Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum is now in a correction phase after reaching a high of about $4,950 in late August, with open interest (OI) dropping more than 8% in the past week.

On the other hand, Binance’s futures market data suggests that the dip may be close to running out of steam, which could set the stage for the next rally.Reading the Futures Market Tea Leaves

According to analysis shared by crypto researcher Burak Kesmeci, local bottoms for Ethereum have frequently been preceded by drops in Binance’s open interest. Over the last three months, an average OI drop of 14.9% on the hourly timeframe has corresponded with spot price corrections averaging 10.7%.

“Drops in OI have signaled spot price corrections ahead of time,” wrote the analyst.

He provided three precise examples: a 10.52% OI fall from 11.4 billion to 10.2 billion on August 17, a 25.38% crash from 13 billion to 9.7 billion on August 20, and an 8.69% decrease from 11.39 billion to 10.4 billion on September 13.

In each case, the reduction in open interest served as a leading indicator for upcoming spot market weakness. According to Kesmeci, the OI may need to ease down to about 9.69 billion to signal a full reset. This cooling of leveraged positions is not necessarily a bearish omen, but rather a needed market cleanse.

He concluded that while ETH’s spot price might see slightly more downside, the market is likely in the process of establishing a low, setting the stage for its next upward move.

“The futures side is almost ‘cooled off,’ and we may be looking at an ETH preparing for the next leg of the rally,” claimed Kesmeci.

His outlook comes at a time when ETH is trading at $4,487, down 0.8% over 24 hours but still holding onto a 3.9% gain for the week. While derivatives traders have reduced exposure, on-chain data shows the opposite trend: long-term holders are locking up tokens.

CryptoQuant reported previously that Ethereum staking deposits hadrisento a record 36.2 million ETH, while exchange balances have dwindled to multi-year lows, showing that investors are reluctant to sell into weakness.

At the same time, U.S. spot ETFs now own 6.7 million ETH, which is almost twice as much as they did in April. This means that more companies want to buy ETH.Road Ahead

Kesmeci’s short-term technical view exists alongside a divergence in fundamental perspectives. For instance, banking giant Citigroup has set a year-end 2025 price objective of $4,300 for Ethereum, a figure that appears conservative next to September’s record high near $4,955.

As noted by CryptoQuant analysts, the bank’s cautious position accounts for macroeconomic risks and potential regulatory challenges.

Over the past month, ETH has gained nearly 4%, while its yearly growth remains at 96%. Despite the correction, the asset is holding comfortably above its September low of $4,307 and sits only 9.3% below its all-time high reached on August 24.

With Kalshi enjoying an uptick in trading volume, the prediction market platform has partnered with Solana and Base on the launch of an ecosystem hub.

"We’re backing offchain and onchain innovation, with dedicated grants partnering with Solana and Base," Kalshi posted to X on Wednesday, announcing the launch of its Kalshi Ecosystem support network.

The move comes as the Paradigm-backed Kalshi has experienced an uptick in monthly trading volume. Last month, Kalshi registered $875 million in volume, compared to Polymarket's $1 billion, according to The Block Data Dashboard.

After a big trading season ahead of last November's U.S. elections, Kalshi's trading volumes fell considerably. The platform has yet to complete a full month of over $1 billion in trading volume since last year. Meanwhile, Polymarket has recorded more than $1 billion in monthly volume multiple times, also according to The Block Data Dashboard.

Kalshi and Polymarket poised for growth

The prediction platforms landscape appears ripe for growth given the Trump administration's willingness to facilitate innovation in the digital assets sector. Although their business profiles differ slightly, both Kalshi and Polymarket provide a means for people to wager on events like elections and sporting events using crypto.

Recently, Polymarket CEO Shayne Coplan said that the Commodity Futures Trading Commission had given his platform the "green light" to relaunch in the lucrative U.S. market. In 2022, Polymarket settled with the CFTC for allegedly offering illicit binary options contracts. In return, it agreed to wind down its non-compliant markets, and take preventative steps to block U.S. users on an ongoing basis.

In July, Polymarket acquired derivatives exchange QCEX in an effort to pave the way for its return to the U.S.

With Polymarket appearing to have the go ahead to relaunch in the U.S., last week reports suggested Polymarket is considering raising additional capital at a valuation between $9–$10 billion. Kalshi, meanwhile, is said to be "close to raising money at a $5 billion valuation," according to a report last week.

Kalshi, which raised $185 million in June in a funding round led by Paradigm, is hoping to overtake Polymarket; and sports betting could be a path forward. Popular stock and crypto trading app Robinhood said last month its is launching a pro and college football prediction market with the help of Kalshi.

On the heels of Kalshi promoting the new ecosystem hub on Wednesday, one popular X user said they'd partnered with the platform in order to develop content around "competitive events" like the FIFA World Cup, League of Legends World Championship, and NBA and NFL games.

Coinbase, Crypto.com, and Underdog all rolling out, or exploring, their own prediction market platform.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

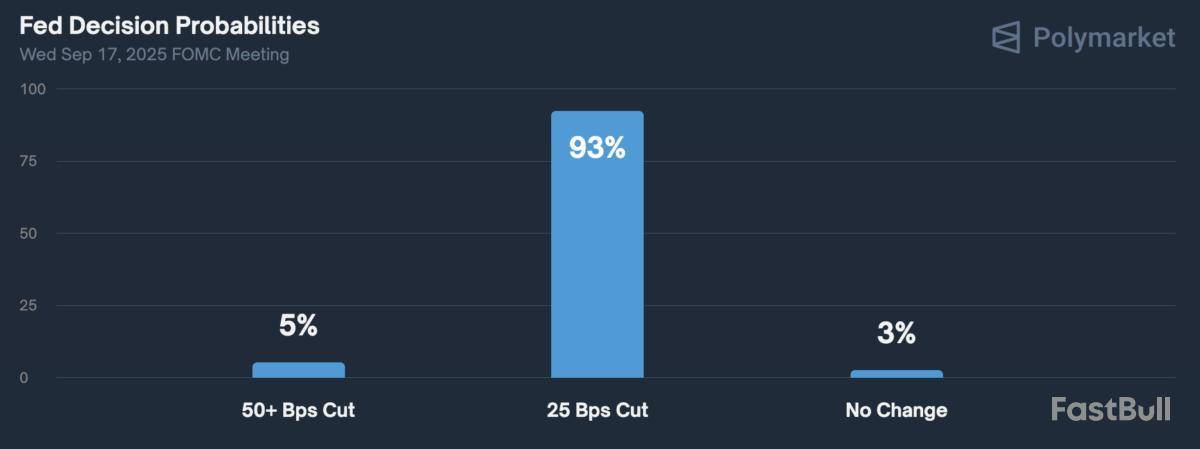

As most expected, the Federal Open Market Committee (FOMC) lowered the benchmark federal funds rate by 25 basis points (bps) to a range between 4% and 4.25%, by a vote of 11-1.

"Recent indicators suggest that growth of economic activity moderated in the first half of the year," the U.S. Federal Reserve said Wednesday in a statement. "Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated."

The Fed most recently trimmed interest rates by 25 bps in September, November, and December 2024. According to Wednesday's FOMC statement, the Fed is signaling two more cuts by year end.

President Donald Trump has repeatedly called for rate cuts since taking office in January, even floating the idea of firing Fed Chairman Jerome Powell. In a Truth Social post on Monday, Trump said the Fed must cut rates "bigger than [Powell] had in mind."

Lower interest rates typically make traditional investments less attractive, leading many investors to seek higher returns through alternative assets such as cryptocurrencies. Wednesday's rate cut could inject more liquidity into the markets and lead to increased trading volume for bitcoin, ether, and more.

Analysts noted that a dovish shift in the dot plot could fuel a sharper rally, while a more cautious stance might strengthen the U.S. dollar and keep markets choppy in the near term. In fact, the next 100bps could be the most consequential for asset prices this cycle.

"While the Fed Funds rate is 100bps below its 2024 peak of 525–550bps, the real story lies in the next wave of rate cuts," Kraken Global Economist Thomas Perfumo said in an email. "Investors see normalized interest rates as closer to 300–350bps. Given the convexity of interest rates and their impact on asset prices, the next 100bps could be more consequential than the last."

The price of bitcoin traded around $116,000 at publication time, down 0.6% over the past 24 hours according to The Block's price data. Ethereum ticked slightly higher to $4,491.

September is historically one of the worst months of returns for both cryptocurrencies and the broader markets, but things may be setting up for an end-of-year rally.

"Watching the crypto market right now is like watching the Super Bowl pre-game show," Bitwise CIO Matt Hougan wrote in a Tuesday note. "Things are set up for a spectacular end-of-year rally, with rate cuts, surging exchange-traded product inflows, rising concerns about the dollar, and incredible momentum in tokenization and stablecoins."

On Tuesday, the U.S. Senate confirmed crypto-friendly Stephen Miran to the Federal Reserve Board. He was previously a senior strategist at Hudson Bay, an investment firm that has been trading claims in the FTX bankruptcy. Miran was the only Fed governor who preferred to lower the target range by 0.5%.

Also of note, the Federal Reserve will hold a conference next month that will include discussions around stablecoin business models and the tokenization of financial products and services.

Interest rate impact on stablecoin yields, institutional flows

While the Fed's rate cut is broadly positive for risk assets, CoinFund President Chris Perkins says the impact on stablecoins is more nuanced.

"Yield is central to their value, and issuers aren't really hurt by lower rates. In fact, when rates go down, demand for stablecoin yield often goes up, a dynamic the market hasn't fully grasped," Perkins said in a statement. "Issuers are already distributing significant interest, so the effect on them is limited. In DeFi, yield-seeking behavior will continue regardless."

The CoinFund president noted that 35% of USDT holders use it as a savings vehicle, while 63% of transactions involve USDT.

"So, will lower rates slow stablecoin adoption? I don't think so," Perkins said. "Most users aren't receiving direct interest anyway, and stablecoins will remain a key gateway for DeFi participants who want the dollar as a store of value.”

Lower rates may blunt some of the debate around yield-bearing stablecoins, since it becomes less compelling in a low-rate environment.

"More broadly, I don't think there's reason to expect rates to return to zero anytime soon, but the path clearly favors payments utility over yield as the long-term driver for stablecoins," said Will Beeson, co-founder of Uniform Labs, who formerly led the tokenized assets division of Standard Chartered.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

In line with most expectations and its hint last month, the US Federal Reserve made the first interest rate cut for 2025, reducing it by 25 bps.

Most market commentators believed crypto and the rest of the financial markets had already priced in this cut, so it would be interesting to follow how BTC will react in the following hours and days.

Federal Reserve cuts interest rates by 25bps. pic.twitter.com/JQ9KAvIloX

— CryptoPotato Official (@Crypto_Potato) September 17, 2025

Recall that the primary cryptocurrency exploded in late August during and after Jerome Powell’s speech from Jackson Hole, when the Fed chair hinted that the US central bank will finally cut the rates.

Experts anticipated a 25 bps rate reduction during the subsequent FOMC meeting, which took place yesterday and today.

The Federal Reserve announced today a cut in interest rates by 25 basis points, citing unsteady labor market conditions and increased inflation.

For the typical American, these rate cuts mean lower borrowing costs and may be a positive catalyst for the crypto market. However, the decision also carries intensified inflation risks and increased concerns over the Fed’s independence.

Fed Cuts Rates for the First Time in 9 Months

Bitcoin’s price ticked higher immediately after the US Federal Reserve cut interest rates by 25 basis points on Wednesday.

The Federal Open Market Committee (FOMC) did what many economists and traders predicted: It cut the benchmark federal funds rate to a lower range of between 4.00% and 4.25%. This is the first rate cut in nine months, and follows a 25 basis-point cut in December 2024.

“In support of its goals, the Committee decided to lower the target range for the federal funds rate by 1/4 percentage point to 4 to 4-1/4 percent,” the Federal Reserve said in a statement. “Recent indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.”

Regarding the possibility of further rate cuts, it said:

“In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks.”

The decision’s impact on Bitcoin may also positively affect the rest of the crypto market in the coming days.

A Positive Catalyst for Crypto?

The crypto market was cautiously optimistic before the Fed decided on interest rates. Now that the cuts turn into reality, good things may be in store for traders. According to data from CryptoQuant, investors have been getting ready to buy.

“In general, a Fed cut is a positive catalyst for risk assets such as cryptocurrencies,” said Julio Moreno, Head of Research at CryptoQuant.

Investors are holding onto their most valuable crypto assets, including Bitcoin and Ethereum. This move signifies that large holders are not panicking and likely expect prices to increase after the cut.

“For BTC and ETH, it seems that investors are expecting a rally as inflows into exchanges are at low levels–this means they don’t expect to sell,” Moreno added.

Meanwhile, money is flowing into stablecoins. Moreno explained that these assets are often used as cash on exchanges, which suggests that investors are getting ready to buy.

“Higher stablecoin deposits are the ‘dry powder’ of investors before deploying capital (buying),” he said.

On-chain data also shows that some investors are cashing out on their less valuable assets, like altcoins. This indicates caution or a strategic move in preparation for the main event.

Most of the data aligns with how crypto markets have historically reacted to interest rate cuts. Lower borrowing costs have traditionally encouraged investors to seek higher returns in riskier, more speculative assets.

The rate cuts between 2020 and 2021, following the COVID-19 pandemic, serve as a key example of how this financial easing fueled a historic bull run in cryptocurrencies. During that time, the influx of capital directly translated into an increased risk appetite among retailers.

However, the relationship between interest rate cuts and the crypto market is not always linear.

A Politically Charged Decision

Powell’s announcement comes amid heightened tension between the Federal Reserve and the Trump administration. Since assuming office, Trump has repeatedly pressured the FOMC to cut interest rates, even trying to fire Fed Governor Lisa Cook.

Just yesterday, the Senate confirmed Stephen Miran, a former top economic advisor to Trump, to the Federal Reserve’s Board of Governors.

These consistent pressures have drawn scrutiny over the Fed’s independence in its decision-making process. Whether Powell cut rates over the state of the economy or under executive pressure remains blurry. As such, experts remain divided over whether the cuts are even necessary.

If today’s decision was overwhelmingly taken out of political pressure, it will likely lead to higher inflation, eroding Americans’ purchasing power and causing the economy to overheat. This volatility will also lower risk appetite, drawing trading volumes away from the cryptocurrency market.

That said, the American economy has been undergoing significant turbulence in recent months.

What’s Next for the American Consumer?

Recent data has shown a decidedly soft job market with slower employment growth than previously estimated. Inflation also remains a significant concern.

The Fed’s preferred inflation measure, the Personal Consumption Expenditures (PCE) price index, is expected to stay well above the central bank’s 2% target. This is partly due to Trump’s import taxes, which economists warn could further increase prices in the coming months.

The coming months will determine whether this fresh round of interest rate cuts will effectively balance the Fed’s dual mandate of maximum employment and price stability. They will also be key in determining whether the crypto market will stand to profit this time.

Pi Coin is struggling to register any bullish momentum, and all indicators suggest this might continue into the foreseeable future. Since its launch, the Pi Network price has crashed by about 88%, which has left many early supporters and holders worried about its future. Recent market data shows that the decline can be attributed to massive token unlocks and weak liquidity on crypto exchanges. Furthermore, new developments show that unless market dynamics improve, Pi Network may face even more declines in the coming months.

Heavy Selling Pressure Pi Due To Token Unlocks

Pi’s price action has been full of downtrends, with data showing the cryptocurrency down across multiple timeframes. At the time of writing, the token is currently moving between $0.353 and $0.3606 with poor liquidity and continued unlocking of the tokens. The unlocks have done nothing to help with the situation of things.

One of the biggest influences behind Pi Network’s downtrend is the continuous release of unlocked tokens into the market. Pi was created with a max supply of 100 billion tokens, but only 8 billion of those are currently in circulation. Its tokenomics are set up such that tokens are unlocked into circulation every day.

According to data from PiScan, there are about 5 billion Pi Network tokens locked right now, and 135.7 million of those are set to be unlocked in the next 30 days. Notably, one unlock event added around 163 million PI tokens worth about $60 million into circulation, a move that contributed further to the cryptocurrency’s price decline.

More token unlocks are expected in the near future, and the increase in circulating supply has far outpaced demand. Data from PiScan shows that about 4.5 million Pi worth $1.614 million are released every day. This oversupply problem could leave the price of Pi Network vulnerable, and each token release could further weaken the value of those in circulation.

Furthermore, the current order books for Pi Network across several exchanges are extremely thin, leaving too few buyers in the market to absorb the wave of selling pressure.

Project Delays: Calls For Bold Action

Pi Network’s own development delays have contributed to skepticism among many investors. The long-promised KYC rollout, the V23 upgrade, and full mainnet decentralization have created frustration among users who had anticipated faster progress.

In a lengthy post on the social media platform X, prominent community member Mr Spock urged the Pi Core Team to take what he described as bold economic steps to restore stability and build a valuable and sustainable economy. He called for a comprehensive buyback and burn program, noting that aggressive deflationary measures are the only way to protect Pi’s value. According to him, the Core Team should buy back Pi from the open market, permanently burn all transaction fees instead of recycling them, and stop flooding the market with excess supply.

He further suggested that Pi’s mining model must be reconsidered either by ending it completely to lock the supply or by introducing utility-based mining that rewards only those who contribute real value to the ecosystem.

At the time of writing, Pi Network is trading at $0.3552, down by 1% in the past 24 hours. A drop below $0.350 could guarantee further declines to $0.34.

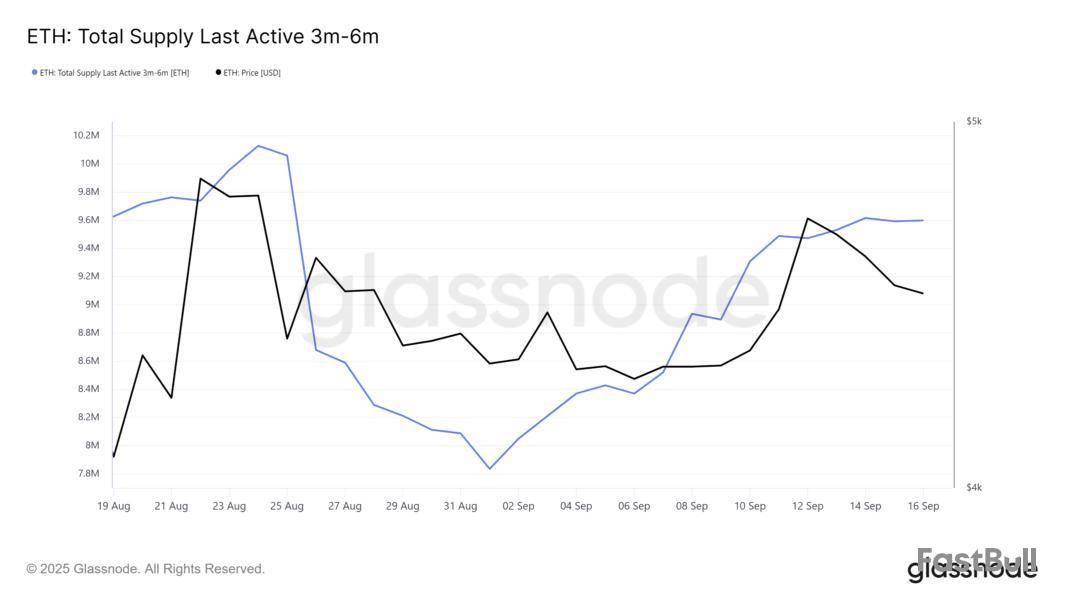

Ethereum has seen a 4% decline in recent days, pulling the altcoin king just under $4,500.

While this short-term dip may concern some traders, the long-term outlook remains bullish as strong fundamentals and investor behavior suggest resilience ahead.

Ethereum Supply Is Maturing

Ethereum supply has matured significantly, reinforcing investor confidence in the asset’s long-term strength. Since the beginning of the month, the 3-6 month-old supply has grown by 1.76 million ETH, now valued at nearly $8 billion. This indicates that holders refrained from liquidating even during market volatility.

Such conviction suggests that investors anticipate higher prices and are willing to ride out short-term declines. By keeping ETH locked, these holders are reducing the circulating supply, which can create favorable conditions for upward price momentum when demand returns. This behavior is a bullish foundation for Ethereum’s growth.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

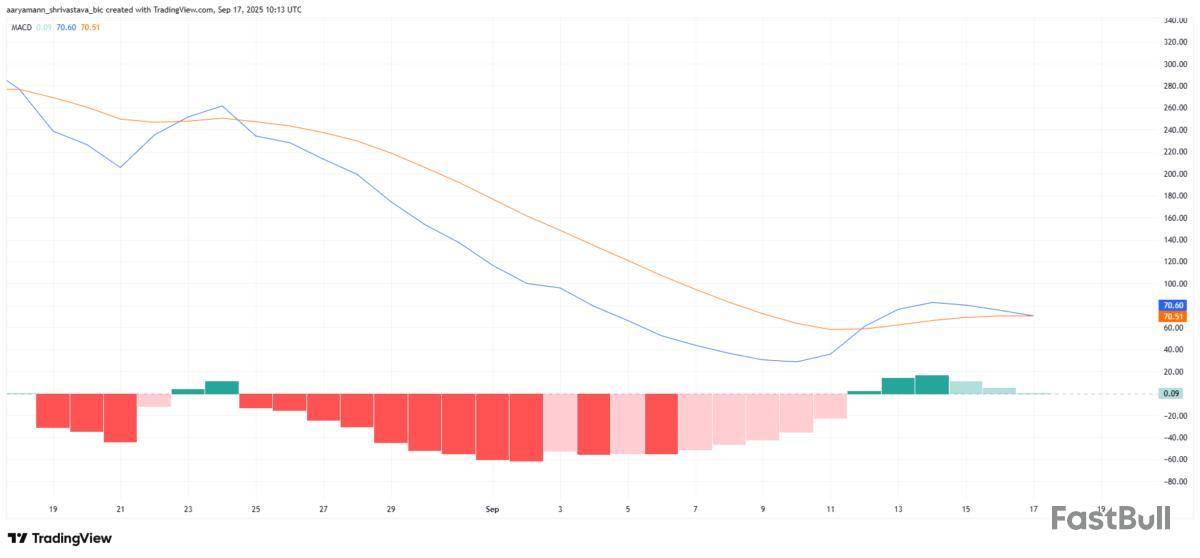

On the technical side, Ethereum’s momentum appears mixed in the near term. The Moving Average Convergence Divergence (MACD) indicator is nearing a bearish crossover, signaling the possibility of short-lived downside pressure. This aligns with ETH’s recent price slip below the $4,500 level.

However, the broader market cues remain constructive. Even if the MACD confirms a bearish crossover, investor sentiment and maturing supply could support a quick recovery. Such dynamics highlight that any decline would likely be temporary, with ETH primed for a strong rebound soon after.

ETH Price Could Bounce Back

Ethereum is currently trading at $4,495, just below the $4,500 support line. It has not yet closed below $4,500, so the support is still valid.

The maturing supply and bullish long-term outlook indicate that Ethereum could bounce from the support. With fewer coins entering circulation, the altcoin has structural support for renewed upward momentum to $4,775 despite short-term volatility.

However, if the price closes below the support, ETH may slip toward $4,307, invalidating the bullish outlook.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up