Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US-listed spot Ethereum ETFs listed in the US pulled in more than $1 billion in net inflows on Monday, their highest daily total since debut, according to data tracked by Farside Investors.

BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH) also posted their largest single-day inflows, drawing about $640 million and $277 million, respectively. Except for Invesco’s fund, all other Ether ETFs posted positive results.

BlackRock has maintained its top position, with assets under management exceeding $13 billion as of August 11.

Monday’s gains pushed Ethereum funds into a five-day winning streak. Their longest winning streak on record took place between July 3 and July 31.

The strong performance came as ETH hovered around $4,300, its highest level since December 2021. The digital asset is now around 12% away from its all-time high of $4,868 set in November 2021 during the bull run market, TradingView data shows.

Ethereum's price surge comes amid aggressive accumulations from publicly traded companies, such as Tom Lee's BitMine and SharpLink Gaming.

Furthermore, on Monday, Fundamental Global, soon to be renamed FG Nexus, which recently filed a $5 billion shelf registration with the SEC to expand its Ethereum accumulation strategy, announced it had acquired 47,331 ETH as part of its ambition to take a 10% stake in the network.

BNB price is correcting gains from the $825 zone. The price is now facing hurdles near $815 and might aim for a fresh surge in the near term.

BNB Price Holds Support

After a steady increase, BNB price failed to clear the $830 zone. There was a downside correction below the $820 and $815 levels, like Ethereum and Bitcoin.

The price even dipped below $800 and tested $792. A low was formed at $792 and the price is now attempting a fresh increase. There was a move above the 50% Fib retracement level of the downward move from the $827 swing high to the $792 low.

The price is now trading above $810 and the 100-hourly simple moving average. There is also a key contracting triangle forming with support at $804 on the hourly chart of the BNB/USD pair.

On the upside, the price could face resistance near the $815 level or the 61.8% Fib retracement level of the downward move from the $827 swing high to the $792 low. The next resistance sits near the $820 level. A clear move above the $820 zone could send the price higher.

In the stated case, BNB price could test $832. A close above the $832 resistance might set the pace for a larger move toward the $840 resistance. Any more gains might call for a test of the $850 level in the near term.

Another Decline?

If BNB fails to clear the $815 resistance, it could start another decline. Initial support on the downside is near the $804 level. The next major support is near the $800 level.

The main support sits at $792. If there is a downside break below the $792 support, the price could drop toward the $780 support. Any more losses could initiate a larger decline toward the $768 level.

Technical Indicators

Hourly MACD – The MACD for BNB/USD is gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BNB/USD is currently above the 50 level.

Major Support Levels – $804 and $792.

Major Resistance Levels – $815 and $820.

Major cryptocurrency whales are offloading their Solana holdings, triggering growing concerns within the market.

This surge in selling activity comes amid Solana’s underwhelming performance, as the altcoin continues to lag behind the broader global cryptocurrency market.

Solana’s Price Struggles as Whales Dump Millions in SOL

Lookonchain highlighted that CMJiHu deposited 96,996 SOL worth around $17.45 million to exchanges. Additionally, 5PjMxa deposited 91,890 SOL valued at nearly $15.98 million to Kraken. Lastly, HiN7sS transferred 37,658 SOL worth 6.73 million to Binance, realizing a profit of $1.63 million.

The pattern of sell-offs isn’t new. Over the weekend, Galaxy Digital moved 224,000 SOL valued at $41.12 million to Binance and Coinbase. Additionally, BeInCrypto reported last week that the digital asset financial services firm unstaked 250,000 SOL, valued at around $40.7 million.

The firm then transferred it to Binance. Similarly, another whale has been unstaking significant portions of their Solana holdings. The selling pressure coincides with a lack of investor enthusiasm, as evidenced by the performance of the REX Osprey Solana exchange-traded fund.

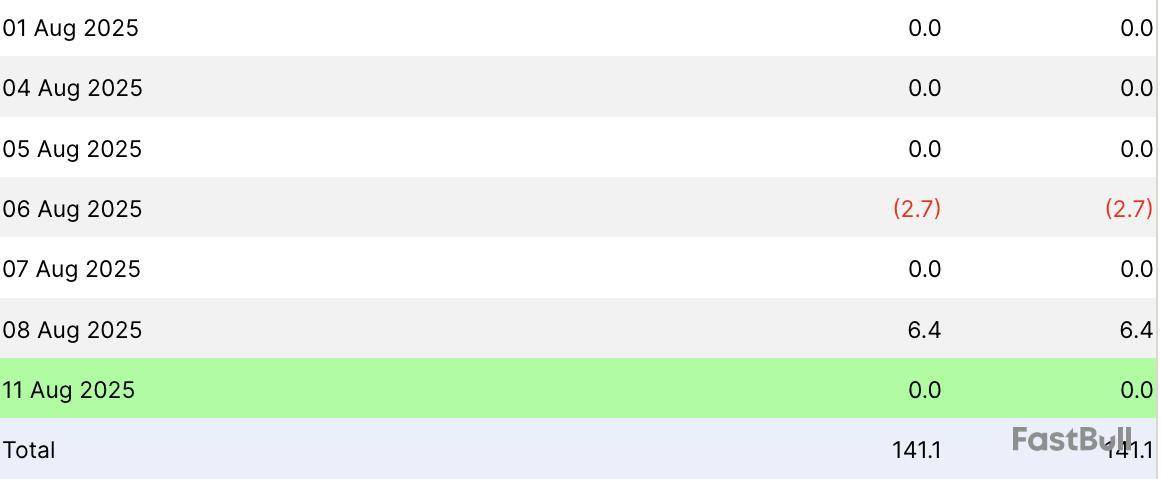

According to data from Farside Investors, the ETF recorded zero net flows for most of August’s trading sessions, with only one day of a positive flow.

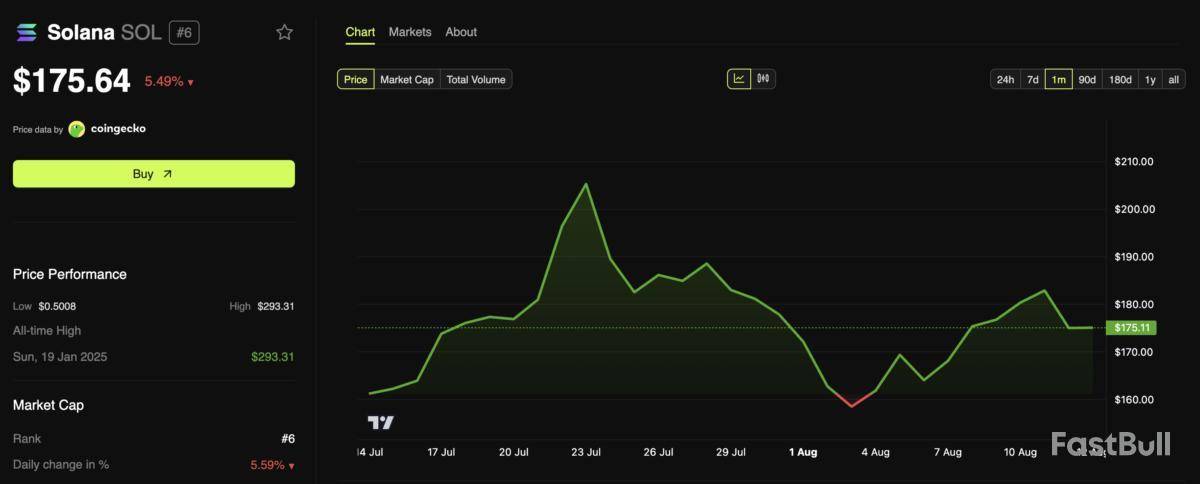

At the same time, SOL’s price performance has been lackluster. BeInCrypto Markets data revealed that the altcoin has struggled to approach its record highs, still remaining 40% below the all-time high (ATH).

In contrast, other cryptocurrencies such as ETH have experienced significant rallies, with the latest uptrend pushing its price to levels not seen since 2021. Furthermore, SOL has slipped 5.49% over the past day. At press time, it was trading at $175.64.

Positive Shifts for Solana as Whales Continue Offloading

Nonetheless, not all is bad for Solana. Some positive developments have emerged. For instance, OSL HK, a regulated cryptocurrency exchange, has announced that it will offer Solana trading to retail investors.

“We are pleased to announce that OSL HK will become the first exchange in Hong Kong to support Solana retail trading,” the announcement said.

Additionally, Jeff Bezos’ Blue Origin has begun accepting SOL, alongside Bitcoin , Ethereum, Tether , and USDC for spaceflight bookings, signaling growing mainstream adoption.

“Crypto is now a $4 trillion asset class, and the sky is the limit when it comes to its potential in the current payments ecosystem. We believe crypto and stablecoins are going to become an increasingly popular way for consumers to pay, particularly for high-end purchases, as both the consumer and merchant benefit financially from these transactions,” Alex Wilson, Head of Crypto at Shift4, stated.

The Solana ecosystem also saw a milestone with its meme token graduation rate surpassing 3%, reflecting increased activity.

While these developments show promise for Solana’s broader adoption, the ongoing whale sell-offs highlight the uncertainty surrounding the asset. It remains to be seen whether the whales will continue offloading their holdings or shift strategies, which will likely impact the token’s future trajectory.

The 'Stablecoin Summer' event takes place on August 12, 2025, with talks about syrupUSD’s growth and new products for earning yield. If these updates attract new users or investors, or if they make holding AAVE or ELX more rewarding, it could lead to a strong move in price. Many traders watch stablecoin projects for new ways to earn steady returns. But if the event does not show clear new benefits, there may be little impact. Key details are listed by Maple Finance here.

Maple@maplefinanceAug 11, 2025Tomorrow at 10am ET @MartindRijke will be live with @chainlink and Stablecoin leaders to cover:

- syrupUSD Growth Roadmap

- Potential for new Maple products

- Yield opportunities for Users, DAOs, and Treasuries

We'll see you there. https://t.co/4nCizh2gd9

Injective plans to reveal a new financial primitive on August 12, 2025. This could be a big step for the INJ ecosystem because it may give users new tools or markets not seen before. Recent news, like a possible ETF and digital asset treasury, already made interest in Injective higher. If this new primitive is useful and gets attention from more users, the price of INJ could move up fast. But if people do not like it or see little benefit, price changes might not be strong. Read more from their post here.

Zircuit will upgrade its mainnet with zkVM Prover Fork on August 25, 2025. This brings new technology to help the network become safer and more efficient. Investors may see this upgrade as a sign the team is building strong technology, which could push the ZRC price up if users and developers stay interested. However, if people do not see much change or value from this upgrade, or if there are problems after the fork, the price may not change much. Read more about the upgrade here.

Zircuit@ZircuitL2Aug 11, 2025The team has just completed the fork of Zircuit's testnet to use zkVM provers!

The upgrade went smoothly, and the network is progressing and finalizing as usual.

The same upgrade will be applied to the Zircuit mainnet on August 25 pic.twitter.com/bp5g0Ccz36

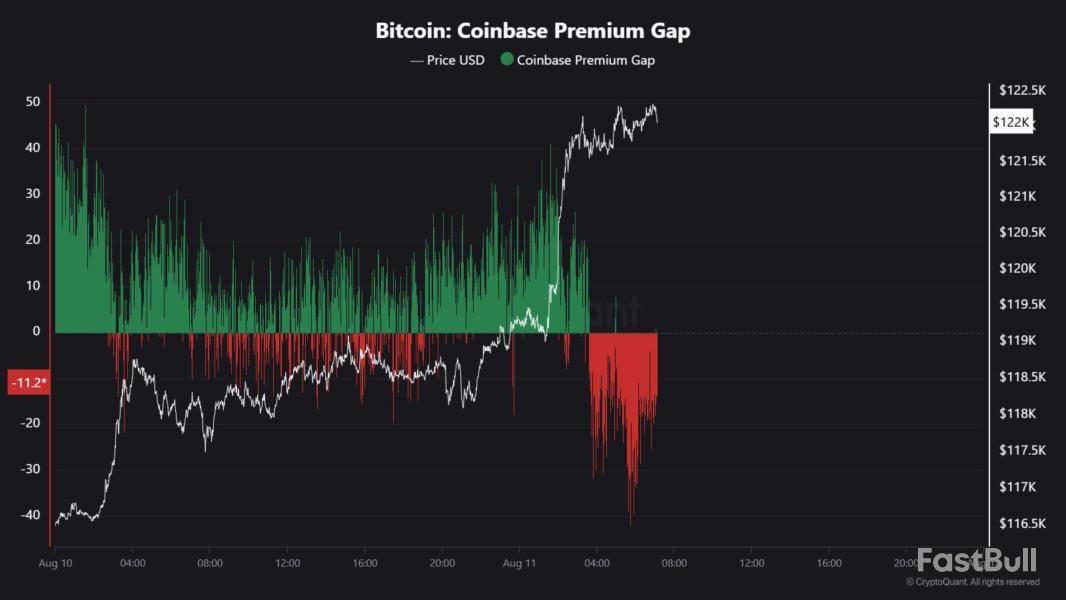

Bitcoin has seen a retrace back below the $120,000 level as data shows the Coinbase Premium Gap has dropped into the negative zone.

Bitcoin Coinbase Premium Gap Has Plummeted Into The Red Region

In a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the Bitcoin Coinbase Premium Gap. This indicator measures the difference between the BTC price listed on Coinbase (USD pair) and that on Binance (USDT pair).

The former cryptocurrency exchange is popularly used by American investors, especially the large institutional entities, while the latter is the destination of the global investors. As such, the Coinbase Premium Gap tells us about how the buying or selling behaviors differ between US-based and foreign whales.

When the metric has a positive value, it means the cryptocurrency is going for a higher price on Coinbase than Binance. Such a trend suggests the users of the former are applying a higher buying pressure or lower selling pressure as compared to the traders of the latter.

On the other hand, the indicator registering a negative value implies the American investors may be selling more relative to global investors, which has brought the price on Coinbase lower than on Binance.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past day:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap was above the zero mark when BTC’s recovery run to the $122,000 level occurred, indicating that US-based whales were buying and helping fuel the surge.

While BTC was at its high, however, the indicator’s value saw a sharp reversal and plunged into the negative zone. What has followed these red levels in the metric is a retrace for the coin to prices below $120,000.

Thus, it seems the trend in the Coinbase Premium Gap foreshadowed the price action. This pattern is something that has been witnessed a lot since the start of 2024, as American institutional entities have been in the driving seat.

Given the price action of the past day, it seems the influence of these investors remains strong, so the Bitcoin Coinbase Premium Gap could be worth keeping an eye on, as where it will go next may also carry hints about the cryptocurrency’s future trajectory.

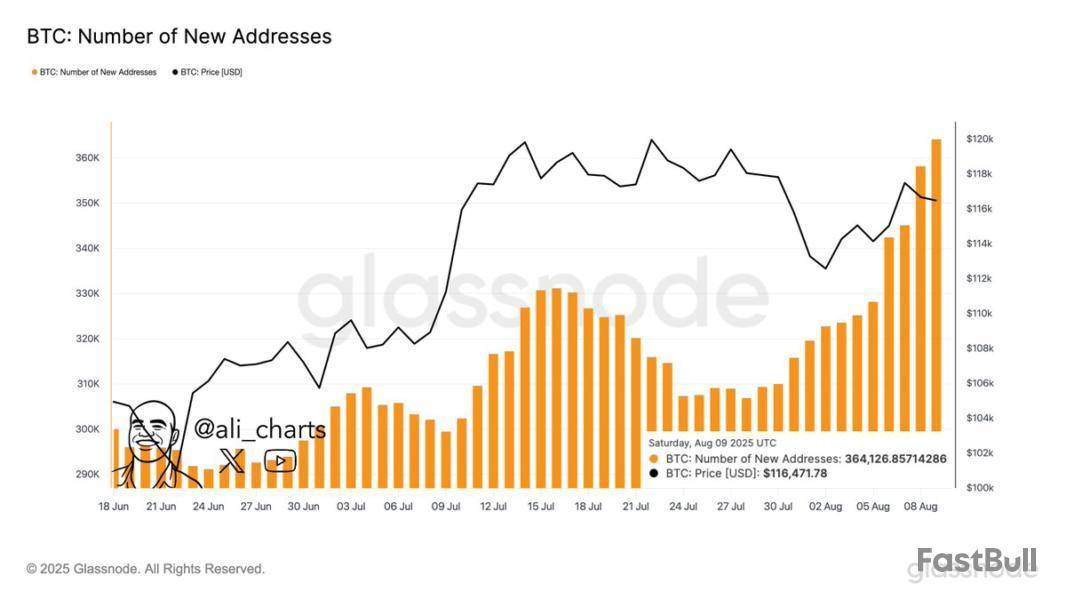

In some other news, address generation on the BTC network has reached its highest level in a year, as analyst Ali Martinez has pointed out in an X post.

From the chart, it’s apparent that the daily total number of new addresses on the Bitcoin blockchain has spiked to a high of 364,126.

BTC Price

At the time of writing, Bitcoin is trading around $119,300, up around 5% over the past week.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up