Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key takeaways:

Solana’s DeFi dominance and growing fees sustain network demand, boosting investors’ long-term confidence.

Institutional investors’ interest in SOL futures, ETP exposure and staking yield add to SOL’s resilience.

Solana’s native token SOL (SOL) dropped 15.5% since reaching $209.80 on Thursday, its highest price in more than six months. The pullback raised concerns that a double top formation might signal a bearish reversal. Yet, four key indicators suggest the opposit, and Solana may soon retest the $200 level, contradicting short-term trader pessimism.

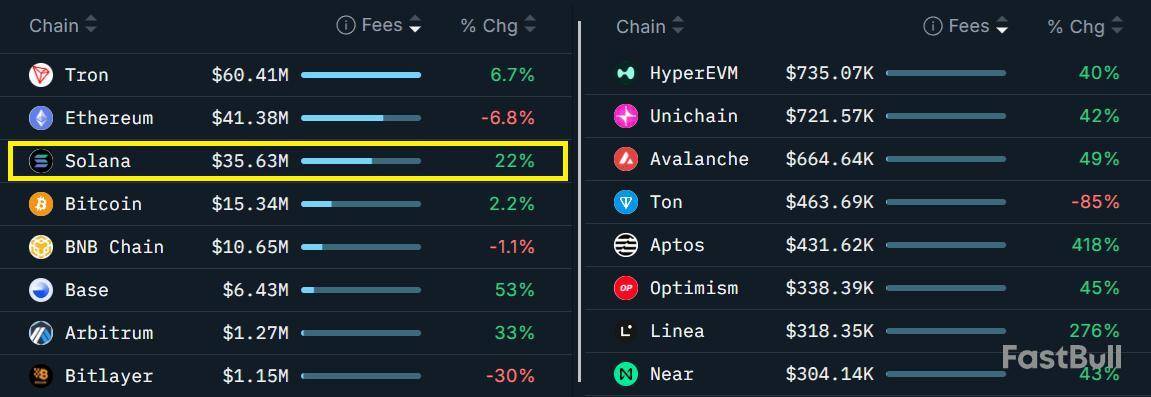

Solana has consolidated its role as the second-largest decentralized exchange (DEX) ecosystem, recording $111.5 billion in 30-day volumes. While Ethereum remains dominant, Solana outpaced the combined Ethereum layer-2 networks, which generated $93.1 billion. BNB Chain trailed with $60 billion, according to DefiLlama.

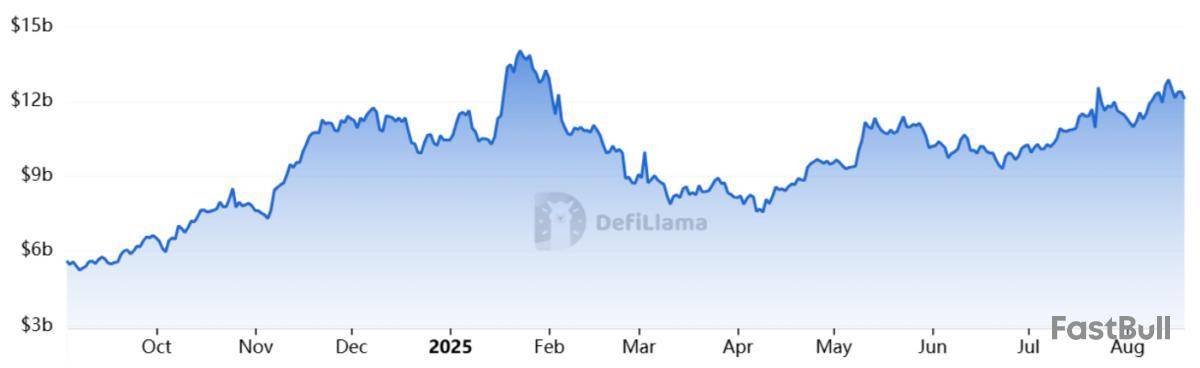

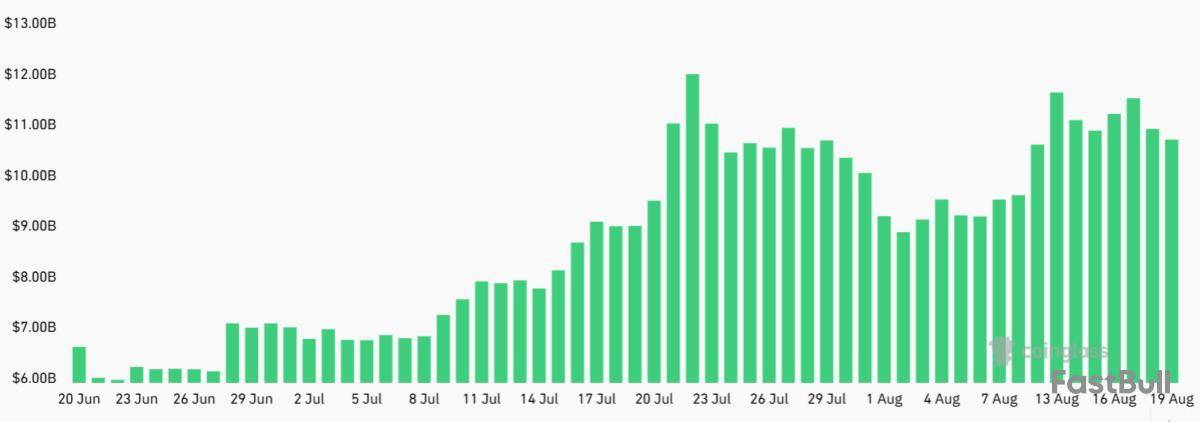

The total value locked (TVL) on Solana reached $12.1 billion this week, up 20% in two months, further securing its vice-leadership position over BNB Chain at $7.8 billion. Several decentralized applications (DApps) such as Kamino, Jito, Jupiter, Sanctum, Raydium, and Marinade each surpassed $2 billion in TVL. Sustained activity reinforces SOL demand, as transaction fees are essential to maintaining native staking yields.

Network fees highlight this dynamic. Solana generated $35.6 million over 30 days, a 22% increase from the prior month. Ethereum led with $41.4 million but declined 7% in the same period. Solana’s advantage comes from its low fees and frictionless user experience, eliminating reliance on bridges and complex layer-2 solutions.

Solana ranking third in network fees is notable, considering Ethereum maintains a far larger smart contract deposit base. Solana’s success is not easily replicable, since validators demand higher hardware capacity and capital commitment, making the network more robust than competitors.

Solana institutional participation expands in futures and exchange-traded products

Open interest on SOL futures climbed to $10.7 billion, up from $6.9 billion two months ago. This now exceeds XRP futures, despite XRP having an 81% larger market capitalization. The growth signals rising institutional participation, a positive factor for long-term adoption.

Further evidence of institutional demand comes from $2.8 billion in Solana exchange-traded futures and products (ETF / ETP). The 7.3% native staking yield could drive strong demand once Solana spot ETFs launch in the United States. Bloomberg analysts project a 90% or greater likelihood of US Securities and Exchange Commission approval by year-end.

The retracement from $209.80 sparked fears of a bearish double top. However, Solana’s leadership in DEX volumes, TVL expansion, accelerating fee growth, and mounting institutional exposure collectively argue otherwise. Rather than confirming a bearish shift, these drivers support a renewed push toward $200, validating the hypothesis that traders may have turned bearish too soon.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

Happy Tuesday, and welcome to The Daily.U.S. spot Ethereum ETFs now hold over 5% of ETH’s current supply, while corporate treasuries continue accumulating: SharpLink added $667 million in ETH, KindlyMD began a $679 million bitcoin buildout, and Thumzup — backed by Donald Trump Jr. — is eyeing a DOGE and LTC miner.

Stablecoins are gaining momentum. Wyoming launched a state-backed stablecoin across seven blockchains, and Bullish settled a $1.15 billion IPO using stablecoins.

In policy and politics, Illinois passed new crypto oversight laws, and Sen. Tim Scott is pushing legislation ahead of a key September deadline — blaming Sen. Elizabeth Warren for holding things up. Meanwhile, Tether hired former White House crypto lead Bo Hines as U.S. strategy advisor. Elsewhere: Bernstein analysts now expect the crypto bull market to run through 2027. MetaMask added support for TRON, Robinhood is rolling out prediction markets via Kalshi, and Valantis acquired the liquid staking platform StakedHYPE.

P.S. I also write The Funding" href="https://u22280551.ct.sendgrid.net/ls/click?upn=u001.ihhpQ9ZFh9w4doolsiHJ1bnwCOXhXmIr0ufyEph-2FiXKRpt3D-2FGO9KMe7ZYqWU0-2Bmjhk3FFIx5UUvc-2FXfXRgY6-2FCEm9GM9bIzs0Zwq72PCoOte-2FQAzPmSzQZMzefYE5E7VF-2FWMpcCP89lK7xtvKH596t6M-2BrJOK3zq2P4TCjAW3x3naojpp5UfRWQ2aiJF6pmKYw6P865hSD9oj-2BF3szhzUBpoPhChz33UfKZIJW8dwD8jzlXsv0eJN4uRL8kTVX9HWDgwJXy8SJTF7TerQu79x857iD9J328BBMbD8PT6UdJKoJnf53-2F1Ll0tZdETf72zogpqTwwM25Vs7hfvublRg-3D-3Dg385_2MWE3dlBbANdgWtAj3IpYnqwRWJcsDsILBDY72466c9ow2g5F3NLlFhlKmcReybdho1W-2B-2B4ED4L9HG5uNc9gMN1Cxp1CDay-2Fg36jzU20XldFDis9uTlefUKjTPQcA5iV0bA7A4-2Fme-2BUBZQ8Vaiaamj4hr40icMJm-2BtAYSbD27ADC9-2B5RelX1q790tmTG2nq8c8PdLAj0BrUIXV4A0krFr-2FxWWkGxdNsemZ2-2F4NCoF7Ss5CXVFGp2EWsAF9o2rMNDrNd-2BOBlKOfrImTX6eOyZIM3zBISPF68Gw9VJjmC8yQqgEEoxaAnXatAoY2yKP05akt5c-2B10uQbPzQz-2FC9KzmkL-2BRhtW-2BQpyNpm6t9lAvIZFdwz427BOcfLR7mulnTsxyRUSnUg9zvBY7KK3LWYFe0E8wDRYHeG5aGTGNqHQiyz1SJHmE9C-2BbM5nBfOsbiMJ0R9OAOD-2FcTxXOBCf-2Bkw3hC3SG6lT8-2Bwh2aC2IV0mPHJhQBhrkDurav37RBFuqeh-2F6eGvBj2XUD5Jx-2F-2FVur5XCRovwLPwDyRtg3i0WXlKD1TXCyeSFRynqy5eE7kKL2-2FFCFkJuuw2-2FE-2Fg-2BU7p4UjYXbiTtWGO-2FvZQ0xGCkDESXHRAyl6Fe-2BidID3faULfPkb4yRSMIVx40kjExqx4vjWoZKG334fOkQOjbSSp-2B9QLtb-2F1pZ2OiFjhRAneHwGmCGHHZJj4T-2BnkXyNTLFGp3DFdwzxIp-2FN-2BleZmYSuopmm-2F-2BTzHiZX4lEPPHc3Tsxc6Fypg5BycKj0BccpobajaKI5wkz1rqWrlbTAmnQfbaZgloZaV2i70BfiZZtgjdXLVXEYK4r6FgBB4UY5n9ktrlO9n4kifAfap5jKms9vAt-2BihTPOM-2FmHKPu7JSP2zh4AmeY4P-2BXud4s-2FIDS35TfVlTHQQS1SCwkFot0N0z8CZtr-2B5sXcVs-2BIUVJ98B1a0UPH5VskSv-2B6kfn5E3bF-2FzZ-2BG40v3y1Fe1-2F-2BBELy0-2FZGdJcD2F-2BPd0fo5OhbIRlQeoAFMt4bmlKVtrhUisQUjtiUPYYGL6RQ-3D-3D" target="_blank" rel="noopener" data-saferedirecturl="https://www.google.com/url?hl=en&q=https://u22280551.ct.sendgrid.net/ls/click?upn%3Du001.ihhpQ9ZFh9w4doolsiHJ1bnwCOXhXmIr0ufyEph-2FiXKRpt3D-2FGO9KMe7ZYqWU0-2Bmjhk3FFIx5UUvc-2FXfXRgY6-2FCEm9GM9bIzs0Zwq72PCoOte-2FQAzPmSzQZMzefYE5E7VF-2FWMpcCP89lK7xtvKH596t6M-2BrJOK3zq2P4TCjAW3x3naojpp5UfRWQ2aiJF6pmKYw6P865hSD9oj-2BF3szhzUBpoPhChz33UfKZIJW8dwD8jzlXsv0eJN4uRL8kTVX9HWDgwJXy8SJTF7TerQu79x857iD9J328BBMbD8PT6UdJKoJnf53-2F1Ll0tZdETf72zogpqTwwM25Vs7hfvublRg-3D-3Dg385_2MWE3dlBbANdgWtAj3IpYnqwRWJcsDsILBDY72466c9ow2g5F3NLlFhlKmcReybdho1W-2B-2B4ED4L9HG5uNc9gMN1Cxp1CDay-2Fg36jzU20XldFDis9uTlefUKjTPQcA5iV0bA7A4-2Fme-2BUBZQ8Vaiaamj4hr40icMJm-2BtAYSbD27ADC9-2B5RelX1q790tmTG2nq8c8PdLAj0BrUIXV4A0krFr-2FxWWkGxdNsemZ2-2F4NCoF7Ss5CXVFGp2EWsAF9o2rMNDrNd-2BOBlKOfrImTX6eOyZIM3zBISPF68Gw9VJjmC8yQqgEEoxaAnXatAoY2yKP05akt5c-2B10uQbPzQz-2FC9KzmkL-2BRhtW-2BQpyNpm6t9lAvIZFdwz427BOcfLR7mulnTsxyRUSnUg9zvBY7KK3LWYFe0E8wDRYHeG5aGTGNqHQiyz1SJHmE9C-2BbM5nBfOsbiMJ0R9OAOD-2FcTxXOBCf-2Bkw3hC3SG6lT8-2Bwh2aC2IV0mPHJhQBhrkDurav37RBFuqeh-2F6eGvBj2XUD5Jx-2F-2FVur5XCRovwLPwDyRtg3i0WXlKD1TXCyeSFRynqy5eE7kKL2-2FFCFkJuuw2-2FE-2Fg-2BU7p4UjYXbiTtWGO-2FvZQ0xGCkDESXHRAyl6Fe-2BidID3faULfPkb4yRSMIVx40kjExqx4vjWoZKG334fOkQOjbSSp-2B9QLtb-2F1pZ2OiFjhRAneHwGmCGHHZJj4T-2BnkXyNTLFGp3DFdwzxIp-2FN-2BleZmYSuopmm-2F-2BTzHiZX4lEPPHc3Tsxc6Fypg5BycKj0BccpobajaKI5wkz1rqWrlbTAmnQfbaZgloZaV2i70BfiZZtgjdXLVXEYK4r6FgBB4UY5n9ktrlO9n4kifAfap5jKms9vAt-2BihTPOM-2FmHKPu7JSP2zh4AmeY4P-2BXud4s-2FIDS35TfVlTHQQS1SCwkFot0N0z8CZtr-2B5sXcVs-2BIUVJ98B1a0UPH5VskSv-2B6kfn5E3bF-2FzZ-2BG40v3y1Fe1-2F-2BBELy0-2FZGdJcD2F-2BPd0fo5OhbIRlQeoAFMt4bmlKVtrhUisQUjtiUPYYGL6RQ-3D-3D&source=gmail&ust=1755720470509000&usg=AOvVaw0gU5TEvprOQnzcvZ_HLh3C">P.S. I also write The Funding, a biweekly newsletter covering crypto VC trends. The latest edition explored" href="https://u22280551.ct.sendgrid.net/ls/click?upn=u001.ihhpQ9ZFh9w4doolsiHJ1bnwCOXhXmIr0ufyEph-2FiXKA7d76mnaLyjnLFVQXju-2BCcZdlOo-2BZRMYBILh5wqPPcmiLn-2FbbAezLuY-2FgKak7rhuw-2B9sN5RbXlOEu5imOsDr3ZUSqHJMTuLIDqblcKKLIrljIGcx1bKBmcjw8Ni1ujBtX-2FOF40TlLiQFJ54XuwowIqT5foMA-2B8ycelBMvkCxzpGqi4INQdnCi5Y96rV1yblg-3DFmuP_2MWE3dlBbANdgWtAj3IpYnqwRWJcsDsILBDY72466c9ow2g5F3NLlFhlKmcReybdho1W-2B-2B4ED4L9HG5uNc9gMN1Cxp1CDay-2Fg36jzU20XldFDis9uTlefUKjTPQcA5iV0bA7A4-2Fme-2BUBZQ8Vaiaamj4hr40icMJm-2BtAYSbD27ADC9-2B5RelX1q790tmTG2nq8c8PdLAj0BrUIXV4A0krFr-2FxWWkGxdNsemZ2-2F4NCoF7Ss5CXVFGp2EWsAF9o2rMNDrNd-2BOBlKOfrImTX6eOyZIM3zBISPF68Gw9VJjmC8yQqgEEoxaAnXatAoY2yKP05akt5c-2B10uQbPzQz-2FC9KzmkL-2BRhtW-2BQpyNpm6t9lAvIZFdwz427BOcfLR7mulnTsxyRUSnUg9zvBY7KK3LWYFe0E8wDRYHeG5aGTGNqHQiyz1SJHmE9C-2BbM5nBfOsbiMJ0R9OAOD-2FcTxXOBCf-2Bkw3hC3SG6lT8-2Bwh2aC2IV0mPHJhQBhrkDurav37RBFuqeh-2F6eGvBj2XUD5Jx-2F-2FVur5XCRovwLPwDyRtg3i0WXlKD1TXCyeSFRynqy5eE7kKL2-2FFCFkJuuw2-2FE-2Fg-2BU7p4UjYXbiTtWGO-2FvZQ0xGCkDESXHRAyl6Fe-2BidID3faULfPkb4yRSMIVx40kjExqx4vjWoZKG334fOkQOjbSSp-2B9QLtb-2F1pZ2OiFjhRAneHwGmCGHHZJj4T-2BnkXyNTLFGp3DFdwzxIp-2FN-2BleZmYSuopmm-2F-2BTzHiZX4lEPPHc3Tsxc6Fypg5BycKj0BccpobajaKI5wkz1rqWrlbTAmnQfbaZgloZaV2i70BfiZZtgjdXLVXEYK4sxF48BNgf3w5PAfy6Gp2iAbwDjSZa1T1smvFLrcqCePi-2BBF810rLMtliJoFb5BODfQ-2BbGOVEn6s5VvbnmJSlCYpSuVCaP4AivDe-2F7qB4Il3SeR5Vp9esq-2FMdKLpCBw3T3ILo6hzRAdzM7L9yKwx7PTQRVyX-2FHO92fZTCOuS4Knhn6Tx3gMbc3Luu8SI7QsRzIy4QvJ876iBKqe501ymBzg-3D-3D" target="_blank" rel="noopener" data-saferedirecturl="https://www.google.com/url?hl=en&q=https://u22280551.ct.sendgrid.net/ls/click?upn%3Du001.ihhpQ9ZFh9w4doolsiHJ1bnwCOXhXmIr0ufyEph-2FiXKA7d76mnaLyjnLFVQXju-2BCcZdlOo-2BZRMYBILh5wqPPcmiLn-2FbbAezLuY-2FgKak7rhuw-2B9sN5RbXlOEu5imOsDr3ZUSqHJMTuLIDqblcKKLIrljIGcx1bKBmcjw8Ni1ujBtX-2FOF40TlLiQFJ54XuwowIqT5foMA-2B8ycelBMvkCxzpGqi4INQdnCi5Y96rV1yblg-3DFmuP_2MWE3dlBbANdgWtAj3IpYnqwRWJcsDsILBDY72466c9ow2g5F3NLlFhlKmcReybdho1W-2B-2B4ED4L9HG5uNc9gMN1Cxp1CDay-2Fg36jzU20XldFDis9uTlefUKjTPQcA5iV0bA7A4-2Fme-2BUBZQ8Vaiaamj4hr40icMJm-2BtAYSbD27ADC9-2B5RelX1q790tmTG2nq8c8PdLAj0BrUIXV4A0krFr-2FxWWkGxdNsemZ2-2F4NCoF7Ss5CXVFGp2EWsAF9o2rMNDrNd-2BOBlKOfrImTX6eOyZIM3zBISPF68Gw9VJjmC8yQqgEEoxaAnXatAoY2yKP05akt5c-2B10uQbPzQz-2FC9KzmkL-2BRhtW-2BQpyNpm6t9lAvIZFdwz427BOcfLR7mulnTsxyRUSnUg9zvBY7KK3LWYFe0E8wDRYHeG5aGTGNqHQiyz1SJHmE9C-2BbM5nBfOsbiMJ0R9OAOD-2FcTxXOBCf-2Bkw3hC3SG6lT8-2Bwh2aC2IV0mPHJhQBhrkDurav37RBFuqeh-2F6eGvBj2XUD5Jx-2F-2FVur5XCRovwLPwDyRtg3i0WXlKD1TXCyeSFRynqy5eE7kKL2-2FFCFkJuuw2-2FE-2Fg-2BU7p4UjYXbiTtWGO-2FvZQ0xGCkDESXHRAyl6Fe-2BidID3faULfPkb4yRSMIVx40kjExqx4vjWoZKG334fOkQOjbSSp-2B9QLtb-2F1pZ2OiFjhRAneHwGmCGHHZJj4T-2BnkXyNTLFGp3DFdwzxIp-2FN-2BleZmYSuopmm-2F-2BTzHiZX4lEPPHc3Tsxc6Fypg5BycKj0BccpobajaKI5wkz1rqWrlbTAmnQfbaZgloZaV2i70BfiZZtgjdXLVXEYK4sxF48BNgf3w5PAfy6Gp2iAbwDjSZa1T1smvFLrcqCePi-2BBF810rLMtliJoFb5BODfQ-2BbGOVEn6s5VvbnmJSlCYpSuVCaP4AivDe-2F7qB4Il3SeR5Vp9esq-2FMdKLpCBw3T3ILo6hzRAdzM7L9yKwx7PTQRVyX-2FHO92fZTCOuS4Knhn6Tx3gMbc3Luu8SI7QsRzIy4QvJ876iBKqe501ymBzg-3D-3D&source=gmail&ust=1755720470509000&usg=AOvVaw1qQwS9KI_2aC7IWUfLatL4">The latest edition explored whether massive treasury deals are hurting early-stage startup funding. Subscribe here" href="https://u22280551.ct.sendgrid.net/ls/click?upn=u001.ihhpQ9ZFh9w4doolsiHJ1bnwCOXhXmIr0ufyEph-2FiXKRpt3D-2FGO9KMe7ZYqWU0-2Bmjhk3FFIx5UUvc-2FXfXRgY6-2FCEm9GM9bIzs0Zwq72PCoOte-2FQAzPmSzQZMzefYE5E7VF-2FWMpcCP89lK7xtvKH596t6M-2BrJOK3zq2P4TCjAW3x3naojpp5UfRWQ2aiJF6pmKYw6P865hSD9oj-2BF3szhzUBpoPhChz33UfKZIJW8dwD8jzlXsv0eJN4uRL8kTVX9HWDgwJXy8SJTF7TerQu79x857iD9J328BBMbD8PT6UdJKoJnf53-2F1Ll0tZdETf72zogpqTwwM25Vs7hfvublRg-3D-3DMR2g_2MWE3dlBbANdgWtAj3IpYnqwRWJcsDsILBDY72466c9ow2g5F3NLlFhlKmcReybdho1W-2B-2B4ED4L9HG5uNc9gMN1Cxp1CDay-2Fg36jzU20XldFDis9uTlefUKjTPQcA5iV0bA7A4-2Fme-2BUBZQ8Vaiaamj4hr40icMJm-2BtAYSbD27ADC9-2B5RelX1q790tmTG2nq8c8PdLAj0BrUIXV4A0krFr-2FxWWkGxdNsemZ2-2F4NCoF7Ss5CXVFGp2EWsAF9o2rMNDrNd-2BOBlKOfrImTX6eOyZIM3zBISPF68Gw9VJjmC8yQqgEEoxaAnXatAoY2yKP05akt5c-2B10uQbPzQz-2FC9KzmkL-2BRhtW-2BQpyNpm6t9lAvIZFdwz427BOcfLR7mulnTsxyRUSnUg9zvBY7KK3LWYFe0E8wDRYHeG5aGTGNqHQiyz1SJHmE9C-2BbM5nBfOsbiMJ0R9OAOD-2FcTxXOBCf-2Bkw3hC3SG6lT8-2Bwh2aC2IV0mPHJhQBhrkDurav37RBFuqeh-2F6eGvBj2XUD5Jx-2F-2FVur5XCRovwLPwDyRtg3i0WXlKD1TXCyeSFRynqy5eE7kKL2-2FFCFkJuuw2-2FE-2Fg-2BU7p4UjYXbiTtWGO-2FvZQ0xGCkDESXHRAyl6Fe-2BidID3faULfPkb4yRSMIVx40kjExqx4vjWoZKG334fOkQOjbSSp-2B9QLtb-2F1pZ2OiFjhRAneHwGmCGHHZJj4T-2BnkXyNTLFGp3DFdwzxIp-2FN-2BleZmYSuopmm-2F-2BTzHiZX4lEPPHc3Tsxc6Fypg5BycKj0BccpobajaKI5wkz1rqWrlbTAmnQfbaZgloZaV2i70BfiZZtgjdXLVXEYK4LDi6WXv1NS7snnc8Z-2B7RltPDx5bCEWTs9QAB6MauC5adpJwuJYpQ2WtEBodzfG2Rr-2F3qWwVcyZOjEho5iIk-2Fzohh5L2IHJIb-2Bz-2BMLCLtdqtYrWxLYOY0QaZKGT3oc-2Feg4q8rBJy5ohgZ2xtKPuTcvSf46LHApRp5G5-2F-2Bd8W7yUi43ySy4RN3TImevcxqQYC9ynPkxd3hn-2BQjKvXZ9foJYg-3D-3D" target="_blank" rel="noopener" data-saferedirecturl="https://www.google.com/url?hl=en&q=https://u22280551.ct.sendgrid.net/ls/click?upn%3Du001.ihhpQ9ZFh9w4doolsiHJ1bnwCOXhXmIr0ufyEph-2FiXKRpt3D-2FGO9KMe7ZYqWU0-2Bmjhk3FFIx5UUvc-2FXfXRgY6-2FCEm9GM9bIzs0Zwq72PCoOte-2FQAzPmSzQZMzefYE5E7VF-2FWMpcCP89lK7xtvKH596t6M-2BrJOK3zq2P4TCjAW3x3naojpp5UfRWQ2aiJF6pmKYw6P865hSD9oj-2BF3szhzUBpoPhChz33UfKZIJW8dwD8jzlXsv0eJN4uRL8kTVX9HWDgwJXy8SJTF7TerQu79x857iD9J328BBMbD8PT6UdJKoJnf53-2F1Ll0tZdETf72zogpqTwwM25Vs7hfvublRg-3D-3DMR2g_2MWE3dlBbANdgWtAj3IpYnqwRWJcsDsILBDY72466c9ow2g5F3NLlFhlKmcReybdho1W-2B-2B4ED4L9HG5uNc9gMN1Cxp1CDay-2Fg36jzU20XldFDis9uTlefUKjTPQcA5iV0bA7A4-2Fme-2BUBZQ8Vaiaamj4hr40icMJm-2BtAYSbD27ADC9-2B5RelX1q790tmTG2nq8c8PdLAj0BrUIXV4A0krFr-2FxWWkGxdNsemZ2-2F4NCoF7Ss5CXVFGp2EWsAF9o2rMNDrNd-2BOBlKOfrImTX6eOyZIM3zBISPF68Gw9VJjmC8yQqgEEoxaAnXatAoY2yKP05akt5c-2B10uQbPzQz-2FC9KzmkL-2BRhtW-2BQpyNpm6t9lAvIZFdwz427BOcfLR7mulnTsxyRUSnUg9zvBY7KK3LWYFe0E8wDRYHeG5aGTGNqHQiyz1SJHmE9C-2BbM5nBfOsbiMJ0R9OAOD-2FcTxXOBCf-2Bkw3hC3SG6lT8-2Bwh2aC2IV0mPHJhQBhrkDurav37RBFuqeh-2F6eGvBj2XUD5Jx-2F-2FVur5XCRovwLPwDyRtg3i0WXlKD1TXCyeSFRynqy5eE7kKL2-2FFCFkJuuw2-2FE-2Fg-2BU7p4UjYXbiTtWGO-2FvZQ0xGCkDESXHRAyl6Fe-2BidID3faULfPkb4yRSMIVx40kjExqx4vjWoZKG334fOkQOjbSSp-2B9QLtb-2F1pZ2OiFjhRAneHwGmCGHHZJj4T-2BnkXyNTLFGp3DFdwzxIp-2FN-2BleZmYSuopmm-2F-2BTzHiZX4lEPPHc3Tsxc6Fypg5BycKj0BccpobajaKI5wkz1rqWrlbTAmnQfbaZgloZaV2i70BfiZZtgjdXLVXEYK4LDi6WXv1NS7snnc8Z-2B7RltPDx5bCEWTs9QAB6MauC5adpJwuJYpQ2WtEBodzfG2Rr-2F3qWwVcyZOjEho5iIk-2Fzohh5L2IHJIb-2Bz-2BMLCLtdqtYrWxLYOY0QaZKGT3oc-2Feg4q8rBJy5ohgZ2xtKPuTcvSf46LHApRp5G5-2F-2Bd8W7yUi43ySy4RN3TImevcxqQYC9ynPkxd3hn-2BQjKvXZ9foJYg-3D-3D&source=gmail&ust=1755720470509000&usg=AOvVaw2nqRWJqVFWdoIKRkevnGaj">Subscribe here.

Let’s get started.

US spot Ethereum ETFs now hold over 5% of ETH supply

U.S.-listed spot Ethereum exchange-traded funds have crossed a new milestone: they now hold 5.08% of the current ETH supply, or 6.3 million ETH worth around $26.7 billion, according to The Block’s data dashboard.

Despite $196.6 million in net outflows on Monday — the second-largest daily outflow since launch — these ETFs have still seen net inflows of $3.7 billion over the past nine sessions. Last week alone, they brought in $2.85 billion, up from $325.8 million the week prior.

Meanwhile, Coinbase estimates that crypto treasuries (or DATs) now control over 2% of the ETH supply, signaling deepening institutional conviction in Ethereum’s asset value.

Sen. Tim Scott blames Sen. Elizabeth Warren for blocking crypto bill progress

Sen. Tim Scott is pushing to finalize a comprehensive crypto market structure bill by Sept. 30, but says Sen. Elizabeth Warren is “standing in the way” of Democratic support.

Speaking at the Wyoming Blockchain Symposium, Scott said he’s targeting 12–18 Democratic votes but alleged that Warren — a vocal crypto skeptic — is discouraging her colleagues from joining.

Scott’s bill, co-authored with Sens. Cynthia Lummis, Bill Hagerty, and Bernie Moreno, follows a similar market structure bill passed in the House last month with 78 Democratic votes. While stablecoin legislation has advanced more smoothly, market structure is proving more contentious.

Warren has criticized the proposal as an “industry handout,” arguing it would give crypto firms government blessings while weakening financial safeguards.

Trump Jr.-backed Thumzup is acquiring a Dogecoin and Litecoin miner in an all-stock deal

Social media marketing company Thumzup, which recently pivoted into a crypto treasury strategy, is acquiring Dogehash Technologies in an all-stock deal. Dogehash is an industrial-scale miner focused on Dogecoin and Litecoin.

The acquisition will see Dogehash shareholders receive 30.7 million shares of Thumzup, with the combined firm to be renamed Dogehash.

Technologies Holdings and listed on Nasdaq under “XDOG.” The deal is expected to close by year-end.

Thumzup raised $50 million in July via a common stock offering to acquire crypto assets, including DOGE, BTC, ETH, LTC, and XRP, and invest in mining. The company counts Donald Trump Jr. as a notable shareholder, deepening the Trump family’s web of connections to the crypto industry.

Bernstein sees crypto bull run extending through 2027

Bernstein analysts reiterated that the current crypto bull market could stretch into 2027 — beyond the traditional four-year cycle — driven by U.S. policy momentum, institutional support, and broader participation beyond bitcoin.

In a new note, the firm raised or maintained its price targets on Coinbase ($510), Robinhood ($160), and Circle ($230), citing surging trading volumes, product expansion, and infrastructure positioning.

“We expect a long crypto bull market, continuing the surge into 2026 and potentially peaking in 2027,” the analysts wrote.

They forecast that bitcoin could reach $150K–$200K within the next year but emphasized the coming cycle will broaden to include Ethereum, Solana, and DeFi tokens — fueling inflows into trading platforms and stablecoin issuers.

Valantis acquires Hyperliquid-based LST protocol StakedHYPE

Valantis, a modular DEX protocol, has acquired StakedHYPE, the second-largest liquid staking platform on Hyperliquid’s HyperEVM chain, as it doubles down on LST-focused infrastructure.

The deal gives Valantis control of StakedHYPE’s development and scaling, with Thunderhead’s (the entity behind StakedHYPE) founder, Addison Spiegel, joining as an advisor.

StakedHYPE currently holds over $200 million in TVL, and Valantis plans to integrate it deeply across its stack. Valantis says this vertical integration will deepen liquidity and efficiency in LST trading.

While Valantis is VC-backed, Thunderhead has been profitable and bootstrapped since launch. The full deal has closed, but financial terms remain undisclosed.

In the next 24 hours

The Federal Reserve releases minutes from its July policy meeting on Tuesday.

Internationally, the U.K. reports July consumer price index (CPI) inflation data.

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

A portfolio of over 280 Bitcoin-related domain names, some registered just after the cryptocurrency’s launch in 2010, is on the auction block.

According to Lloyds Auctions, many domains in the lot were registered as early as 2010 and are now being offered as a single lot to bidders.

The collection spans core Bitcoin sectors including payments, custody, exchanges, education and infrastructure. Examples include BitcoinBlockchain.com, BitcoinWallets.com, BitcoinExchanges.com, BitcoinRemittances.com and BitcoinBooks.com.

The lot also features geographically targeted names such as JapanBitcoin.com, GermanyBitcoin.com, AfricaBitcoin.com and UnitedKingdomBitcoin.com.

While the origins of the registrations have not been disclosed, the early dates have fueled speculation that the names may be linked to the original Bitcoin developer community.

Lee Hames, chief operations officer at Lloyds Auctions, described the offering as “a full suite of digital assets that define the Bitcoin space online.” He added that the buyer “won’t just own names, they’ll own the language of Bitcoin’s digital economy.”

The sale follows the record $3 million auction of XBT.com in April of this year by Lloyds Auctions, an Australian auction house that handles a wide range of sales, including vehicles, real estate, collectibles, and digital assets.

Related: ENS token rises 10% as ENS Labs reveals 'Namechain’ Ethereum L2

Crypto names join the ranks of record domain sales

High-value domain sales have long been part of the internet economy, with names such as Voice.com selling for $30 million in 2019 and 360.com for $17 million in 2015. Short, highly-brandable .com addresses have consistently commanded premium prices from companies seeking visibility and authority online.

Crypto-related domains have followed a similar trajectory. In 2014, BTC.com was sold for around $1 million, while ETH.com changed hands for $2 million in 2017, and in 2018, Monaco rebranded as Crypto.com after acquiring the domain in a deal worth $10 million to 12 million.

More recently, NFTs.com sold for $15 million in 2022, while CryptoBank.com fetched $1.35 million the same year.

In 2025, .ai and .com domains have dominated top sales rankings, but crypto-related names remain active. The domain crypto.bot sold through Sedo for $250,000, while Lloyds’ $3 million auction of XBT.com in April set the latest benchmark for Bitcoin-related domains.

Web3 domains gain traction alongside traditional sales

Blockchain-based “Web3 domains” have emerged as another market corner. Unlike conventional domains leased through registrars, Web3 domains are recorded on blockchains and function as digital identifiers and wallet addresses.

The Ethereum Name Service (.eth) is the most widely used, though other providers such as Unstoppable Domains offer extensions like .crypto and .nft.

Some of these names have also fetched significant sums. Paradigm.eth changed hands in October 2021 for 420 ETH, or about $1.5 million. Other notable transactions include 000.eth for 300 ETH, or around $320,000 at the time of sale.

AI Eye: AI is good for employment says PWC — Ignore the AI doomers

The U.S. Federal Reserve's Michelle Bowman says the central bank is at a "crossroads" — one that will determine whether it leads in financial innovation or lags behind.

"We stand at a crossroads: we can either seize the opportunity to shape the future or risk being left behind," Bowman said on Tuesday in remarks before the Wyoming Blockchain Symposium. "By embracing innovation with a principled approach, we can define the course of history and fulfill our responsibility to promote the safety and soundness of the banking system and financial stability."

Bowman, the Fed's vice chair for supervision, spoke about the need for banks and regulators to be open to new technologies and depart from "an overly cautious mindset." Bowman was tapped by President Donald Trump to take on her new role at the central bank after serving as Fed governor since 2018.

Since her confirmation in June, the Fed has ended its program supervising banks involved in crypto and also removed "reputational risk" from bank examinations, which was viewed as a win against crypto debanking. In April, the central bank withdrew guidance that previously discouraged banks from participating in crypto and stablecoin activities.

Artificial intelligence and blockchain technology can be beneficial to the banking system, Bowman said Tuesday.

"Some bankers have expressed concerns about new technologies posing a threat to traditional business models and practices," Bowman said. "But the banking system is constantly evolving, and technology can change the banking system regardless of how banks and regulators choose to respond."

Within the Federal Reserve, Bowman said staff should hold a small amount of crypto to get a better understanding.

"I certainly wouldn't trust someone to teach me to ski if they'd never put on skis, regardless of how many books and articles they have read, or even wrote, about it," Bowman said. "We should consider whether limits on staff investment activities may be a barrier to recruiting and retaining examiners with the necessary expertise, and for existing staff to better understand the technology."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Neobank SoFi is tapping Bitcoin Lightning service Lightspark for parts of its upcoming international money transfer service, according to an announcement on Tuesday. The app will enable users to send funds abroad directly from the SoFi app, offering lower fees and faster delivery than typically associated with remittances.

Lightspark, the Bitcoin Lightning project led by former Facebook blockchain lead David Marcus, with provide its Universal Money Address protocol to enable seamless transactions across the open Lightning BTC payments network.

According to the announcement, this makes SoFi one of the first U.S. banks to offer a blockchain-powered remittances service. The move comes at a time when major institutions — from Bank of America to JPMorgan Chase look to blockchain as a potential solution for intra- and internal transfers.

SoFi’s service is expected to roll out next year and will be accessible directly on the SoFi app. It will be available first in Mexico, with additional countries to follow.

"By embedding this directly into SoFi’s app, we’re unlocking the value of blockchain technology, to give members faster, smarter, and more inclusive access to their money," SoFi CEO Anthony Noto said in a statement.

Similar to Stripe’s initial payments architecture, SoFi’s international money transfer service will convert U.S. dollars to Bitcoin, which will then find the path of least resistance across the Lightning network, before being instantaneously reconverted into a local currency and deposited into the ultimate recipient’s bank account. The announcement notes Lightspark boasts a “global network of partner banks and financial platforms.”

This is not SoFi’s first foray into crypto. In 2019, the neobank introduced crypto trading — a service that was later curtailed following the regulatory backlash amid the FTX collapse. The firm has since signaled it intends to reenter the sector, including offering staking and borrowing services.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

SkyBridge Capital Founder Anthony Scaramucci said his investment company plans to tokenize $300 million worth of the firm's assets on the Avalanche blockchain, according to a report from Fortune.

The firm will tokenize assets part of two different funds, the report said. Skybridge will tokenize assets from one fund that invests directly in cryptocurrencies like bitcoin, in addition to tokenizing assets from a second fund, which invests in both venture and crypto funds.

Avalanche, an alternative smart contract blockchain, is popular for real-world asset projects.

Scaramucci told Fortune that the amount of money the firm plans to tokenize makes up about 10% of SkyBridge Capital's assets under management. A former Goldman Sachs executive, Scaramucci also briefly worked for President Donald Trump.

SkyBridge's move into tokenization is a part of a larger movement of financial institutions, with both traditional and crypto native firms seeking to tokenize real-world assets like Treasury bills, credit, publicly traded stocks, mineral rights, and real estate. Tokenizing assets involves assigning easily traded and transferred digital tokens to real-world assets.

Scaramucci's involvement in crypto-related investments dates back at least as far as 2020, when the firm had invested as much as $182 million into bitcoin on behalf of its funds. Shortly after that news, the firm launched SkyBridge Bitcoin Fund LP in order to provide qualified investors with exposure to BTC.

The former Goldman exec has been a bitcoin bull for years, saying at one point BTC could hit $700,000. At one point, SkyBridge was closely linked to now-bankrupt exchange FTX.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up