Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum Classic will conduct a community call on Discord on April 25th at 15:00 UTC. Community members are expected to reconnect, share updates on their projects, and discuss various topics during the session.

Refer to the official tweet by ETC:

Ethereum Classic@eth_classicApr 17, 2025Join us on Friday, April 25th at 1500 UTC in the ETC Discord for a casual voice chat. Whether you’ve been around or just checking in, this is an open space to reconnect, hear what folks are working on, and share what’s on your mind.https://t.co/R81fv8d9cP

ETC Info

Ethereum Classic (ETC) is a hard fork of Ethereum , launched in July 2016 as a direct response to a major security breach. It serves as a smart contract network, capable of hosting decentralized applications (DApps). Its inception was grounded in preserving the original Ethereum blockchain without reversing the effects of the DAO hack, emphasizing blockchain immutability and integrity.

Ethereum Classic operates using a Proof-of-Work (PoW) consensus algorithm, similar to the original Ethereum before its shift towards Proof-of-Stake (PoS). This choice reflects ETC’s commitment to traditional blockchain principles, specifically decentralization and security. The network supports the development and deployment of DApps and smart contracts, aiming to offer a stable and unchanged protocol for developers and users. Its governance is more decentralized, with the community playing a significant role in decision-making processes.

The native token of Ethereum Classic, ETC, is used for transaction fees and as a reward for miners within the network. Unlike its counterpart Ethereum, which has moved towards a PoS consensus algorithm, Ethereum Classic continues to reinforce its PoW mechanism. ETC has found support among a faction of users and investors who advocate for the original ethos of Ethereum, particularly in terms of immutable transactions and a more traditional approach to blockchain governance.

Kadena has introduced a new feature to its website on April 18th.

Refer to the official tweet by KDA:

Kadena@kadena_ioApr 18, 2025📢 ANNOUNCEMENT BAR 📢

We have added this new feature to the $KDA website (desktop + mobile) today. This will help make it easier to bring more attention to the latest #Kadena news or alerts and provide more details to upcoming events. pic.twitter.com/pmIDF95ySs

KDA Info

Kadena is a public blockchain platform that provides a secure, scalable, and user-friendly environment for developing and launching distributed applications (dApps).

One of the unique features of Kadena is its utilization of a new form of Proof-of-Work (PoW) in its consensus protocol. This protocol, called "Chainweb," is designed to achieve high throughput and scalability while maintaining security and decentralization.

The Kadena token (KDA) is a digital currency that is used to pay for computation on the Kadena public chain. Similar to ETH on Ethereum, KDA on Kadena is the token in which miners are compensated for mining blocks on the network and is the transaction fee that users pay in order to have their transactions included in a block.

Galaxy Digital, a leading crypto investment firm, has recently captured the crypto community’s attention. The firm recently transferred massive Ethereum holdings to centralized exchanges.

The move comes when the crypto market navigates significant volatility, prompting investors to question whether this signals a major sell-off or reflects Galaxy Digital’s strategic portfolio management.

Galaxy Digital’s Persistent ETH Transfers to Exchanges

On-chain data reveals Galaxy Digital has executed a series of substantial ETH transfers to major exchanges in less than a week. On the morning of April 18, 2025, the firm sent 12,500 ETH, valued at approximately $20 million, to Binance.

Just a day earlier, on April 17, Galaxy Digital moved 12,181 ETH, worth around $19.02 million, to another centralized exchange. On April 16, an additional 12,500 ETH, valued at $20.31 million, was transferred to Binance. On April 15, another transaction involving 12,500 ETH and 5 million USDT was sent to the same platform.

In total, Galaxy Digital has moved a significant volume of ETH, worth over $100 million, out of its wallets in a short period. The scale and frequency of these transactions have sparked widespread speculation about the firm’s true intentions.

Sell-Off or Strategic Restructuring?

Large-scale ETH transfers to exchanges are often interpreted as a precursor to selling. If Galaxy Digital is offloading ETH, it could exert downward pressure on the asset’s price, particularly given the current market uncertainty.

ETH’s price has already declined significantly from its cycle peak. And Galaxy Digital’s transactions could amplify bearish sentiment among investors.

However, not all exchange transfers equate to a sell-off. Galaxy Digital might be preparing for other activities, such as providing liquidity for its financial products or executing swaps to diversify its portfolio. Still, these transfers’ sheer volume and rapid pace have raised concerns about their potential impact on ETH’s price.

Adding to the intrigue, these transactions coincide with Christine Kim’s resignation as Galaxy Digital’s Vice President of Research.

Kim, a well-known Ethereum expert, recently left the firm to pursue her ventures. While no direct evidence links her departure to the ETH transfers, the timing has fueled speculation about whether Galaxy Digital is reevaluating its stance on Ethereum.

Coinbase’s Layer-2 (L2) Network, Base, has faced intense backlash over rug-pull allegations after it promoted an unofficial memecoin that crashed by over 90%, sparking a debate about the future of memecoins and on-chain content.

The Rise And Fall Of Base’s Unofficial Memecoin

On Wednesday, Base’s official X account posted an image with the text “Base is for everyone.” Moments later, they shared a link to the on-chain social protocol Zora and the caption “Coined it,” sparking a speculative frenzy among investors.

The protocol allows users to make social media posts into tradable tokens, automatically minting them. After Base’s post was turned into a token, the crypto community quickly skyrocketed its market capitalization to $17 million.

However, online reports showed that the memecoin collapsed by around 92% after the top holders, who owned 47% of the supply, sold the memecoin just over an hour after launching.

Some community members noted that the token was “HORRIFICALLY sniped,” while on-chain data analytics platform Lookonchain highlighted that “3 wallets bought a large amount of ‘Base is for everyone’ before Base posted and sold them, making a profit of ~$666K.”

As a result, the community criticized the network’s team for the memecoin, calling the incident a rug pull and asking them to “stop launching worthless tokens that will all inevitably go to 0. You are diluting your brand and the value of real base assets.”

Zora data shows Base has earned around $81,000 from the memecoin, which has recovered from the initial sell-off with a peak market capitalization of $26 million before retracing to the $9 million-$10 million range.

Base’s Public Experiment

Base responded to the backlash, clarifying they will never sell their holdings, but they weren’t an official network token either. The team explained that they posted on Zora because they believe everyone should bring content on-chain and use the tools that make it possible.

Memes. Moments. Culture. If we want the future to be onchain, we have to be willing to experiment in public. That’s what we’re doing. To be clear, Base will never sell these tokens, and these are not official network tokens for Base, Coinbase, or any other related product. The content we share is creative, and we’re going to keep bringing culture onchain.

The public on-chain experimentation opened a debate about memecoin culture and on-chain content, with Base’s creator, Jesse Pollak, weighing in.

In a series of X posts, Pollak explained that “not all coins are the same,” outlining the differences between these two types of tokens. Is On-Chain Content The Future For Creators?

According to his posts, a contentcoin is one piece of content with singular value and no expectations. Additionally, multiple of them can be created by the same person, with “big ones” potentially turning into memes.

On the contrary, a memecoin is an “aggregation of content,” with aggregated value and high expectations, where the creator “should” only create one. He also noted that big ones turn into projects.

Pollack considers that “someone has to normalize putting all of our content onchain. and i’m not afraid for it to be us. why? because in the wake of the chaos, we’ll normalize the behavior and create a better future for creators.”

Nonetheless, many users remain skeptical, with community members also criticizing Base’s post announcing investors can mint a deleted scene of the “Vitalik: An Ethereum Story” documentary, where the project’s founder, Vitalik Buterin, shows what’s in his backpack.

“Through ‘the financialization of everything’ we come to learn that most things are worthless,” the user stated.

Ethereum reached a notable milestone earlier this month when the US Securities and Exchange Commission (SEC) approved options trading for several spot exchange-traded funds (ETFs). The move is expected to increase liquidity, attract interest from institutional investors, and solidify Ethereum’s position as a major cryptocurrency.

Yet Ethereum’s smaller market cap relative to Bitcoin means it is also vulnerable to gamma squeezes, thereby increasing investor risks. BeInCrypto consulted an expert in derivatives trading and representatives from FalconX, BingX, Komodo Platform, and Gravity to analyze the potential impact of this new characteristic.

Ethereum ETF Options Gain SEC Approval

The Ethereum community rejoiced earlier this month when the SEC approved options trading for existing Ethereum ETFs. This approval marks a significant regulatory development for digital assets.

This week marked the official debut of options trading for spot Ethereum ETFs in the United States. BlackRock’s iShares Ethereum Trust (ETHA) was the first to list options, with trading commencing on the Nasdaq ISE.

Shortly after, a broader availability of options followed, including those for the Grayscale Ethereum Trust (ETHE) and the Grayscale Ethereum Mini Trust , as well as the Bitwise Ethereum ETF (ETHW), all of which began trading on the Cboe BZX exchange.

This move allows a wider range of investors, beyond crypto traders, to benefit from hedging and speculation opportunities on Ethereum’s price through options on familiar investment vehicles like ETFs without direct ownership.

The timing of this news is particularly positive, as Ethereum has been losing some ground in the market lately.

Options Trading to Bolster Ethereum’s Market Position

A significant decline in market confidence surrounded Ethereum this week, with BeInCrypto reporting its price had plummeted to its lowest point since March 2023. This drop coincided with a broader market downturn, worsened by Donald Trump’s Liberation Day.

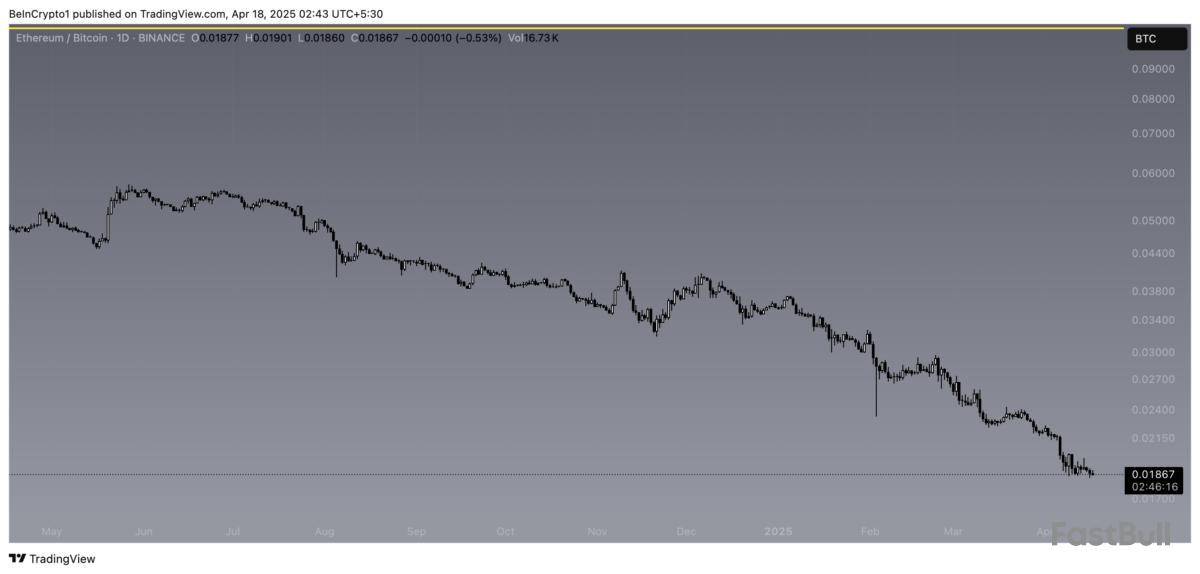

Further fueling this bearish sentiment, the ETH/BTC ratio has reached a five-year low, highlighting Bitcoin’s growing dominance over Ethereum.

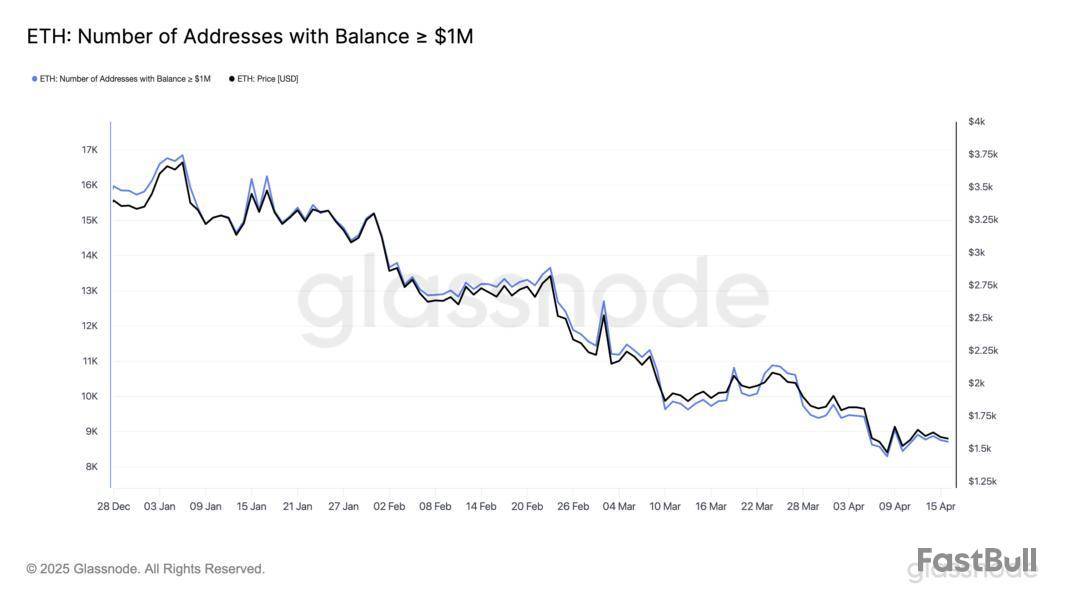

Meanwhile, large Ethereum holders are increasingly selling off substantial amounts, putting downward pressure on their prices. Ethereum’s value has fallen sharply by 51.3% since the beginning of 2025, and investor confidence has waned, as evidenced by a decrease in addresses holding at least $1 million in ETH.

With options trading now accessible to more traders, experts anticipate that Ethereum’s market position will improve.

“ETH’s been leaking dominance, stuck sub-17%. Options give it institutional gravity. It becomes more programmable for fund strategies. More tools mean more use cases, which then in turn means more capital sticking around,” Martins Benkitis, CEO and Co-Founder of Gravity Team, predicted.

This newfound accessibility of options trading will create additional opportunities for investors and the broader Ethereum ecosystem.

Greater Investor Access and Liquidity

The SEC’s approval of Ethereum ETFs in July 2024 was significant because it allowed traditional investors to enter the crypto market without directly holding the assets. Now, with options trading also available, these benefits are expected to be even greater.

“It will provide additional opportunities for portfolio diversification and create more avenues for ETH-based products. With options beyond the limited Bitcoin ETF offerings, investors may reconsider how they allocate their funds. This shift could result in more sophisticated trading strategies and greater participation in Ethereum-based products,” Vivien Lin, Chief Product Officer at BingX, told BeInCrypto.

The Ethereum ETF market will naturally become more liquid with increased participation through options trading.

High Trading Volumes and Hedging Demands

The SEC’s fresh approval of options trading for Ethereum ETF investors suggests that the market will likely initially experience a high trading volume. As a result, market makers must be prepared.

An increase in call options will require institutional market makers to hedge by buying more Ethereum to meet demand.

“This is the canonically accepted dynamic of options markets bringing better liquidity to spot markets,” explained derivatives trader Gordon Grant.

Ethereum will also secure a unique advantage, particularly in institutional trading, enhancing its perceived quality and driving optimism among key market participants.

“ETH just got a serious institutional tailwind. With options now in play, Ether is stepping closer to BTC in terms of tradable instruments. This levels up ETH’s legitimacy and utility in hedging strategies, narrowing the gap on Bitcoin’s dominance narrative,” Benkitis told BeInCrypto.

Yet, rapid surges in options trading could also have unintended consequences on Ethereum’s price, especially in the short run.

Will Investors Suffer a Gamma Squeeze?

As market makers rush to acquire more of the underlying asset in case of a higher volume of options calls, Ethereum’s price will naturally increase. This situation could lead to a pronounced gamma squeeze.

When market makers hedge their positions in this scenario, the resulting buying pressure would create a positive feedback loop. Retail investors will feel more inclined to join in, hoping to profit from Ethereum’s rising price.

The implications of this scenario are especially pronounced for Ethereum, considering its market capitalization is notably smaller than that of Bitcoin.

Retail traders’ aggressive buying of ETHA call options could compel market makers to hedge by acquiring the underlying ETHA shares, potentially leading to a more pronounced effect on the price of ETHA and, by extension, Ethereum.

“We believe option sellers will generally dominate in the long-run but in short bursts we could see retail momentum traders become massive buyers of ETHA calls and create gamma squeeze effects, similar to what we’ve seen on meme coin stocks like GME. ETH will be easier to squeeze than BTC given it is only $190 billion market cap vs BTC’s $1.65 trillion,” Joshua Lim, Global Co-head of Markets at FalconX, told BeInCrypto.

Meanwhile, Grant predicts arbitrage-driven flows will further exacerbate price swings.

Arbitrage Opportunities Expected to Emerge

Experienced investors in options trading may pursue arbitrage to gain profits and reduce risk exposure.

Arbitrage involves exploiting price differences for the same or nearly identical assets across different markets or forms. This is done by buying in the cheaper market and selling in the more expensive one.

According to Grant, traders will increasingly look for and exploit these price differences as the market for ETH options on different platforms develops.

“I would expect more arbitrage behaviors between deribit CME and spot eth options and while one sided flows across all three markets could be temporarily destabilizing, greater liquidity through a diverse array of venues should ultimately dampen the extrema of positioning driven dislocations and the frequency of such dislocations. For instance, it appears –anecdotally as the data is still inchoate– that vol variance on btc is declining post intro of iBit options,” he explained.

While arbitrage activity is expected to refine pricing and liquidity within the Ethereum options market, the asset continues to operate under the shadow of Bitcoin’s established market leadership.

Will Landmark Options Approval Help Ethereum Close the Gap on Bitcoin?

Though Ethereum achieved a major landmark this week, it faces competition from a major rival: Bitcoin.

In late fall of 2024, options trading started on BlackRock’s iShares Bitcoin Trust (IBIT), becoming the first US spot Bitcoin ETF to offer options. Though not even a year has passed since the original launch, options trading on Bitcoin ETFs experienced strong trading volumes from retail and institutional investors.

According to Kadan Stadelmann, Chief Technology Officer of Komodo Platform, options trading for Ethereum ETFs will be comparatively underwhelming. Bitcoin will still be the cryptocurrency of choice for investors.

“Compared to Bitcoin’s Spot ETF, Ethereum’s ETF has not seen such stalwart demand. While options trading adds institutional capital, Bitcoin remains crypto’s first mover and enjoys a greater overall market cap. It is not going anywhere. It will remain the dominant crypto asset for institutional portfolios,” Stadelmann told BeInCrypto.

Consequently, his outlook does not include Ethereum’s market position surpassing Bitcoin’s in the immediate term.

“The once-promised flippening of Bitcoin’s market capitalization by Ethereum remains unlikely. Conservative and more-monied investors likely prefer Bitcoin due to its perceived safety compared to other crypto assets, including Ethereum. Ethereum, in order to achieve Bitcoin’s prominence, must depend on growing utility in DeFi and stablecoin markets,” he concluded.

While that may be the case, options trading doesn’t harm Ethereum’s prospects; it only strengthens them.

Can Ethereum’s Options Trading Era Capitalize on Opportunities?

Ethereum is now the second cryptocurrency with SEC approval for options trading on its ETFs. This single move will further legitimize digital assets for institutions, increasing their presence in traditional markets and boosting overall visibility.

Despite recent significant blows to Ethereum’s market position, this news is a positive development. Although it might not be sufficient to surpass its primary competitor, it represents a step in the right direction.

As investors get used to this new opportunity, their participation level will reveal how beneficial it will be for Ethereum.

Ethereum ETFs remained completely stagnant, while spot Bitcoin ETFs saw a solid net inflow of $108 million led by BlackRock's IBIT ETF with $80.96 million. Despite the fluctuations on the market, all nine spot Ethereum ETFs reported zero net flows, indicating a lack of investor confidence or engagement. There is no more pronounced difference between the activity of Ethereum ETFs and Bitcoin ETFs.

Even though the market is starting to recover, Ethereum is still being overlooked because companies like Fidelity VanEck and Grayscale are witnessing ongoing capital movement in Bitcoin-related products. Even though Ethereum has been the second-largest cryptocurrency for a long time, this stagnation shows that the asset's story is currently not very compelling to institutions. Chart by TradingView">

According to Ethereum's price chart, the state of affairs mirrors the ETF's lack of activity. In an effort to create temporary stability close to the $1,580 region, ETH is still trading in a tight descending wedge. Nevertheless it has not demonstrated any noteworthy breakout potential. The asset's continued strong bearish trend is demonstrated by the fact that it is still well below the 50, 100 and 200 EMA levels ($1,800, $2,267 and $2,568, respectively).

Additionally volume has been gradually declining, indicating that institutional and retail participants are not as interested or motivated. The RSI shows that ETH is still hovering close to oversold territory without producing a real reversal signal, and the weak bullish attempts are routinely rejected.

As Bitcoin absorbs all the capital attention, Ethereum is essentially stagnating due to zero flows into ETH ETFs and no discernible buying pressure on the spot market. ETH might keep falling behind unless there is a significant fundamental catalyst that materializes soon, such as the approval of ETF staking or a favorable regulatory change.

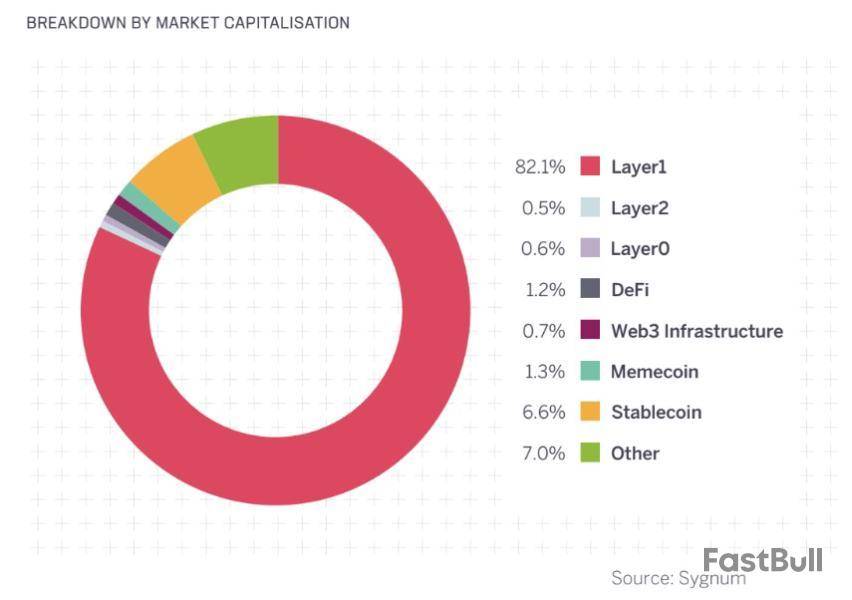

Altcoins may see a resurgence in the second quarter of 2025 as regulations for digital assets continue to improve, according to Swiss bank Sygnum.

In its Q2 2025 investment outlook, Sygnum said the space has seen “drastically improved” regulations for crypto use cases, creating the foundations for a strong alt-sector rally for the second quarter. However, it added that “none of the positive developments have been priced in.”

In April, Bitcoin dominance reached a four-year high, signaling that crypto investors are rotating their funds into an asset perceived to be relatively safer.

But Sygnum believes regulatory developments in the US, such as President Donald Trump’s establishment of a Digital Asset Stockpile and advancing stablecoin regulations, could propel broader crypto adoption.

“We expect protocols successful in gaining user traction to outperform and Bitcoin’s dominance to decline,” Sygnum wrote.

Increased focus on economic value ignites competition

Sygnum also said that competition would increase as the market focuses on economic value. Increased competition in a market often results in better products, ultimately benefiting consumers:

Sygnum added that while high-performance blockchains address limitations of the Bitcoin, Ethereum and Solana blockchains, these chains find it challenging to achieve meaningful adoption and fee income.

The report highlighted that some approaches have been more sustainable. These include Berachain’s approach of incentivizing validators to provide liquidity to decentralized finance (DeFi) applications, Sonic’s rewarding developers that attract and retain users, and Toncoin’s Telegram affiliation to access one billion users.

Aside from layer-1 chains, Sygnum highlighted that layer-2 networks like Base also have potential. The report pointed out that while the memecoin frenzy on the blockchain pushed its users and revenue to new highs, it made an equally sharp decline after memecoins started losing steam.

Despite this, Sygnum noted that Base remains the layer-2 leader in metrics like daily transactions, throughput and total value locked.

Memecoins still a leading crypto narrative in Q1

Despite recent price declines, memecoins remained a dominant crypto narrative in Q1 2025. A CoinGecko report recently highlighted that memecoins remained dominant as a crypto narrative in the first quarter of 2025. The crypto data company said memecoins had 27.1% of global investor interest, second only to artificial intelligence tokens, which had 35.7%.

While retail investors are still busy with memecoins, institutions have a different approach. Asset manager Bitwise reported on April 14 that publicly traded firms are stacking up on Bitcoin. At least twelve public companies purchased Bitcoin for the first time in Q1 2025, pushing public firm holdings to $57 billion.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up