Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

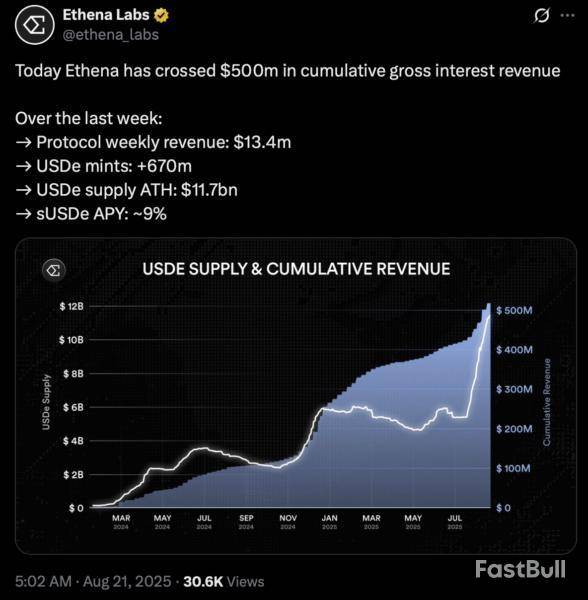

Ethena Labs on Thursday said its Ethena protocol has generated more than $500 million in cumulative revenue. Growth in both revenue and the circulating supply of its synthetic stablecoin, Ethena USDe (USDe), has accelerated since July as synthetic stablecoins gain market share.

Ethena Labs shared the news via a post on X, saying that in the past week, protocol revenue hit $13.4 million and USDe supply hit an all-time high of $11.7 billion.

“Ethena’s revenue has been driven by strong inflows into USDe and favorable market conditions that have amplified returns from its delta-neutral hedging reserve model,” an Ethena Labs spokesperson told Cointelegraph. “The protocol’s momentum reflects growing demand for and confidence in USDe as a store of value.”

According to decentralized finance analytics platform DefiLlama, Ethena USDe has the third-largest market capitalization of all stablecoins at this time of writing. It also has the top market capitalization among synthetic stablecoins. In the past month, the market cap of Ethena USDe has risen 86.6%.

Along with Ethena USDe, other synthetic stablecoins are gaining momentum and market share. Sky Dollar (USDS), which powers the Sky ecosystem and is an upgraded version of DAI (DAI), has seen a 14% increase in market cap. Falcon USD (USDf), a synthetic dollar created by Falcon Finance, has seen its market cap jump 89.4%.

Synthetic stablecoins have benefits as well as risks. Because they are not collateralized by physical assets, they may have lower transaction costs. But there’s a risk of instability and depegging, which can result in significant investor losses.

Stablecoin market jumps 4% in August 2025

According to DefiLlama, the stablecoin market cap has jumped 4% in August, rising to $277.8 billion on Thursday from $266.6 billion on July 31. The uptick comes amid growing regulatory clarity in the United States, with President Donald Trump signing the GENIUS Act into law on July 18.

At the Wyoming Blockchain Symposium 2025, US Federal Reserve Governor Christopher Waller stated that the GENIUS Act could help stablecoins reach their full potential and expand the dollar’s role worldwide.

China may counter with its own stablecoin move. In what would be a significant policy shift, it is reportedly considering allowing Chinese yuan-backed stablecoins.

Lemmy The Bat (LBAI) will be listed on BitMart, a larger crypto exchange, on August 22. When a new token begins trading on a better-known platform, it can get more buyers. This can make the price go up quickly, as more people become interested. However, sometimes early investors use a big listing to sell their coins, which can make prices fall after a short jump. The listing may bring more attention and more trading. Price changes can be fast, so keep watching after the opening. Source: source

BitMart@BitMartExchangeAug 21, 2025#BitMart will list Lemmy The Bat (LBAI) @lbai_lemmy on our digital assets platform on August 22, 2025

Trading pair: LBAI/USDT

Deposit: Available

Trading: 8/22/2025 9:00 AM UTC

Learn more: https://t.co/P2yqbq74Jb pic.twitter.com/DmidFJb7OC

The end of the XMAQUINA (DEUS) token sale could impact prices soon. When a sale finishes, new tokens may enter trading, changing supply and demand. If many people buy $DEUS in the sale, they might want to sell when trading starts to take profits, which can make prices fall. But if the project has strong support and interesting features, demand can grow, causing a price increase. Watch for listing announcements or community excitement right after the sale. This event matters for both early buyers and future traders. Source: source

Impossible Finance@impossiblefiAug 20, 202512 hours left!

Secure your $DEUS allocation at $0.045 per token before the extended deadline on August 21, 7am UTC .

Deposit USDT here: https://t.co/R35xCzUZYY

Full details: https://t.co/mSsLwrvuJj https://t.co/xuhVCm5Msf

The MIP-B45 vote is important for Moonwell (WELL). Community members will decide on fixing lost rewards for users by using an airdrop. If the vote wins, WELL stakers who lost rewards could get new tokens, which might increase trust in the project. This can help more people want to buy or hold WELL, possibly pushing up the price. But if the vote does not pass, holders may lose faith, and the price could drop. Watch community reaction after the result for hints about price moves. Source: source

Moonwell@MoonwellDeFiAug 20, 2025️ Phase 1 of the Base Safety Module Remediation Plan has been submitted for onchain voting.

If passed, WELL stakers on @Base will be reimbursed for their lost rewards through a @merkl_xyz airdrop campaign.

An anti-central bank digital currency provision has been added to what is viewed as must-pass defense funding legislation.

That measure was added in the latest version of the House's National Defense Authorization Act (NDAA), first reported by Bloomberg Law on Thursday.

The new title in the bill is called the Anti-CBDC Surveillance State Act, and contains the same legislation that was previously introduced by House Majority Whip Tom Emmer in a standalone bill. Earlier in the summer, the full House voted 219-210 for Emmer's bill, which would block the Federal Reserve from issuing a central bank digital currency directly to individuals.

A CBDC is a digital form of fiat money, directly issued and regulated by a country's central bank. Federal Reserve Chair Jerome Powell has also said the central bank won't issue a CBDC without congressional approval. Many Republicans have taken issue with a CBDC over concerns of broad monitoring of financial transactions. Emmer has said that CBDCs are “government-controlled programmable money that, if not designed to emulate cash, could give the federal government the ability to surveil Americans' transactions and choke out politically unpopular activity."

Democrats have criticized the bill in the past, saying it would "stifle" research.

The NDAA is an annual law that authorizes funding for the Department of Defense. The Senate will vote on its version of the bill when it comes back to Washington on Sept. 2 and the House will likely take it up as well early next month, Punchbowl News reported on Thursday.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

An investor lost 783 BTC, worth about $91.4 million, after a fraudster impersonating a hardware wallet support agent gained access to their wallet, Coindesk reported. The theft, disclosed by blockchain investigator ZachXBT, is one of the largest individual social engineering scams in recent months.

Funds Routed Through Wasabi Wallet

The incident occurred on August 19. The attacker tricked the victim into handing over wallet credentials, allowing them to transfer the Bitcoin. The funds were then moved through Wasabi Wallet, a privacy tool commonly used to hide transaction trails.

The case adds to a series of major crypto scams in 2025. Investors lost $3.1 billion to hacks and fraud in the first half of the year, with social engineering becoming an increasingly common tactic.

The theft also comes exactly one year after the $243 million Genesis creditor hack, which led to multiple arrests in California earlier this year. Both incidents underline how attackers continue to exploit weaknesses beyond technical security.

Security Concerns Persist

The $91 million loss highlights the ongoing risks facing crypto investors, even as firms improve technical safeguards. Analysts warn that impersonation and phishing schemes remain difficult to prevent, with scammers increasingly targeting users through trusted support channels.

North Wales Police has warned cryptocurrency holders to remain vigilant after a victim was defrauded of £2.1 million in Bitcoin. The force described the incident as a “sophisticated” scam and urged the public to be cautious when approached with unexpected requests involving digital assets.

Read more: BTC Remains Under Trendline; North Wales Police Investigate £2.1M Bitcoin Scam

The scam unfolded as criminals impersonated senior UK police officers and fabricated a story about a supposed security breach. The victim was told that an arrested individual’s phone contained personal identification documents linked to them, prompting them to hand over their Bitcoin.

The warning comes as Bitcoin faces selling pressure in the market. BTC/USD has been trending lower along a descending trend line on the hourly chart, with horizontal support observed around 112,800. A drop below this level could add to downside momentum, while a breakout above the trend line may draw in intraday buyers.

Ethereum is down $116.84 today or 2.68% to $4239.59

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up