Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The case for Dogecoin reaching $1 became stronger the moment the first U.S. Dogecoin ETF began trading and exceeded expectations.

The Rex Osprey Doge ETF (DOJE) reached $5.81 million in turnover within the first hour of trading, which is 140% higher than the day-one forecast of Bloomberg analyst Eric Balchunas and almost six times higher than the average for new ETFs over a full session.

For context, it takes many products weeks to reach that level of liquidity, but DOJE did it before lunch.

This came on top of an already noticeable price increase on spot markets.

Dogecoin to the Moon meme is back

Over the last 24 hours, Dogecoin has gained 13.9%, and over the last seven days, it has increased by 38%, taking the coin to $0.2963. This is the highest price since January, and it is only a few cents away from the key $0.30 handle that traders mark as short-term resistance.

Market voices are adding fuel to the fire. Traders such as Unipcs, who turned a $16,000 BONK investment into $13.7 million on paper, argue that most are under-exposed and that the parabolic phase has not yet begun for DOGE.

Unipcs (aka 'Bonk Guy') 🎒@theunipcsSep 18, 2025the renowned Bloomberg ETF analyst @EricBalchunas just posted that the first Dogecoin ETF in the US has gotten 140% more volume than his day 1 expectation in just the first hour

and many continue to underestimate how aggressively $DOGE is about to pump

Doge is getting ready to… https://t.co/pyLf5sInyg

With ETF liquidity confirmed, institutional wallets buying nine-figure sums of tokens and price levels moving back toward $0.30, the path to $1 DOGE in this cycle appears less like a meme and more like a mathematical certainty, says the top meme coin trader.

500,000,000 DOGE complete picture

On the weekly chart, this also reset the eight-month high, placing DOGE at the top of the large-cap leaderboard, above Solana, XRP and Ethereum in terms of percentage gains over this period.BINANCE:DOGEUSDT by TradingView">

In the meantime, U.S. company CleanCore Solutions disclosed the accumulation of over 500 million DOGE in the days following its market entry and confirmed plans to increase this figure to one billion DOGE within 30 days.

This equates to almost $300 million at current prices and highlights how corporate wallets are stepping in alongside retail.

TL;DR

EtherNasyonaL, a popular crypto analyst on X,outlineda possible scenario for XRP in the near future that relies on historic data, and especially its performance during the 2017 cycle. The chartist noted that the asset is currently following a very similar path, which sent it flying eight years ago.

If history is to repeat, the analyst predicted that XRP could resume its bull run from earlier this year and peak somewhere between $5 and $7 in 2025.

Naturally, similar mindblowing price projections excite the XRP Army, and they are quick to pick up and comment on them. Ripple Bull Winkle, one of the loudest on X, was among the first.

In a recent video, he outlined several bullish factors for Ripple’s native token for the near future, including regulatory clarity after the conclusion of the lawsuit against the US SEC. Additionally, he noted the network’s building infrastructure, impressive partnerships as of late, and the highly anticipated (but not guaranteed) approvals for spot XRP ETFs.

Such a product alreadyreachedthe US markets this week, but the majority of applications sitting on the regulator’s desk are still to be greenlighted.

However, experts, as well as Ripple Bull Winkle, remain bullish on these approvals, as current odds are above 90%. Consequently, the analyst doubled down on the “face-melting rally predictions” for XRP and asked his followers whether they are adequately positioned before this happens.

XRP Mega Cycle About To Detonate $XRP isn’t dead — it’s loading.

The mega cycle is coiled like a spring.

Reg clarity Ripple building infrastructure Face-melting highs incoming

Are you positioned BEFORE it happens? pic.twitter.com/Qf8F4Z4WKK

— Ripple Bull Winkle | Crypto Researcher (@RipBullWinkle) September 18, 2025

As of press time, though, XRP’s price has remained around the $3 support, which has been tested on several occasions in the past few weeks.

BlackRock, a major American investment management corporation overseeing trillions in assets, purchased $390 million in Bitcoin and Ethereum on Friday, continuing its aggressive expansion into digital assets.

The latest acquisition adds to BlackRock's substantial crypto holdings, which have grown rapidly since the firm began offering cryptocurrency ETFs. The investment management giant now holds nearly 765,000 BTC following the approval of spot Bitcoin ETFs in early 2024.

BlackRock's growing digital asset portfolio reflects broader institutional adoption trends, with traditional finance firms increasingly allocating portions of their portfolios to crypto assets through exchange-traded funds.

Since launching its cryptocurrency investment products, BlackRock has accumulated billions in value across Bitcoin and Ethereum holdings, establishing itself as one of the largest institutional holders in the space.

An IEO, or exchange offering, can quickly drive price moves for a project. This is because many people want to get the token early, and exchanges often promote new listings. The fact that LAAI will have a limited token amount could make even more buyers come in. If there is hype and strong interest, price may shoot up around the IEO. But high prices may not last if people sell for fast profit. If the project is strong, it might keep value after launch. source

Dex-Trade@dextrade_Sep 19, 2025LAURA AI AGENT (LAAI) IEO BOOM SOONhttps://t.co/W0C9qz4P6h

We are ready to announce the new IEO SOON

Be ready to buy LAURA AI AGENT (LAAI).

The number of LAAI is limited!

Your lovely Dex-Trade team! pic.twitter.com/4hKBFNMXfC

A snapshot means the team will record who owns the token at a given time. Many times, this is for an airdrop or new reward, and it can increase the price because people want to buy before the snapshot. Sometimes after the event, price goes down as people sell. If this snapshot leads to a good reward or special game feature, price could move up even more. But if there are no strong benefits for holders, price might not react much. Watch for more details from the team. source

Wolf Game@wolfdotgameSep 19, 2025The next chapter for Wolf Game is on the horizon.

There will be a snapshot for $WOOL and Pouches on Monday, Sept 22nd at 10 AM ET / 2 PM UTC.

Stay tuned for more information!

Sahara AI's new roadmap brings more features, plans for the mainnet, and better use for the SAHARA token. When projects show clearer plans and new steps, people often get excited and think the price could go up. Mainnets and new tools can bring more users and money. But, if the team does not deliver on time, or if users are not impressed, there might not be a price move. Traders will watch how the project keeps its promises. More news or actions by the team will likely drive short-term price changes. source

Sahara AI@SaharaLabsAISep 19, 2025New roadmap just dropped!

From new vertical-domain agents → to expanding $SAHARA utility → to Mainnet launch and more!

Here’s everything coming up in Q4 2025 and beyond for Sahara AI https://t.co/0rMMe88nQT

An analyst has pointed out how Dogecoin could see a rally to $0.36 or even $0.45 if its price can manage to break past this resistance barrier.

Dogecoin Is Retesting Upper Boundary Of A Parallel Channel

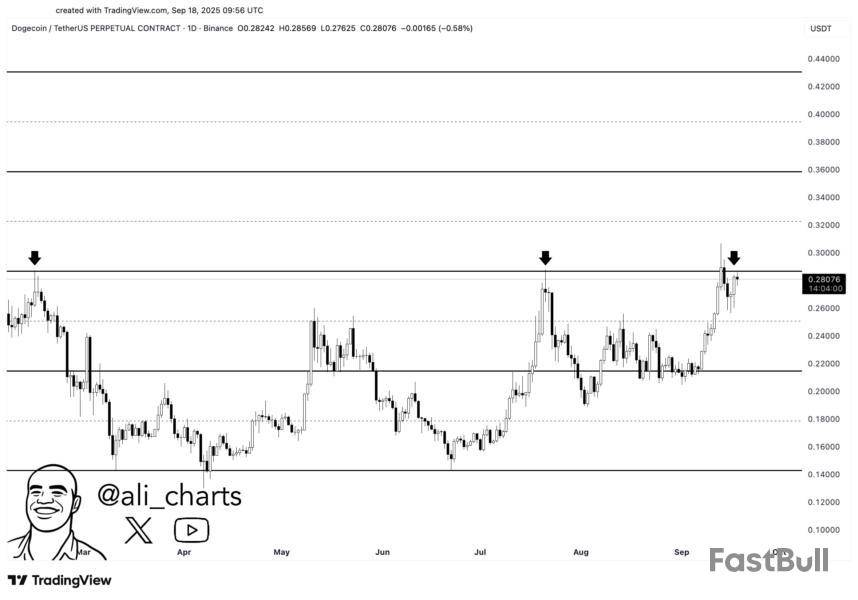

In a new post on X, analyst Ali Martinez has shared a technical analysis (TA) pattern forming in the 1-day price of Dogecoin. The pattern is a “Parallel Channel,” which forms when an asset observes consolidation between two parallel trendlines.

There are a few different types of parallel channels, each with a distinct orientation of the trendlines in respect to the graph axes. The Ascending Channel forms when the trendlines are angled upward. That is, when the price travels to a net upside inside the channel. Similarly, the Descending Channel has trendlines that have a negative slope.

In the context of the current topic, neither of these versions of the Parallel Channel is of interest, but rather the most simple case of the pattern: a channel parallel to the time-axis.

When the asset is moving inside this type of channel, it observes resistance at the upper line and support at the lower one, and moves in an exactly sideways manner trapped between the two.

Now, here is the chart shared by Martinez that shows the Parallel Channel that Dogecoin has been stuck inside for the last few months:

As is visible in the above graph, Dogecoin retested the upper line of the Parallel Channel earlier in the month, but found rejection. The memecoin now appears to be approaching another retest of this line situated at $0.29.

Generally, a break above the upper line of a Parallel Channel is considered to be a bullish signal. Thus, if DOGE can manage to surge above the pattern, it may see a sustained rally.

Martinez has suggested two potential targets for the memecoin: $0.36 and $0.45. These are based on the fact that Parallel Channel breakouts can be of the same length as the height of the channel; the former corresponds to half this distance and latter to the full one. It now remains to be seen whether Dogecoin can surpass this huddle in the near future and if any sustained bullish momentum will follow.

In some other news, Dogecoin whales have been buying recently, as the analyst has pointed out in another X post.

From the above chart, it’s visible that DOGE whales have added a total of 158 million tokens of the cryptocurrency (worth $41.9 million) to their holdings with this accumulation spree.

DOGE Price

At the time of writing, Dogecoin is trading around $0.265, down more than 6% over the last 24 hours.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up