Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

NYSE-listed DDC Enterprise has secured $124 million in equity financing to accelerate its bitcoin accumulation strategy, the company said Tuesday.

The round was led by PAG Pegasus Fund and Mulana Investment Management, with additional backing from OKG Financial Services. Founder and CEO Norma Chu also contributed $3 million personally.

Shares were issued at $10 apiece — a 16% premium to DDC’s Oct. 7 closing price. The company said the funds will be used to expand its bitcoin treasury, targeting 10,000 BTC, worth over $1.2 billion in today's prices, by the end of 2025.

DDC currently holds 1,058 BTC, according to public disclosures, ranking it 47th among listed bitcoin treasuries. Achieving its stated goal would move the company just outside the global top 10. At today’s levels, DDC stock trades near $9, with a market-to-net-asset-value ratio of 0.63 relative to its bitcoin holdings, meaning its shares trade at a steep discount to the value of its underlying bitcoin.

Chu framed the financing as a strategic endorsement of DDC’s dual identity as both a meal platform and a digital asset treasury. “Their investment is a strong endorsement of our vision and the growing importance of public bitcoin treasuries,” she said in a statement.

The company, best known for its DayDayCook and Nona Lim brands, reported $37.4 million in 2024 revenue as it expanded further into U.S. markets.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Key takeaways:

Investor optimism over a handful of pending XRP ETF decisions could lift XRP price.

Whale accumulation is strong: $1.1 billion in XRP added despite retail pessimism.

A break above $3.30 could trigger 60% to85% upside, as the monthly chart indicates bullish structure.

After breaking above $3 on Oct. 2, XRP (XRP) struggled to sustain momentum, falling back to $2.84 on Tuesday. The daily close below the psychological level also marked a loss of support from the 50-period exponential moving average (EMA), signaling short-term weakness. However, several structural and on-chain indicators suggest that XRP’s struggle may be temporary, with catalysts lining up for a potential rebound in the coming weeks.

XRP ETF approvals could unlock institutional inflows

October could prove pivotal for XRP as the US Securities and Exchange Commission (SEC) approaches final deadlines on 16 crypto ETF applications, including multiple spot XRP ETF filings expected between Oct. 18 and Oct. 25. The regulatory environment has evolved since the SEC approved new generic listing standards in September 2025, streamlining approvals for commodity-based exchange-traded products.

All eleven XRP ETF proposals have already surpassed their listing standards deadlines, raising the possibility of simultaneous approval. If approved, analysts estimate these ETFs could attract $3 to $8 billion in institutional inflows, comparable to the early stages of Bitcoin and Ethereum ETF adoption.

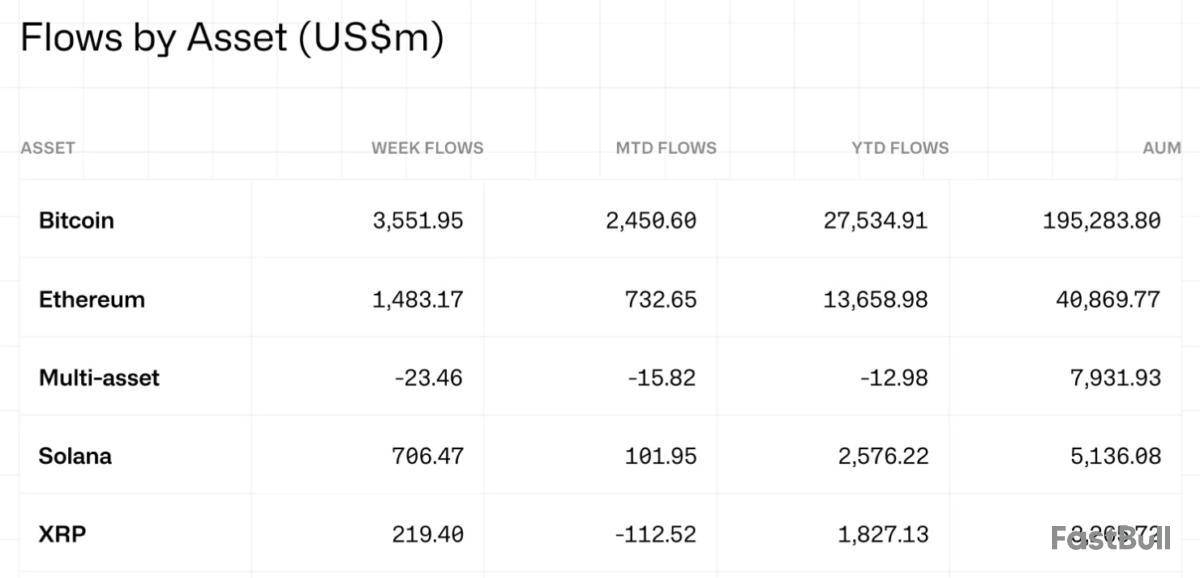

CoinShares data further underscored this optimism, showing XRP investment products drew $220 million in inflows last week, pushing year-to-date inflows to $1.8 billion and assets under management to $3.2 billion.

Whale accumulation offsets retail pessimism

Earlier, Cointelegraph reported that XRP’s bullish-to-bearish sentiment ratio had dipped below 1.0, suggesting that negative mentions now outnumber positive ones across social platforms. Historically, such retail “fear, uncertainty, and doubt” (FUD) phases have preceded strong rebounds, as capitulation often marks market bottoms.

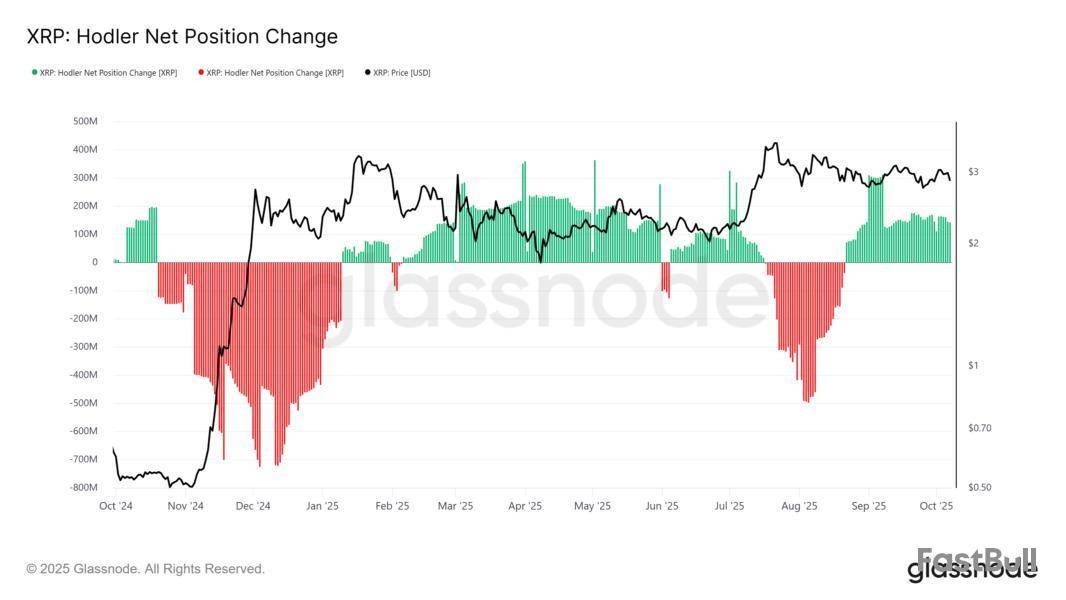

Meanwhile, large holders have been taking advantage of the weakness. Over the past three days, whales accumulated 55 million XRP worth nearly $1.1 billion. Onchain data also showed the Net Holder Position Change has remained positive since August, indicating consistent accumulation around the $3 level.

Related: Altcoin ETFs face decisive October as SEC adopts new listing standards

Traders eye a potential move toward $5

Despite its short-term consolidation, XRP’s price structure remains historically strong. The asset is currently maintaining its highest-ever weekly and monthly closing range since surpassing its 2017 highs.

Meanwhile, crypto analyst EtherNasyonal said that XRP’s seven-and-a-half-year descending channel against Bitcoin was broken in late 2024, marking a significant structural shift, with consistent accumulation over the past year.

The current pattern resembled a bullish market fractal that could yield 60% to 85% gains if XRP breaks decisively above $3.30. Trader Dentoshi observed a similar pattern, inferring that a longer consolidation or price base could lead to a bigger breakout.

However, veteran trader Peter Brandt noted that a daily close below $2.65 could be a defining point for $XRP. This would lead to the confirmation of a descending triangle pattern. Brandt said,

Related: XRP sees highest ‘retail FUD’ since Trump tariffs: Is a major sell-off next?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Crypto expert BarriC has shared a bold view about the future of the XRP price. He believes that it could rise to $1,000 or even higher if it reaches full global use by banks and financial institutions. BarriC says the world has never seen what happens when a digital asset is used on a massive scale by traditional finance. According to him, this level of use could set XRP apart from all other cryptocurrencies.

XRP Price Poised For Historic Gains Amid Global Bank Adoption

BarriC predicts that the XRP price has the potential to reach record-breaking levels once banks and financial firms worldwide begin to adopt the cryptocurrency on a daily basis. If banks move money through XRP on a daily, weekly, and monthly basis, the amount of value flowing through the network could be substantial. BarriC believes this could be in the range of millions, billions, or even trillions of dollars over time.

He explains that no other cryptocurrency has reached this level of real-world use before, which makes XRP’s case very different from past market cycles. BarriC says that when global financial institutions begin using XRP for regular transactions, it will no longer behave like most digital assets. It could then become a key part of how money moves worldwide, and such growth could naturally lead to XRP prices that surpass what the market has seen before.

BarriC’s analysis suggests that the real turning point could come from trust and utility in XRP. As more institutions rely on the network for fast and inexpensive transfers, confidence in the asset is likely to grow significantly. The demand would likely reduce selling pressure and increase the token’s value over time, which, according to BarriC, is when XRP could start to climb toward its predicted $1,000 mark.

XRP Breaking The Traditional Cycle And Entering Uncharted Territory

BarriC also believes that XRP will eventually diverge from Bitcoin’s typical four-year market cycle. He says XRP could move in its own direction once banks widely use it. In his view, the cryptocurrency would no longer need to follow Bitcoin’s ups and downs because it would have its own strong use case. This independence could allow the price to move much higher and stay stable even when other coins face downturns.

He describes this possible phase as “uncharted territory” for XRP, as it would be the first time a cryptocurrency reaches that level of adoption and the network becomes a significant part of the global payment system. BarriC expects that once this shift happens, XRP could rise far beyond previous highs, possibly reaching $100, $1,000, or more.

The overall analysis by BarriC paints a very hopeful picture for the XRP price. The digital asset may become one of the most valuable cryptocurrencies on the market if the $ 1,000 price prediction comes to fruition.

The U.S. Senate confirmed Jonathan McKernan, who has been critical of overregulation and crypto debanking, to a top position at the Treasury Department.

The Senate voted for McKernan 51-47 later in the day on Tuesday for the Treasury Under Secretary for Domestic Finance. In a statement, Treasury Secretary Scott Bessent said he is an "ideal leader."

"He will play an instrumental role in strengthening our economy by clawing back the government overreach and excess that defined the previous administration," Bessent said in the statement. "I look forward to working with him as we lay the economic foundation for America’s Golden Age."

Bessent was previously tapped by President Donald Trump to lead the Consumer Financial Protection Bureau, but reportedly later pivoted to nominate McKernan for his role at the Treasury Department. In his new position, McKernan will oversee financial markets and advise top officials on the financial system and other economic matters.

McKernan was also previously a board member at the Federal Deposit Insurance Corporation.

McKernan himself hasn't spoken directly on crypto debanking, but has praised the work of Worldwide Stablecoin Payment Network CEO Austin Campbell and others.

“The U.S. banking system … is increasingly unattractive. It is also failing various market tests," McKernan posted on X, quoting an essay "on debanking" by Tyler Cowen, a libertarian economist at George Mason University. "How innovative is it? … Can it integrate with crypto? Relative performance is sliding, there is no other way to put it."

During his nomination hearing in front of the Senate Finance Committee for the Treasury role in July, McKernan said he would "champion reforms that foster growth, both within and outside our financial system."

"The Office of Domestic Finance has a wide ambit spanning financial institutions, financial markets, and financial stability, all of which have a role to play in creating more jobs, wealth, and prosperity for all Americans," McKernan said.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Square, the payments processor owned by Jack Dorsey’s Block Inc., has launched a new feature enabling local businesses to accept Bitcoin at the point of sale and hold the digital asset in an integrated wallet — a move that could help advance Bitcoin’s use as a medium of exchange.

Announced on Wednesday, the new Square Bitcoin offering allows merchants to accept Bitcoin (BTC) payments and automatically convert a portion of their sales into BTC. Square is waiving processing fees through 2026, with a 1% transaction fee set to take effect on Jan. 1, 2027.

Merchants can store their Bitcoin in a dedicated wallet accessible through Square’s existing dashboard, where they can also buy, sell or withdraw the asset. The service is available only to US sellers, excluding New York State, and is not open to international merchants.

The rollout could mark a significant step toward broader crypto adoption, as more than 4 million merchants use Square’s payments platform, according to company data.

Square’s embrace of Bitcoin isn’t surprising. The company had previously announced plans to roll out the service by 2026, and the move aligns with Block Inc.’s broader crypto strategy and the vision of CEO Jack Dorsey, a longtime Bitcoin advocate.

Dorsey previously integrated Bitcoin trading and payments into Cash App, Block’s peer-to-peer payments service, and has spearheaded efforts to develop an open-source Bitcoin mining system to reduce costs in the energy-intensive mining sector.

Block Inc. currently holds 8,692 BTC on its balance sheet, ranking it as the 13th-largest public Bitcoin holder worldwide, according to industry data.

Crypto payments back in focus

The use of cryptocurrency in payments is returning to the spotlight, driven by a more favorable regulatory environment in the United States and growing recognition of digital assets as a legitimate asset class.

Square cited research from eMarketer indicating that US crypto payment usage is projected to grow by 82% between 2024 and 2026, reflecting renewed momentum in the sector.

A recent YouGov survey found that consumers in the US and the United Kingdom increasingly view payments as a leading use case for cryptocurrency. The study also noted that advances in artificial intelligence could accelerate adoption, as emerging AI tools integrate financial and transactional capabilities.

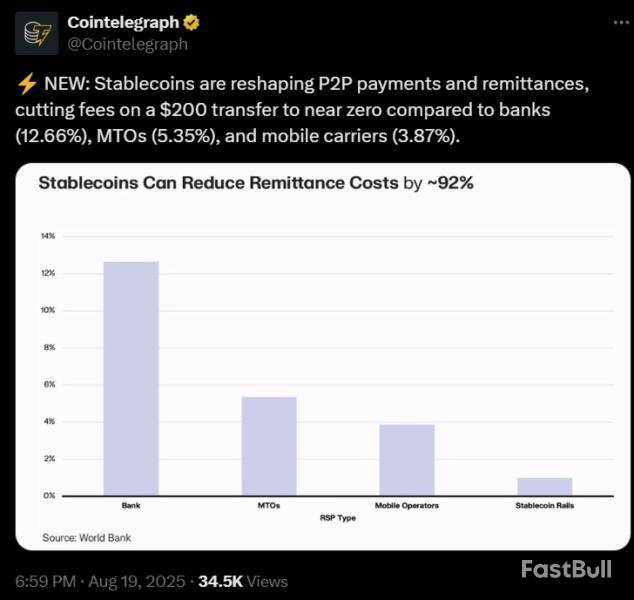

This aligns with a broader trend in which AI agents are expected to accept and initiate cryptocurrency transactions, particularly using stablecoins. Google’s newly announced Agent Payments Protocol aims to facilitate this shift, positioning crypto as a key component of the AI-driven economy.

Meanwhile, payment giant PayPal is expanding its peer-to-peer crypto offerings, allowing users to send and receive payments using Bitcoin, Ether (ETH), and its US dollar-pegged stablecoin PYUSD (PYUSD).

Financial technology firm Fiserv and the Bank of North Dakota said Wednesday they plan to launch a stablecoin next year.

In honor of former U.S. President Theodore Roosevelt and his Rough Riders, the two companies have decided to call the new coin the "Roughrider" stablecoin. The coin will be available to banks and credit unions in the state, the companies said.

In August, the Wyoming Stable Token Commission unveiled the mainnet launch of its first official state-backed stablecoin. The move came about one month after President Donald Trump signed the first federal stablecoin bill into law, creating a framework for issuers to operate.

"As one of the first states to issue our own stablecoin backed by real money, North Dakota is taking a cutting-edge approach to creating a secure and efficient financial ecosystem for our citizens," North Dakota Governor Kelly Armstrong said in the statement. "The new financial frontier is here, and The Bank of North Dakota and Fiserv are helping North Dakota financial institutions embrace new ways of moving money with the Roughrider coin."

The Roughrider coin will leverage the FIUSD digital asset platform and should eventually be interoperable with other coins, according to Wednesday's statement.

In June, Fiserv said it unveiled the FIUSD stablecoin so the firm's customers could use the "interoperable digital asset" for banking and payments.

"We're entering a new era where payments are instant, interoperable, and borderless," said Fiserve COO Takis Georgakopoulos. "...North Dakota's vision and leadership in launching this initiative show how forward-thinking policy can drive real progress in digital finance."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The DeFi landscape remains highly fragmented. Liquidity is siloed within isolated blockchains, and moving assets across them requires bridges that introduce latency, exorbitant fees, and significant counterparty risk. This fragmentation limits capital efficiency and undermines seamless user experiences.

Meanwhile, high-frequency trading and micropayments are unviable on-chain. Blockspace constraints and gas fees make real-time interactions cost-prohibitive and slow.

What’s missing in the digital assets space is a purpose-built clearing layer that can unify fragmented liquidity, enable transparent price discovery, and scale with demand.

Yellow’s Clearing Layer Approach

Yellow addresses fragmentation by introducing a chain-agnostic clearing network that drastically reduces cross-chain friction and settlement delays. Instead of settling each transaction on-chain, Yellow batches off-chain trades and finalizes only the net outcomes.

This architecture supports billions of off-chain messages per day, offering throughput that far exceeds existing Layer-1 and Layer-2 networks.

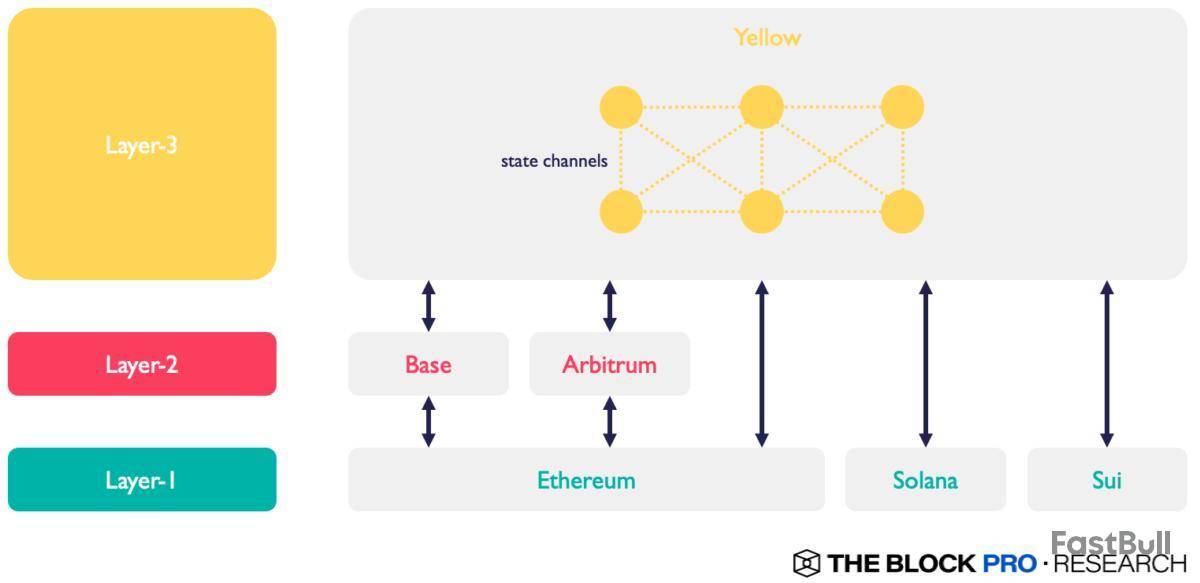

At its core, Yellow is a Layer-3 mesh network composed of state channels, designed to abstract away the underlying blockchains. It provides a unified virtual ledger where applications interact seamlessly across chains.

Developers no longer need to engineer around interoperability challenges. They can build directly on Yellow, focusing on product logic and user experience rather than infrastructure.

Yellow’s design draws inspiration from Bitcoin’s Lightning Network. Participants post collateral into smart contracts on supported blockchain networks and open high-speed state channels with other brokers. Within these channels, liabilities are updated off-chain at high frequency while maintaining synchronized virtual balances.

When liabilities become significant or at scheduled settlement times, channels are closed and net settlements are written back to the base layer using state channel contracts. This eliminates the bottlenecks of on-chain settlements while preserving security and enforcing transaction finality.

By combining high-frequency off-chain updates with efficient net settlement, Yellow resolves two of DeFi’s most critical pain points: multi-chain fragmentation and cross-chain communication latency. This lays the groundwork for scalable, trust-minimized financial infrastructure across all chains.

Technical Framework

At the heart of Yellow’s architecture is Nitrolite, a modular framework built on the ERC‑7824 standard for off-chain state channels. Nitrolite enables users and brokers to conduct real-time trading by exchanging liabilities and updating positions off-chain, while retaining cryptographic guarantees of enforceability through smart contracts. This setup ensures that all activity remains verifiable and enforceable on-chain.

Each broker on Yellow operates a ClearNode, which provides a trustless execution layer that functions as the network’s message hub and settlement engine. ClearNodes coordinate high‑frequency liability updates across participants and enforce net settlements on multiple blockchains, forming the backbone of Yellow’s chain-agnostic clearing network.

Applications

Gaming & Real-time Applications

Yellow’s infrastructure is purpose-built to support gaming environments that require real-time responsiveness, on-chain asset ownership, and seamless cross-chain portability.

A working example is Ducklings, an NFT-based trading card game where players collect, trade, and evolve “duckling” NFTs. Gameplay includes purchasing booster packs, melding existing cards to create higher-rarity species, and earning token rewards through quests or ownership of rare cards.

Yellow plans to introduce blockchain-agnostic NFT primitives that enable a seamless cross-chain user journey by processing the majority of operations off-chain through state channels.

Developers can leverage the same infrastructure to build cross-chain games in which assets minted on one blockchain can be used, traded, or recognized across others. This eliminates the need for constant bridging while preserving decentralization and asset sovereignty.

Trading & Payments

Yellow’s founding mission is to build a lightning-fast, off-chain clearing and settlement network for digital assets, serving as a crypto-native analogue to the Electronic Communication Networks (ECNs) in traditional securities markets.

At the core of this vision is NeoDAX, Yellow’s modular brokerage infrastructure stack. It offers a streamlined setup experience and is designed for high scalability, capable of supporting hundreds of thousands of transactions per second.

NeoDAX combines the performance of centralized exchanges (CEXs) with the security principles of decentralized exchanges (DEXs).

Yellow’s peer-to-peer liquidity aggregation system mitigates counterparty risk through a fully automated net settlement process. The network levies a small clearing fee, calculated as a percentage of the net settlement liability, which directly funds the Yellow treasury.

Beyond exchange trading, Yellow facilitates cross-chain token transfers, which opens the door to broader applications, enabling near-instant, low-cost payments in contexts such as retail or live events.

At the same time, Yellow’s role as a trustless, chain-agnostic clearing layer makes it more directly comparable to SWIFT’s function in global financial markets, which is a neutral infrastructure layer that connects fragmented institutions and ensures secure, efficient settlement across borders. In the digital asset space, Yellow provides that same backbone for brokers and exchanges operating across multiple blockchains.

Enterprise Integration

Yellow’s modular architecture allows enterprises to integrate crypto functionality gradually, adding components such as sign-in modules, custody contracts, trading interfaces, and admin panels directly into their existing Web2 products. This incremental approach reduces technical overhead and accelerates time-to-market for digital asset features.

Because Yellow is chain-agnostic, enterprises can support multiple blockchains without hassle. State channels abstract away the complexities of cross-chain settlement and collateral management, enabling seamless interaction across disparate networks.

For instance, a fintech or e-commerce company can integrate Yellow to offer asset trading or token-based payments within their existing services. A ticketing platform can embed a Yellow-compatible wallet to enable users to purchase event tickets and merchandise with digital assets from any supported blockchain.

This benefits developers through plug-and-play modules that accelerate deployment, while users enjoy a frictionless, low-fee experience. The result is a significantly lower barrier to Web3 integration for traditional businesses looking to expand into the realm of digital assets.

Key Differentiators

Yellow’s Layer-3 clearing network addresses liquidity fragmentation more effectively than bridges or single-chain DEX aggregators, by linking brokers and exchanges across multiple blockchains through state-channel infrastructure.

Because only the net outcome of trade batches is written to the base chain, Yellow achieves throughput on par with centralized exchanges, far exceeding what today’s Layer-1 and Layer-2 blockchains can support.

Its chain-agnostic design contrasts with other interoperability solutions that require bespoke bridge infrastructure or custom chain adapters, allowing developers to build cross-chain products without dealing with low-level plumbing.

Its trustless model further distinguishes Yellow from legacy clearing houses, since collateral is locked in smart contracts rather than with centralized intermediaries, mitigating counterparty default risk and preserving user control.

Finally, regulatory alignment differentiates Yellow from most DeFi protocols by mirroring traditional capital market structures, separating custody, clearing, and execution, while still allowing KYC/AML enforcement at the network edge. This reduces compliance friction and simplifies licensing requirements across jurisdictions.

Adoption Drivers

Several upcoming milestones could be critical in driving Yellow’s initial adoption.

In 2025, the team plans to deliver the first major release of the ClearNode technology stack, establishing the foundation for Yellow’s production-ready clearing infrastructure.

Following this, the roadmap includes expanding support for both EVM and non‑EVM blockchains, introducing account-abstraction-enabled cross-chain swaps, and growing the brokerage ecosystem. Together, these steps will broaden protocol utility while reducing integration barriers for developers and partners.

Yellow abstracts away the complexity of interoperability, enabling builders to easily integrate the Layer-3 network into their applications. Gaming studios, fintech platforms, and emerging DeFi apps can tap into Yellow without re-engineering their infrastructure, accelerating time-to-market and expanding the protocol’s network effects.

The introduction of the native protocol token, YELLOW, adds a powerful economic layer to the network. Transaction and clearing fees will be paid in YELLOW, and brokers must lock the token as collateral to open state channels. If a participant fails to settle within the pre-agreed period, their deposit can be slashed, creating strong incentives for honest behavior.

Institutional backing further strengthens Yellow’s position. A $10 million seed round led by Ripple co‑founder Chris Larsen, with participation from Consensys Ventures and GSR Capital, signals strong industry confidence.

As traditional financial institutions deepen their investment in modern, blockchain‑based clearing systems, Yellow’s trustless, scalable design aligns well with evolving infrastructure demands.

Ultimately, the pace and scale of adoption will depend on execution and market receptivity. But with a solid technical roadmap, regulatory alignment, and strong capital backing, Yellow has the foundations to play an important role in emerging cross-chain financial infrastructure.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up