Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Spot Silver Continued Its Decline, With Intraday Losses Widening To 15%, Currently Trading At $74.86 Per Ounce

The Thailand Futures Exchange (TFEX) Has Announced A Temporary Suspension Of Online Trading In Silver Futures

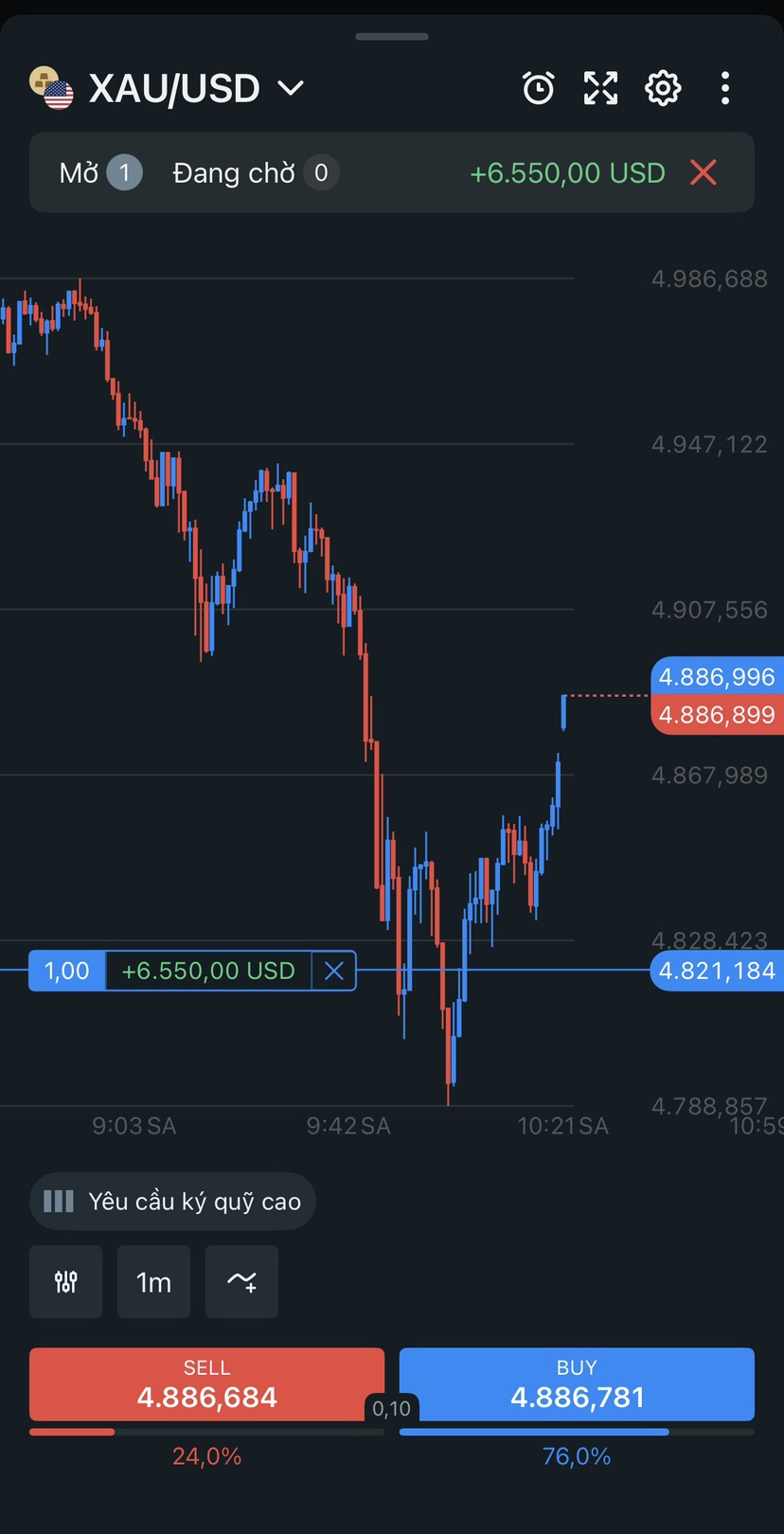

Spot Gold Fell Below $4,880 Per Ounce, Down 1.71% On The Day. New York Gold Futures Fell Below $4,900 Per Ounce, Down 1.13% On The Day

Spot Gold Fell Below $4,900 Per Ounce At One Point, But Has Since Rebounded To $4,932 Per Ounce, Narrowing Its Daily Decline To 0.69%

Japan Prime Minister Takaichi: TSMC's Kumamoto Chip Factory Has A Huge Economic Impact, And We Hope To Establish A Win-win Cooperative Relationship With TSMC

Japan Prime Minister Takaichi: 3-Nm Chips Used In Autonomous Vehicles And Robotics Have Great Significance For For Economic Security

Gold Association - China's 2025 Gold Consumption Down 3.57% Year-On-Year To 950.096 Metric Tons

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks

No matching data

View All

No data

Ethereum core developers have officially named the network’s next upgrade after Glamsterdam as "Hegota," further defining the network’s 2026 development cycle as it continues its twice-a-year release cadence.

Hegota blends the execution layer’s "Bogota" upgrade, following the tradition of naming updates after Devcon host cities, with the consensus layer’s "Heze", named after a star. Developers said the headliner EIP for Hegota will not be selected until February, while work on Glamsterdam — Ethereum’s first scheduled upgrade of 2026 — continues.

The naming decision was made during the All Core Developers Execution (ACDE) call on Thursday, the final meeting of the year. ACDE calls are set to resume on Jan. 5, when developers aim to finalize Glamsterdam’s scope.

2026 release cycle

The naming comes at a moment when Ethereum’s upgrade process is settling into its intended rhythm.

With Pectra and Fusaka shipped in 2025, the network has effectively begun its twice-annual upgrade schedule. The approach intends to make improvements more iterative, predictable, and narrowly scoped, reducing the need for rare, sweeping overhauls.

Based on the established cadence, Glamsterdam would likely land in the first half of 2026, with Hegota following later in the year.

While Hegota itself remains in early planning, its eventual upgrade is expected to draw from long-running roadmap goals and any overflow items deferred from Glamsterdam. Particularly, Verkle Trees — a prerequisite for fully stateless clients — have been frequently cited as a candidate for inclusion in one of the 2026 hard forks. However, no formal selection has been made.

Other areas under discussion include state and history expiry mechanisms and additional execution-layer optimizations. Notably, state expiry conversations may garner more attention following a recent batch of proposals from the Ethereum Foundation.

As The Block previously reported, the EF’s Stateless Consensus team warned that state bloat — the steady expansion of Ethereum’s stored data — is becoming a growing burden for node operators.

Glamsterdam focuses on Layer 1 efficiency and builder decentralization

Meanwhile, developers continue to refine Glamsterdam’s hard fork. Proposals still under consideration include enshrined proposer-builder separation, or ePBS, intended to curb centralization in block building; block-level access lists, which aim to reduce state access bottlenecks; and gas repricings to better align EVM costs with resource usage.

More complex changes, such as reducing slot times, have already been pushed to later cycles. Any items that prove too ambitious for the timeline may roll into Hegota, with final decisions expected once calls resume in the new year.

A roadmap that stretches beyond 2026

Hegota's reveal also situates Ethereum within its broader, multi-phase technical roadmap. Back in September 2022, developers executed the first part of this path, dubbed The Merge, which transitioned Ethereum from a proof-of-work blockchain to a proof-of-stake network.

The following components have been framed as The Surge, The Verge, The Purge, and The Splurge.

The Surge focuses on achieving massive rollup-driven scaling. Fusaka advanced this goal through PeerDAS and expanded blob capacity, while Glamsterdam aims to improve Layer 1 performance further to better support rising rollup activity without creating new centralization pressures.

Next, The Verge centers on statelessness and light-client verification. Potential Verkle integration in Hegota aligns directly with this phase by reducing node storage requirements and enabling broader network participation. Later phases — The Purge and The Splurge — address historical cleanup and long-term protocol simplification.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

LONDON, Dec. 19, 2025 /PRNewswire/ -- Bybit, a leading global cryptocurrency exchange with more than 80 million users worldwide, today announced its official launch in the United Kingdom. The launch makes Bybit's platform available to UK users, offering access to Spot trading on 100 pairs and P2P, and supported by deep global liquidity and robust operational standards.

Crypto adoption in the UK continues to grow rapidly, with the Financial Conduct Authority estimating that 8% of UK adults now own digital assets. This rising engagement underscores user expectations for reliable, high-quality platforms. Bybit's initial products are designed to support reliable access and offer users flexibility in how they engage with digital assets.

"Our goal is to give UK users reliable access to global opportunities in digital assets," said Mykolas Majauskas, Senior Director of Policy at Bybit. "The UK is home to one of the most sophisticated financial ecosystems in the world, and its clear regulatory direction makes it an ideal environment for responsible innovation. In the months ahead, we aim to embody this innovative spirit by introducing new products tailored to the needs of UK users, always within a framework that prioritises transparency, and compliance."

Bybit's UK operations follow rigorous AML and KYC standards designed to enhance platform integrity, and all services comply with local financial-promotion requirements.

This product carries significant investment risk, including the possibility of losing the full amount invested. Protection mechanisms may not apply in the event of an issue. Please take 2 mins to learn more to review the further information.

About Bybit

Bybit is a leading cryptocurrency exchange by trading volume, serving a global community of over 80 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a more user-centered, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its global custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at http://www.bybit.com/en-gb.

In the European Economic Area, Bybit EU GmbH operates under MiCAR permissions, which allow services to be offered across the EEA.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit's Communities and Social Media

Disclaimer

Cryptoassets are high risk and highly volatile. Cryptoasset liquidity is not guaranteed, and you may find it difficult to buy or sell cryptoassets when you want to. You could lose all the money you invest and past performance is not a reliable guide to future results. Bybit provides services in the UK through arrangements designed to meet applicable FCA financial promotion rules and is not authorised, regulated, or registered by the FCA. Cryptoasset services are not covered by the Financial Ombudsman Service or the Financial Services Compensation Scheme. Make sure you understand how cryptoassets work and that you can afford the risk of loss. Tax may apply to any gains. This information is for general information only and does not constitute investment, tax, or legal advice. Seek independent financial advice if you are unsure.

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Approved by Archax 18/12/2025

Concerns over quantum computing are weighing on Bitcoin’s price and slowing some investment flows, amid a sharp divide between developers and many investors.

Developers Call Threat Distant

According to Bitcoin developer Adam Back of Blockstream, quantum machines remain far from able to break Bitcoin’s protections. He said the tech is still “ridiculously early” and that research hurdles persist.

Back expects no real threat within the next decade and argued that even if parts of Bitcoin’s cryptography were compromised, the network would not automatically be emptied.

Security, he noted, does not rest solely on encryption in a way that would allow mass theft on the blockchain.

Adam Back@adam3usDec 18, 2025i think the risks are short term NIL. this whole thing is decades away, it’s ridiculously early and they have massive R&D issues in every vector of the required applied physics research to even find out if it’s possible at useful scale. but it’s ok to be “quantum ready” and

The Risk That Keeps Some Awake

Other voices in the community disagree. Jameson Lopp, a well-known Bitcoin engineer, has warned about the worst-case outcome if quantum advances allowed attackers to break the ECDSA signature scheme that secures many wallets.

In that scenario, forged signatures could be used to move funds, and user confidence might erode quickly. That warning has been repeated as a technical possibility, not as something imminent.

Jameson Lopp@loppSep 14, 2025How should we treat quantum vulnerable coins in a future where quantum computing becomes a threat? This panel from the Presidio Quantum Bitcoin Summit features myself, @theblackmarble, and @cryptoquick.https://t.co/jhr6hjLXru

Investors Worry, Capital Shifts

Nic Carter, a partner at Castle Island Ventures, told observers that it is “extremely bearish” when influential developers appear to dismiss any quantum risk outright.

He said the gap between investor concern and developer assessment is large. Reports have disclosed that some capital is being held back while large holders consider spreading risk into other assets.

Craig Warmke of the Bitcoin Policy Institute added that perceived quantum risk has already pushed some holders to reduce their Bitcoin positions.

Craig Warmke@craigwarmkeDec 18, 2025Quantum risk is stemming the flow of capital into bitcoin, and encouraging large holders to diversify out of bitcoin.

When non-technical people express concerns, they sometimes use technically incorrect language. It’s frustrating to see technical people dismiss concerns with an… https://t.co/MtSNY7Ivg3

Current Technology Falls Short

Most cryptographers agree quantum computers today are not powerful enough to crack Bitcoin’s cryptography. That assessment is widely reported by analysts who follow both fields.

vitalik.eth@VitalikButerinAug 27, 2025Metaculus’s median date for when quantum computers will break modern cryptography is 2040:https://t.co/Li8ni8A9Ox

Seemingly about a 20% chance it will be before end of 2030.

Still, the timeline is debated. Based on reports from researchers and public comments from industry figures like Vitalik Buterin, there is a measurable chance — about ~20% — that a machine capable of breaking today’s crypto could exist by 2030. That estimate has prompted calls for proactive steps.Calls For Preparedness Grow

Financial institutions and national programs, the reports say, are investing heavily in quantum work, and tools like AI are accelerating research in the field. As a result, many in the crypto world argue contingency plans should be ready well before any practical threat appears.

Suggestions include moving to quantum-resistant signature schemes and improving wallet practices so funds are not left exposed while upgrades take place. Some experts point out that banks and other big targets may face attacks earlier, which could give the crypto sector time to respond.

Featured image from Shutterstock, chart from TradingView

New York, USA, December 19th, 2025, Chainwire

Atomic Wallet, the self-custodial ecosystem trusted by over 15 million users, has announced a defining milestone: the official launch of Atomic Perps. Powered by the high-performance Hyperliquid network, this major update transforms the wallet into a comprehensive cross-platform trading terminal. Users can now access institutional-grade perpetual futures seamlessly across both Desktop and Mobile, bridging the gap between professional tools and on-the-go agility.

The End of "Fragmented" Trading

Until now, non-custodial traders faced a difficult choice: use powerful but stationary desktop dApps, or struggle with limited functionality in mobile browsers. Atomic Wallet ensures a seamless transition between platforms by delivering a unified experience.

Powered by Hyperliquid: Speed Meets Security

Atomic Perps is built on top of Hyperliquid, currently the most performant L1 for futures, to solve the "CEX Fatigue" driving users away from centralized exchanges. The integration offers:

About Atomic Wallet

Established in 2018, Atomic Wallet is a leading non-custodial decentralized wallet for managing over 1,000 cryptocurrencies. With a focus on security, anonymity, and user sovereignty, it provides a powerful interface for buying, staking, exchanging, and now—trading perpetual futures via Atomic Perps. Atomic Wallet serves a global community of millions, driving the mass adoption of decentralized finance.

Contact

Oliver

Atomic Wallet

media@atomicwallet.io

DUBAI, UAE, Dec. 19, 2025 /PRNewswire/ -- Bybit, the world's second-largest cryptocurrency exchange by trading volume, has released its latest Crypto Derivatives Analytics Report in collaboration with Block Scholes, highlighting persistently bearish sentiment across digital asset markets and little evidence of a year-end recovery rally.

The analysis reviews recent developments in spot and derivatives markets against a backdrop of easing U.S. monetary policy and weakening labor data. Despite the Federal Reserve delivering a third consecutive interest rate cut earlier in December and U.S. unemployment rising to 4.6 percent, crypto markets have remained under pressure. Bitcoin and Ether continue to trade well below their 2025 highs, with recovery attempts proving short-lived.

Key Highlights:

Perpetuals: Open interest across major tokens has remained largely unchanged, signaling subdued participation and limited position-taking. Bitcoin funding rates have stayed mostly positive, contrasting with broader measures of weak sentiment, while altcoin funding rates have been more volatile, reflecting sharper price swings and higher uncertainty.

Options: Options markets continue to price in downside risk. Volatility smiles across Bitcoin and Ether maintain a consistent skew toward out-of-the-money put options at all tenors, indicating sustained demand for downside protection. Although short-dated volatility expectations have eased from earlier extremes, the overall term structure remains elevated, suggesting caution extending into the new year.

Han Tan, Chief market analyst at Bybit Learn, said, "Cryptocurrencies remain largely rudderless for the time being, drawing scant motivation from the highest U.S. jobless rate since 2021 and the slowest core CPI growth in four years unveiled this week. Such tepid responses to recent macro events, coupled with listless signals from the crypto derivatives space, suggest digital assets are set to end the year on a whimper, a far cry from the rip-roaring enthusiasm that greeted the start of 2025."

For detailed insights, readers may download the full report.

#Bybit / #TheCryptoArk / #BybitLearn

About Bybit

Bybit is the world's second-largest cryptocurrency exchange by trading volume, serving a global community of over 70 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For more details about Bybit, please visit Bybit Press

For media inquiries, please contact: media@bybit.com

For updates, please follow: Bybit's Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Bitcoin may be approaching one of its most pivotal turning points in years. A leading valuation metric, the BTC Yardstick, currently reads -1.6 standard deviations below its long-term mean, signaling the pioneer crypto’s deepest undervaluation since the 2022 bear market low.

Historically, this level has coincided with major cycle bottoms, including 2011, 2017, 2020, and 2022.

BTC Yardstick Shows Strongest Undervaluation in Years

The Yardstick measures Bitcoin’s market price against the cost and power required to secure its network. This includes mining infrastructure and operational expenditures.

“BTC Yardstick at –1.6σ = Bitcoin is insanely undervalued. Other occurrences: 2022 bear market low, 2020 COVID crash bottom, 2017 pre-blow-off base, 2011 bear market bottom…All occurrences coincided with strong accumulation…Bottom was in as well!” wrote analyst Gert van Lagen in a post.

Whale Accumulation Hits Highest Levels in Over a Decade

Meanwhile, the undervaluation signal coincides with unprecedented accumulation activity. Over the past 30 days, BTC whales and large holders purchased 269,822 BTC, worth approximately $23.3 billion. According to Glassnode data, this is the largest monthly accumulation since 2011.

“Largest accumulation in 13 years. The 4-year cycle is dead; the Supercycle is here,” wrote crypto analyst Kyle Chasse.

The bulk of this buying occurred in wallets holding between 100 and 1,000 BTC. This suggests that both high-net-worth individuals and smaller institutions are positioning for a potential market rebound.

Market Sentiment After Bitcoin’s Minor Correction As Frustration Breeds Opportunity

Despite the record accumulation and undervaluation, Bitcoin’s price has faced downward pressure this year. According to Bloomberg ETF analyst Eric Balchunas, recent losses are modest relative to prior gains.

The launch of spot Bitcoin ETFs in early 2024 contributed to previous surges, driving the asset to its then-record highs near $69,000 in March 2024.

Overall, Bitcoin returned 155.42% in 2023 and 121.05% in 2024 before experiencing an 7% decline year-to-date. This suggests the current dip may be a natural correction after exceptional gains.

Analysts note that market rallies often begin not when hope is high, but when investors are weary.

“We are not scared anymore, we are tired. Tired of waiting. Tired of believing. But listen, market rallies don’t start when hope is high; it’s when people are tired, frustrated, and ready to give up,” wrote analyst Ash Crypto.

The convergence of historically low valuation, record whale accumulation, and declining leverage suggests that Bitcoin may be nearing another cyclical inflection point.

While timing remains uncertain, these indicators highlight a unique window of potential opportunity for long-term investors.

In a single day, about 844 million XRP were transferred between accounts. Such a large volume of payments does not occur in a vacuum, particularly not when the price is close to local lows. At a time when market sentiment regarding XRP has been severely damaged, on-chain activity is increasing. This contrast is where things get interesting.

XRP's lack of strengh

In terms of price, XRP remains objectively weak. The price is trading inside a declining channel and below important moving averages on the daily chart, which is still locked in a downward trend. Recovering higher levels has been repeatedly unsuccessful, and momentum has not yet turned bullish. RSI is in the lower range, indicating fatigue as opposed to strength. In technical terms, XRP is still under pressure. Chart by TradingView">

On-chain data, however, presents a different picture. An increase in payment volume to over 844 million XRP indicates capital movement and increased network usage rather than passive holding. In the past, long-term increases in transaction volume have typically preceded structural price changes rather than occurring right away.

XRP still needs to demonstrate its value in the near future. Although a bounce is conceivable, it is unlikely to be particularly strong unless the market as a whole becomes supportive. Stabilization, tighter ranges, slower downside and efforts to establish a base is the most likely near-term result. The argument for a relief move will be strengthened if transaction volume stays high and the price stays in its current range.

Long-term growth in on-chain payments may serve as the foundation for a recovery. Pricing does not immediately follow usage; it does so over time. The risk profile of XRP will significantly alter if these volume spikes become a pattern rather than an isolated incident.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up