Investing.com -- With the S&P 500 hovering near record highs, smart money has been seeking high-value opportunities with untapped upside potential.

Not by coincidence, several lesser-known names have been gaining significant momentum since the start of July, while the Mag 7 has mostly stalled.

Is the market simply catching up to those names, or is a bigger shift brewing beneath the surface?

While it may be too soon to call, the fact is that when markets are this expensive, identifying where the real value lies usually proves the difference between average and game-changing gains.

However, uncovering such names is often a difficult game to play. Unless, that is, if you have access to AI-powered investment-grade financial models designed for stock picking.

In fact, , our premium members received a list of AI-picked high-potential names at the start of July, including Thyssenkrupp (OTC:TYEKF) (ETR:TKAG), up a massive +25% in July ALONE.

*Pro members can jump straight to the picks here.

Not only that, but this is the second trade our AI makes for ThyssenKrupp stock this year, with the first one yielding an eye-popping +149% return from January to April.

TyssenKrupp is not alone, though. Since our AI’s global strategies hit the market in January this year, it has unlocked several other non-US rallies. Such as:

- Siemens Energy AG (ETR:ENR1n) (Germany): +81.89% this year ALONE.

- Gentera (BMV:GENTERA) (Mexico) +74.68% this year ALONE.

- Indra Sistemas SA (OTC:ISMAY) (BME:IDR) (Spain): +126.46% this year ALONE.

- Banco Santander (BME:SAN) (Spain): +69.63% this year ALONE.

- Hyundai Heavy Industries Holdings (KS:267250) (Korea): +69.12% this year ALONE.

*These are real-world gains, not backtested or fictional results.

And it doesn’t stop here. In July alone, there are already FIFTEEN 10%+ winners globally, including names such as:

- Commerzbank (OTC:CRZBY) (ETR:CBKG) (Germany): 13.90%

- Tongyang Life (KS:082640) (Korea): 19.89%

- Banco de Sabadell (OTC:BNDSY) (BME:SABE) (Spain): 12.81%

.

Those results have pushed the AI-picked strategies toward significant outperformance against their respective benchmarks since the start of the year. See below:

- Italian Growth Stars: +29.14% since launch this year, beating the benchmark by 10.63%

- Korean Value Bargain Stocks: +42.16% since launch this year, beating the benchmark by 11.59%

- Industrial Champions Germany: +48.13% since launch this year, beating the benchmark by 25.70%

- Best Brazilian Stocks: +23.49% since launch this year, beating its respective benchmark by 8.37%

- Spanish Market Leaders: +36.22% since launch this year, beating the benchmark by 13.77%

These global strategies were built on the overwhelming success of our US-focused AI models, launched in November 2023.

In fact, since the original launch in the US, our list of tech-focused picks is up a massive 116.73%, outperforming the S&P 500 by 77.94%.

Those gains were buoyed by timely additions of names such as:

- Nvdia (NASDAQ:NVDA): +226.4%

- Super Micro Computer (NASDAQ:SMCI): +185.8%

- MicroStrategy Incorporated (NASDAQ:MSTR): +94.9%

Just to name a few... As a matter of fact, the streak continued this year, with US picks such as:

- ON Semiconductor (NASDAQ:ON): +45.41%

- Heico Corporation (NYSE:HEI): +33.91%

- Lumen Technologies (NYSE:LUMN): +28.41%

- Clear Secure (NYSE:YOU): +23.53%

No black box investing

On top of providing fresh picks for the month ahead, our AI also explains exactly why it picked that given stock, helping its users ensure the picks align with their goals and risk tolerance.

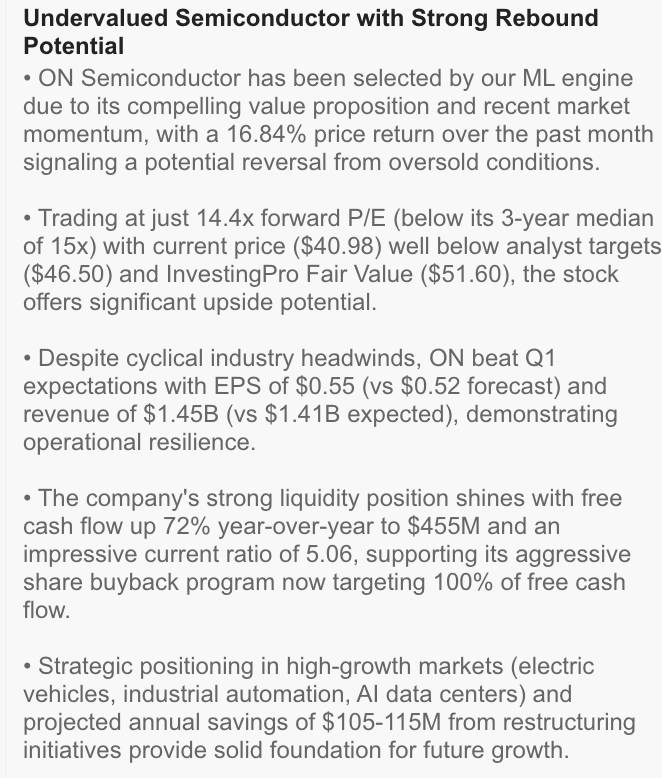

Below is its rationale for picking On Semi stock, one of our standout winners for June:

But how does the AI do it?

At the start of each month, our AI refreshes each strategy with up to 20 stock picks. These selections are based on a blend of more than 150 well-established financial models compiled by our machine learning model on over 15 years of financial data worldwide.

Some stocks are added, others retained, and a few are removed, reflecting how the model reassesses each company’s medium-term growth potential.

To track performance, each strategy uses equal weighting across all selected stocks. While you’re not required to follow that weighting exactly, it offers a consistent benchmark to evaluate how well the model identifies opportunities across the board.

At the end of the day, stock picking is still a game of probabilities. But the key isn’t just finding winners — it’s knowing when to move on from the ones that no longer stack up.

Since launch, the model has done just that — delivering more than a few standout success stories along the way.

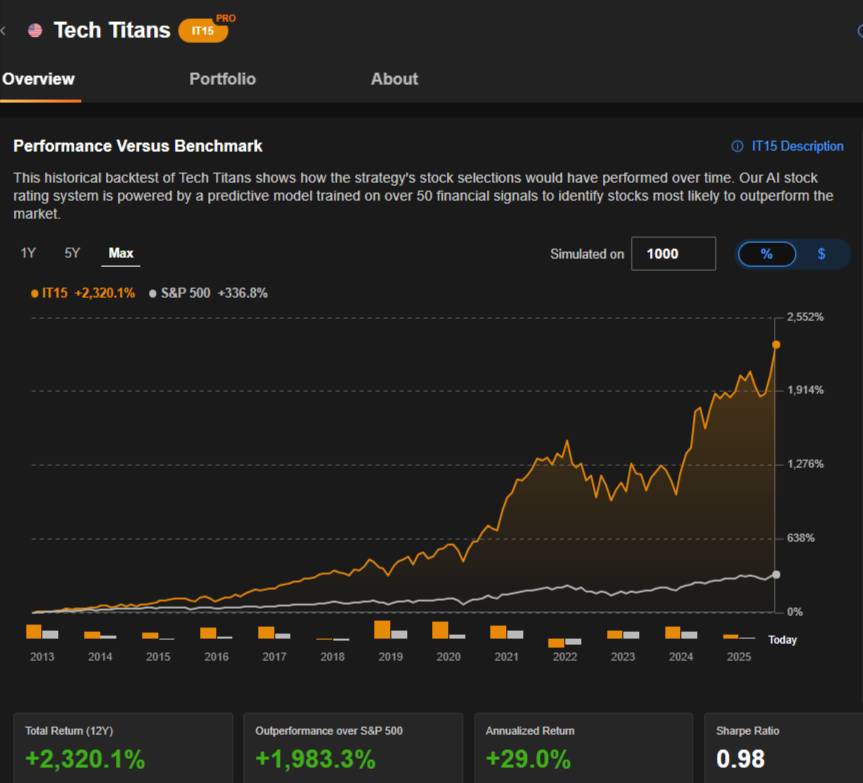

As a matter of fact, our backtest suggests that going the long run is the surest path to long-term wealth generation.

Check out the 12-year outperformance of Tech Titans over the S&P 500 below:

This means a $100K principal in our strategy would have turned into an eye-popping $2,420,100.

.