chains that accept crypto payments.

Since 2022, Chipotle has accepted almost 100 different cryptocurrencies via Flexa, including Bitcoin, Ether and Solana .

One of the earliest adopters of crypto payments is Subway, which has piloted Bitcoin payments as far back as 2013 at select franchises.

KFC offered a “Bitcoin Bucket” promotion in Canada in 2018, allowing purchases with BTC, while McDonald's accepts Bitcoin in Lugano, Switzerland, as part of a local crypto initiative.

Burger King accepted crypto gift cards and direct crypto payments in select countries like Germany, the Netherlands, and Venezuela. In September, Donald Trump used Bitcoin to buy burgers at a New York City bar.

Pizza Hut became one of the first mainstream outlets to accept BTC in El Salvador, where it was made legal tender in 2021.

The first-ever Bitcoin transaction was made to buy fast food by Laszlo Hanyecz on May 22, 2010, which later became the famous Bitcoin Pizza Day. He paid 10,000 BTC for two pizzas, worth $40 at the time. Today, those pizzas would be more than a billion dollars.

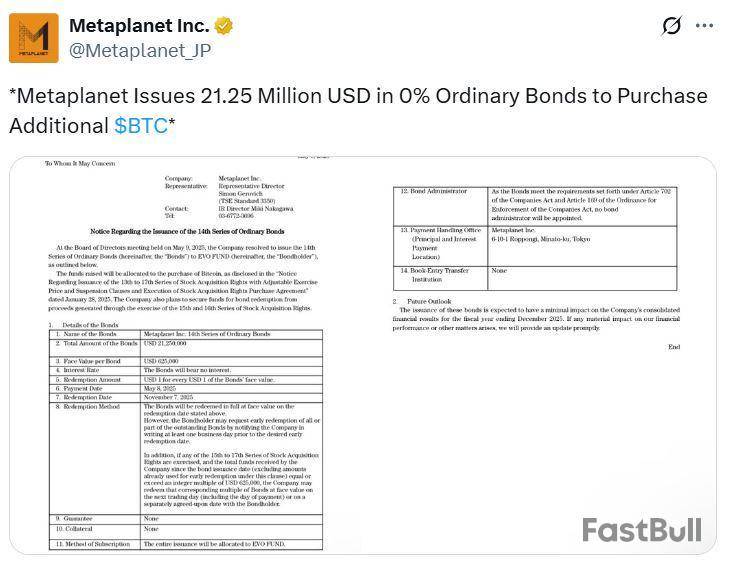

Fresh off its most recent Bitcoin purchase, Japanese investment firm Metaplanet is raising more funds through another bond issue to expand its growing crypto treasury.

Through a $21.25 million issue of “0% Ordinary Bonds,” the firm said in a May 9 statement that the “funds raised will be allocated to the purchase of Bitcoin.”

Zero-coupon bonds don’t offer any interest to the holder. Most of the time, they are issued at a steep discount from their normal value, and when they mature, the holder receives the full value.

Following a board of directors meeting, the firm said it will issue a 14th Stock Acquisition Rights to EVO Fund, an investment management firm in the Cayman Islands, with a redemption date of Nov. 7.

At current prices, Metaplanet could buy 206 Bitcoin if it raises the full $21.25 million, according to CoinGecko. The firm first flagged plans to buy Bitcoin last April.

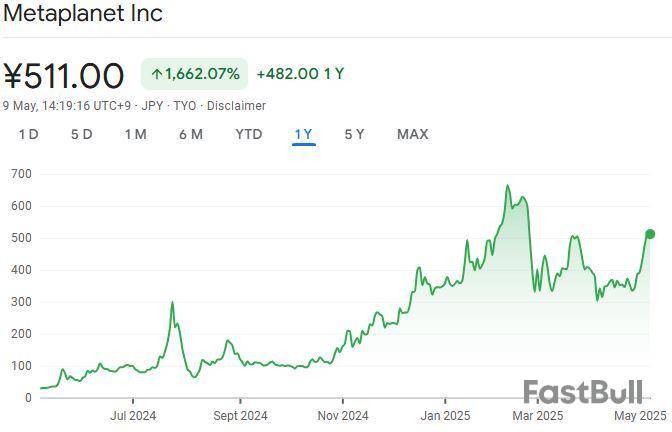

BitcoinTreasuries.NET shows Metaplanet is Asia’s largest public corporate holder of Bitcoin and ranks 11th globally.

Metaplanet’s stock (3350T) has shot up over 1,600% in the last year and is trading for 511 Japanese yen ($3.50), according to Google Finance.

Metaplanet just keeps buying Bitcoin

On May 7, the Tokyo-listed firm disclosed that it spent $53.4 million acquiring 555 Bitcoin at an average price of $96,134. The company now holds 5,555 BTC, purchased for $481.5 million at an average price of $86,672.

Metaplanet also announced on May 7 the issuance of another $25 million in zero-coupon ordinary bonds to fund more Bitcoin buys

On May 1, Metaplanet said it would launch a wholly owned US subsidiary, Metaplanet Treasury, based in Florida. It plans to raise $250 million to further its Bitcoin strategy and tap the US capital markets.

Meanwhile, a growing number of companies have decided to add Bitcoin to their balance sheets, following in the steps of Michael Saylor’s company, Strategy, formerly MicroStrategy.

Strive Asset Management announced on May 7 that it will transition into a Bitcoin treasury company. Meanwhile, video game retailer GameStop Corporation (GME) finished a convertible debt offering on April 1 that raised $1.5 billion, with some proceeds earmarked for buying Bitcoin.

Ripple CEO Brad Garlinghouse has taken to the X social media network to urge U.S. senators to pass pivotal stablecoin legislation.

"The sooner that the US can pass workable, clear rules, the faster it reaps the benefits of this technology," he said.

Garlinghouse has noted that stablecoins are currently "exploding" globally based on the sheer number of announcements across crypto and traditional finance.

As reported by U.Today, the GENIUS Act, which is meant to create a clear regulatory framework for stablecoins, failed to pass a procedural hurdle in the Senate on Thursday in order to be able to advance to a full vote.

Arizona Senator Ruben Gallego claimed that the Democrats did not have enough time to familiarize themselves with the proposed changes, which is why the bill did not get enough votes to meet cloture. Some Republican senators, including libertarian Rand Paul, also voted against the high-stakes stablecoin bill.

It is likely that a new version of the bill will be considered by senators next week.

In a statement reposted by Garlinghouse, Treasury Secretary Scott Bessent stated that the bill presented a "once-in-a-generation opportunity" to expand the dominance of the U.S. dollar. Bessent has warned that cryptocurrency innovation could move offshore.

Galaxy CEO Mike Novogratz has stressed that it is "imperative" for the Senate to pass stablecoin legislation, stressing that it should not be partisan.

Bitcoin (BTC), the market’s leading cryptocurrency, has surpassed the $100,000 mark for the first time since February, driven by a notable shift in President Donald Trump’s tariff policies, which sparked renewed optimism in the crypto market.

Bitcoin Only 6% Off Its All-Time High

Over the past months, aggressive tariff strategies implemented by Trump negatively impacted cryptocurrency prices, with Bitcoin experiencing a significant correction. The digital asset dropped to as low as $74,000, marking a 25% decline from its record high of $109,000 reached in January.

However, the President’s decision to pause his so-called “tariff war” has led to a remarkable rebound in crypto prices boosted by a $6 billion trade deal with the UK announced on Thursday.

In the thirty-days time frame, the market’s largest cryptocurrency has recorded a staggering 31% price surge, positioning it just 6.7% below its all-time high. Antoni Trenchev, co-founder of the crypto exchange Nexo, remarked:

Bitcoin has not only reclaimed $100,000 for the first time in three months but has also reaffirmed its status as the ultimate bouncebackable asset as the prospects for US trade deals brighten.

Other major cryptocurrencies have also benefited from this shift. Ethereum (ETH) has regained the $2,000 mark for the first time since late March, experiencing a 12% surge in just 24 hours, while Dogecoin (DOGE) followed closely with an 11% increase.

Trenchev pointed out that Bitcoin’s recent performance is bolstered by a supportive pro-crypto administration and increased buying interest from spot-exchage-traded fund (ETF) investors. He noted that Bitcoin’s outperformance against US equity benchmarks in 2025 reinforces its status as a resilient and safe-haven asset.

Analysts Warn Of Challenges Ahead Amid Global Uncertainty

Despite the current bullish sentiment, Trenchev cautioned that Bitcoin’s resilience will be tested amid an uncertain global macroeconomic and geopolitical environment.

Rising tensions between India and Pakistan pose potential risks, while the US Federal Reserve (Fed) remains cautious about cutting interest rates amid concerns over unemployment and inflation.

Since the introduction of the tariff policy in early April, Bitcoin has gained more than 16%, while spot gold has risen nearly 6%, and the S&P 500 has seen only marginal gains, illustrating Bitcoin’s growing appeal as a hedge against traditional market fluctuations.

In order to confirm its upward trend, analysts predict that Bitcoin will need to break above its January high of over $109,350. According to Trenchev, the cryptocurrency’s price might stay between $70,000 and $109,000 for the months following the election.

Nevertheless, he emphasized that reclaiming the $100,000 milestone is a significant achievement for Bitcoin. “Buying during peak fear—just last month Bitcoin was languishing around $74,000—can be exceptionally lucrative,” he concluded.

Featured image from DALL-E, chart from TradingView.com

Bitcoin mining and energy infrastructure firms MARA Holdings, CleanSpark, and Hut 8 have released their financial reports for the first quarter of 2025. MARA and CleanSpark’s reports highlighted significant revenue growth despite substantial net losses.

The former saw a 30% year-over-year revenue increase, while CleanSpark’s revenue surged by 62.5%. However, Hut 8’s revenue declined by 58.1%.

MARA and CleanSpark Report Strong Revenue Growth Amid Net Losses

In their latest shareholder letter, MARA Holdings revealed that its Q1 2025 revenue reached $213.9 million, up from $165.2 million in Q1 2024. The revenue growth was driven by a 77% increase in the average Bitcoin price, despite a 21.8 million decrease in Bitcoin production due to the halving event.

Furthermore, the company’s Bitcoin holdings expanded dramatically to 47,531. This marked a 174% increase from the previous year. The holdings were valued at approximately $3.9 billion.

“We produced an average of 25.4 BTC each day during the quarter compared to 30.9 BTC each day in the prior year period, which resulted in 525 less BTC in the first quarter of 2025 as compared to the prior year period. Despite lower production, we saw an 81% increase in number of blocks won,” the letter read.

The company’s net loss was $533.4 million. This represented a 258% decrease in income, primarily attributed to a decline in Bitcoin prices at the quarter’s end.

MARA is currently focused on transforming itself into a vertically integrated digital energy and infrastructure company. The company is prioritizing strategic growth by expanding its operations with low-cost energy solutions and efficient capital deployment, including investments in renewable energy sources like a 114 MW wind farm in Texas.

“MARA is investing in and developing digital energy technologies, which can both improve the efficiency of our operations and diversify our revenue streams. From chips to cooling infrastructure and software, we’re building the systems that will power the next generation of high-performance, energy-efficient computing,” the company added.

Meanwhile, CleanSpark’s revenue performance was also strong. Revenue increased year over year from $111.8 million to $181.7 million. Bitcoin production grew to 1,957 coins, generating an average revenue per coin of $92,811.

At the same time, the company reported a net loss of $138.8 million, a stark contrast to the $126.7 million income in Q1 2024. Adjusted EBITDA dropped from $181.8 million in Q1 2024 to a loss of $57.8 million.

“As other players shift direction or decelerate growth, CleanSpark has doubled down on being the only remaining pure-play, public bitcoin miner. We believe that focus matters now more than ever, and we remain on track to reach our 50 EH/s target during June, all while growing our bitcoin treasury, strengthening the balance sheet, and prioritizing long-term stockholder value,” CEO Zach Bradford stated.

Additionally, as of March 31, 2025, CleanSpark’s total assets amounted to $2.7 billion, with $97.0 million in cash and $979.6 million in Bitcoin. The company’s total current assets were valued at $947.5 million. The working capital was $838.2 million.

Hut 8 Q1 2025 Revenue Dips 58.1%

In contrast to MARA Holdings and CleanSpark’s revenue performance, Hut 8’s revenue declined in Q1 2025. The report highlighted a revenue of $21.8 million, down from $51.7 million in the same period last year.

The company recorded a net loss of $134.3 million. In Q1 2024, it generated a net income of $250.7 million. Adjusted EBITDA declined sharply from a profit of $297.0 million last year to a loss of $117.7 million this year.

Hut 8’s strategic Bitcoin reserve grew to 10,264 BTC. The reserve’s market value stood at $847.2 million as of quarter end.

The total energy capacity under management reached 1,020 megawatts. Additionally, Hut 8 upgraded its ASIC fleet, resulting in a 79% increase in hashrate and a 37% improvement in fleet efficiency.

BeInCrypto reported that the firm also launched American Bitcoin, a subsidiary focused on industrial-scale Bitcoin mining and accumulation.

“As reflected in our results, the first quarter was a deliberate and necessary phase of investment. We believe the returns on this work will become increasingly visible in the quarters ahead,” CEO of Hut 8, Asher Genoot, remarked.

Another Bitcoin mining firm, Core Scientific, also released its fiscal report on May 7. Although the firm experienced a 55.7% revenue loss, its net income increased by 175.6%. Thus, the financial outcomes for Q1 2025 illustrate the dual challenges and opportunities within the sector.

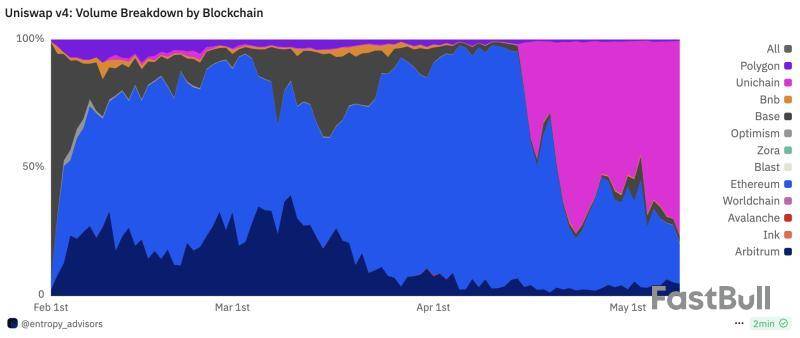

Unichain, Uniswap's native Layer 2 blockchain, has emerged as the dominant chain for Uniswap version 4, surpassing Ethereum in transaction volume.

A Dune Analytics dashboard by Entropy Advisors shows that Unichain has overtaken Ethereum to become the leading chain for Uniswap v4, with a market share of about 75% at the time of writing. Ethereum's share, by contrast, is below 20%. This shift began accelerating in mid-April 2025, driven by Unichain's growth and strategic incentives.

Notably, Ethereum remains the dominant chain for Uniswap v3 in terms of trading volume, and that version is currently more widely used by end users.

Uniswap v4, launched in January 2025, is the DEX's latest version and introduces hooks for custom code execution, dynamic fees, gas savings, and native ETH support. Unichain primarily focuses on Uniswap v4 and does not operate Uniswap v3 as a core component of its ecosystem.

Uniswap v4: Volume Breakdown by Blockchain. Source: Dune Analytics (via entropy_advisors)

Unichain's dominance in v4 is also attributed to a $45 million liquidity incentive program, which has driven a sharp increase in active addresses and value locked. According to DeFiLlama, it is currently the third-largest Layer 2 rollup by total value locked, at $800 million.

Unichain, built on the Optimism Superchain, offers roughly 95% lower transaction costs than Ethereum's Layer 1. It features one-second block times, with plans to introduce 250ms sub-blocks to achieve near-instant transactions.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up