Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

What Happened?

A number of stocks fell in the afternoon session after an unexpectedly sharp rise in wholesale inflation fueled concerns about rising costs and their impact on corporate profits. The primary catalyst was the July 2025 Producer Price Index (PPI), a measure of inflation at the wholesale level, which jumped 0.9% against forecasts of a 0.2% rise. This represents the most significant monthly increase in over three years, pointing to mounting cost pressures for manufacturers, with tariffs cited as a key factor. This data complicates the Federal Reserve's upcoming interest rate decisions, as persistent inflation may prevent rate cuts, creating a headwind for cyclical sectors like Industrials.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Alta (ALTG)

Alta’s shares are extremely volatile and have had 55 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 2 days ago when the stock gained 5.3% on the news that an in-line inflation report fueled hopes for interest rate cuts and the U.S. and China agreed to extend their tariff truce. The Consumer Price Index (CPI), a key measure of inflation, came in largely as expected, holding steady at 2.7% year-over-year. This reading boosted investor optimism that the Federal Reserve will have room to lower interest rates at its next meeting, which could reduce borrowing costs for companies and consumers. Adding to the positive sentiment, the U.S. and China extended their tariff truce for another 90 days. This development alleviates concerns about renewed trade tensions, which is a significant relief for industrial companies reliant on global supply chains and international sales. Together, these events create a favorable outlook for economic growth, benefiting cyclical sectors like industrials.

Alta is up 28.1% since the beginning of the year, and at $8.39 per share, it is trading close to its 52-week high of $8.62 from July 2025. Investors who bought $1,000 worth of Alta’s shares 5 years ago would now be looking at an investment worth $938.48.

What Happened?

A number of stocks jumped in the morning session after an in-line inflation report fueled hopes for interest rate cuts and the U.S. and China agreed to extend their tariff truce. The Consumer Price Index (CPI), a key measure of inflation, came in largely as expected, holding steady at 2.7% year-over-year. This reading boosted investor optimism that the Federal Reserve will have room to lower interest rates at its next meeting, which could reduce borrowing costs for companies and consumers.

Adding to the positive sentiment, the U.S. and China extended their tariff truce for another 90 days. This development alleviates concerns about renewed trade tensions, which is a significant relief for industrial companies reliant on global supply chains and international sales. Together, these events create a favorable outlook for economic growth, benefiting cyclical sectors like industrials.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

Zooming In On Wabash (WNC)

Wabash’s shares are extremely volatile and have had 32 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

The previous big move we wrote about was 18 days ago when the stock dropped 8.2% on the news that the company reported weaker-than-expected full-year guidance that overshadowed its second-quarter results. The transportation equipment manufacturer reported a second-quarter adjusted loss of $0.15 per share on revenue of $459 million, both of which were better than analyst expectations. However, investors focused on the company's significantly weakened outlook for the rest of the year. Wabash cut its full-year 2025 revenue forecast to approximately $1.6 billion, well below the $1.71 billion analysts had anticipated. It also lowered its adjusted earnings per share (EPS) guidance to a loss between $1.00 and $1.30, a substantial drop from the consensus estimate of a $0.75 loss. Management pointed to a challenging market, with CEO Brent Yeagy stating that "demand remains muted across the trailer industry." The company's backlog also fell by 23.1% year-over-year, signaling a slowdown in future business.

Wabash is down 38.1% since the beginning of the year, and at $10.52 per share, it is trading 48.1% below its 52-week high of $20.26 from December 2024. Investors who bought $1,000 worth of Wabash’s shares 5 years ago would now be looking at an investment worth $804.28.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Let’s dig into the relative performance of United Rentals and its peers as we unravel the now-completed Q2 specialty equipment distributors earnings season.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 8 specialty equipment distributors stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 2.6% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

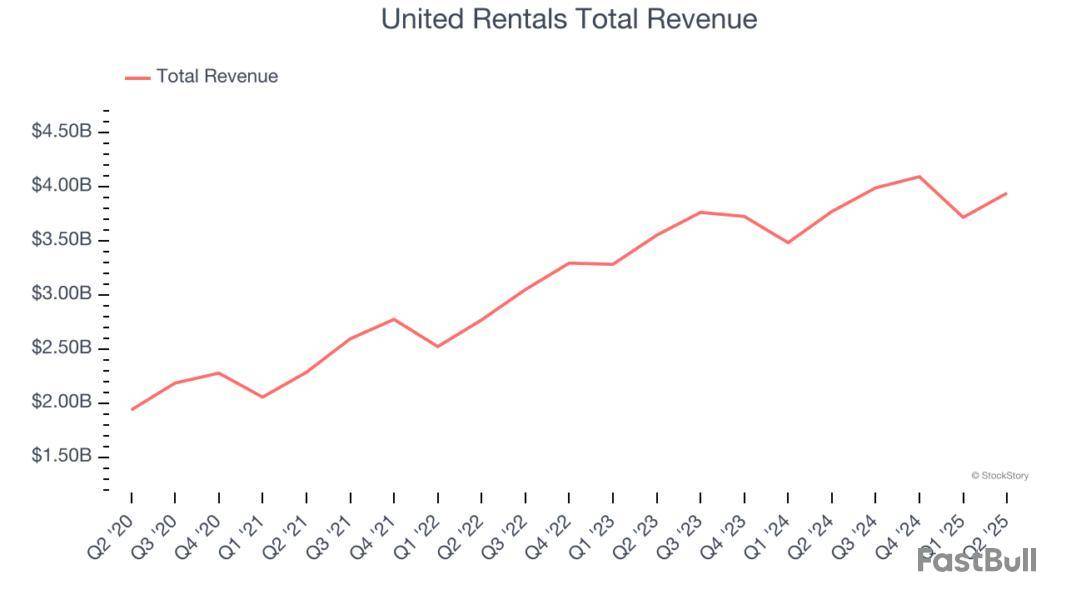

Owning the largest rental fleet in the world, United Rentals provides equipment rental and related services to construction, industrial, and infrastructure industries.

United Rentals reported revenues of $3.94 billion, up 4.5% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

Interestingly, the stock is up 8.8% since reporting and currently trades at $869.70.

Is now the time to buy United Rentals? Access our full analysis of the earnings results here, it’s free.

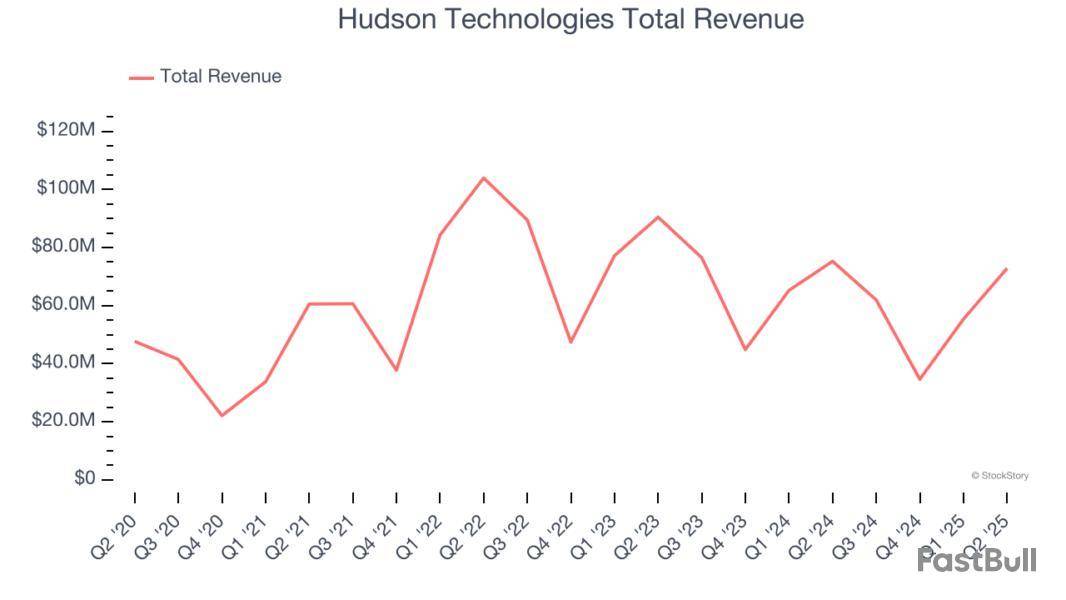

Founded in 1991, Hudson Technologies specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $72.85 million, down 3.2% year on year, outperforming analysts’ expectations by 1.7%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 15.5% since reporting. It currently trades at $9.60.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it’s free.

Founded as Lollicup, Karat Packaging distributes and manufactures environmentally-friendly disposable foodservice packaging solutions.

Karat Packaging reported revenues of $124 million, up 10.1% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and revenue guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 4.1% since the results and currently trades at $25.55.

Read our full analysis of Karat Packaging’s results here.

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings provides equipment rental and related services to a wide range of industries.

Herc reported revenues of $1.00 billion, up 18.2% year on year. This number topped analysts’ expectations by 6.9%. However, it was a slower quarter as it recorded full-year revenue guidance missing analysts’ expectations significantly and full-year EBITDA guidance missing analysts’ expectations significantly.

Herc had the weakest full-year guidance update among its peers. The stock is down 26% since reporting and currently trades at $111.09.

Read our full, actionable report on Herc here, it’s free.

Founded in 1984, Alta Equipment Group is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $481.2 million, down 1.4% year on year. This print beat analysts’ expectations by 0.6%. Overall, it was an exceptional quarter as it also logged an impressive beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 6.4% since reporting and currently trades at $7.60.

Read our full, actionable report on Alta here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up