Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Vietnam Government Preliminary Data: January Foreign Investment Inflows Up 11.3% Year-On-Year To $1.68 Billion

Foreign Ministry Spokesperson: Ukraine Wants To Understand Moscow's And Washington's 'Real Intentions' In Peace Talks

Ukraine's Foreign Ministry Spokesperson Says Russian Mass Strikes On Energy Hinder Peace Talks

Kremlin Confirms Low-Level Russia-France Talks Are Under Way After Macron Talks Of Resuming Contacts

India Government: Official Visit Of Hon'Ble Prime Minister Shri Narendra Modi To Kuala Lumpur, Malaysia (February 07 - 08, 2026)

Kremlin Says There Are Contacts Between Russia And France At A Working Level But There Are Is No Confirmation Of Plans For High-Level Contacts For Now

Kremlin Says Russia's Military Campaign In Ukraine Will Continue Until Kyiv Takes Some Decisions

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)A:--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)A:--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)A:--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)A:--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)A:--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)A:--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)A:--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

trying to push other & test depth of the hole

trying to push other & test depth of the hole

Friday. Mm. I can't fancy how volatile the yen might be in the said period

Friday. Mm. I can't fancy how volatile the yen might be in the said period

No matching data

View All

No data

Ethena's USDe has continued its remarkable growth, with its supply surging to $12 billion as of Aug. 25, more than 15% of USDC supply, the second-largest stablecoin. This positions USDe as a strong contender to challenge the dominance of stronghold stablecoins like USDC and USDT in the coming months.

The growth stems from USDe's unique value proposition as a yield-bearing, crypto-native stablecoin that generates returns through delta-neutral hedging strategies. Unlike non-yielding alternatives such as USDC and USDT, USDe offers holders 9%-11% APY by maintaining a peg through collateral positions in ETH/BTC paired with short futures positions, capitalizing on positive funding rates in the current rising market environment.

Much of the supply expansion is driven by sophisticated yield amplification strategies, where users stake USDe as sUSDe, tokenize it on Pendle, then create recursive borrowing loops on Aave to achieve leveraged yields.

Aave, a decentralized lending protocol, allows users to deposit their PT-sUSDe tokens as collateral to borrow additional USDe. This borrowed USDe can then be restaked and re-tokenized on Pendle, creating a recursive loop that amplifies exposure to the underlying yields. The mechanism has locked a significant supply of USDe in Pendle and Aave, creating a reflexive growth cycle that pays significant leveraged returns.

While the growth reflects genuine demand for yield in favorable market conditions, the leverage-dependent nature of the ecosystem raises questions about sustainability should funding rates turn negative or market conditions deteriorate, echoing patterns seen in previous DeFi cycles.

This is an excerpt from The Block's Data & Insights newsletter. Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The weekly chart of Bitcoin starts showing warning signs that could have serious consequences. The Bollinger Bands, in particular, show that the price might drop below $100,000. That is a line that has been a major support level for the whole crypto market, both technically and in a psychological sense.

The setup is clear on the one-week time frame: Bitcoin rejected the upper band near $124,000 and is now sliding back toward the midline around $107,000. BTC has hit the top of this channel several times in the past, and each time, it has dropped after a short rise.

If the midband does not hold, the lower edge of the structure comes into play near $88,000, which would mean a loss of the six-figure price point.TradingView">

The pattern is important because it is consistent. Earlier this year, a dip into the lower band marked the start of a strong rebound, while rejections in March and July signaled extended drawdowns.

This latest move looks a lot like those earlier reversals, so it seems like the market might be entering a corrective phase again, even though there was optimism after the $124,000 peak.

What's next for Bitcoin?

The outside world is making the situation more fragile. With Bitcoin, the combination of technical rejection and macro uncertainty make it more likely that there will be a deeper retreat if buyers cannot hold the $100,000 level.

For now, the $100,000 line is being used as the dividing point. If it closes below that this week, it will confirm the Bollinger Bands signal and bring attention to $88,000 per BTC as the next big thing to watch.

TL;DR

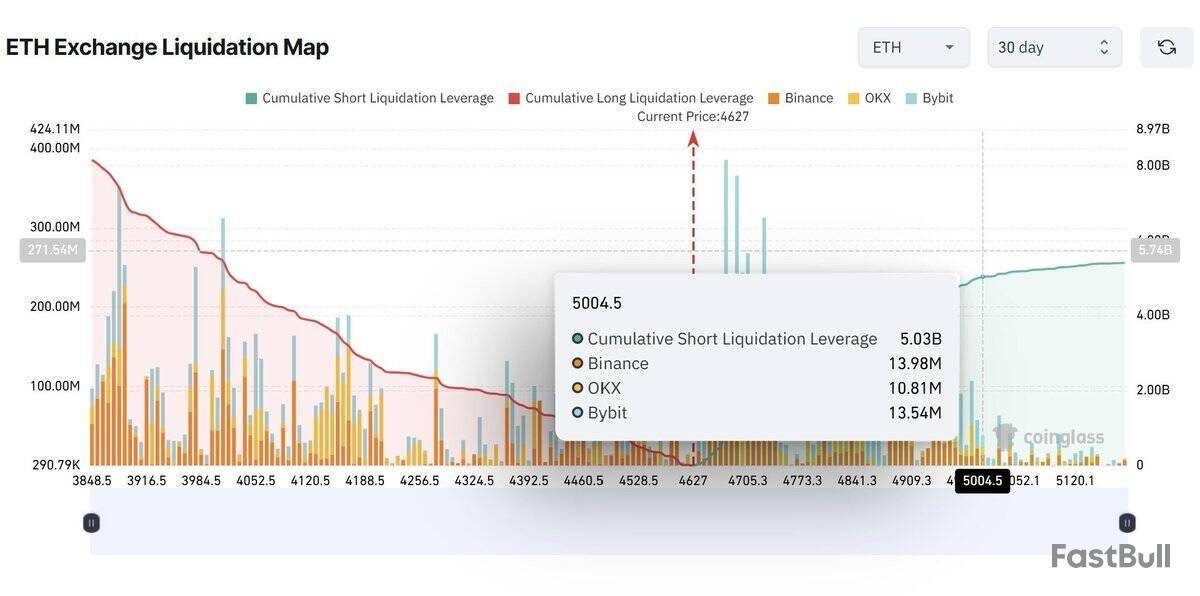

Liquidity Clusters Below Current Price

Ethereum is trading around $4,330, with data showing deep liquidity resting below current levels. A heatmap of the order book highlights large buy concentrations between $3,800 and $4,200, marked by strong horizontal bands.

Analyst Ted commented,

$ETH liquidity is laying to the downside.

I’m ready to buy the Ethereum dip. pic.twitter.com/hbwEi2I63A

— Ted (@TedPillows) August 29, 2025

He added that the next few weeks could bring golden opportunities to buy back $ETH and other altcoins at massive discounts. These bids suggest that if Ethereum dips into this zone, selling pressure may be absorbed quickly by accumulated demand.

While buyers wait lower, a liquidation cluster has formed above. Exchange data shows that if ETH reaches $5,000, more than $5 billion in short positions will be wiped out.

Breakdown figures show $14 million on Binance, $10.81 million on OKX, and $13.54 million on Bybit at that level. Crypto Aman warned,

“Over $5 billion in shorts will be liquidated if $ETH hits $5,000. Will short traders be liquidated?”

Analysts describe such levels as liquidity magnets, where price acceleration can trigger forced buying and drive momentum higher.

Source: X Bullish Pennant Formation on Charts

On the 4-hour chart, ETH has been trading inside a descending channel, which analysts view as a bullish pennant. The asset has tested both the upper and lower boundaries multiple times, with rejections and rebounds marking the structure.

$ETH looks all set for pump hard.

One bullish news, and it will send all at once without any break.

Climbing to higher highs since $1400, i am expecting a little correction right now and then nonstop bullish.

You know rektember is coming, if we look at the past cycles… pic.twitter.com/WnY13Zz6PE

— Henry (@LordOfAlts) August 29, 2025

Henry said,

“$ETH looks all set for pump hard. One bullish news, and it will send all at once without any break.”

He expects a short correction before abreakout, adding that the “road to $5k is clear” once ETH crosses resistance near $4,600.Institutional Signals Add Weight

Since the breakout around $1,400, Ethereum recorded a steady climb, posting progressively higher highs through the following months. For altcoins in general, September is usually a month of corrections.

October is the month when the bounce back is stronger. These seasonal swings fit in with the expectations of a little bit of turbulence before another push higher.

Institutional voices are also weighing in. Jan van Eck, CEO of VanEck,describedEthereum as “the Wall Street token” in a recent Fox Business interview. He said the rise of stablecoins means every bank and financial services company now needs infrastructure to process them.

With heavy buy orders stacked below and liquidation fuel waiting above, Ethereum sits in a zone where both dip demand and breakout pressure could shape the next move.

Bitcoin reached a new all-time high of $124,400 on August 14 before facing a sharp correction. SpacePay’s presale has raised over $1.3 million by offering investors a defensive alternative focused on payment utility rather than price appreciation gambling.

SPY tokens are valued $0.003181 because of infrastructure development that creates value regardless of Bitcoin price changes or market volatility patterns.

This technique appeals to investors looking for Bitcoin exposure without the price volatility associated with speculative trading.

Bitcoin’s Volatility Pattern Creates Investment Uncertainty

The August 14 all-time high followed by immediate correction represents Bitcoin’s characteristic volatility that makes planning and position sizing difficult for retail investors. Emotional trading decisions brought on by abrupt price changes frequently lead to ill-timed purchases and trades. When assets might hit record highs one day and then sharply decline the next, market timing becomes almost impossible.

Investors are forced to continuously monitor positions and make reactive decisions rather than strategic ones due to the erratic price action of Bitcoin.

By instantly converting any cryptocurrency payment to stable fiat cash, SpacePay’s instant settlement functionality functions regardless of fluctuations in the price of Bitcoin. Merchants avoid exposure to sudden price drops that could affect revenue if Bitcoin payments were held in original form.

The platform’s 0.5% flat transaction fee generates consistent income regardless of cryptocurrency market conditions or individual asset price movements.

Professional portfolio management becomes challenging when core holdings experience price swings without fundamental business changes.

SpacePay Provides Defensive Cryptocurrency Exposure

The presale’s success, raising over $1.3 million during Bitcoin market volatility, shows investor appetite for cryptocurrency projects with stable value propositions.

Platform development continues regardless of Bitcoin price levels or market sentiment fluctuations. Merchant onboarding and payment processing improvements create measurable progress that does not depend on speculative trading outcomes for validation.

SpacePay’s compatibility with 325+ wallet providers creates network effects that strengthen through user adoption rather than price appreciation requirements.

Integration with existing Android point-of-sale systems allows businesses to benefit from cryptocurrency payment acceptance without exposure to Bitcoin volatility concerns. Instant fiat conversion removes merchant risk from dramatic price movements.

The platform’s award recognition as “New Payment Platform of the Year” at CorporateLiveWire Global Awards 2022/23 validates utility-focused approaches that create value through operations rather than market speculation outcomes.

Q4 Positioning Favors Utility Over Speculation

Fourth quarter investment patterns historically reward projects with fundamental business models over speculative assets dependent on continued price appreciation.

Revenue sharing through SPY tokens creates income streams from payment transaction volume that operates independently of Bitcoin price movements or cryptocurrency market sentiment. Token holders benefit from platform growth rather than speculative trading outcomes.

Regulatory compliance across every unsanctioned nation provides operational stability during volatile market periods when speculative investments face increased uncertainty.

Cross-cryptocurrency support means platform success does not depend on Bitcoin maintaining high price levels or avoiding correction periods.

Payment Infrastructure Beats Price Speculation

SpacePay’s merchant adoption creates sustainable demand for cryptocurrency payment services rather than temporary price spikes followed by sharp corrections. Business utility provides lasting value that transcends speculative trading cycles.

Platform sustainability depends on utility generation rather than maintaining specific cryptocurrency price levels or avoiding market corrections. Payment infrastructure creates lasting business value that survives volatile market conditions.

Long-term growth prospects improve through merchant relationship development rather than depending on continued Bitcoin price appreciation.

Business expansion creates compound value that operates independently of speculative market outcomes.

Community building focuses on practical payment applications rather than price speculation discussions that create emotional investment decisions during volatile periods. User engagement centers on utility rather than trading psychology.

SpacePay offers fourth quarter investors a defensive cryptocurrency investment approach that generates value through payment infrastructure development rather than exposure to Bitcoin’s extreme price volatility patterns.

The platform’s utility focus provides cryptocurrency sector participation without the price swings that characterize speculative trading strategies.

Interested investors can participate in SpacePay’s presale by connecting their cryptocurrency wallets to the platform’s secure interface, selecting desired SPY token quantities at current $0.003181 pricing, and completing transactions using multiple supported payment methods.

JOIN THE SPACEPAY (SPY) PRESALE NOW

Website | (X) Twitter | Telegram

The post Bitcoin Plunges After New ATH, Why SpacePay Could Be the Safer Q4 Bet appeared first on 99Bitcoins.

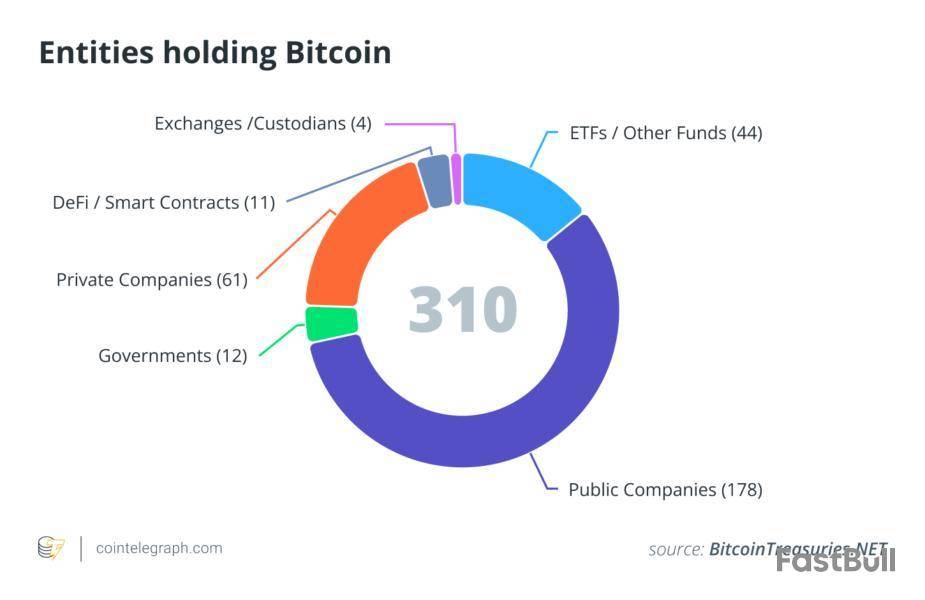

The number of Bitcoin treasury firms keeps on climbing, but announcing a BTC strategy is no longer a guaranteed way to pump a company’s share price.

The model was pioneered by Strategy (formerly MicroStrategy), now the world’s largest publicly traded corporate holder with 632,457 BTC at the time of writing. Since its first purchase in August 2020, Strategy’s stock has risen more than 2,200%.

As of Friday, Aug. 29, 2025, 161 publicly traded companies each hold more than 1 BTC, according to BitcoinTreasuries.net. Together, they hold 989,926 BTC — about 4.7% of Bitcoin’s supply.

A wave of newcomers joined the Bitcoin treasury club in 2025, but the market reaction has cooled. Some firms have diversified into Ether instead, while others have seen their shares trade back down to, or even below, pre-announcement levels.

Here’s a look at some of those companies whose stock performance has failed to keep pace with their Bitcoin ambitions.

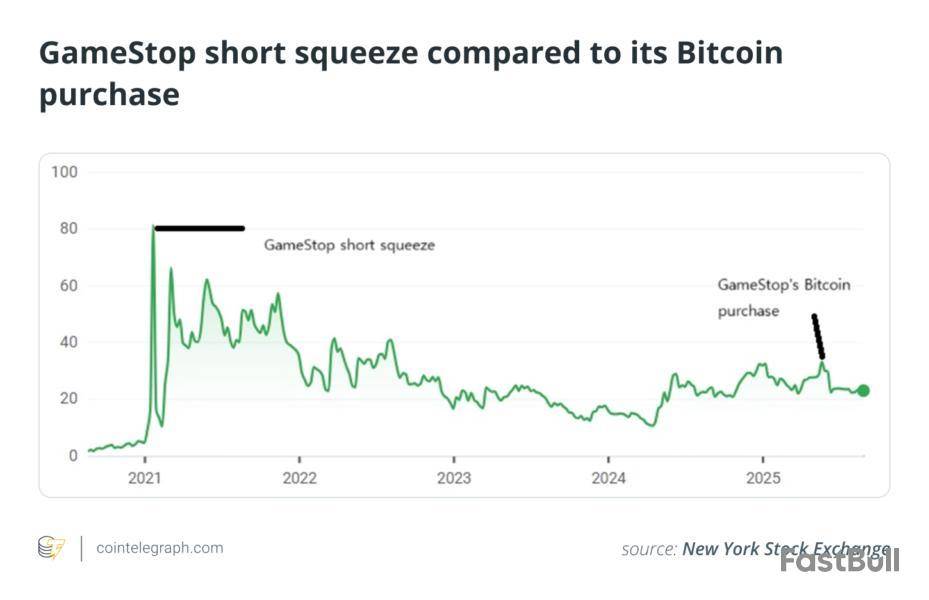

GameStop: Holds 4,710 BTC

GameStop’s fate has long been intertwined with Bitcoin and crypto. In 2021, retail traders on the r/WallStreetBets subreddit triggered a short squeeze on GameStop’s stock, pushing meme finance into the mainstream.

Around the same time, memecoin Dogecoin surged on a wave of cultural hype, online communities and tweets from Elon Musk.

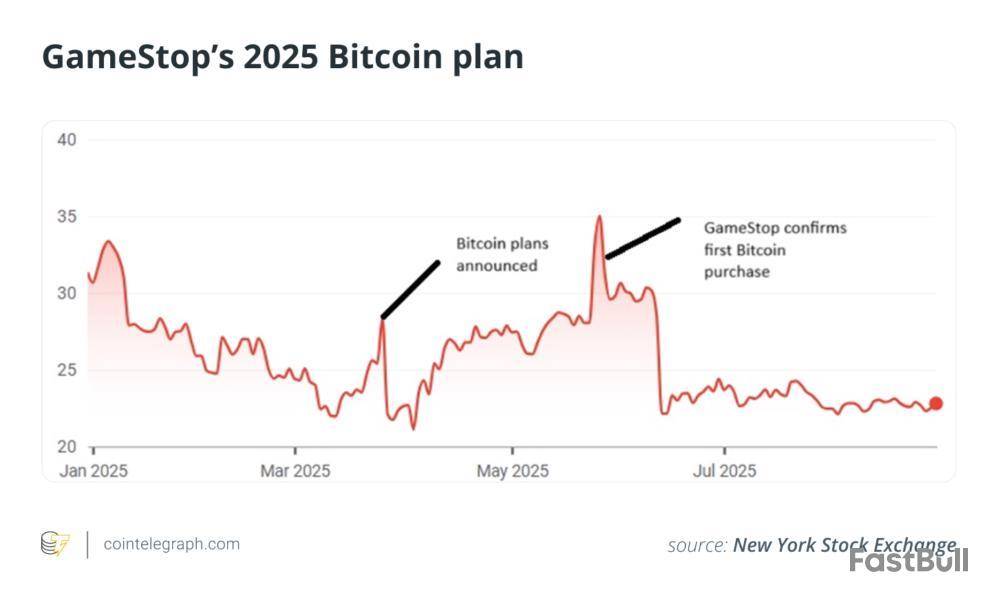

On March 26, 2025, GameStop announced its plan to invest in Bitcoin. Unlike the meme-driven pumps of 2021, Bitcoin failed to recreate the same frenzy. GameStop’s stock initially jumped 12% on the announcement and later peaked at $35 per share on May 28 after the company revealed it had acquired 4,710 BTC.

But investors quickly sold the news in both events. On Thursday, its shares closed at $22.79, down more than 27% year-to-date.

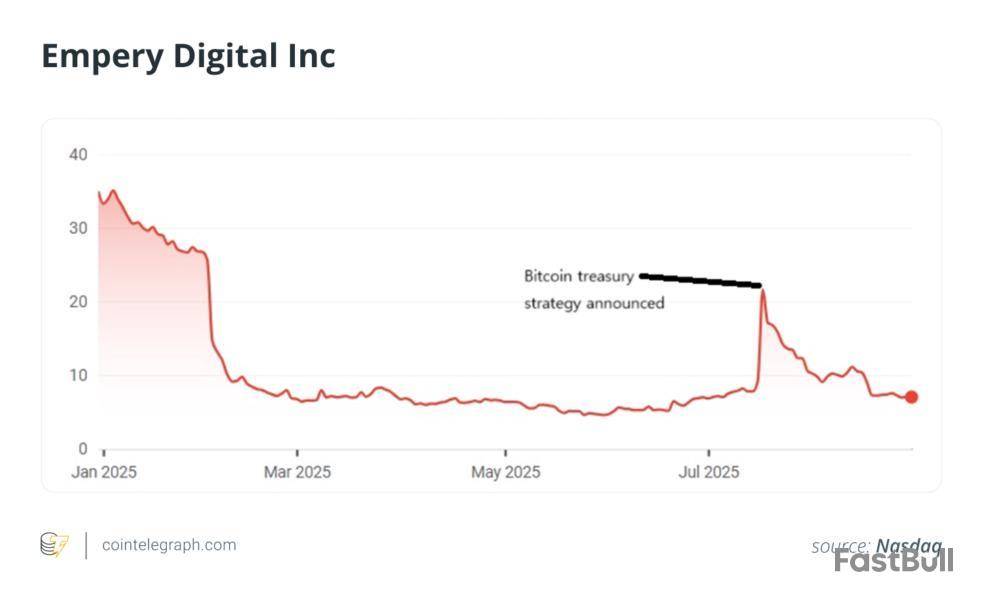

Empery Digital: Holds 4,019 BTC

Not every corporate Bitcoin buyer comes with the backstory of GameStop; many are unrelated to cryptocurrencies or blockchain. MicroStrategy was a business intelligence software firm before it pioneered Bitcoin treasuries. Japan’s Metaplanet started as a budget hotel operator before it began following the Strategy playbook in 2024. Its share price has since surged as much as 6,000%.

Volcon, an electric vehicle maker, announced a $500-million Bitcoin treasury strategy on July 17. Two weeks later, it rebranded as Empery Digital and adopted the ticker EMPD on Nasdaq.

Before the pivot, Empery shares mostly traded between $6 and $7, well below their January high of $35. The Bitcoin announcement briefly lifted the stock to $21 on July 17, but the rally didn’t last. On Thursday, EMPD closed at $6.99, back in its usual range.

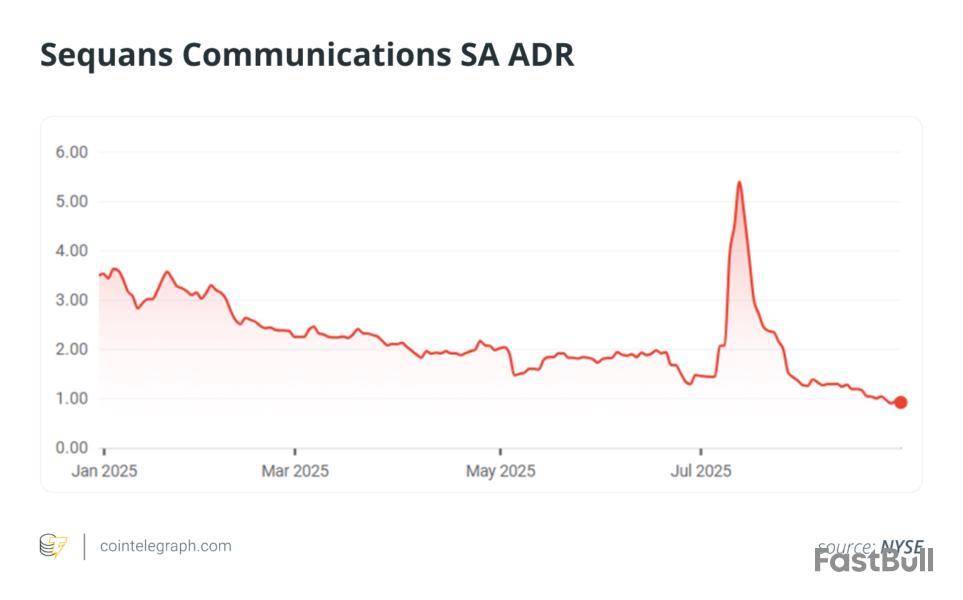

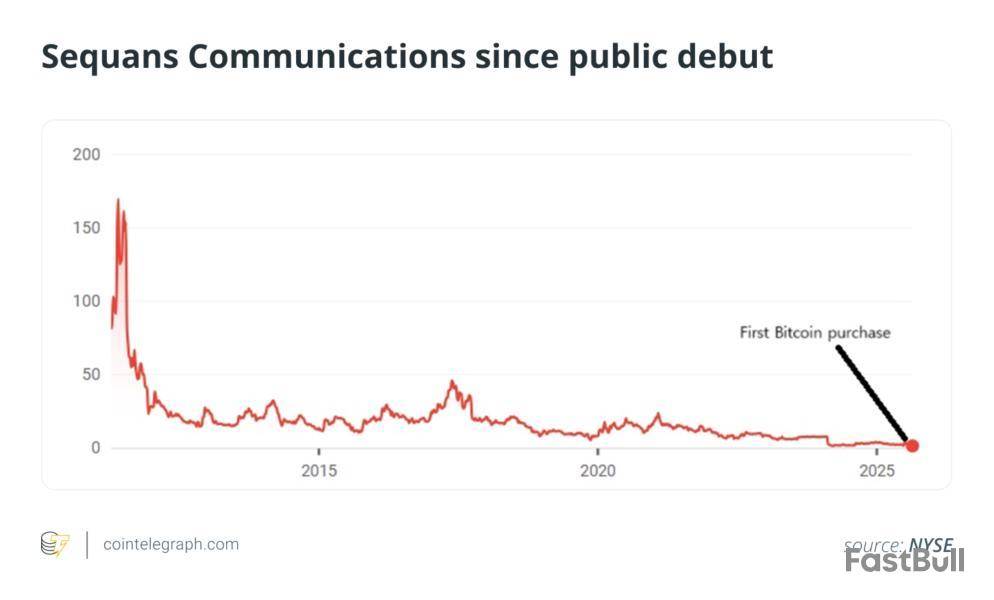

Sequans Communications: Holds 3,170 BTC

Sequans Communications, a French semiconductor firm that listed on the NYSE in 2011 under the ticker SQNS, has a trading history that resembles a lackluster crypto token: hot listing spikes followed by long stretches of investor disappointment.

At the start of July 2025, SQNS was drifting at $1.45 after a year of steady decline. Its first Bitcoin purchase on July 10 briefly ignited a rally, sending shares as high as $5.39 in the following days. But the momentum quickly faded, and by early August, the stock had slid back to $1.25.

On Monday, Sequans announced a $200-million at-the-market equity offering to fund its plans to accumulate 100,000 BTC by 2030. The news did not stop SQNS from sliding; on Thursday, it closed at $0.91.

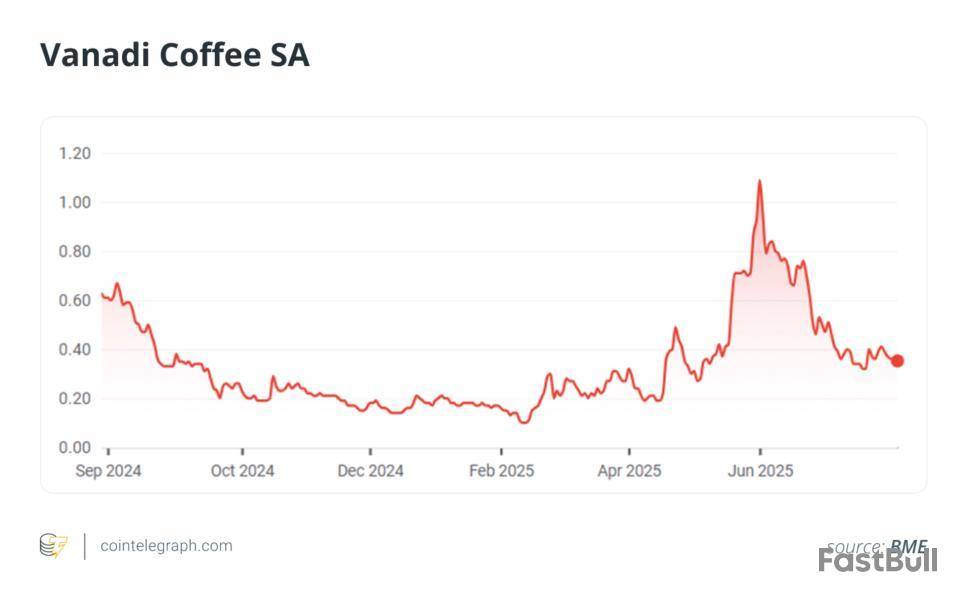

Vanadi Coffee: Holds 100 BTC

Like many firms that turned to Bitcoin, Spanish cafe chain Vanadi Coffee was pushed into the strategy by financial distress. In 2024, the company reported 3.33 million euros ($3.9 million) in annual loss, up from 2.87 million euros the year before.

The Bitcoin plan became official on June 29, and the next day, its shares surged to 1.09 euros, closing the month up more than 300% from the 0.27-euro opening price.

By mid-trading on Friday, Aug. 29, 2025, the stock had slipped back to 35 euro cents. It’s still up 95.6% year-to-date but down 44% from the same point in 2024.

Ming Shing Group: Holds 833 BTC

Ming Shing Group, a Hong Kong-based construction and engineering company, was listed on the Nasdaq in November 2024. Soon after going public, it began accumulating Bitcoin, making its first purchase on Jan. 13, 2025, with 500 BTC. At the time of writing, it holds 833 BTC.

After debuting on Nasdaq at $5.59 on Nov. 22, 2024, its Bitcoin strategy initially drove shares to an all-time high of $8.50. Since then, the stock has slumped to $1.85 on Thursday’s close.

On Aug. 21, the company announced a $483-million deal to acquire an additional 4,250 BTC through a share issuance. If completed, Ming Shing would become Hong Kong’s largest corporate Bitcoin holder, surpassing Boyaa Interactive, which holds 3,640 BTC and currently ranks as Asia’s second-largest public Bitcoin treasury behind Metaplanet.

The recent announcement briefly lifted Ming Shing’s struggling share price, though most of the gains were erased the same day.

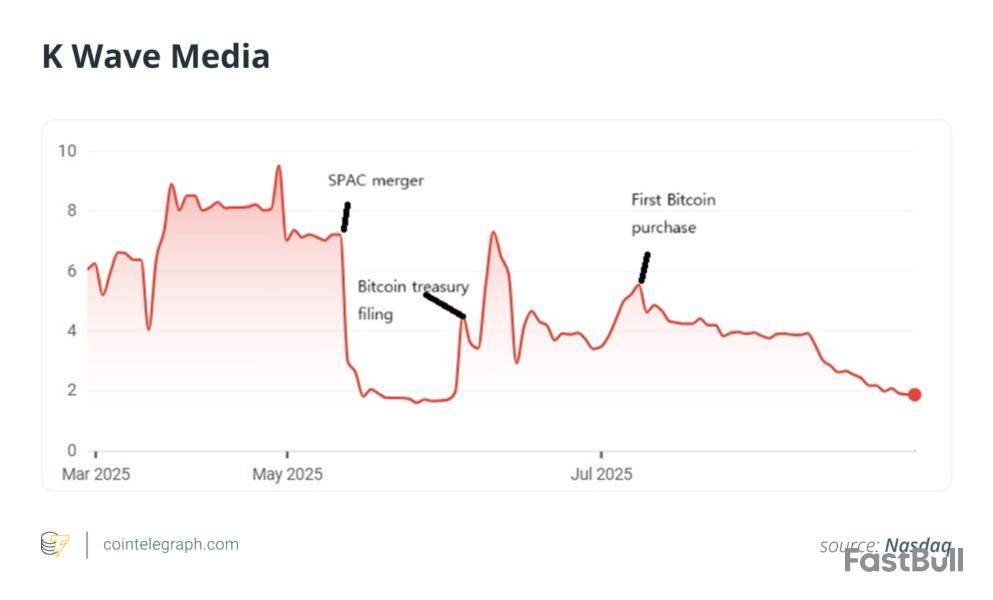

K Wave Media: Holds 88 BTC

South Korean entertainment company K Wave Media made its first Bitcoin purchase in July 2025, but its shares have been sliding ever since. The company has raised $1 billion for BTC acquisitions, yet the stock remains under pressure.

The initial announcement came on June 4 in a Securities and Exchange Commission filing, where K Wave disclosed a $500-million standby equity purchase agreement with Bitcoin Strategic Reserve. The filing also outlined plans to operate Lightning Network nodes and integrate BTC into its financial and consumer platform.

On May 13, Global Star Acquisition and K Enter Holdings completed a special purpose acquisition company (SPAC) merger to form K Wave Media. While the subsequent Bitcoin strategy briefly lifted the stock from its post-SPAC sell-off, the momentum quickly faded. Since the company’s first BTC purchase on July 10, shares have continued to decline, closing at $1.85 on Aug. 28 — just below the $1.92 level recorded on July 3, the day before its Bitcoin treasury filing.

Early success cases among Bitcoin treasury companies

These cases show that announcing a Bitcoin strategy remains a Hail Mary for struggling firms and doesn’t guarantee lasting gains. Share prices often spike on the news but rarely hold.

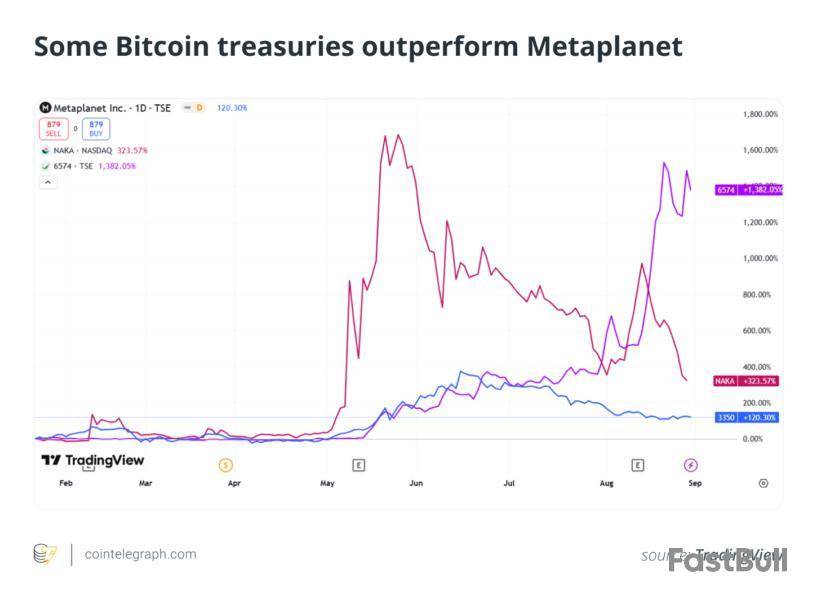

There are, however, a few digital diamonds in the rough. On May 12, healthcare provider KindlyMD announced plans to merge with Nakamoto Holdings to form a Bitcoin treasury company, now trading on Nasdaq under the ticker NAKA.

In recent months, Nakamoto Holdings has outperformed Metaplanet and has become the 16th-largest publicly traded Bitcoin holder, with 5,765 BTC.

Japanese nail salon franchiser Convano has been outperforming both Nakamoto Holdings and Metaplanet. At the time of writing, it holds 365 BTC, which is a relatively small war chest when compared to the likes of Metaplanet and Nakamoto Holdings.

Ethereum-based NFT brand Pudgy Penguins, in partnership with Mythical Games, has announced the global release of Pudgy Party, a mobile party game now available on iOS and Android. The launch marks the brand’s expansion into gaming and could signal a positive outlook for its PENGU token price.

Pudgy Penguins Explores Gaming

Pudgy Penguins, the well-known NFT brand, has teamed up with Mythical Games, the studio behind FIFA Rivals, to launch Pudgy Party, a new Web3 mobile game. Released globally on Friday, the game is a fun party-royale filled with fast-paced mini-games and features Pudgy Penguins characters, each with their own unique traits, abilities, and personalities.

Pudgy Party is similar to games like Fall Guys, offering a colorful take on the battle royale style where players compete in obstacle courses and survival challenges.

Each match is made to feel different, with rotating challenges and surprises that keep every game unique.

Pudgy Penguins CEO Luca Netz said, “The heart of Pudgy Penguins has always been about connection and spreading good vibes. Bringing our beloved, viral characters to life in a mobile multiplayer game is an exciting step forward in our mission to create joyful, meaningful experiences for our growing global community. Pudgy Party is fun, accessible to players of all ages, and designed to bring people together.”

Players can collect outfits, emotes, and other in-game items, including special costumes that can be turned into NFTs and traded on the marketplace.

Also read: Bitcoin Asia: Adam Back Predicts Companies May Eventually Hold Bitcoin in Treasuries

The game is kicking off with its first seasonal event, Dopameme Rush, a meme-themed challenge inspired by internet culture. New seasons will arrive each month, offering both free and premium passes, along with special events and leaderboard competitions.

Pudgy Penguins Expands Aggressively

Pudgy Party is now available as a free download on iOS and Android, marking the latest step in Pudgy Penguins’ growing ecosystem. The launch follows last year’s debut of its desktop game Pudgy Worlds, the Solana-based PENGU token, and its line of plush toys and collectibles sold through Walmart.

First announced in May 2024, the game also offered early supporters a soulbound token called Early to the Party, a non-transferable digital badge given to those who pre-registered ahead of release

The new game doesn’t feature the PENGU token just yet, but Pudgy Penguins and Mythical Games say they’re looking at future ways to bring PENGU, MYTH, and other tokens into the experience.

According to on-chain data, Pudgy Penguins is currently the second most expensive NFT collection by floor price and ranks fourth overall by market cap at $417 million.

At the Bitcoin Asia Conference 2025 in Hong Kong, Blockstream CEO Adam Back made a bold prediction: in the future, most companies will hold Bitcoin as part of their corporate treasury.

Bitcoin Magazine@BitcoinMagazineAug 29, 2025JUST IN: Cypherpunk legend Adam Back says, “Eventually all companies will be #Bitcoin treasury companies”

Nothing stops this train 🚀 pic.twitter.com/X2cmjLalE2

According to Back, the smartest way for companies to keep pace with Bitcoin is to make it part of their strategy.

“The only way for a company to match or even outperform Bitcoin is to buy Bitcoin and use capital markets to increase Bitcoin per share, operate their core business, reinvest profits to buy more Bitcoin, and use additional profits to expand products and services.” “From that point of view, I think eventually, probably all companies will be Bitcoin treasury companies,” he added.

Corporate Adoption Accelerates

According to Bitwise, 28 new companies bought 140,600 BTC in July and August, which is about the same as a whole year’s supply of new Bitcoin. This shows how quickly businesses are adopting Bitcoin and adds to the bullish outlook.

BitcoinTreasuries.NET@BTCtreasuriesAug 29, 2025JUST IN: Bitwise reports 28 new #Bitcoin treasury companies bought 140.6K BTC in July & August, equivalent to a whole years of supply.

Bullish 🔥 pic.twitter.com/TX2NqhRVav

Institutions and governments continue to stack Bitcoin. Data from Bitcointreasuries.net shows that publicly traded companies now hold close to 1 million BTC, led by MicroStrategy with over 632,000 BTC, followed by MARA Holdings and others.

Private companies together hold about 296,945 BTC, while government entities control 526,357 BTC.

Adam Back’s BSTR Gears Up for Nasdaq Debut

Adam Back’s Bitcoin Standard Treasury Company has also announced plans to go public by merging with Cantor Equity Partners I, a SPAC backed by Cantor Fitzgerald, in a deal with up to $1.5 billion in funding, the biggest ever for a Bitcoin treasury SPAC.

BSTR will launch with 30,021 Bitcoin on its balance sheet, making it the fourth-largest corporate Bitcoin holder. The company expects to begin trading on Nasdaq under the ticker “BSTR” after the deal closes, expected in Q4 2025.

How Corporate Treasuries Could Unlock Trillions

Back has previously said that companies like MicroStrategy are taking advantage of the gap between today’s fiat money and Bitcoin’s future potential. He says that this strategy could be highly profitable and scalable, worth trillions if widely adopted, and could allow most large publicly traded companies to hold Bitcoin in their treasuries, positioning them ahead of a future where Bitcoin becomes a dominant global currency.

With corporate adoption accelerating, Bitcoin is no longer just an asset; it’s becoming a foundation for the future of global finance.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up