Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Numerai, a hedge fund that utilizes crowdsourced machine learning models, has announced plans to repurchase $1 million worth of its native token, Numeraire (NMR), from the open market. The move follows notable growth in the firm’s staking ecosystem and aims to support long-term alignment among participants.

The buyback is scheduled to occur gradually, with orders placed at or near the prevailing bid prices, according to its blog post published Thursday. Numerai stated that the approach is intended to ensure transparency and avoid market disruption. Currently, $1 million worth of NMR amounts to over 110,000 tokens.

The buyback comes as Numerai reports a more than twofold increase in assets under management over the past year, growing from about $173 million to over $441 million. According to the firm, it now executes over $1 billion in monthly trading volume across more than 30 global markets, guided by predictions from a global network of data scientists.

Participants submit weekly forecasts to Numerai’s tournament and stake NMR on their model outputs. These stakes feed into the firm’s Stake-Weighted Meta Model, which aggregates submissions based on staked amounts. Numerai claims the model has consistently outperformed individual entries.

"The success of our Stake-Weighted Meta Model speaks for itself: it's outperformed every individual model over the past year," said Richard Craib, Numerai's founder and CEO. "As our AUM grows and top institutional allocators join us, the role of NMR has never been more critical."

The buyback is tied directly to the success of its staking mechanism and the scarcity of NMR, with fewer than 3 million tokens now remaining in Numerai's treasury (from a fixed supply of 11 million), according to the project.

This limited supply, combined with the expanding scale of its staking program, has raised questions about the long-term distribution of rewards. The buyback, the company said, is meant to reinforce its commitment to the ecosystem and help maintain economic balance as it scales.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

SharpLink Gaming and BitMine Immersion Technologies, two of the largest publicly traded Ethereum holders, have both boosted their ETH exposure to over $1 billion.

This development coincides with a significant rally in ETH. The altcoin recently broke the $3,600 mark, reflecting a 21.2% increase over the past week. This surge outpaces Bitcoin’s modest 2.96% gain in the same period, highlighting growing institutional appetite for ETH.

Ethereum’s Growing Institutional Appeal: Public Companies Boost ETH Holdings

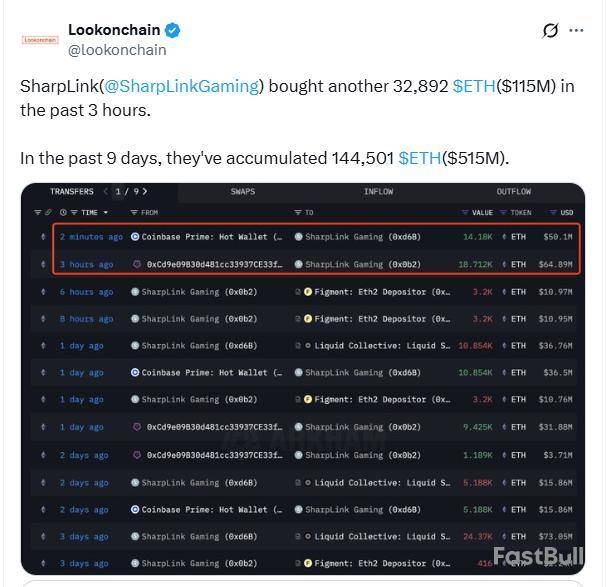

According to the latest data from Lookonchain, SharpLink Gaming has purchased 32,892 ETH, valued at approximately $115 million. This follows the firm’s addition of 20,279 ETH yesterday.

Lookonchain added that over the past nine days, SharpLink has acquired 144,501 ETH, totaling $515 million. The firm’s total holdings have surpassed $1 billion. Notably, this is just the beginning for SharpLink.

The firm filed a ‘prospectus supplement’ with the US Securities and Exchange Commission (SEC) to amend its previous offering. It plans to issue up to $5 billion in additional common stock through a sales agreement. The proceeds will further bolster its SharpLink’s Ethereum reserves and support operational growth.

“With this Prospectus Supplement, we are increasing the total amount of Common Stock that may be sold under the Sales Agreement to $6 billion, comprising of up to $1 billion under the Prior Prospectus and an additional $5 billion under this Prospectus Supplement,” the statement read.

Besides SharpLink, Tom Lee-backed BitMine also revealed that its holdings have increased to 300,657 ETH, worth over $1 billion.

“At BitMine, we have surpassed $1 billion in Ethereum holdings, just seven days after closing on the initial $250 million private placement. We are well on our way to achieving our goal of acquiring and staking 5% of the overall ETH supply,” Lee, Chairman of BitMine’s Board of Directors, noted.

Beyond these two giants, GameSquare Holdings has completed its $70 million public offering. This is a part of its broader plan to create a $100 million Ethereum treasury.

According to the latest press release, the firm raised $70 million through the sale of 46.66 million shares at $1.50 each.

“The deal includes a 15% overallotment, which if fully exercised, will bring the total raise to approximately $80.5 million. Combined with the $9.2 million raised last week, total gross proceeds across both offerings are over $90.0 million,” GameSquare CEO Justin Kenna said.

Additionally, BTC Digital, a Bitcoin mining firm, has followed Bit Digital’s footsteps. The firm announced that it will convert all of its Bitcoin holdings into Ethereum.

Furthermore, it revealed that it has closed a $6 million financing round and acquired an additional $1 million in Ethereum.

Ray Youssef, CEO of NoOnes, mentioned to BeInCrypto that the trend of accumulating ETH treasuries is gaining momentum for good reason. He pointed out that corporations are recognizing Ethereum not only as a utility network but also as a strategic store of value, aligning with its ‘digital oil’ narrative.

“Ethereum is quietly cementing its status as the foundational infrastructure for the next evolution of digital finance by facilitating the convergence between decentralized finance (DeFi) and traditional finance (TradFi). With tokenized assets under management on the Ethereum network surpassing $5 billion, the protocol’s dominance in real-world utility is no longer just theoretical. From tokenized US treasuries to institutional-grade stablecoin rails, Ethereum is becoming the de facto layer for compliant, on-chain finance,” Youssef remarked.

He further explained that Ethereum’s appeal is strengthened by its evolving monetary profile. Its improving utility, strong fundamentals, unique features like deflationary mechanics, and potential for passive income via yield-bearing staking rewards make ETH an attractive option for treasury allocation models.

These qualities are especially appealing to institutions seeking a high-beta alternative to the widely adopted Bitcoin treasury models.

“Ethereum is steadily emerging as the institutional complement to Bitcoin. Where Bitcoin is held as a macro hedge or ideological reserve, ETH is being increasingly treated as a foundational asset of the compliant on-chain digital economy,” he added.

Meanwhile, Jamie Elkaleh, Chief Marketing Officer at Bitget Wallet, noted that ETH’s recent price surge is not just a result of positive market trends or investor enthusiasm. Instead, it indicates a broader shift in the way institutional investors perceive and value digital assets like Ethereum.

“Ethereum’s appeal today is its dual identity: yield-bearing asset and infrastructure layer. For institutions, it’s no longer just about owning crypto—it’s about owning the network that powers the ecosystem,” Elkaleh told BeInCrypto.

Thus, the wave of Ethereum adoption by public companies and its outperformance of Bitcoin suggest a shift in cryptocurrency investment. However, the long-term implications remain subject to market and regulatory developments.

Amid hype around the prevailing bullish wave in the crypto market, traders and investors must brace for volatility due to expiring options for Bitcoin and Ethereum contracts.

Markets tend to stabilize shortly after the options expire, as traders adjust to the new trading environment.

What Traders Should Expect from Today’s Expiring Options

With crypto markets riding a bullish wave, a major options expiry could shake up the markets today, potentially influencing market behavior into the weekend.

Specifically, over $5.76 billion in notional value is tied to Bitcoin and Ethereum contracts scheduled to expire this Friday.

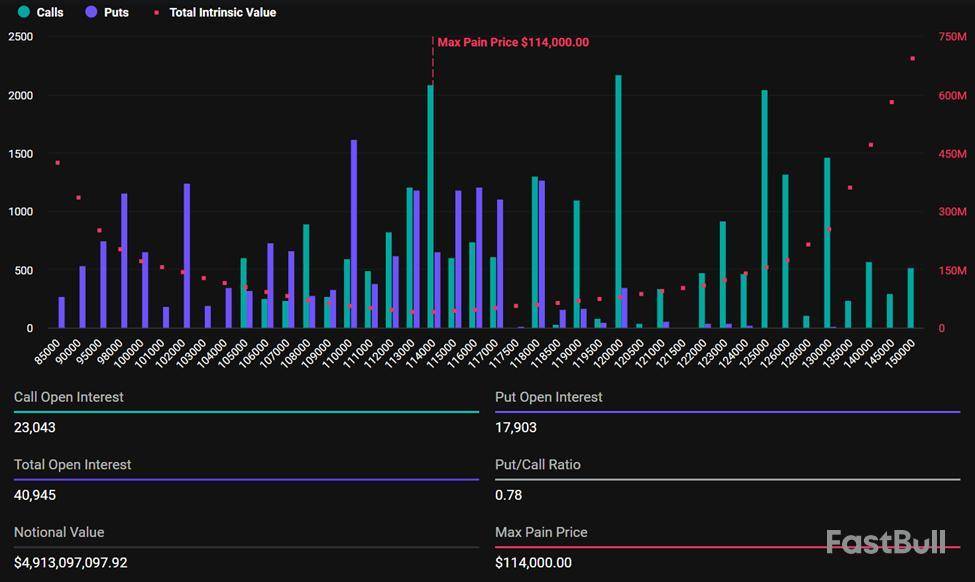

According to derivatives exchange Deribit, Bitcoin’s total open interest stands at 40,945 contracts, representing a notional value of $4.91 billion.

The max pain point, which is the price at which most options expire worthless, is a staggering $114,000. This is significantly below current spot levels, with BTC trading at $120,259 as of this writing.

With a put-to-call ratio of 0.78, traders appear to be leaning bullish, favoring call purchase options that would profit from price appreciation.

In contrast, Ethereum’s options market is showing a more neutral tone. The open interest is 237,466 contracts.

Meanwhile, the notional value is $851 million, and the put-to-call ratio is 1.01, signaling a nearly balanced sentiment between bearish and bullish bets. The max pain level is $2,950, significantly lower than ETH’s current market range.

Notably, this week’s expiring options are slightly more than last week’s contracts. As BeInCrypto reported, 36,970 BTC contracts with a notional value of $4.31 billion expired on July 11. In the same tone, 239,926 Ethereum contracts expired, with a notional value of $712 million.

Cautious Optimism Ahead of Options Expiry

Analysts at Greeks.live describe the broader sentiment as mixed. Some traders believe the top is in following recent rallies, while others continue to target higher valuations later in the year.

“…expecting 150,000 BTC by Q4 but anticipating a correction until September,” the firm noted.

In the near term, however, traders employ risk reversal strategies, a classic tactic in options markets. This involves selling 30-day puts and buying 30-day calls, expressing a bullish stance while adding small put positions for black swan protection.

This strategy suggests that some market participants expect upside continuation but remain cautious about sudden downside shocks.

As traders brace for volatility, current market positioning reveals diverging sentiment across Bitcoin and Ethereum markets.

Volatility also remains a key focus. Ethereum’s implied volatility is hovering around 70%, even after its recent price spike. Analysts say this creates opportunities for basis trades and volatility squeeze plays.

According to Greeks.live, traders actively manage their exposure before today’s options expiry, expecting significant turbulence. In particular, the combination of large notional value, skewed max pain levels, and diverging sentiment sets the stage for potential volatility.

With both assets trading above their max pain levels, Bitcoin and Ethereum prices will likely pull back as these options are near expiration. However, the market could stabilize thereafter as traders adjust to new trading environments.

Joseph Lubin-backed SharpLink Gaming has drastically increased the equity it intends to sell to scoop up more Ether — and has added $515 million of Ether to its treasury in just the last nine days.

In a prospectus supplement filed with the US Securities and Exchange Commission on Thursday, SharpLink said it has increased the amount of common stock it can sell by an extra $5 billion, up from a billion under its initial May 30 filing.

Similar to its prior prospectus, SharpLink said it will use the majority of the proceeds to acquire Ether .

“We intend to contribute substantially all of the cash proceeds that we receive to acquire Ether [...] We also intend to use the proceeds from this offering for working capital needs, general corporate purposes, operating expenses and core affiliate marketing operations.”

If SharpLink were to use $6 billion to buy ETH for its treasury today, it would hold nearly 1.38% of ETH’s circulating supply.

ETH acquisition continues

On Monday, SharpLink became the largest corporate holder of ETH, and in a more recent X post, SharpLink hinted that it intends to hold 1 million ETH for its treasury.

As of Tuesday, the company held more than 280,000 ETH in its reserve, with approximately 99.7% of the asset being staked.

SharpLink has generated 415 ETH, worth $1.49 million, as a staking reward between June 2 and July 15.

Following the regulatory filing of its increased share offering, SharpLink bought another 32,892 ETH, worth $115 million.

The company has now purchased $515 million worth of ETH in the past nine days, according to Lookonchain.

Galaxy Research noted that SharpLink surpassing the Ethereum Foundation’s total ETH holding acts as a positive catalyst for the ecosystem.

Stock dips

Sharplink Gaming (SBET) stock ended Thursday’s trading session at $36.40, a decrease of 2.62%. The stock further fell after the bell and ended the after-hours trading session with a cut of 4.95% at $34.60, according to Google Finance.

SBET is up 350% year-to-date; however, the stock is down 54% from its May 29 high of $79.21.

In the March quarter, SharpLink saw its revenue decline 24% year-on-year, while its net profit margin decreased by 110% during the quarter.

The company is expected to announce its next quarterly results on Aug. 13, according to Nasdaq.

Ethereum’s recent price trajectory has caught the attention of traders and analysts, as the asset extends its bullish rally well into today. With the price currently hovering around $3,420, Ethereum has registered a daily gain of 7.7% and a weekly surge of more than 23%.

The momentum follows a decisive breakout above the $3,000 level earlier this week, sparking renewed optimism across the derivatives and spot markets.

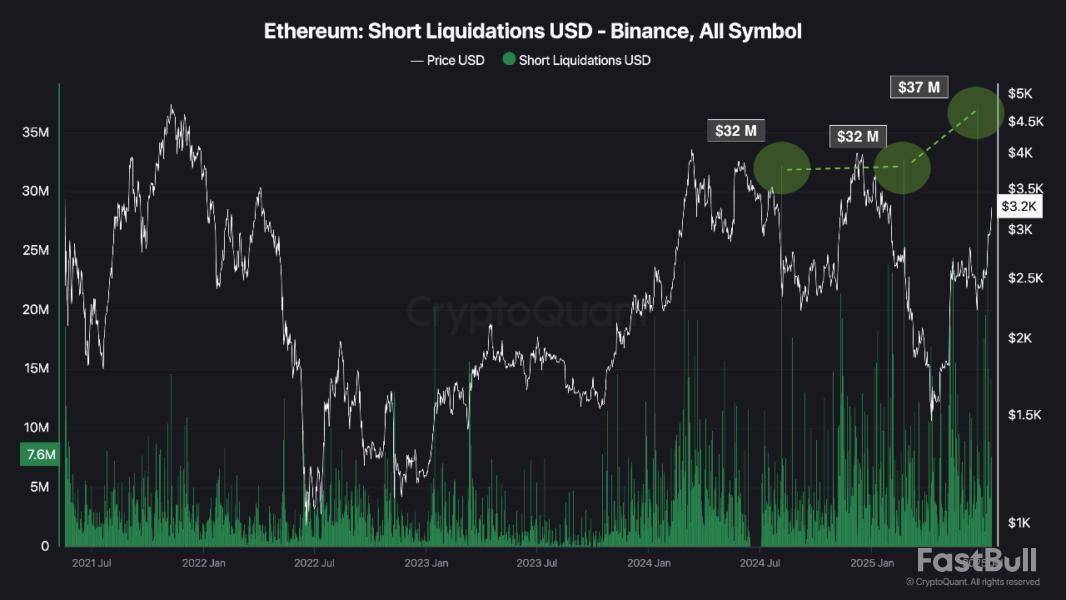

The latest insights from the on-chain analytics platform CryptoQuant provide context for Ethereum’s price action, suggesting that activity on Binance is a major catalyst.

Ethereum Short Liquidations Shift Market Dynamics

CryptoQuant contributor Darkfost notes that the recent uptick coincides with a structural shift in the derivatives market, particularly around short liquidations.

A deeper analysis of exchange flows and taker behavior further supports the case for sustained upward movement, with indicators suggesting that Ethereum may be positioning itself to revisit previous highs.

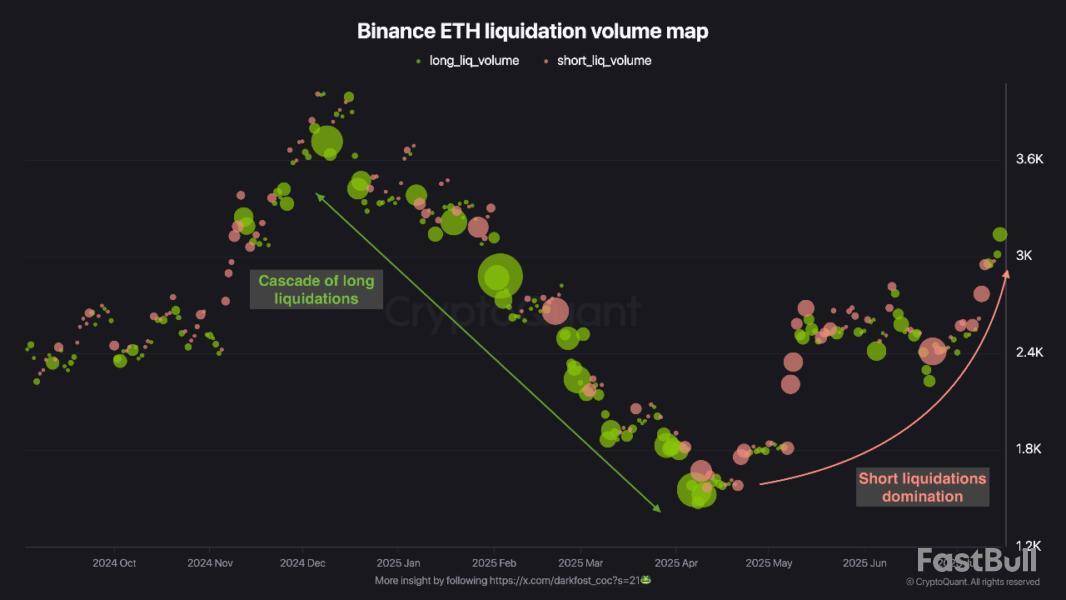

According to Darkfost, Ethereum’s current rally follows a prolonged five-month correction phase that began in December 2024. During this period, the market experienced a flush of long positions, especially on Binance, contributing to what he describes as a necessary “cleanup” in the derivatives space.

This recalibration helped reset speculative positioning and laid the groundwork for the recovery observed since late April. Now, the pattern has reversed. “Short liquidations are now dominating on Binance,” Darkfost observed, emphasizing how forced exits of bearish positions are reinforcing Ethereum’s upward price momentum.

Liquidation data shows multiple short squeezes in recent weeks, with volumes reaching $32 million and $35 million, respectively. This trend suggests that many traders are positioned counter to the prevailing market movement, adding fuel to the rally as they’re forced to close out positions.

Darkfost also highlighted that, if this pace of short liquidations continues, Ethereum may be poised to test its all-time high. He added that ongoing inflows into spot Ethereum ETFs and increasing adoption by institutions viewing ETH as a long-term asset could further support this potential breakout.

Taker Volume on Binance Hints at Bullish Continuation

In a separate post, CryptoQuant analyst Crazzyblockk pointed to taker-side activity on Binance as another critical signal. The ETH Taker Buy/Sell Ratio (7-day moving average) recently crossed the 1.00 threshold, signaling stronger buy-side pressure from market participants.

This shift was accompanied by a spike in price volatility, which reached 261.5, mirroring Ethereum’s latest price surge beyond $3,434.

Crazzyblockk noted that this pattern, rising buy-side taker volume aligned with surging volatility, has historically preceded extended price rallies. The divergence between taker long and short volumes further underlines dominant bullish sentiment.

The analyst emphasized that tracking taker momentum on Binance may offer early signals for future market direction, as the Ethereum price appears highly responsive to activity on the platform.

Featured image created with DALL-E, Chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up