Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

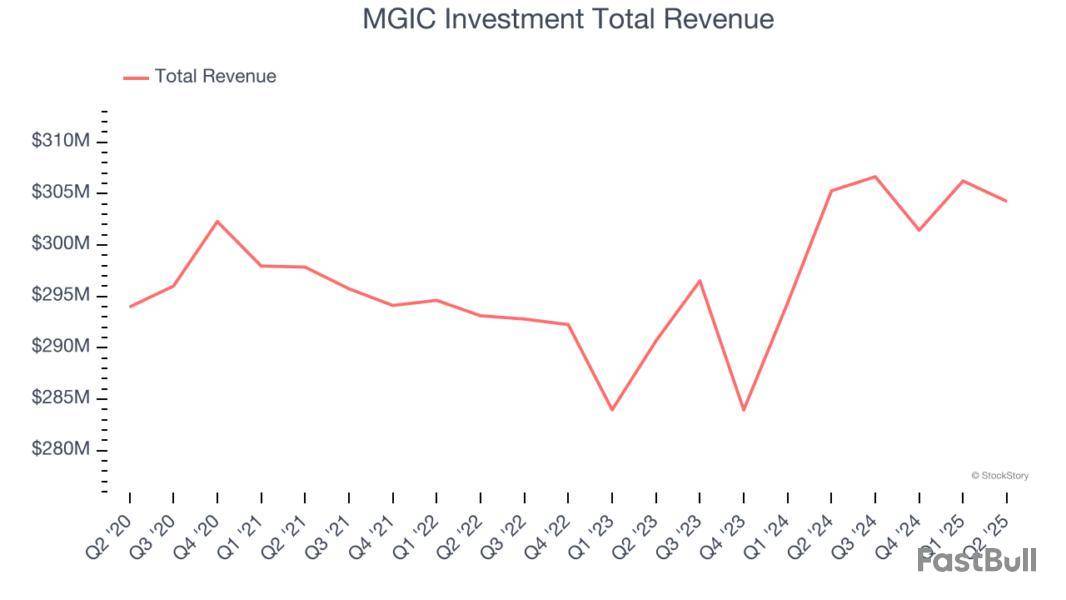

Mortgage insurer MGIC Investment missed Wall Street’s revenue expectations in Q2 CY2025, with sales flat year on year at $304.2 million. Its non-GAAP profit of $0.82 per share was 14.3% above analysts’ consensus estimates.

Is now the time to buy MTG? Find out in our full research report (it’s free).

MGIC Investment (MTG) Q2 CY2025 Highlights:

StockStory’s Take

MGIC Investment’s second quarter was marked by steady insurance portfolio performance and continued capital returns, despite revenue coming in slightly below Wall Street expectations. Management attributed the flat top line to persistent headwinds in the housing market, including limited growth of insurance in force and ongoing affordability challenges for homebuyers. CEO Tim Mattke noted the company’s focus on disciplined risk management and a resilient underwriting approach, stating, “Our disciplined risk management and strong underwriting standards remain key drivers of the quality of our portfolio.” The positive market reaction reflected investor appreciation for the company’s ability to maintain profitability and return excess capital in a sluggish housing environment.

Looking forward, MGIC Investment’s guidance is shaped by expectations for a muted housing market, flat in-force premium yields, and continued strong credit performance. Management believes capital return to shareholders will remain elevated, given limited avenues for organic growth and continued robust capital generation. CFO Nathan Colson explained that, “If the credit conditions continue to be attractive and the lack of growth on the in-force side persists, then we expect that we will continue to generate excess capital and be able to continue to pay dividends.” The company also highlighted its ongoing focus on operational efficiency and prudent expense management, while closely monitoring regional housing dynamics and delinquency trends.

Key Insights from Management’s Remarks

Management cited disciplined risk selection and operational efficiency as major contributors to profitability, while highlighting subdued new insurance growth due to market conditions.

Drivers of Future Performance

MGIC Investment’s outlook hinges on persistent housing market challenges, capital allocation, and evolving credit trends.

Catalysts in Upcoming Quarters

In the coming quarters, the StockStory team will be watching (1) whether MGIC Investment can maintain strong credit performance amid potential increases in delinquencies, (2) management’s ability to sustain elevated capital returns in the absence of portfolio growth, and (3) any signs of improvement or further deterioration in the U.S. housing market, especially in regions experiencing shifting supply-demand dynamics. Execution on expense control and the impact of further regulatory changes will also inform our view.

MGIC Investment currently trades at $27.52, up from $25.40 just before the earnings. In the wake of this quarter, is it a buy or sell? See for yourself in our full research report (it’s free).

High Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the property & casualty insurance industry, including MGIC Investment and its peers.

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

The 33 property & casualty insurance stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.5%.

In light of this news, share prices of the companies have held steady as they are up 3.5% on average since the latest earnings results.

Founded in 1957 when the modern mortgage insurance industry was in its infancy, MGIC Investment provides private mortgage insurance that protects lenders when homebuyers default on their loans, enabling borrowers to purchase homes with smaller down payments.

MGIC Investment reported revenues of $304.2 million, flat year on year. This print fell short of analysts’ expectations by 0.6%, but it was still a strong quarter for the company with a beat of analysts’ EPS estimates and net premiums earned in line with analysts’ estimates.

Tim Mattke, CEO of MTG and Mortgage Guaranty Insurance Corporation ("MGIC") said, "For the second quarter we earned net income of $192.5 million and recorded an annualized 15% return on equity building upon the momentum we've maintained over the past few years.

Interestingly, the stock is up 8.3% since reporting and currently trades at $27.52.

Is now the time to buy MGIC Investment? Access our full analysis of the earnings results here, it’s free.

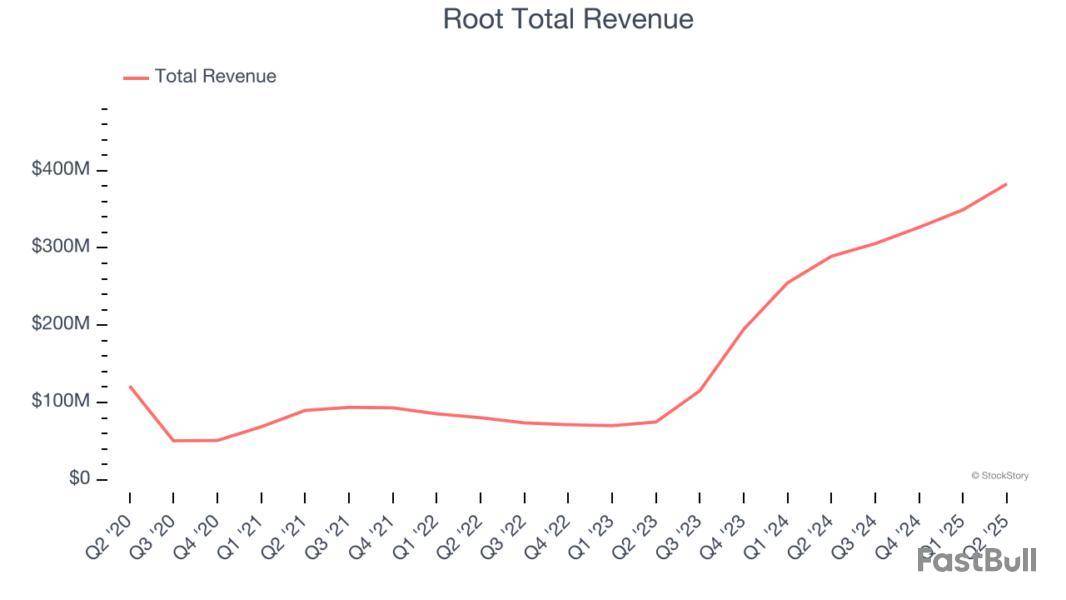

Pioneering a data-driven approach that rewards good driving habits, Root is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $382.9 million, up 32.4% year on year, outperforming analysts’ expectations by 7.5%. The business had an incredible quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ net premiums earned estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 26.9% since reporting. It currently trades at $90.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Selective Insurance Group

Founded in 1926 during the early days of automobile insurance, Selective Insurance Group is a property and casualty insurance company that sells commercial, personal, and excess and surplus lines insurance products through independent agents.

Selective Insurance Group reported revenues of $127.9 million, down 89.3% year on year, falling short of analysts’ expectations by 90.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates and a significant miss of analysts’ book value per share estimates.

Selective Insurance Group delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 13.4% since the results and currently trades at $78.35.

Read our full analysis of Selective Insurance Group’s results here.

Founded in 2009 during the aftermath of the financial crisis when many insurers were retreating from riskier markets, Kinsale Capital Group is an insurance company that specializes in writing policies for hard-to-place, unusual, or high-risk businesses that standard insurers typically avoid.

Kinsale Capital Group reported revenues of $469.8 million, up 22.2% year on year. This print surpassed analysts’ expectations by 8.2%. Zooming out, it was a satisfactory quarter as it also recorded a solid beat of analysts’ net premiums earned estimates but a slight miss of analysts’ book value per share estimates.

The stock is down 7.6% since reporting and currently trades at $436.98.

Read our full, actionable report on Kinsale Capital Group here, it’s free.

With roots dating back to 1853 and majority ownership by Loews Corporation, CNA Financial is a commercial property and casualty insurance provider offering coverage for businesses, including professional liability, surety bonds, and specialized risk management services.

CNA Financial reported revenues of $3.72 billion, up 5.6% year on year. This result missed analysts’ expectations by 0.8%. In spite of that, it was a very strong quarter as it put up a beat of analysts’ EPS estimates.

The stock is up 8.4% since reporting and currently trades at $47.52.

Read our full, actionable report on CNA Financial here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Each stock in this article is trading near its 52-week high. These elevated prices usually indicate some degree of investor confidence, business improvements, or favorable market conditions.

But not every company with momentum is a long-term winner, and plenty of investors have lost money betting on short-term fads. Keeping that in mind, here are three stocks getting more buzz than they deserve and some you should buy instead.

Teledyne (TDY)

One-Month Return: +1%

Playing a role in mapping the ocean floor as we know it today, Teledyne offers digital imaging and instrumentation products for various industries.

Why Are We Wary of TDY?

Teledyne’s stock price of $542.03 implies a valuation ratio of 24x forward P/E. Dive into our free research report to see why there are better opportunities than TDY.

Ryder (R)

One-Month Return: -0.3%

As one of the first companies to introduce the idea of leasing trucks, Ryder provides rental vehicles to businesses and delivers packages directly to homes or businesses.

Why Do We Steer Clear of R?

At $173.91 per share, Ryder trades at 12.3x forward P/E. Check out our free in-depth research report to learn more about why R doesn’t pass our bar.

MGIC Investment (MTG)

One-Month Return: +7%

Founded in 1957 when the modern mortgage insurance industry was in its infancy, MGIC Investment provides private mortgage insurance that protects lenders when homebuyers default on their loans, enabling borrowers to purchase homes with smaller down payments.

Why Is MTG Not Exciting?

MGIC Investment is trading at $27.33 per share, or 1.2x forward P/B. If you’re considering MTG for your portfolio, see our FREE research report to learn more.

Stocks We Like More

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up