Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Dogecoin price appears to be on a continued rebound, with bulls regaining some control over the market after weeks of sideways trading and downward pressure. However, the momentum is being tested as strong resistance builds around the $0.205 level. A recent analysis highlights this crucial zone and outlines the roadmap for Dogecoin’s next move.

Dogecoin Price Recovery Faces Critical Resistance

TradingView crypto analyst Lingrid recently shared a technical analysis featuring a classic continuation pattern unfolding for Dogecoin. The analyst revealed that the Dogecoin price is attempting a recovery after rebounding from a key ascending trendline and breaking out of a Falling Wedge pattern.

Following this, Dogecoin is now retesting the breakout level around $0.175, where both the wedge resistance and ascending trendline converge. The cryptocurrency has also formed a higher low structure on its price chart. Notably, this breakout zone is critical, as holding above it would confirm the breakout and set the stage for potential gains.

Lingrid has revealed that traders are currently watching closely for continuation toward the next resistance area. The $0.19 level has been set as the next immediate breakout target, aligning with the top of the previous range and the midpoint of the broader resistance area.

A push beyond $0.19 would open the door for a run toward the range between $0.2 – $0.21, a key resistance area where selling pressures could intensify. While Dogecoin’s structure remains relatively bullish with higher lows forming, Lingrid has also cautioned that overhead resistance near $0.19 and $0.2 could slow down the momentum.

Notably, Dogecoin’s trading volume will also play a key role in its price action and future moves. As the price approaches the wedge apex, fluctuations in volume could either sustain the strength of the rally or weaken it.

DOGE To Decline Further If Support Fails

Since the beginning of this year, the Dogecoin price has recorded its fair share of unexpected price declines and volatility. While Lingrid’s analysis shares encouraging signs of a potential price recovery and bull rally, Dogecoin’s breakout remains at risk.

If its price fails to hold the critical support zone at $0.175, especially with a strong candle close below this level, the projected breakout could be invalidated. This would, in turn, potentially lead to a steeper price breakdown toward $0.15, representing a 25% decrease from its current market value of $0.2.

Lingrid also mentions that a failure to maintain buyer interest near the wedge apex and weakening volume could also contribute to market indecision, making a swift recovery less likely. As a result, traders are advised to watch the $0.175 zone closely as a key breakout point that will determine whether Dogecoin resumes its climb or faces renewed downward pressure.

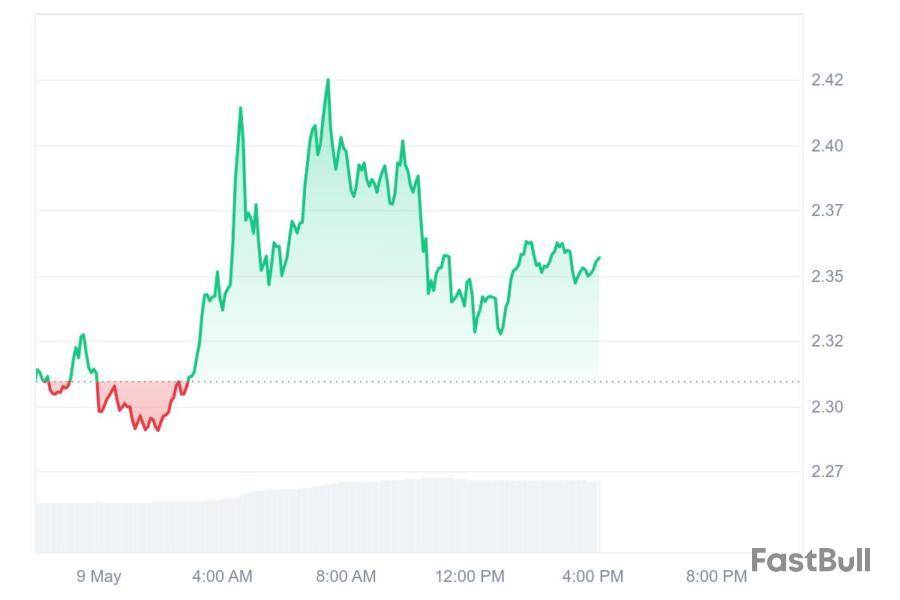

On May 9, blockchain monitoring firm Whale Alert identified a massive transfer of 29,532,534 XRP, worth $69,536,183, to leading U.S.-based crypto exchange Coinbase.

This large transaction has raised eyebrows as it coincides with the ongoing bull market run, prompting investors to closely monitor on-chain activities.

Whales already dumping?

According to the data, the massive transfer was executed by an unknown wallet address in a single transaction, suggesting a possible sell-off attempt.

Although the exact motive behind the transaction remains unclear, it has sparked concern within the XRP community, especially as it aligns with a period of bullish momentum for the token.

Despite the transfer, XRP continues to exhibit strong bullish indicators. Over the past 24 hours, CoinMarketCap data shows that XRP has experienced a 3% daily surge, following an 8% gain the day prior. As of press time, XRP is trading at $2.35.

CoinMarketCap">

In addition to the price uptick, XRP has also recorded a 60.35% surge in trading volume, reflecting heightened activity among both retail and institutional traders.

While large transfers to exchanges are often associated with intent to sell, this specific transfer has the XRP community questioning whether whales are starting to take profits after the recent bull run.

What next for XRP?

XRP’s current positive price trend has fueled investor optimism, with expectations that the token could reach the $3 mark soon. Longer-term, some believe XRP could hit a new all-time high (ATH) before the onset of the next bear cycle.

However, if large holders begin to sell off holdings, this could stall XRP’s bullish trajectory. Whale profit-taking can lead to a spike in supply, outpacing demand and potentially driving prices down.

Such actions might also trigger panic selling among smaller, less experienced investors, leading to further downward pressure on the token’s price.

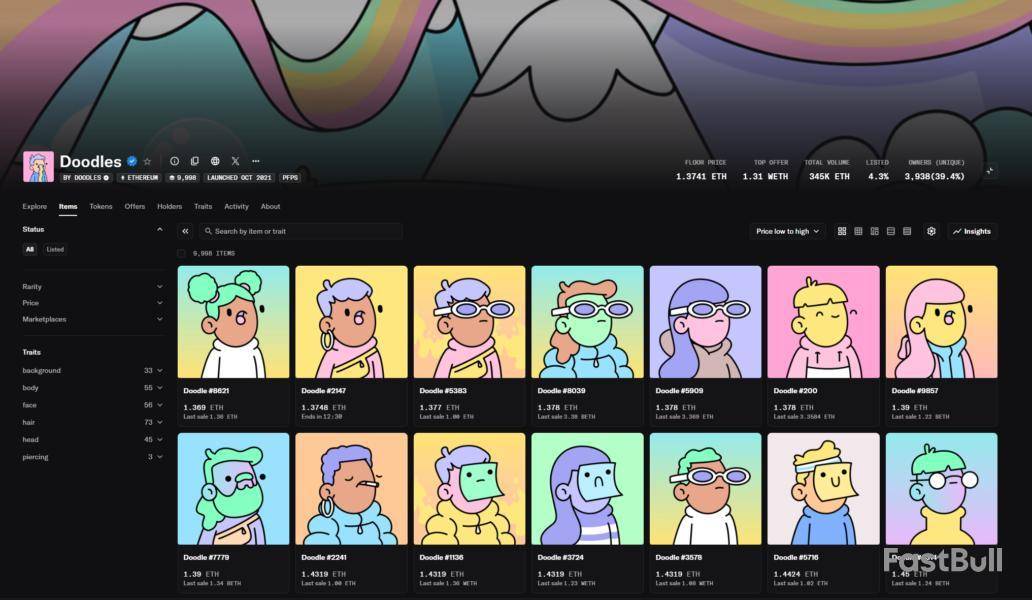

The newly launched DOOD token from Ethereum-based NFT project Doodles has seen a steep drop in market capitalization following its May 9 airdrop on the Solana network.

According to data from DEX Screener, DOOD’s market cap fell from over $100 million shortly after launch to around $60 million at the time of writing.

Overall, the much-anticipated airdrop was “[d]efinitely underwhelming,” a crypto commentator said in a May 9 X post.

Falling NFT values

Joining the trend, NFTs in Doodle’s flagship collection sharply dropped in value on May 9.

The collectibles are down roughly 60% to less than 1.5 Ether per NFT from about 3.5 ETH on May 8, according to OpenSea. As of May 9, the NFTs are collectively worth around $31 million, according to data from CoinGecko.

NFT prices often dip immediately after an airdrop, as holders look to capitalize on their allocations by selling into the market. For instance, sales of Doodles’ NFTs surged by some 97% on May 8 in anticipation of the airdrop.

Over the past week, Doodles clocked roughly $2.6 million in total sales volume, up more than 350% from the week prior, according to data from CryptoSlam.

Doodles announced its token launch in February, outlining plans to mint 10 billion DOOD tokens on Solana and to eventually bridge them to Base, an Ethereum layer-2.

Doodles is the latest Ethereum-native NFT brand to list a token on the Solana network. It follows Pudgy Penguins, an even larger NFT project that airdropped its PENGU token on Solana in December.

Similarly to Doodles, Pudgy Penguin’s token dropped by around 50% on the day of its airdrop.

The PENGU token’s market cap reached an all-time high of roughly $2.8 billion and has since traded down to roughly $900 million, according to CoinGecko.

Metaplex (MPLX) is holding a community vote on Proposal #17 from May 30 to June 5, 2025. Votes about changes or upgrades can be important for price, depending on what the proposal is. If the community supports big changes that help the project, MPLX could gain attention and price could rise. On the other hand, if the news is not exciting or causes worry, it may not help the price. The outcome and community mood are key. Follow updates about the proposal here.

Metaplex@metaplexMay 08, 20251/ The Metaplex DAO Treasury Initiative voting cycle is live.

Proposal 1 by @SlorgoftheSlugs is open for voting until May 21. If it doesn’t pass, Proposal 2 by @JosipVolarevic2 will follow May 22–29. Proposal 3 by @Metapsilo is next, with voting May 30–June 5 pic.twitter.com/zro14L1gPp

Space and Time (SXT) will be listed on Bitrue exchange with SXT/USDT trading starting May 12, 2025. Token listings on new exchanges often help prices because more people can buy the token. Listing on Bitrue means new users and higher liquidity. Sometimes, prices move up before the listing as traders buy in early, but there can also be selling after. Bitrue’s user rewards could attract even more interest. Overall, this event could be a positive price driver in the short term. Read more here.

Bitrue@BitrueOfficialMay 09, 2025New listing $SXT is coming to #Bitrue Spot! @SpaceandTimeDB

Deposits opened via ERC20 networks

SXT/USDT trading starts: 10:00 UTC, May 12, 2025

Upcoming event: New Bitrue users can get up to 150 $SXT! Stay tuned!

Learn More: https://t.co/nDWaOw5tSD pic.twitter.com/hydlk6R8Cl

Casper Network will hold an AMA with KuCoin on Twitter Spaces, talking about Casper 2.0 on May 12, 2025. Such events can be good for price because more people hear about the project and new upgrades are shared. If the team shares big news or important updates, there could be strong buying. However, AMAs sometimes do not lead to big moves unless something unexpected is announced. Watch trading volumes around this time for signs of interest. KuCoin’s large user base also helps to bring attention. See details here.

Casper@Casper_NetworkMay 09, 2025Casper 2.0 X Spaces with KuCoin

Monday, May 12th

️ 9 AM CET

Twitter Spaces

Don’t miss our upcoming Casper 2.0 X Spaces with @kucoincom! KuCoin is the go-to platform for emerging crypto trends — the perfect stage to unveil Casper 2.0, and what’s next for #Casper.

Key Takeaways:

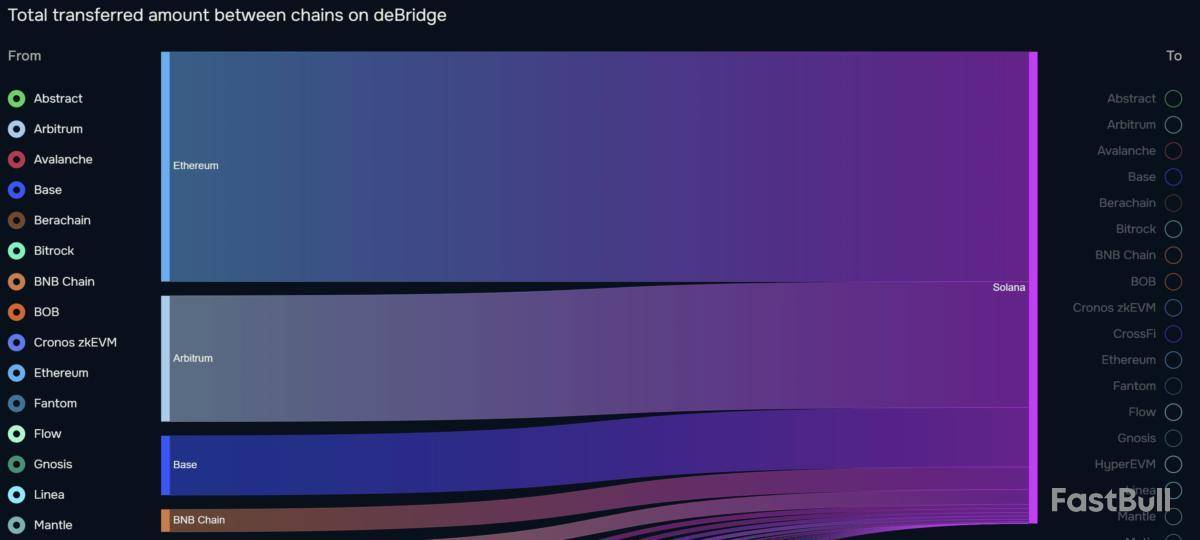

Solana's 15% surge and potential close above the 50-week EMA signal strong bullish momentum, which previously led to a 515% rally in 2024.

The $120 million in liquidity bridged to Solana reflects growing network confidence.

Solana (SOL) price gained 18% this week, signaling rising bullish momentum. The altcoin is approaching a pivotal point, with a potential close above the 50-week exponential moving average (EMA), a level that has historically catalyzed significant rallies.

In March, SOL dipped below the 50-week EMA and briefly dropped under $100 on April 7. Since then, Solana has staged a strong recovery, reclaiming key EMA levels (100W and 200W), with the 50-week EMA (blue line) now in focus.

Historical patterns reinforce a bullish outlook. In October 2023, SOL breached the 50- and 100-week EMAs, consolidating above these levels before rallying 515% by March 2024.

Notably, the relative strength index (RSI) was below 50 during both periods, mirroring the current setup, with the indicator rebounding above 50 after the 50-week EMA flipped to support. If the 50-week moving average holds, the price targets for SOL could be between $250 and $350 by September 2025.

The daily chart bolsters this narrative. Solana recently closed above the 200-day EMA, with immediate resistance at $180. A break above this level in the coming weeks and turning the range into a support level could potentially ignite a parabolic rally by Q3 2025.

Related: Solana lacks ‘convincing signs’ of besting Ethereum: Sygnum

Users bridge $165 million to Solana

In the last 30 days, over $165 million in liquidity has been bridged to Solana from other blockchains, reflecting growing confidence in the network. Ethereum led with $80.4 million in transfers, followed by Arbitrum with $44 million, per Debridge data. Base, BNB Chain, and Sonic contributed $20 million, $8 million, and $6 million, respectively.

Similarly, data from DefiLlama indicates that Solana posted the highest decentralized exchange (DEX) volumes, 3.32 billion, over the past 24 hours. The network currently holds 28.99% of the market share among other chains.

With a 28.99% market share among competing chains, Solana’s dominance in DeFi activity highlights its scalability and user adoption.

Currently, substantial liquidity inflows and strong DEX volumes position Solana for a sustained price breakout.

Related: Chance of Bitcoin price highs above $110K in May increasing — Here’s why

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up