Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

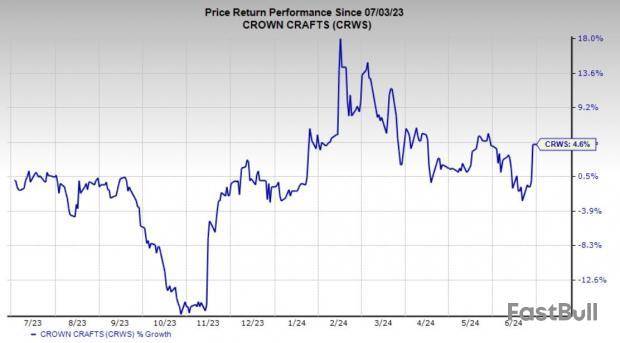

July 22 (Reuters) - Crown Crafts Inc CRWS.O:

CROWN CRAFTS ACQUIRES THE ASSETS OF BABY BOOM CONSUMER PRODUCTS

CROWN CRAFTS INC - ACQUIRES BABY BOOM ASSETS FOR $18 MILLION

CROWN CRAFTS : DEAL IS EXPECTED TO BE ACCRETIVE TO EARNINGS & TO ADD ABOUT $20 MILLION ANNUALLY TO CROWN CRAFTS' NET SALES

Source text for Eikon: (Full Story)

Further company coverage: CRWS.O

GONZALES, La., July 22, 2024 (GLOBE NEWSWIRE) -- Crown Crafts, Inc. (NASDAQ-CM: CRWS) (“Crown Crafts” or the “Company”) today announced that it has acquired substantially all of the assets of Baby Boom Consumer Products, Inc. (“Baby Boom”), a leading provider in the toddler bedding and diaper bag categories.

Baby Boom designs, sources, markets and sells high-quality and functional toddler bedding and diaper bags. In addition to its own brands, Baby Boom offers licensed products, including Bluey, Ms. Rachel, Cocomelon, Paw Patrol, Eddie Bauer and others.

“We are excited to add Baby Boom’s portfolio of branded and licensed products to our lineup. This acquisition enhances our presence in the toddler bedding segment, and the addition of diaper bags expands our offerings to our customers. Baby Boom’s strong portfolio of licenses is very complementary to our existing lineup,” said Olivia Elliott, Chief Executive Officer of Crown Crafts.

Crown Crafts paid $18 million for the acquisition, subject to customary working capital adjustments. Crown Crafts financed the transaction through a combination of an $8 million term loan and additional borrowings under Crown Crafts’ revolving line of credit. The term loan is repayable monthly over four years. The term of the line of credit was extended from July 11, 2028 to July 19, 2029 and its borrowing capacity increased from $35 million to $40 million. The acquisition is expected to be accretive to earnings and to add approximately $20 million annually to Crown Crafts’ net sales.

“Crown Crafts is a well-known and respected company in the infant and toddler product category. We believe it is the right partner for our products and look forward to Crown Crafts’ continued growth in these market segments,” said Steven Betesh, President of Baby Boom.

D.A. Davidson & Co. served as financial advisor; Smith, Gambrell & Russell, LLP served as legal advisor to Crown Crafts; and The CIT Group provided the debt financing for the transaction. Sills, Cummis & Gross P.C. served as legal advisor to Baby Boom.

About Crown Crafts, Inc.

Crown Crafts, Inc. designs, markets and distributes infant, toddler and juvenile consumer products. Founded in 1957, Crown Crafts is one of America’s largest producers of infant bedding, toddler bedding, bibs, toys and disposable products. The Company operates through its two wholly owned subsidiaries, NoJo Baby & Kids, Inc. and Sassy Baby, Inc., which market a variety of infant, toddler and juvenile products under Company-owned trademarks, as well as licensed collections and exclusive private label programs. Sales are made directly to retailers such as mass merchants, large chain stores and juvenile specialty stores. For more information, visit the Company’s website at www.crowncrafts.com.

About Baby Boom Consumer Products

Founded in 1988 and headquartered in Newark, New Jersey, Baby Boom Consumer Products designs, sources, markets, and sells high-quality and functional diaper bags and toddler bedding. Its product offering includes diaper bags, crib bedding, baby blankets, nursery décor, travel accessories, and soft bath products.

Forward-Looking Statements

The foregoing contains forward-looking statements within the meaning of the Securities Act of 1933, the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Such statements are based upon management’s current expectations, projections, estimates and assumptions. Words such as “expects,” “believes,” “anticipates,” “will” and variations of such words and similar expressions identify such forward-looking statements. The forward-looking statements in this press release do not constitute guarantees of future performance and include, without limitation, statements regarding the anticipated benefits of the Company’s acquisition of substantially all of the assets of Baby Boom, including enhanced market presence, expanded product offerings and a complimentary license portfolio; expectations regarding the acquisition’s impact on the Company’s growth, earnings and net sales; and the potential value and synergies that the acquisition may provide to the Company.

Forward-looking statements involve known and unknown risks and uncertainties that may cause future results to differ materially from those suggested by the forward-looking statements. These risks include, among others, the Company’s ability to realize the potential benefits of its acquisition of the assets of Baby Boom; potential disruptions to the operations of the Company due to the acquisition, the distraction of management and other risks related to the Company’s integration of Baby Boom’s products, business and team; the Company’s ability to retain Baby Boom’s key personnel; unexpected or increased charges, expenses or costs resulting from the acquisition; potential adverse reactions or changes to business relationships resulting from the announcement and completion of the acquisition; general economic conditions, including changes in interest rates, in the overall level of consumer spending and in the price of oil, cotton and other raw materials used in the Company’s products; changing competition; changes in the retail environment; the Company’s ability to successfully integrate newly acquired businesses generally; the level and pricing of future orders from the Company’s customers; the extent to which the Company’s business is concentrated in a small number of customers; the Company’s dependence upon third-party suppliers, including some located in foreign countries; customer acceptance of both new designs and newly-introduced product lines; actions of competitors that may impact the Company’s business; disruptions to transportation systems or shipping lanes used by the Company or its suppliers; and the Company’s dependence upon licenses from third parties. Reference is also made to the Company’s periodic filings with the Securities and Exchange Commission for additional factors that may impact the Company’s results of operations and financial condition. The Company does not undertake to update the forward-looking statements contained herein to conform to actual results or changes in our expectations, whether as a result of new information, future events or otherwise.

Contact:

Craig J. DemarestVice President and Chief Financial Officer (225) 647-9118cdemarest@crowncrafts.com

Investor Relations:

Three Part AdvisorsSteven Hooser, Partner, or John Beisler, Managing Director(817) 310-8776

Crown Crafts, Inc. CRWS delivered earnings per share (EPS) of 10 cents in the fourth quarter of fiscal 2024, up 25% compared with 8 cents in the year-ago period.

Full-year fiscal 2024 EPS was 48 cents, down 14.3% compared with the fiscal 2023-end.

Revenues in Detail

Crown Crafts registered revenues of $22.6 million in the fiscal fourth quarter, up 4.5% year over year.

Full-year fiscal 2024 revenues were $87.6 million, indicating a 16.8% uptick from the comparable fiscal 2023 period.

Segment Details

Crown Crafts’ operations consist of two business segments — Bedding, blankets and accessories, and Bibs, toys and disposable products.

In fiscal 2024, Bedding, blankets and accessories reported revenues of $32 million, down 12.8% from the fiscal 2023-end. This primarily resulted from the continued overall softness of that market, the impact of retailers that have been managing inventory levels and consumers who have lowered their spending due to inflationary pressures.

Revenues in the Bibs, toys and disposable products segment totaled $55.6 million in fiscal 2024, up 45.1% from fiscal 2023. The segment was partly aided by revenues from Manhattan Toy, which generated net sales of $18.5 million for developmental toy, feeding and baby care products.

Crown Crafts’ Gross Margin

For the fourth quarter of fiscal 2024, Crown Crafts’ gross profit was $5.2 million, up 10.7% year over year. The gross margin for the quarter was 23.2%, up 130 basis points (bps) from the prior-year quarter’s 21.9%.

For fiscal 2024, Crown Crafts’ gross profit was $23 million, up 15.9% from the comparable fiscal 2023 period. The gross margin for fiscal 2024 was 26.2%, down 20 bps from 26.4% in the comparable fiscal 2023 period.

Crown Crafts’ Operating Expenses Analysis

The marketing and administrative expenses in the quarter under review were $3.9 million, up 4% year over year.

The marketing and administrative expenses during fiscal 2024 were $16.1 million, up 27.3% from the comparable fiscal 2023 period. The increase was primarily attributed to costs incurred by Manhattan and Manhattan Toy Europe Limited, which were $3.9 million higher than the prior fiscal year and included credit losses and advertising costs that were $360,000 and $213,000 higher than the prior fiscal year, respectively.

Profitability

Income from operations in the fiscal fourth quarter was $1.3 million, up 36.8% year over year. In fiscal 2024, income from operations was $6.9 million, down 3.9% from the comparable fiscal 2023 period.

Net income in the fiscal fourth quarter was $1 million, up 21.3% year over year. In fiscal 2024, the net income was $4.9 million, down 13.4% from the comparable fiscal 2023 period.

Liquidity & Debt Management

Crown Crafts exited fiscal 2024 with cash and cash equivalents of $0.8 million compared with $1.7 million at the fiscal 2023-end.

Total long-term debt at the end of fiscal 2024 was $8.1 million compared with $12.7 million at the fiscal 2023-end.

Cumulative net cash provided by operating activities at the end of fiscal 2024 was $7.1 million compared with $7.7 million a year ago.

Our Take

Crown Crafts exited fourth-quarter fiscal 2024 with encouraging top-line and bottom-line results. Robust performance by its Bibs, toys and disposable products segment was impressive. Gross margin expansion bodes well. Robust net income during the reported quarter is also encouraging. Continued benefits from the integration of Manhattan Toy are also promising.

However, the decline in the Bedding, blankets and accessories segment’s revenues was disappointing. The company continuing to navigate through the ongoing effects of the inflationary environment and its negative impact on consumers’ discretionary spending raises apprehension.

Zacks Investment Research

Net sales grew to $87.6M in fiscal 2024, with net income at $4.9M and EPS of $0.48, despite higher expenses and a slight margin decline. Management remains focused on integration, cross-selling, and long-term growth.

Original document: Crown Crafts, Inc. [CRWS] SEC 8-K Current Report — Jun. 28 2024

Net sales grew 16.8% to $87.6M, driven by the Manhattan Acquisition, but net income fell 13.4% to $4.9M as margins and expenses shifted. Customer concentration and licensing remain key risks, while the company maintains strong liquidity.

Original document: Crown Crafts, Inc. [CRWS] SEC 10-K Annual Report — Jun. 28 2024

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up