Investing.com-- The S&P 500 rose Thursday, flirting with record highs underpinned by a chip-led rally in tech stocks as investors continue to bet on faster AI adoption.

At 12:44 p.m. ET (16:44 GMT), the Dow Jones Industrial Average rose 352 points, or 0.8%, the S&P 500 index gained 0.7% to 6,131.46 just shy of an all-time high at 6,147.43, and the NASDAQ Composite climbed 0.7%.

The main averages on Wall Street ended in mixed fashion on Wednesday, pausing a two-day rally, as investors gauged a ceasefire between Israel and Iran and assessed testimony from Federal Reserve Chair Jerome Powell.

U.S. economy contracted in Q1

Tensions in the Middle East seemed to be calming, with the ceasefire between Israel and Iran appearing to hold, and the U.S. planning to meet with Iran next week.

Iran’s parliament approved a bill on Wednesday to suspend cooperation with the IAEA, the U.N.’s nuclear watchdog, but Russian Foreign Minister Sergei Lavrov said on Thursday that his country wants Iran to continue its cooperation with the International Atomic Energy Agency.

Attention is now turning to the state of the U.S. economy, and the news is less favorable.

U.S. gross domestic product shrank by an annualized 0.5% in the first quarter, according to a final revision of the data on Thursday which confirmed the first contraction since 2022 and suggested possible headwinds from sweeping U.S. tariffs.

In the prior revised figure released in May, January-to-March GDP contracted by 0.2%, marking a reversal from growth of 2.4% in the final three months of 2024.

The number of Americans filing new applications for jobless benefits fell 10,000 last week, but the unemployment rate could rise in June as more laid off people struggle to find work.

May’s personal consumption expenditures price index reading, the Fed’s preferred gauge of inflation, is due out on Friday, and will be studied carefully for clues over when the U.S. central bank next easing monetary policy.

Powell under pressure

Federal Reserve Chair Jerome Powell maintained a wait-and-see approach to future interest rate decisions in his comments to Congressional lawmakers this week, saying this strategy is appropriate until more clarity emerges around the impact of aggressive U.S. tariffs on the broader economy.

This stance prompted further vitriol from President Donald Trump, who has been persistently calling for lower interest rates.

“I know, within three or four people, who I’m going to pick,” Trump said, talking about a replacement for Powell. “He goes out pretty soon fortunately, because I think he’s terrible.”

A report from the Wall Street Journal said Trump has toyed with the idea of naming Powell’s replacement as early as September, which could undermine Powell’s authority for the remainder of his term to next May.

A couple of Powell’s colleagues had also called for lower rates, but the Fed chief received some support Thursday as Federal Reserve Bank of Richmond President Thomas Barkin said tariffs are very likely to push inflation up over coming months, in remarks that said central bank policy is where it needs to be to deal with what lies ahead.

Walgreens impresses with Q3 earnings

There are more earnings to digest Thursday.

Walgreens Boots Alliance (NASDAQ:WBA) posted third-quarter earnings and sales that topped estimates, as cost savings helped to offset front-end sales at the likely soon-to-be private retail pharmacy chain.

Micron Technology (NASDAQ:MU) reported fourth-quarter revenue above estimates on robust demand for the memory chip maker’s high-bandwidth memory chips used in artificial intelligence data centers.

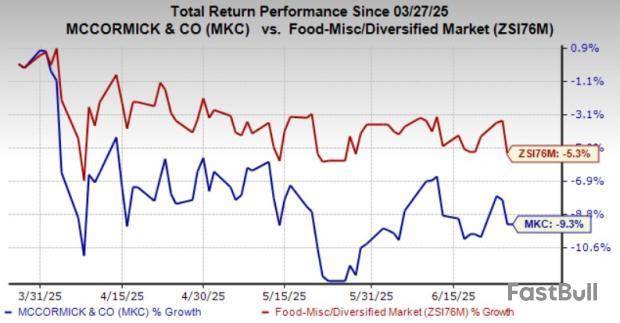

McCormick & Company (NYSE:MKC) reported better-than-anticipated profit in its fiscal second quarter and backed its full-year outlook thanks to plans for the spices retailer to mitigate the impact of tariff-related headwinds.

Nvidia (NASDAQ:NVDA) made fresh record highs after adding to its recent gains, which has seen the chipmaker rally about 40% since a Trump-led rout in early April when the president unveiled reciprocal tariffs.

Micron Technology (NASDAQ:MU), meanwhile, also pushed chips higher after its guidance and second-quarter results topped analysts estimates.

Ayushman Ojha contributed to this article