Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

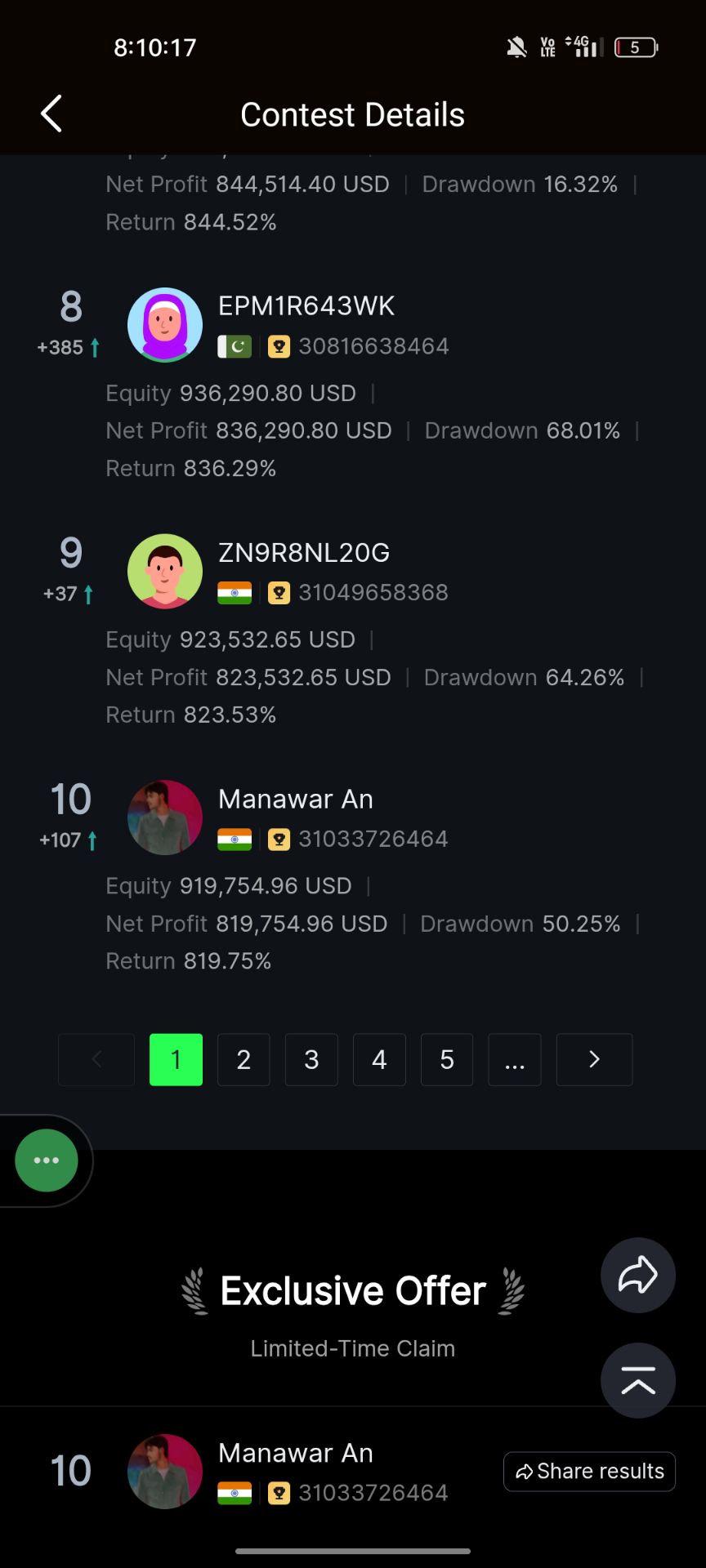

Signal Accounts for Members

All Signal Accounts

All Contests

White House Official - President Trump Not Indicating USA Would Decertify Canadian Built Airplanes In Operation

The White House Announced That President Trump Will Attend A Policy Meeting At 2 P.m. ET On Friday (3 A.m. Beijing Time The Following Day) And Sign An Executive Order At 11 A.m. ET On Friday (midnight Saturday Beijing Time)

According To The Japan Exchange Website, From 10:21:49 To 10:31:59 Beijing Time On January 30, 2026, The Osaka Exchange Activated Its Circuit Breaker Mechanism For Platinum Futures, Temporarily Suspending Trading. This Was Due To A Sharp Drop In Global Platinum Prices, With The Decline Reaching The 10% Limit Set By The Previous Day. The Circuit Breaker Mechanism Is A Measure Taken By Exchanges To Cope With Severe Market Volatility, Aiming To Temporarily Restrict Or Suspend Trading To Encourage Investors To Remain Calm. This Was The First Time The Circuit Breaker Mechanism For Platinum Futures Had Been Activated Since December 30, 2025, Starting At 10:21 AM Beijing Time And Lasting For 10 Minutes

Hsi Down 498 Pts, Hsti Down 105 Pts, Cspc Pharma Down Over 12%, Shk Ppt, Huabao Intl Hit New Highs

Citi Predicts Cn Allocation To Push Copper To Usd15-16K/ Ton In Coming Weeks, But Rather Unlikely To Sustain

Bombardier - Have Taken Note Of Post From President Of United States To Social Media And Are In Contact With Canadian Government

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

By Rhiannon Hoyle

Aluminum Corp. of China and Rio Tinto agreed to buy a majority stake in Companhia Brasileira de Aluminio for about $900 million.

Chinalco subsidiary Chalco and Rio Tinto will acquire the nearly 69% stake in CBA from Brazilian conglomerate Votorantim for roughly 4.69 billion reais, equivalent to $903.5 million. The shareholding will be bought via a joint venture that will be 67% owned by the Chinese metals giant, the acquirers said in separate statements Friday.

The purchase comes amid a pickup in dealmaking in the metals and mining industry, as both Chinese and Western companies seek to expand their footprints through acquisitions.

Aluminum is expected to face a shortage in the coming years, as demand rises and new smelters become more difficult to build. The metal is widely used in the manufacturing of electric vehicles, jet engines and cell phones, among other things.

For Chalco, the acquisition "is aligned with the company's strategic direction of optimizing its global industrial layout and holds significant importance," it said.

CBA, Brazil's oldest established aluminum company, operates three bauxite mines that together produce around 2 million metric tons annually. It also has an aluminum operation in Sao Paulo that includes an alumina refinery, an aluminum smelter and other processing facilities.

Rio Tinto said the joint venture will tap into complementary expertise to "unlock the next phase of growth at CBA." Chinalco has an 11% stake in Rio Tinto.

The deal price of 10.50 reais a share in cash represents a 21% premium to CBA's 20-day weighted-average trading price, Rio Tinto said. Once the deal is completed, the joint venture will begin a mandatory tender offer for the remaining shares in CBA not held by Votorantim, it said.

For the Anglo-Australian company, the world's second-biggest miner by market value, the deal reflects a "strategy to deliver value for shareholders by extending our low-carbon, renewable-powered aluminum footprint in rapidly growing markets," said aluminum chief Jérôme Pécresse.

"It also provides the opportunity to grow our bauxite and alumina supply chain in the Atlantic region," he said.

Rio Tinto is meantime considering a possible combination with rival Glencore that could transform it into the world's largest miner with a market value of more than $200 billion.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

By David Winning and Kimberley Kao

The London Metal Exchange delayed the start of trading on Friday due to technical issues, temporarily stifling activity as commodities markets experience one of their wildest weeks.

Trading on the LME, which sets benchmark prices for a range of commodities including copper and aluminum, was offline for roughly one hour. The LME's electronic platform usually starts trading at 1.00 a.m. London time.

The outage happened after days of intense volatility in metals markets as traders responded to triggers such as the threat of U.S. military action against Iran and renewed tariff threats by the White House against allies including South Korea and Canada.

Copper prices have jumped to a record high as a weaker dollar and demand for physical assets fuels a buying frenzy. On Thursday, three-month copper futures on the LME surged by as much as 10% at their peak.

The LME outage was the second to roil a major exchange in as many months. In late November, CME Group wasn't able to offer trading in futures tied to U.S. stock indexes, Treasurys, crude oil and more for over 10 hours because a data center that it relied on had overheated.

Write to Kimberley Kao at kimberley.kao@wsj.com

Iron ore edges higher in the Asia session, reversing earlier losses in a volatile start to the day. As China's steel mills enter the off-peak season, Nanhua Futures analysts expect to see weakness in both supply and demand for the steelmaking material. However, they view downside for iron ore as limited given that steel market dynamics remain relatively supportive and the overall industrial chain remains profitable. The most-traded iron-ore contract on the Dalian Commodity Exchange is 0.25% higher at CNY793.0 a ton. (tracy.qu@wsj.com)

Copper futures dropped more than 3% to around $6 per pound on Friday, reversing a sharp rally from the previous session amid a broad retreat across the metals complex.

Investors locked in profits after copper, gold, silver, and other metals surged to record levels, while a nascent rebound in the dollar added further pressure.

Market participants also reassessed the fundamentals behind the recent speculative rally, which had been driven in part by expectations of higher long-term demand amid limited supply following decades of underinvestment in new mining projects.

Demand projections are supported by surging investment in data centers and the electrification infrastructure needed for AI services and electric vehicle charging stations.

Recurring tariff threats from US President Donald Trump further amplified the rise in metal prices, as investors sought hard assets amid economic uncertainty and deteriorating confidence in the dollar.

Asian investors are pouring record amounts into gold exchange-traded funds, leading some to question whether the rally in bullion is getting close to topping out.

Precious metals ETFs listed in the region have attracted $7.1 billion in net inflows in January, with a number drawing in all-time amounts of capital, according to data compiled by Bloomberg. The biggest gains were seen by funds listed in China that cater to retail investors, with Huaan Yifu Gold ETF alone luring in $1.9 billion.

The price of bullion has skyrocketed is recent weeks, with the yellow metal advancing more than 20% since the start of January, despite a pullback on Friday. High levels of buying by retail investors is often seen as a sign a rally is in its later stages and an asset is overvalued.

“We have been major gold bulls in this cycle,” buying both gold-mining stocks and ETFs, said Nick Ferres, chief investment officer at Vantage Point Asset Management in Singapore. “However, the recent price action has become rapid, emotional and non-linear, which is a warning sign that the trend is extended tactically.”

Gold’s breakneck rally has been underpinned by elevated central-bank purchases and inflows into bullion-backed ETFs. Total holdings in gold-backed funds rose every month last year except May, according to World Gold Council data. Precious metals have also benefited from a switch away from the dollar due to unpredictable US policymaking and increasing American isolation.

Amid other warnings signs, gold’s relative strength index has climbed to about 90, above the level of 70 that is taken to indicate a pullback is overdue. A successful outcome from policies set by the Trump administration would accelerate economic growth, leading to higher interest rates and a stronger US dollar, pushing gold lower, the World Gold Council said in its 2026 outlook published last month.

Among other China-listed funds that have seen sizable inflows in January, the ChinaAMC Gold ETF drew in $420 million, while the GF Shanghai Gold ETF attracted $191.4 million, both set for records, data compiled by Bloomberg show.

Some silver-focused Asian ETFs are also heading for monthly inflow records. South Korea-listed Samsung KODEX Silver Futures Special Asset ETF has gained $231.6 million in net inflows for January, also set for a record.

Subscriptions Halted

In another sign of frenzied demand, China’s only pure-play silver fund — the UBS SDIC Silver Futures Fund LOF — paused subscriptions on Wednesday and halted trading Friday, after massive inflows drove the fund to an elevated premium over its underlying assets.

Asset management companies are set to respond to the rising demand for gold ETFs by bringing new products to the market, according to Bloomberg Intelligence.

“ETF issuers are likely to tap demand for safe-haven assets with more gold-related funds,” analysts Rebecca Sin and Michelle Leung wrote in a research note. “Hong Kong, which offers tools ranging from low-cost physical tracking to leveraged futures and mining equities, has two new listings this week as it seeks to strengthen its position as a gold trading hub.”

Palladium futures fell to around $1,900 per ounce, retreating from over three-year highs amid weakness across platinum group metals.

The broader sell-off reflected profit-taking and a firmer US dollar, which strengthened as markets positioned ahead of key developments in US monetary policy.

Investors were closely watching President Donald Trump, who announced he would reveal his choice for Federal Reserve chair on Friday morning, bringing an end to a months-long selection process that had fueled speculation about the central bank’s future direction.

On the supply side, short-term concerns were heightened by a pending review of the Canada–United States–Mexico trade deal and ongoing 50% tariff threats, given Canada’s role as a key global supplier of palladium.

Year to date, the metal gained 16.41% on supportive demand from slowing electric vehicle adoption.

Palm oil prices fall in early Asian trading. Malaysia has a long weekend ahead and there has been some profit-taking after recent gains, says AmInvestment Bank in a note. However, technical analysis suggests crude palm oil futures market remains bullish and any price pullback could offer an opportunity to initiate long positions, it adds. AmInvestment Bank expects crude palm oil futures to find support at 4,147 ringgit a ton and face resistance at 4,362 ringgit a ton. The Bursa Malaysia Derivatives contract for April delivery is lower by 90 ringgit at 4,227 ringgit a ton.(yingxian.wong@wsj.com)

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up