Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

At least one Coinbase user was reportedly scammed out of 400 bitcoin, worth an estimated $33.5 million at current prices, in a series of social engineering attacks targeting users of the U.S.-based cryptocurrency exchange, according to on-chain investigator ZachXBT.

Details on how the funds were stolen remain unclear. However, ZachXBT identified the wallet "bc1qvl" as the theft address and noted at least three additional incidents since March 16. The other thefts involved 20 BTC, 46 BTC, and 60 BTC, respectively.

The stolen bitcoin was moved to Ethereum’s blockchain using bridging tools like THORChain and Chainflip, ZachXBT said.

"After uncovering this theft, I noticed multiple other suspected thefts from Coinbase users in the past two weeks, bringing the total stolen this month to $46M+,”"the sleuth shared on Telegram.

ZachXBT has previously flagged similar attacks against Coinbase users in recent months. In one case last year, scammers stole $234 million in bitcoin from a Gemini creditor by posing as Coinbase support staff. Miami police later arrested three suspects based on information provided by ZachXBT.

Last month, the investigator claimed that criminals exploited Coinbase users for $65 million between December 2024 and January 2025.

"Coinbase has not flagged any of the theft addresses from these victims in compliance tools," ZachXBT said in a Friday Telegram post regarding the latest March heists.

The Block has contacted Coinbase for comment.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

RUGGEL, Liechtenstein, March 28, 2025 (GLOBE NEWSWIRE) — In a bold leap forward to redefine education worldwide, Legacy Network announces the expansion of it’s $LGCT token onto the Base blockchain.

This strategic upgrade is poised to establish $LGCT as the universal currency for education, enhancing global access and slashing transaction costs.

With an ecosystem bursting with innovative products powered by $LGCT, the company's ambition stretches far beyond traditional learning boundaries.

Deploying $LGCT onto the Base means enormous benefits for everyday users and investors alike. Expect near-zero transaction costs, effortless gas-free transactions, and enhanced liquidity. As Legacy Network positions $LGCT as a cornerstone in educational tech, the promise of new listings on prominent centralised exchanges amplifies excitement, ensuring easier global access and boosted market visibility. A key part of that vision is Legacy Academy, the company’s flagship mobile app, which blends gamification with self-improvement. Since its launch in July, the app has seen over 800,000 downloads globally, maintaining a strong 4.6-star user rating and resonating across diverse communities.

Operating fully regulated from Central Europe, Legacy Network sets high standards of compliance, backed by a dynamic team of 50 professionals combining expertise from technology, finance, and education to reshape learning as we know it.

With eyes fixed firmly on the future, Legacy Network remains steadfastly committed to dismantling traditional limitations in education. The upcoming Base blockchain integration is just one significant step within an ambitious, multifaceted strategy aimed at making $LGCT education's currency of choice.

For more information visit www.legacynetwork.io or contact our media team at dominic.haas@legacynetwork.io / luka.petrovic@legacynetwork.io

Follow Legacy Network:

Instagram: @legacynetwork.io / @Legacyacademyio

Twitter: @Legacynetworkio

YouTube: LegacyNetworkio

Media Contact:

Company: Legacy Network

Email: dominic.haas@legacynetwork.io

Disclaimer: This press release is provided by Legacy Network. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining related opportunities involves significant risks, including the potential loss of capital. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. However, due to the inherently speculative nature of the blockchain sector--including cryptocurrency, NFTs, and mining--complete accuracy cannot always be guaranteed. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.Speculate only with funds that you can afford to lose.Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/20bf48fc-2986-48e2-ad83-fbffc8ce539b

legacy-network-feat image

legacy-network-feat image

TL;DR

Increased Optimism From Traders

Dogecoin (DOGE) witnessed an impressive surge in December last year, with its price exceeding $0.45. Since then, though, it has retreated by approximately 60% and currently trades at around $0.18. Despite the evident downtrend in the past few months, many investors remain bullish on the OG meme coin.

The renowned analyst, going on X as Ali Martinez, revealed that more than 76% of the traders on Binance Futures that have hopped on the Dogecoin bandwagon have opened long positions.

76.65% of traders on Binance Futures are long on #Dogecoin $DOGE! pic.twitter.com/Qpr3pGCwh7

— Ali (@ali_charts) March 28, 2025

Predominant optimism can be interpreted in various ways. People might speculate that some of those traders have inside information about potential major developments surrounding Dogecoin that could positively impact the price of the underlying token.

One example could be the possible launch of a spot DOGE ETF in the United States. Grayscale, Bitwise, and Osprey Funds are among the entities that have filed to introduce such a product, while the odds of approval before the end of the year are estimated at slightly under 70%.

It is important to note, though, that the bullish sentiment may be taken as a bearish factor. After all, cryptocurrencies tend to do the opposite of what the crowd expects, while famous investors have previously warned people not to follow the ongoing trend. Warren Buffett’s advice, for instance, states: “Be fearful when others are greedy and greedy when others are fearful.”Price Predictions

Crypto X also seems predominantly positive on DOGE’s future, with multiple industry participants envisioning a resurgence in the short term. Crypto VIP Signal recently claimed that the meme coin “has broken the resistance area and is now retesting it.”

“You can accumulate some DOGE during this retest, and we can expect a continuation of the upward movement after some accumulation,” they added.

Trader Tardigrade also gave their two cents. The market observer pointed to the declining RSI ratio to envision a price explosion to as high as $1 in the following months.

The Relative Strength Index (RSI) measures the speed and change of price movements and varies from 0 to 100. Readings below 30 suggest Dogecoin might have entered oversold territory, meaning it could be gearing up for a rally. The RSI has plunged below 40 in the past several hours and is nearing the bullish zone.

Pi Network, once a well-loved crypto project among millennial investors, is in freefall. With the promise of user-friendly mobile crypto mining and a growing community of enthusiasts and supporters, the Pi Network quickly became one of the top projects in recent years. So it wasn’t surprising that its native token, PI, promptly raced to its all-time high of $2.99 when the developers launched the Pi mainnet.

However, after hitting a peak of $2,99, the token has crashed by nearly 50% over the past two weeks. The Pi coin trades between $0.80 and $0.83, with bearish market signals moving forward.

Pi Coin Holders Looking For Answers

The Pi Network launched its Open Mainnet on February 20th to much fanfare and anticipation. Supporters and crypto miners on social media heavily advertised the project’s official launch, marking its move from a closed ecosystem to complete decentralization. The token’s price immediately fluctuated, briefly surging to $1.96 before dropping to $0.74 and settling to $1.29.

Pi Open Mainnet@piopennetworkMar 26, 2025Almost 10M $PI coins will be unlocked today until tomorrow. That’s why price is . At least the @PiCoreTeam is not making rollbacks. On March 29 things will get better. #PiNetwork pic.twitter.com/MijB0zFpMF

However, the first 30 days of Pi Network were filled with plenty of challenges and issues. For example, the Pi Network community faced issues with Binance, including its recent rejection of its possible listing. There was also a loss of confidence in the project, pushing a bearish sentiment on the token. More than 10 million Pi coins were added to circulation, pushing the price 12% down.

Pi Network Devs Promise Things ‘Will Be Better’ Soon

In a Twitter/X post, the Pi Network announced adding 10 million new tokens to circulation. While this news immediately pushed the price down, the dev team assured holders and investors that things would improve soon.

Pi Network’s recent unlock schedule was transparent and immediately shared with the investing public. The devs also said they’re adding 102 million PI tokens to the current circulation next month. Although the developers have been transparent with these efforts, many holders, particularly the pioneers, have blasted the move.The Road Ahead For Pi Network

In recent days, the Pi Network has been caught in heated discussions about the unclear rules for establishing the Pi Network Super Node. Many pioneers and crypto analysts are questioning the team and asking if it’s a transparent and decentralized project. Making matters worse is the recent data from PiScan showing that the Pi Network’s team keeps nearly 83 billion coins out of the total 100 billion in circulation.

Debates and questions intensified after Pi Network members didn’t receive complete answers and guidance on how they serve as SuperNode validations. Still, the project’s developer team remains bullish, and it aims to launch its new domain auction. According to recent data, the bidding attracted 200k bids in less than a week.

Featured image from MakeUseOf, chart from TradingView

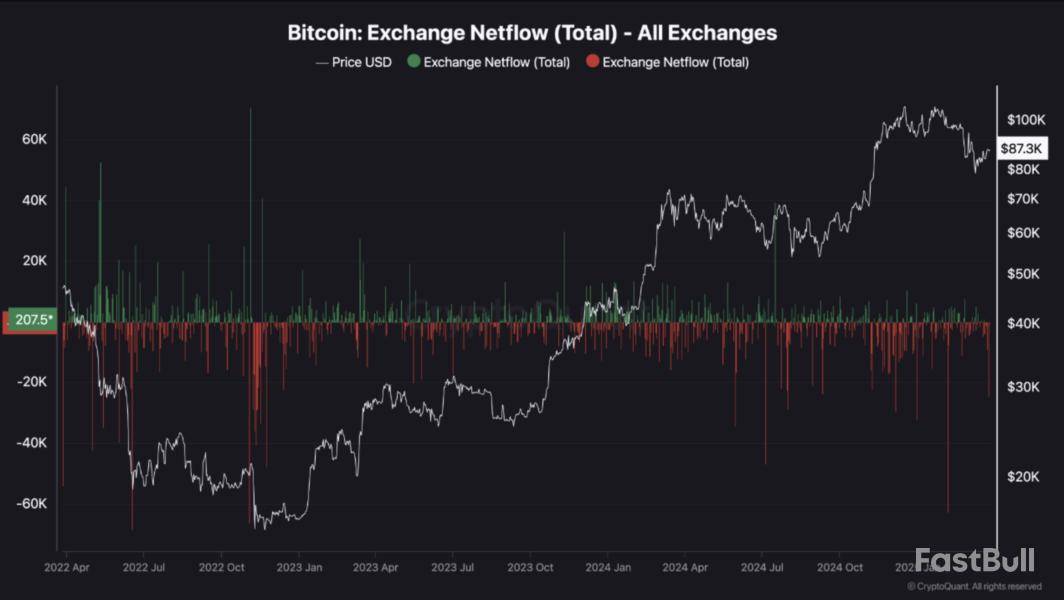

According to a CryptoQuant Quicktake post published earlier today, Bitcoin (BTC) may be on the verge of a significant price rally. Since February 6, net flow across crypto exchanges has remained negative – a historically bullish signal for the digital asset.

Bitcoin To Benefit From Negative Exchange Net Flow

The past 24 hours have been highly volatile for the crypto market, with liquidations exceeding $360 million, the majority involving long positions. However, despite this market pullback, on-chain data remains bullish, suggesting that concerns may be overstated.

In a Quicktake post shared today, CryptoQuant analyst ibrahimcosar highlighted Bitcoin’s exchange flows. He noted that since February 6, BTC has experienced a persistent negative net flow across trading platforms.

To explain, when a large quantity of BTC is withdrawn from exchanges, it often indicates that investors – likely those who bought at lower prices – are expecting a price rally. These investors move their holdings to cold wallets, anticipating long-term gains and paying network fees to secure their assets. Over time, this behavior results in a negative net flow of BTC across exchanges, a bullish indicator.

Conversely, when a significant amount of BTC is deposited onto exchanges, it increases selling pressure, often signalling a bearish trend. Extended periods of high crypto deposits lead to positive net flows, typically preceding price declines.

The analyst stated that recent data – from February 6 onwards – suggests that a large amount of BTC is being withdrawn from crypto exchanges. The analyst added:

Historically, such high outflows have led to significant price increases in Bitcoin. This suggests that market volatility to the upside could be on the horizon.

Ibrahimcosar’s insights align with a recent analysis from CryptoQuant analyst ShayanBTC, who noted that BTC reserves on exchanges are rapidly decreasing. A sustained decline in exchange reserves could set the stage for a supply shock-driven price rally, reversing Bitcoin’s recent downtrend.

Momentum, Macroeconomic Factors Point Toward Bullish Trend

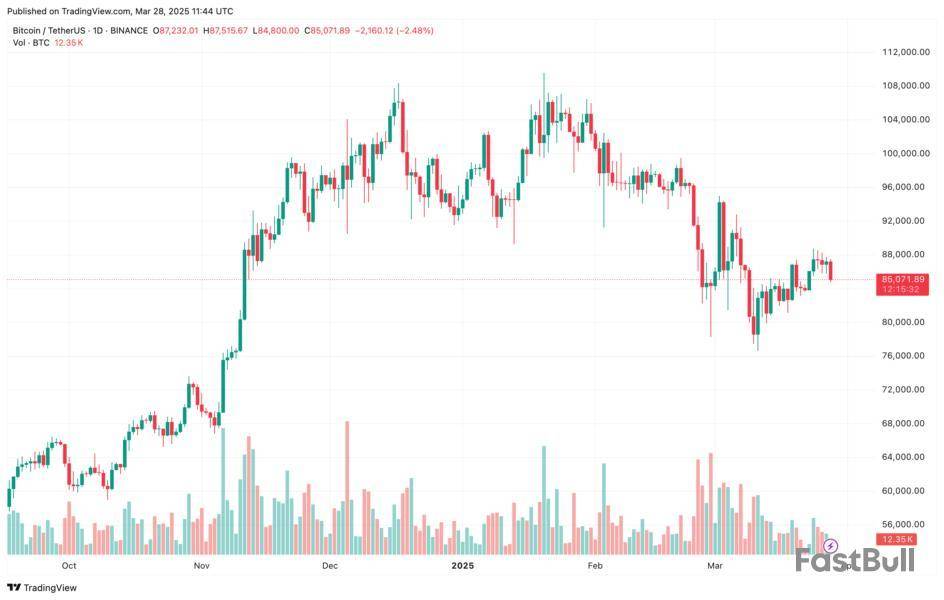

Beyond on-chain metrics, technical indicators like the Relative Strength Index (RSI) have also turned bullish. A recent analysis by Rekt Capital highlighted that BTC’s daily RSI has broken its multi-month downtrend, suggesting that a price rally may be imminent.

Additionally, macroeconomic factors appear to be fueling optimism. Reports suggest that US President Donald Trump may reconsider upcoming reciprocal tariffs set to take effect on April 2, potentially easing market concerns.

Meanwhile, Bitcoin whales – wallets with substantial BTC holdings – have resumed accumulation after a brief period of dormancy, further reinforcing a bullish sentiment. At press time, BTC trades at $85,071, down 2.1% in the past 24 hours.

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

It's Friday! With just a few days to go, and despite the hopes and dreams of a banner year coming into 2025, bitcoin still looks set to suffer its worst Q1 close since 2020 as the latest inflation data weighs heavy on market sentiment.

In today's newsletter, U.S. spot Bitcoin ETFs' 10-day inflow streak surpasses $1 billion, former crypto miner CoreWeave nets $1.5 billion in a below-target IPO, HashKey and Bosera are set to launch tokenized money market ETFs in Hong Kong and more.

Meanwhile, our Editor-in-Chief, Tim Copeland, takes a look at 25 key crypto hires, promotions and exits in March's hiring roundup, brought to you by Campus, The Block’s newest crypto hiring tool.

Let's get started.

Bitcoin ETFs' longest yearly inflow streak exceeds $1 billion

U.S. spot Bitcoin ETFs extended their positive streak to 10 days on Thursday — the longest this year and since 15 consecutive days of net inflows across November and December.

CoreWeave nets $1.5 billion in below-target IPO

AI hyperscaler CoreWeave raised $1.5 billion in a downsized initial public offering, Bloomberg reported Thursday, citing an anonymous source with knowledge of the matter, well below its previous $2.7 billion target.

HashKey and Bosera to launch tokenized money market ETFs

Crypto financial services firm HashKey and asset manager Bosera plan to launch tokenized shares of two existing money market ETFs in April under the Hong Kong Monetary Authority's "Project Ensemble" sandbox initiative — in what they claim to be a world first.

NYAG and Galaxy Digital settle LUNA lawsuit for $200 million

New York Attorney General Letitia James and Mike Novogratz's Galaxy Digital have agreed to a $200 million settlement over alleged violations in promoting the doomed LUNA cryptocurrency.

Terraform Labs to open crypto creditor claims portal on March 31

Terraform Labs, the defunct blockchain company behind that $40 billion collapse of TerraUSD and LUNA in 2022, will open its crypto creditor claims portal on March 31, with a deadline for submissions set for April 30.

Looking ahead to next week

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: This article was produced with the assistance of OpenAI’s ChatGPT 3.5/4 and reviewed and edited by our editorial team.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The U.S. Federal Deposit Insurance Corporation is taking a new approach under the Trump administration toward digital assets and is turning back standards requiring financial institutions to notify the agency before engaging in crypto-related activities.

In a statement released on Friday, the FDIC said it would be rescinding old guidance and providing a new one to clarify that its supervised institutions can "engage in permissible crypto-related activities" without getting the agency's go-ahead beforehand.

"With today's action, the FDIC is turning the page on the flawed approach of the past three years," said FDIC Acting Chair Travis Hill in a statement on Friday. "I expect this to be one of several steps the FDIC will take to lay out a new approach for how banks can engage in crypto and blockchain related activities in accordance with safety and soundness standards."

The FDIC previously warned that crypto activities could pose a risk to the U.S. banking system. In recognizing those risks, the agency released a Financial Institution Letter in April 2022, urging its supervised institutions to inform the agency about their current and intended crypto-related activities.

On Tuesday, the FDIC also looked to put an end to "reputational risk" as a way to supervise banks following criticism from some in the crypto industry who say they have been blocked from key financial services. Separately, another U.S. agency, which regulates and supervises national banks and federal savings associations, also rescinded previous digital asset restrictions earlier this month. The Office of the Comptroller of the Currency clarified that crypto-related activities are allowed in the federal banking system.

This all comes after President Donald Trump has signaled a friendlier approach to crypto than the previous Biden administration. Trump has criticized the Biden administration's approach to banks and crypto, saying on March 7 at a White House Summit that the previous administration "strong-armed banks into closing the accounts of crypto businesses and entrepreneurs, effectively blocking some money transfers to and from exchanges, and they weaponized government against the entire industry."

Bo Hines, executive director of the President's Council of Advisers for Digital Assets, said the FDIC's move was "another big win."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up