Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Applied Materials AMAT is scheduled to report third-quarter fiscal 2025 results on Aug. 14.

For the fiscal third quarter, AMAT expects net sales of $7.2 billion (+/-$400 million). The Zacks Consensus Estimate for revenues is pegged at $7.2 billion, suggesting a rise of 6.2% from the year-ago quarter’s reading.

Applied Materials projects non-GAAP earnings of $2.35 (+/-$0.20) per share. The Zacks Consensus Estimate for earnings is pegged at $2.34 per share, indicating growth of 10.4% from the year-ago quarter’s reported figure. The figure has remained unchanged in the past 60 days.

AMAT has an impressive earnings surprise history. In the last reported quarter, the company delivered an earnings surprise of 3.5%. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 4.9%.

Applied Materials, Inc. Price and EPS Surprise

Applied Materials, Inc. price-eps-surprise | Applied Materials, Inc. Quote

Earnings Whispers for Applied Materials

Our proven model does not conclusively predict an earnings beat for Applied Materials this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

AMAT carries a Zacks Rank #2 and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Factors to Note Ahead of Applied Materials’ Q3 Results

Applied Materials is at the forefront of leading-edge logic, compute memory or high-performance DRAM, stacking technology and advanced packaging. AMAT’s positioning in key processes of chip manufacturing is expected to aid the company in capitalizing on the growing proliferation of AI, hyperscale and high-performance computing space.

Rising demand for advanced semiconductor chips that power AI-based data centers is expected to have contributed to the third quarter of fiscal 2025 results of the company. Its strong capabilities in logic and solid position in DRAM patterning are likely to have acted as boons.

AMAT’s patterning systems and technologies that are designed to address the shrinking pattern dimension challenges and the growing complexity in vertical stacking are likely to have benefited the segment. Applied Materials’ manufacturing equipment, which helps improve the performance, power, yield and costs of semiconductor devices that serve the IoT, communications, automotive, power and sensors markets, is likely to have contributed well to the top-line growth of the segment.

However, escalating tensions between the United States and China do not bode well for semiconductor companies. This is likely to have hindered the top-line growth of the segment. Changes in the spending patterns of key customers and supply-chain constraints are likely to have been other headwinds. Weak spending in the LCD equipment market is likely to have hurt Applied Materials’ Display and Adjacent Markets segment sales in the to-be-reported quarter.

Applied Materials’ Price Performance & Valuation

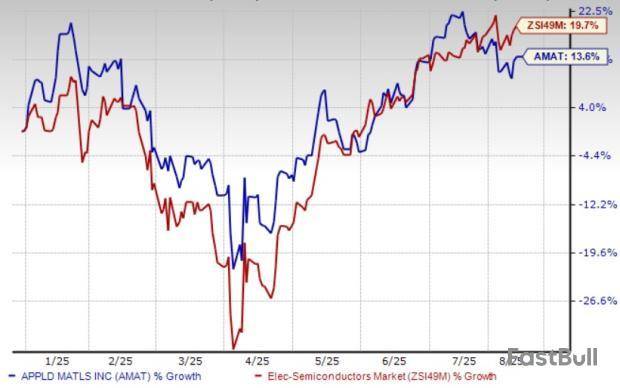

Applied Materials shares have gained 13.6% year to date, underperforming the Zacks Electronics – Semiconductors industry, which has gained 19.7% over the same time frame.

AMAT YTD Performance Chart

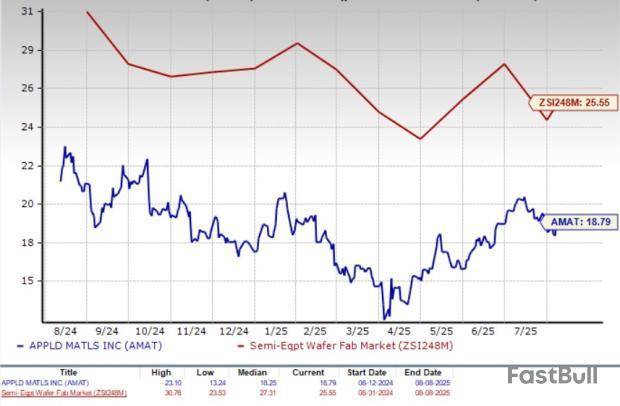

Let us now look at the value Applied Materials offers to its investors at current levels. AMAT is currently trading at a discount with a forward 12-month price-to-earnings (P/E) of 18.79X compared with the industry’s 25.55X.

AMAT Forward 12 Month (P/E) Valuation Chart

Investment Thesis on Applied Materials

Applied Materials’ business continues to be on a growth trajectory with significant design wins. It is well-positioned to capitalize on the technology-inflection-led growing demand for next-generation chips on the back of its product innovations and leadership in leading-edge logic, compute memory, high bandwidth memory and advanced packaging.

However, Applied Materials faces near-term challenges that could impact its stock. The U.S.-China trade tensions, particularly the restrictions on high-tech exports to China, have created uncertainties for companies operating in the semiconductor industry. Competition from players like KLA Corporation KLAC, Lam Research LRCX and ASML Holdings ASML in the semiconductor supply chain market is also a concern for AMAT.

Lam Research’s memory segment, accounting for both Dynamic Random Access Memory and Non-Volatile Memory divisions, is gaining traction on the back of AI. Lam Research’s memory and Non-Volatile Memory division’s sales are gaining traction. The rising demand for AI chips is also ramping up the demand for advanced process control and process-enabling solutions provided by KLA Corporation.

KLAC’s advanced packaging solutions are also experiencing robust traction on the back of AI and high-performance computing. ASML Holding’s DRAM and logic customers are driving the demand for its products. These customers are ramping leading-edge nodes using ASML’s NXE:3800E EUV systems. Additionally, ASML noted that multiple DRAM customers are adopting EUV lithography, which helps in shortening cycle time and lowering costs.

Conclusion: Buy AMAT Stock Right Now

Although our model does not conclusively predict an earnings beat for Applied Materials this quarter, its strong fundamentals and favorable valuation make the stock worth investing in at present, despite facing competition from KLAC, ASML and LRCX.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Growth is a hallmark of all great companies, but the laws of gravity eventually take hold. Those who rode the COVID boom and ensuing tech selloff in 2022 will surely remember that the market’s punishment can be swift and severe when trajectories fall.

The risks that can come from buying these assets is precisely why we started StockStory - to isolate the long-term winners from the losers so you can invest with confidence. Keeping that in mind, here are three growth stocks where the best is yet to come.

Monday.com (MNDY)

One-Year Revenue Growth: +32.3%

Founded in 2014 and named after the dreaded first day of the work week, Monday.com is a software-as-a-service platform that helps organizations plan and track work efficiently.

Why Are We Backing MNDY?

At $261 per share, Monday.com trades at 10.6x forward price-to-sales. Is now a good time to buy? Find out in our full research report, it’s free.

Lam Research (LRCX)

One-Year Revenue Growth: +23.7%

Founded in 1980 by David Lam, the man who pioneered semiconductor etching technology, Lam Research is one of the leading providers of wafer fabrication equipment used to make semiconductors.

Why Will LRCX Outperform?

Lam Research is trading at $96.19 per share, or 23.7x forward P/E. Is now the time to initiate a position? See for yourself in our full research report, it’s free.

SouthState (SSB)

One-Year Revenue Growth: +28.6%

With roots dating back to the Great Depression era of 1933, SouthState is a financial holding company that provides banking services, wealth management, and correspondent banking services across six southeastern states.

Why Do We Love SSB?

SouthState’s stock price of $93.07 implies a valuation ratio of 1x forward P/B. Is now a good time to buy? Find out in our full research report, it’s free.

Stocks We Like Even More

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return).

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

The S&P 500 Index ($SPX) (SPY) Tuesday closed down -0.49%, the Dow Jones Industrials Index ($DOWI) (DIA) closed down -0.14%, and the Nasdaq 100 Index ($IUXX) (QQQ) closed down -0.73%. September E-mini S&P futures (ESU25) fell -0.46%, and September E-mini Nasdaq futures (NQU25) fell -0.71%.

Stock indexes gave up an early advance on Tuesday and turned lower on some disappointing news on US services activity, along with signs of sticky price pressures in the service sector. The US Jul ISM services index unexpectedly fell -0.7 to 50.1, weaker than expectations of an increase to 51.5. Also, the Jul ISM services prices paid sub-index unexpectedly rose +2.4 to a 2.75-year high of 69.9, versus expectations of a decline to 66.5.

Stocks initially opened higher Tuesday on strength in technology stocks, led by a +7% jump in Palantir Technologies after it reported stronger-than-expected profits and raised its full-year forecasts. Stocks have continued support from speculation that last Friday's dismal payroll and ISM manufacturing reports will prompt the Fed to cut interest rates. The chances of a Fed rate cut at the September FOMC meeting rose to 94% from 40% before the reports were released.

The US trade deficit for June was smaller than expected, a positive factor for Q2 GDP. The June US trade deficit shrank to -$60.2 billion from -$71.7 billion in May, better than expectations of -$61.0 billion and the smallest deficit in 1.75 years.

Dovish comments late Monday from San Francisco Fed President Mary Daly were supportive for stocks when she said the time is nearing for Fed interest rate cuts, given mounting evidence that the job market is softening and there are no signs of persistent tariff-driven inflation.

In recent tariff news, President Trump said Monday that he would be "substantially raising" the tariff on US imports from India from the current 25% due to India's purchases of Russian oil. Last Thursday, President Trump raised tariffs on some Canadian goods to 35% from 25% and announced a 10% global minimum, along with tariffs of 15% or higher for countries with trade surpluses with the US, effective after midnight on August 7. According to Bloomberg Economics, the average US tariff will rise to 15.2% if rates are implemented as announced, up from 13.3% earlier, and significantly higher than the 2.3% in 2024 before the tariffs were announced.

The markets this week will focus on earnings reports and any fresh tariff or trade news. On Thursday, weekly initial unemployment claims are expected to increase by +3,000 to 221,000. Also on Thursday, Q2 nonfarm productivity is expected to be +2.0% with unit labor costs rising +1.5%.

Federal funds futures prices are discounting the chances for a -25 bp rate cut at 94% at the September 16-17 FOMC meeting and 62% at the following meeting on October 28-29.

Q2 earnings reports released thus far suggest that S&P 500 earnings are on track to rise +9.1% for the second quarter, much better than the pre-season expectations of +2.8% y/y and the most in four years, according to Bloomberg Intelligence. With over 67% of S&P 500 firms having reported Q2 earnings, around 83% exceeded profit estimates.

Overseas stock markets on Tuesday settled higher. The Euro Stoxx 50 closed up by +0.14%. China's Shanghai Composite closed up +0.96%. Japan's Nikkei Stock 225 closed up +0.64%.

Interest Rates

September 10-year T-notes (ZNU25) Tuesday closed down -2.5 ticks. The 10-year T-note yield rose by +1.0 bp to 4.202%. Sep T-notes fell from a 3-month high Tuesday and posted modest losses, and the 10-year T-note yield moved up from a 3-month low of 4.183%.

Supply pressures are weighing on T-notes as the Treasury will auction $125 billion of T-notes and T-bonds in this week's August quarterly refunding. Also, signs of price pressures in the US service sector are bearish for T-notes after the July ISM services prices paid sub-index unexpectedly rose +2.4 to a 2.75-year high of 69.9. T-notes remained lower Tuesday on weak demand seen for the Treasury's $58 billion auction of 3-year T-notes that had a bid-to-cover ratio of 2.53, below he 10-auction average of 2.58.

Losses in T-notes were limited after the Jul ISM services index unexpectedly declined. T-notes found support from dovish comments late Monday from San Francisco Fed President Mary Daly, who said the time is nearing for Fed interest rate cuts given labor market weakness and no signs of tariff inflation. T-notes also have positive carryover support from last Friday's weaker-than-expected payroll and ISM manufacturing reports, which boosted the chance of a Fed rate cut at next month's FOMC meeting to 92% from 40% before the reports.

European government bond yields on Tuesday were mixed. The 10-year German bund yield fell to a 1.5-week low of 2.601% and finished unchanged at 2.624%. The 10-year UK gilt yield rebounded from a 1-month low of 4.496% and finished up +0.8 bp to 4.516%.

The Eurozone July S&P composite PMI was revised downward by -0.1 to 50.9 from the previously reported 51.0.

The UK July S&P composite PMI was revised upward by +0.5 to 51.5 from the previously reported 51.0.

Swaps are discounting the chances at 16% for a -25 bp rate cut by the ECB at the September 11 policy meeting.

US Stock Movers

Inspire Medical Systems (INSP) closed down more than -34% after cutting its full-year revenue forecast to $900 million-$910 million from a previous forecast of $940 million-$955 million, well below the consensus of $949.2 million.

Gartner (IT) closed down more than -27% to lead losers in the S&P 500 after cutting its full-year revenue forecast to $6.46 billion from a previous forecast of $6.54 billion, weaker than the consensus of $6.57 billion.

Vertex Pharmaceuticals (VRTX) closed down more than -20% to lead losers in the Nasdaq 100 after it said it won't advance its Journavx to a phase-3 trial, as the FDA said it doesn't see a path forward for broad use of the drug to treat peripheral neuropathic pain.

TransDigm Group (TDG) closed down more than -12% after reporting Q3 net sales of $2.24 billion, weaker than the consensus of $2.30 billion, and lowered its full-year net sales forecast to $8.76 billion-$8.82 billion from a previous forecast of $8.75 billion-$8.95 billion.

GlobalFoundries (GFS) closed down more than -9% to lead semiconductor stocks lower after forecasting Q3 adjusted EPS of 33 cents to 43 cents, the midpoint below the consensus of 42 cents. Also, KLA Corp (KLAC) closed down more than -3%. In addition, ARM Holdings Plc (ARM), Applied Materials (AMAT), Lam Research (LRCX), Broadcom (AVGO), ASML Holding NV (ASML), Advanced Micro Devices (ADM), and ON Semiconductor Corp (ON) closed down more than -1%.

Fidelity National Information (FIS) closed down more than -8% after forecasting Q3 adjusted EPS of $1.46-$1.50, below the consensus of $1.54.

Henry Schein (HSIC) closed down more than -7% after reporting Q2 adjusted EPS of $1.10, weaker than the consensus of $1.19.

Eaton Corp (ETN) closed down more than -7% after forecasting full-year organic revenue of +8.50% to 9.50%, the midpoint below the consensus of 9.09%.

Axon Enterprise (AXON) closed up more than +16% to lead gainers in the S&P 500 and Nasdaq 100 after reporting Q2 net sales of $668.5 million, above the consensus of $640.3 million, and raising its full-year adjusted Ebitda forecast to $665 million-$685 million from a previous forecast of $650 million-$675 million.

Palantir Technologies (PLTR) closed up more than +7% after reporting Q2 revenue of $1.0 billion, stronger than the consensus of $939.3 million, and raising its full-year revenue forecast to $4.14 billion-$4.15 billion from a previous forecast of $3.89 billion-$3.90 billion.

Leidos Holdings (LDOS) closed up more than +7% after reporting Q2 revenue of $4.25 billion, better than the consensus of $4.24 billion, and raising its full-year revenue forecast of $17.00 billion-$17.25 billion from a previous forecast of $16.90 billion-$17.30 billion.

Health insurance companies rallied Tuesday after Wolfe Research published a note that said thresholds for private Medicare Advantage plans to earn bonus payments may get easier next year. As a result, UnitedHealth Group (UNH) closed up more than +4% to lead gainers in the Dow Jones Industrials. Also, CVS Health (CVS) closed up more than +3%, Humana (HUM) closed up more than +2% and Cigna Group (CI) closed up more than +1%.

Broadridge Financial Solutions (BR) closed up more than +6% after reporting Q4 adjusted EPS of $3.55, stronger than the consensus of $3.50.

Archer-Daniels-Midland (ADM) closed up more than +6% after reporting Q2 adjusted EPS of 93 cents, better than the consensus of 80 cents.

Pfizer (PFE) closed up more than +5% after reporting Q2 revenue of $14.65 billion, higher than the consensus of $13.50 billion.

Cummins (CMI) closed up more than +3% after reporting Q2 net sales of $8.64 billion, above the consensus of $8.46 billion.

Earnings Reports (8/6/2025)

Airbnb Inc (ABNB), American International Group Inc (AIG), APA Corp (APA), Atmos Energy Corp (ATO), Bio-Techne Corp (TECH), CDW Corp/DE (CDW), Cencora Inc (COR), CF Industries Holdings Inc (CF), Charles River Laboratories Int (CRL), Corpay Inc (CPAY), Corteva Inc (CTVA), Dayforce Inc (DAY), DoorDash Inc (DASH), Emerson Electric Co (EMR), Federal Realty Investment Trust (FRT),

Fortinet Inc (FTNT), Global Payments Inc (GPN), Iron Mountain Inc (IRM), MarketAxess Holdings Inc (MKTX), McDonald's Corp (MCD), McKesson Corp (MCK), MetLife Inc (MET), NiSource Inc (NI), NRG Energy Inc (NRG), Occidental Petroleum Corp (OXY), Paycom Software Inc (PAYC), Pinnacle West Capital Corp (PNW), Realty Income Corp (O), Rockwell Automation Inc (ROK), STERIS PLC (STE), Texas Pacific Land Corp (TPL), TKO Group Holdings Inc (TKO), Trimble Inc (TRMB), Uber Technologies Inc (UBER), Walt Disney Co/The (DIS).

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. This article was originally published on Barchart.com

The S&P 500 Index ($SPX) (SPY) today is up +0.90%, the Dow Jones Industrials Index ($DOWI) (DIA) is up +0.77%, and the Nasdaq 100 Index ($IUXX) (QQQ) is up +1.28%. September E-mini S&P futures (ESU25) are up +0.95%, and September E-mini Nasdaq futures (NQU25) are up +1.36%.

Stock indexes are moving higher today as they recover from some of last Friday's sharp losses. Strength in the Magnificent Seven technology stocks and semiconductor chip makers is supporting the broader market. Additionally, the expectation that last Friday's dismal payroll and ISM manufacturing reports will prompt the Fed to lower interest rates is underpinning equity prices. The chances of a Fed rate cut at the September FOMC meeting rose to 90% from 40% before the reports were released.

In the latest tariff news, President Trump last Thursday raised tariffs on some Canadian goods to 35% from 25% and announced a 10% global minimum, along with tariffs of 15% or higher for countries with trade surpluses with the US, effective after midnight on August 7. According to Bloomberg Economics, the average US tariff will rise to 15.2% if rates are implemented as announced, up from 13.3% earlier, and significantly higher than the 2.3% in 2024 before the tariffs were announced.

The markets this week will focus on earnings reports and any fresh tariff or trade news. Later this morning, Jun factory orders are expected to fall -4.8% m/m. On Tuesday, the June trade deficit is expected to narrow to -$61.3 billion. Also on Tuesday, the July ISM services index is expected to climb by +0.7 to 51.5. On Thursday, weekly initial unemployment claims are expected to increase by +3,000 to 221,000. Also on Thursday, Q2 nonfarm productivity is expected to be +2.0% with unit labor costs rising +1.5%.

Federal funds futures prices are discounting the chances for a -25 bp rate cut at 90% at the September 16-17 FOMC meeting and 76% at the following meeting on October 28-29.

Early results show that S&P 500 earnings are on track to rise +4.5% for the second quarter, better than the pre-season expectations of +2.8% y/y, according to Bloomberg Intelligence. With over 66% of S&P 500 firms having reported Q2 earnings, around 82% exceeded profit estimates.

Overseas stock markets today are mixed. The Euro Stoxx 50 is up sharply by +1.35%. China's Shanghai Composite rebounded from a 2-week low and closed up +0.66%. Japan's Nikkei Stock 225 fell to a 1.5-week low and closed down -1.25%.

Interest Rates

September 10-year T-notes (ZNU25) today are up +4 ticks. The 10-year T-note yield is down -1.4 bp to 4.202%. Sep T-notes today recovered from overnight losses and rallied to a 3-month nearest-futures high, and the 10-year T-note yield fell to a 1-month low of 4.196%. T-notes are climbing on positive carryover from last Friday's weaker-than-expected payroll and ISM manufacturing reports, which boosted the chance of a Fed rate cut at next month's FOMC meeting to 90% from 40% before the reports. Also, today's -2% drop in WTI crude oil prices has reduced inflation expectations, a bullish factor for T-notes. In addition, today's strength in European government bonds is providing carryover support to T-notes.

Gains in T-notes are limited by a rebound in equity markets, which curbs safe-haven demand for government securities. Also, supply pressures are weighing on T-notes as the Treasury will auction $125 billion of T-notes and T-bonds in this week's August quarterly refunding, beginning with Tuesday's $58 billion auction of 3-year T-notes.

European government bond yields today are moving lower. The 10-year German bund yield fell to a 1.5-week low of 2.638% and is down -3.5 bp to 2.643%. The 10-year UK gilt yield dropped to a 1-month low of 4.502% and is down -1.6 bp to 4.512%.

The Eurozone Aug Sentix investor confidence index unexpectedly fell -8.2 to -3.7, weaker than expectations of an increase to 6.9.

Swaps are discounting the chances at 16% for a -25 bp rate cut by the ECB at the September 11 policy meeting.

US Stock Movers

Strength in the Magnificent Seven technology stocks is supporting gains in the broader market. Alphabet (GOOGL) is up more than +1%. Also, Nvidia (NVDA), Tesla (TSLA), Meta Platforms (META), Apple (AAPL), and Microsoft (MSFT) are up more than +1%.

Chip stocks are moving higher today, a supportive factor for the overall market. Advanced Micro Devices (AMD), Marvell Technology (MRVL), Broadcom (AVGO), Micron Technology (MU), and ARM Holdings Plc (ARM) are up more than +2%. Also, Lam Research (LRCX), ASML Holding NV (ASML), Applied Materials (AMAT), and Microchip Technology (MCHP) are up more than +1%.

Steelcase (SCS) is up more than +46% after being acquired by HNI for $2.2 billion or about $18.30 per share.

Idexx Labs (IDXX) is up more than +22% to lead gainers in the S&P 500 and Nasdaq 100 after reporting Q2 revenue of $1.11 billion, better than the consensus of $1.07 billion, and raising its full-year EPS forecast to $12.40-$12.76 from a previous forecast of $11.93-$12.43, stronger than the consensus of $12.21.

Wayfair (W) is up more than +11% after reporting Q2 adjusted EPS of 87 cents, well above the consensus of 33 cents.

Tyson Foods (TSN) is up more than +4% after reporting Q3 sales of $13.88 billion, above the consensus of $13.55 billion.

Spotify (SPOT) is up more than +7% after it said it will increase the monthly cost of premium subscriptions in Markets across South Asia, the Middle East, Africa, Europe, and Latin America.

Walt Disney (DIS) is up more than +2% to lead gainers in the Dow Jones Industrials after Morgan Stanley raised its price target on the stock to $140 from $120.

BJ's Restaurants (BJRI) is up more than +1% after Benchmark Co. upgraded the stock to buy from hold with a price target of $44.

Bruker Corp (BRKR) is down more than -11% after reporting Q2 revenue of $797.4 million, below the consensus of $810.2 million.

ON Semiconductor (ON) is down more than -7% to lead losers in the S&P 500 and Nasdaq 100 after forecasting Q3 adjusted gross margin of 36.5% to 38.5%, the midpoint weaker than the consensus of 37.7%.

Berkshire Hathaway (BRK.B) is down more than -2% after reporting Q2 operating earnings fell -3.8% y/y to $11.16 billion.

Waters (WAT) is down more than -2% after forecasting Q3 adjusted EPS of $3.15-$3.25, the midpoint below the consensus of $3.23.

Earnings Reports (8/4/2025)

Axon Enterprise Inc (AXON), Coterra Energy Inc (CTRA), Diamondback Energy Inc (FANG), Equity Residential (EQR), IDEXX Laboratories Inc (IDXX), Loews Corp (L), ON Semiconductor Corp (ON), ONEOK Inc (OKE), Palantir Technologies Inc (PLTR), SBA Communications Corp (SBAC), Simon Property Group Inc (SPG), Tyson Foods Inc (TSN), Vertex Pharmaceuticals Inc (VRTX), Waters Corp (WAT), Williams Cos Inc/The (WMB).

On the date of publication, Rich Asplund did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. This article was originally published on Barchart.com

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up