Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Serial entrepreneur and innovative tech billionaire Elon Musk has shared two tweets related to his most recent brainchild — AI chatbot Grok integrated on the X social media platform. Both mentioned recently reached milestones, and one of them was about Grok and memes.

This triggered a wave of enthusiastic and bullish comments from the crypto community.

Musk revealed that now Grok is capable of explaining memes. He retweeted a post from a Doge team member who calls himself DogeDesigner, in which the chatbot explained the meaning of a meme related to voter ID laws.

In response, many users tweeted images of memes that feature Grok as a square-headed robot, often depicted as a winner — sitting on the throne, wearing a crown and so on.

In another X post, Musk offered users to upload any medical images to Grok and get its “non-doctor opinion” on them. The billionaire revealed that a friend of his was accurately diagnosed by Grok using his scans.

Elon Musk@elonmuskNov 09, 2024You can upload any image to Grok, including medical imaging and get its (non-doctor) opinion.

Grok accurately diagnosed a friend of mine from his scans. https://t.co/vyJVmIYAng

Grok is the product of the xAI startup founded by Musk in July 2023 with the goal of creating a “maximally truth-seeking” artificial intelligence. The decision to create this company was made after Musk’s public disappointment in OpenAI, which he helped to fund in 2015, and the course chosen for it by the CEO Sam Altman.

Altman has turned the initially non-profit company into a fully profit-making one as it launched the ChatGPT bot. Besides, Musk has been accusing OpenAI of constructing a “woke” AI, which is being trained to lie to users, avoiding discussions on acute topics, such as gender identity, sex, politics, religion and so on.

Opposing Grok to ChatGPT and all other AI software that Musk considers “woke,” he is making sure that Grok does not avoid sharing his take on socially sensitive issues and is trained to have a sense of humor, unlike OpenAI’s product. Grok even has an “unhinged mode” as Musk referred to it, in which it can offer not only humorous but also ironic and sometimes sarcastic replies and explanations.

Jack Dorsey’s payments and blockchain infrastructure company, Block Inc., is shifting its focus to develop new tools for Bitcoin miners and enhance its self-custody crypto wallet.

According to the latest shareholder letter, the firm plans to reduce its investment in TIDAL, Jay-Z’s former music streaming platform, while also winding down TBD, its Bitcoin-focused unit that aimed to create a decentralized internet known as “Web5.”

Interestingly, the announcement of Block’s focus on Bitcoin mining came in the same week that Donald Trump won the US presidential election, promising a more crypto-friendly environment in the world’s largest economy.

Trump had previously met with Bitcoin mining leaders at Mar-a-Lago in June, bringing together key players from companies such as Marathon Digital and Riot Platforms. During the closed-door meeting, the president-elect expressed support for Bitcoin mining in the US and criticized the Joe Biden administration’s position on cryptocurrency.

Later, Trump reiterated his belief that Bitcoin should be mined in the US, claiming it would help the country achieve energy dominance and urging a shift away from foreign mining operations.

Meanwhile, Dorsey’s shareholder letter noted,

“Within our emerging initiatives, we are refining our investments based on our progress. We are scaling back our investment in TIDAL and winding down TBD. This gives us room to invest in our bitcoin mining initiative, which has strong product market fit and a healthy pipeline of demand, and Bitkey, our self-custody wallet for bitcoin.”

Besides redirecting resources to focus on mining equipment development, Block also plans to allocate resources to Bitkey, which happens to be the firm’s self-custodial Bitcoin wallet which waslaunchedin December 2023.

The cost-cutting efforts, on the other hand, come months afterlayoffsat the fintech firm.

Chainlink price has recently broken free from a three-month consolidation range, signaling a possible uptrend as it aims for $14 and potentially higher.

This breakout has sparked optimism among investors, with many eyeing the altcoin’s potential for significant gains. With bullish sentiment building, LINK appears to be on track to hit new targets.

Chainlink Supply Aims for Profits

Crypto analyst Michael van de Poppe has predicted a strong rally ahead for Chainlink, fueled by its recent breakout above $13.00. Van de Poppe highlights that LINK’s prolonged struggle to surpass this level might now be over, opening the door to a potential rise toward $17.83. Such a climb would represent a 37% increase, marking substantial gains for LINK holders.

The successful move above $13.00 is expected to bolster investor confidence in Chainlink’s trajectory, with the $17.83 target setting the stage for a new phase of growth. Van de Poppe’s forecast aligns with the current bullish sentiment, suggesting that this breakout could lead to an extended rally.

Chainlink’s macro momentum is further supported by its Global In/Out of the Money (GIOM) indicator. The GIOM data reveals that about 120 million LINK tokens, worth over $1.6 billion, were purchased between the $14 and $18.43 range. If Chainlink’s price continues to rise, this supply could become profitable, fueling even greater interest in the asset.

If van de Poppe’s prediction holds true, these holders may see substantial gains, increasing the likelihood of Chainlink surpassing its target of $17.83. The potential profitability of these tokens adds an element of anticipation among LINK investors, as further profits could encourage them to hold for even higher gains. This profitable zone could propel Chainlink toward an even stronger breakout.

LINK Price Prediction: Beating the Odds

Chainlink’s price has surged by 33.56% over the last three days, currently trading at $13.56. Should the bullish momentum continue, LINK could flip the resistance at $14.45 into a support level. Establishing this support would strengthen the rally, giving LINK the foundation needed to approach its next targets.

With support at $14.45, Chainlink could push toward $17.83 and further, reaching $18.34. Achieving these levels would make the $1.6 billion supply of LINK profitable, supporting the upward trend.

Cardano Price Analysis. Source: Trading View

However, if Chainlink fails to break past the $14.45 resistance, it may retrace to the support level of $12.94. Losing this support would undermine the bullish outlook, potentially bringing LINK down to $11.64. This move would caution investors and could signal a shift in market sentiment.

The price of Bitcoin has turned in an impressive performance, forging successive all-time highs over the past week. Similarly, other large-cap assets, such as Ethereum, Solana, and Cardano, have been experiencing massive upside movement in the past few days.

Interestingly, the latest on-chain observation suggests that the crypto market — particularly Bitcoin — may not be done just yet. This projection is as investors seem to be doubling down on their positions rather than selling off their assets for some short-term gains.

Bitcoin Investors Continue To Load Their Bags

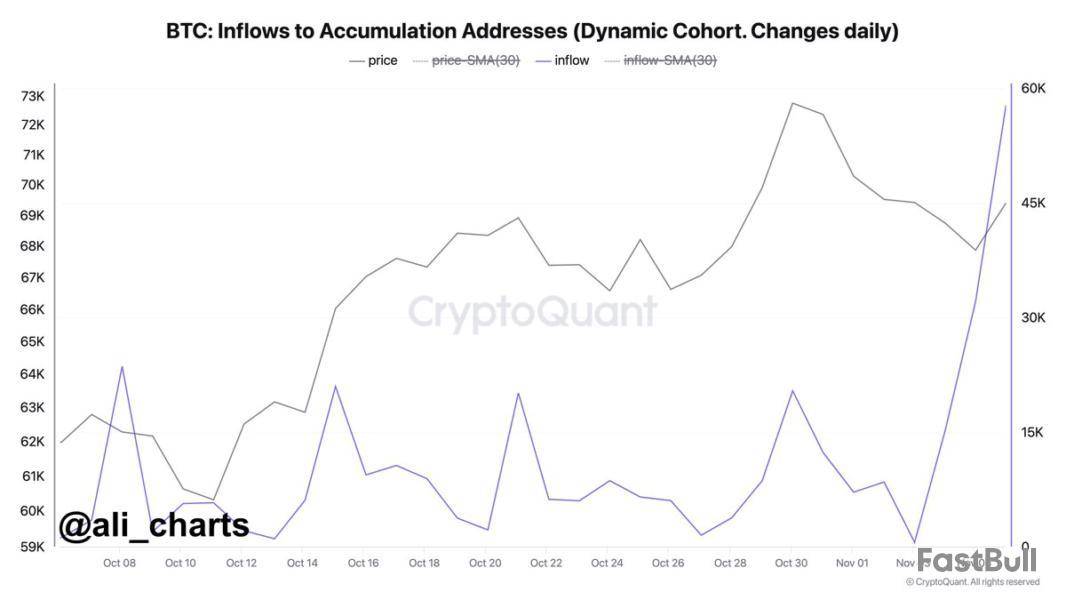

Popular crypto pundit Ali Martinez took to the X platform to reveal that Bitcoin accumulation addresses have been witnessing significant inflows over the last few days. This on-chain revelation is based on the spike in CryptoQuant’s “Inflows to Accumulation Addresses” metric.

Accumulation addresses can be defined as addresses, excluding miners’ and exchange addresses, that have zero outgoing transactions or at least haven’t spent their holdings over a period. Moreover, these addresses must have received at least two incoming transfers and hold more than 10 BTC. These Bitcoin addresses are usually controlled by major entities, including whales, institutional players, and so on.

According to data from CryptoQuant, a whopping 57,800 BTC (equivalent to approximately $4.16 billion) has made its way to these accumulation addresses since November 3. As shown in the chart below, inflows into the Bitcoin accumulation addresses have been on the rise in recent weeks.

Typically, this positive trend is a favorable sign for the price of BTC, which has been on a ride of its own in the past few days. The choice to “hodl” rather than sell for profit also indicates the increased faith in the long-term success of Bitcoin, implying that major investors expect the flagship cryptocurrency to keep rising.

As of this writing, the Bitcoin price stands at around $76,550, reflecting a measly 1% increase in the past 24 hours. However, the market leader is up by more than 10% on the weekly timeframe.

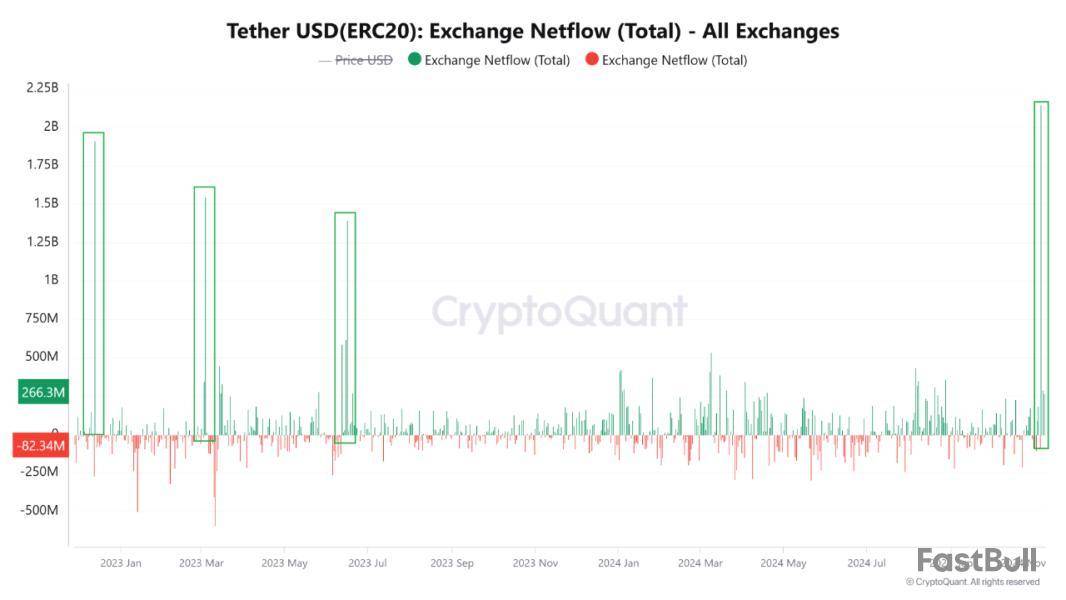

USDT Netflow On Exchanges Surpasses $2 Billion

According to a recent Quicktake post on the CryptoQuant platform, there has been a significant inflow of the USDT stablecoin into centralized exchanges. On-chain data shows that the stablecoin’s net inflows have crossed $2 billion, its highest level since December 2022.

Higher stablecoin balances (which are often used as an indicator of increased liquidity) suggest a high amount of buying power for investors, leading to elevated investor demand. If this rising liquidity on exchanges is correlated with the growing accumulation, it could positively impact the Bitcoin price.

Tether, the issuer of the popular stablecoin USDT, announced the successful completion of its first crude oil transaction in the Middle East.

This marks a significant step toward Tether’s goal of entering the commodities trading sector as a lender.

Tether’s Oil Trade Signals Shift Toward Broader Commodity Investments

In October, Tether‘s investment arm financed a physical crude oil trade, marking its entry into the region’s energy sector. The transaction used USDT to facilitate the transfer between the major publicly traded oil company and a leading commodity trader. This milestone involved the loading and transport of 670,000 barrels of Middle Eastern crude oil, valued at $45 million.

Tether CEO Paolo Ardoino said the transaction marks the beginning of the company’s expansion into supporting various commodities and industries to promote more inclusive, innovative financial solutions worldwide. Ardoino also highlighted how USDT brings speed and efficiency to markets traditionally slowed down by costly payment structures.

“With USDT, we’re bringing efficiency and speed to markets that have historically relied on slower, more costly payment structures. This transaction marks the beginning, as we look to support a broader range of commodities and industries, fostering greater inclusivity and innovation in global finance,” Ardoino stated.

Tether’s Trade Finance division was launched earlier this year and aims to bring efficient capital solutions to the $10 trillion trade finance industry. This division is part of Tether Investments. However, it operates independently of USDT stablecoin reserves and leverages the company’s strong financial performance.

Meanwhile, this transaction coincides with Tether’s recent cooperation with Canadian law enforcement to recover stolen digital assets. The company disclosed it helped the Ontario Provincial Police (OPP) to reclaim approximately $10,000 CAD (around $7,188) in stolen crypto.

Tether voluntarily helped freeze the stolen USDT assets, enabling authorities to recover the funds and return them to the victim. Detective Staff Sergeant Addison Hunter of the OPP noted that Tether’s proactive support played a key role in the successful asset recovery.

“With the voluntary assistance and cooperation of Tether International Ltd., the stolen digital assets were successfully seized and returned to the victim. This collaboration was instrumental in ensuring the swift recovery of the assets,” Hunter said.

Ardoino reaffirmed Tether’s commitment to assisting government agencies globally in combatting criminal activity. This collaboration is one of many, with the stablecoin company helping to freeze over $2 billion linked to illicit activities.

Ethereum has seen a significant uptick in buying pressure near the $2.4K support level, driving an impulsive price surge and reclaiming several key resistance regions. This action is signaling a potential shift towards a bullish market sentiment, with higher price levels expected in the mid-term.Ethereum Price Analysis

By ShayanThe Daily Chart

The daily chart shows that intensified buying near the channel’s middle boundary of $2.4K has sparked a substantial upward move, allowing Ethereum to break through several critical resistance points:

This strong performance suggests a bullish shift, with Ethereum reclaiming these resistance levels. Additionally, crossing the psychological $3K threshold reinforces a positive market sentiment, raising the possibility of reaching a new all-time high by year-end. However, a brief consolidation corrections phase might be necessary to sustain this trend healthily, allowing for potential profit-taking and market stabilization.The 4-Hour Chart

The 4-hour chart shows an initial surge from $2.4K, the lower boundary of the descending flag pattern, where buying pressure has been strong. Ethereum has now surpassed the $2.8K resistance, which had acted as a significant barrier in recent months.

This break highlights buyers’ intent to increase the price, with eyes potentially set on a new ATH.

Currently, Ethereum is approaching $3.1K, the flag’s upper boundary, where notable selling pressure may emerge. Given the impulsive nature of the recent increase, a short-term rejection followed by a temporary corrective retracement seems possible. In this case, a brief correction toward the support range of $2.7K —$2.6K (bounded by the 0.5 and 0.618 Fibonacci retracement levels) would be beneficial, setting the stage for a healthier uptrend.Onchain Analysis

By Shayan

The fund market premium metric is an essential indicator, as it reflects the difference between a fund’s market price and its Net Asset Value (NAV). When the premium is elevated, it suggests strong buying pressure within a specific region, indicating that investors are paying a higher price for fund shares relative to the underlying assets.

This premium metric substantially declined from mid-November 2021, when Ethereum reached its all-time high. This decline aligned with waning interest in Ethereum funds, a typical response as investors became cautious during the subsequent bear market.

However, a pivotal shift occurred as Ethereum reached its bear market low. The premium metric started to rise modestly, marking a return on investor interest. Since January 2023, this premium has steadily increased, signaling a resurgence in confidence for Ethereum-backed assets. Recently, the premium moved above zero, revealing positive market sentiment and suggesting robust demand for Ethereum funds.

In summary, the positive shift in the premium metric is a promising sign of renewed market optimism. If this trend persists, it could reinforce Ethereum’s broader price momentum, potentially contributing to its future price growth trajectory.

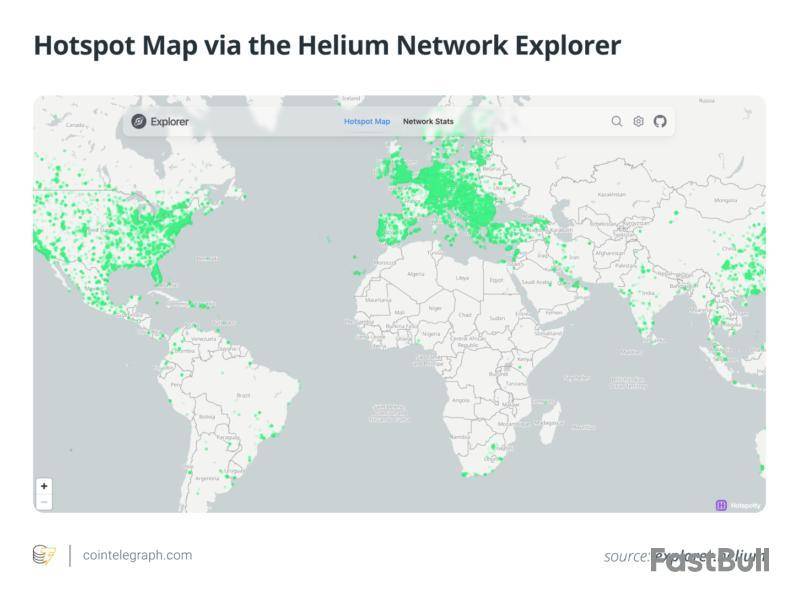

What is Helium mining?

Helium mining is the mechanism that powers the Helium network to provide global wireless technology for Internet-of-Things devices.

Helium involves running a hotspot to provide coverage for Internet-of-Things (IoT) devices via the Helium Network. Miners are required to run specialist hardware devices to create wireless connectivity.

The hotspots build a decentralized infrastructure of low-powered, long-range wireless networks known as “The People’s Network.” It is an innovative use of blockchain technology that incentivizes the creation and maintenance of a global wireless network through Helium (HNT) token rewards from mining.

The decentralization of wireless infrastructure reduces the reliance on traditional telecom providers and lowers the cost of IoT connectivity. The Helium project showcases the true versatility of blockchain tech, expanding its application beyond financial transactions into real-world infrastructure. It’s a potential revolution in wireless technology, representing a paradigm shift in the future of decentralized infrastructure.

For users of the world’s largest contiguous wireless network, it gives wider coverage, allowing devices to communicate 200x further than WiFi.

Did you know? The Helium network started development in 2013 by Helium Inc. It was a network of low-range hotspots that were installed in concentrated areas with building owners paid in fiat currency. It switched strategy in 2017 to offer individuals payment in crypto to run nodes in homes and offices. Since then, Helium Inc rebranded to Nova Labs in 2022 and received $200 million in investment funding.

How Helium mining works

Helium mining uses a proof-of-coverage (PoC) consensus mechanism to verify hotspot validity, confirm payments, and secure the blockchain network.

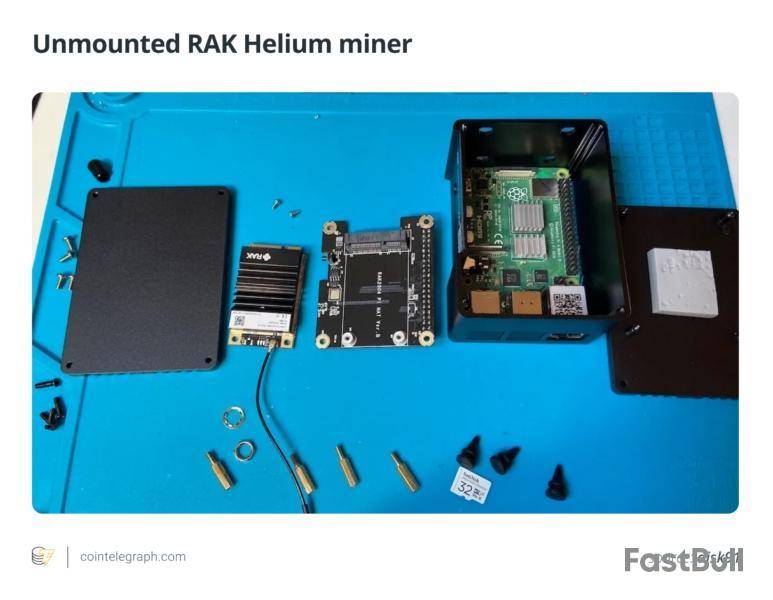

The core mechanics behind Helium mining are devices that combine a wireless gateway and a blockchain node. This hardware performed two key functions: validating transactions on the helium blockchain and providing wireless network coverage.

Helium uses a unique consensus mechanism called proof-of-coverage (PoC) to maintain the protocols on the blockchain. This mechanism verifies that hotspots are providing legitimate wireless coverage and rewards them in HNT tokens for their services. To be a valid participant on the network, Helium miners must solve random quizzes and communicate with other nodes to verify and confirm the answer, which relates to their network location.

For example, a hotspot in a large city might provide network coverage for smart meters or environmental sensors. In return, it earns HNT based on the data transmitted through the hotspot.

The Helium mining hardware, referred to as a hotspot, is the backbone of the network. Traditional 4G and 5G connectivity requires big intrusive cell towers, often unwanted in many communities. Contrastingly, Helium hotspots are compact and decentralized, allowing anybody to operate or connect to the network.

These hotspots run using the Low Power Wide Area Networking Protocol (LoRaWAN), which was built from a leading wireless invention called LongFi.

Did you know? Helium’s network supports a wide range of applications, from smart agriculture to environmental monitoring to asset tracking and smart buildings. It shows a broad potential for becoming one of the first worldwide decentralized physical infrastructure network (DePIN) blockchains.

Benefits of Helium mining

Financial incentives and low barriers to entry encourage scaleable widespread participation in the network, thereby accelerating the growth of IoT global connectivity.

Did you know? DePINs provide an exciting bridge between the physical and digital blockchain worlds. It allows data and tangible assets like bandwidth, GPUs or real estate to be tokenized in a decentralized fashion.

Current profitability of Helium mining

In the right circumstances, Helium network mining income can be profitable, especially when you have a location with hundreds of IoT devices and low competition from other hotspots.

Is Helium mining profitable? Like any cryptocurrency mining operation, it comes down to investment and returns. To work out Helium mining return on investment (ROI), you need to factor in Helium mining setup and costs, including hardware and electricity requirements. Then subtract this from your likely rewards. You can use the Helium Explorer for information on HNT prices, rewards and network demand.

There’s no exact formula to work out how much HNT you can earn over a specific period. That being said, there are some main concepts to understand to improve your profitability.

So, how much can you earn with Helium mining? Well, daily rewards for hotspots have been known to vary wildly between $0 and $300 per day. You can play around with the Helium mining calculator to get a rough estimate of earnings.

The top-earning hotspots have the ability to provide data to hundreds of devices per day. This requires a high-density population (or device) area that doesn’t have high competition from other miners. These could be locations like large stadiums, business centers or university campuses.

Adding to this, elevated areas like rooftops offer the ability to deliver wide, uninterrupted coverage in your area. Contrastingly, a low-density area where the hotspot simply runs from a ground-floor window is unlikely to be a profitable mining operation.

Factors affecting Helium mining profitability

Helium mining in 2024 can still be profitable in selected areas and with 5G upgrades, but this is highly influenced by miner location, HNT price and equipment costs.

As the network matures, potential miners should assess the factors below and consider both initial costs and ongoing network demand to make informed decisions.

Future outlook of Helium mining

Earning potential with Helium mining and network developments will shape the long-term viability of Helium mining.

HNT’s market prices play a factor in its growth. More IoT devices relying on the network will help drive positive HNT prices and payouts for miners.

However, low usage and depressed market prices can present a challenge for many Helium miners to make any more. And with robust Helium mining rewards, the network could thrive.

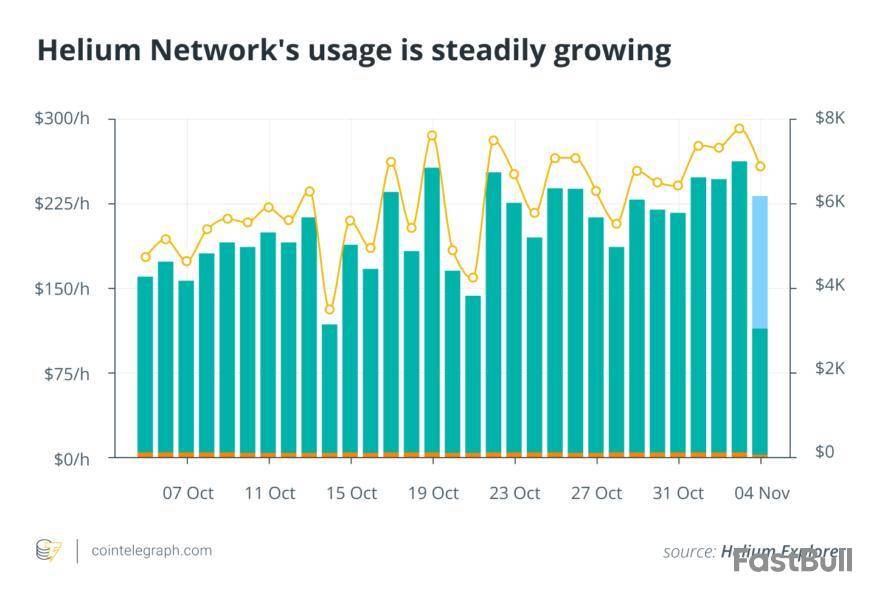

Is Helium mining worth it? Network usage shows steady growth through 2024. This is coupled with a growing market capitalization of over $1 billion for HNT, helping the token price rise from $2 to over $6 as of November 2024.

These two elements paint a positive picture for long-term Helium mining profitability. Of course, cryptocurrency markets are volatile, so current profits from Helium mining can change quickly to affect network growth and Helium mining returns.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up