Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

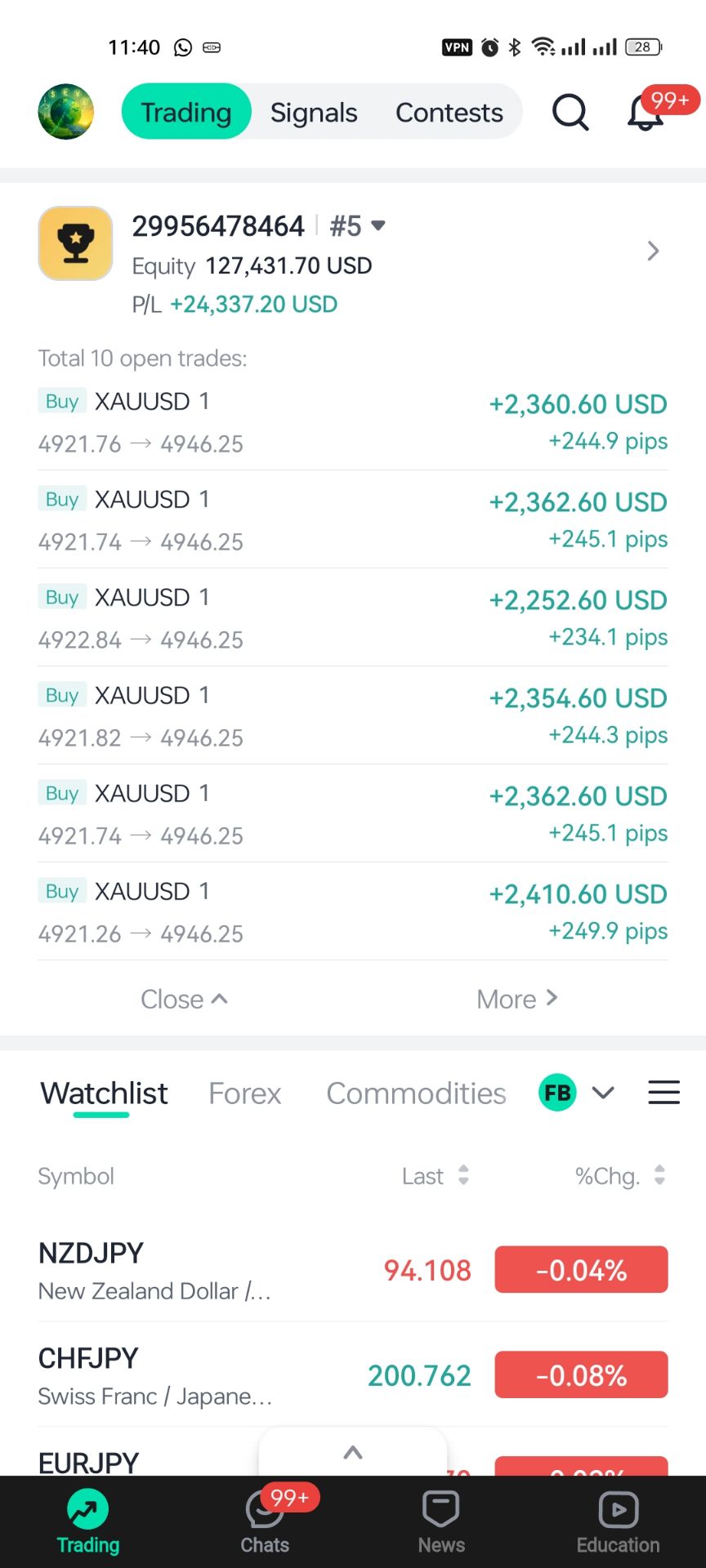

Signal Accounts for Members

All Signal Accounts

All Contests

China Central Bank Injects 75 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

US Official - US Has Returned Remaining $200 Million From Initial $500 Million Oil Sale To Venezuela

New York And New Jersey Are Seeking Emergency Assistance In Response To Plans To Suspend Construction On Friday

The U.S. States Of New York And New Jersey Have Filed A Lawsuit Against President Trump For His Decision To Withhold $16 Billion In Tunnel Project Funds

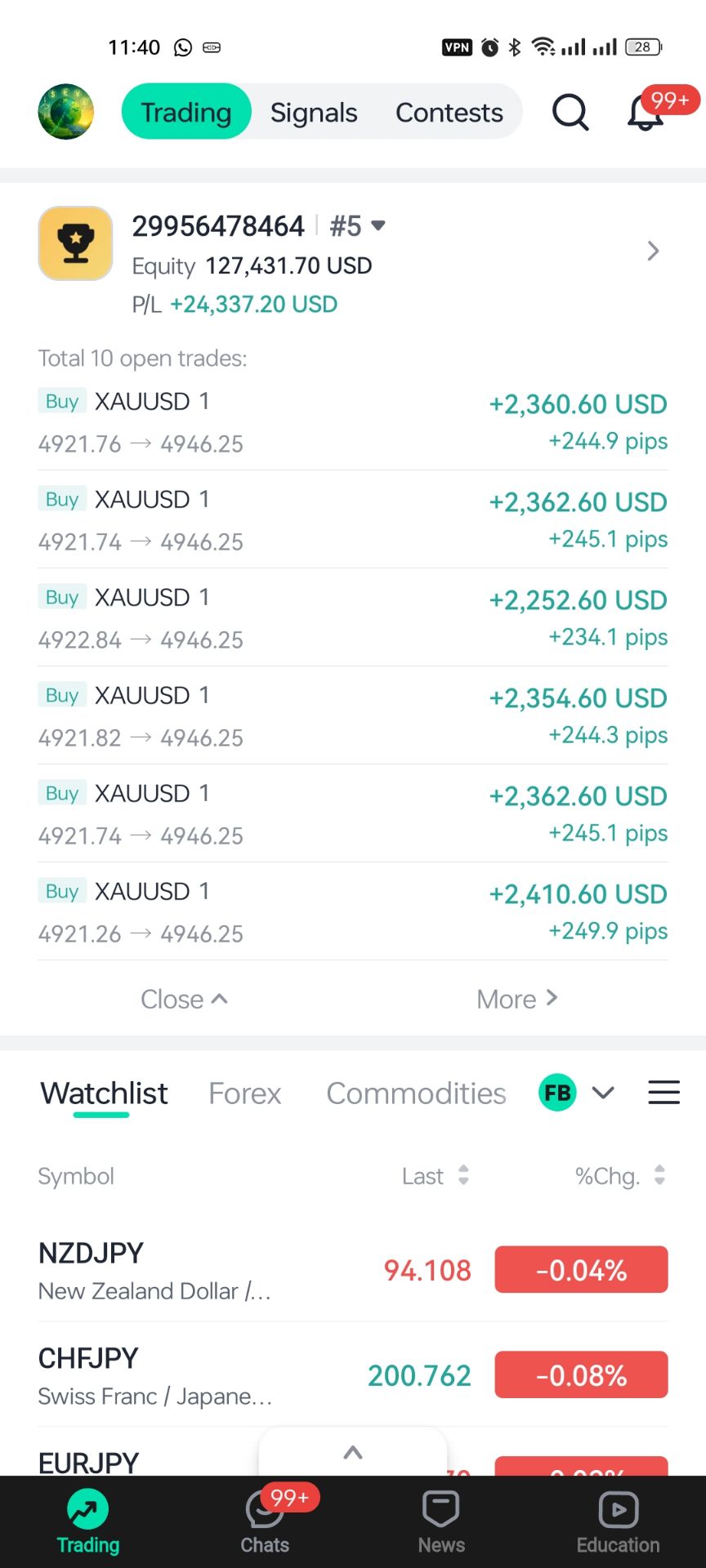

Spot Gold Broke Through $5,000 Per Ounce, With Intraday Gains Widening To 1.1%, Rebounding Nearly $600 From This Week's Low

Spot Silver Rebounded During The Day After Falling More Than 2%, And Is Currently Trading At $85.4 Per Ounce

A U.S. Official Said The Iranian Revolutionary Guard Had Planned To Conduct Live-fire Military Exercises In The Strait Of Hormuz On Sunday And Monday, But Canceled The Exercises After Receiving A Warning From The United States

U.S. Trade Representative Greer: The Government Will Work With Congress To Modernize And Reform The Africa Trade Preference Program

U.S. Trade Representative Greer: The African Growth And Opportunity Act's Trade Preference Program Has Been Authorized To Be Extended To December 31, 2026, With Retroactive Effect Until September 30, 2025

USA Trade Representative Greer: President Trump Signed Into Law Legislation That Reauthorizes African Growth And Opportunity Act

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)--

F: --

P: --

No matching data

View All

No data

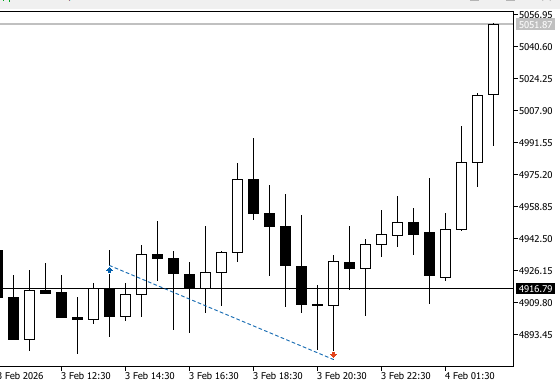

Coinbase CEO Brian Armstrong says he’s optimistic that US senators are moving closer to advancing key cryptocurrency market structure legislation by Thanksgiving, suggesting that there’s now far more agreement on both sides of the aisle than there are differences.

“Even though the government is shut down, the Senate is working hard on getting market structure legislation passed for crypto,” Armstrong said in a video posted on X.

According to Armstrong, roughly 90% of the legislative framework has already been agreed upon, with the remaining 10% focused on issues like decentralized finance (DeFi). He added that policymakers are looking for ways to protect innovation while ensuring that “centralized intermediaries, like Coinbase, should be regulated — not the protocols.”

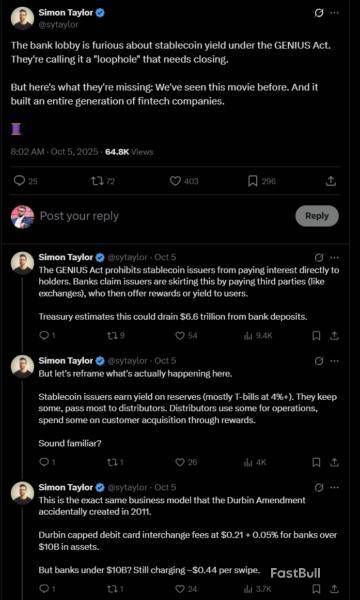

Armstrong also underscored the importance of “preserving stablecoin rewards” in the wake of the GENIUS Act, passed earlier this year, which set federal standards for stablecoin reserves, transparency and consumer protections.

“The big banks are coming for their cash grab, trying to block that,” he said. “We’re not going to let them re-litigate that.”

Banking lobby pushback on the GENIUS Act

Armstrong’s criticism of the banking industry comes as many lobbyists oppose the GENIUS stablecoin act, particularly over what they view as a loophole allowing interest payments.

While the GENIUS Act explicitly prohibits stablecoin issuers from offering interest or yield, that restriction does not apply to exchanges, according to the Bank Policy Institute (BPI).

By excluding crypto exchanges like Coinbase, “the requirements in the GENIUS Act can be easily evaded and undermined by allowing payment of interest indirectly to holders of stablecoins,” the BPI said.

As Cointelegraph reported, banking lobbies have grown increasingly concerned that stablecoins could threaten their business model — one that currently offers depositors minimal interest. Industry insider and New York University professor Austin Campbell noted that bankers are “panicking” over the prospect of stablecoin holders earning yields.

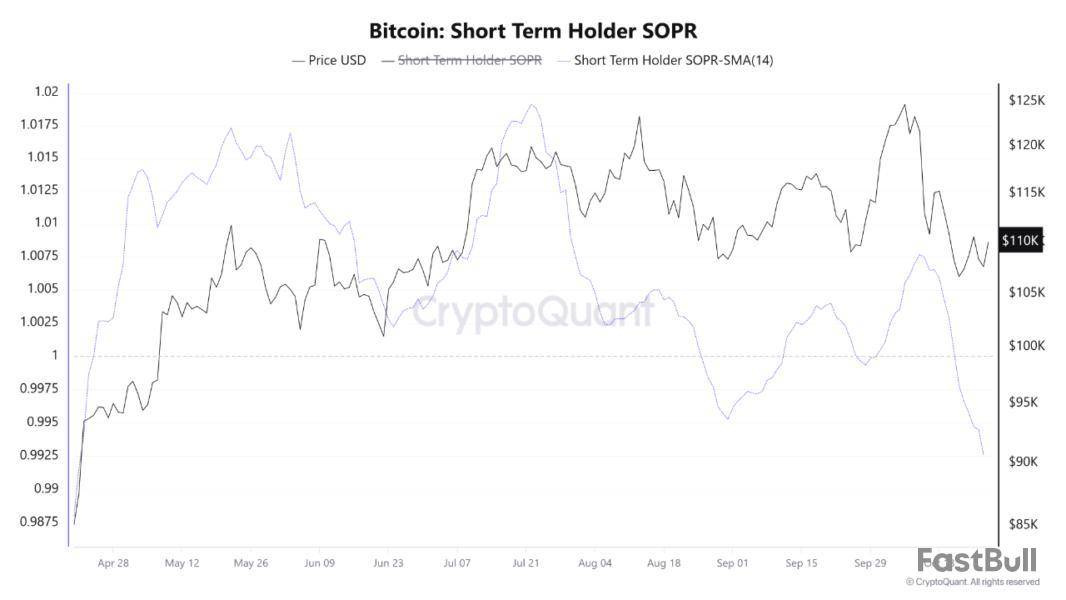

Bitcoin is showing signs of renewed weakness as short-term investors begin to fold under selling pressure. According to the latest data from CryptoQuant, the Short-Term Holder Spent Output Profit Ratio (STH-SOPR) has fallen to 0.992, its lowest level since late April. This key on-chain metric tracks the average profit or loss realized by Bitcoin holders who have owned their coins for less than 155 days — a group often associated with speculative or reactive behavior.

When the STH-SOPR dips below 1.0, it indicates that these holders are selling their coins at a loss, signaling a wave of capitulation and rising fear among newer market participants. The current value implies an average loss of 0.8%, reflecting a notable shift in sentiment after weeks of volatile price action.

Historically, such phases of short-term capitulation often mark moments of emotional exhaustion, where retail traders give up amid uncertainty. While this can reinforce short-term bearish pressure, it also tends to precede market stabilization — as weaker hands exit and long-term investors absorb supply.

Bitcoin STH-SOPR Signals Short-Term Weakness and Long-Term Opportunity

According to CryptoOnchain’s latest insights shared on CryptoQuant, Bitcoin’s Short-Term Holder Spent Output Profit Ratio (STH-SOPR) remains below the crucial 1.0 threshold, reinforcing a bearish short-term outlook. As long as both the STH-SOPR and its 14-day moving average stay under this key level, the indicator acts as a form of resistance — reflecting that short-term holders continue selling at a loss. In such conditions, every price rally risks being met with renewed selling pressure, as these investors look to exit positions at break-even or with minimal loss, creating a ceiling for upward momentum.

However, this same behavior can also plant the seeds for a long-term bullish setup. Historically, extended periods of loss realization by short-term holders have coincided with the final stages of market corrections. This process — often described as a “cleansing” phase — shakes out weak hands and redistributes Bitcoin to long-term holders who are less sensitive to short-term volatility. When capitulation reaches its peak, it often signals the market is approaching “maximum pain”, a point that tends to precede strong recoveries.

While Bitcoin’s current structure suggests ongoing weakness, this phase could also mark the foundation of the next uptrend. Traders should closely monitor the STH-SOPR for a decisive reclaim above 1.0, as that would confirm a shift from loss-driven selling to profit realization — signaling renewed market strength and the potential start of a new bullish phase.

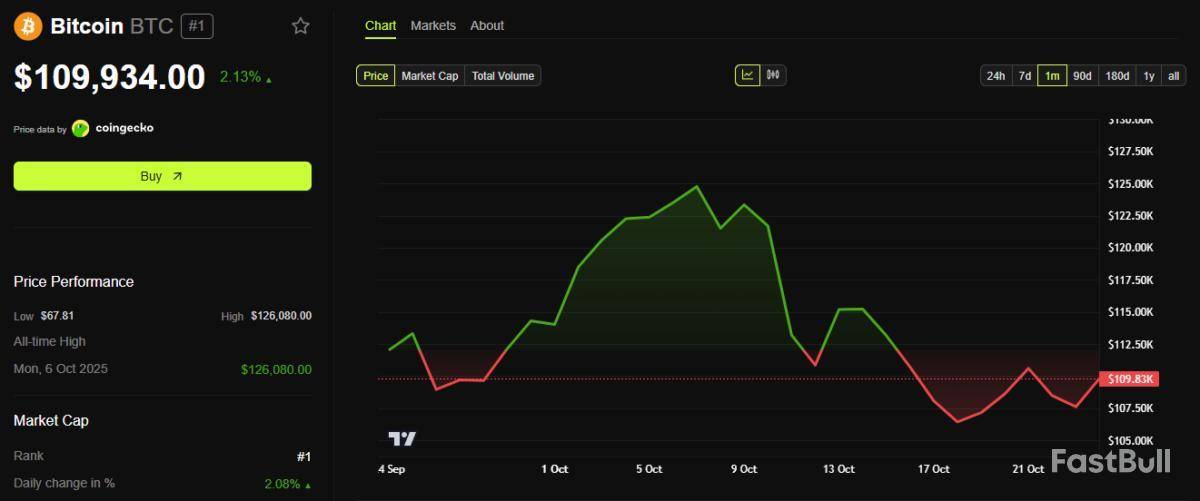

Bears Defend Resistance, Bulls Struggle to Reclaim Momentum

Bitcoin is currently trading around $109,400, showing a modest rebound but still facing strong resistance at higher levels. As seen in the 1-day chart, BTC remains trapped below both the 50-day and 100-day moving averages, which are now converging near $112,000–$114,000 — a zone that has repeatedly acted as supply during recent recoveries.

The 200-day moving average, positioned around $106,000, continues to provide short-term support. However, the repeated retests of this level suggest weakening buyer strength. The inability to sustain a close above $110,000 highlights persistent selling pressure, with traders preferring to de-risk amid broader market uncertainty.

If Bitcoin manages to reclaim $112,000, momentum could shift toward $117,500, the key horizontal resistance and previous range high. A decisive breakout above this level would invalidate the recent bearish structure and open the path toward $123,000.

On the downside, failure to hold the $106,000–$107,000 support range could expose BTC to further downside risk, with potential targets near $102,000 or even $98,000 if selling accelerates.

Featured image from ChatGPT, chart from TradingView.com

A Bitcoin wallet dating back to the cryptocurrency’s earliest days has just come to life after more than 14 years of inactivity.

The address, believed to have mined around 4,000 BTC between April and June 2009, transferred 150 BTC this week — the first movement since June 2011.

Rare Movement from the Early Bitcoin Era

The coins, worth just $67,724 when last active, are now valued at roughly $16 million. On-chain data shows the wallet initially consolidated its mined BTC into a single address in 2011 and had remained untouched since.

Transfers from Satoshi-era wallets are extremely rare. Data from Glassnode suggests only a handful of pre-2011 wallets move funds each year.

The coins from this period were mined when Bitcoin’s creator, Satoshi Nakamoto, was still active in online discussions, making such movements a magnet for speculation.

Historically, old-wallet awakenings trigger short-term jitters in the market. Traders often interpret these moves as early holders preparing to sell, sparking fears of large inflows to exchanges.

However, in most past cases, the coins were not sold but simply moved to new addresses for security, inheritance, or consolidation purposes.

Why the Timing Matters

The move comes as Bitcoin trades around $110,000, consolidating after a steep drop from its recent all-time high above $126,000 earlier this month.

The market is recovering from the largest liquidation event in crypto history, with $19 billion wiped out across leveraged positions.

Sentiment remains fragile. Any signal suggesting potential sell pressure — especially from long-dormant wallets — can amplify caution.

Still, the 150 BTC transfer represents a negligible share of daily Bitcoin trading volume, which exceeds $20 billion, making the market impact mostly psychological.

Possible Explanations

There are several plausible reasons behind the move. The owner could be migrating coins to a modern, secure wallet, executing estate planning, or testing transaction functionality.

Unless the funds are later traced to exchange-linked addresses, it is unlikely that the coins were sold.

Similar awakenings in 2021 and 2023 did not lead to sustained price drops. Those transactions were eventually linked to personal reorganization rather than liquidations.

Market Context and Implications

The Bitcoin market has been volatile in recent weeks, shaped by macroeconomic tension and heightened sensitivity to on-chain data.

With prices consolidating between $108,000 and $111,000, traders are looking for direction amid fears of further corrections.

In this environment, old-wallet movements act as symbolic reminders of Bitcoin’s early decentralization — and the immense fortunes still sitting dormant.

For investors, unless these coins reach exchange wallets, such awakenings hold psychological weight, not market-moving power.

Bottom Line

The 14-year-old wallet’s activity is a historic anomaly rather than a harbinger of major market shifts. It reflects Bitcoin’s longevity and the vast untapped wealth from its earliest mining era.

For now, the market continues to watch closely — but the move appears more like digital housekeeping than a signal of imminent selling.

The total crypto market cap gained $80 billion on Thursday to hover about $3.8 trillion during the mid-North American trading session. Bitcoin price rallied over 2% during the past 24 hours to reach a range high of about $111,295 before retracing to trade around $110,275 at press time.

Binance coin (BNB) and Solana led the wider altcoin market in mild recovery on Thursday. Following the sudden crypto rebound, around $366 million was liquidated from the leveraged crypto market.

Main Reasons Why Crypto Gained Today?

Regulatory Goodwill from the United States

On Thursday, the crypto community celebrated the announcement that former Binance CEO Changpeng Zhao (CZ) has been pardoned by President Donald Trump. According to President Trump, the war on crypto orchestrated by the Biden administration is over.

Furthermore, a bipartisan group has been pushing to pass the Clarity Act to enhance crypto legislation in the United States.

Trade War Certainties amid Anticipated Fed’s QE

The White House announced that President Trump will meet with China’s President Xi next week. Ahead of next week’s meeting, Treasury Secretary Scott Bessent is expected to meet with China’s vice premier on Friday, thus increasing the odds of a trade deal.

Meanwhile, the Federal Reserve is expected to begin its Quantitative Easing (QE) next week. Ahead of the anticipated Fed rate cut next week, CNBC noted that the Fed $1.5 trillion following the October and November rate cuts.

Capital Rotation from Gold Amid ‘Uptober’ Narrative

Following the recent gold retrace, calls for capital rotation to Bitcoin and the wider crypto market have increased. With only 7 days remaining till the end of October, Bitcoin and the wider crypto market are expected to gain more bullish momentum, fueled by rising institutional demand.

Can BTC Price Reach New ATH By Halloween 2025?

From a technical analysis, the Bitcoin price has been forming a market reversal pattern following the recent capitulation.

CRYPTOWZRD@cryptoWZRD_Oct 23, 2025⚠️ A BULLISH FLIP 🔥

This is one hell of a crazy similarity…

🚨 BINANCE:BTCUSDT has an identical structure to the 2022/23 flip of resistance that resulted in an +80% rally, why do you think it’s over? 😳

Higher to go 🚀 pic.twitter.com/jlPCEtfRCo

In the four-hour timeframe, the BTC/USD pair has been forming a potential inverse head and shoulders pattern coupled with bullish divergence of the Relative Strength Index (RSI). As such, BTC price has a high chance of reaching a new all-time high by Halloween 2025, unless it consistently falls below the support level around $106.5k.

CoinDesk Bitcoin Price Index is up $2412.09 today or 2.24% to $110268.81

Note: CoinDesk Bitcoin Price Index (XBX) at 4 p.m. ET close

Data compiled by Dow Jones Market Data

JPMorgan analysts said Stripe is positioning itself to lead what they described as “twin revolutions in intelligence and money movement,” forecasting the company could tap into a $350 billion-plus market opportunity by the end of the decade.

The report, published Thursday by analysts Jon Hacunda, Lula Sheena, and Celal Sipahi, highlighted Stripe’s growing role in both AI-powered commerce and digital-asset infrastructure.

The $107 billion fintech firm processes more than $1.4 trillion in payments annually across 195 countries and turned a profit last year, with net revenue climbing 28% year-over-year to about $5.1 billion.

JPMorgan described Stripe as “a beneficiary of borderless financial services” and said its early traction with AI startups gives it a structural advantage as "agentic commerce" scales.

Stripe has also made inroads into the crypto and stablecoin sectors though acquisitions of Bridge, a stablecoin orchestration platform, and Privy, a crypto-wallet provider. The company is also incubating Tempo, a Layer-1 blockchain built for high-throughput payments in partnership with Paradigm.

Stripe CEO Patrick Collison has described Tempo as “the payments-oriented L1, optimized for real-world financial-services applications.” Last week, the network revealed it had raised $500 million at a $5 billion valuation.

JPMorgan said those initiatives put Stripe in a position to benefit as AI agents, stablecoins, and programmable money become integrated into global commerce.

Still, the analysts noted risks tied to enterprise expansion, unbundling, and regulatory exposure, especially around stablecoin oversight in the U.S. and MiCA rules in Europe.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up