Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

What Happened?

A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official boosted hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On 1st Source (SRCE)

1st Source’s shares are not very volatile and have only had 3 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

The previous big move we wrote about was 28 days ago when the stock gained 3.4% on the news that a cooler-than-expected inflation report fueled optimism for potential Federal Reserve interest rate cuts.

The September Consumer Price Index (CPI) report indicated a 3.0% year-over-year increase in prices, just below the 3.1% that economists had forecast. While still above the Federal Reserve's 2% target, investors interpreted this softer inflation reading as a sign that price pressures are easing. This development increases the likelihood that the central bank may move to cut interest rates. Lower interest rates can benefit banks by reducing their cost of funding and potentially stimulating loan demand from businesses and consumers. The positive sentiment was widespread, contributing to a broader market rally that saw the S&P 500, Dow, and Nasdaq all reach new record highs.

1st Source is up 7.6% since the beginning of the year, and at $62.18 per share, it is trading close to its 52-week high of $67.65 from February 2025. Investors who bought $1,000 worth of 1st Source’s shares 5 years ago would now be looking at an investment worth $1,617.

The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Independent Bank and the rest of the regional banks stocks fared in Q3.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 94 regional banks stocks we track reported a satisfactory Q3. As a group, revenues missed analysts’ consensus estimates by 1.1%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Tracing its roots back to 1907 and serving as a financial cornerstone in New England for over a century, Independent Bank Corp. operates as the holding company for Rockland Trust, providing banking, investment, and financial services across Eastern Massachusetts and Rhode Island.

Independent Bank reported revenues of $243.7 million, up 39.1% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with an impressive beat of analysts’ net interest income estimates and a solid beat of analysts’ tangible book value per share estimates.

Interestingly, the stock is up 7.5% since reporting and currently trades at $69.23.

Is now the time to buy Independent Bank? Access our full analysis of the earnings results here, it’s free for active Edge members.

Originally founded with a "high-tech, high-touch" branch-light banking strategy, Customers Bancorp is a bank holding company that provides commercial and consumer banking services through its Customers Bank subsidiary, with a focus on business lending and digital banking.

Customers Bancorp reported revenues of $232.1 million, up 38.5% year on year, outperforming analysts’ expectations by 7%. The business had a stunning quarter with a solid beat of analysts’ net interest income estimates and an impressive beat of analysts’ revenue estimates.

The market seems content with the results as the stock is up 2% since reporting. It currently trades at $66.83.

Is now the time to buy Customers Bancorp? Access our full analysis of the earnings results here, it’s free for active Edge members.

Operating behind the scenes of many popular fintech apps and prepaid cards you might use daily, The Bancorp is a bank holding company that specializes in providing banking services to fintech companies and offering specialty lending products.

The Bancorp reported revenues of $174.6 million, up 38.8% year on year, falling short of analysts’ expectations by 10%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue and net interest income estimates.

As expected, the stock is down 20.3% since the results and currently trades at $61.55.

Read our full analysis of The Bancorp’s results here.

With roots dating back to 1885 and a strategic focus on middle-market commercial lending, Cadence Bancorporation is a bank holding company that provides commercial banking, retail banking, and wealth management services to middle-market businesses and individuals.

Cadence Bank reported revenues of $519.3 million, up 15.1% year on year. This result missed analysts’ expectations by 0.6%. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ tangible book value per share estimates but a slight miss of analysts’ revenue estimates.

The stock is up 1.9% since reporting and currently trades at $37.75.

Read our full, actionable report on Cadence Bank here, it’s free for active Edge members.

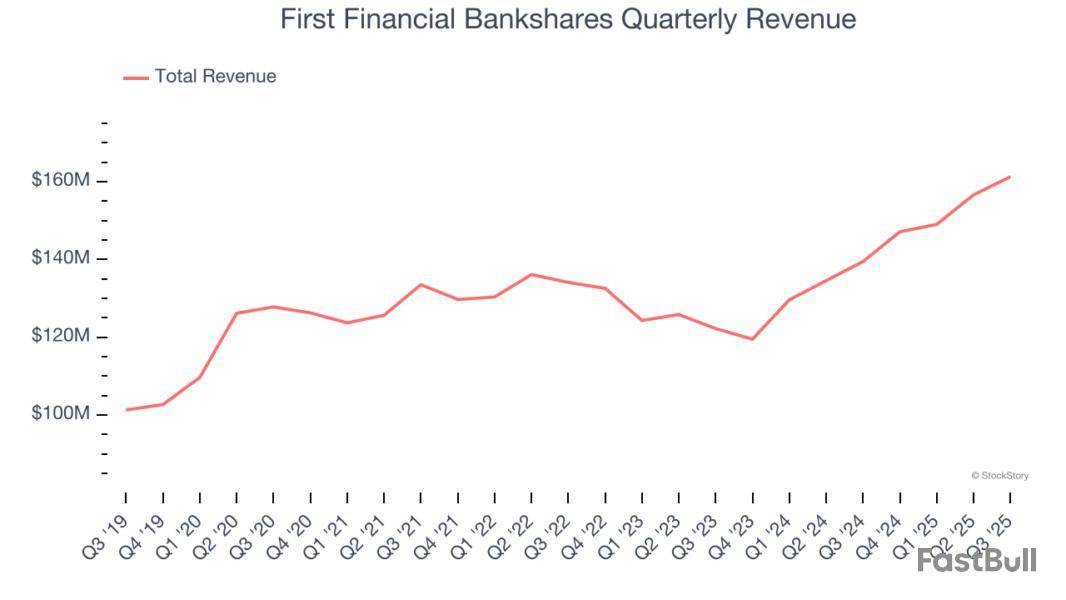

With roots dating back to 1890 and a network spanning over 70 locations across the Lone Star State, First Financial Bankshares is a Texas-focused regional bank providing commercial banking, trust services, and wealth management across numerous communities throughout the state.

First Financial Bankshares reported revenues of $161.3 million, up 15.6% year on year. This print beat analysts’ expectations by 1.8%. More broadly, it was a slower quarter as it recorded a significant miss of analysts’ EPS estimates and a slight miss of analysts’ net interest income estimates.

The stock is down 2.2% since reporting and currently trades at $31.14.

Read our full, actionable report on First Financial Bankshares here, it’s free for active Edge members.

Over the past six months, First Financial Bankshares’s shares (currently trading at $30.65) have posted a disappointing 11% loss, well below the S&P 500’s 19.8% gain. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now a good time to buy FFIN? Find out in our full research report, it’s free for active Edge members.

Why Is FFIN a Good Business?

With roots dating back to 1890 and a network spanning over 70 locations across the Lone Star State, First Financial Bankshares is a Texas-focused regional bank providing commercial banking, trust services, and wealth management across numerous communities throughout the state.

1. Long-Term Revenue Growth Shows Momentum

Net interest income and and fee-based revenue are the two pillars supporting bank earnings. The former captures profit from the gap between lending rates and deposit costs, while the latter encompasses charges for banking services, credit products, wealth management, and trading activities.

Luckily, First Financial Bankshares’s revenue grew at a decent 5.7% compounded annual growth rate over the last five years. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

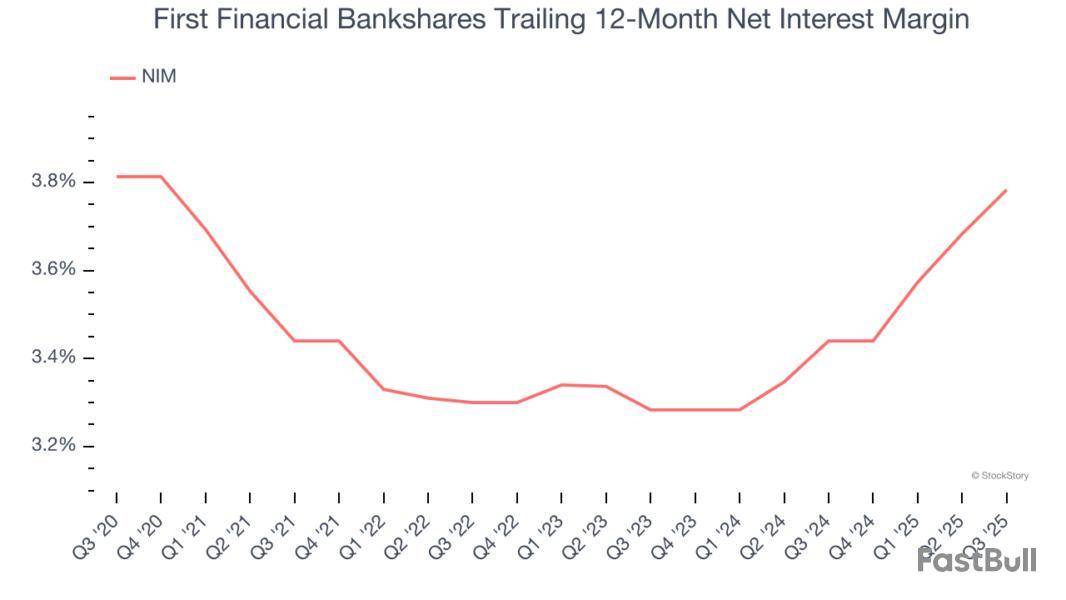

2. Increasing Net Interest Margin Juices Financials

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, First Financial Bankshares’s net interest margin averaged 3.6%, climbing by 50 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

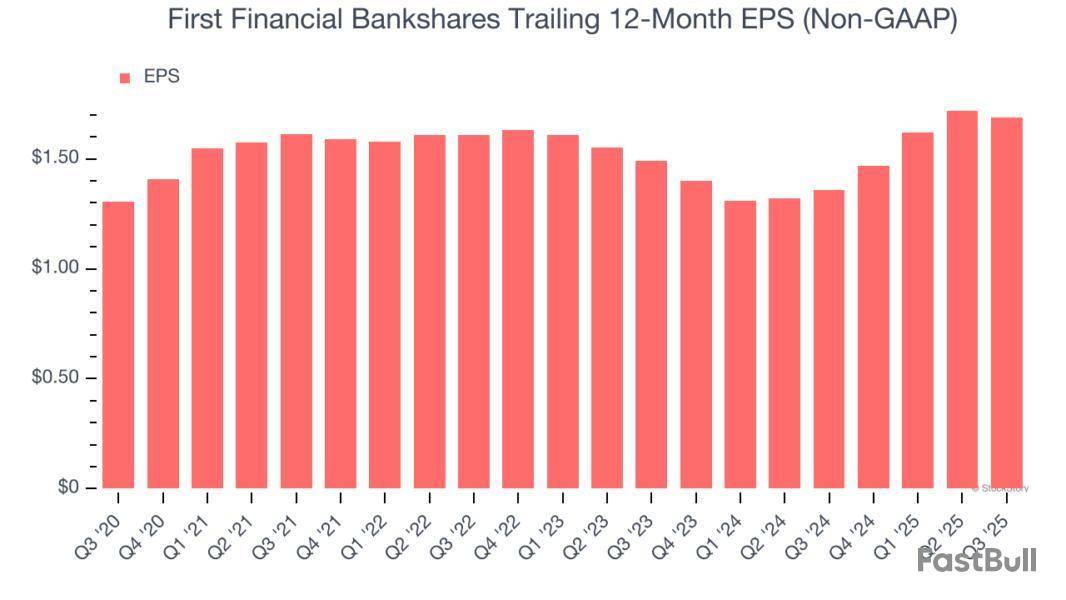

3. EPS Moving Up Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

First Financial Bankshares’s decent 5.3% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Final Judgment

These are just a few reasons why First Financial Bankshares ranks highly on our list. After the recent drawdown, the stock trades at 2.3× forward P/B (or $30.65 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than First Financial Bankshares

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up