Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Circle, issuer of the world's second-largest stablecoin USDC, unveiled a protocol update on Tuesday it says will reduce cross-chain settlement time from several minutes to a matter of seconds.

The company's newly launched Cross-Chain Transfer Protocol V2, or CCTP V2, will improve upon CCTP V1 "with a new set of smart contracts and APIs," slashing cross-chain transaction settlement time from "an average of 13 to 19 minutes for a typical blockchain transaction" between Ethereum and Layer 2 blockchains to only seconds, according to a statement.

"CCTP V2 reduces the barriers that have hindered the fluid movement of digital dollars between supported blockchains," said Nikhil Chandhok, chief product officer of Circle, in the statement. "CCTP V2 gives developers greater flexibility to tailor cross-chain transactions to their specific needs and unlocks low-latency use cases in crypto capital markets, effectively abstracting away cross-chain complexities for developers and their users."

As the USD-pegged stablecoin market, by most accounts, is poised to keep growing, improving transaction time could prove beneficial to Circle as competition potentially heats up in the coming months and years. Out of the roughly $235 billion worth of USD stablecoins in circulation, Circle's USDC accounts for $58 billion, according to The Block Data Dashboard. USDC ranks a distant second to Tether's USDT, the clear market leader.

Avalanche, Base and Ethereum to begin with

Circle said CCTP V2 will initially be available for developers working on Avalanche, Base and Ethereum, but the plan is to add support for more blockchains as the year progresses. "CCTP V1 will remain available on 11 blockchains," Circle said, adding that since launched in 2023, "CCTP has facilitated more than $36 billion in transaction volume."

Some of CCTP V2's new features Circle highlighted on Tuesday include "Hooks," which it said makes it possible for developers "to automate post-transfer actions on the destination blockchain."

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ethereum’s price has been in a clear downtrend since reaching a local high above $3,600, forming consistent lower highs and lower lows.

The price is now on the verge of solidifying below the key $2,000 support, which could cause even more capitulations in the short term.Technical Analysis

By Edris Derakhshi (TradingRage)The Daily Chart

On the daily chart, it is evident that the price has been falling rapidly over the past couple of months with no slowing down. The 200-day moving average, located around the $3,000 mark, was also lost in February. With attempts to reclaim it failing, bearish momentum has been confirmed.

Yet, the RSI is in oversold territory, suggesting a potential short-term relief bounce. Meanwhile, if ETH fails to hold above the $2,000 area, the next strong support lies at the $1,600 area.The 4-Hour Chart

Looking at the 4-hour timeframe, ETH has been trading within a falling wedge pattern (marked in yellow), which is generally a bullish reversal signal if confirmed with a breakout to the upside.

Recently, the cryptocurrency’s price broke below the key $1,900 support and tested the $1,800 demand zone, where buyers stepped in to prevent further decline. The price is now attempting to reclaim the $1,900 area, signaling potential recovery.

Moreover, the RSI on the 4H timeframe shows a rebound from oversold levels, suggesting that bearish momentum could be fading.

If ETH manages to break back above $1,900, it could see a short-term push toward the $2,100 resistance zone. However, if this recovery fails, another drop toward the $1,600 support level will be highly likely.Sentiment Analysis

By Edris Derakhshi (TradingRage)Coinbase Premium Index

The Coinbase Premium Index shows a strong correlation with Ethereum’s price movements, reflecting buying or selling pressure from U.S. investors.

In the current market, the premium has been negative for an extended period, indicating that ETH is trading at a discount on Coinbase compared to Binance. This suggests weaker demand from U.S. institutional and retail investors, which aligns with ETH’s broader bearish trend. Historically, sustained negative premium values have coincided with price declines, as seen in past drawdowns.

For ETH to regain bullish momentum, the Coinbase Premium Index needs to turn positive, signaling renewed U.S. buying pressure.

A shift into green territory would indicate institutional accumulation, often preceding price recoveries. However, with ETH trading around $1,900 and the premium still negative, demand remains weak, increasing the risk of further downside unless sentiment shifts.

Ripple’s price has been consolidating in a wide range over the recent month against both USDT and BTC. Yet, the future direction of the market might soon be revealed.

By Edris Derakhshi (TradingRage)The USDT Paired Chart

XRP has been in a corrective downtrend after reaching a local high above $3.00 last week, with the price now testing the $2.00 psychological support.

The 200-day moving average remains far below the current price near $1.70, indicating that the long-term uptrend is still intact despite short-term weakness.

If $2.00 holds as support, XRP could attempt a recovery toward $2.50-$2.60, while a stronger rebound could lead to a revisit of the $3.00 resistance zone. However, a break below $2.00 would expose the 200-day moving average as the next target.The BTC Paired Chart

The XRP/BTC ratio has been consolidating after a strong rally in November last year, with the price currently trading around 2,500 SAT.

The pair has faced resistance near 3,000 SAT, which has led to the recent pullback. The 200-day moving average at approximately 1,700 SAT remains intact, indicating that, similar to the USDT pair, the broader uptrend is still in play.

Yet, the RSI is trending lower, suggesting a potential weakening of momentum, but as long as XRP holds above 2,000 SAT, a bullish continuation above the 3,000 SAT area could be expected.

The recent decline in the price of Bitcoin to $80,000 has prompted speculation regarding whether this represents a sign of frailty or an opportunity to invest.

Market watchers differ in opinion. While some view the drop as a passing setback, others see it as an opportunity. One analyst predicts that Bitcoin might yet reach $150,000 this year, which would inspire interest on its future.

An Unexpected Drop In The Value Of Bitcoin

Bitcoin tumbled to $80,000 over the weekend, marking its lowest point in months. This drop came after weeks of price swings that kept traders on edge. The selling demand was too strong, although many investors projected Bitcoin to stay above $85,000.

Different elements helped to explain the fall. Rising US inflation concerns and a stronger dollar pressured risk assets, including cryptocurrencies. Some analysts, meantime, also noted profit-taking by long-term holders trying to lock in their gains after Bitcoin’s recent ascent.

Analyst Anticipates $150K Increase

Although the economy has experienced a decline, there are still individuals who are optimistic. Tom Lee, a renowned Bitcoin analyst, anticipates that the price will rebound and reach $150,000 by the end of the year. He claims Bitcoin bull runs are marked by abrupt occurrences, and that failure to capitalize on these sudden shifts in market dynamics could result in big losses.

Lee points to historical patterns. Past Bitcoin corrections have often led to explosive rallies, with prices doubling or tripling in a short time. He also highlights the growing interest from institutional investors as a reason why Bitcoin could still see a strong upward move. Some traders share this optimism, believing that any dips below $80,000 will be short-lived.

The most recent price action has made people in the market feel a range of emotion. There are investors who are nervous and investors who see the pullback as a good correction. Meanwhile, the Crypto Fear & Greed Index, a tool that measures how investors feel, has moved into the “Extreme Fear” zone. This shows that people aren’t sure what Bitcoin will do next.

On-chain data shows that the way people trade has changed. Whales, or people who own a lot of Bitcoin, have been buying more during the drop, which shows that they are optimistic about the long-term outlook. On the other hand, retail traders seem to be more cautious and are looking for signs of stability before getting back in.

Featured image from Gemini Imagen, chart from TradingView

Solana’s SOL entered murky waters as Monday's broad crypto-market drop sent the token of the high-speed, low cost blockchain diving as much as 8% to $124.

That's less than the realized price of $134 for the first time since May 2022, according to Glassnode data. The realized price is the average cost basis of all coins last moved and current values mean the average holder is underwater, a bearish signal that can trigger panic selling or capitulation.

The drop comes as Solana’s validators debate a proposal known as SIMD-0228 that could slash the network’s 4.7% annual inflation rate by 80% to roughly 1.5% over time.

Unlike the market price, which fluctuates with exchange trades, realized price is a cost-basis anchor.

The price action forms a descending channel, with resistance between $134, formerly a support level, and $130, and support at $120 and $115. The trend remains bearish, but if $120 holds and $128 breaks with volume, a rebound to $134 is possible, driven by dip buyers.

TL;DR

What’s New Around Pi Network?

The crypto project has taken center stage lately due tolaunchingits Open Network on February 20. This allowed exchanges to list Pi Network’s native token and make it publicly accessible. The first to embrace it included Bitget, OKX, and MEXC.

Binance was also rumored to join the list. The world’s biggest cryptocurrency exchange evenheld a community voteto determine whether its users would want to see PI available for trading. Over 86% of the voters clicked the “yes” option, but the company has remained silent on the matter.

It is worth mentioning that there has been rising speculation that Binance might do so as soon as this week, more specifically on March 14. The date is special for the community since it will mark the sixth birthday of Pi Network. It also aligns with Pi Day, a celebration of the mathematical constant π (pi), which is approximately 3.14.

Despite reaching the aforementioned milestone, Pi Network remains quite controversial. For instance, it keeps extending the deadline to pass KYC procedures and migrations to the mainnet. The process, known as “the Grace Period,” was supposed to run until February 28, but the team later moved it to March 14.

Earlier this week, the developers warned users to complete the required steps before that date “to avoid forfeiting most of your Pi other than Pi mined within the rolling window of the last 6 months before your Pi is migrated.How’s XRP Doing?

Ripple’s native token is also among the top-trending topics in the crypto space. The asset has been on a massive uptrend since the election of Donald Trump, almost reaching its all-time high of $3.40 in January this year.

Since then, though, it has headed south and is currently trading at around $2.10 (per CoinGecko’s data). Several hours ago, it even dipped to a multi-month low of $1.92 before the bulls recovered some of the losses.

Despite the bearish environment, numerous analysts continue to envision a resurgence to new peaks for XRP. The X user Dark Defender recently suggested that the asset successfully broke the multi-year resistance line in November 2024 and tested previous resistance as support.

“I’ve never seen XRP bullish more than this before,” Dark Defender stated.

For their part, EGRAG CRYPTO predicted a rather ridiculous price explosion to the $27-$222 range. Such high prices would require XRP’s market capitalization to multi-trillion levels, which as of the moment, seems highly unlikely.Is SHIB Poised for a Comeback?

Last but not least, we will touch upon Shiba Inu, whose price has also suffered the negative consequences of the broader crypto market crash. As of this writing, the meme coin is worth around $0.00001162, representing a 28% decline on a monthly scale.

According to the popular analyst Jeremie Davinci, though, SHIB still has a chance to go “to the moon.” The Bitcoin advocate assumed that such progress would rely heavily on Shibarium’s advancement.

“I like Shiba Inu, as you know, and I think it will do relatively well in this cycle, but it may not go as high as you expect. I think Shiba Inu has a lot of utility now that they have Shibarium, and basically, it’s a chain that you can actually run all kinds of applications.

However, nobody is using it, and there are no applications for using your tokens on Shibarium yet. If they get that solved, Shiba Inu will go to the moon,” he said.

At the beginning of the year, the layer-2 scaling solution gained attention for handling millions of transactions each day. By February, the total transactions on the network exceeded 900 million. However, in recent weeks, Shibarium’s activity has slowed significantly.

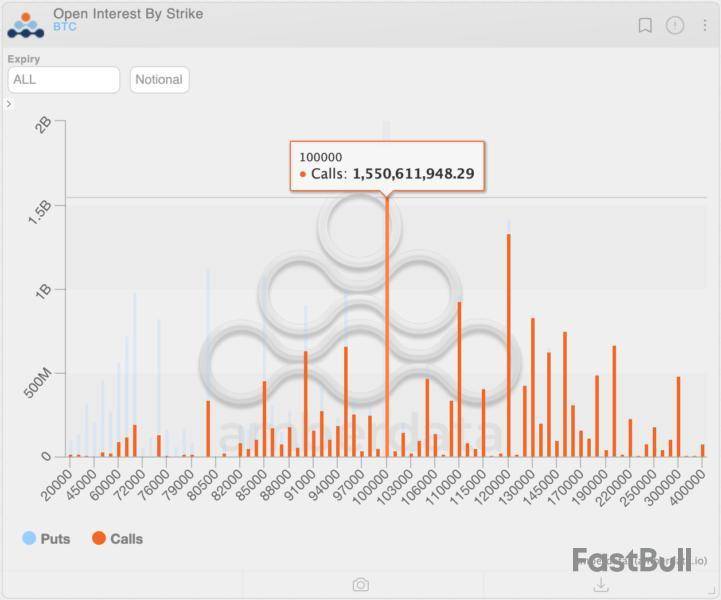

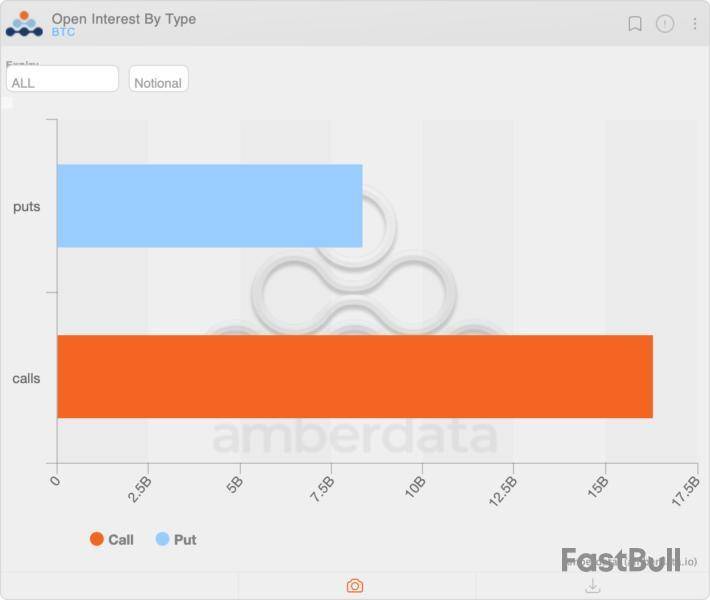

The recent crypto market downturn has caused the once-popular $120,000 bitcoin options bet to lose its crown to the $100,000 bet in a sign that traders are reassessing their bullish expectations.

At press time, the $100,000 call was the most popular BTC options contract on the exchange, boasting a notional open interest of $1.55 billion. The notional open interest represents the dollar value of the number of active option contracts at a given time.

Meanwhile, the $120,000 call, the former leader up until last month, stood at the number two position, with a notional open interest of $1.33 billion.

A call gives the purchaser the right but not the obligation to purchase the underlying asset at a predetermined price at a later date. A call buyer is implicitly bullish on the market. Hence, a significant built-up of open interest in higher strike out-of-the-money calls, such as $100,000 and $120,000, reflects bullish expectations.

The shift lower in the most preferred call to the $100,000 strike likely shows traders opting for a more conservative bet in the wake of the recent price crash to under $80,000. Additionally, it may signal a broader reassessment of bullish sentiment.

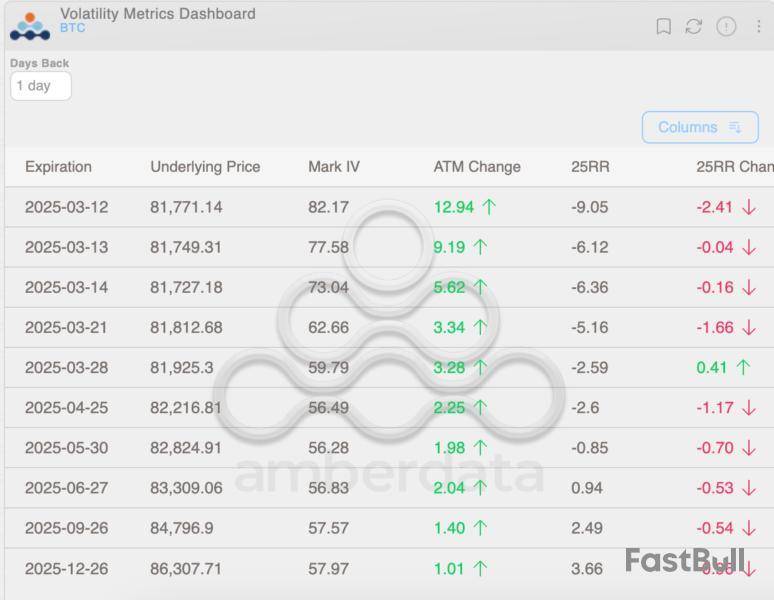

The 25-delta risk reversals, which measure the difference between implied volatility (demand) for higher strike calls relative to lower strike puts, show negative readings or bias for protective put options out to the May end expiry. It's representative of fears of an extended price slide in the market.

The pricing remains bullish in favor of call options after May. Besides, the dollar value of the total number of calls open at press time was over $16 billion – nearly twice more than $8.35 billion in put options.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up