Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The dYdX community is voting on a proposal to start a $DYDX buyback program from March 7 to March 11, 2025. Buyback programs can support token prices as they reduce supply in the market. If the vote passes, the positive effect on price could be significant, especially if the buyback schedule is aggressive. Community support is crucial, and traders need to follow the outcome of the vote. A successful buyback could signal confidence, attracting more buyers. Keep track of the results on the source here.

dYdX Foundation@dydxfoundationMar 07, 2025️ On-Chain Vote Created ️

Should the community implement Stage 1 of the dYdX Treasury SubDAO $DYDX Buyback Program?

Vote ends on March 11, 2025 at 00:51 UTC*

Sui is scheduled to unlock 64.19 million tokens on April 1, 2025. This influx of tokens can expand the market supply, potentially leading to lower prices if demand does not match the increase. Investors must consider how this affects market cap and liquidity. Depending on market expectations, the price change might be limited if the unlock is widely known. Market participants should pay attention to trading activity surrounding the date. For comprehensive details, check the source here.

Berachain will release 63.75 million tokens on 6th February 2026. Token unlocks can impact prices as they affect supply. A large number of new tokens entering the market might dilute the value, causing prices to drop. However, if the market has anticipated this release and it is priced in, the impact might be minimal. Investors should watch trading volumes and market sentiment closely when this unlock occurs. Such events can offer both risk and opportunity, depending on market conditions at that time. For more details, visit the source here.

Delaware's official registration portal shows that "Canary Sui ETF" was registered on March 6. Such registration typically signals that a fund manager is preparing to file an S-1 registration with the U.S. Securities and Exchange Commission.

The registration comes after Canary filed an S-1 registration with the SEC on Wednesday for an AXL ETF. Canary also seeks to launch ETFs that track Hedera, Litecoin, XRP and Solana.

The Block has reached out to Canary Capital for confirmation on the Sui ETF registration, as there have been instances of bogus filings in the past. For example, in November 2023, someone registered an entity named "iShares XRP Trust" and put the name of Blackrock asset management firm, which was later proved to be a fake filing.

Also on Thursday, Sui Foundation said it plans to collaborate with the World Liberty Financial crypto project, backed by U.S. President Donald Trump, although it's not immediately clear how the two will cooperate.

Developed by Mysten Labs, Sui leads in one-year price performance among L1 tokens. As of March 5, Sui recorded a one-year gain of 79%, followed by BNB's 39.7%, according to The Block's data dashboard. The price of Sui climbed 5.4% over the past 24 hours to change hands at $2.83.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Layer-1 (L1) coin SUI has defied the broader market downturn, surging 4% in the past 24 hours to become the top-performing cryptocurrency.

The price surge follows news that World Liberty Financial (WLFI), a decentralized finance (DeFi) protocol affiliated with US President Donald Trump, has entered a “strategic reserve deal” with the blockchain network.

SUI’s Uptrend Gains Momentum

According to a March 6 blog post by the Sui Foundation, the developer team behind Layer-1 blockchain Sui has entered into a partnership with WLFI. The collaboration explores product development opportunities by leveraging Sui’s technology and includes integrating Sui-based assets into WLFI’s “Macro Strategy” reserve.

Following the news, SUI’s price jumped by double digits and reached a high of $3.11 on Thursday. This price hike was also fueled by news that Canary Capital filed to establish a trust entity in Delaware for its proposed Canary SUI ETF.

While it has since experienced a slight correction, Sui has continued to experience steady demand over the past 24 hours, increasing the likelihood of a sustained rally in the short term.

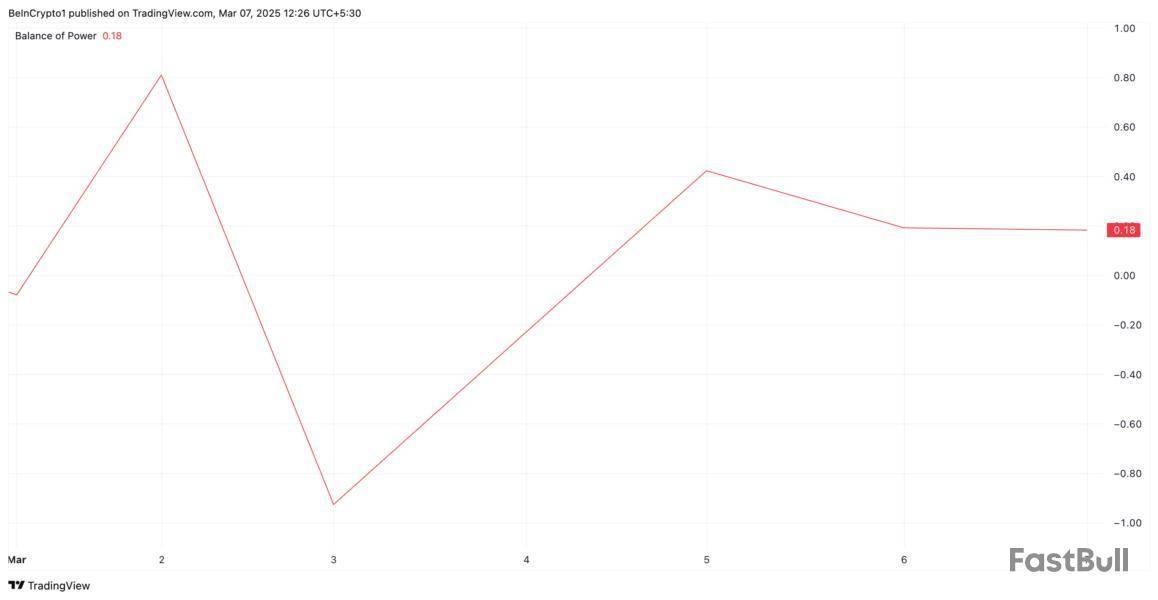

SUI’s Balance of Power (BoP) on the daily chart confirms this buying pressure. At press time, this indicator, which compares the strength of the bulls against the bears, is above zero at 0.18.

When an asset’s BoP climbs during a price rally, buying pressure strengthens, with bulls exerting significant control over price action. This suggests that SUI’s current uptrend has strong momentum and could potentially continue if demand remains high.

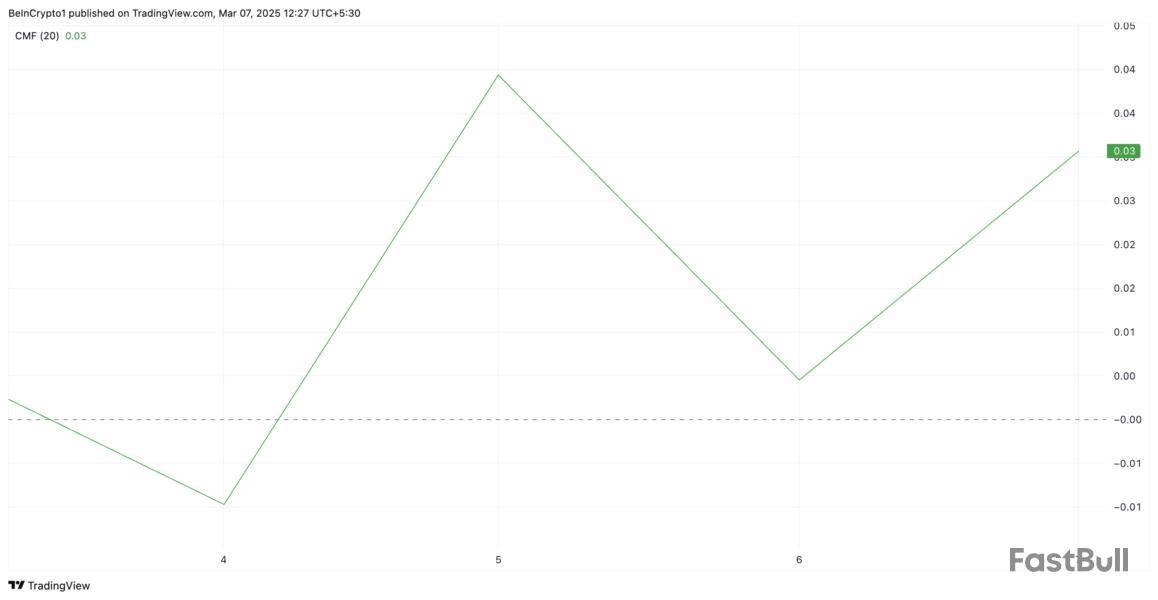

Furthermore, its rising Chaikin Money Flow (CMF) supports this bullish outlook. At press time, this indicator, which tracks how money flows into and out of an asset, posts a positive value of 0.02.

SUI’s CMF setup indicates more capital flows into its spot markets than out. This suggests strong accumulation and is a bullish signal, reinforcing the likelihood of continued price appreciation.

SUI Faces Key Decision Point

SUI trades at $2.79 at press time, exchanging hands slightly below the resistance formed at $3. If demand strengthens, SUI could break above this resistance and flip it into a support floor.

A successful breach of this level could propel the coin’s price to revisit its all-time high of $5.35, last reached on January 6.

However, if this fails, it will trigger a downturn, which could cause SUI to shed its recent gains and drop to $2.10.

With the documents for the U.S. Strategic Bitcoin Reserve signed, the price of the major cryptocurrency experienced a big sell-off, momentarily losing 4.9% within just an hour. Not quite the reaction the crypto community would expect, but it seems the old market rule to "buy the rumor, sell the news" is still alive in 2025.

Markets do not forget their own habits. Psychology runs deep, patterns repeat. Some traders saw an opportunity, took profits and left the crowd wondering what’s next.

What to expect next is the question making crypto market participants scratch their heads intensely, such as in the first crypto roundtable at the White House today. It could be a space for potential manipulation and high-stakes positioning.

Anything could happen; sentiment could swing fast. Some will speculate, others will hedge. But one thing seems certain: no matter in which direction exactly, volatility will come.

For Max Keiser, though, there is no hesitation. The direction is obvious. Thus, one of the most vocal early Bitcoin evangelists, in a recent post, made his expectations clear, proclaiming that Bitcoin will reach $100,000 in the next few hours. That is pretty ambitious, considering that the price of BTC right now is quoted 13.37% below the coveted six-figure mark.

Max Keiser@maxkeiserMar 07, 2025I predict we cross $100,000 in the next few hours and cross $120,000 this month.

Yet confidence like Keiser’s is not unusual in crypto - some see it as overoptimism, others as conviction. And what’s more stunning in Keiser’s prediction is his call for BTC to hit $120,000 this March. That would mean a new all-time high, something the market has not seen since January.

It is worth mentioning is that Keiser’s long-term Bitcoin vision is $220,000. So, his recent price prediction may not be the final stop at all. Some believe it, some dismiss it. But the market? The market will decide.

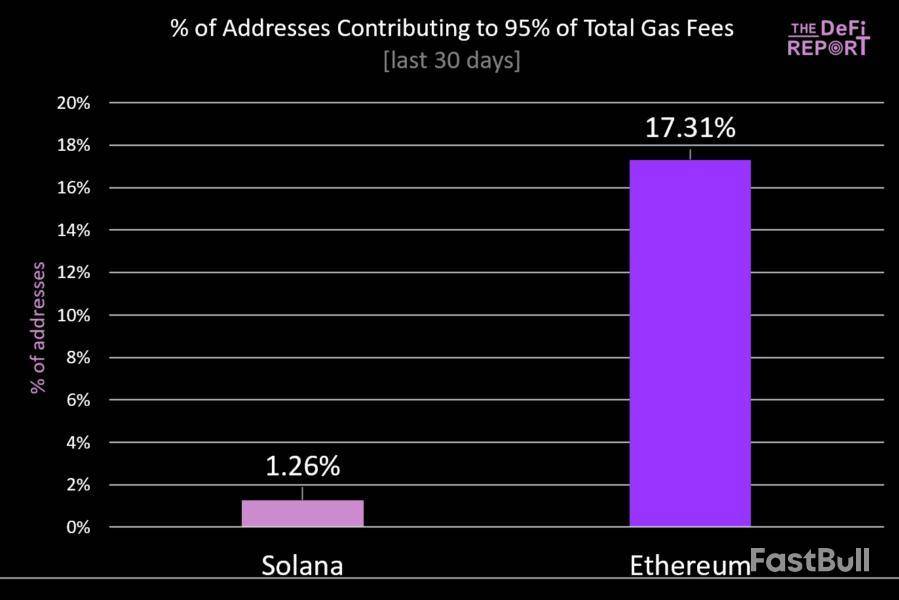

According to The DeFi Report, over the past month, only 1.26% of Solana’s wallet addresses have generated 95% of its total fees.

This concentration has raised significant concerns about the blockchain’s fee model and its implications for decentralization.

Solana’s Fee Structure Faces Criticism

Data from DefiLlama, shows that Solana generated 89.73 million in fees in February. As of March 7, it had generated 8.21 million.

In comparison, Ethereum generated 46.28 million in fees in February, with 7.49 million as of March 7. While these numbers suggest Solana is ahead, Michael Nadeau, the founder of The DeFi Report, claims this comparison may be misleading.

Although Nadeau acknowledges Solana’s impressive growth, he cautions that it might be less organic than it seems.

“But if you look under the hood, it looks like a house of cards,” he wrote.

According to Nadeau, over the past 30 days, 17.31% of addresses have contributed to 95% of the total fees generated on Ethereum. For Solana, the figure is strikingly small, only 1.26%.

Nadeau added that Wintermute, a prominent market-making firm, is the primary driver behind this fee generation. The rest of the fee is attributed to bots.

He claimed that these wallets drive the network’s activity through practices such as sandwich attacks and pumping meme coins. This often comes at the expense of retail investors.

For context, a sandwich attack is a front-running strategy in which an attacker exploits large trades. The attacker buys the asset before the large trade, anticipating a price increase, and sells afterward, profiting from the price movement while negatively impacting the original trader.

Nadeau cautioned that the reliance on a small subset of users for fee generation creates vulnerabilities. If retail traders become aware of the extent of bot-driven manipulation, they may withdraw from the ecosystem. This, in turn, could significantly impact Solana’s revenue projections.

“Nothing against Solana. Massive comeback story. But my sense tells me another period of “chewing glass” is yet to come,” he concluded.

Solana’s speed and cost efficiency have made it a favorite among developers and traders. However, this concentration of fees has raised concerns among market analysts.

“When 95% of fees come from 1.26% of users, it’s less “decentralized finance” and more “exclusive finance,” Superchargd co-founder wrote on X.

Another user also warned that Solana may not thrive well as the industry matures and free market forces fully take effect.

“Solana doesn’t have a future; it’s a Ponzi scheme designed for grifting,” he said.

Meanwhile, some questioned SOL’s inclusion in President Trump’s US crypto strategic reserve.

“Solana is a complete house of cards built on wash trading bots and centralized control,” a user remarked.

He also emphasized that validators profiting from failed transactions and the rise of Solana meme coins have harmed the space.

The criticism comes just after financial giant Franklin Templeton predicted in a report that Solana’s DeFi ecosystem could rival—and even surpass—Ethereum’s market valuation. The firm highlighted Solana’s scalability, low fees, and surging user activity as key factors driving its potential.

Amid the mounting criticism, Solana faces a pivotal moment. While its technological advancements and cost-efficiency have earned it a loyal following, its centralized fee-generation model and reliance on market manipulation tactics could pose significant risks to its future. How Solana adapts to these concerns will determine whether it can sustain its growth or struggle to maintain relevance.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up