Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

TL;DR

Ethereum Shows Monthly MACD Crossover

Ethereum (ETH) has printed a fresh crossover on the monthly MACD indicator, which some market analysts see as a potential turning point. Crypto trader Merlijn The Trader called the move a “monster ignition” and pointed to the completion of a multi-year consolidation phase.

ETHEREUM IS CHARGING THE MONSTER MOVE

Fresh MACD crossover. 3-year squeeze at apex. Monthly candle screaming bullish.

Break $4,450 and $ETH doesn’t walk… it rips. Don’t call it hopium. Call it ignition. pic.twitter.com/kKgug4l34p

— Merlijn The Trader (@MerlijnTrader) September 8, 2025

Remarkably, the MACD crossover on the monthly chart is considered rare, especially following a three-year squeeze. The last time this occurred was before the 2020–2021 rally, where Ethereum moved sharply higher over several months. ETH is now trading near a key level of $4,450, which marks the top of its long-standing resistance range.

Ethereum’s recent breakout and pullback appear similar to its price behavior during the 2020–2021 cycle. Back then, ETH broke out of a long downtrend, retested its breakout level, and then started a steep climb tonew highs.

Charts shared by Merlijn The Trader show that Ethereum has again broken above a downward trendline and returned to test former resistance near $3,650–$4,000. The trader noted, “2021 gave us the pattern. 2025 gives us the chance,” suggesting that the setup may lead to a repeat of previous price behavior.

ETHEREUM IS REPEATING HISTORY

2021 showed us the pattern. 2025 is showing us the opportunity.

The retest is where legends buy. The breakout is where fortunes are made.$ETH isn’t done. It’s just getting started. pic.twitter.com/81TVrNlp70

— Merlijn The Trader (@MerlijnTrader) August 29, 2025

While comparisons to past cycles offer perspective, Ethereum would still need to confirm strength above $4,450 to open the door for further upside.ETH Holds Strong as Momentum Builds

ETH recently bounced from its 50-day exponential moving average, which is now acting as support around $4,164. The ability to stay above this level shows that buyers are still active and defending key zones.

Notably, the price is also positioned above all other major EMAs (20, 50, 100, and 200), which gives it astrong technical base. Holding these levels often reflects trend stability and provides structure for future moves.

Meanwhile, the daily Relative Strength Index (RSI) sits at 52. This neutral zone shows that the market is balanced, with neither strong buying nor selling pressure. In previous market cycles, similar RSI levels during uptrends allowed for gradual price increases without the need for a deep correction.

As of press time, Ethereum was priced at around $4,360. It has gained 1% in the last 24 hours, while showing a slight weekly decline. Trading volume over the past day is $30.36 billion.

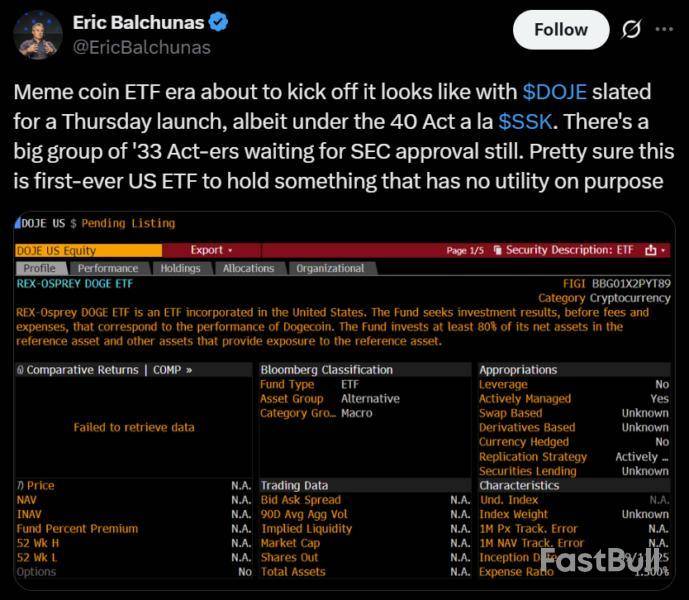

The United States’ first memecoin exchange-traded fund (ETF) is set to debut on Thursday, marking the latest step in the expansion of regulated crypto products after the successful rollout of Bitcoin and Ether funds last year.

In a social media post on Tuesday, Bloomberg ETF analyst Eric Balchunas said the Rex-Osprey Doge ETF (tDOJE) has been approved by the US Securities and Exchange Commission (SEC).

“Pretty sure this is the first-ever US ETF to hold something that has no utility or purpose,” Balchunas said.

Balchunas hinted at the potential launch last week under the Investment Company Act of 1940 — a different framework from the Securities Act of 1933, which typically governs grantor trusts that hold physical commodities or derivatives.

This is a developing story, and further information will be added as it becomes available.

Two major global banks — BNP Paribas and HSBC — have joined the Canton Foundation, the development organization of the tokenization-focused Canton Network, underscoring continued institutional interest in real-world asset applications of blockchain technology.

The foundation announced Tuesday that BNP Paribas and HSBC are now members, alongside recent entrants Goldman Sachs, Hong Kong FMI Services and Moody’s Ratings. With more than 30 members, the Canton Foundation provides governance and strategic direction for the network while advancing blockchain-based financial use cases.

Canton Network is a blockchain designed for institutional finance, with a core focus on real-world asset (RWA) tokenization, regulatory compliance and interoperability.

BNP Paribas’ head of global markets, Hubert de Lambilly, said the move reflects the bank’s commitment to adopting distributed ledger technology “to serve our evolving client needs.”

BNP’s involvement builds on its prior backing of Digital Asset, the company behind the Canton Network. The French bank participated in Digital Asset’s $135 million funding round, which the firm said would accelerate institutional adoption and decentralized finance initiatives on Canton.

HSBC’s head of digital assets and currencies, John O’Neil, said joining the foundation would help foster the blockchain industry’s maturation and support the creation of real liquidity in digital asset markets.

HSBC has been active across blockchain initiatives, with reports indicating it is preparing to apply for a stablecoin license in Hong Kong under the city’s new regulatory regime. HSBC Hong Kong is also exploring blockchain applications in custody, tokenization and bond issuance, according to previous disclosures.

Institutional interest in tokenized RWAs grows

Institutional demand for tokenized real-world assets is shaping crypto’s 2025 narrative, marking a sharp departure from earlier cycles dominated by retail speculation in the 2017 and 2021 bull markets.

The World Economic Forum (WEF) recently highlighted the trend, noting that the industry now benefits from a unique mix of institutions, regulators and technology companies working together to “build trusted, interoperable frameworks.” If successful, the WEF said, this collaboration could allow asset tokenization to fulfill its long-promised potential.

Regulation is also playing a decisive role. In the United States, passage of the stablecoin-focused GENIUS Act, along with House of Representative approvals of market structure and anti-CBDC bills, has bolstered confidence among major financial institutions exploring blockchain adoption.

So far, tokenization efforts have concentrated on private credit markets and Treasury bills. But the scope is expanding, with experiments in equities, commodities and energy infrastructure underway.

As Cointelegraph recently reported, digital asset exchange Kraken has engaged with the SEC’s crypto task force to discuss tokenization, underscoring how the sector’s future is increasingly tied to regulatory dialogue.

So far, no cryptocurrency service has reported losses as a result of clipper malware being injected into NPM packages, inevitable instruments for JavaScript developers. At the same time, cryptocurrency users should stay particularly vigilant these days.

Polygon, Ledger, Trezor break silence on yesterday's NPM hack

According to official statements by cryptocurrency teams, more and more services have confirmed that their tech architectures are unaffected by the Sept. 8 NPM attack, the biggest hack in the history of JavaScript.

Polygon (POL), the largest layer-2 blockchain on Ethereum Virtual Machine, assured readers that both Polygon Proof-of-Stake and Agglayer are unaffected by the collapse.

Most importantly, similar statements have been released by the cryptocurrency wallet's team. Hardware wallet producer Ledger, whose CTO Charles Guillemet informed the crypto space about the hack, stressed that all funds are safe.

Ledger devices are not and have not been at risk during an ecosystem-wide software supply chain attack that was discovered. Ledger devices are built specifically to protect users against attacks like these.

Trezor, another top-tier provider of hardware cryptocurrency wallets, outlined that at no stage were the gadgets exposed to the attackers.

Trezor Suite, an app necessary to connect Trezor wallets to computers, is also safe, the statement says.

Largest JavaScript NPM hack: What you should know

Yesterday, on Sept. 8, 2025, the account of a reputable JavaScript software developer was hacked. The malefactors uploaded tampered NPM packages — elements of JS code — infiltrated with the malware targeting crypto on all major blockchains.

Altered NPM packages might be downloaded billions of times as JS is one of the dominant programming languages right now.

Clipper malware replaces the address a victim sends crypto to with the address of the hacker. As a result, the user sends money to the attacker without knowing it.

All crypto users should be super cautious these days while sending funds on-chain and when signing approvals via Web3 wallets.

Tether CEO Paolo Ardoino issued an unconventional message this Tuesday, writing that "Bitcoin, Gold and Land are the hedge against incoming darker times." This grim remark carries weight not just because of who said it but because the backdrop for global markets is now what may be called bright.

Fresh U.S. data shows employment for March 2025 was revised down by 911,000 jobs, a huge miss that reshapes the outlook for monetary policy.

At the same time, the Federal Reserve is forced to choose between a 0.25% or 0.5% rate cut next week on Wednesday, highlighting just how controversial the economy looks heading into the end of the year.

Paolo Ardoino 🤖@paoloardoinoSep 09, 2025Bitcoin, Gold and Land are the hedge against incoming darker times.

In that context, Ardoino's mention of "darker times" reflects the same pressure points policymakers are dealing with.

What about Tether?

Tether, though, is quite well prepared, judging by Ardoino's playbook. As of June 30, 2025, the company reported $162.57 billion in assets, dominated by $105.5 billion in U.S. Treasuries, but also holding $8.72 billion in precious metals and $8.93 billion in Bitcoin.

So, Tether itself has shifted a share of its backing into assets seen as hedges rather than pure cash equivalents.

What is significant is that Ardoino is framing Bitcoin not as a speculative play but as part of the same safety basket that traditionally included gold and land. For a market searching for direction, it signals how crypto is becoming a defensive strategy.

Sam Altman's proof of humanity project World has seen its token's price surge over 80% in less than two days amid the launch of a WLD digital asset treasury.

On Monday, the Nasdaq-listed Eightco Holdings Inc. said it had launched a WLD digital asset treasury with a $250 million private placement. Hours before the announcement, WLD's price had already started rising.

WLD was changing hands at $1.87 as of 11:10 a.m. ET on early Tuesday, up over 20% on the day, according to The Block Price Page.

The token, however, has risen more than 80% since Sunday evening. WLD's all-time high of over $11 came in March 2024.

The World project has garnered significant press thanks largely to Altman, who is famously the CEO of OpenAI. The project, formerly known as Worldcoin, has been primarily developed by Tools for Humanity, a firm co-founded by Altman and Alex Blania. World gives people WLD tokens when they sign up for a World ID, which involves having a space-age looking silver orb scan individuals' eyeballs to verify they are human.

Providing a way to prove humanity and create digital identifications that people can use online is seen by many technology thought leaders as a necessary tool society will come to rely on as the number of artificial intelligence-powered actors populating the internet grows.

"When you think about these orbs, the iris scanning, in my opinion this is going to be the de facto standard when we think about separating from bots, identifying humans," Dan Ives said in a CNBC interview on Monday. Ives was announced as chairman of the board for the WLD treasury Eightco.

On Monday, Eightco, ticker symbol OCTO, said it signed a private placement for the purchase and sale of over 170 million shares of common stock for approximately $250 million, according to a statement. Eightco also issued shares to BitMine, the world's largest corporate holder of Ethereum, for another $20 million.

"The transaction was led by MOZAYYX with participation from a premier list of institutional investors including World Foundation, Discovery Capital Management, GAMA, FalconX, Kraken, Pantera, GSR, Coinfund, Occam Crest, Diametric and Brevan Howard," according to the statement.

Digital asset treasuries, or DATs, have become one of the biggest stories across crypto as token holders and investors seek to tap capital markets in order to accumulate certain digital assets.

After Eightco's shares rose over 3,000% on Monday, the company's shares were down about 18% as of 11:31 a.m. ET, according to Yahoo Finance.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Major crypto exchange Binance has issued an important security reminder for crypto projects, urging them to stay vigilant against fake listing agents and scams.

Binance, in an official blog post, stated that it has become aware of bad actors attempting to exploit the Binance brand by falsely claiming to be Binance Business Development (BD) employees, official "listing agents," or intermediaries who can guarantee a listing on the Binance platform for a fee.

These claims are a scam, Binance added, as such listings are never guaranteed. This is because Binance evaluates every project on its merits, taking into account factors such as community demand, market conditions, compliance, project viability and business model sustainability, among others.

Crypto projects should note that Binance does not accept or recognize any third-party individual or agency to apply for a listing or negotiate on their behalf.

Binance also does not charge a "listing fee" or any other fees for the platform itself as it seeks to list and support promising projects to meet user demand, not to collect application fees.

In this light, anyone claiming to represent or be affiliated with Binance and requesting payments in any form of fees or tokens before the conditions above are met might be a scam. In addition, Binance will never contact users by "official email" for listing matters or ask for "listing fees" in any channels.

Binance opens crypto payments for 31,000 merchants in South Africa

Through a new partnership with Zapper, one of South Africa’s leading payment providers, over 31,000 merchants will now be able to accept crypto.

From Sept. 9, 2025, Binance Pay will be accepted at over 31,000 South African merchants through Zapper, expanding the Binance Pay network to 63,000 merchants.

Binance Pay currently supports more than 100 cryptocurrencies, including 1INCH, ACH, ACT, ADA, APE, APT, ATOM, AXS, BNB, BONK, BTC, BCH, CAKE, CHZ, COTI, CTSI, DAI, DOGE, DOT, EGLD, EOS, ETC, ETH, EUR, FDUSD, FIL, FLOKI, FTM, GALA, HBAR, INJ, IOTX, LINK, LTC, MANA, NEO, NEIRO, NOT, OM, ONT, OSMO, PEPE, POL, QTUM, SHIB, SOL, TON, TRX, TUSD, UNI, USDC, USDP, USDT, VET, XLM, XRP, XTZ, ZEC and ZIL.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up