Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Dominari Holding's Strategic Interest in Bitcoin Mining Set to Go Public

PR Newswire

NEW YORK, May 13, 2025

American Bitcoin Enters into Definitive Merger Agreement with Nasdaq-listed

Gryphon Digital Mining to Build World's Largest, Most Efficient Pure-Play

Bitcoin Minor Alongside A Robust and Strategic Bitcoin Reserve

NEW YORK, May 13, 2025 /PRNewswire/ — Dominari Holdings Inc. , today congratulates American Bitcoin on entering into a definitive merger agreement with Gryphon Digital Mining, Inc. . The strategic stock-for-stock transaction will result in American Bitcoin becoming a publicly traded entity on Nasdaq in which former American Bitcoin stockholders, including Dominari Holdings, will own approximately 98% of the combined company.

Upon closing, which is expected to occur in the third quarter of this year, the company will operate under the American Bitcoin brand, led by the management and current board of directors of American Bitcoin. American Bitcoin is expected to trade on Nasdaq under the ticker symbol "ABTC."

American Bitcoin was launched earlier this year, in partnership with Eric Trump, who will remain an advisor and chief strategy officer, with the goal of building the world's largest, most efficient pure-play Bitcoin miner alongside a robust strategic Bitcoin reserve. American Bitcoin is purpose-built to enable Bitcoin accumulation at scale through low-cost Bitcoin mining and other complementary strategies.

"As an early investor in American Bitcoin, we are proud to support its journey toward becoming a public market leader," said Kyle Wool, President of Dominari Holdings Inc. "This merger marks a significant milestone not only for American Bitcoin, but also for Dominari. American Bitcoin was formed as a joint venture between American Data Centers, an independent company that we created a few short months ago, and Hut 8. From the outset, we recognized its potential to become a formidable force in the digital asset mining sector. The merger between American Bitcoin and Gryphon Digital Mining validates that vision and highlights the strength of our broader strategy and business model. We believe the combined company is exceptionally well-positioned to capitalize on structural tailwinds in Bitcoin mining and digital infrastructure, and we look forward to supporting its continued growth as a strategic partner. For Dominari shareholders, this is notable value creation."

The announcement regarding the signing of the definitive merger agreement is available at https://www.globenewswire.com/news-release/2025/05/12/3078943/0/en/Hut-8-Subsidiary-American-Bitcoin-Announces-Go-Public-Transaction.html.

For additional information about Dominari Holdings Inc., please visit: https://www.dominariholdings.com/

About Dominari Holdings Inc.

The Company is a holding company that, through its various subsidiaries, is currently engaged in wealth management, investment banking, sales and trading and asset management. In addition to capital investment, Dominari provides management support to the executive teams of its subsidiaries, helping them to operate efficiently and reduce cost under a streamlined infrastructure. In addition to organic growth, the Company seeks opportunities outside of its current business to enhance stockholder value, including in the AI and Data Center sectors.

Dominari Securities LLC's Mission Statement:

Dominari Securities LLC, a principal subsidiary of Dominari Holdings Inc., is a dynamic, forward-thinking financial services company that seeks to create wealth for all stakeholders by capitalizing on emerging trends in the financial services sector and identifying early-stage future opportunities that are expected to generate a high rate of return for investors.

Securities Brokerage and Registered Investment Adviser Services are offered through Dominari Securities LLC, a Member of FINRA, MSRB and SIPC. Securities brokerage, investment adviser and other non-bank deposit investments are not FDIC insured and may lose some or all of the principal invested. You can check the background of Dominari Securities and its registered investment professionals and review its SEC Form CRS on FINRA's BrokerCheck site at https://brokercheck.finra.org. Information for Dominari Securities LLC and its registered investment professionals as well as its SEC Form CRS may also be found on FINRA's BrokerCheck site.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. Words such as "may," "might," "will," "should," "believe," "expect," "anticipate," "estimate," "continue," "predict," "forecast," "project," "plan," "intend" or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties, including without limitation those set forth in the Company's filings with the SEC, which include but are not limited to the Risk Factors set forth in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022 relating to its business. Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements whether as a result of new information, future events or otherwise, except as required by law.

Contacts:

Dominari Holdings Inc.

https://www.dominariholdings.com/

Investor Relations

Hayden IR

Brett Maas, Managing Partner

Phone: (646) 536-7331

Email: brett@haydenir.com

www.haydenir.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/dominari-holdings-strategic-interest-in-bitcoin-mining-set-to-go-public-302453353.html

SOURCE Dominari Holdings Inc.

Trader and investor Zion Thomas, known colloquially as Ansem, one of the most influential opinion leaders in meme coin segment, shares an extremely bullish take on XRP, a Ripple-linked cryptocurrency. It seems that some DOGE-style green candles for XRP price cannot surprise Ansem at all.

XRP may have wild run in BTC pair: Top trader opinion

XRP, the fourth biggest cryptocurrency by market cap, has all the chances to impress the community with new rallies. Such a statement was shared by Zion "Ansem" Thomas, prominent meme coin investor and cofounder of Bullpen social trading platform, with his 720,000 followers on X.

Ansem 🐂🀄️@blknoiz06May 13, 2025dont know why but really feels like xrp is going to have one of the runs doge had last cycle where its xrpbtc pair just goes way higher than any previous cycle - i still do not understand this coin

In particular, the rate might go way higher compared to all previous cycles. The price action of XRP might resemble that of Dogecoin , Ansem points out.

At the same time, the specifics of Ripple-linked XRP cryptocurrency remains a puzzle for the meme coin veteran, he admitted:

I still do not understand this coin.

In general, his audience agrees about the bright prospects of XRP crypto in the long run. However, all commentators attributed it to the hype on social media and its popularity among occasional cryptocurrency users:

The four horse man of NormieFi: XRP, DOGE, ADA, HBAR (...) Ripple owns a tremendous amount of the crypto ecosystem (...) $XRP - most hated rally (...)

XRP hit its all-time high in the BTC pair in early January 2018 at about 0.00014 Bitcoin per XRP. Should XRP get closer to this rate with current Bitcoin valuation, its price might reach $14,7 per coin.

XRP price yet to revisit its January 2018 ATH

The XRP price is sitting at $2.54 today, up 5% in the last 24 hours. Should Ansem's prediction pay out, XRP is due to a 478% rally.

In January 2021, Dogecoin jumped by 10x in a Bitcoin pair in less than one day, triggered by sudden Elon Musk's endorsement.

Launched in 2011, XRP gained popularity in the 2017-2018 bull run when it became the best-performing large altcoins. Its marvelous run resulted in the creation of XRP Army, a large and aggressive community of supporters in social media.

At the same time, just like its general rival Ethereum , XRP has failed to eclipse the price record of the previous rally.

With the asset currently trading close to the $103,000 range, Bitcoin is once again attempting to break through the price action record. The market seems to be preparing for a new push toward higher highs after recovering important technical levels. However, investors should be closely monitoring three key price levels before Bitcoin can reach another all-time high (ATH).

Initial barrier: $104,780

Around $104,780, which represented prior local highs in the early stages of the current rally, is the first significant resistance level. Just below this line, Bitcoin is presently consolidating; a clear breakout above it might lead to yet another buying frenzy. This level is a temporary psychological and technical ceiling; breaking it would indicate that bulls are once again in command. Chart by TradingView">

Gate of short-term momentum: $106,000

The $106,000 mark, which corresponds to extended Fibonacci retracement targets and is probably going to be a crucial decision point, is just above. Should Bitcoin surpass $104,780, the next stress test will be $106,000. Regaining it would cause a strong shift in market sentiment toward optimism, as this range has historically caused hesitancy.

Pre-ATH launchpad: $109,000

The value of $109,000 is the last significant barrier that must be overcome before Bitcoin can reach previously unheard-of heights. Prior to Bitcoin's last notable upward move, this level served as the last consolidation zone.

Technical resistance will be minimal before the price tests or breaks its ATH if bulls are able to break through this barrier. In terms of momentum, the 50 EMA is about to surpass the 100 EMA, a bullish crossover that frequently denotes intensifying upward pressure. The RSI is around 70, indicating significant momentum without being overbought. Volume is still stable confirming the validity of the current action.

If Bitcoin can overcome these crucial levels, all indications point to a breakout phase. Whether or not bulls can maintain the pressure and overcome these obstacles or if the market stalls just short of history will determine the market's next move.

New York Mayor Eric Adams is set to host the City’s first Crypto Summit next week to discuss mutual benefits between the city and the crypto industry.

“This is the Empire State,” Adams said at a press conference at Gracie Mansion on Monday. “We should be looking forward to building empires, particularly in the crypto space.”

Can New York Become The “Crypto Capital” Of The World?

New York Mayor Eric Adams announced that he’s hosting the city’s first-ever official crypto summit next week, which he said will bring together public officials and crypto industry innovators.

In an April press release announcing the event, Adam’s office described the summit as “coming on the heels of the White House Digital Asset Summit in March.”

“We’re going to attract world-class talent, provide opportunities for underbanked communities, and make government more user-friendly,” Adams postulated. “We are focused on the long-term values of these technologies for our city and its people, not chasing memes or trends.”

Specifically, the New York mayor mentioned the positive impact of crypto and blockchain on the city’s underbanked population, who have historically faced obstacles to traditional means of saving resources.

Adams then reaffirmed his goal of making New York City a crypto hub, saying at the press briefing that he would work with tech and crypto companies and create a friendly environment to help them succeed in the city.

“My goal remains the same as it was on day one as mayor: making New York City the crypto capital of the globe,” Adams asserted. His statements echo similar promises from President Donald Trump, who has often said he wants to make the U.S. the “crypto capital of the planet.”

Earlier this year, the Department of Justice under the Trump administration directed prosecutors in the Southern District of New York to dismiss corruption charges against Adams. The judge dismissed the charges with prejudice. Adams and Trump have been close since January, when Adams traveled to Florida to meet with the president at Mar-a-Lago.

Adams’ History With Crypto

Eric Adams has long been a supporter of crypto assets, describing himself as crypto-friendly even before assuming office as New York mayor. Adams recalled converting his first three paychecks into Bitcoin and Ethereum, and people laughed at him for making such a move.

“All I can say is, who’s laughing now?” he quizzed, adding. “We’re seeing how this industry is growing, and since then, the number of crypto and blockchain startups that have made New York City home has skyrocketed.”

The New York mayor, however, believes that while the crypto industry views mass adoption as inevitable, balanced regulation is needed that is strong enough to protect investors but not so stringent that it impedes innovation and growth.

“Our state should embrace the crypto and blockchain-friendly environment we have in New York City,” he quipped. “The right regulations can provide safety, but overregulation could hurt the industry — and we don’t want that.”

Meanwhile, Adams is currently running for reelection in the 2025 mayoral election.

Bulls are losing their initiative as most of the coins are in the red zone, according to CoinStats.CoinStats">

The rate of XLM has fallen by almost 2% over the last day.TradingView">

Despite today's fall, the price of XLM is rising after a false breakout of the local support of $0.2974. If bulls can hold the gained initiative, one can expect a test of the resistance by tomorrow.TradingView">

On the bigger time frame, the rate of XLM has made a false breakout of the $0.30 level. The price is far from the key levels, which means none of the sides is dominating.

In this case, there are low chances of seeing sharp moves. All in all, sideways trading in the narrow range of $0.3050-$0.32 is the more likely scenario.TradingView">

From the midterm point of view, the price of XLM has bounced off the resistance of $0.3251. If the bar closes far from that mark, traders may witness a test of the $0.30 zone soon.

XLM is trading at $0.3089 at press time.

The crypto market has undergone a significant correction. In the past 24 hours, the liquidation of $716 million impacted over 210,000 investors.

Several whales made notable moves, from taking profits on long positions in ETH and XRP to opening short positions on BTC, ETH, and SOL. These actions reflect the cautious sentiment of large investors and signal potential further volatility in the market.

Massive Liquidation Wave Hits Market

According to CoinGlass data, the crypto market saw $716 million liquidated in the past 24 hours at press time, affecting over 210,000 investors. Most positions were long, and $582 million was liquidated, indicating that many investors bet incorrectly during this correction.

Post-correction, Bitcoin dropped to $101,000 while Ethereum fell 4% to $2,400, and Solana lost 6% of its value, trading around $175.

This high liquidation level is a consequence of the market overheating last week. Bitcoin reclaimed the psychological $100,000 mark, while ETH surged over 40% to $2,500. The Fear & Greed Index hit 78, signaling excessive greed.

The simultaneous decline of major coins created significant pressure on the market, pushing many retail investors into losses. Meanwhile, whales seized the opportunity to take profits and adjust strategies.

Crypto Whales Take Profits and Shift to Shorting

Crypto whales swiftly capitalized on the market correction. According to Lookonchain, one whale closed long positions on ETH and XRP, locking in approximately $7.5 million in profits.

Transaction data shows this whale closed 17,702 ETH (worth $14.8 million) and 9.83 million XRP ($24.2 million). Simultaneously, the whale opened a new long position on SOL with 13,871 SOL (worth $2.5 million), but is currently facing an unrealized loss of $560,000.

On May 12, OnchainLens reported that this same whale deposited 5.84 million USDC into Hyperliquid and opened a 2x leveraged long position on XRP.

Another whale, which lost $5.73 million on ETH in late February 2025, recently gained $4.71 million in profits on ETH, demonstrating the resilience and acumen of large investors.

Meanwhile, some crypto whales shifted to shorting to capitalize on the downward trend. A whale labeled “Hyperliquid 50x Address” reversed a short position and earned $1.18 million in profits. The whale then quickly closed the position to lock in gains.

On the same day, another whale deposited an additional 10 million USDC into Hyperliquid to increase short positions on BTC, ETH, and SOL, valued at $14.8 million , $13.3 million , and $2.5 million , respectively. These moves suggest crypto whales anticipate further short-term market corrections.

Short-Term Downward Pressure but Long-Term Potential Remains

Whales’ profit-taking and shorting are creating significant short-term pressure on the market. However, long-term signals remain positive.

Analyst Davinci Jeremie’s observation of Bitcoin supply on exchanges suggests, “A supply shock is brewing.” Meanwhile, analyst Merlijn The Trader shared a chart indicating BTC has exited the “accumulation cylinder.”

“Historically, this is when things go parabolic. If this plays out, $500K+ isn’t hopium, it’s structure,” Merlijn confidently stated.

However, veteran analyst Michaël van de Poppe offers a different perspective, suggesting the altcoin bear market has ended, driven by Bitcoin’s dominance peaking.

“Strong bearish divergence on the weekly timeframe indicating that the #Bitcoin dominance has peaked. The end of the bear market for #Altcoins,” Michaël van de Poppe shared.

Bitcoin defied expectations in April, delivering double-digit gains while posting lower volatility than major traditional assets.

According to analysts at Galaxy Digital, Bitcoin’s (BTC) realized volatility over the past 10 trading sessions dropped to 43.86, lower than the S&P 500’s 47.29 and the Nasdaq 100’s 51.26 — an unusual “positioning for a digital asset traditionally known for its outsized volatility.”

The data point comes against a backdrop of renewed financial turbulence. Since US President Donald Trump’s Liberation Day tariff announcement on April 2, traditional markets have wobbled.

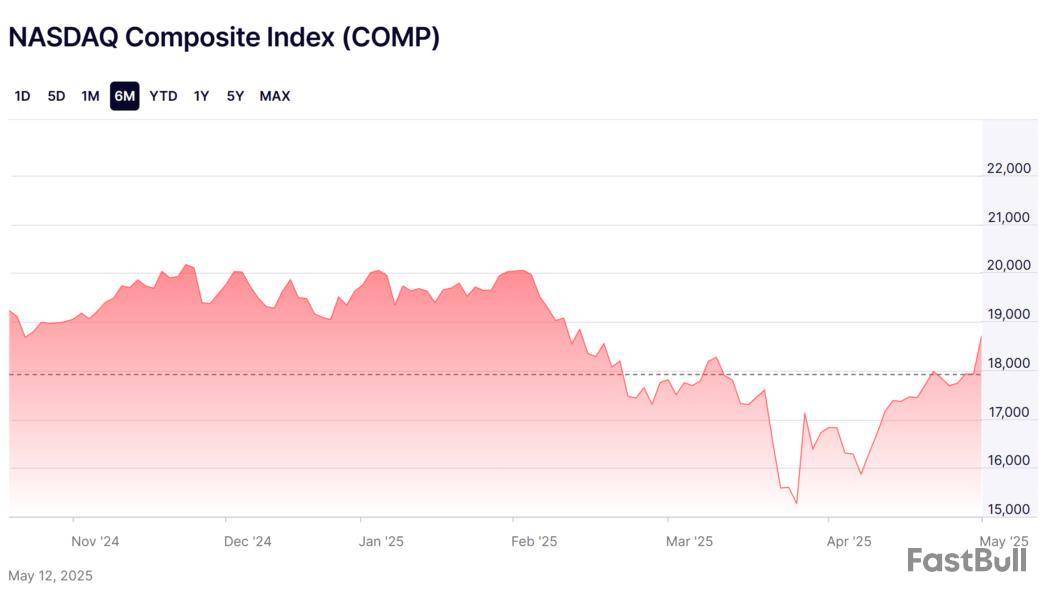

The Nasdaq Composite is flat, the Bloomberg Dollar Index fell nearly 4%, and even gold (typically a safe haven) briefly hit $3,500 per ounce before pulling back to a 5.75% gain, Galaxy Digital analysts wrote in a May 12 note.

However, they noted that Bitcoin surged 11% over the same period, reinforcing its evolving role as a macro hedge amid geopolitical and fiscal uncertainty.

Bitcoin’s correlation with major indexes declines

The analysts noted that Bitcoin still maintains elevated 30-day correlations with major indexes, around 0.62 with the S&P and 0.64 with the Nasdaq. However, its beta has declined, signaling that investors may be treating it less as a high-risk asset and more as a long-term allocation.

“Bitcoin as a non-sovereign asset means an investor doesn’t need the full faith or tax basis of a nation to support the integrity of the asset,” said Chris Rhine, head of liquid active strategies at Galaxy.

Galaxy said that the recent investor behavior mirrors what was observed during the 2018–2019 US-China trade tensions when Bitcoin rallied amid rising global uncertainty.

Hank Huang, CEO of Kronos Research, told Cointelegraph that surging ETF inflows and Strategy’s ongoing Bitcoin purchases are helping reshape Bitcoin into a digital version of gold, less tied to equities.

“As institutions deepen liquidity, volatility drops, making Bitcoin a cornerstone for portfolios,” Huang added.

Meanwhile, Galaxy’s OTC trading desk said the market posture is “tactically cautious but structurally constructive,” marked by disciplined leverage and low hedging stress.

With 95% of Bitcoin’s total supply already mined and growing interest from institutions, ETFs, and even governments, Bitcoin is increasingly being viewed as a digital store of value.

“Bitcoin’s supply and demand dynamics are solidifying its place as a mature digital store of value,” said Ian Kolman, co-portfolio manager at Galaxy.

On April 25, Jay Jacobs, BlackRock’s head of thematics and active ETFs, said there has been a long-term trend where countries have been reducing their reliance on dollar-based reserves in favor of assets like gold and, increasingly, Bitcoin.

He noted that geopolitical fragmentation is fueling demand for uncorrelated assets, with Bitcoin increasingly viewed alongside gold as a safe-haven asset.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up