Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

There is a “huge opportunity” for Ethereum to become a decentralized partner in solving current problems with artificial intelligence platforms, according to a former core Ethereum developer.

Ethereum’s “biggest mainstream moment is waiting in the wings with AI,” said Eric Connor on X on April 15.

While AI is on a fast track to reshape almost every aspect of our lives, it is “plagued by black-box models, centralized data silos, and privacy pitfalls,” Connor continued. However, these problems create an opportunity for Ethereum to shine, he said.

Ethereum offers transparency through verifiable smart contracts, decentralization against big tech monopolies, aligned incentives via token economies, and built-in micropayment infrastructure, he added.

Smart contracts can provide transparent records of AI model training processes and data sources, addressing the “black box” problem.

However, major AI players may resist open models “as they profit from secrecy and control,” he said. Demand for transparency, fairness, and security will only grow, and that’s where Ethereum “offers an alternative path,” he added.

By proactively building the tooling, research and real-world use cases, Ethereum can give AI developers a reason to embrace decentralized approaches, “and that could deliver mainstream adoption far beyond finance,” Connor concluded.

The next frontier for crypto will be decentralizing AI, Zain Jaffer, co-founder of Vungle, told Cointelegraph earlier this year.

Connor left the Ethereum community in January amid growing leadership concerns to pursue interests in AI.

AI agents on Ethereum

Ethereum may also be important for the development of agentic AI — an emerging and experimental technology, according to a recent post on the Ethereum blog.

AI agents are software programs that use artificial intelligence to autonomously perform tasks, make decisions, learn from data, and adapt to changes, and they are growing in numbers on Ethereum.

The Ethereum blockchain provides key advantages for AI agents, including access to transparent, real-time blockchain data, true digital asset ownership, and the ability to execute transactions and interact with smart contracts, it noted.

The post highlighted three notable projects, which were Luna, an autonomous virtual influencer that controls its own onchain wallet; ¡` ×\AIXBT, an AI agent providing crypto market analysis; and Botto, a decentralized autonomous artist creating NFTs guided by community voting.

Meanwhile, projects like Bankr and HeyAnon are simplifying blockchain interactions through conversational interfaces, allowing users to manage wallets and execute transactions via simple chat commands.

Michael Saylor’s Bitcoin (BTC) proxy firm, Strategy, has made headlines once again by purchasing an additional $285.8 million worth of Bitcoin (BTC) during a week characterized by significant fluctuations in the company’s stock (MSTR) price.

Saylor’s Strategy Reports 11.4% Year-to-Date Bitcoin Yield

To finance this latest acquisition, Strategy utilized its at-the-market stock program, selling shares to raise capital for further Bitcoin purchases. This strategic move aligns with the firm’s ongoing commitment to expanding its Bitcoin holdings, which have become a cornerstone of its financial strategy.

According to Bloomberg, demand for Strategy’s convertible debt has been partly fueled by hedge funds looking to exploit the company’s stock volatility.

These funds are reportedly engaged in trades that involve buying the bonds while simultaneously short-selling the shares, effectively betting on the stock’s price movements.

This most recent Bitcoin purchase, which involved acquiring 3,459 BTC at an average price of around $82,618 between April 7 and April 13, brings Strategy’s total Bitcoin holdings to 531,644 BTC.

In a social media update, Saylor revealed that the firm has achieved a year-to-date Bitcoin yield of 11.4% as of April 13, 2025. Strategy now holds a total of $35.92 billion in BTC at an average price of $67,556 per Bitcoin.

This impressive figure represents approximately 2.5% of the total 21 million Bitcoin that will ever be issued, solidifying Strategy’s status as the largest corporate holder of Bitcoin. However, the firm’s financial landscape is not without challenges.

$42 Billion By 2027 To Fuel Ongoing BTC Purchases

Last week, NewsBTC reported that Strategy would register an unrealized loss of $5.9 billion for the first quarter of the year due to an accounting change mandating that digital assets be valued at market prices.

In the same quarter, the company reportedly spent $7.79 billion on Bitcoin, reflecting its aggressive purchasing strategy, which has included nine acquisitions during this period.

Looking ahead, Strategy has announced plans to raise $42 billion in capital through 2027, utilizing proceeds from both at-the-market stock sales and fixed-income securities to continue funding its Bitcoin purchases.

Since Saylor began investing the firm’s cash into Bitcoin as a hedge against inflation in 2020, shares of Strategy have surged approximately 2,300%, highlighting the dramatic impact of its cryptocurrency strategy on shareholder value.

As of now, the market’s leading cryptocurrency has successfully regained the crucial $85,000 level, reflecting a 7% increase over the past week. However, despite this recovery, the cryptocurrency is currently trading 21% below its all-time high of $109,000, which was reached in January of this year.

Experts attribute some of the market’s recent challenges to President Donald Trump’s tariff policies, which have impacted overall market sentiment. But with the president’s recent 90-day pause on the so-called “tariff war,” the market has regained long-awaited catalysts that could mean further gains.

Featured image from DALL-E, chart from TradingView.com

The governor of the Northern Mariana Islands, a small Pacific US territory just north of Guam, has killed the legislation that would have allowed one of the territory’s local governments to launch a fully backed US dollar-pegged stablecoin.

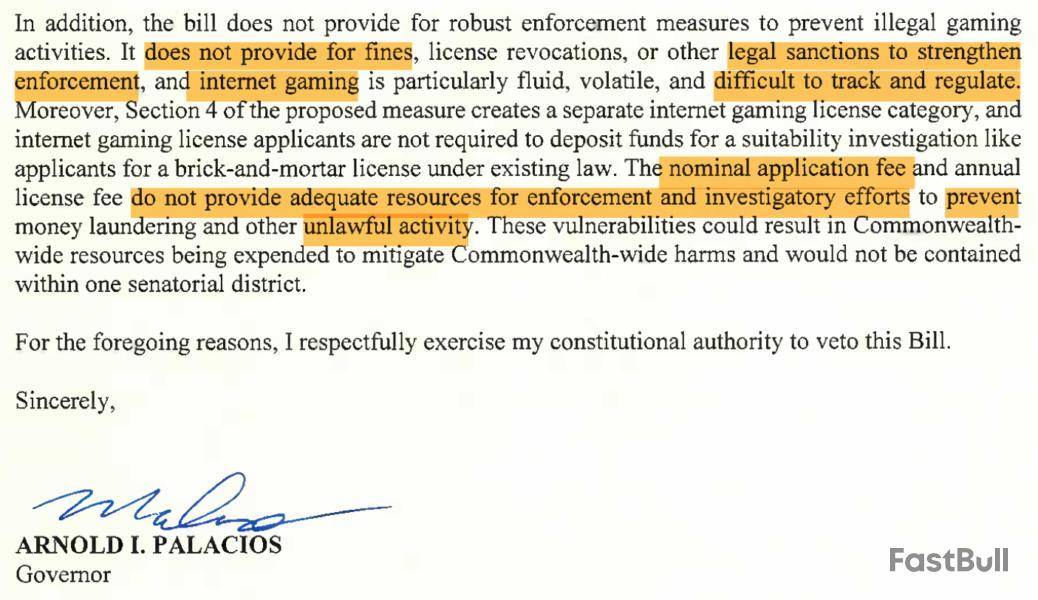

In an April 11 letter seen by Cointelegraph, Northern Mariana Islands Governor Arnold Palacios said he vetoed the bill as it “presents several legal issues and may be unconstitutional.”

Palacios’ letter said the bill, which largely dealt with issuing licenses to internet casinos, would regulate an activity that could not “be clearly restricted” to Tinian, a small island forming part of the territory that was hoping to launch a stablecoin.

Tinian, which has just over 2,000 residents and a largely tourism-based economy, is governed by the local government, the Municipality of Tinian and Aguiguan, one of four municipalities in the Commonwealth of the Northern Mariana Islands.

In February, Republican Northern Marianas Senator Jude Hofschneider led the introduction of the bill to amend a local Tinian law to allow internet-only casino licenses, which tacked on a provision allowing the Tinian treasurer to issue, manage and redeem a “Tinian Stable Token.”

The four-member Tinian delegation to the Marianas legislature passed the bill in a unanimous vote on March 12.

In vetoing the bill, Palacios didn’t comment on the proposed stablecoin, instead taking issue with its aim to police an industry that can cross jurisdictional boundaries, and said the measure lacked “robust enforcement measures to prevent illegal gaming activities.”

Tinian misses chance at beating Wyoming

The bill’s passage could have seen Tinian’s government be the first US government entity to issue a stablecoin ahead of Wyoming, whose Governor Mark Gordon said in March that the state’s stablecoin could be ready for a launch in July.

The stablecoin was to be known as the Marianas US Dollar (MUSD), which was to be fully backed by cash and US Treasury bills held in reserve by the Tinian Municipal Treasury, according to statements shared with Cointelegraph last month.

The Tinian local government chose tech services firm Marianas Rai Corporation, based in the Commonwealth’s capital of Saipan, to exclusively provide the infrastructure to issue and redeem MUSD and develop its ecosystem.

The token was slated to launch on the eCash blockchain, a network that rebranded from Bitcoin Cash ABC in 2021 and is a fork of Bitcoin Cash — a blockchain that split off from Bitcoin in 2017.

The launch of MUSD was meant to coincide with Google’s $1 billion plan announced in April to route fiber-optic subsea cables from the mainland US through Tinian and onto Japan to improve internet connectivity.

According to data provided by CoinGlass, Binance users are overwhelmingly long on XRP.

An impressive 67.6% of accounts are on the long side of the trade. The long/ratio currently stands at 2.09.

Notably, the same also applies to the exchange's top traders, who are in the top 20% of Binance's users by margin balance.

This is not the case for Bitcoin: the largest cryptocurrency is currently being shorted by nearly 55% of Binance accounts.

Overall, however, a slight majority of traders (51.32%) are still betting against the Ripple-affiliated token, so the bullishness is limited to Binance and several other trading platforms, such as BitMEX.

XRP's open interest, which represents the total number of open derivatives contracts, currently stands at $3.15 billion after declining by more than 4% over the past 24 hours.

Nearly $4 million worth of XRP has been liquidated over the past 24 hours. Long positions make up the lion's share of liquidations (61.5%).

At press time, XRP is up by 1.18% on the Binance exchange, changing hands at $2.15. Earlier today, the cryptocurrency reached an intraday high of $2.16.

The token has now recovered by roughly 25% after plunging to a multimonth low of $1.60 on Apil 7 amid a broader market sell-off driven by macroeconomic uncertainty.

Tech giant Meta has been given the green light from the European Union’s data regulator to train its artificial intelligence models using publicly shared content across its social media platforms.

Posts and comments from adult users across Meta’s stable of platforms, including Facebook, Instagram, WhatsApp and Messenger, along with questions and queries to the company’s AI assistant, will now be used to improve its AI models, Meta said in an April 14 blog post.

The company said it’s “important for our generative AI models to be trained on a variety of data so they can understand the incredible and diverse nuances and complexities that make up European communities.”

“That means everything from dialects and colloquialisms, to hyper-local knowledge and the distinct ways different countries use humor and sarcasm on our products,” it added.

However, people’s private messages with friends, family and public data from EU account holders under the age of 18 are still off limits, according to Meta.

People can also opt out of having their data used for AI training through a form that Meta says will be sent in-app, via email and “easy to find, read, and use.”

EU regulators paused tech firms' AI training plans

Last July, Meta delayed training its AI using public content across its platforms after privacy advocacy group None of Your Business filed complaints in 11 European countries, which saw the Irish Data Protection Commission (IDPC) request a rollout pause until a review was conducted.

The complaints claimed Meta’s privacy policy changes would have allowed the company to use years of personal posts, private images, and online tracking data to train its AI products.

Meta says it has now received permission from the EU’s data protection regulator, the European Data Protection Commission, that its AI training approach meets legal obligations and continues to engage “constructively with the IDPC.”

“This is how we have been training our generative AI models for other regions since launch,” Meta said.

“We’re following the example set by others, including Google and OpenAI, both of which have already used data from European users to train their AI models.”

An Irish data regulator opened a cross-border investigation into Google Ireland Limited last September to determine whether the tech giant followed EU data protection laws while developing its AI models.

X faced similar scrutiny and agreed to stop using personal data from users in the EU and European Economic Area last September. Previously, X used this data to train its artificial intelligence chatbot Grok.

The EU launched its AI Act in August 2024, establishing a legal framework for the technology that included data quality, security and privacy provisions.

Mantra has just gone through a crash that has wiped out most of its value. Here’s how on-chain metrics have changed during this collapse.

Mantra Has Seen A Reaction In Several On-Chain Indicators

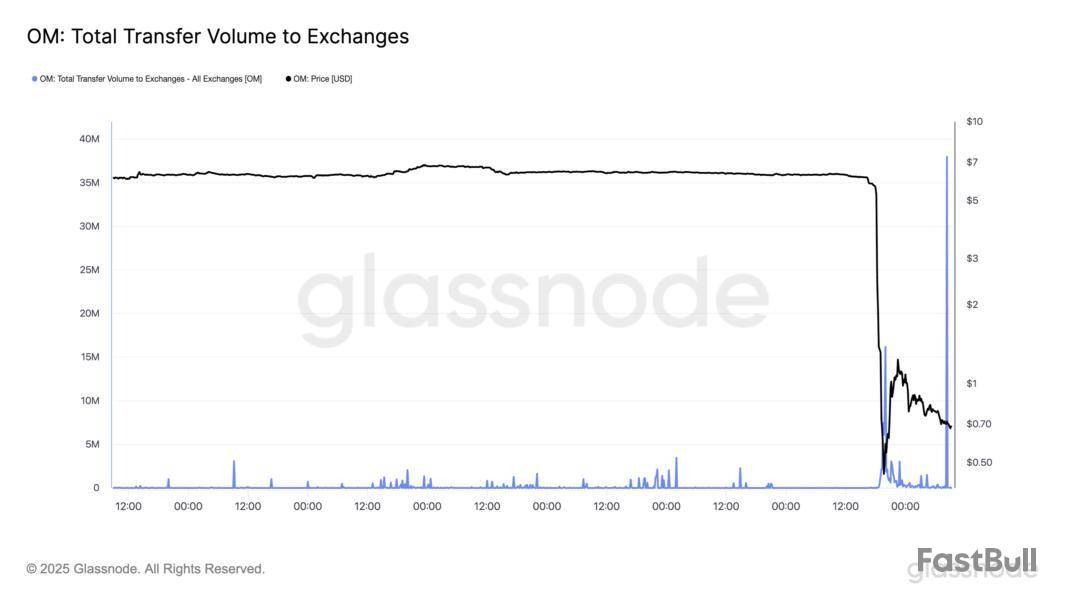

In a new post on X, the on-chain analytics firm Glassnode has discussed about the sudden price plunge that Mantra saw in the past day. During this crash, the asset’s value went from above $6 to around $0.50 in the matter of a few hours.

First, here is how the Exchange Inflow (that is, the total amount of OM being transferred to centralized exchanges) changed along with this volatile move:

As displayed in the above graph, Mantra interestingly didn’t see any large spikes in the indicator in the leadup to the crash. Investors use exchanges for selling-related purposes, so large deposits tend to appear before intense volatility.

In OM’s case, though, it seems there were no such inflows. Large deposits have still occurred in the past day, but they only came after the collapse was already over. These late inflows likely corresponded to reactionary moves from the investors.

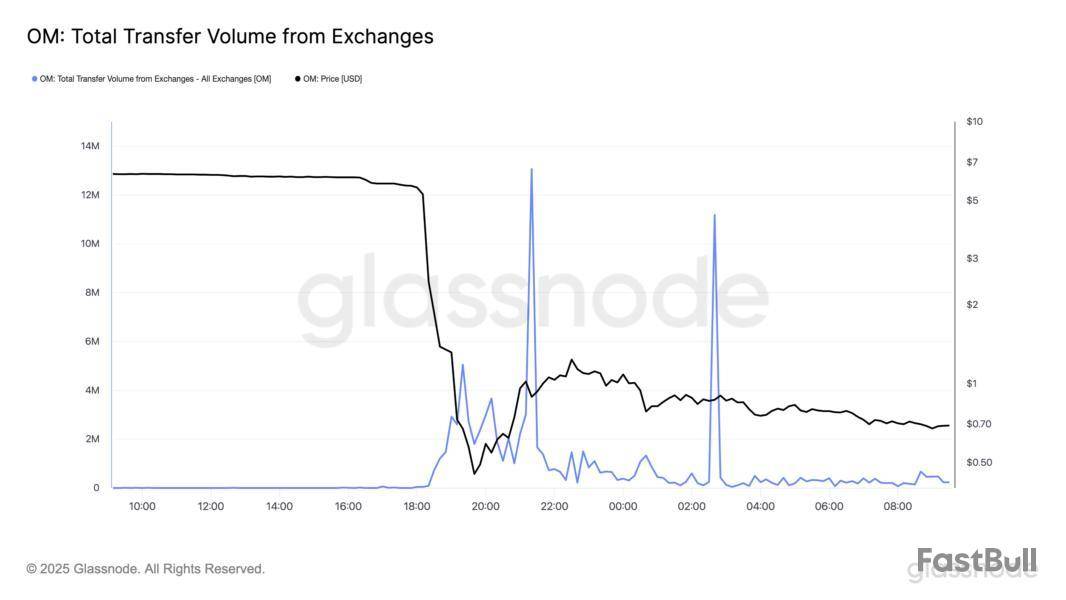

The opposite indicator, the Exchange Outflow, also saw spikes following the price plummet, as the below chart shows.

While the largest withdrawals only came after the crash was over, there were some significant outflows also made before the low was reached. “This could reflect withdrawals post-liquidation, opportunistic buys followed by self-custody, or exchanges reducing exposure,” explains the analytics firm.

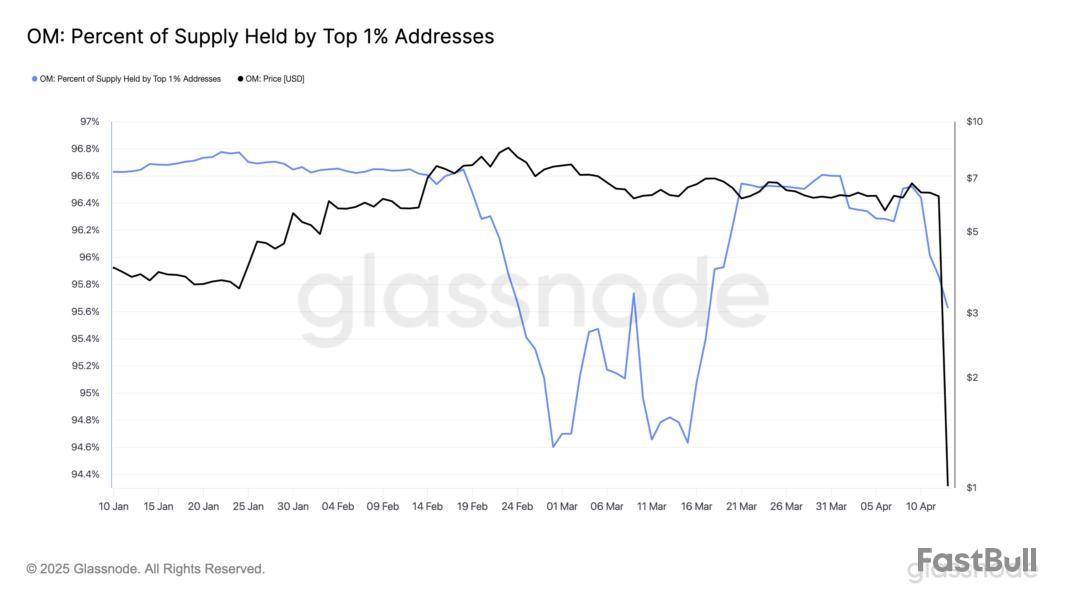

A metric that did register a change ahead of time was the percentage of the Mantra supply held by the top 1% addresses.

The top 1% addresses reduced their supply share from 96.4% to 95.6% before the OM collapse took place. “While not the largest drop in recent months, it’s notable,” notes Glassnode.

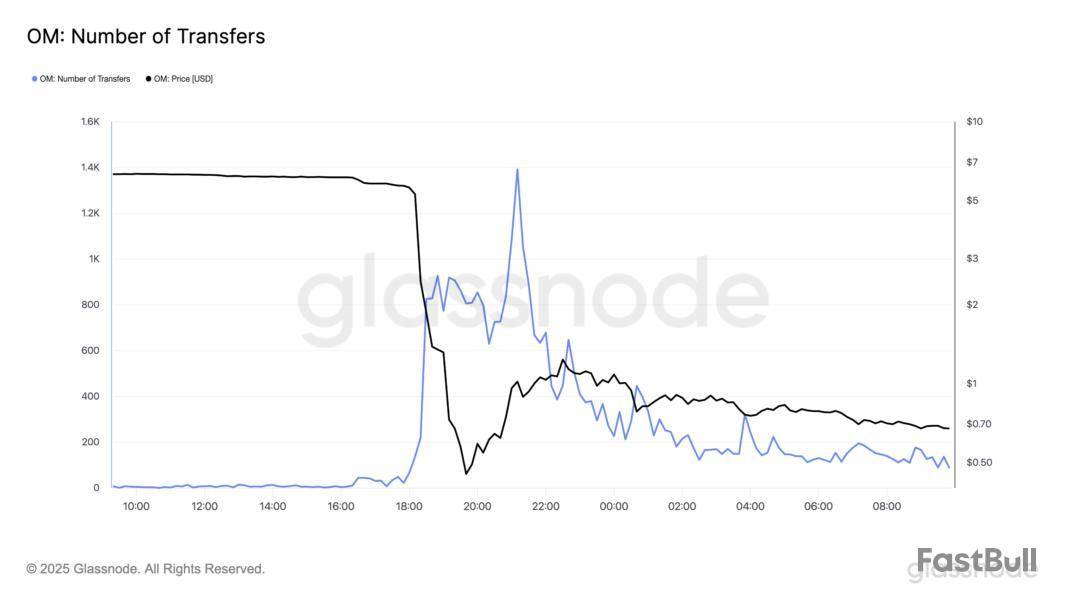

Another indicator that showcases the market panic is the Number of Transfers, which observed a huge spike as OM went through its volatility.

The Number of Transfers peaked at around 1,400 inside a 10-minute window. Given the scale involved, it’s likely that a large amount of traders were responsible for these moves.

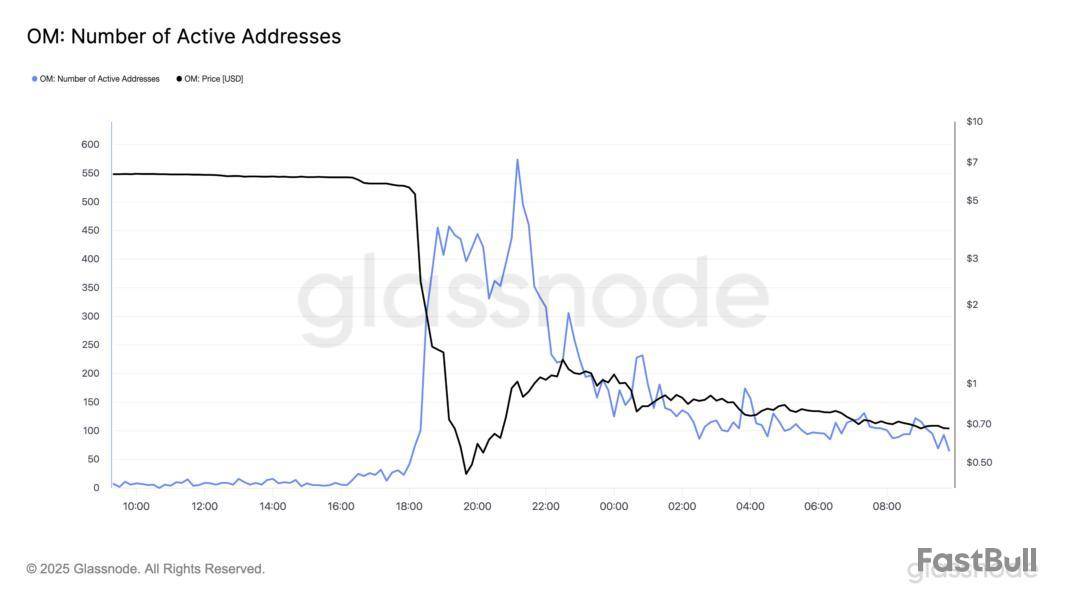

And indeed, the trend in the Active Addresses, a metric keeping track of the number of addresses becoming involved in transactions on the chain, would confirm this.

From the chart, it’s apparent that the Active Addresses mimicked the trend in the Number of Transfers very closely, so the Mantra selloff wasn’t contained to a few addresses at all.

OM Price

At the time of writing, Mantra is trading around $0.50, down more than 91% in the past day.

Platform improves XRP routing, automation, and asset compatibility to support seamless NFT creation and transfer across chains

Dubai, United Arab Emirates--(Newsfile Corp. - April 15, 2025) - Colle AI (COLLE), a multichain AI-powered NFT platform, is advancing its XRP cryptocurrency infrastructure to further strengthen its multichain framework. These enhancements support faster, more reliable NFT transactions and broaden creator access to XRP-based capabilities across the Colle AI ecosystem.

Smarter NFT creation with fast, AI-powered multichain performance.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8833/248508_b763206d74c07be1_001full.jpg

The latest improvements include refined smart contract execution tailored for the XRP Ledger, updated asset routing logic, and increased metadata compatibility between XRP and other supported blockchains. These backend refinements streamline NFT creation and enable users to interact with XRP-based assets without additional manual configuration.

Colle AI's AI engine has also been calibrated to better support XRP-specific functions, improving transaction efficiency, reducing latency, and enhancing real-time adaptability. These updates allow creators to deploy and manage NFTs across XRP, Ethereum, Solana, BNB Chain, and Bitcoin from a single, unified interface.

By continuing to optimize its XRP integration, Colle AI reinforces its mission to offer intelligent, accessible multichain solutions that scale with the needs of Web3 creators and developers.

About Colle AI

Colle AI leverages AI technology to simplify the NFT creation process, empowering artists and creators to easily transform their ideas into digital assets. The platform aims to make NFT creation more accessible, fostering innovation in the digital art space.

Media Contact

Dorothy Marley

KaJ Labs

+1 707-622-6168

media@kajlabs.com

Social Media

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/248508

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up