Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Paying interest on stablecoin deposits could spark a wave of bank outflows similar to the money market fund boom of the 1980s, Citi’s Future of Finance head Ronit Ghose warned in a report published Monday.

According to the Financial Times, Ghose compared the potential outflows caused by paying interest on stablecoins to the rise of money market funds in the late 1970s and early 1980s.

Those funds ballooned from about $4 billion in 1975 to $235 billion in 1982, outpacing banks whose deposit rates were tightly regulated, Federal Reserve data showed. Withdrawals from bank accounts exceeded new deposits by $32 billion between 1981 and 1982.

Sean Viergutz, banking and capital markets advisory leader at consultancy PwC, similarly suggested that a shift from consumers to higher-yielding stablecoins could spell trouble for the banking sector.

“Banks may face higher funding costs by relying more on wholesale markets or raising deposit rates, which could make credit more expensive for households and businesses,” he said.

Related: Banking lobby fights to change GENIUS Act: Is it too late?

US banks argue against stablecoin yield

The GENIUS Act does not allow stablecoin issuers to offer interest to holders, but it does not extend the ban to crypto exchanges or affiliated businesses. The regulatory setup led to a significant reaction by the banking sector.

Several US banking groups led by the Bank Policy Institute have urged local regulators to close what they say is a loophole that may indirectly allow stablecoin issuers to pay interest or yields on stablecoins.

In a recent letter, the organization argued that the so-called loophole may disrupt the flow of credit to American businesses and families, potentially triggering $6.6 trillion in deposit outflows from the traditional banking system.

The crypto industry is not having it

The crypto industry pushed back against banks’ concerns, with two industry organizations urging lawmakers to reject proposals to close the “loophole.” The organizations warned that the revisions would tilt the playing field toward traditional banks while stifling innovation and consumer choice.

The US government has emerged as a leading supporter of the adoption of dollar-pegged stablecoins. Treasury Secretary Scott Bessent said in March that the US government will use stablecoins to ensure that the US dollar remains the world’s global reserve currency. He said at the time:

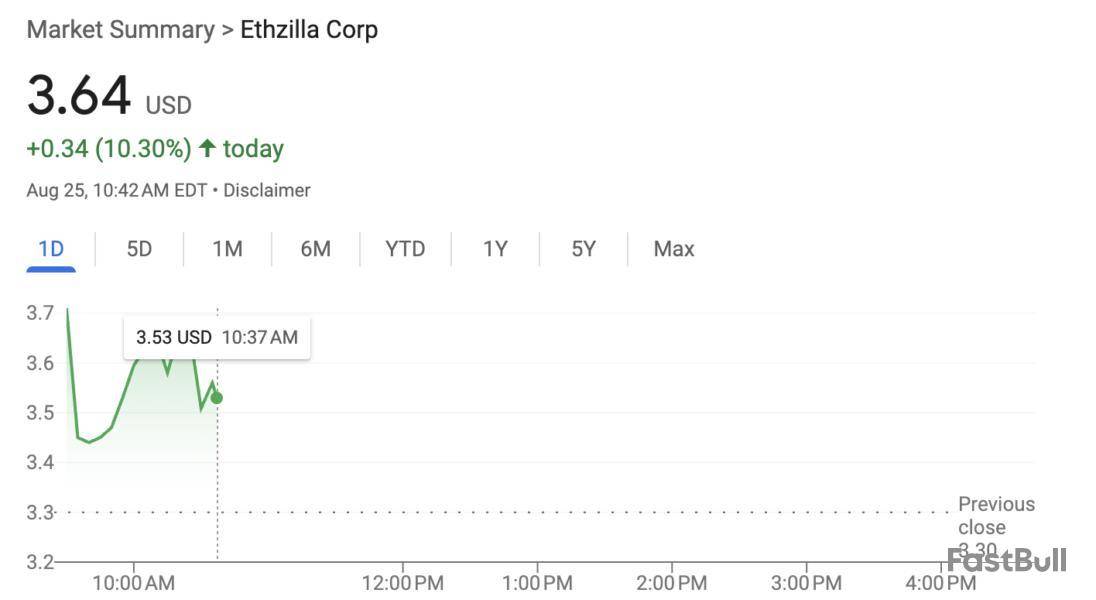

ETHZilla, an Ethereum treasury firm, announced a $250 million stock buyback after company shares fell nearly 30% last week. This caused a brief bounce, relieving stock dilution concerns.

Still, this kind of move won’t directly enable the next Ethereum purchase. ETHZilla holds around $489 million in ETH, representing a recent acquisition, but it needs to keep building this stockpile.

ETHZilla’s Ethereum Plan

Ethereum has been doing well lately, reaching an all-time high last Friday, and corporate investment is doing a lot to power the trend. The token is receiving a lot of institutional confidence, and one recent development illustrates this.

Although ETHZilla’s shares tanked after its last Ethereum purchase, it’s preparing to do it again:

“At ETHZilla, we continue to deploy capital to accelerate our Ethereum treasury strategy with discipline and record speed. As we continue to scale our ETH reserves and pursue differentiated yield opportunities, we believe an aggressive stock repurchase program at the current stock price underscores our commitment to maximizing value,” claimed McAndrew Rudisill, Executive Chairman.

Specifically, the firm is conducting a $250 million stock buyback to stabilize its valuation. Despite Ethereum’s solid performance, concerns of share dilution sapped ETHZilla investors’ confidence.

Last week, the company planned to offer 74.8 million shares to fund ETH purchases, representing a 46% in the total number of shares.

In other words, share dilution means that ETHZilla stockholders could lose money, even if Ethereum continues rising.

To remedy this, the firm’s $250 million stock buyback plan has helped momentarily stabilize things, opening the door to future acquisitions:

A Brief Reprieve

SEC documents related to this buyback reveal that ETHZilla currently holds around $489 million worth of Ethereum, making it a substantial private holder.

This is significantly higher than the firm’s reported holdings last week, so it has made a solid purchase recently.

Still, a $250 million stock buyback will also cut into its purchasing capabilities. ETHZilla has attracted corporate investment, but stock sales are its main vehicle for ETH purchases.

These purchases, in turn, are the only way it can promise future value to potential investors.

There’s an inherent contradiction here. If this trade collapses due to diminishing returns, it could cause serious problems.

Stock buybacks may bring temporary stability, but they can’t power real growth.

ETH staking its massive treasury could provide passive income, but Vitalik Buterin warned that this might not be sustainable either.

In other words, ETHZIlla may now be caught in a similar pickle to Strategy.

Last week, Saylor’s company claimed it would start selling shares for other reasons than BTC acquisition. This prompted a little backlash and fears that the firm is losing its momentum.

ETHZilla’s new buyback program is similarly untethered from Ethereum, although unverified social media rumors claim it bought $35.2 million in ETH today.

Between this alleged acquisition and last week’s purchase, the firm has some staying power. Still, it always needs to keep moving.

Otherwise, the inherent risks of a DAT strategy could blow up in ETHZilla’s face.

Bitcoin’s latest slide has pushed prices toward $111K, as the market teeters on fragile footing after recent highs.

Amidst this turbulence, BTC wallet cohorts are showing mixed signals, with $105K emerging as the strongest structural support level.All Eyes on $105K Support Zone

BTC’s recent pullback from its all-time high of $124K has drawn attention to $105K as a potentially decisive level in the ongoing correction, according to the latest analysis shared by CryptoQuant.

Wallet behavior across cohorts pointed to a mixed but telling picture of accumulation and distribution patterns. The smallest holders (0-0.1 BTC) distributed heavily at the peak but quickly returned to accumulation as prices declined. This indicates their tendency to follow rather than shape the market.

Wallets holding 0.1-1 BTC, however, began accumulating at ATH levels and have maintained steady buying. Meanwhile, 1-10 BTC holders stopped distributing around $107K and have been accumulating.

On the other hand, 10-100 BTC wallets shifted from accumulation at $118K into distribution, reflecting a cautious stance by this cohort. The 100-1K BTC cohort appears most crucial as they show a balance of accumulation and distribution around $105K, which means that this level is a structural support zone. Larger wallets, particularly 1K-10K BTC and 10K+ BTC holders, remain in distribution, though selling pressure has noticeably slowed as the correction deepened.

Overall, distribution outweighs accumulation, but the intensity is waning. If Bitcoin revisits $105K, CryptoQuant stated that this level will be tested as a critical “last stronghold.” A breakdown below could spark increased fear and accelerate selling, while strength could mean that the asset is poised for a stronger recovery.

While wallet cohorts reveal cautious accumulation and distribution patterns, the derivatives market has already flushed weak hands through a major long squeeze.Weak Hands Flushed?

Bitcoin’s plunge hastriggeredmillions in long liquidations, wiping out late buyers who had piled in with excessive leverage. The event, known as a long squeeze, unfolded as forced sell orders cascaded through the derivatives market, which collapsed open interest and dragged Binance’s cumulative net taker volume to -$1 billion.

While the violent move rattled sentiment, it also performed a structural “reset” – overextended positions were flushed, leverage was reduced, and weak hands were shaken out. This cleanup leaves the market leaner and less vulnerable to further forced selling, but experts stated that with open interest reset and speculative froth drained, conditions now resemble a healthier foundation for upside.

Episode 5 of The Big Brain Podcast, hosted by The Block's President Larry Cermak and MegaETH CSO Namik Muduroglu, was recorded with Standard Crypto Co-Founder Alok Vasudev and Dragonfly Partner Tom Schmidt.

Listen below, and subscribe to The Big Brain Podcast on YouTube, Apple, Spotify or wherever you listen to podcasts. Please send feedback and revision requests to podcast@theblock.co

In this episode of the Big Brain Podcast, Larry and Namik are joined by Dragonfly's Tom Schmidt Alok Vasudev of Standard Crypto. They dive into current trends in venture capital within the crypto space, touching on how market conditions have evolved since 2021, the role of treasury companies, and the evolving regulatory landscape.

OUTLINE 00:00 Introduction

01:06 Alok's Background

04:45 Tom's Background

06:21 Cap Table Competition

07:53 Crypto 'Metas'

13:09 Copycat Crypto Projects

15:26 Brand Positioning

17:45 Web3 Moats

19:29 Crypto Treasury Companies

27:28 Regulatory Tailwinds

30:38 Consumer Adoption

SHOW LINKS: - Apple: https://apple.co/43F3vmq- Spotify: https://spoti.fi/44NT1lZ

- Larry: https://x.com/lawmaster

- Namik: https://x.com/NamikMuduroglu

- The Block Podcasts: https://x.com/TheBlockPods

GUEST LINKS

- https://x.com/tomhschmidt

- https://x.com/AlokVasudev

The Block Newsletters The Block's newsletters bring you the latest news and analysis of the fast-moving crypto and DeFi markets. To subscribe, visit theblock.co/newsletters

Are you hiring in crypto? Use Campus to quickly find your best candidates with our challenging Crypto Assessment Test.

Faster hiring, stronger teams.

Sign up for a trial today: theblock.co/campus

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Key takeaways:

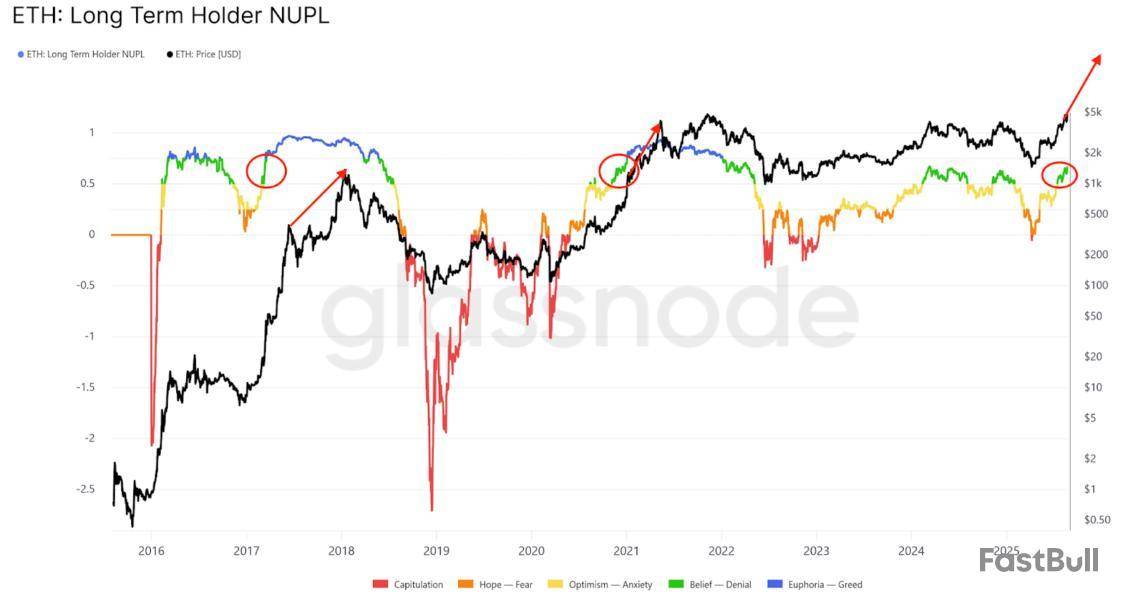

Ether’s long-term holder net unrealized profit/loss indicator suggests the price has entered the “belief” phase.

The market value to realized value suggests ETH is undervalued, with room to run toward $5,500.

Ether’s rounded bottom pattern targets $12,100.

Ether price has rallied more than 240% since April to set a record high above $5,000 on Sunday. As a result, investors’ profitability has risen to levels seen in the past bull cycles, suggesting that the ETH market is entering the “belief” phase, increasing the chances of an extended rally.

Ethereum investor sentiment in “belief”

Onchain data points out similarities between the current stage of the Ether market and previous bull cycles.

Ether’s long-term holder (LTH) net unrealized profit/loss (NUPL) indicator has entered the “belief-denial” (green) zone, a position that historically precedes significant price rallies, said popular analyst Gert van Lagen in an X post on Monday.

The LTH NUPL measures the difference between the relative unrealized profit and relative unrealized loss of investors who have held Bitcoin for at least 155 days.

This zone is particularly significant because it suggests ETH has not yet reached the euphoric phase (blue) typically associated with cycle peaks.

In previous market cycles, the transition from belief to euphoria has coincided with substantial price increases.

For that to occur, ETH price “still needs to climb further,” van Lagen explained, adding:

The market value to realized value (MVRV) ratio adds another layer of validation to the bullish thesis. With a current daily reading of 2.08, significantly lower than a peak of 3.8 in 2021 and 6.49 in 2017, the metric suggests Ethereum remains relatively undervalued.

This lower MVRV ratio indicates subdued profit-taking and increased potential for sustained price appreciation.

Ether’s MVRV extreme deviation pricing bands also suggest that ETH price still has more room for further expansion before the unrealized profit held by investors reaches an extreme level represented by the uppermost MVRV band at $5,500, as shown in the chart below.

ETH price analysts target $10,000 and beyond

But the price can go even higher from a technical perspective. Ether’s price action has validated a megaphone, a chart pattern that has been forming on the weekly candle chart since December 2023, as observed by crypto analyst Jelle.

“This bullish megaphone has a target of $10,000, and $ETH has defeated every resistance level standing in its way,” the analyst said in an X post on Monday, adding:

Fellow analyst Mickybull Crypto echoed this view, saying that “ETH delivered as expected,” referring to Ether’s run to all-time highs above $5,000 on Sunday.

The analyst added that their cycle targets for Ether are $7,000-$11,000.

The pair displayed strength after breaking above a rounded bottom chart pattern on the daily chart. The price retested the neckline of the pattern at $4,100 to confirm the breakout.

The bulls will now attempt to push the price toward the technical target of the prevailing chart pattern at $12,130, or a 161% rise from the current price.

Other analysts also predict that Ether could reach $12,000 and even higher in 2025, citing possible interest rate cuts, capital inflows via spot Ethereum ETFs, and demand from ETH treasury companies, which remain notably strong.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up