Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Citigroup, the third-largest banking institution in the U.S., is exploring an option to issue its own stablecoin to expand digital payment capabilities, Reuters reported citing CEO Jane Fraser.

Following an earnings call on Tuesday, Fraser reportedly informed analysts that Citigroup is exploring a "Citi stablecoin." However, the CEO said Citi is placing more value on its opportunity in tokenized deposits.

Citigroup's crypto endeavor could come in the form of managing reserves for stablecoins or providing custody services for cryptocurrencies, Fraser said.

Earlier this week, JPMorgan Chase CEO and longtime crypto skeptic Jamie Dimon said his bank is going to be involved in deposit coins and stablecoins. This confirmation follows last month's news that said JPMorgan Chase is planning to launch a stablecoin-like blockchain asset called JPMD on the Base network.

The Depository Trust & Clearing Corporation (DTCC) was also reported to be developing a stablecoin last month.

Wall Street's surging interest in stablecoins is in line with ongoing efforts in the U.S. to institutionalize and promote U.S. dollar-backed stablecoins, under President Donald Trump's strong push.

The GENIUS Act, which aims to establish legal fundamentals for USD stablecoins, passed the Senate last month and is currently in the House of Representatives. While House lawmakers voted against advancing the bill on Tuesday, Trump said he met with key members of Congress and confirmed that they will vote in favor in the upcoming vote later today.

Standard Chartered's Global Head of Digital Assets Research Geoffrey Kendrick said Tuesday that 90% of his recent conversations with clients and policymakers in Washington, New York, and Boston were about stablecoins.

Kendrick added that once stablecoins reach a $750 billion market capitalization, they will start to impact traditional finance assets and policies. Stablecoins hold a total market cap of $257 billion, according to DefiLlama, and Kendrick predicts them to hit $750 billion by the end of 2026.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

After peaking at a new all-time high of over $122,800 earlier this week, Bitcoin has undergone a correction, driven by macroeconomic pressures and profit-taking.

In fact, an old Bitcoin whale from the Satoshi era has also started moving its holdings, exacerbating sell-off fears. Still, experts argue that Bitcoin’s ability to weather such transfers without significant price disruption highlights its maturation as a highly liquid asset.

Can Bitcoin Withstand Satoshi-Era Whale Transfers?

In a recent post on X, blockchain analytics firm Lookonchain revealed that the whale who held 80,009 Bitcoins valued at approximately $9.46 billion, transferred 40,009 BTC, worth about $4.68 billion, to Galaxy Digital, adding to its trend of earlier transfers.

Furthermore, Galaxy Digital then deposited 6,000 BTC, worth $706 million, directly into two major cryptocurrency exchanges, Binance and Bybit. This indicated that the firm is likely preparing to sell these assets.

“There’s still a remaining 40,000 BTC in four separate wallets, totaling 10,000. Galaxy Digital doesn’t sell to exchanges immediately after the transfers are made; it waits a while before selling in increments of 200-300 BTC,” The Crypto GEMs added.

Nonetheless, the activity revealed a great deal about Bitcoin’s liquidity. A market watcher, Vijay Boyapati, stressed that the volume rivaled Germany’s Bitcoin sales from the previous year. Despite this, the market absorbed the pressure with only a modest decline.

“Bitcoin is now one of the most deeply liquid markets on Earth, up there with gold and Treasuries,” he wrote.

In a separate post, Boyapati stated that the transfers should not be viewed as a cause of concern. Instead, it marks an important step in the process of monetization.

This shift from a few large holders to a broader group is a sign that Bitcoin is increasingly becoming a widely recognized form of money.

Furthermore, Bloomberg’s ETF analyst James Seyffart also weighed in. He noted that the transfers exemplify how substantial capital is now required to move Bitcoin’s price significantly, both upwards and downwards, further reinforcing its growing maturity.

“Obviously price moves at the margins and a lack of either buyers or sellers at any given time could cause relatively massive moves. but broadly speaking what i said is correct,” Seyffart said.

Many industry leaders echoed this sentiment, highlighting the maturation of the current Bitcoin cycle.

“Bitcoin’s move above $120,000 isn’t just another milestone. It’s a signal that crypto has entered a new phase where institutional confidence is driving consistent demand. What stands out this time is the quality of the rally. It’s spot-driven, not built on leverage, and it’s unfolding in a relatively calm market. That points to a more mature and resilient structure compared to previous cycles,” Alexander Zahnd, interim CEO of Zilliqa told BeInCrypto.

Meanwhile, Shawn Young, Chief Analyst at MEXC Research, explained to BeInCrypto that the movement of such long-held assets usually indicates a major shift in macroeconomic sentiment. He elaborated that the transfers follow a coordinated OTC strategy, typical of institutional investors.

Young revealed that most of the funds are moving through brokerage-linked wallets and custodial structures. This suggests a reallocation rather than market dumping.

“The distinction matters. A reallocation to institutional custody is a sign of market maturation. A broad sell-off, on the other hand, would signal risk-off sentiment at the highest levels. So far, the market’s muted reaction suggests the former. But all eyes are on the next move,” he mentioned.

The analyst added that the main question is not the whale’s identity, but the strategy behind the move. If the assets hit exchanges, it could cause short-term supply pressure. If they remain in custodial setups, it may signal long-term planning for asset protection or regulatory shifts.

“The timing isn’t random. Bitcoin just hit an all-time high of almost $123,000. Institutional demand is strong, with $297 million flowing into spot ETFs in just one day. With all this going on, a reawakened whale might be testing the market’s appetite or moving their holdings to safer custodians. Either way, this isn’t a hit-and-run situation, but a staged, slow-motion capital deployment,” Young told BeInCrypto.

Whether Bitcoin will drop or remain resilient amid these transfers remains uncertain. For now, the largest cryptocurrency trades just 3.7% below its record peak.

BeInCrypto data showed that at press time, BTC’s trading price was $118,251, up 1.08% over the past day.

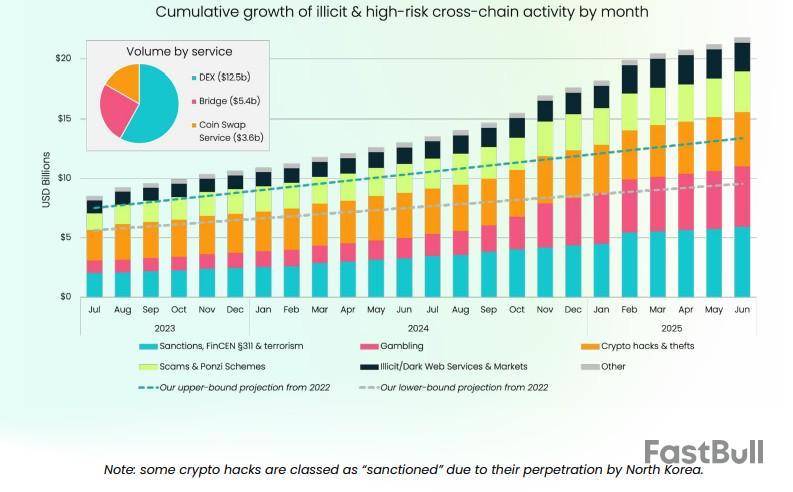

At least $21.8 billion in illicit or high-risk crypto has flowed through crosschain swaps, up from $7 billion in 2023, according to estimates by UK-based blockchain analytics firm Elliptic. Elliptic attributes 12% of those movements to North Korea.

Crosschain swaps were once a niche activity reserved for advanced traders and decentralized finance (DeFi) users, but they’ve evolved into a core component of money laundering. Illicit actors no longer simply send crypto through mixers or dump tokens on a single decentralized exchange (DEX). Nowadays, the funds move around multiple blockchains to frustrate investigators and evade detection.

This swift 211% increase, from $7 billion to $21.8 billion, reflects the growing use of blockchain bridges, DEXs and coin swap services, as well as the expanding number of blockchains.

“When you look back, let’s say a decade ago, the primary cryptocurrencies and blockchains out there were Bitcoin and Ethereum and a few others,” Arda Akaturna, Elliptic’s APAC lead crypto threat researcher, told Cointelegraph.

“It’s an increasingly multichain ecosystem... that just widens the available assets and the available obfuscation channels open to criminals.”

Bridges are crosschain laundering highways

A single bridge transaction might reflect ordinary user behavior, but patterns of structured or multi-hop activity are red flags for coordinated efforts to break the onchain trail, Elliptic said in its 2025 crosschain crime report published on Wednesday.

Structured chain-hopping involves splitting funds and distributing them simultaneously across several blockchains. Multi-hop chain-hopping is the act of moving assets from one chain to another repeatedly. Both techniques are inefficient by design, and come with high fees in order to confuse investigators.

These methods are increasingly common in high-stakes laundering operations. In one early 2025 case, hackers suspected to be linked to North Korea stole $75 million from an unnamed exchange and bridged the funds in sequence from Bitcoin to Ethereum, then to Arbitrum, Base and finally Tron — employing both structured and multi-hop tactics.

These patterns are no longer limited to state actors or large-scale thefts. In a separate case involving a $200,000 fraud in the UK, the now-convicted culprit split funds across 90 different assets on multiple chains to fund online gambling.

Akaturna explained:

Elliptic estimates that around a third of blockchain investigations now involve tracing flows across at least three different networks.

Crosschain laundering starts in DeFi

DEXs are often viewed as transparent and traceable as they operate on blockchains. However, they’re increasingly being used as entry points in the crypto laundering cycle, especially when low-liquidity tokens are involved.

DEXs are platforms where such assets can be swapped for more widely accepted tokens like USDt or Ether without relying on centralized platforms that may enforce Know Your Customer (KYC) rules.

A case study by Elliptic in its 2025 crosschain crime report analyzed the May 2025 exploit on Cetus — a major liquidity provider on the Sui blockchain — that enabled attackers to drain over $200 million in tokens. The attacker initially used a DEX to swap USDT to USDC, which Elliptic suspects was possibly to take advantage of lower bridging costs.

These stablecoins were then bridged to Ethereum, where a DEX aggregator was used again to convert the USDC into ETH. Centralized stablecoins like USDt and USDC have functions that allow their issuers to freeze funds. Ether, which is the native asset of the Ethereum blockchain, does not inherently have that functionality.

Criminals also exploit the open design of DEX aggregators and automated market makers (AMMs) to route transactions in ways that reduce slippage and avoid detection. For instance, laundering flows often pass through multiple obscure trading pairs before settling in a liquid token. In many cases, these swaps are performed in small batches or via smart contracts to avoid triggering Anti-Money Laundering (AML) alarms.

Though DEXs are not inherently crosschain, the distinction is becoming less clear in newer services as they also offer native cross-asset swaps, Elliptic said.

Coin swap sites star in crosschain laundering

Coin swap services operate more like underground currency changers. They allow users to anonymously exchange assets across different blockchains with minimal friction, no registration, and often no meaningful anti-money laundering (AML) checks. As a result, these services have become a go-to tool for a wide range of illicit actors, particularly those operating in darknet markets, ransomware networks and online carding fraud.

These platforms are distinct from bridges and DEXs in that they function as centralized intermediaries but deliberately operate in opaque or permissive jurisdictions. Many advertise directly on darknet forums and Telegram channels, often promising to accept “dirty BTC” or emphasizing their non-cooperation with law enforcement.

Some even offer services like armed cash pickups, money counting, or “treasure” cash drops, where physical currency is buried in pre-agreed locations in exchange for crypto.

Elliptic reported that around 25% of illicit and high-risk flows through coin swap services are linked to online gambling, especially platforms lacking mainstream licenses. Many of these sites, particularly those tied to Russian-speaking and Southeast Asian operators, are also connected to scams such as pig butchering and narcotics trafficking, creating a closed loop of high-risk funds being recycled between illicit gambling and laundering networks.

The cat-and-mouse tools chasing crosschain laundering

Chain-hopping, once a fringe tactic, is now routine. Laundering methods that once relied on mixers or simple swaps have evolved into complex sequences that span multiple chains, tokens and platforms — often structured to waste analysts’ time or break automated tracing.

In the $75 million case Elliptic linked to North Korea, funds moved through five blockchains in rapid succession. Similar patterns are showing up in smaller frauds as well, suggesting that complexity itself has become the strategy.

Tracing these movements still depends on visibility — and a growing set of tools. Platforms like Elliptic Investigator, Chainalysis Storyline and TRM Forensics are built to automate and visualize crosschain analysis, while centralized stablecoin issuers reserve the ability to freeze flagged assets.

“It doesn’t matter if they’ve tried to do it over five different blockchains or just once — we’re able to follow those funds automatically through our investigation tools. Something that’s really manual and might take several hours, you can now do in mere clicks and minutes because it’s all automated,” said Akaturna.

It's an uneven match, but the infrastructure for fighting crypto crime is adapting, too.

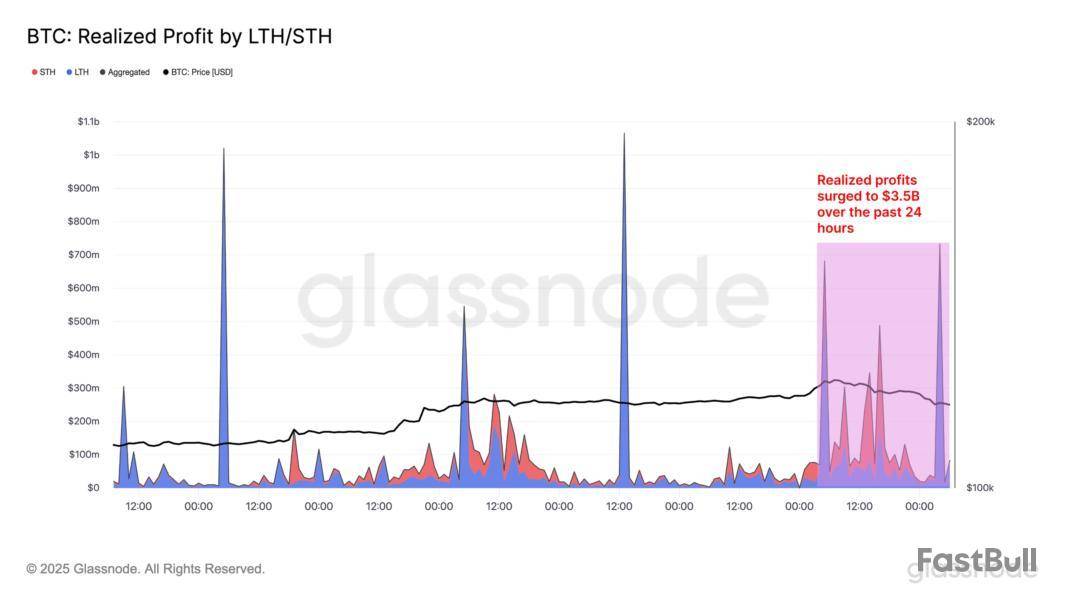

The Bitcoin price has slipped under $117,000 as on-chain data shows the network has observed one of its largest profit realization days of the year.

Bitcoin Long-Term Holders Did The Major Share Of Profit-Taking

In a new post on X, the on-chain analytics firm Glassnode has talked about the latest trend in the Bitcoin Realized Profit indicator for the short-term holders and long-term holders. The “Realized Profit” measures, as its name suggests, the total amount of profit that the BTC investors are realizing through their transactions.

The metric works by going through the transfer history of each coin being sold to see what price it was moved at prior to this. The difference between that previous price and the current selling price denote the amount of profit or loss involved in the sale.

Naturally, the sale realizes a gain if the difference is positive. The Realized Profit adds up this value involved in all transactions of the type occurring on the blockchain. Another indicator known as the Realized Loss keeps track of the sales of the opposite type.

In the context of the current discussion, the Realized Profit of two specific segments of the sector is of interest: short-term holders (STHs) and long-term holders (LTHs). Investors are divided into these groups based on the basis of holding time. More particularly, holders who have been carrying their coins for 155 days or less are put in the STHs and those who have made it past this threshold are considered LTHs.

Below is the chart shared by Glassnode that shows the trend in the Realized Profit for the two sides of the Bitcoin market.

As displayed in the graph, the Bitcoin Realized Profit has seen spikes for both of these groups during the last 24 hours, implying investors across the market have harvested gains taking advantage of the rally to the new all-time high (ATH) above $123,000.

In total, the holders took profits equal to $3.5 billion inside this window, making the profit-taking event one of the largest for the year. Interestingly, the LTHs occupied for a higher share ($1.96 billion or 56%) of the profit realization than the STHs ($1.54 billion or 44%).

Generally, the longer an investor holds onto their coins, the less likely they become to sell them. As such, the LTHs with their relatively long holding time are considered to represent the resolute side of the market.

Despite their strong resolve, however, it seems the latest Bitcoin price surge provided a temptation strong enough for even these diamond hands to be swayed. The result of the selloff has so far appeared to be a price decline to levels below $117,000.

BTC Price

At the time of writing, Bitcoin is floating around $116,700, up over 7% in the last week.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up