Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The passing of two key crypto bills in the US will usher in a new wave of crypto participation that could upend the traditional four-year market, says Galaxy Digital CEO Mike Novogratz.

Novogratz told Bloomberg on Tuesday that the stablecoin-regulating GENIUS Act, signed into law in July, and the CLARITY Act, which outlines regulatory agencies’ jurisdiction over crypto, would lead to a surge of new investors that would disrupt the four-year cycle pattern.

Many crypto investors believe the market follows a pattern of price movement coinciding with the Bitcoin (BTC) halving roughly every four years. The last halving occurred in April 2024, with some believing the current bull market could soon end.

However, Novogratz said this crypto market cycle may differ, as investors are unlikely to sell at peak levels at the end of this year as they did in 2017 and 2021.

He added that people couldn’t previously use stablecoins on their iPhones or in social media apps because they weren’t necessarily legal, “but now they are.”

CLARITY Act a “freight train”

Coinbase CEO Brian Armstrong echoed Novogratz’s sentiment on Sept. 17, stating that he was certain Congress would pass the CLARITY Act, which defines the roles of the country’s financial regulatory agencies with crypto.

“I’ve actually never been more bullish on the market structure [bill] getting passed, it’s a freight train leaving the station,” he said at the time.

Last week, Representative French Hill said the House Financial Services Committee hopes that action will be taken on the legislation in either October or November.

Democrats could push back on legislation

Novogratz also played down concerns about the Trump family’s involvement in crypto, confident that the Securities and Exchange Commission would follow up with any conflicts of interest.

“I don’t think you can prevent the children of people in power from participating in business,” he said.

He said Democratic lawmakers could make a big deal over what they perceive as “grift” from the Trumps and potentially push back on the crypto market structure bill.

Novogratz said there are now enough Democrats who see the value in crypto to get the bill passed, but it was “dumb for Democrats to be anti-crypto” during last year’s Presidential election.

Chinese miners and Hayes added to market slump

Speaking on this week’s leverage flushout, which saw almost $200 billion wiped out from spot crypto markets, Novogratz pinned the drop on “big Chinese mining selling,” and Arthur Hayes’ “bearish commentary around Hyperliquid.”

Hayes sold his entire stash of HYPE to put a deposit on a Ferrari, and the token has fallen more than 23% since its all-time late high last week as whales continue to offload it.

Ethereum price started a fresh decline below $4,220. ETH is now consolidating and might decline further if it breaks the $4,125 support zone.

Ethereum Price Is Now At Risk

Ethereum price failed to continue higher above the $4,500 zone and started a fresh decline, like Bitcoin. ETH price declined below the $4,420 and $4,350 support levels.

The bears even pushed the price below $4,200. A low was formed at $4,000 and the price recently started a minor recovery wave. There was a move above the 23.6% Fib retracement level of the downward wave from the $4,636 swing high to the $4,000 low.

Ethereum price is now trading below $4,220 and the 100-hourly Simple Moving Average. On the upside, the price could face resistance near the $4,220 level. The next key resistance is near the $4,280 level.

The first major resistance is near the $4,315 level and the 50% Fib retracement level of the downward wave from the $4,636 swing high to the $4,000 low. A clear move above the $4,315 resistance might send the price toward the $4,370 resistance. There is also a key bearish trend line forming with resistance at $4,370 on the hourly chart of ETH/USD.

An upside break above the $4,370 region might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $4,450 resistance zone or even $4,550 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $4,215 resistance, it could start a fresh decline. Initial support on the downside is near the $4,125 level. The first major support sits near the $4,050 zone.

A clear move below the $4,050 support might push the price toward the $4,000 support. Any more losses might send the price toward the $3,880 region in the near term. The next key support sits at $3,750.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $4,125

Major Resistance Level – $4,320

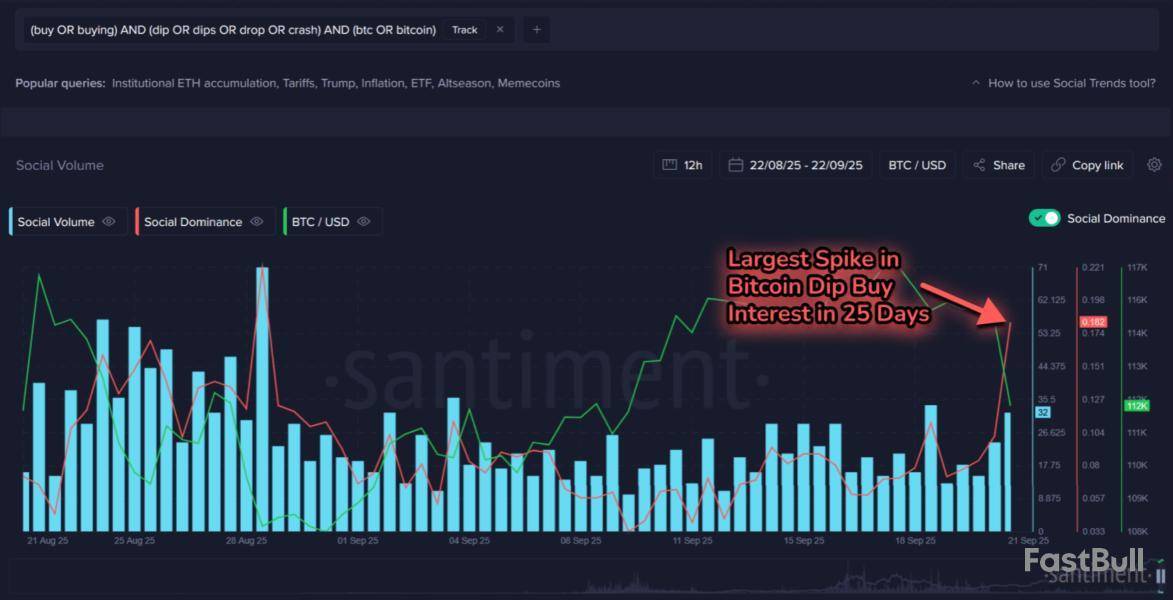

Bitcoin has seen “buy the dip” mentions spike on social media after the price crash, but Santiment warns this could be a contrarian signal.

Social Media Users Are Calling To Buy The Bitcoin Dip

In a new Insight post, analytics firm Santiment has talked about how the market has been reacting to the latest plunge in the Bitcoin price. “One of the first things we like to look for is a sign of retailers showing enthusiasm toward buying the dip,” notes Santiment.

The indicator cited by the analytics firm is the “Social Volume,” which measures the total amount of posts/messages/threads appearing on the major social media platforms that make unique mentions of a given term or topic.

Santiment has filtered the Social Volume for Bitcoin-related keywords and terms pertaining to calls for “buy the dip.” Below is a chart showing the trend in the metric over the past month.

As is visible in the graph, the Bitcoin Social Volume has spiked for these terms, indicating that interest in buying the dip has surged among social media users. At the current value, dip-buying calls are at their highest in 25 days.

While this could sound like a signal that a rebound may be coming soon for the cryptocurrency, history has had many examples of the contrary. “Prices typically move the opposite direction of the crowd’s expectations,” explains the analytics firm. Considering this, the dip-buying hype could actually be a sign that more pain may be ahead for BTC before the bottom can actually be in.

“Once the crowd stops feeling optimistic, and they begin to sell their bags at a loss, this is typically the time to strike with your dip buys,” says Santiment. Another gauge for market sentiment is through the Binance Funding Rate, which is a metric that keeps track of the periodic fee that derivatives traders are exchanging between each other on the largest cryptocurrency exchange by trading volume.

The indicator turned sharp red just ahead of the latest plummet in the Bitcoin price, indicating that short positions became dominant on Binance. After the decline, however, traders changed their tune as the metric switched back to being green.

This trend would suggest that investors are hoping Bitcoin would rebound soon. “Ideally, for a notable price bounce to occur, we need to see a sustained period of shorts outpacing longs,” notes the analytics firm. As such, this could be another indicator to keep an eye on, as a flip into the negative for an extended phase may pave the way toward a bottom.

BTC Price

Bitcoin has been unable to make recovery from its crash so far as its price continues to trade around $112,700.

Bitcoin price extended losses after it traded below $114,000. BTC is now consolidating losses and might decline further to test the $110,500 support zone.

Bitcoin Price Starts Consolidation

Bitcoin price failed to stay above the $115,500 zone and started a fresh decline. BTC declined below the $115,000 and $114,000 support levels to enter a short-term bearish zone.

The decline gained pace below the $113,500 level. A low was formed at $111,557 and the price is now consolidating losses below the 23.6% Fib retracement level of the recent decline from the $117,920 swing high to the $111,557 low.

Bitcoin is now trading below $113,200 and the 100 hourly Simple moving average. Besides, there is a bearish trend line forming with resistance at $113,600 on the hourly chart of the BTC/USD pair.

Immediate resistance on the upside is near the $113,000 level. The first key resistance is near the $113,500 level and the trend line. The next resistance could be $114,000. A close above the $114,000 resistance might send the price further higher.

In the stated case, the price could rise and test the $114,750 resistance level or the 50% Fib retracement level of the recent decline from the $117,920 swing high to the $111,557 low. Any more gains might send the price toward the $115,500 level. The next barrier for the bulls could be $116,250.

Another Decline In BTC?

If Bitcoin fails to rise above the $114,000 resistance zone, it could start a fresh decline. Immediate support is near the $112,000 level. The first major support is near the $111,750 level.

The next support is now near the $110,500 zone. Any more losses might send the price toward the $108,800 support in the near term. The main support sits at $107,500, below which BTC might gain bearish momentum.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $112,000, followed by $111,750.

Major Resistance Levels – $113,600 and $114,000.

Solana (SOL) has entered a crucial zone as the price tightens near the $200 support level. The recent pullback in crypto markets, which pushed Bitcoin below $112,000, has also put pressure on Solana. Despite the bearish sentiment, bulls remain active around this key support.

Trading volumes have surged past $12 billion within 24 hours, indicating strong participation from both buyers and sellers. Analysts point out that a drop below $200 could trigger liquidity-driven volatility, but any decline might also serve as a springboard toward $250 in the near term.

The daily chart shows SOL consolidating within an ascending channel, with RSI cooling to neutral territory. If the midline support around $210 holds, a retest of $250 remains a possibility.

Institutional Confidence and Treasury Growth

While short-term volatility weighs on the Solana price, institutional adoption continues to strengthen its long-term outlook. Roughly 590,000 SOL, worth over $120 million, has been added to portfolios in the past month. Corporate staking commitments now exceed 8.27 million SOL, equating to more than $1.7 billion.

This growing treasury activity is no accident. With staking yields averaging 7%–8%, Solana offers businesses a more lucrative reserve strategy than Bitcoin, which provides no yield, and Ethereum, which averages around 3%–4%.

Nasdaq-listed firms like DeFi Development Corp. and Fragmetric Labs have even launched Solana-focused treasuries in South Korea, further strengthening the network’s appeal as a corporate asset.

Adoption Beyond Solana Price Action

Adoption cycles are increasingly positioning Solana as a competitor to Bitcoin and Ethereum. Payment giants like Stripe and PayPal are integrating Solana into their systems, reflecting confidence in its speed and low-cost efficiency.

Forward Industries has taken a further step, announcing plans to tokenize its public equity directly on Solana’s blockchain, a move that signals the merging of traditional finance with decentralized technology.

Despite lacking an exchange-traded fund (ETF), Solana’s fundamentals suggest strong upside potential. Analysts believe that if SOL closes above $250, the token could target $300 before year-end. With institutional portfolios still holding less than 1% of Solana’s supply, the room for growth remains significant.

For now, all eyes are on whether Solana can defend the $200 support. A short-term dip may be inevitable, but with adoption accelerating and treasuries expanding, the long-term narrative suggests that Solana’s challenge to Bitcoin is only beginning.

Cover image from ChatGPT, SOLUSD chart from Tradingview

Tether Holdings is in talks with investors to raise as much as $20b, a deal that could value the stablecoin issuer near $500b and place it among the world’s most valuable private companies.

The firm is seeking between $15b and $20b through a private placement for about a 3% stake, Tuesday.

The transaction would reportedly involve new equity, not secondary sales by existing backers. Cantor Fitzgerald is acting as lead adviser on the process.

A valuation near half a trillion dollars would place Tether alongside companies such as OpenAI and SpaceX, an extraordinary mark for a lightly regulated crypto business, even as rivals expand and lower US interest rates threaten its windfall earnings. Circle, the closest public peer in stablecoins, was valued near $30b on Tuesday afternoon.

Tether didn’t respond to Cryptonews’ request for comment by press time.

Tether, issuer of the world’s largest stablecoin, is in talks with investors to raise as much as $20 billion, a deal that could propel the crypto firm into the highest ranks of the world’s most valuable private companies — Bloomberg (@business) Tether Monetizes Reserves While Maintaining Market Lead In Dollar-Pegged Tokens

Tether issues USDT, the largest dollar-pegged token, with a market value around $172b. USDC from Circle ranks second at about $74b. The company earns yield by parking reserves in cash like assets, including US Treasuries.

Tether reported $4.9b in profit for the second quarter in July. Chief executive Paolo Ardoino has said profit margins are about 99%. These figures are not subject to the reporting standards required of public companies.

Prospective investors have been granted data room access in recent weeks to assess the deal. Bloomberg reported the fundraising plans are expected to close by year end, depending on final terms and allocations.Data Room Opens As Investors Weigh Governance, Policy Risks And Growth Plan

The fundraise comes as Tether lays groundwork to return to the US. The company has outlined a plan for a US-regulated stablecoin and appointed Bo Hines, a former White House crypto official, to lead the effort.

Earlier this month, Tether announced USA₮, a dollar backed token intended to strengthen the role of the US dollar in digital markets. The push follows a shift in the US policy climate, with the GENIUS Act expected to expand the role of stablecoins and potentially allow banks, card networks and technology firms to issue their own tokens.

Tether has a history of run-ins with US regulators. In 2021, it paid a $41m fine to settle allegations that it misrepresented reserves. The firm had largely stayed out of the US before a recent change in tone toward crypto policy.

A successful raise would give Tether deep capital to defend market share and invest across infrastructure, compliance and product. It would also test investor appetite for private crypto champions at a time when rates are easing and yield on reserves may moderate, a shift that could weigh on future earnings.

The US Commodity Futures Trading Commission is looking to allow tokenized assets, including stablecoins, to be used in derivatives markets as collateral in a move supported by crypto executives.

CFTC acting chair Caroline Pham said on Tuesday that her agency will “work closely with stakeholders” on the scheme and is encouraging feedback on using tokenized collateral in derivatives markets until Oct. 20.

If implemented, stablecoins like USDC (USDC) and Tether (USDT) would be treated similarly to traditional collateral like cash or US Treasurys in regulated derivatives trading. Congress passed laws earlier this year regulating stablecoins, which have seen their adoption grow among financial institutions.

Stablecoin, crypto heavyweights back move

Crypto executives from stablecoin issuers Circle Internet Group, Tether, Ripple Labs and crypto exchanges Coinbase and Crypto.com all gave their stamp of approval for the CFTC’s move.

Circle president Heath Tarbert said that the GENIUS Act “creates a world where payment stablecoins issued by licensed American companies can be used as collateral in derivatives and other traditional financial markets.”

“Using trusted stablecoins like USDC as collateral will lower costs, reduce risk, and unlock liquidity across global markets 24/7/365,” Tarbert added.

US President Donald Trump signed the GENIUS Act into law in July. It’s geared toward establishing clear rules for payment stablecoins, but is still awaiting final regulations before implementation.

Coinbase chief legal officer Paul Grewal also backed the move, and said in a X post on Tuesday that “tokenized collateral and stablecoins can unlock US derivatives markets and put us ahead of global competition.”

Meanwhile, Jack McDonald, senior vice president of stablecoins at Ripple, said the initiative is a key step toward integrating stablecoins into the “heart of regulated financial markets,” and driving greater efficiency and transparency in derivatives markets.

Initiative in the works since early 2025

Pham said the tokenized asset initiative will build on the CFTC’s Crypto CEO Forum and is also part of the previously announced crypto sprint to apply the President’s Working Group on Digital Asset Markets recommendations.

The crypto CEO forum in February called for crypto industry CEOs to provide input on an upcoming digital asset pilot program and discussed the use of tokenized non-cash collateral.

The CFTC’s Global Markets Advisory Committee also released a recommendation last year from its Digital Asset Markets Subcommittee on expanding the use of non-cash collateral through distributed ledger technology.

US crypto regulatory landscape changing

Pham’s announcement comes the same day Securities and Exchange Commission Chair Paul Atkins said his agency is working on an innovation exemption that would act as a regulatory carve-out, giving crypto companies temporary relief from older securities rules while the SEC develops tailored regulations.

He also announced Project Crypto in July, which hopes to modernize the securities rules and regulations around crypto and move America’s financial markets to move onchain.

Magazine: US risks being ‘front run’ on Bitcoin reserve by other nations — Samson Mow

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up