Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

On Sept. 9, over 2.6 trillion Shiba Inu tokens left centralized exchanges, causing one of the biggest exchange outflows in the company's history. Although the reason for this enormous movement is still unknown, it is nearly always seen as a sign that the asset is in a strong bull market.

Shiba Inu pressure alleviated?

Large holders, frequently whales or institutional investors, usually shift their assets into cold storage or custody solutions when tokens leave exchanges in such massive quantities. By lowering the market's immediate selling pressure, this fosters an environment in which even slight demand can result in a large price increase. In short, the path of least resistance for prices is upward when supply on exchanges decreases. Chart by TradingView">

Based on the SHIB/USDT chart, the price is currently testing resistance at the $0.0000130-$0.0000138 levels after breaking out of a triangle consolidation pattern. A possible breakout structure is indicated by the moving averages' close clustering. A strong trend continuation might be sparked by a clean move above the 200-day EMA, particularly if volume starts to rise from this point.

This outflow incident also emphasizes how crucial it is to monitor exchange inflows and outflows, in addition to technical levels. Massive outflows, such as the one that was seen, indicate confidence and accumulation, but an abrupt spike in inflows frequently signals profit-taking and increased selling pressure. Since inflows are still slow right now, the outflow is all the more noteworthy.

What to expect?

In a larger sense, SHIB has had significant speculative swings and volatility throughout 2025. This most recent development, however, may signal a change in investor behavior from speculative short-term investing to more committed long-term investing. The conditions may be favorable for Shiba Inu to launch a long-term rally if there are no notable inflows in the upcoming weeks.

The 2.6 trillion SHIB outflow is a possible turning point rather than merely a technical anomaly. It lowers downside risk and puts SHIB in a favorable position for growth should demand continue to rise, even though it does not promise instant gains.

The XRP price experienced a 9.12% dip in the last 30 days as the asset faces volatility, which pulled it away from the $3 level. Despite this setback, XRP’s historical data suggests that the altcoin could reclaim $3 and hit a new target of $3.50 this September.

Historical XRP data points to strong September gains

Cryptorank data shows that in the last four consecutive years, XRP has always closed the month in the green. Although it preceded that four-year streak with three years of straight losses, XRP has recorded more gains in September than losses.XRP Monthly Returns Chart | Source: Cryptorank">

The highest growth figures were recorded in 2013 when the coin spiked by 94.4%, followed by 2018 with a 73.2% growth rate. Other notable years of growth were in 2016 and 2022, with 46.9% and 46.2% growth rates, respectively.

Overall, XRP has an average growth rate of 14.1% in the month of September. That figure suggests that a repeat of history could see XRP reach $3.50 in the cryptocurrency trading at $2.96, representing a 1.29% decrease over the market.

As of press time, the XRP price was changing hands at $2.96, representing a 1.29% decrease in the last 24 hours. The asset slipped from a peak of $3.03, exiting the $3 zone after traders moved in for profit.

If XRP registers 14.1% growth, the XRP price may trade around $3.38. Other market forces and events could make it climb as high as $3.50.

XRP's RSI and technical indicators show mixed signals

Meanwhile, the asset’s Relative Strength Index (RSI) shows it has been overbought. This has triggered a significant pullback by investors. Notably, the coin’s trading volume has also declined by 32.45% and is currently at $4.42 billion.

XRP investors will have to hope history will repeat itself for the asset to rally and reclaim the $3.50 target.

As reported by U.Today, XRP’s technical indicators suggest that the current sideways movement of the price is temporary. Notably, the Bollinger Bands indicate that bears might be caught in a trap as the price surges unexpectedly.

TL;DR

New ATH in September?

Over the past few days, Ripple’s cross-border token has been dancing around the $3 level, currently trading slightly below it. This represents a substantial decline of almost 20% since the all-time high of $3.65 witnessed in July, but according to some of the most popular AI chatbots, a new record may be knocking on the door.

Specifically, we asked ChatGPT, Grok, and Perplexity to predict the highest price that XRP can record in September. ChatGPT said the asset’s technicals “look promising,” noting that many analysts expect a possible breakout to $3.30-$3.50 and even a fresh peak of $4.70.

It estimated that such breakouts hinge on catalysts like institutional inflows, regulatory clarity, and ETF-related news. The Ripple-SEC case has concluded, and the community now awaits the launch of the first spot XRP ETF in the USA.

The product will allow investors to gain direct exposure to the token through a traditional brokerage account. This will simplify the process and is expected to increase the interest in XRP and positively impact its price. According to Polymarket, the approval odds before the end of 2025 currently stand at around 92%.

At the same time, ChatGPT warned that the crypto market is quite volatile and XRP isn’t immune to sharp pullbacks. It suggested that losing the $2.77 support could lead to a drop to the $2.50-$2.60 zone.

We now move to Grok. The AI chatbot built into the social media platform X started its examination with the disclaimer that predicting XRP’s highest price in September is “inherently speculative” as volatile factors like macroeconomic events, institutional adoption, and on-chain activity such as whale accumulations influence crypto markets.

Later on, Grok estimated that the asset has been recently consolidating in a symmetrical triangle or descending channel pattern with key support at $2.77-$2.80 and resistance at $3-$3.40.

“A breakout above $3.13–$3.40 could signal bullish continuation, targeting $3.60–$5.00 by month-end. Failure to hold $2.65–$2.70 risks a drop to $2.50, but on-chain data shows strong whale buying absorbing sells.”

Last but not least, Grok claimed that XRP’s recent push above $3 was fueled bythe rising rumorsthat Apple plans to purchase $1.5 billion worth of the cryptocurrency on September 9. This turned out to be pure speculation, as even some of the hard-core XRP fans rejected the possibility.How About a Lower Target?

Perplexity was less bullish than the other AI chatbots, projecting XRP’s peak this month at $3.36. While it acknowledged that many market observers expect further upside, it described that target as the most “reliable” one.

“There is historical precedence for XRP performing strongly in September, with an average gain of about 87% in previous years, although volatility can be significant,” it added.

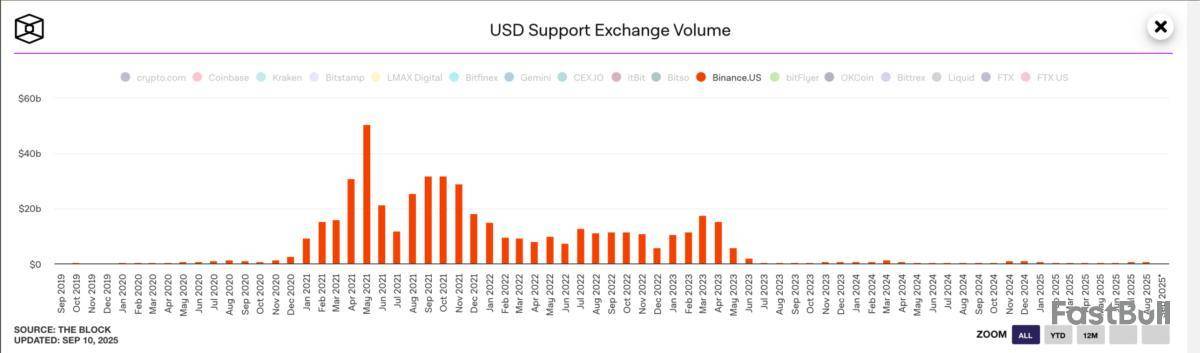

Binance.US, the American affiliate of global crypto exchange Binance, has reduced fees on more than 20 trading pairs, including Ethereum, Solana, BNB, and Cardano, as its trading volumes have all but dried up.

The exchange said it will now offer 0% maker fees and 0.01% taker fees on the pairs, with no subscription or volume requirements. Maker fees apply to orders that add liquidity by resting on the order book, while taker fees apply to orders that remove liquidity by filling immediately against existing orders.

Binance.US has also added more than 20 pairs to its "Tier 0" pricing model. All Tier 0 pairs — including BTC/USD, which replaces BTC/USDC — will now carry a 0.01% taker fee while keeping 0% maker fees.

The Tier 0 pricing model was first introduced in 2022 with bitcoin pairs, briefly drawing significant trading activity at the time.

But since June 2023, when the U.S. Securities and Exchange Commission sued Binance and related entities, Binance.US's volumes have collapsed. Its share of U.S. dollar–supporting exchange volume has fallen to about 0.20% as of August, down from around 10% previously. Although the SEC dropped its case against Binance and related entities in May, activity on Binance.US has remained negligible, according to The Block's Data Dashboard.

Chris Blodgett, chief operating officer at Binance.US, declined to comment on why volumes remain low but said, "We look forward to continuing our mission of building the best and safest digital asset trading experience in the U.S. with high liquidity and tight spreads for even better price discovery and the best possible value."

The latest fee cuts mark another attempt by Binance.US to regain share in a U.S. market dominated by Coinbase and Kraken.

Earlier this year, Binance.US restored U.S. dollar deposits and withdrawals for the first time in almost two years. Dollar rails had been suspended in June 2023, days after the SEC sued Binance, Binance.US, and co-founder Changpeng Zhao for securities violations. That left Binance.US operating as a crypto-only platform, sending its market share into a nosedive. Later that year, Binance and Zhao pled guilty to Bank Secrecy Act violations and agreed to pay more than $4 billion to resolve a Justice Department probe.

In May of this year, the SEC moved to dismiss its case against Binance as the agency charted a new regulatory course under the President Donald Trump administration. Several other high-profile cases — against Coinbase, Uniswap, and OpenSea — have also been dropped in recent months.

By lowering fees again, Binance.US is seeking to regain its standing as the lowest-cost venue in the country. Whether fee reductions alone can revive trading remains to be seen.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

MEXC will list Marinade under the MNDE/USDT trading pair on September 10th.

MNDE Info

Marinade.Finance is a non-custodial liquid staking protocol built on Solana.

Marinade helps users to stake Solana without locking in liquidity by turning SOL into mSOL — tokenized version of staked SOL. This way users can both secure the network by staking SOL, and use your mSOL as the ultimate unit in Solana DeFi ecosystem. To provide liquidity, deposit in lending protocols and even buy NFTs.

The MNDE token serves as a governance mechanism for Marinade, a DAO operating on the Solana blockchain. Launched in October 2021 without an Initial Coin Offering (ICO) or Venture Capital allocation, the MNDE token empowers holders to participate in decision-making processes, such as voting on proposals and influencing delegation strategies. A distinct feature of MNDE is its role in directing 20% of the total SOL in the Marinade Stake Pool, thereby offering influence over validator selection. It also supports tools like the MNDE calculator to assist users in estimating expected ROI. Furthermore, holders of locked MNDE tokens can exercise governance over the protocol’s treasury and influence its development.

A coalition of Web3 companies has introduced a new Ethereum token standard designed to streamline compliance and reduce fragmentation in the growing real-world asset (RWA) sector.

According to an announcement sent to Cointelegraph, the standard, ERC-7943, creates a minimal, modular interface designed to work across Ethereum layer-2s and Ethereum Virtual Machine (EVM) chains, while remaining agnostic to implementation and vendor-specific infrastructure. This means it can work in any setup and isn’t locked into any specific company’s tools.

Dario Lo Buglio, the co-founder of Brickken and the author of the Ethereum Improvement Proposal (EIP)-7943, told Cointelegraph that the new standard acts as a “universal layer” that sits on top of any token type. This allows developers and institutions to avoid having to use wrappers and custom bridges while integrating tokenized assets into apps.

ERC-7943 is backed by a coalition of Web3 and fintech firms, including Bit2Me, Brickken, Compellio, Dekalabs, DigiShares, Hacken, Forte Protocol, FullyTokenized, RealEstate.Exchange, Stobox and Zoth.

Responding to a “perfect storm” of institutional interest

According to Lo Buglio, EIP-7943 is a direct response to developer frustration and a “perfect storm of institutional interest.”

Data from the RWA tracker RWA.xyz shows that the total value of tokenized RWAs onchain has reached $28.44 billion, up nearly 6% in the last 30 days. Meanwhile, stablecoins’ total stablecoin value and total asset holders are up nearly 7% and 9%, respectively.

The growth of RWAs shows that institutions are currently adopting RWAs at scale, with issuers competing for market share. Lo Buglio said this highlights the need for a new token standard that addresses the needs of developers and financial institutions alike.

“Financial institutions want programmable controls that match their compliance frameworks. Developers, on the other hand, are stuck rewriting custom logic for every RWA token,” Lo Buglio told Cointelegraph. “We needed a common foundation.”

Lo Buglio told Cointelegraph that the standard entered the review stage of the EIP process and has already received feedback from compliance professionals and other token standard authors.

“The EIP still stands on the review stage, which is where the main feedback will be proposed and incorporated.”

Tackling fragmentation and enabling composability

Earlier efforts to standardize RWA tokenization on Ethereum include ERC-1400 and ERC-3643. ERC-1400 introduced a hybrid model blending features of fungible and non-fungible tokens (NFTs), with built-in compliance tools.

ERC-3643 focused on regulated assets like securities, integrating onchain identity and permission layers to enforce Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

Lo Buglio said ERC-1400 aims to focus on separating logic from storage and said that ERC-3643 is strong for securities, but it’s tightly coupled to its own identity and permissioning stack. Unlike these solutions, he said, it differentiates itself by being a minimal, implementation-agnostic interface.

“EIP-7943 defines only what must exist — not how it’s built — so any project or protocol can slot it into their stack without friction,” Lo Buglio told Cointelegraph.

“Its primary goal is to solve the problem of industry fragmentation by providing a single, standardized set of functions for compliance.”

The XRP Ledger has lost one of its biggest signals of strength.

Daily payment volumes, which often held steady above 200-300 million XRP and sometimes touched 2 billion, have now dropped sharply to 114.07 million XRP in the last 24 hours. For a network built around payments rather than DeFi or NFTs, this slide raises tough questions about demand and market confidence.

Payment Volumes Show Cracks in Utility

The XRP Ledger was designed to power fast, low-cost cross-border transactions at scale. For years, Ripple has promoted this as a key advantage over other blockchains. But falling transaction volumes suggest real-world adoption isn’t keeping pace with the company’s vision.

Ripple CEO Brad Garlinghouse insists XRPL remains “a decentralized, battle-tested, open-source blockchain designed to function at scale,” but these numbers are now challenging that narrative.

XRP Price Steady, But Momentum Weak

XRP is trading around $2.97, stuck between resistance at $3.10 and support near $2.92 at the 50-day EMA. The RSI sits at 55, showing neutral momentum. But price stability without growth in network activity is a warning sign for traders.

Any rally without a rebound in on-chain demand may struggle to hold.

Binance Reserves Surge, TVL Drops

Market data points to other signs. Binance now holds a record 3.57 billion XRP, up by 670 million since September began. That kind of accumulation on exchanges is often linked to selling pressure.

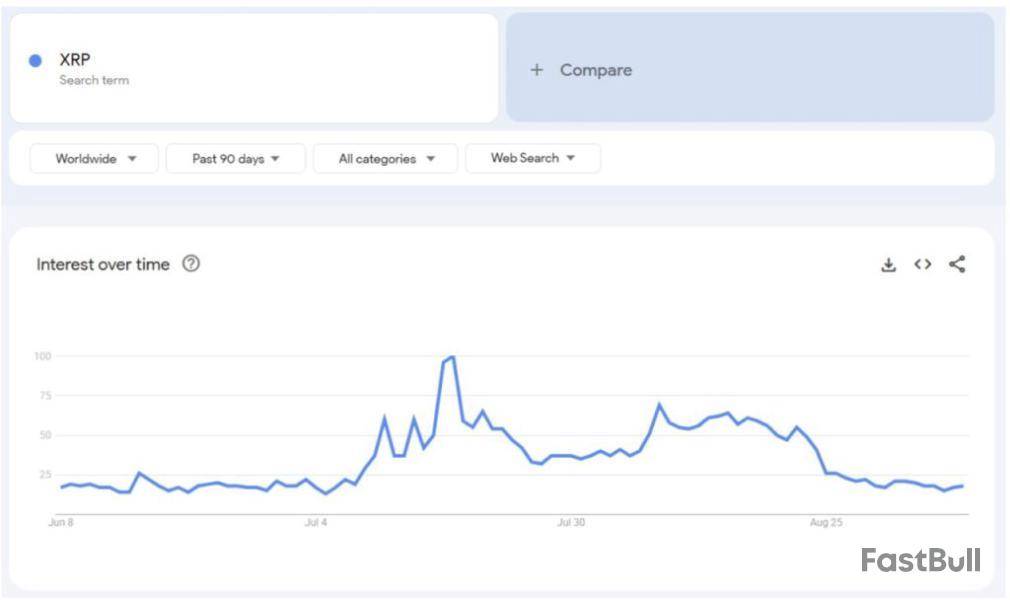

Total value locked on XRPL has also slipped from $120M to $98M, while DEX activity hit its lowest level since April. And Google Trends data shows interest in “Ripple ” has collapsed from a score of 100 to just 19 in two months.

A Critical Moment for XRP

Ripple continues to position itself as a leader in global payments, building solutions for cross-border transfers, stablecoins, and custody services. But the latest on-chain numbers tell a different story.

With regulatory pressure from the SEC still clouding sentiment, and key adoption metrics falling, XRP is at a crossroads. The asset may need more than price rallies to prove its place in the market.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up