Investing.com – U.S. stocks were lower after the close on Friday, as losses in the Basic Materials, Technology and Industrials sectors led shares lower.

At the close in NYSE, the Dow Jones Industrial Average fell 0.36%, while the S&P 500 index lost 0.43%, and the NASDAQ Composite index declined 0.94%.

The best performers of the session on the Dow Jones Industrial Average were Verizon Communications Inc (NYSE:VZ), which rose 11.83% or 4.71 points to trade at 44.52 at the close. Meanwhile, Chevron Corp (NYSE:CVX) added 3.34% or 5.71 points to end at 176.90 and Coca-Cola Co (NYSE:KO) was up 1.88% or 1.38 points to 74.81 in late trade.

The worst performers of the session were Visa Inc Class A (NYSE:V), which fell 2.99% or 9.93 points to trade at 321.87 at the close. 3M Company (NYSE:MMM) declined 2.06% or 3.22 points to end at 153.16 and Unitedhealth Group (NYSE:UNH) was down 1.83% or 5.36 points to 286.93.

The top performers on the S&P 500 were Deckers Outdoor Corporation (NYSE:DECK) which rose 19.46% to 119.34, Verizon Communications Inc (NYSE:VZ) which was up 11.83% to settle at 44.52 and Charter Communications Inc (NASDAQ:CHTR) which gained 7.62% to close at 206.12.

The worst performers were KLA Corporation (NASDAQ:KLAC) which was down 15.24% to 1,427.94 in late trade, Newmont Goldcorp Corp (NYSE:NEM) which lost 11.49% to settle at 112.35 and Western Digital Corporation (NASDAQ:WDC) which was down 10.12% to 250.23 at the close.

The top performers on the NASDAQ Composite were eLong Power Holding Ltd (NASDAQ:ELPW) which rose 3,141.11% to 13.94, Phoenix Asia Holdings Ltd (NASDAQ:PHOE) which was up 997.44% to settle at 133.12 and Innovation Beverage Group Ltd (NASDAQ:IBG) which gained 456.72% to close at 3.73.

The worst performers were Kaixin Auto Holdings (NASDAQ:KXIN) which was down 88.15% to 1.20 in late trade, Brand Engagement Network Inc (NASDAQ:BNAI) which lost 52.97% to settle at 24.75 and Twin Hospitality Group Inc (NASDAQ:TWNP) which was down 43.38% to 0.15 at the close.

Falling stocks outnumbered advancing ones on the New York Stock Exchange by 1645 to 1085 and 95 ended unchanged; on the Nasdaq Stock Exchange, 2198 fell and 1216 advanced, while 143 ended unchanged.

Shares in Chevron Corp (NYSE:CVX) rose to 3-years highs; gaining 3.34% or 5.71 to 176.90. Shares in Coca-Cola Co (NYSE:KO) rose to all time highs; gaining 1.88% or 1.38 to 74.81. Shares in Kaixin Auto Holdings (NASDAQ:KXIN) fell to all time lows; losing 88.15% or 8.93 to 1.20. Shares in Phoenix Asia Holdings Ltd (NASDAQ:PHOE) rose to all time highs; rising 997.44% or 120.99 to 133.12. Shares in Twin Hospitality Group Inc (NASDAQ:TWNP) fell to all time lows; falling 43.38% or 0.12 to 0.15.

The CBOE Volatility Index, which measures the implied volatility of S&P 500 options, was up 3.26% to 17.43.

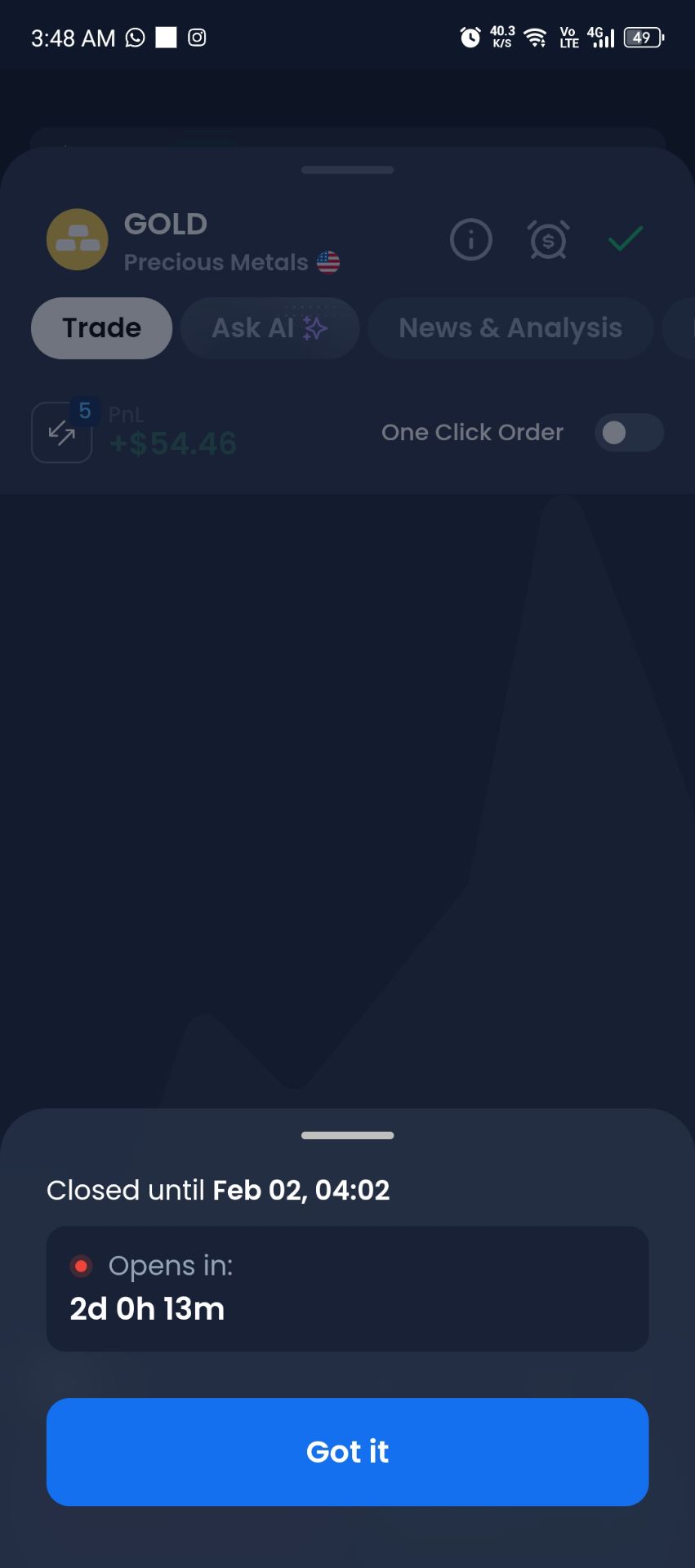

Gold Futures for April delivery was down 8.61% or 460.84 to $4,893.96 a troy ounce. Elsewhere in commodities trading, Crude oil for delivery in March rose 0.50% or 0.33 to hit $65.75 a barrel, while the April Brent oil contract rose 0.40% or 0.28 to trade at $69.87 a barrel.

EUR/USD was down 0.99% to 1.19, while USD/JPY rose 1.09% to 154.78.

The US Dollar Index Futures was up 0.88% at 96.98.