Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Disclaimer: This article contains a video that may be disturbing for some readers.

A brazen attempt to kidnap the daughter and grandson of Pierre Noizat, the co-founder and CEO of French crypto exchange Paymium, was foiled after the daughter and passersby reportedly fought off the kidnappers.

Three masked men attacked Noizat’s daughter and a male partner on May 13 while she was walking with her son in Paris’ 11th district. The assailants tried to force Noizat’s daughter and her son into a waiting van, the French state-owned media outlet France24 reported on May 13.

The accompanying male partner was assaulted when he tried to intervene, but Noizat’s daughter resisted and managed to take one of the guns off an assailant in a scuffle and throw it away, police said.

Le Figaro@Le_FigaroMay 13, 2025En plein Paris, un homme a été violenté par des individus cagoulés, habillés tout en noir. Ils tentaient de l'enlever. Un homme a surgi, extincteur à la main, pour les faire fuir. →https://t.co/P0qV6PR40v pic.twitter.com/9f4r2Gi7ho

Eventually, people passing by intervened, and the masked assailants fled in the van, which was found nearby. All three victims suffered injuries and were taken to a local hospital.

Local outlet Le Parisien reported that the botched daylight kidnapping is being investigated by the Brigade for the Suppression of Banditry, a special police unit of the French Ministry of the Interior.

Michael Englander, co-founder and CEO of Polish crypto exchange Plasbit, says this incident should serve as a wake-up call for the rest of the industry.

“If you’re in crypto and still flaunting it online, you’re not just stupid, you’re putting your family in danger,” he said in a May 13 post to X.

Offline crypto-linked attacks grow

Crypto-focused lawyer Sasha Hodder said on X that “crypto theft is evolving. It’s not just social engineering or SIM swaps anymore.”

In May, Las Vegas police said three teenagers had allegedly kidnapped a man at gunpoint who was returning from a local crypto event and robbed him of $4 million in crypto and non-fungible tokens (NFTs).

On May 3, Paris police freed the father of a crypto entrepreneur who was held for several days in connection with a 7 million euro ($7.8 million) kidnapping plot.

At the start of the year, David Balland, co-founder of crypto hardware wallet manufacturer Ledger, was abducted from his home in central France during the early hours of Jan. 21. He was held captive until a police operation on the night of Jan. 22 secured his release.

Jameson Lopp, a cypherpunk and co-founder of self-custodial firm Casa, has created a list on GitHub recording dozens of offline crypto robberies, with 22 incidents of in-person crypto-related theft so far this year.

A University of Cambridge study in September found these so-called “wrench attacks” are often underreported due to revictimization fears and involve a diverse group of attackers ranging from organized crime groups to friends and family.

New York Times (gated) with the report:

Nothing suss!

Crypto analyst BarriC has asserted that an XRP price rally to between $10 and $20 would only be the start for the altcoin. The analyst still expects XRP to rally to four digits and has in the past explained why he believes such an ambitious price target is possible.

XRP Price To Still Rally To $1,000

In an X post, BarriC stated that a potential XRP price rally to between $10 and $20 is just the beginning. He added that the long game for the altcoin is $1,000. The analyst urged market participants to be prepared for life-changing and generational wealth. In his other X posts, BarriC provided a roadmap for how it can reach four digits.

In one post, he stated that once the XRP price reclaims $3, it will move rapidly to $5. The analyst predicts that the altcoin will then skyrocket into double digits, sitting comfortably at between $10 and $20 as a new all-time high. However, BarriC believes that is just the start for XRP as it will still reach $100 and then $1,000.

He asserted that these price targets for XRP will happen much sooner than people think. In another post, the analyst alluded to banks using XRP as one factor that could spark this XRP price surge. BarriC stated that the fact that investors can still accumulate the altcoin at around $2 means that banks aren’t utilizing it yet.

The analyst said that once banks and financial institutions worldwide adopt and utilize XRP in the way they conduct finance, the altcoin will skyrocket to $1,000. He referenced the 2017 bull cycle when the token’s price went from $0.006 to $3.80, which is why he is confident that such a parabolic surge is possible.

The Altcoin Approaching Key Resistance Levels

In an X post, crypto analyst CasiTrades stated that the XRP price is approaching key resistance levels following its latest surge. She highlighted $2.69 as the major resistance, as this price level is also the .236 Fib retracement from the all-time high (ATH) and a key level to watch for a correction.

Commenting on the current price action, she noted that what stands out is the continued price increase despite low momentum and a completed 5-wave count. The analyst remarked that this slow, controlled push higher often signals strong underlying demand, strong trend, and heavy accumulation.

CasiTrades stated that if the XRP price breaks and holds above $2.69, it would open the door for an explosive move toward $3. However, if the altcoin doesn’t hold this level, she claimed it could record a short-term dip toward $2.30 for a reset.

At the time of writing, the XRP price is trading at around $2.50, up almost 5% in the last 24 hours, according to data from CoinMarketCap.

With a sharp increase in capitalization that has moved it above Tether in the rankings, XRP is making waves once more. XRP is now firmly among the top three digital assets by capitalization, having officially overtaken the largest stablecoin in the world with a market cap of over $150 billion.

Strong on-chain signals and a sound technical breakout support the recent spike in XRP's value, which is not just the result of conjecture. XRP has confirmed the move with high volume on the daily chart after breaking out of a descending wedge pattern that lasted for months. Its bullish position has been cemented by the breakout above the $2.40 resistance zone and persistent trading above important moving averages, such as the 50 and 100 EMA. This upward trend is further supported by momentum indicators. Chart by TradingView">

There is potential for more upside as the RSI is still high but not yet in extremely overbought territory. Increased transaction volume and whale activity are indicated by on-chain metrics, which could indicate the start of institutional accumulation. The market's general shift toward altcoins and the increase in network activity have made it ideal for XRP to grow in value and recognition.

Flipping USDT in terms of capitalization is more than just symbolic; it signifies a resurgence of trust in XRP as a useful asset as opposed to a speculative altcoin. Investor confidence in XRP's future integration into international payment systems seems to be growing as regulatory clarity surrounding Ripple's ongoing legal battle continues to develop.

Nevertheless, XRP continues to encounter resistance in the $2.70-$2.90 range, which might halt the current upswing. It would not be shocking to see a drawback, especially considering how big the most recent move was. As long as XRP maintains its position above $2.20, the trend is still positive.

Shiba Inu bulls gain more

In addition to price action, a crucial technical event — the bullish crossover between important exponential moving averages — has made Shiba Inu a surprising leader in the current cryptocurrency cycle. In addition to reviving momentum in SHIB, the recent cross between the 50 and 100 EMA has given the meme coin market new hope. After a protracted consolidation phase, SHIB surged higher, surpassing the resistance level of $0. 000015 and tagging $0.000017 on May 12, a level not seen in months.

Trade volume increased in tandem with this move, indicating strong buying pressure as traders scrambled to get on the breakout wave. The asset has, however, entered a corrective phase following the euphoric push, losing about half of its recent gains. At first glance, that might seem concerning, but the context reveals otherwise. SHIB is currently retesting its breakout level and lining up with EMAs that have already been breached, which is a typical bullish retest pattern.

The 200 EMA, which was ultimately regained during the rally, is where the price is consolidating. The 50 EMA's continued steep upward angle has also caught the market's attention, indicating medium-term bullish sentiment. Although the volume spike was initially caused by buying, it has tapered during the correction, indicating that profit-taking rather than panic is driving the pullback.

Ethereum wakes up

Even though Ethereum's recent surge may be waning a little, the overall trend is still going strong. Despite the current correction, the asset's price action still demonstrates underlying strength, suggesting that ETH is not yet ready to give up its gains. A key long-term trend indicator that frequently serves as a litmus test between bullish and bearish markets, Ethereum's decisive break above the 200 EMA is the most noteworthy technical accomplishment.

With ETH now firmly above it, there may be a change in the market's structure and a possible long-term uptrend at work. With its strong upward push, the 26 EMA appears poised to make a bullish short-term crossover with the 100 EMA.

A brief correction from the $2,700 zone has not stopped the volume from being abnormally high. This is probably profit-taking during a trend shift rather than weak-handed distribution, especially in light of ETH's explosive rise from $1,800 to almost $2,700 in a few days. Buyer interest is still strong and is only consolidating.

Although RSI levels have retreated from the overbought area, they are still above the neutral line, indicating that the bullish momentum has not been completely destroyed but has instead been moderated. As long as Ethereum stays above $2,400 and stays close to recent highs, the bulls will continue to have firm control.

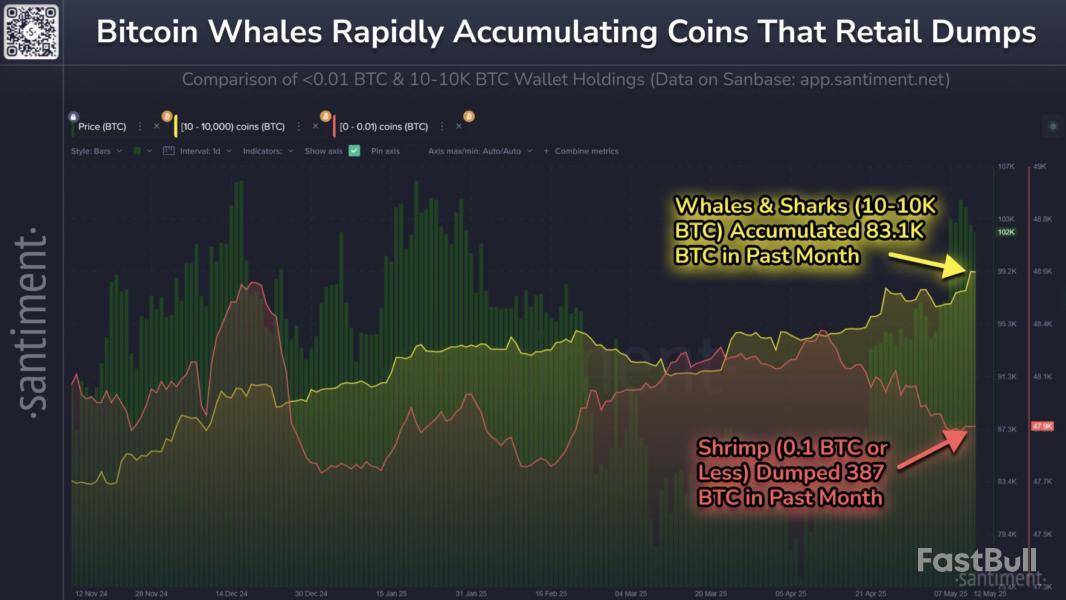

On-chain data shows the large Bitcoin investors have continued to buy as the coin’s price has been approaching its all-time high (ATH).

Bitcoin Investors With 10 to 10,000 BTC Have Expanded Holdings Recently

In a new post on X, the on-chain analytics firm Santiment has talked about the latest trend in the supply held by Bitcoin’s key investors: those holding between between 10 and 10,000 BTC.

At the current exchange rate, this range converts to $1 million at the lower end and $1 billion at the upper end. Thus, the only investors who would be able to qualify for it would be the ones with substantial holdings. Generally, the influence of any entity in the market goes up the more supply that they control, so the holders belonging to this range would hold an important place in the ecosystem. Collectively, these investors are popularly known as the sharks and whales.

Now, here is the chart shared by the analytics firm, which shows the trend in the Supply Distribution for the sharks and whales, an indicator that tracks the combined supply held by members of these cohorts:

As displayed in the above graph, the Bitcoin sharks and whales have seen their Supply Distribution go up recently, which suggests these large investors have been expanding their holdings. More specifically, the investors falling in the 10 to 10,000 BTC range have added around 83,100 tokens to their wallets over the past month. This accumulation hasn’t come in a constant manner, however, as these investors in fact reduced their supply for a period earlier in the month.

This selling from the cohorts followed BTC’s recovery beyond $97,000, so it’s likely that the motive behind it was profit-taking. From the chart, it’s also visible that this selloff resulted in a pullback for the cryptocurrency.

During the latest renewal of bullish momentum, the sharks and whales have again resumed their Bitcoin accumulation and have notably surpassed their holdings from the earlier peak. So far, the groups have shown no signs of profit-taking, which can naturally be a bullish sign for the rally’s sustainability.

In the same chart, Santiment has also attached the data for the Supply Distribution of the investors carrying less than 0.1 BTC. Interestingly, these investors have been selling while the sharks and whales have gone through accumulation.

This could be an indication that the shrimps believe the top could be in soon. Given the accumulation from the large investors, though, the analytics firm notes, “it may be a matter of time until Bitcoin’s coveted $110K all-time high level is breached, particularly after the U.S. & China tariff pause.”

BTC Price

At the time of writing, Bitcoin is trading around $103,800, up 11% in the last seven days.

A growing chorus of Bitcoin commentators is raising the alarm over the recent boom in publicly traded companies adopting Bitcoin-centric treasury strategies. The debate ignited this week after pseudonymous investor Stack Hodler (@stackhodler) described the trend as a speculative mania disguised in corporate form, writing on X that “Bitcoin treasury companies are this cycle’s shitcoins.” His argument: these companies are “creating shares out of thin air to sell to people hoping to outperform Bitcoin,” with little more than exposure to BTC as their core product. “It’s just TradFi shitcoinery,” he warned. “And many will get rekt.”

Stack Hodler allowed that these companies are currently soaking up speculative liquidity that might otherwise chase illiquid altcoins. “But the bad news is that many of these businesses will inevitably be forced to dump their stacks one day,” he added, pointing to the moment when short-term investors realize that holding equity in a Bitcoin proxy may be less efficient than self-custody. “Fiat shenanigans with the potential to unwind” was how he framed the model. In contrast, he celebrated companies that generate real economic value and use their profits to accumulate Bitcoin—something he views as a sustainable force in Bitcoin’s monetization arc.

Bitcoin podcaster Stephan Livera entered the conversation by referencing MicroStrategy’s Q1 2025 earnings call, where Michael Saylor laid out the rationale for the company’s persistent premium to net asset value. “Saylor outlined some reasons for MSTR being at a multiple to NAV,” Livera said. While acknowledging the cyclical nature of that premium—comparing it to the GBTC discount blowout in the previous cycle—he argued there’s a broader structural context. “Bitcoin is a $2 trillion asset in a world of $1,000 trillion in assets,” Livera noted, emphasizing that many large capital allocators remain unable to directly hold Bitcoin due to regulatory, tax, or mandate-related restrictions. “There’s a case for some treasury companies to exist long-term, so long as they’re managed prudently.”

The Bitcoin Treasury Copy-Cat Surge

But Stack Hodler wasn’t referring to MicroStrategy. “I’m talking about the copycats that are popping up at an accelerating pace,” he responded. “They’re trying to draft off MSTR’s success, similar to how shitcoins drafted off of BTC’s success.” He said he doesn’t deny that regulatory arbitrage might support a few of these firms in the short to medium term, but questioned the viability of companies whose primary activity appears to be printing shares and using the proceeds to buy Bitcoin. “I love seeing companies with real profitable businesses stack BTC. Fiat engineering seems shakier to me long-term.”

Scott Melker, host of “The Wolf of All Streets” podcast, added to the discussion: “I hate to even think this, because I’m a huge fan—but Bitcoin treasury companies raising debt to buy Bitcoin could be the next bubble.” Market structure analyst Dave Weisberger agreed that risk is present, but took a more measured stance. “Sure. But bubbles have to inflate before we worry about them… spoiler, Bitcoin is NOT near bubble territory.”

Technical analyst FiboSwanny, a 25-year market veteran, focused on leverage and market structure. “If there’s a bubble forming, it’s likely in the financial instruments and leverage around Bitcoin,” he said, citing debt-funded treasury purchases, ETFs, and derivatives. “Not in actual Bitcoin itself.” Lark Davis took a more bearish tone: “This is our GBTC leverage this cycle that will have a horrific unwind with devastating consequences later. Especially the companies buying altcoins.”

Swan CEO Cory Klippsten didn’t mince words either. “Already jumped the shark,” he wrote. “Have been predicting it for a year, but it’s inevitable now.”

The current landscape includes dozens of public companies with direct Bitcoin holdings, some of which are drawing intense retail speculation. MicroStrategy remains the dominant force, with well over half a million Bitcoin on its books. Other names include Metaplanet in Japan, Semler Scientific, KULR Technology, and various new entrants who have reoriented their corporate missions entirely around Bitcoin accumulation. Many of these firms are now trading at multi-billion-dollar valuations, far above what their underlying business models would suggest.

But the sustainability of the model remains in question. Most of these companies rely on issuing new equity at inflated valuations to finance further Bitcoin purchases, creating a reflexive cycle where rising BTC prices inflate share prices, which in turn enable more buying. That dynamic works beautifully in a bull market but can reverse quickly in a downturn.

The debate over how institutional exposure is structured becomes increasingly relevant. Stack Hodler framed it simply: “Bitcoin is and always will be the best risk-return asset to hold in this space. Part of successfully holding Bitcoin is being able to resist all the ‘better Bitcoins’ that inevitably arise during your journey.” Whether the new class of treasury companies represents innovation, opportunism, or simply a bubble waiting to burst, remains one of the key questions of this cycle.

At press time, BTC traded at $103,709.

Key Takeaways:

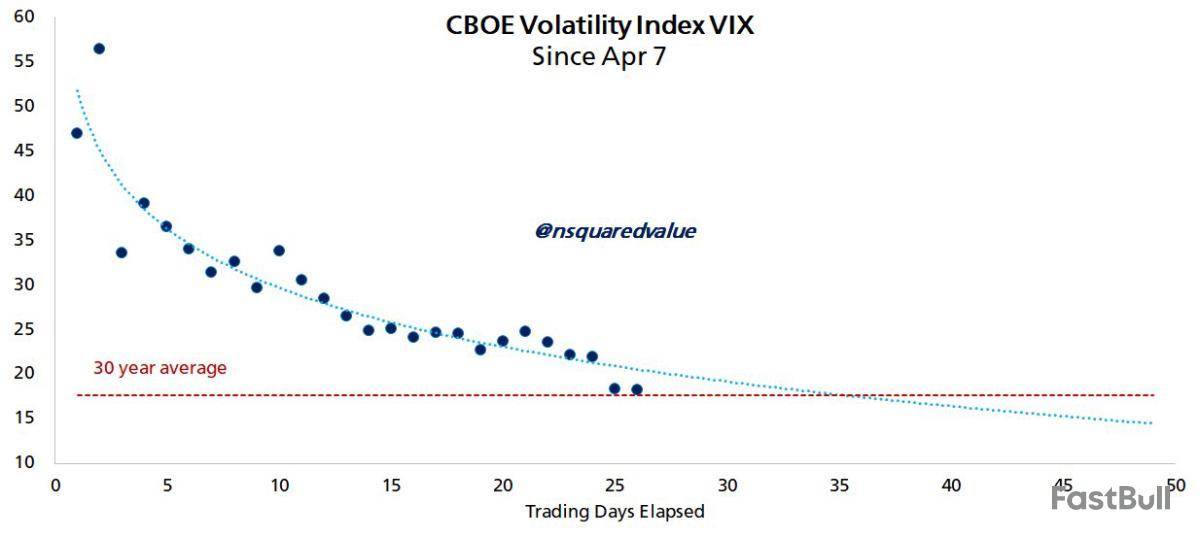

Bitcoin price holds above $100,000, driven by "risk-on" sentiment after the CBOE Volatility Index (VIX) dropped to 20.

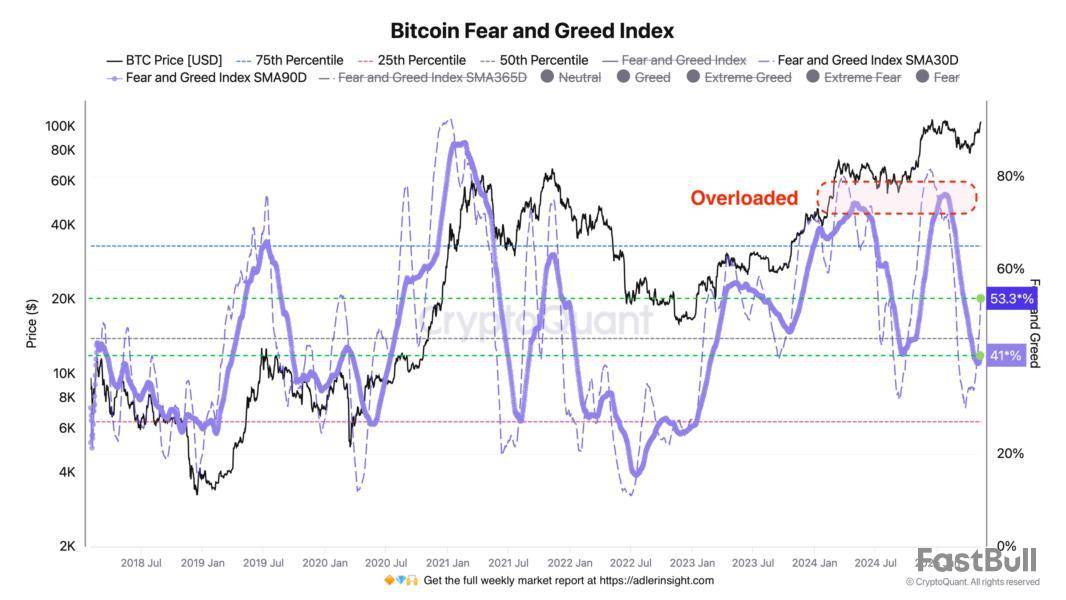

The Bitcoin Bull Score Index surged to 80, and the Fear & Greed Index suggests growing optimism, with historical patterns indicating potential for further price gains.

Bitcoin (BTC) price continues to consolidate higher above $100,000 after the CBOE Volatility Index (VIX) dropped to its 30-year average of 20, down from a peak of 60 earlier in 2025. This decline follows a US-China trade deal on May 12, which introduced a 90-day tariff pause and a 115% reduction on both sides.

The agreement has fueled a "risk-on" sentiment, boosting Bitcoin and equities as investors lean into higher-risk assets, according to Bitcoin network economist Timothy Peterson. The analyst said,

Adding to the bullish sentiment, the US Consumer Price Index (CPI) inflation rate dropped to 2.3% year-over-year in April 2025, the lowest since February 2021, down from 2.4% in March and below consensus forecasts of 2.4%. This softer-than-expected CPI reading signals easing inflationary pressure, potentially increasing the likelihood of Federal Reserve interest rate cuts in 2025, assuming other economic indicators align.

With respect to the current macroeconomic dynamics—lower volatility, cooling inflation, and a trade war truce- it creates favorable market conditions for Bitcoin.

Earlier this month, Peterson noted that BTC could reach $135,000 within 100 days, citing a drop in the CBOE Volatility Index (VIX) from 55 to 25, signaling a "risk-on" environment. With 95% accuracy, his model links low VIX levels to increased investor confidence in riskier assets like Bitcoin.

Related: Bitcoin shrugs off US CPI win as Binance CEO says BTC 'leading pack'

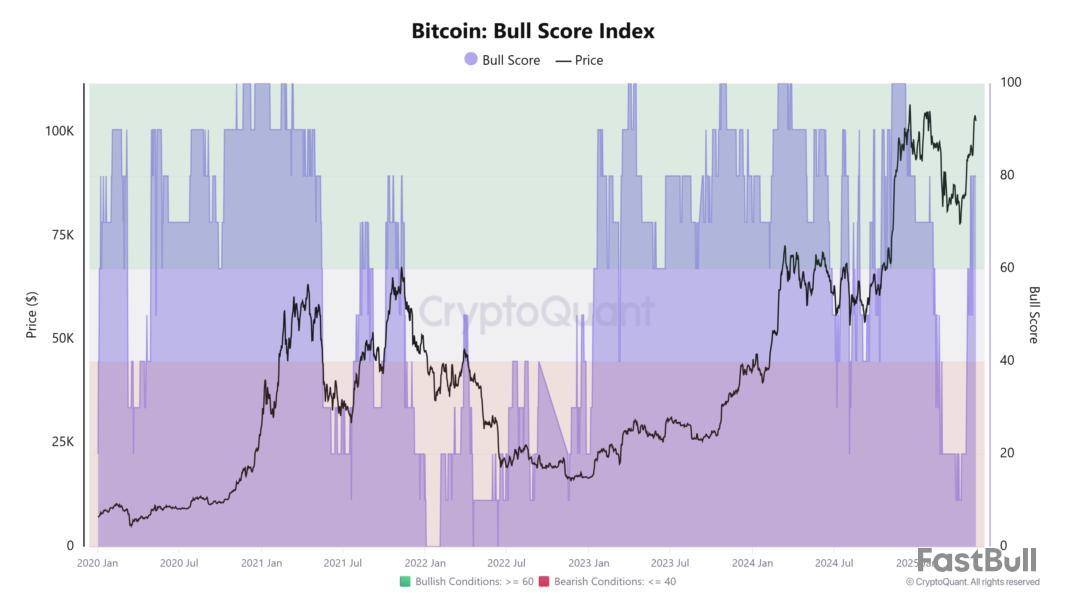

Bitcoin bull score index reaches yearly high

After posting one of its least bullish phases in two years during April, Bitcoin sentiment flipped drastically to its highest reading in 2025. Data from CryptoQuant indicated a dramatic rise in the Bitcoin Bull Score Index, soaring from 20 to 80, a level historically associated with significant price surges.

This shift, driven by rising spot demand outpacing supply, reflects patterns observed after the April 2024 halving, suggesting Bitcoin could be poised for further gains.

Likewise, Bitcoin researcher Axel Adler Jr noted that while the Bitcoin Fear & Greed Index is climbing, currently at 53.3%, it remains below the "overloaded" zone above 80%. The analyst discussed the possibility of a market “upswing,” expressing hope for a successful test and surpassing Bitcoin’s all-time high near $110,000.

Related: Bitcoin profit taking at $106K the first stop before new all-time BTC price highs

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up