Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Bitcoin Bounces Nearly 10% From This Morning'S Low Point, Providing Market Relief] February 6Th: Bitcoin Fell To $60,000 This Morning, Hitting Its Lowest Point Since October 2024. In The Past 105 Minutes, It Has Rebounded By 9.75%, Providing The Market With Some Breathing Room

Bank Of Japan Board Member Masu: Neutral Rate Estimate Is Just One Reference In Setting Monetary Policy

Bank Of Japan Board Member Masu: We Also Need To Look Carefully At Whether Japan's Inflation Is Driven Just By Supply Factors, Or Driven By Combination Of Supply And Demand Factors

Bank Of Japan Board Member Masu: I Am Personally Focusing On How Prices Of Processed Food, Excluding Rice, Would Move As That Would Be Key To Japan's Inflation Outlook

Bank Of Japan Board Member Masu: Bank Of Japan Must Scrutinise Market Developments In Examining Future Pace Of Its Bond Buying

Bank Of Japan Board Member Masu: It's Clear Deflationary Customs Are Being Eradicated, Japan Entering Period Of Inflation

Bank Of Japan Board Member Masu: Bank Of Japan Expected To Continue Raising Interest Rates If Economic, Price Forecasts Materialise

Bank Of Japan Board Member Masu: Must Be Vigilant To Whether Inflation Driven By Weak Yen Pushes Up Overall Prices, Affect Underlying Inflation

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)A:--

F: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)A:--

F: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)A:--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)A:--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest RateA:--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)A:--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending RateA:--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit RateA:--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing RateA:--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. Japan Foreign Exchange Reserves (Jan)

Japan Foreign Exchange Reserves (Jan)A:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest Rate--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve Ratio--

F: --

P: --

India Repo Rate

India Repo Rate--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo Rate--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)--

F: --

P: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)--

F: --

P: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)--

F: --

P: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

No matching data

View All

No data

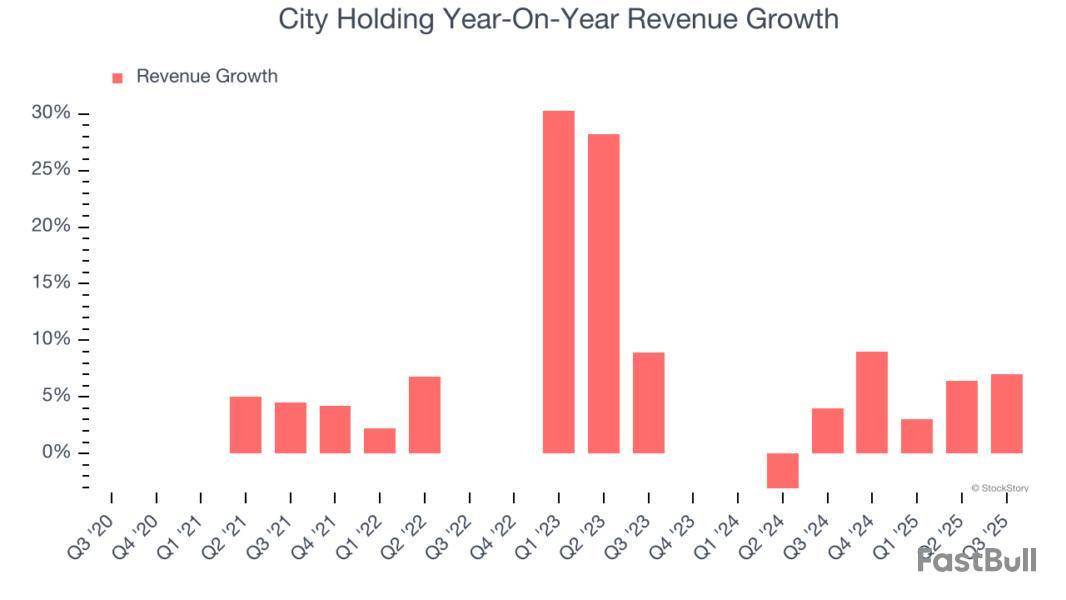

Regional banking company City Holding missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 6.8% year on year to $80.2 million. Its non-GAAP profit of $2.18 per share was 3.6% below analysts’ consensus estimates.

City Holding (CHCO) Q4 CY2025 Highlights:

Company Overview

With roots dating back to 1957 and a strategic presence along the I-64 and I-81 corridors, City Holding (NASDAQGS:CHCO) operates as a financial holding company providing banking, trust, and investment services through its subsidiary City National Bank across West Virginia, Kentucky, Virginia, and Ohio.

Sales Growth

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Regrettably, City Holding’s revenue grew at a tepid 7.3% compounded annual growth rate over the last five years. This was below our standard for the banking sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. City Holding’s recent performance shows its demand has slowed as its annualized revenue growth of 3.2% over the last two years was below its five-year trend.

This quarter, City Holding’s revenue grew by 6.8% year on year to $80.2 million, missing Wall Street’s estimates.

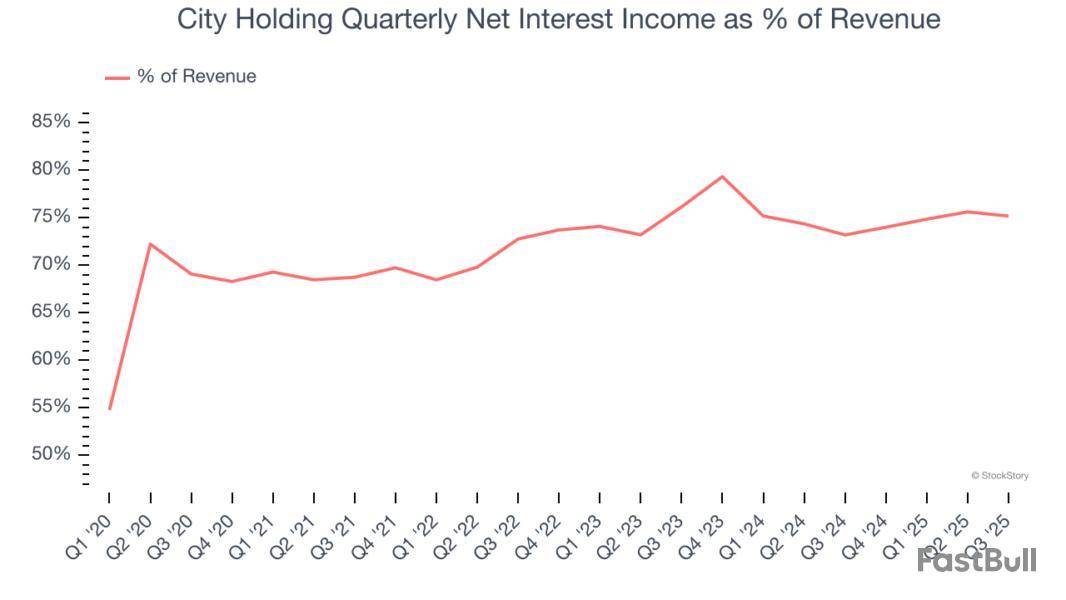

Net interest income made up 72.6% of the company’s total revenue during the last five years, meaning lending operations are City Holding’s largest source of revenue.

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Tangible Book Value Per Share (TBVPS)

The balance sheet drives banking profitability since earnings flow from the spread between borrowing and lending rates. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential.

When analyzing banks, tangible book value per share (TBVPS) takes precedence over many other metrics. This measure isolates genuine per-share value by removing intangible assets of debatable liquidation worth. EPS can become murky due to acquisition impacts or accounting flexibility around loan provisions, and TBVPS resists financial engineering manipulation.

City Holding’s TBVPS grew at a mediocre 4.2% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 14.4% annually over the last two years from $34.69 to $45.41 per share.

Over the next 12 months, Consensus estimates call for City Holding’s TBVPS to grow by 8.8% to $49.40, paltry growth rate.

Key Takeaways from City Holding’s Q4 Results

We struggled to find many positives in these results. Its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $124.13 immediately after reporting.

So do we think City Holding is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).

As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the regional banks industry, including City Holding and its peers.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 94 regional banks stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.3%.

Thankfully, share prices of the companies have been resilient as they are up 9.4% on average since the latest earnings results.

With roots dating back to 1957 and a strategic presence along the I-64 and I-81 corridors, City Holding (NASDAQGS:CHCO) operates as a financial holding company providing banking, trust, and investment services through its subsidiary City National Bank across West Virginia, Kentucky, Virginia, and Ohio.

City Holding reported revenues of $81.29 million, up 7.2% year on year. This print exceeded analysts’ expectations by 1.9%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ tangible book value per share estimates and a beat of analysts’ EPS estimates.

Interestingly, the stock is up 4.4% since reporting and currently trades at $125.69.

Is now the time to buy City Holding? Access our full analysis of the earnings results here, it’s free for active Edge members.

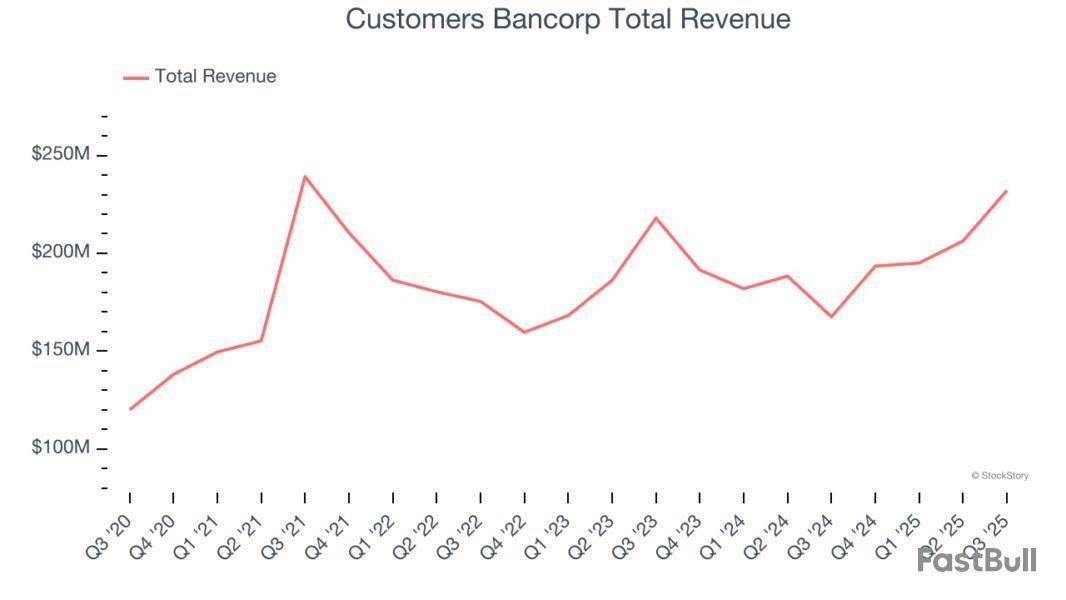

Originally founded with a "high-tech, high-touch" branch-light banking strategy, Customers Bancorp is a bank holding company that provides commercial and consumer banking services through its Customers Bank subsidiary, with a focus on business lending and digital banking.

Customers Bancorp reported revenues of $231.8 million, up 38.3% year on year, outperforming analysts’ expectations by 6.9%. The business had a stunning quarter with an impressive beat of analysts’ net interest income estimates and a solid beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 9.4% since reporting. It currently trades at $71.74.

Is now the time to buy Customers Bancorp? Access our full analysis of the earnings results here, it’s free for active Edge members.

Operating behind the scenes of many popular fintech apps and prepaid cards you might use daily, The Bancorp is a bank holding company that specializes in providing banking services to fintech companies and offering specialty lending products.

The Bancorp reported revenues of $174.7 million, up 38.8% year on year, falling short of analysts’ expectations by 9.9%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ net interest income estimates.

The Bancorp delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 10.3% since the results and currently trades at $69.28.

Read our full analysis of The Bancorp’s results here.

Created through strategic mergers to serve the growing Texas business community, Stellar Bancorp is a Texas bank holding company that provides commercial banking services primarily to small and medium-sized businesses and professionals.

Stellar Bancorp reported revenues of $105.7 million, down 2% year on year. This result was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ tangible book value per share estimates but EPS in line with analysts’ estimates.

The stock is up 9.2% since reporting and currently trades at $32.17.

Read our full, actionable report on Stellar Bancorp here, it’s free for active Edge members.

Founded in Conway, Arkansas in 1998 and growing through strategic acquisitions across the Southeast, Home Bancshares operates as the bank holding company for Centennial Bank, providing commercial and retail banking services to businesses and individuals across multiple states.

Home Bancshares reported revenues of $275.5 million, up 6.3% year on year. This number surpassed analysts’ expectations by 1.6%. Taking a step back, it was a mixed quarter as it also logged an impressive beat of analysts’ tangible book value per share estimates but a narrow beat of analysts’ EPS estimates.

The stock is up 4.1% since reporting and currently trades at $28.59.

Read our full, actionable report on Home Bancshares here, it’s free for active Edge members.

(17:33 GMT) City Holding Price Target Announced at $125.00/Share by Piper Sandler

What Happened?

Shares of regional banking company City Holding jumped 2.9% in the afternoon session after comments from a key Federal Reserve official boosted hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

The shares closed the day at $122.01, up 2.6% from previous close.

Is now the time to buy City Holding? Access our full analysis report here.

What Is The Market Telling Us

City Holding’s shares are not very volatile and have only had 1 move greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful, although it might not be something that would fundamentally change its perception of the business.

The biggest move we wrote about over the last year was about 1 month ago when the stock gained 2.8% on the news that the earnings season got off to a strong start as several big banks reported third-quarter results that surpassed Wall Street's expectations.

The positive results were driven by a rebound in investment banking and strong trading desk performance. JPMorgan Chase reported a significant jump in profit and revenue, boosted by increased trading and dealmaking. Similarly, Wells Fargo saw its shares climb after reporting strong net interest income and raising its guidance. Citigroup also exceeded revenue estimates across all its business lines. While Goldman Sachs also beat expectations, its shares dipped slightly on news of potential job cuts aimed at curbing costs. Overall, the strong reports from these financial giants suggest a healthy pickup in corporate activity and trading.Also, Fed Chair Jerome Powell gave investors a major reason for optimism by suggesting the Fed could soon stop its quantitative tightening (QT) program. For months, this policy acted like a brake on the economy, systematically draining cash from the financial system to cool inflation. Powell's comments signal that the Fed may be ready to ease its pressure, which would leave more liquidity in the market to flow into assets like stocks.

City Holding is up 4% since the beginning of the year, and at $122.01 per share, it is trading close to its 52-week high of $133.96 from November 2024. Investors who bought $1,000 worth of City Holding’s shares 5 years ago would now be looking at an investment worth $1,792.

Looking back on regional banks stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Preferred Bank and its peers.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 94 regional banks stocks we track reported a satisfactory Q3. As a group, revenues missed analysts’ consensus estimates by 1.1%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

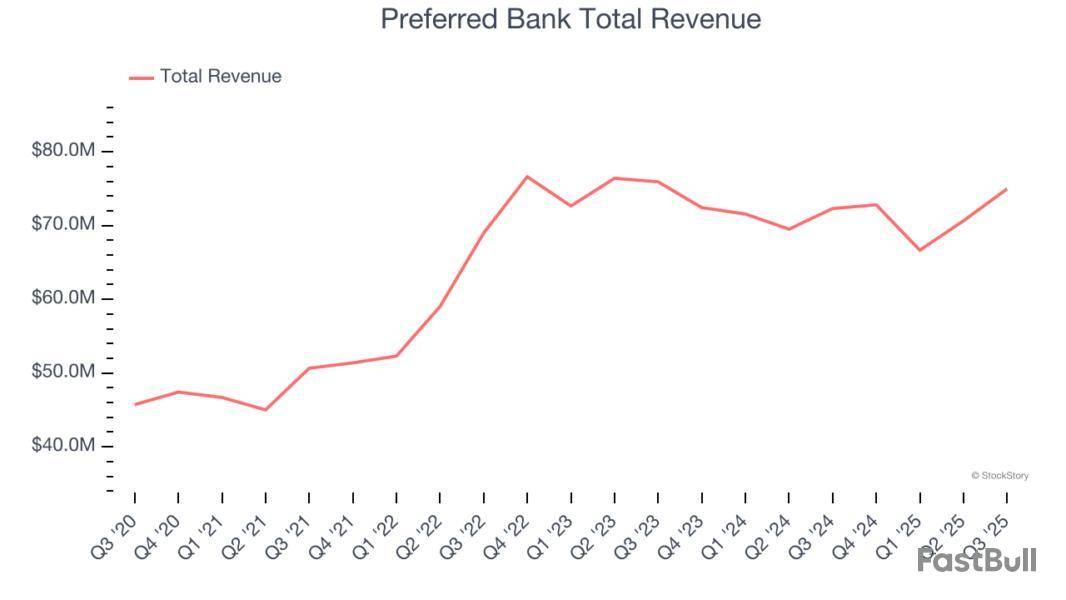

Founded in 1991 with a focus on serving the Pacific Rim community in Southern California, Preferred Bank is a commercial bank that provides banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, and high net worth individuals.

Preferred Bank reported revenues of $74.98 million, up 3.7% year on year. This print exceeded analysts’ expectations by 3.5%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ revenue estimates and a solid beat of analysts’ net interest income estimates.

Li Yu, Chairman and CEO, commented, “We are pleased to report a quarterly record for diluted earnings per share of $2.84 for the third quarter of 2025. Net income for the quarter was $35.9 million.

Interestingly, the stock is up 6% since reporting and currently trades at $91.29.

Is now the time to buy Preferred Bank? Access our full analysis of the earnings results here, it’s free for active Edge members.

Originally founded with a "high-tech, high-touch" branch-light banking strategy, Customers Bancorp is a bank holding company that provides commercial and consumer banking services through its Customers Bank subsidiary, with a focus on business lending and digital banking.

Customers Bancorp reported revenues of $232.1 million, up 38.5% year on year, outperforming analysts’ expectations by 7%. The business had a stunning quarter with a solid beat of analysts’ net interest income estimates and an impressive beat of analysts’ revenue estimates.

The market seems content with the results as the stock is up 3.1% since reporting. It currently trades at $67.60.

Is now the time to buy Customers Bancorp? Access our full analysis of the earnings results here, it’s free for active Edge members.

Operating behind the scenes of many popular fintech apps and prepaid cards you might use daily, The Bancorp is a bank holding company that specializes in providing banking services to fintech companies and offering specialty lending products.

The Bancorp reported revenues of $174.6 million, up 38.8% year on year, falling short of analysts’ expectations by 10%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ net interest income estimates.

As expected, the stock is down 18.6% since the results and currently trades at $62.69.

Read our full analysis of The Bancorp’s results here.

Founded in 1910 during a wave of community banking expansion in the Midwest, German American Bancorp is a financial holding company that provides banking, wealth management, and insurance services across southern Indiana and Kentucky.

German American Bancorp reported revenues of $94.15 million, up 50.9% year on year. This result topped analysts’ expectations by 3.6%. It was a strong quarter as it also put up an impressive beat of analysts’ tangible book value per share estimates and a solid beat of analysts’ revenue estimates.

The stock is up 1.5% since reporting and currently trades at $39.82.

Read our full, actionable report on German American Bancorp here, it’s free for active Edge members.

With roots dating back to 1957 and a strategic presence along the I-64 and I-81 corridors, City Holding (NASDAQGS:CHCO) operates as a financial holding company providing banking, trust, and investment services through its subsidiary City National Bank across West Virginia, Kentucky, Virginia, and Ohio.

City Holding reported revenues of $81.26 million, up 7% year on year. This print surpassed analysts’ expectations by 2%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ tangible book value per share estimates and a beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $120.10.

Read our full, actionable report on City Holding here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Regional banking company City Holding announced better-than-expected revenue in Q3 CY2025, with sales up 7% year on year to $81.26 million. Its GAAP profit of $2.41 per share was 11.8% above analysts’ consensus estimates.

Is now the time to buy City Holding? Find out by accessing our full research report, it’s free for active Edge members.

City Holding (CHCO) Q3 CY2025 Highlights:

Company Overview

With roots dating back to 1957 and a strategic presence along the I-64 and I-81 corridors, City Holding (NASDAQGS:CHCO) operates as a financial holding company providing banking, trust, and investment services through its subsidiary City National Bank across West Virginia, Kentucky, Virginia, and Ohio.

Sales Growth

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income. Over the last five years, City Holding grew its revenue at a decent 5.2% compounded annual growth rate. Its growth was slightly above the average banking company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. City Holding’s recent performance shows its demand has slowed as its annualized revenue growth of 3% over the last two years was below its five-year trend.

This quarter, City Holding reported year-on-year revenue growth of 7%, and its $81.26 million of revenue exceeded Wall Street’s estimates by 2%.

Net interest income made up 72.7% of the company’s total revenue during the last five years, meaning lending operations are City Holding’s largest source of revenue.

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Tangible Book Value Per Share (TBVPS)

The balance sheet drives banking profitability since earnings flow from the spread between borrowing and lending rates. As such, valuations for these companies concentrate on capital strength and sustainable equity accumulation potential.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark. By excluding intangible assets with uncertain liquidation values, this metric captures real, liquid net worth per share. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

City Holding’s TBVPS grew at a mediocre 4.1% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 21.4% annually over the last two years from $29.98 to $44.19 per share.

Over the next 12 months, Consensus estimates call for City Holding’s TBVPS to grow by 6.7% to $47.13, mediocre growth rate.

Key Takeaways from City Holding’s Q3 Results

We enjoyed seeing City Holding beat analysts’ tangible book value per share expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.8% to $122.41 immediately after reporting.

Sure, City Holding had a solid quarter, but if we look at the bigger picture, is this stock a buy? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.

Net income and EPS rose year-over-year, driven by higher net interest income and loan growth, while credit quality remained strong and capital ratios exceeded regulatory minimums. Shareholder returns were supported by dividends and share repurchases, and liquidity and funding capacity remain robust.

Original document: City Holding Company [CHCO] SEC 10-Q Quarterly Report — Oct. 22 2025

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up