Here’s a roundup of the most significant insider transactions disclosed on Tuesday, November 4, 2025, highlighting key moves by corporate executives and directors.

Top Insider Buys

Criteo S.A. (NASDAQ:CRTO) saw significant insider buying as Director Frederik van der Kooi purchased a total of 10,000 shares on November 3. The director acquired 2,299 shares at $22.61 per share for $51,980, and an additional 7,701 shares at the same price for $174,119, bringing the total investment to approximately $226,100. This insider buying comes as management has been aggressively repurchasing shares, with the stock currently trading at $22.07.

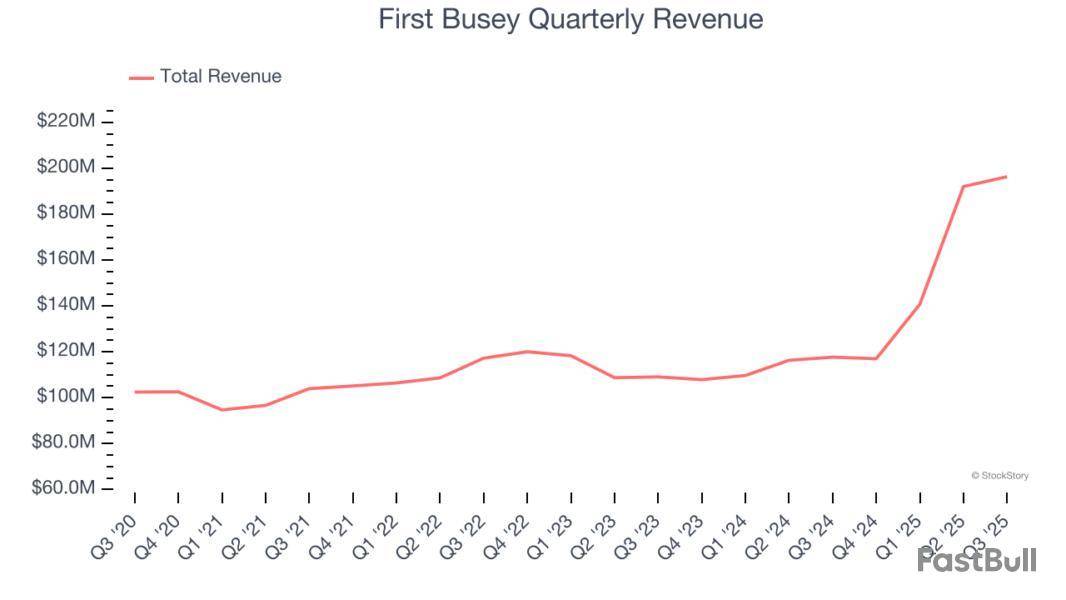

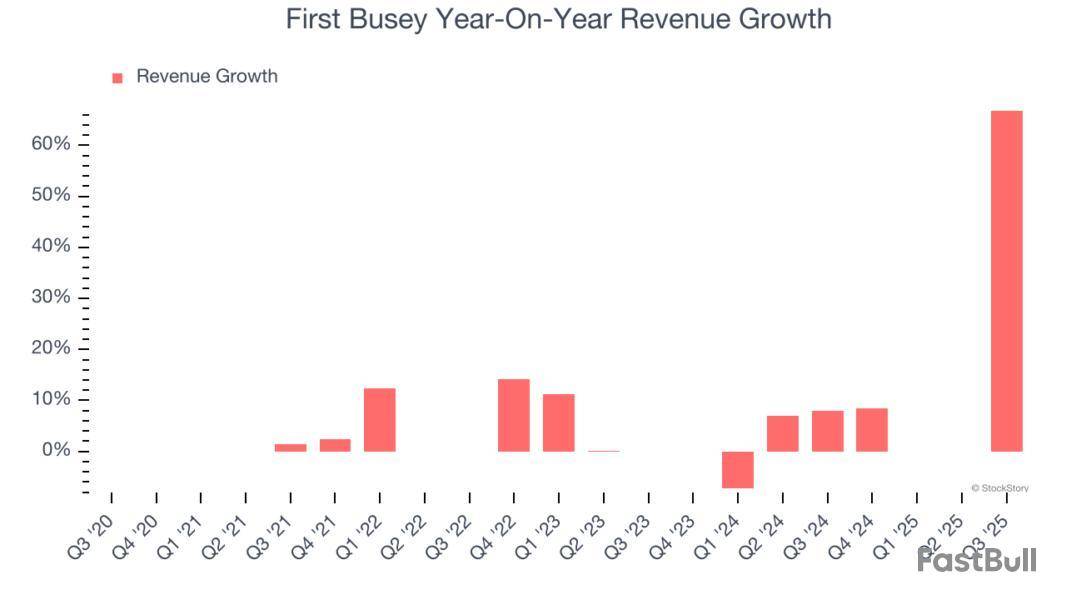

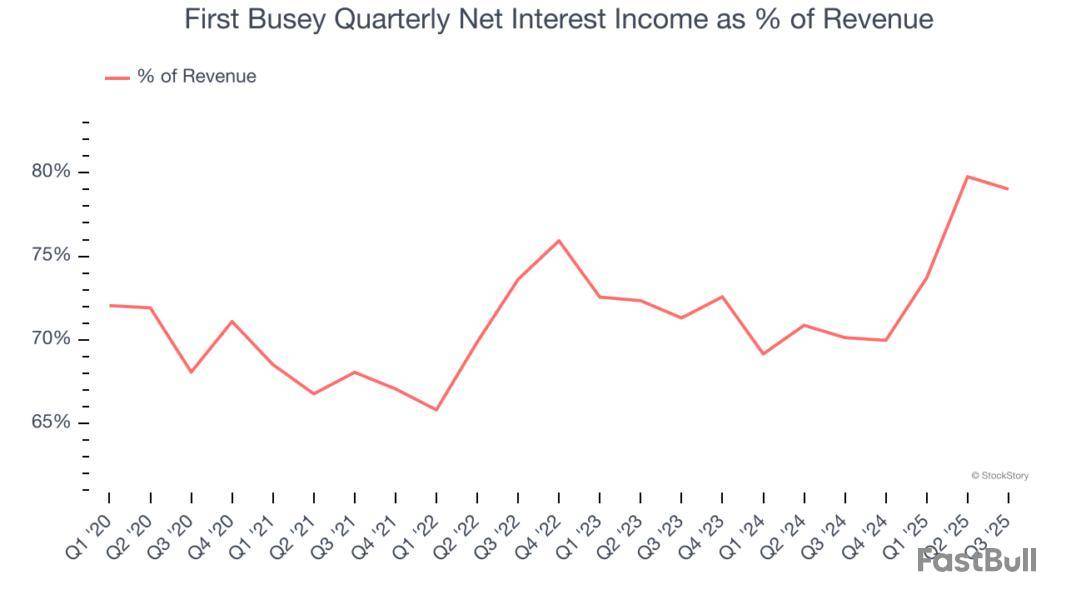

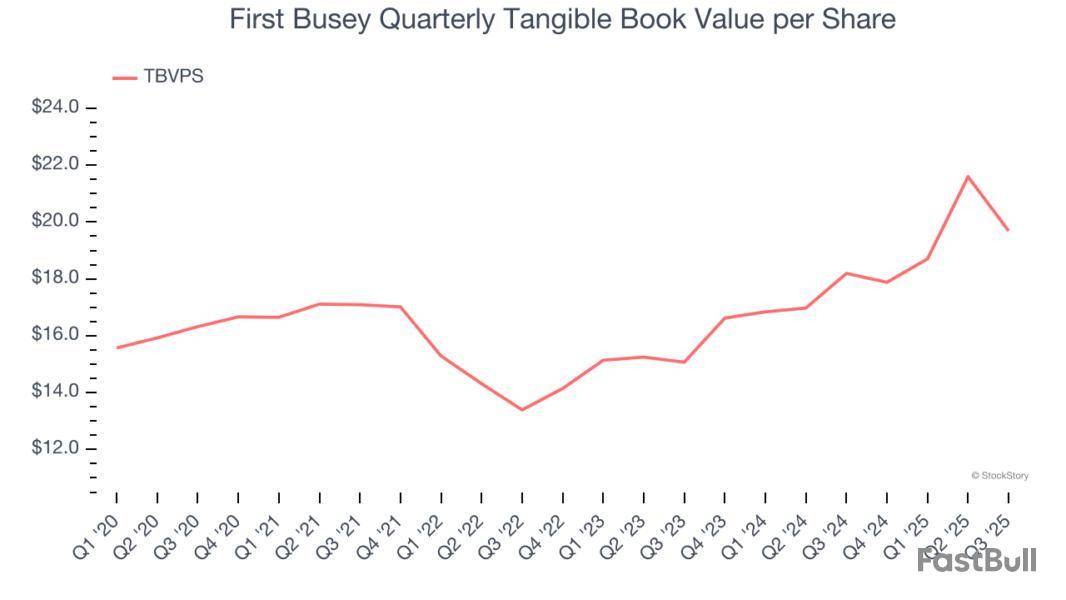

First Busey Corp (NASDAQ:BUSE) Chief Accounting Officer Scott A. Phillips reported purchasing 1,350 depositary shares on October 31. The transactions were executed at a weighted average price of $25.6367, resulting in a total value of $34,609. Phillips also acquired 96 shares of common stock at no cost, representing dividend equivalent rights accrued on Restricted Stock Units. Following these transactions, Phillips directly owns 15,995.5334 shares. First Busey, currently trading at $22.66 with a market capitalization of $2.01 billion, has maintained dividend payments for 37 consecutive years, offering a 4.41% dividend yield and trading at a price-to-book ratio of 0.82.

SPAR Group, Inc. (NASDAQ:SGRP) President William Linnane acquired 173,000 shares of common stock on October 3 at a price of $1.02, for a total transaction value of $176,460. The purchase was made as part of an employment agreement related to Linnane’s promotion to President and Interim CEO, using after-tax proceeds from a one-time cash award of $250,000. Following the transaction, Linnane directly owns 190,909 shares of SPAR Group, which currently trades at $1.09 despite having fallen over 55% from its 52-week high.

Waste Management (NYSE:WM) Director Sean E. Menke reported purchasing 2,000 shares of common stock on November 3 at a price of $196.4201, for a total transaction value of $392,840. Following the transaction, Menke directly owns 7,314 shares through ASM Assets, LP.

Amrize Ltd (None:AMRZ) Chief Technology Officer Roald Brouwer purchased 4,000 shares on October 31 at prices ranging from $51.76 to $51.78, for a total value of $207,100. Brouwer acquired 3,000 shares at $51.78 and 1,000 shares at $51.76, bringing his direct ownership to 9,000 shares. Amrize currently trades at $51.08, slightly below Brouwer’s acquisition price, with a market capitalization of $28.1 billion and a P/E ratio of 24.3. The company maintains a "GOOD" financial health score and has been profitable over the last twelve months with diluted earnings of $2.12 per share.

Top Insider Sells

Netflix (NASDAQ:NFLX) director Reed Hastings sold a total of 40,374 shares of common stock on October 31 for approximately $45.3 million. The sales were executed at prices ranging from $1104.64 to $1134.18. On the same day, Hastings also exercised options to acquire 40,374 shares at $98.30 per share, for a total value of $3,968,764. Netflix shares, currently trading at $1092.96, have delivered a robust 43% return over the past year, with the entertainment giant carrying a market capitalization of $461.86 billion and a P/E ratio of 45.52.

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) saw multiple insider sales. Director Sameer K. Gandhi sold 5,290 shares of Class A common stock on November 3 at prices ranging from $545.89 to $555.56, totaling $2,751,010. The shares were sold indirectly through Potomac Investments L.P. - Fund 1, which still beneficially owns 765,456 shares following the transactions. Additionally, President and CEO George Kurtz sold 6,815 shares on the same day at prices between $545.95 and $555.70, resulting in a total value of $3,835,496. These sales were made to cover tax withholdings due on vesting restricted stock units. Following the transactions, Kurtz directly owns 2,108,082 shares and indirectly owns 100,000 shares through the Kurtz Family Dynasty Trust. CrowdStrike shares have shown a remarkable 74% return over the past year.

Unity Software Inc (NYSE:U) Director Tomer Bar-Zeev sold a total of 250,000 shares on November 3, amounting to $9.49 million. The transactions involved two separate sales: 234,701 shares at prices ranging from $37.50 to $38.49, totaling $8,904,475, and 15,299 shares at prices ranging from $38.50 to $38.70, totaling $589,748. Unity, with a market capitalization of approximately $15.2 billion, has seen its stock price increase by nearly 66% over the past year, though it currently trades at $35.87, approximately 7% below the director’s selling prices.

Palo Alto Networks Inc (NASDAQ:PANW) EVP, Chief Product & Tech Officer Lee Klarich sold 100,364 shares of common stock on November 3 for approximately $26.3 million. The sales were executed in multiple transactions with prices ranging from $215.88 to $220.40 per share under a pre-arranged Rule 10b5-1 trading plan adopted on September 27, 2024.

Why Monitor Insider Transactions

Tracking insider buying and selling can provide valuable insights for investors. When corporate insiders purchase shares of their own companies, it often signals confidence in future performance and potential undervaluation. Conversely, insider selling may occur for various reasons including portfolio diversification, tax planning, or personal financial needs, and doesn’t necessarily indicate negative outlook. However, large or coordinated selling patterns, especially among multiple insiders, might warrant closer attention. By monitoring these transactions, investors can gain additional context for their investment decisions, though insider activity should always be considered alongside fundamental analysis and broader market conditions.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.