Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

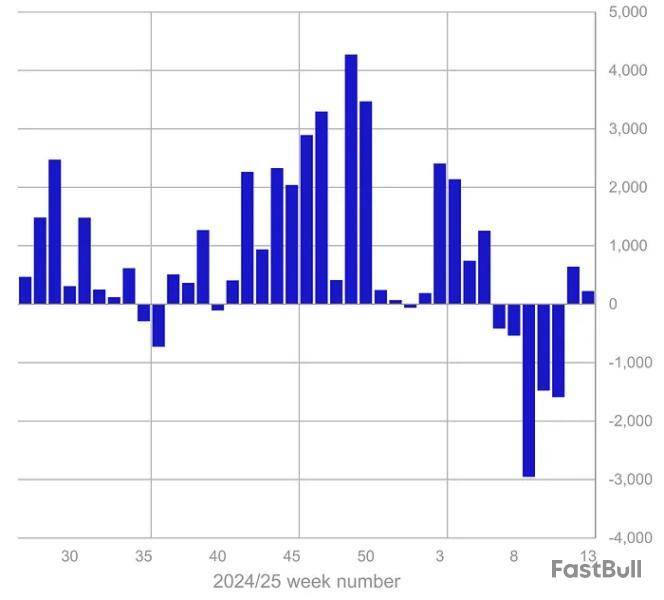

Cryptocurrency exchange-traded products (ETPs) continued to see modest inflows last week, extending a reversal from a record-breaking streak of outflows.

Global crypto ETPs posted another $226 million in inflows in the last trading week, adding to the prior week’s $644 million inflows, CoinShares reported on March 31.

Despite the two-week positive trend after a five-week outflow streak, total assets under management (AUM) continued to decline, dropping below $134 million by March 28.

Last week’s inflows suggest positive but cautious investor behavior amid core Personal Consumption Expenditures in the US coming in above expectations, CoinShares’ head of research James Butterfill said.

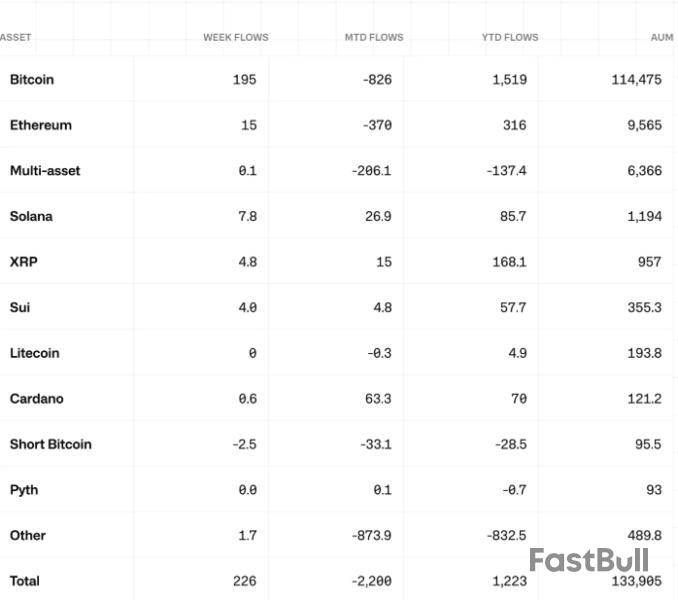

Bitcoin leads weekly inflows

Bitcoin investment products attracted the majority of inflows, totaling $195 million for the week, while short-BTC investment products saw outflows for the fourth consecutive week, totaling $2.5 million.

Altcoins, in aggregate, saw their first week of inflows totaling $33 million, following four consecutive weeks of outflows totaling $1.7 billion.

Among individual altcoins, Ether (ETH) saw $14.5 million in inflows. Solana (SOL), XRP (XRP) and Sui (SUI) followed with $7.8 million, $4.8 million and $4 million, respectively.

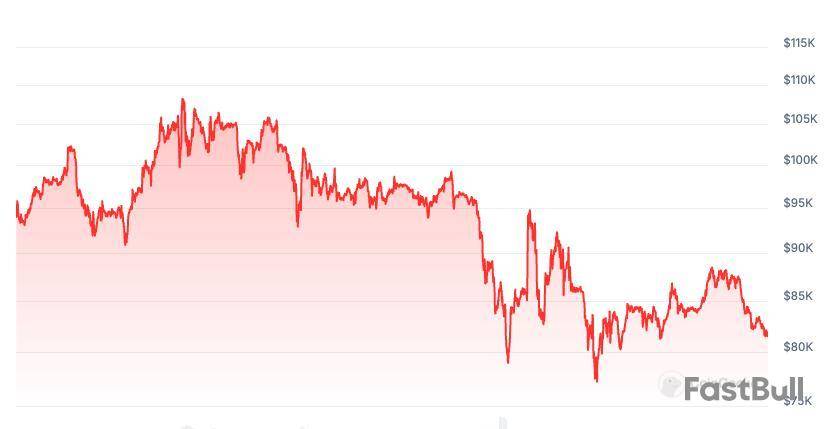

AUM drops to lowest level in 2025 amid price slump

Despite recent inflows, crypto ETPs have failed to trigger a reversal in terms of total AUM.

Since March 10, the total crypto ETP AUM dropped 5.7% from 142 billion, amounting to 133.9 billion as of March 28, the lowest level in 2025.

According to CoinShares’ Butterfill, the AUM decline could be attributed to a slump in cryptocurrency prices.

“Recent price falls have pushed Bitcoin global ETP’s total assets under management to their lowest level since just after the US election at $114 billion,” Butterfill wrote.

Since Jan. 1, 2025, the BTC price has dropped 13.6%, while the total market capitalization has tumbled nearly 20%, according to data from CoinGecko.

Metaplanet issued ¥2 billion ($13.3 million) worth of zero-interest bonds to fund its bitcoin acquisition plan following a meeting of its board of directors, according to a disclosure filing. The debt security will be allocated via Metaplanet’s EVO FUND, allowing investors to redeem bonds at full face value by Sept. 30, 2025.

Simon Gerovich, CEO of Metaplanet, said the firm was “buying the dip!” in a post on X. Bitcoin was down roughly 2%, trading under $81,800 per The Block’s price page.

Metaplanet is Asia’s largest BTC holder, having spent an estimated $260 million on bitcoin since last year. Its most recent purchase, as of writing, increased the firm’s total reserve to some 3,200 BTC — ranking Metaplanet 10th in a cast of the world’s largest corporate BTC holders led by Michael Saylor's firm, Strategy, per BitcoinTreasuries data. The Tokyo-listed giant also added Eric Trump, son of U.S. President Donald Trump, to its advisory board.

“It’s a positive story for BTC where Metaplanet sees the long-term value in owning bitcoin” said Paul Howard, Senior Director at crypto market maker Wincent, about the news.

While Howard perceived Metaplanet’s expanded BTC buying power as bullish, the company’s stock dropped over 9% after the announcement, according to Google Finance data. Metaplanet stock fell amid a broader decline in Japan’s Nikkei 225, which dipped 4% in anticipation of fresh tariffs from President Trump on April 2. Howard expects other stock markets to follow suit.

“Almost all global markets are seeing the impact of the tariffs from the U.S., so the Nikkei, one of the first large markets to open, will always reflect this position before other markets open. The expectation is other markets will follow suit on opening,” Wincent’s Senior Director told The Block.

Aran Hawker, CoinPanel CEO, shared a similar outlook, adding that macroeconomic factors looked likely to kneecap bitcoin and risk-assets in the short term. “As for the Nikkei dip — whether it's being driven by the post-holiday catch-up (Liberation Day) or concerns about a new wave of Trump-era tariffs — it's clear that global macro signals are jittery right now. That sort of backdrop tends to pull capital toward lower-risk assets, at least in the short term,” Hawker opined.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The SHIB community continues its regular attempts to make a noticeable dent in the circulating Shiba Inu supply by burning these meme coins. Yet another large token burn has been conducted during the past day.

In the meantime, the SHIB team has issued a critical warning regarding scammers who are trying to impersonate Shiba Inu lead Shytoshi Kusama.

SHIB burns soar 750%

According to data published on the Shibburn website, over the last 24 hours, the community has succeeded in giving the SHIB burn rate a significant rise of almost 750%. This increase came as a result of 17,127,069 SHIB meme coins burned in total.Shibburn">

The largest amount of coins transferred to an unspendable wallet in a single move here constituted 16,274,641 SHIB, and it occurred roughly 16 hours ago. The second-biggest transfer was less than even one million meme coins, comprising 792,393 SHIB.

Two billion SHIB burned last week

Per tweets published by the same data source, last week, the meme coin community witnessed the destruction of a staggering two billion SHIB tokens. They were burned in chunks slightly surpassing 1,000,000,000 SHIB, with a two-day pause in between.

The second transfer was even spotted by the SHIB team and highlighted on the X platform by their marketing lead, Lucie.

She confirmed that the anonymous whale who made the one-billion SHIB burn last Thursday also stood behind the similar token removal made on Monday. That proved to be the account of the meme coin CENT that runs on Shibarium.

SHIB team issues big Kusama warning

On Sunday, the @susbarium X account affiliated with the Shiba Inu team addressed the SHIB community with an important warning, mentioning the name of pseudonymous Shiba Inu lead Shytoshi Kusama.

The tweet warned the SHIB army to beware of fake profiles on social media claiming to be Kusama or any other official SHIB team representatives – they will not match the verified tone or style, the warning said.

Susbarium | Shibarium Trustwatch@susbariumMar 30, 2025🚨 ShibArmy Alert!🚨

Beware of profiles claiming to be Shytoshi Kusama or other official Shib representatives that don't match the verified tone or style. Always check for authenticity and verify information directly with trusted sources.

Stay united and vigilant!

🔥🐾… pic.twitter.com/SjQ4DJue5Q

The tweet added that it is always crucial to “check for authenticity and verify information directly with trusted sources.”

As for Shytoshi Kusama, last week, he finally broke the silence he kept on the X platform for more than a month, stating that he had a very interesting journey. Kusama added that he had asked his astrologer analyze it for him.

Global crypto investment products run by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares attracted another $226 million worth of net inflows last week, according to CoinShares data.

The second consecutive week of inflows suggests a "positive but cautious" investor, CoinShares Head of Research James Butterfill wrote in a Monday report.

"Following the largest outflows on record, ETPs have seen nine consecutive trading days of inflows," Butterfill said. "Last Friday was the exception, seeing minor outflows totalling $74 million, likely in reaction to core personal consumption expenditure in the U.S. coming in above expectations, implying the U.S. Federal Reserve is likely to remain hawkish despite recent data alluding to weak growth."

Weekly crypto asset flows. Images: CoinShares.

However, the flows align with price action for bitcoin and the broader cryptocurrency market, which traded up until Friday wiped out all the week's gains, with participants also remaining jittery over President Trump's volatile tariff announcements ahead of "Liberation Day" on Wednesday.

"President Trump's proposed tariff hikes including a 25% levy on Mexican and Canadian goods effective April 2 — have resumed trade war anxieties," Bitget Research Chief Analyst Ryan Lee told The Block. "Historically, such protectionist measures trigger risk aversion across asset classes, and crypto has not been immune."

"The timing proves particularly delicate as digital assets maintain elevated correlation with traditional markets; bitcoin's 0.67 correlation coefficient with the Nasdaq suggests equities weakness could continue dragging crypto prices lower," Lee added.

Bitcoin ended up falling around 6% over the past week, according to The Block's BTC price page, while the GMCI 30 index of leading cryptocurrencies dropped 10.6%. The recent price falls have pushed global bitcoin investment products' total assets under management to their lowest level since the U.S. presidential election in November at $114 billion, CoinShares' Butterfill noted.

US and Bitcoin lead as altcoin products see inflows for first time in 5 weeks

Unsurprisingly, U.S. investors led regionally, accounting for $204 million of last week's net inflows. However, it was not the only region witnessing positive flows for the second week in a row, with funds based in Switzerland and Germany also adding $14.7 million and $9.2 million, respectively. Crypto investment products in Hong Kong and Brazil saw minor outflows.

Bitcoin-based funds again dominated, registering $195 million in net inflows last week. Investors also continued to exit their short-Bitcoin positions for a fourth-consecutive week, with net weekly outflows totaling $2.5 million.

The U.S. spot Bitcoin exchange-traded funds clocked up $196.4 million of the net inflows alone, according to data compiled by The Block — also registering positive flows every day last week bar Friday.

Meanwhile, global altcoin-based investment products saw aggregate net inflows of $33 million for the first time in five weeks, following four consecutive weeks of net outflows that totaled $1.7 billion. Ethereum, Solana, XRP and Sui-based funds were the main beneficiaries, adding $14.5 million, $7.8 million, $4.8 million and $4 million last week, respectively.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin (BTC) is flashing a critical supply signal as investors withdrew at least 30,000 BTC from crypto exchanges in a week.

With corporations like Strategy aggressively accumulating the number one cryptocurrency, market watchers warn of a liquidity crunch that could ignite volatility.Bitcoin Outflows Point to Reduced Selling Pressure

Recent on-chain data from Santiment, shared by analyst Ali Martinez on X, shows that over 30,000 BTC, valued at $2.5 billion, had been withdrawn from exchanges since March 24. Martinez also noted a parallel $106 million worth of Bitcoin had been transferred to private wallets in the last few hours.

When traders remove their BTC from exchanges into private wallets, it is often for long-term holding. This reduces the available supply in the market, potentially driving up prices if demand remains strong.

The trend aligns with a corporate buying spree that has intensified the supply squeeze. Strategy (formerly MicroStrategy)added6,911 BTC valued at $584 million to its holdings last week, bringing its total ownership of the asset to a staggering 506,137 BTC.

Japan’s Metaplanet and California-based KULR Technology also contributed to the scarcity of available BTC, buying$12.6 millionand $5.3 million worth of the cryptocurrency, respectively. Even meme stock darling GameStop entered the fray, approving aplanthat will see it spend $1.3 billion on the digital asset.Consolidation Before the Next Move

Meanwhile, trader @TedPillows recently pointed out that BTC might be in a Wyckoff re-accumulation phase. This is when large institutional investors or the so-called “smart money” acquire crypto at lower prices, as it occurs right after a downtrend.

According to Ted’s analysis, Bitcoin’s drop below $85,000 is a form of “manipulation” designed to shake out weaker hands. He predicts that if the OG cryptocurrency recovers to surpass $92,000, bearish traders could face significant losses.

Changing hands at under $82,000 at the time of this writing, BTC’s price action suggests short-term weakness but long-term strength. It is down about 1.2% in the last 24 hours and 6.1% over the past seven days, a shade below the broader crypto market’s 7.60% drop in the same period. However, zooming out to the last 12 months reveals more encouraging data, with Bitcoin maintaining a 16.5% gain in that time.

A rare and potentially bearish signal has appeared for Bitcoin as the MVRV Death Cross emerges, raising concerns about growing downside risks. According to a recent CryptoQuant Quicktake, Bitcoin’s MVRV (Market Value to Realized Value) ratio has reached a crucial phase, hinting at a shift in market momentum.

CryptoQuant.com@cryptoquant_comMar 31, 2025MVRV Dead Cross Signals Mounting Downside Risk

“In early March, the 30DMA crossed below the 365DMA — a bearish dead cross — signaling weakening short-term momentum and growing downward pressure…

With the MVRV now converging toward its long-term historical average, it appears… pic.twitter.com/8rWEgpviNJ

The MVRV (Market Value to Realized Value) ratio is an important on-chain indicator that compares Bitcoin's market capitalization to its realized value, helping to spot periods of market overvaluation or undervaluation.

In general, a high MVRV indicates an overheated market, whereas a low value indicates probable undervaluation.

The MVRV 30DMA has formed a bearish death cross with the 365DMA, indicating weakening short-term momentum and growing downward pressure. As with past cycles, this cross was followed by a price decrease when Bitcoin reached a local top, demonstrating the MVRV's usefulness as a market sentiment indicator.

What comes next?

With the MVRV now converging toward its long-term historical average, CryptoQuant indicated that it appears the market might have exited the overheated zone. However, no definitive bottom signal has emerged yet.

As Bitcoin continues to follow a corrective pattern similar to previous cycles, investors should be wary of additional downside risk.

Bitcoin fell 2.31% in the previous 24 hours to $81,449 during early Asian-market hours on Monday, as the weekend decline saw major tokens lose momentum following last week's brief rise. Bitcoin is on course for its fourth day of declines since March 27, with today's dip reaching an intraday low of $81,265.

What do other indicators reveal?

Glassnode's Bitcoin Cost Basis Distribution provides insight into current investor behavior. Per this indicator, the most efficient traders bought nearly 15,000 BTC at the $78,000 low on March 10 and sold at the $87,000 local top. With little BTC left at the $78,000 level, support there is now thin.

The support cluster of $80,920 exists below Bitcoin's spot price, where nearly 20,000 BTC were added. If the correction deepens, six-month cost basis data points to this potential structural support below the spot price: $74,000, where 49,000 BTC were added, and $71,000, where nearly 41,000 BTC were added.

According to Glassnode, these levels reflect conviction-driven accumulation zones that could absorb additional downside pressure. Meanwhile, a key resistance may be forming around $95,000, where investor cost basis clusters have grown by 12,000 BTC since March 24.

Key takeaways

US crypto investors must file their 2024 tax returns by April 15, 2025, ensuring all crypto transactions are accurately reported to the IRS.

Crypto held for less than a year is taxed as ordinary income (10%-37%), while holdings over a year qualify for lower capital gains rates (0%, 15%, or 20%).

Selling, trading, or spending crypto triggers taxes, while holding or transferring between wallets does not.

Mining, staking, airdrops, and crypto payments are taxed as income at applicable rates.

The world of cryptocurrencies can indeed be an exciting space for investors, but as the tax season approaches, many US investors find themselves grappling with confusion and uncertainty.

With the upcoming tax filing deadline of April 15, 2025, it’s a critical time to get a handle on crypto tax obligations. Ask most US crypto investors, and they’ll likely tell you that figuring out what transactions trigger a taxable event feels like navigating a maze.

Understanding various aspects of tax filing is crucial for accurately filing taxes, avoiding penalties and staying compliant with the Internal Revenue Service (IRS). This article breaks down key elements like tax brackets, rates, exemptions and other critical details.

How does the IRS tax crypto?

The Internal Revenue Service, the agency responsible for collecting US federal taxes, treats cryptocurrencies as property for tax purposes. You pay taxes on gains realized when selling, trading or disposing of cryptocurrencies. For short-term capital gains (held less than a year), you pay taxes at the rates of 10%–37%, depending on your income bracket.

Long-term capital gains (assets held for over a year) benefit from reduced rates of 0%, 15% or 20%, also based on your taxable income.

When you dispose of cryptocurrency for more than its purchase price, you generate a capital gain. Conversely, selling below the purchase price results in a capital loss. You must report both your capital gains and losses for the year in which the transaction occurs, with gains being taxable and losses potentially offsetting gains to reduce your tax liability.

With the upcoming April 15, 2025, deadline for filing 2024 tax returns, US crypto investors need to ensure these transactions are accurately tracked and reported.

To illustrate, suppose you purchased Ether (ETH) worth $1,000 in 2023 and sold it after a year in 2024 for $1,200, netting a $200 profit. The IRS would tax that $200 as a long-term capital gain, applying the appropriate rate based on your 2024 income.

Taxes are categorized as capital gains tax or income tax, depending on the type of transactions:

Capital gains tax: Applies to selling crypto, using crypto to purchase goods or services, or trading one cryptocurrency for another.

Income tax: Applies to crypto earned through mining, staking, receiving it as payment for work, or referral bonuses from exchanges.

These distinctions are crucial for accurate reporting by the April 15 deadline. Gains are taxed, while losses can help offset taxable income, so detailed record-keeping is a must.

Did you know? In Australia, gifting cryptocurrency triggers a capital gains tax (CGT) event. The giver may need to report gains or losses based on the asset’s market value at the time of transfer, though certain gifts — like those between spouses — may qualify for exemptions. While this differs from US rules, it highlights how crypto taxation varies globally.

How crypto tax rates work in the US

In the US, your crypto tax rate depends on your income and how long you’ve held the cryptocurrency. Long-term capital gains tax rates range from 0% to 20%, and short-term rates align with ordinary income tax rates of 10%–37%. Transferring crypto between your own wallets or selling it at a loss doesn’t trigger a tax liability.

You only owe taxes when you sell your crypto, whether for cash or for any other cryptocurrency. Consider this example: Suppose you bought crypto for $1,000 in 2024, and by 2025, its value rose to $2,000. If you don’t sell, no tax is due — unrealized gains aren’t taxable.

If you sell cryptocurrency after holding it for a year or less, your profits are subject to short-term capital gains tax. These gains are taxed as ordinary income, meaning they are added to your total taxable earnings for the year.

Tax rates are progressive, based on income brackets, so different portions of your income are taxed at different rates. For instance, a single filer in 2025 pays 10% on the first $11,000 of taxable income and 12% on income up to $44,725. Short-term rates are higher than long-term rates, so timing your sales can significantly impact your tax bill.

Understanding crypto capital gains tax in the US

If you sell cryptocurrency after holding it for a year or less, your profits are subject to short-term capital gains tax. These gains are treated as ordinary income and added to your total taxable earnings for the year. Since tax rates are based on income brackets, different portions of your earnings are taxed at different rates, as explained above.

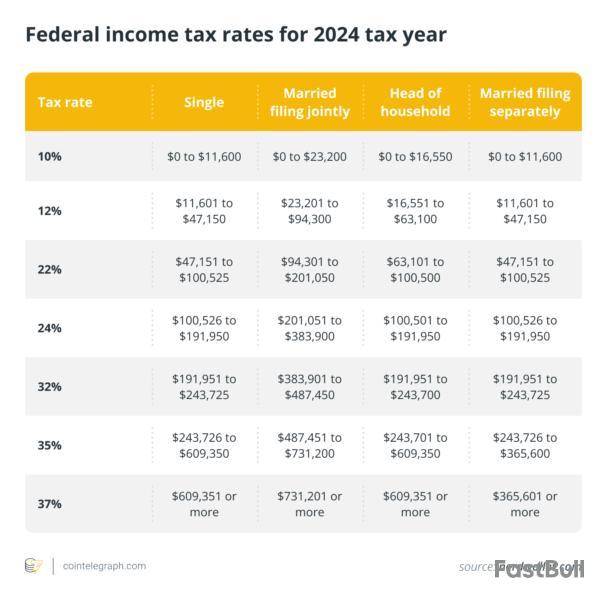

2024–2025 federal income tax brackets for crypto earnings

Here are the federal income tax rates for the 2024–2025 tax year. You apply the 2024 tax brackets to income earned in the 2024 calendar year, reported on tax returns filed in 2025.

Long-term capital gains tax for crypto earned in 2024

You pay long-term capital gains tax if you sell cryptocurrency after holding it for more than a year. Unlike short-term gains, these aren’t taxed as ordinary income. Instead, tax rates are based on your total taxable income and filing status. Long-term capital gains tax rates are 0%, 15% or 20%, making them lower than short-term rates. Holding crypto longer can reduce your tax burden significantly.

Here is a table outlining long-term crypto capital gains tax for the calendar year 2024. These rates are applicable when filing tax returns in 2025.

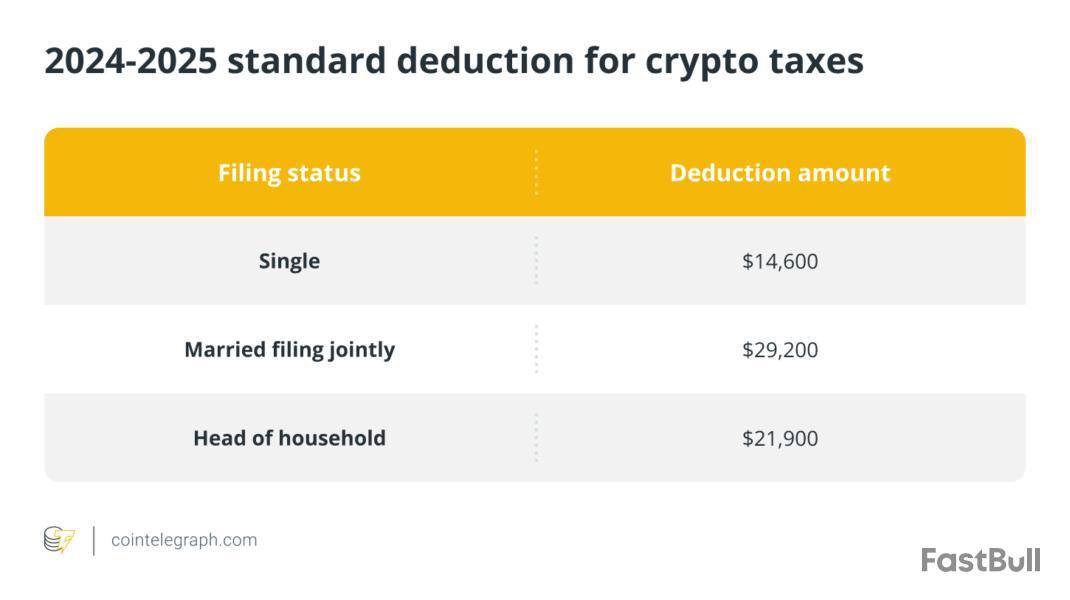

2024–2025 standard deduction: Reduce your crypto taxable income

The standard deduction is the portion of your income that’s exempt from federal taxes before tax rates are applied, reducing your taxable income.

Here is a table regarding tax deductions in the calendar year 2024. These amounts are applicable when filing for tax returns in 2025.

How are crypto airdrops taxed in the US?

In the US, crypto airdrops are treated as ordinary income by the IRS and taxed at the time they come under the taxpayer’s full control. The taxable amount is based on the tokens’ fair market value at that moment, even if the taxpayer didn’t request them. Later, selling or trading those tokens may trigger capital gains tax, depending on the price difference between receipt and disposal.

The taxable event hinges on control: If tokens automatically appear in a taxpayer’s wallet, the income is typically recognized upon arrival. If the tokens require manual claiming (e.g., through a transaction), the taxable event occurs when the claim is completed. Either way, the fair market value at that point determines the income reported.

When the taxpayer sells or trades the airdropped tokens, they incur a capital gain or loss, calculated as the difference between the value at receipt (the basis) and the value at sale or trade. Moreover, the holding periods matter: If sold within a year, gains are taxed at ordinary income rates (10%–37%, based on income brackets). If held longer than a year, gains qualify for lower long-term capital gains rates (0%, 15% or 20%, depending on income). Proper tracking of receipt dates and values is essential for accurate tax reporting.

Crypto gifting rules and tax implications in the US

In the US, gifting cryptocurrency is generally not a taxable event for either the giver or the recipient, meaning no immediate tax is owed. However, specific thresholds and reporting requirements must be followed to stay compliant with IRS rules.

For the 2024 tax year (filed by April 15, 2025), if the total value of crypto gifts to a single recipient exceeds $18,000, the giver must file a gift tax return using Form 709.

When the recipient eventually sells the gifted cryptocurrency, they’ll calculate capital gains or losses based on the giver’s original cost basis — the price the giver paid for the crypto. If this cost basis isn’t documented or available, the recipient may need to assume a basis of $0, which could increase their taxable gain upon sale. To avoid complications, both parties should keep detailed records of the gift’s fair market value at the time of transfer and the giver’s original cost basis.

Did you know? In the UK, giving cryptocurrency as a gift may result in capital gains tax for the giver, except for gifts to spouses or civil partners. Additionally, inheritance tax could apply if the giver dies within seven years of the gift.

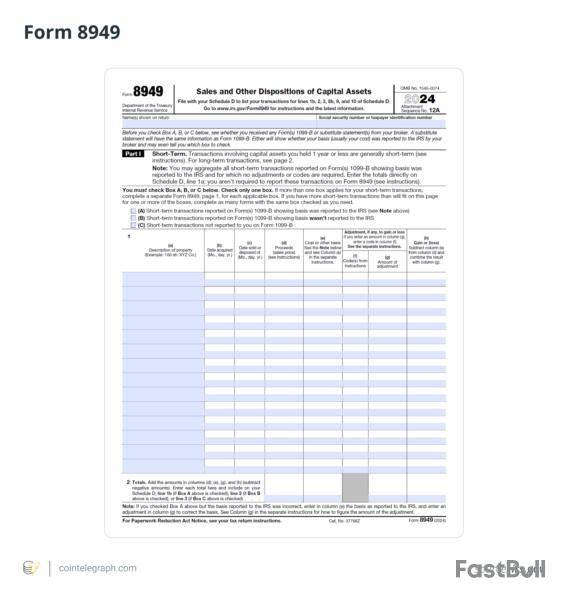

Essential forms for filing crypto taxes in 2024

With the April 15, 2025, deadline nearing, here are the key forms for reporting 2024 crypto transactions:

Form 8949: For reporting capital gains and losses from crypto sales, trades and disposals. Each transaction must be listed individually.

Schedule D (Form 1040): Summarizes total capital gains and losses from Form 8949; used for calculating taxable income.

Schedule 1 (Form 1040): Reports additional income, including staking rewards, airdrops and hard forks, if classified as taxable income.

Schedule C (Form 1040): Used by self-employed individuals or businesses to report crypto-related income from mining, consulting or freelance work.

Form 1099-MISC: Issued for staking, mining or payment income over $600

Form 1040: The main return form to combine income, deductions and tax liability.

FBAR (FinCEN Form 114): File separately if foreign crypto accounts exceeded $10,000 in 2024.

Step-by-step guide to filing crypto taxes for the 2024–2025 tax season

Here’s how to file, step by step, leveraging the detailed tax rates and forms outlined above.

Step 1: Gather all crypto transaction records

Collect records for every 2024 crypto transaction:

Dates of buying, selling, trading or receiving crypto

Amounts (e.g., 0.5 Bitcoin) and US dollar fair market value (FMV) at the time

Cost basis (what you paid, including fees) and proceeds (what you received).

To ensure complete records, pull data from wallets, exchanges (e.g., Coinbase) and blockchain explorers. Export transaction histories or CSVs, and note staking rewards, airdrops or mining income separately with their FMV on receipt.

Step 2: Identify taxable events

Pinpoint which 2024 actions trigger taxes:

Taxable: Selling crypto for cash/stablecoins, trading crypto, spending crypto or earning it (mining, staking, airdrops).

Non-taxable: Buying and holding with USD, moving crypto between your wallets, gifting up to $18,000 per recipient.

Classify each taxable event as short-term (≤1 year) or long-term (>1 year) for rate purposes.

Step 3: Calculate capital gains and losses

For taxable sales or trades:

Formula: Proceeds (FMV at disposal) - Cost Basis = Gain/Loss

Example: Bought 1 Ether (ETH) for $2,000 in May 2024, sold for $2,500 in November 2024 = $500 short-term gain.

Use first-in, first-out or specific identification for cost basis (be consistent). Sum your net gains/losses. See the “2024 Federal Income Tax Brackets” section for how these are taxed.

Step 4: Calculate crypto income

For earnings (mining, staking, airdrops):

Record FMV in USD when received (e.g., 10 Cardano worth $5 on June 1, 2024 = $5 income).

Add to your other 2024 income to set your tax bracket, detailed in the sections above.

Step 5: Apply the 2024 standard deduction

Lower your taxable income with the standard deduction:

Single: $14,600

Married filing jointly: $29,200

Head of household: $21,900

Subtract this from total income (including short-term gains and crypto income). Long-term gains are taxed separately.

Step 6: Determine your tax rates

Apply rates to your gains and income (refer to “How Crypto Tax Rates Work in 2024”):

Short-term gains and income: Ordinary rates (10%–37%).

Long-term gains: 0%, 15% or 20%, based on income.

Offset gains with losses (up to $3,000 net loss against other income; carry forward excess).

Step 7: Complete the necessary tax forms

Fill out the required IRS forms (see “Essential Forms for Filing Crypto Taxes in 2024”):

List capital gains/losses and income on Form 8949, Schedule D and Schedule 1 as applicable.

Use Schedule C if self-employed (e.g., mining business).

Combine everything on Form 1040.

Check Form 1099-MISC if received and file FBAR for foreign accounts over $10,000.

Step 8: File your return by April 15, 2025

Submit via IRS e-file or mail, postmarked by April 15, 2025.

Need more time? File Form 4868 for an extension to Oct. 15, 2025, but pay estimated taxes by April 15 to avoid penalties.

Step 9: Pay any taxes owed

Estimate your tax from Step 6, then pay via IRS Direct Pay or check. Late payments after April 15 incur a 0.5% monthly penalty plus interest.

Step 10: Keep records for audits

Store transaction records and forms for three to six years. The IRS is intensifying crypto scrutiny — be prepared.

Did you know? In Canada, giving cryptocurrency as a gift is generally considered a taxable disposition, requiring the giver to determine and report any capital gains or losses.

Important dates and deadlines for 2024–2025 tax season and beyond

Here are important dates regarding the 2024–2025 tax season and 2025 transition:

2024 tax season

Jan. 31, 2025: Some exchanges may issue voluntary 1099s (e.g., 1099-MISC).

April 15, 2025: File taxes on crypto earned in 2024.

2025 transition

Jan. 1, 2025: Form 1099-DA reporting begins.

Dec. 31, 2025: Safe harbor ends for adjusting universal cost basis.

Jan. 31, 2026: Receive Form 1099-DA for 2025 trades.

Quarterly estimates

June 15, Sept. 15, 2025, etc., for active traders.

New IRS crypto tax rules for 2025: What you need to know

The IRS introduced new rules for tax filing and reporting aimed at US cryptocurrency taxpayers, but these regulations have encountered significant pushback. Both the US Senate and House of Representatives voted to repeal them under the Congressional Review Act (CRA), and President Donald Trump has signaled support for the rollback. Despite this uncertainty, understanding these rules remains crucial, especially with deadlines looming in 2025.

A core component of the new rules is calculating taxes using a cost basis — the original amount invested in an asset, including fees or commissions. Accurately tracking cost basis is vital for proper tax reporting and prevents double taxation on reinvested earnings. It’s the starting point for determining capital gains or losses.

Under the updated IRS guidelines, crypto investors must now track the cost basis (original purchase price) separately for each account or wallet, moving away from a universal tracking approach. This requires recording the purchase date, acquisition cost and specific transaction details.

The rules also mandate specific identification for every digital asset sale, requiring taxpayers to report the exact purchase date, quantity and cost of the assets sold. If this information isn’t provided, the IRS defaults to the first-in, first-out (FIFO) method — selling your earliest coins first — which could inflate taxable gains if those initial purchases had lower costs.

For taxpayers previously using a universal cost basis method, the IRS requires reallocating their basis across all accounts or wallets accurately by Dec. 31, 2025, to comply with these standards.

Form 1099-DA: What to expect for crypto taxes in 2025–2026

As of March 27, 2025, Form 1099-DA is set to become a pivotal tool for the 2025–2026 tax season, simplifying how cryptocurrency transactions are reported in the US. This new form, tailored specifically for digital assets, will be issued by exchanges to both taxpayers and the IRS, providing a detailed breakdown of activities like sales, trades and other taxable crypto events from 2025.

It’s designed to streamline compliance and bolster IRS oversight, reflecting the agency’s growing focus on tracking digital asset income. For taxpayers, it promises easier, more accurate reporting, while exchanges take on a larger role in tax documentation.

For the 2024 tax year — due by April 15, 2025 — this form isn’t yet available; filers must still rely on existing forms like Form 1099-MISC until Form 1099-DA officially takes effect for 2025 earnings.

IRS crypto tax penalties: What happens if you don’t report or under-report in 2024?

US taxpayers who fail to meet their tax obligations may face penalties from the IRS. When tax obligations go unmet, the IRS sends a notice or letter detailing the penalty, its reason (e.g., late filing, non-payment or inaccurate reporting) and your next steps.

Penalties vary:

Late filing or non-payment can incur fines up to 25% of the unpaid tax, plus interest that accrues until settled.

Other triggers — like bounced checks or fraudulent claims — add further costs, and the IRS may launch an audit to scrutinize your filings.

Individuals may face penalties of up to $100,000 and criminal sanctions, including imprisonment for up to five years.

Corporations can be fined up to $500,000.

These stakes are high, especially as the IRS ramps up crypto enforcement in 2024. To dodge these consequences, double-check any notice for accuracy and act fast: Request a filing extension with Form 4868 if needed (due by April 15, 2025), arrange a payment plan for unaffordable penalties, or dispute the penalty if you believe it’s unjustified. Prompt action can save you from escalating costs and legal headaches.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up