Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Much of the large upside action in major cryptocurrencies of late has been in altcoins such as Dogecoin, with the dog coin higher by 43% weekly. Catalysts for Dogecoin's price rise include incoming ETFs and new crypto treasury companies focusing on the dog coin.

In recent news, CleanCore Solutions has now accumulated more than 500,000,000 Dogecoin as part of its strategic acquisition plan. Earlier this week, the U.S.-based cleaning company disclosed an initial purchase of 285 million DOGE to begin its Dogecoin accumulation plan. CleanCore aims to acquire 1 billion DOGE in 30 days, funded by a $175 million private placement backed by Pantera, GSR and FalconX.

In other news, U.S. Triestina Calcio 1918, one of Italy’s oldest professional soccer clubs, announced on Friday that House of Doge, Dogecoin Foundation's corporate arm, has become its largest shareholder. The investment was made through House of Doge’s subsidiary, Dogecoin Ventures, marking the first time a European football club has brought a cryptocurrency commercialization entity directly into its ownership structure.

Dogecoin to melt faces?

Dogecoin has seen a sharp surge in the last 48 hours, posting two large green daily candlesticks for Friday and Saturday, respectively.

Ali@ali_chartsSep 12, 2025Dogecoin $DOGE still in the BUY zone. This bullish breakout will melt faces! pic.twitter.com/JNgCmRJfY0

On Saturday, Dogecoin sharply rose from a low of $0.272 to $0.3069 and is on track for its fourth day of rise since Sept. 9. Taken from Sept. 6, Dogecoin has marked six out of seven days in the green, surpassing the daily SMA 50 barrier at $0.225.

At the time of writing, Dogecoin is up 15.11% in the last 24 hours to $0.3056 and up 43% weekly.

According to crypto analyst Ali, DOGE still remains in the "buy" zone, implying that bulls remain in play, adding that Dogecoin's bullish breakout will melt faces.

The Rex Osprey DOGE ETF, the first of such in the U.S., is expected to debut next week, a bullish catalyst for Dogecoin.

TL;DR

SHIB Security Incident

After PeckShield flagged the suspicious activity on Friday, the official Shiba Inu channel on X said the team had reached out to external security partners to investigate thoroughly. One of the first updates posted on Saturday noted that a sophisticated attack, which was probably planned for months, was carried out using a flash loan to purchase 4.6 million BONE tokens.

The attacker gained access to validator signing keys, achieved majority validator power, and signed a malicious state to drain assets from the bridge. As the tokens were delegated to Validator 1, they remained locked (because of unstaking delays), which allowed the team to freeze them.

A more recent Q&A from the team, reposted by LUCIE, said only a “small amount of ETH/SHIB was moved.” According to another post, the precise amount was 224.57 ETH (valued at around $1 million) and 92.6 billion SHIB (worth roughly $1.33 million).

Other affected tokens include LEASH, ROAR, TREAT, BAD, and SHIFU, but they have not been moved or sold as of the time of the post. The attacker also tried to sell $700,000 worth of KNINE, but they failed as the K9finance DAO multi-sig blacklisted their address.Are Funds Safe and What’s Next?

The team was adamant that all investors’ funds are safe. Staking and unstaking have been paused, and all funds have been moved and secured in multi-sig cold storage. The team has also engaged with leading security firms, such as PeckShield, Seal911, and Hexens, to investigate the incident further.

In terms of next steps, the Shiba Inu team said:

• Secure validator key transfers and confirm full chain integrity.

• Restore stake manager funds once security is assured.

• Continue coordinating with partners to freeze attacker-linked funds

• Publish a full incident report once investigations conclude.

Despite this incident, the largest native token of the project has skyrocketed in the past 24 hours. SHIB has gained over 9% of value and now sits close to $0.0000145, which is the highest level in about a month.

President Trump has turned up the heat on NATO allies, saying he is ready to impose major sanctions on Russia, but only if all NATO members act together and stop buying Russian oil.

In a recent Truth Social post, Trump criticized NATO saying “NATO’S commitment to WIN has been far less than 100%, and the purchase of Russian Oil, by some, has been shocking”. He said it significantly weakens their negotiating power with Russia.

Trump Proposes Tariffs on China

Trump also proposed that NATO, as a group, should place 50–100% tariffs on China, to be lifted once the Russia-Ukraine war ends. He claims that this move would pressure China to break its grip on Russia and help bring the conflict to a close.

The Kobeissi Letter@KobeissiLetterSep 13, 2025BREAKING: President Trump says all NATO nations are preparing to "do major sanctions on Russia" and impose 50% to 100% tariffs on China. pic.twitter.com/lhhiV7OIpk

He also said that this war would never have started under his presidency, calling it Biden and Zelenskyy’s conflict.

Trump Warns Patience with Putin is Running Out

In an interview with Fox News on Friday, Trump said that his patience with Russian President Vladimir Putin is running out fast.

Rapid Response 47@RapidResponse47Sep 12, 2025"Has your patience run out with Putin?"@POTUS: "It's sort of running out and running out fast — but it does take two to tango… When Putin wants to do it, Zelensky didn't. When Zelensky wanted to do it, Putin didn't… We're going to have to come down very, very strong." pic.twitter.com/IunhwDzjcm

And this isn’t the first time either. Trump previously threatened sanctions on Moscow and on countries buying its oil, including major buyers China and India, if the war in Ukraine isn’t resolved. He has slapped a 25% tariff on Indian goods for continuing to import Russian oil, but has not taken a similar action on China.

Russian Action Escalates Tensions

Tensions are spiking. Several Russian drones recently flew into Poland, escalating matters by entering the airspace of a NATO ally. The United States pledged Friday to defend “every inch of NATO territory” after the drones entered Polish airspace, during an attack on Ukraine.

Meanwhile, Peace talks between Russia and Ukraine are currently on “pause,” with President Zelensky warning that Putin still aims to capture all of Ukraine.

Crypto Market Hold Steady

Despite these geopolitical developments, crypto markets remain relatively muted to this development. Bitcoin has held above the $115,000 level, while altcoins are also trading in green – even leading to increased calls for the start of “Altcoin season”.

The global crypto market cap now stands at $4.19 trillion, up 1.9% in the last 24 hours.

Investor Ted notes that the U.S. markets are hitting new highs across the board with gold, stocks and even global money supply (M2) are all at record level, while the national debt continues to climb. Bitcoin is also just 7% away from its all-time high. Yet, the U.S inflation remains at 2.9%, far above the Fed target.

Trump has commanded immense power over the global markets in the past few months and this isn’t an exception. All eyes are on his next policies and the impact they will create.

The AVAX price has surged to $31 as Avalanche accelerates its DeFi ecosystem with major integrations and on-chain growth.

AVAX price today is showing strong momentum, and the price chart is displaying consistent gains. Investors are watching closely as the network’s fundamentals strengthen across DeFi, gaming, and institutional adoption.

DeFi Expansion Fuels AVAX Price Momentum

Avalanche recently onboarded two prominent DeFi players, sUSDe from Ethena Labs and Pendle Finance, unlocking new fixed and variable yield markets.

This move enhances the network’s DeFi infrastructure while leveraging its sub-second transaction finality and low fees.

As a result, AVAX crypto has seen renewed demand, helping drive the recent AVAX price spike above $30.

Avalanche🔺@avaxSep 12, 2025Avalanche adds two giants to DeFi 🔺

sUSDe from @ethena_labs is live, a scalable reward-bearing stable asset.

Together with @pendle_fi it unlocks fixed and variable yield markets on Avalanche’s low fee, sub second rails. pic.twitter.com/WQ9ARWOcql

Moreover, On-chain indicators further support the bullish tone around AVAX price USD.

According to DeFiLlama, Avalanche’s total value locked (TVL) has more than doubled over the past two quarters, climbing from $1 billion in April to around $2.1 billion currently.

This sharp rise reflects a broader return of liquidity to the ecosystem and builds confidence in the medium-term AVAX price forecast.

Key Developments Lay the Foundation for Growth

Multiple strategic milestones have combined to fuel this rebound in September. First major move was the Octane upgrade earlier this year reduced gas fees, making Avalanche more competitive for developers and users.

Meanwhile, in June, global asset manager VanEck announced its PurposeBuilt Fund to back projects on Avalanche.

The Gaming has also played a pivotal role in Avalanche’s resurgence because there are projects like MapleStory that worked out pretty well and even helped in driving the total transactions from 620 million in all of 2024 to over 1.4 billion in just the first half of 2025.

This surge in activity has revitalized network usage indirectly strengthening the AVAX price chart structure.

In addition, SkyBridge Capital had revealed their plans to migrate $300 million in assets to the AVAX network.

These several moves highlight growing institutional trust, which are literally adding weight to the AVAX price prediction 2025 narrative to revisit the lost peak of $147 from 2021.

September Outlook Hints at More Upside

Currently, AVAX is trading at $30.42, marking a 55% gain in the last three months after climbing from $16 in June.

While AVAX price today is consolidating near $30, market watchers expect further upside if momentum holds, with September projections suggesting a potential run toward $42.91 as bullish sentiment continues to build.

Stellar (XLM) is bullish as the asset has recorded an over 3.5% price increase within the last 24 hours, triggering a surge in open interest. As per CoinGlass data, within the same time frame, Stellar’s open interest climbed by 4.63%. This increase could catalyze further price gains.

XLM and open interest trigger

Notably, Stellar investors have committed 917.26 million XLM worth $376.97 million to the asset’s futures market. It suggests that more traders are comfortable holding positions as they anticipate further price gains in Stellar.

For clarity, open interest indicates the volume of futures contracts that investors have open on XLM. The higher the percentage increase in open interest, the higher the confidence and bullish expectations. Hence, a 4.63% increase signals strong bullish expectations.

CoinGlass data indicates that the highest number of bullish traders was recorded on Bitget, which accounts for 26.3% of the total open interest. Bitget users committed 240.97 million XLM valued at $99.15 million on Stellar.

The others completing the top three are Binance and Bybit users with 23.2% and 19.21%, respectively. In fiat terms, these committed $87.46 million and $72.45 million, in that order.

Stellar's historical trends point to $0.50 price target

As of this writing, the Stellar price was trading up by 5.03% at $0.4113. The coin had earlier reached a peak of $0.4141, suggesting that it has potential for further gains. With its Relative Strength Index (RSI) at 57.82, XLM has room for upside, and this could reach $0.50.

A major hurdle to this target is the low trading volume, which remains in the red zone by a significant 7.35% at $299.88 million. If ecosystem bulls step in to support amid sustained open interest, Stellar could easily hit $0.50.

As U.Today reported, XLM’s price has the potential to hit this target as historical data shows a bullish September. If the coin repeats its performances of 2016, 2018, or 2022, Stellar could easily soar past the $0.50 target.

US President Donald Trump believes the war between Russia and Ukraine could end soon, but only if NATO follows his instructions.

The POTUS urged all nations of the union to stop buying oil from Russia, which has weakened their bargaining power. Additionally, he wants to impose “major sanctions” on Russia when all countries within NATO have agreed.

He added that this is not Trump’s war, as it would never have started if he were President at the time. Instead, he reaffirmed his stance that this is Biden’s and Zelenskyy’s war, and he was there to help stop it and save “thousands of Russian and Ukrainian lives.”

“If NATO does as I say, the war will end quickly, and all of those lives will be saved! If not, you are just wasting my time, and the time, energy, and money of the United States,” – Trump remarked.

He also believes that imposing 50% to 100% tariffs on China from all NATO nations would help, as the Asian giant has a “strong control, and even grip, over Russia, and these powerful tariffs will break that grip.”

BREAKING: President Trump says all NATO nations are preparing to “do major sanctions on Russia” and impose 50% to 100% tariffs on China. pic.twitter.com/lhhiV7OIpk

— The Kobeissi Letter (@KobeissiLetter) September 13, 2025

Similar macroeconomic developments, even threats from the US President, tend to impact the ever-volatile cryptocurrency markets, especially when they are published during the weekend when all other financial markets are closed.

However, this hasn’t been the case so far this time. Bitcoin’s price is up by almost 5% in the past week, andstands unshakenclose to $116,000, as it did before Trump’s threats went live.

XRP remains one of the most actively traded tokens, recording volumes above $6.44 billion. Recently, its price climbed back over $3.17, marking a solid 5% gain in just one day.

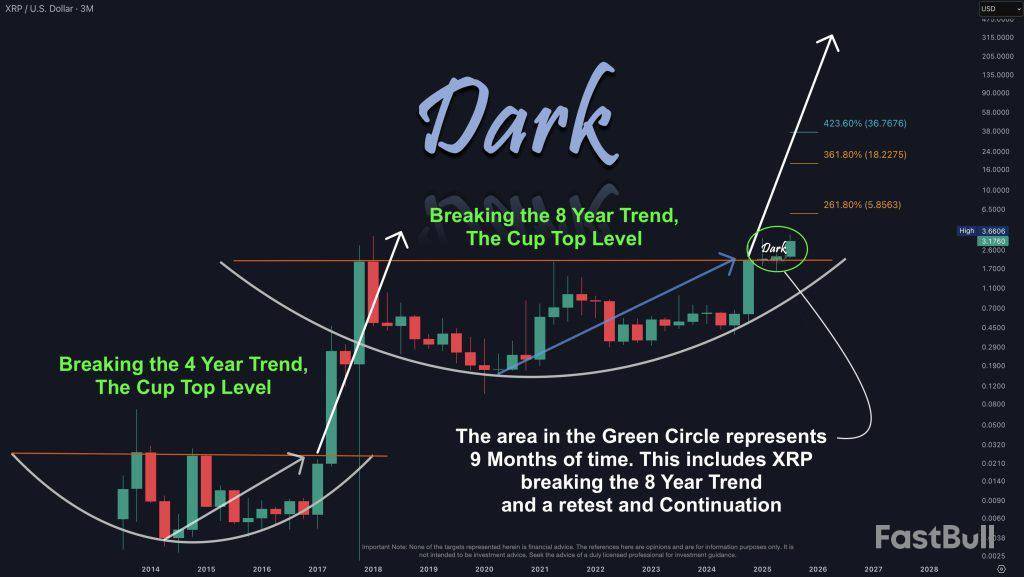

Meanwhile, well-known crypto analyst Dark Defender, believe that XRP may have entered a historic new phase, eyeing $5.86 in short term.

Top Analyst Sees Historic Breakout Ahead

Crypto analyst Dark Defender says XRP has entered a major new phase after breaking free from an 8-year-long consolidation. He compared it to 2017, when XRP skyrocketed after escaping a 4-year pattern, but this time the setup looks much bigger.

His chart shows XRP forming a giant “cup” pattern over nearly a decade. This month, XRP pierced through the top resistance of that structure, signaling the start of a new chapter.

As he put it, “The flight of the Phoenix begins.”

What makes this breakout even more convincing is the retest. XRP didn’t just break resistance, it came back down to test the same level, held firm, and bounced.

How High Can XRP Fly?

Meanwhile, dark Defender’s chart points to some big future price targets for XRP. He believes the token could reach around $5.85, then $18.22, and even as high as $36.76 in the long run.

These are not short-term goals, but if XRP follows its past trend, the next rally could be much stronger than most people think.

All Eyes on SEC’s October Decision

Big investors are buying more XRP, with $14.7 million flowing into XRP funds last week. This brings total inflows for 2025 to over $1.4 billion, showing strong demand.

The real focus is on October 2025, when the SEC will decide on new XRP ETFs. Many firms have applied, and chances of approval look high, which could drive more buying.

A recent XRP ETF listing by Canary Capital caused buzz, but experts say it’s just a normal step before launch, not an approval. Even so, excitement around XRP continues to grow.

As of now, XRP price is trading around $3.17 reflecting a jump of 13% seen in the last 24 hours.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up