Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

September 12, 2025 11:32:07 UTC

Galaxy Digital Backs $1.65B Solana Buy

Galaxy Digital is assisting Forward Industries in acquiring $1.65 billion worth of Solana . In just the past 12 hours, Galaxy Digital withdrew 1.45M ($326M) from exchanges. Forward Industries confirmed the move, saying it completed a $1.65B private placement to fund the purchase.

September 12, 2025 11:08:49 UTC

Bitcoin Price Today Back in Sell Zone, Trader Shifts to Shorts

Bitcoin has re-entered the sell/short zone, with traders calling it time to take profits on BTC, ETH, and altcoin spot bags. The strategy: offload 10% of spot holdings daily while adding to shorts. Current positioning stands at 80% USDT/shorts and 20% spot. Sentiment signals caution as the market faces selling pressure.

September 12, 2025 10:51:58 UTC

$1.35M Stolen From Thorchain Cofounder

A Thorchain cofounder has lost $1.35 million after malware stole keys from a software wallet. The attacker didn’t need a malicious transaction — the malware directly accessed the wallet keys. The incident highlights a major risk: keeping large funds in software wallets is unsafe. Experts warn it’s not a matter of if, but when such wallets will be drained.

September 12, 2025 10:51:58 UTC

Polygon Labs Teams Up With Cypher Capital in the Middle East

Polygon Labs has announced a partnership with Cypher Capital to boost institutional access to POL across the Middle East. The initiative aims to channel long-term capital into the Polygon ecosystem, giving institutions exposure to POL while driving yield, growth, and network security

September 12, 2025 10:40:50 UTC

Trader Closes L Short, Warns of Sharplink Effect

A trader has closed his L short despite being in profit, saying it “feels like a crime about to happen” — similar to past surprise rallies like on Base.

He expects potential headlines around Sharplink building on Linea, which could trigger a sudden short squeeze. While the token might bleed for weeks, he warns of a possible FU candle once the ETH <> Sharplink narrative gains traction.

Sharplink has already confirmed plans to stake on Linea, and with Linea’s ETH burn + buyback mechanism, the setup looks strong. The trader draws parallels with:

He suggests shorts could be caught off guard if the narrative reignites.

September 12, 2025 10:40:50 UTC

Crypto Market Today: Whale Rakes in $57M Profit

An early whale wallet (0x7dac) has cashed out another 67,006 worth $3.82M. The whale originally bought 1.26M for $9.51M at an average of $7.52 and also received 22,270 at genesis. He has already sold 385,513 for $16.15M at an average of $41.9, while still holding 900,663 valued at $50.5M. His total profit now stands at an eye-watering $57M+, making him one of the biggest winners in the market.

September 12, 2025 10:39:37 UTC

Gemini’s $425M Nasdaq Debut Boosts Bitcoin Hype

CNBC reports that the Winklevoss twins’ Bitcoin exchange Gemini has raised $425 million through its Nasdaq IPO. The strong debut highlights soaring Wall Street demand for Bitcoin, signaling growing mainstream acceptance of crypto.

September 12, 2025 10:34:29 UTC

Bitcoin News Today: BTC Liquidation Map Shows Longs at Risk

The green line marks Bitcoin’s current price. The big red and orange bars to the left? Those are long liquidations sitting below the price — and smart money is watching them closely. On the right, short liquidation levels are light, meaning most of the risk is stacked on the long side right now. This shorter-timeframe map (from “optical_opti”) usually clears within days. Think of it as a pain map price often gravitates toward these zones to wipe out over-leveraged positions.

TheKingfisher@kingfisher_btcSep 12, 2025Here's the deal on this BTC liquidation map.

That green line? That's current price. See those big red and orange bars to the left? Those are long liquidations getting wiped out under current price. Smart money is watching those levels.

The lines to the right are short… pic.twitter.com/0IFksy1bC9

Charles Guillemet, the chief technology officer at Ledger wallet, has spread the word about the founder of THORChain and Vultisig falling for a trick pulled off by scammers who stole $1.35 million worth of crypto from his old Metamask software wallet, which he had “completely forgotten about”.

The Ledger CTO issued a security warning to the community after the Thorchain cofounder shared the details of what happened. Other sources add that the hackers were likely from North Korea.

Deep-fake Zoom call worth $1.35 million

The victim, @jpthor, shared the details of the hack in several bullet points. He mentioned that his friends’ Telegram account was compromised, and then he, @jpthor, received what was most likely a fake Zoom link for a conference call, which later proved to be a deep-fake one.

The key to the wallet was stored in his iCloud Keychain system, which obviously was also accessed by the hackers – this was a comment from the Ledger CTO: “the malware simply stole the keys,” and @jpthor did not even have to sign that transaction.

Charles Guillemet@P3b7_Sep 12, 2025$1.35M was stolen from a Thorchain cofounder. Yet another reminder: if your keys are stored in a software wallet, you’re only one malicious code execution away from losing everything.

In this case, the victim didn’t even sign a malicious transaction, the malware simply stole the… pic.twitter.com/nLS4nWNFyt

The overall amount of crypto lost to the hackers was worth approximately $1.35 million.

The Ledger CTO said that holding that much money in a software wallet was insane, and holding a lot of crypto in such an online wallet means “it’s not a question of if you’ll be drained, but when.”

TL;DR

Ripple’s cross-border token has experienced a substantial rebound in the past week, with its price rising by 7% to as high as $3.07. This comes on the back of an overall altcoin resurgence and is accompanied by predictions that the asset has yet to reach new peaks.

Earlier this week, X user Ali Martinez outlined two possible scenarios for XRP. The first one is breaking above $3.05 and tapping $3.60, while the second involves a potential correction to $2.80, followed by a surge above $2.90 and then a pump to $3.60.

Others like CRYPTOWZRD and Dark Defender are even more bullish. The former believes XRP may soon outperform Ethereum (ETH) and hit a new all-time high of $4.50, whereas the latterenvisioneda jump to $6.

It is worth noting that the asset’s positive performance and optimism among industry participants come despite the recent whale exodus.

As CryptoPotatoreported, large investors (those holding between 10 million and 100 million coins) offloaded 40 million XRP in the last 24 hours alone. The stash is worth over $122 million, while this development is usually considered bearish since it increases the amount of assets available on the open market and may lead to panic among smaller players.What About ADA?

Cardano whales initiated a similar selling spree. According to Martinez, they dumped 140 million ADA (worth approximately $120 million) in the span of two weeks.

Contrary to that, the asset’s price has climbed by 9% for that period, currently trading at just south of $0.90. Analysts like the X users Clifton Fx and Hailey LUNC expect a further pump in the short term. The former set a target of $1.80, while the latter forecasted a “parabolic move.”

Additionally, ADA’s exchange netflow has been predominantly negative in recent months, indicating that investors have transitioned from centralized platforms to self-custody. This trend supports the bullish outlook by reducing immediate selling pressure.ETH on the Verge of a Big Move?

The second-largest cryptocurrency is also in green territory on a weekly scale, albeit registering a less substantial increase than XRP and ADA. Currently, it trades at around $4,500, and the volatility in the past several days has not been that dramatic.

The technical analysis tool Bollinger Bands, though, suggests that a major price move could be incoming. Specifically, the bands of the metric have squeezed significantly as of late, which historically has been followed by a huge rally or a painful correction.

Still, the majority of analysts speculating on X believe that the swing will be to the upside. Such is the case with Ted, who thinks ETH is poised for a surge to a new all-time high in the range of $8,000-$10,000 in the following months.

THORChain DEX aggregator THORSwap has made a series of repeated bounty offers to the exploiter of a user's personal wallet over the past few days, with the victim likely to be THORChain founder John-Paul Thorbjornsen, according to ZachXBT.

"Bounty offer: Return $THOR for reward. Contact contact @ thorswap.finance or THORSwap discord for OTC deal," the latest onchain message to the hacker on Friday morning reads. "No legal action will be taken if returned within 72 hours."

Blockchain security company PeckShield flagged the messages on X, initially suggesting the THORChain protocol itself had suffered an exploit of around $1.2 million. However, that post was subsequently corrected to confirm it was a user's personal wallet that had been exploited after clarification from the THORChain team. "This incident involved a user's personal wallet being exploited, and is not related to THORChain," the project said. "This is just a bounty requesting for return of stolen assets. No protocol (thorchain or thorswap) were exploited." THORSwap CEO "Paper X" added.

THORChain founder likely victim

Responding to PeckShield's post on X, onchain sleuth ZachXBT said the exploited wallet likely belongs to THORChain founder John-Paul Thorbjornsen, who had a personal wallet drained for $1.35 million by North Korean hackers on Tuesday.

The source of the attack came via a message from the hacked Telegram account of a friend of the THORChain founder containing a fake Zoom meeting link, Thorbjornsen acknowledged earlier this week. "Ok so this attack finally manifested itself," he followed up on Tuesday. "Had an old MetaMask cleaned out."

Thorbjornsen said the MetaMask wallet was only in another logged-out Chrome profile with its key stored in iCloud Keychain, yet attackers likely accessed one or both via a 0-day exploit — reinforcing his view that threshold signature wallets, which split key shares across devices, are the only real protection.

According to ZachXBT, the attacker stole approximately $1.03 million in Kyber Network tokens and $320,000 in THORSwap tokens. The theft address sent funds to the same "Exploiter 6" address that the onchain bounty messages were sent to. The majority of the stolen funds, matching PeckShield's $1.2 million figure, currently sit at an address beginning "0x7Ab," seemingly swapped to ETH, ZachXBT noted on his official Telegram channel.

The Block reached out to Thorbjornsen for comment.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin is trading around $115,400, up about 1% today. Ethereum has also inched higher, while Dogecoin jumped 4–5%, making it one of the day’s top performers. Overall sentiment in the crypto market is cautiously positive as traders wait for clues from the U.S. Federal Reserve. Hopes of interest rate cuts, along with steady progress on crypto ETFs and regulation, are keeping momentum alive.

Altcoins Attract Big Money

While Bitcoin remains range-bound, altcoins are pulling in fresh capital.

These moves are bringing not just money, but also renewed momentum and excitement into the altcoin sector.

Bitcoin’s Quiet Phase

Over the past week, Bitcoin has been trading between $110,000 and $116,000 without a clear breakout. According to Galaxy Digital CEO Mike Novogratz, this sideways movement is normal as capital rotates into altcoins.

“Bitcoin is simply pausing before its next big run, which could arrive by the end of the year,” Novogratz said.

Fed Cuts and Regulation Could Spark the Next Rally

Novogratz believes the Federal Reserve’s upcoming rate cuts will be a major driver of Bitcoin’s next surge. Historically, lower rates benefit risk assets, and Bitcoin could be one of the top winners.

On the regulatory front, the tone is also shifting. SEC Chair Paul Atkins has been pushing for updated securities rules to bring more activity on-chain. Meanwhile, Nasdaq has filed for approval to tokenize stocks and ETFs, signaling that traditional markets are beginning to embrace blockchain technology.

Beyond Bitcoin’s Store-of-Value Role

For years, Bitcoin has been viewed mainly as a digital store of value, while stablecoins handled payments. But now, with faster blockchains, safer infrastructure, and clearer rules, the crypto landscape is expanding.

Novogratz explained:

“Ethereum, Solana, and other chains each have their own strengths. Instead of one winner, the industry will grow as a full ecosystem.”

From Hype to Real Progress

Summing up the market’s shift, Novogratz said:

“Crypto is moving from narrative to plot — from hype to real progress.”

If he’s right, Bitcoin’s calm phase is just a pause, while altcoins continue to fuel the next chapter of crypto’s growth story.

FAQs

Will Bitcoin go up after the Fed rate cuts?Yes, many analysts, including Mike Novogratz, believe Fed interest rate cuts will boost Bitcoin. Lower rates usually help risk assets, and Bitcoin could benefit the most.

Why are altcoins rising today?Altcoins are rallying due to fresh institutional inflows. Ethereum saw a $200M treasury boost, while Solana gained backing for a $1.65B treasury plan.

Is Ethereum becoming stronger than Bitcoin?Not stronger, but Ethereum is gaining traction as institutions like BitMine increase ETH holdings. Both BTC and ETH are seen as key players in the ecosystem.

What could trigger the next crypto bull run?Analysts point to Fed rate cuts, ETF approvals, rising on-chain adoption, and tokenized assets as key catalysts.

The fight between Coinbase and the U.S. Securities and Exchange Commission (SEC) has taken another sharp turn and Cardano founder Charles Hoskinson just added fuel to the fire with a sarcastic jab at former SEC Chair Gary Gensler.

Here’s what’s buzzing on X.

Coinbase Calls Out SEC Over Destroyed Records

Coinbase’s Chief Legal Officer Paul Grewal revealed this week that the SEC, under Gensler, destroyed internal texts from October 2022 to September 2023. These messages, he said, were directly related to ongoing legal battles and should have been preserved.

“The Gensler SEC destroyed documents they were required to preserve and produce. We now have proof from the SEC’s own Inspector General,” Grewal wrote on X.

He called it a “gross violation of public trust” and confirmed Coinbase is asking the court for expedited discovery, sanctions, and the immediate release of any remaining communications.

For Coinbase, the accusation highlights a double standard: the same regulator that fines crypto companies billions for poor record-keeping is now accused of breaking its own rules.

Hoskinson Turns Gensler’s Line Back on Him

Hoskinson wasted no time in pointing out the irony. Responding to Grewal’s post, he wrote: “I’m sure Gary can come in and register :)”

Charles Hoskinson@IOHK_CharlesSep 12, 2025I'm sure Gary can come in and register 🙂 https://t.co/OLvgqkiBdq

The comment cuts at one of Gensler’s most famous talking points. During his time at the SEC, he repeatedly told crypto firms to “just come in and register.” Industry leaders argued that no clear path for registration existed.

Hoskinson’s one-liner flips that message back on the regulator itself – highlighting what many see as hypocrisy.

Coinbase’s Lengthy Legal Battles

The regulator has previously charged the exchange with operating as an unregistered securities exchange, broker, and clearing agency. It also accused Coinbase of running an unregistered staking-as-a-service program, which has been a major revenue source for the company.

According to the SEC, Coinbase has made billions since 2019 by combining exchange, broker, and clearing functions without registering any of them. The agency argues this deprived investors of critical protections such as proper disclosures, inspections, and safeguards against conflicts of interest.

It goes beyond this too.

In July, it challenged the Federal Deposit Insurance Corporation (FDIC) for allegedly trying to push crypto firms out of banking. In Oregon, it is contesting the state’s attempt to enforce its own crypto rules, arguing that only federal regulators have that authority.

Coinbase says these cases are about forcing real regulatory clarity for the crypto industry.

A New Dawn for Crypto

But things have shifted dramatically under President Trump’s second term. With Chairman Paul Atkins now leading the SEC, the agency has launched Project Crypto – an initiative to draft clear, simple rules and bring digital asset activity back onshore.

Atkins has made it clear that most crypto assets should not be treated as securities, and even where they are, the rules will be rewritten to encourage innovation, not punish it.

Backed by the America First Policy Institute and embraced by industry leaders, the new SEC has signaled a complete break from Gensler’s crackdown era – positioning the U.S. to become the global capital of crypto.

The Smarter Web Company, the United Kingdom’s largest corporate Bitcoin holder, is considering acquiring struggling competitors to expand its treasury, CEO Andrew Webley said.

Webley told the Financial Times that he would “certainly consider” buying out competitors to acquire their Bitcoin (BTC) at a discount.

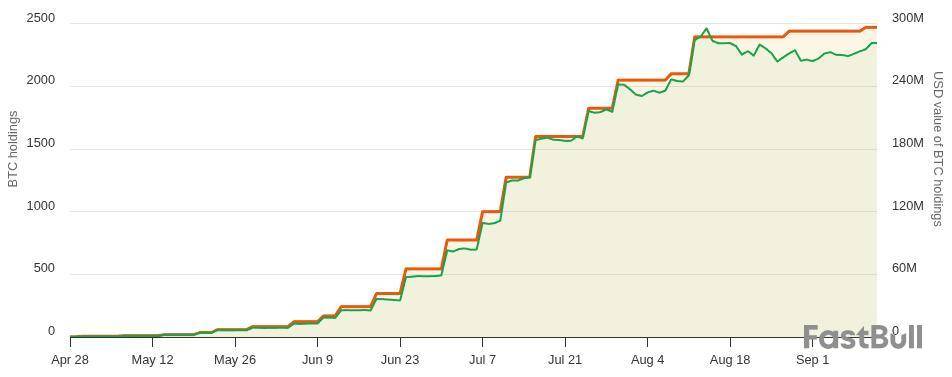

According to BitcoinTreasuries.NET data, The Smarter Web Company is the world’s 25th biggest and the UK’s top corporate Bitcoin treasury. It currently holds 2,470 BTC worth nearly $275 million.

The Smarter Web Company’s CEO also said the company aspires to enter the FTSE 100 — the UK’s top 100 listed companies index. He also noted that the firm changing its name is “inevitable” but said that he needs “to do it properly.”

Alex Obchakevich, the founder of Obchakevich Research, told Cointelegraph that “buying the assets of bankrupt crypto companies often promises discounts, but the reality is actually much tougher than everyone thinks.”

Obchakevich cited the bankruptcies of crypto exchange FTX and crypto lender Celsius. He explained that while initially discounts reached 60% to 70%, “after deducting liabilities liquidated in bankruptcy, encumbrances removed by the court and taxes, the net discount drops to 20–50%.”

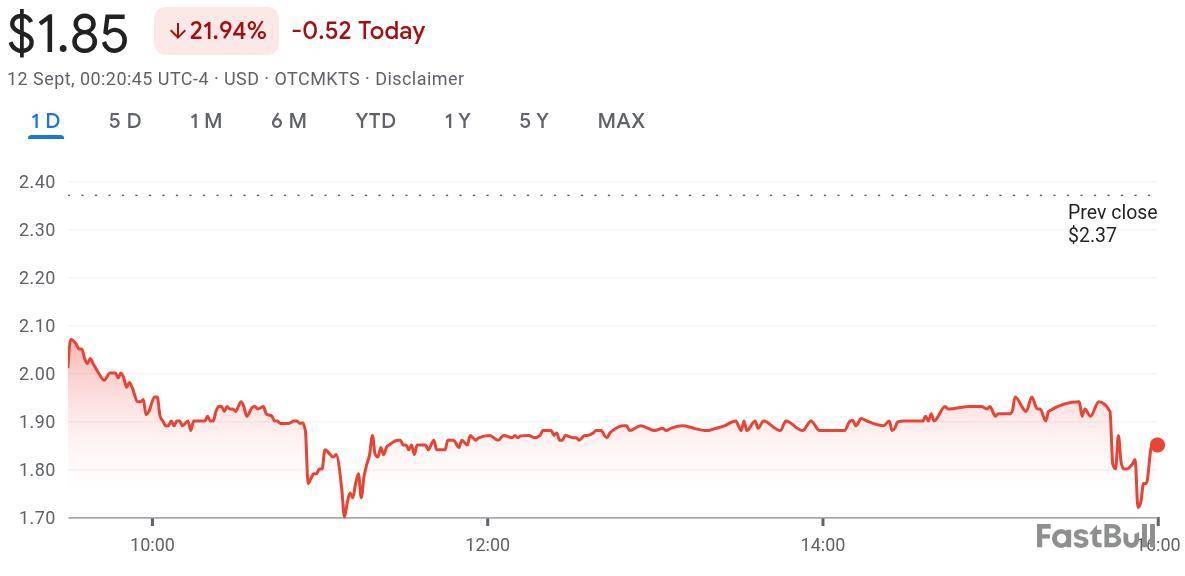

Webley’s comments came after Smarter Web’s stock fell nearly 22% on Friday, dropping from $2.01 at the open to $1.85 at the time of writing. The decline came despite BTC gaining more than 1% over the past 24 hours.

Over the last month, Bitcoin also lost over 4% of its value, while The Smarter Web Company’s price fell by around 35.5%.

Smarter Web’s price correction also comes after the UK allowed retail investors to access crypto exchange-traded notes (cETNs) in early August, with the change taking effect from Oct. 8. This provides an alternative to investing in crypto treasury companies, which were previously the most accessible regulated vehicle for getting exposure to digital assets in the UK.

Profiting from the failure of competitors

Webley’s comments about acquiring competitors follow reports that Bitcoin treasuries, especially new and smaller ones, are likely to encounter trouble. Coinbase head of research David Duong and researcher Colin Basco recently said that crypto-buying public companies are entering a “player vs player” stage that will see firms competing harder for investor money.

They said that “strategically positioned players will thrive” and supercharge the crypto industry with their capital flow. Also, analysts said that this market segment is quickly becoming oversaturated and that many crypto treasuries will not survive in the long term.

Josip Rupena, CEO of lending platform Milo and a former Goldman Sachs analyst, told Cointelegraph at the end of last month that crypto treasury companies mirror the risk of collateralized debt obligations, which played a key role in the 2008 financial crisis.

“There’s this aspect where people take what is a pretty sound product, a mortgage back in the day or Bitcoin and other digital assets today, for example, and they start to engineer them, taking them down a direction where the investor is unsure about the exposure they’re getting,” he said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up