Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

USA Secretary Of Energy Chris Wright Says USA Sees Dramatic Increase In Oil, Gas, Power Production In Venezuela This Year

The 2-year US Treasury Yield Rose Approximately 5.8 Basis Points On Non-farm Payrolls Day. In Late New York Trading On Wednesday (February 11), The Yield On The Benchmark 10-year US Treasury Note Rose 2.77 Basis Points To 4.1704%, Trading Within A Range Of 4.1170%-4.2041% During The Day. It Maintained A Slight Decline Before The Release Of The Non-farm Payrolls Report At 21:30 Beijing Time, Hitting A New Daily Low One Minute Before The Data Release, Before Gapping Up And Quickly Reaching A New Daily High. The 2-year US Treasury Yield Rose 5.79 Basis Points To 3.5099%, Trading Within A Range Of 3.4415%-3.5472% During The Day. After The Release Of The Non-farm Payrolls Report, It Also Rose From Around 3.45% And Quickly Reached A New Daily High

USA Secretary Of Energy Chris Wright Says President Trump Committed To Transforming Relationship With Venezuela

Mexico Central Bank Governor Rodriguez: Hopes Relationship With USA Progresses Without Obstacles

Argentina 2025/26 Soybean Harvest Estimated At 48 Million T Versus 47 Million T Previously Estimated - Rosario Grains Exchange

Fed Governor Miran , In Fox Business Interview, Says January Jobs Data Doesn't Mean Can't Lower Rates

Toronto Stock Index .GSPTSE Unofficially Closes Down 2.64 Points, Or 0.01 Percent, At 33254.19

The S&P 500 Closed Roughly Flat Initially, With The Energy Sector Up 2.6%, Consumer Goods And Materials Up Over 1%, Technology Up 0.3%, And Financials And Telecommunications Down 1.3%. The NASDAQ 100 Closed Up 0.3% Initially, With Micron Technology Up 9.7%, Gilead Sciences Up 6.1%, NXP And Microchip Technology Up Over 5%, While Strategy Fell 5.4%, Atlassian Fell 6.4%, And Shopify Fell 7.3%. IBM Closed Down 6.4%, Salesforce Fell 4.3%, And Boeing Fell 2.4%, Leading The Dow Jones Components In Declines. JPMorgan Chase, Microsoft, And Amazon Also Saw Significant Declines, While Walmart Fell 1.7%, Chevron Rose 1.9%, Coca-Cola Rose 2.5%, And Caterpillar Rose 4.2%

The Nasdaq Golden Dragon China Index Closed Down 0.6% Initially. Among Popular Chinese Concept Stocks, WeRide Closed Down 5.5%, NetEase Down 4%, Yum China, Baidu, Tencent, Alibaba, And Meituan Down More Than 1%, While XPeng Rose 1.6%, Li Auto Rose 1.8%, NIO Rose 2.1%, BYD Rose 2.8%, And Xiaomi Rose 3.9%

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. YieldA:--

F: --

P: --

Mexico Industrial Output YoY (Dec)

Mexico Industrial Output YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Dec)

Brazil PPI MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Russia Trade Balance (Dec)

Russia Trade Balance (Dec)A:--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Jan)

U.S. Average Weekly Working Hours (SA) (Jan)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Jan)

U.S. Private Nonfarm Payrolls (SA) (Jan)A:--

F: --

U.S. Manufacturing Employment (SA) (Jan)

U.S. Manufacturing Employment (SA) (Jan)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Jan)

U.S. Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Jan)

U.S. Average Hourly Wage MoM (SA) (Jan)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Jan)

U.S. U6 Unemployment Rate (SA) (Jan)A:--

F: --

P: --

U.S. Average Hourly Wage YoY (Jan)

U.S. Average Hourly Wage YoY (Jan)A:--

F: --

U.S. Unemployment Rate (SA) (Jan)

U.S. Unemployment Rate (SA) (Jan)A:--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Jan)

U.S. Nonfarm Payrolls (SA) (Jan)A:--

F: --

Canada Building Permits MoM (SA) (Dec)

Canada Building Permits MoM (SA) (Dec)A:--

F: --

U.S. Employment Benchmark (Not SA)

U.S. Employment Benchmark (Not SA)A:--

F: --

P: --

U.S. Employment Benchmark (SA)

U.S. Employment Benchmark (SA)A:--

F: --

P: --

U.S. Government Employment (Jan)

U.S. Government Employment (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)A:--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. Budget Balance (Jan)

U.S. Budget Balance (Jan)A:--

F: --

P: --

FOMC Member Hammack Speaks

FOMC Member Hammack Speaks Japan Domestic Enterprise Commodity Price Index MoM (Jan)

Japan Domestic Enterprise Commodity Price Index MoM (Jan)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Jan)

Japan Domestic Enterprise Commodity Price Index YoY (Jan)--

F: --

P: --

Japan PPI MoM (Jan)

Japan PPI MoM (Jan)--

F: --

P: --

Australia Consumer Inflation Expectations (Feb)

Australia Consumer Inflation Expectations (Feb)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Jan)

U.K. 3-Month RICS House Price Balance (Jan)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Dec)

U.K. Monthly GDP 3M/3M Change (Dec)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Trade Balance (Dec)

U.K. Trade Balance (Dec)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Dec)

U.K. Trade Balance Non-EU (SA) (Dec)--

F: --

P: --

U.K. Manufacturing Output MoM (Dec)

U.K. Manufacturing Output MoM (Dec)--

F: --

P: --

U.K. Construction Output MoM (SA) (Dec)

U.K. Construction Output MoM (SA) (Dec)--

F: --

P: --

U.K. Services Index YoY (Dec)

U.K. Services Index YoY (Dec)--

F: --

P: --

U.K. Industrial Output YoY (Dec)

U.K. Industrial Output YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Dec)

U.K. Services Index MoM (SA) (Dec)--

F: --

P: --

U.K. Construction Output YoY (Dec)

U.K. Construction Output YoY (Dec)--

F: --

P: --

U.K. GDP MoM (Dec)

U.K. GDP MoM (Dec)--

F: --

P: --

U.K. Industrial Output MoM (Dec)

U.K. Industrial Output MoM (Dec)--

F: --

P: --

U.K. Trade Balance (SA) (Dec)

U.K. Trade Balance (SA) (Dec)--

F: --

P: --

U.K. Manufacturing Output YoY (Dec)

U.K. Manufacturing Output YoY (Dec)--

F: --

P: --

U.K. Trade Balance EU (SA) (Dec)

U.K. Trade Balance EU (SA) (Dec)--

F: --

P: --

U.K. GDP YoY (SA) (Dec)

U.K. GDP YoY (SA) (Dec)--

F: --

P: --

U.K. GDP Revised YoY (Q4)

U.K. GDP Revised YoY (Q4)--

F: --

P: --

U.K. GDP Revised QoQ (Q4)

U.K. GDP Revised QoQ (Q4)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Gold Production YoY (Dec)

South Africa Gold Production YoY (Dec)--

F: --

P: --

South Africa Mining Output YoY (Dec)

South Africa Mining Output YoY (Dec)--

F: --

P: --

India CPI YoY (Jan)

India CPI YoY (Jan)--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)--

F: --

P: --

Brazil Services Growth YoY (Dec)

Brazil Services Growth YoY (Dec)--

F: --

P: --

No matching data

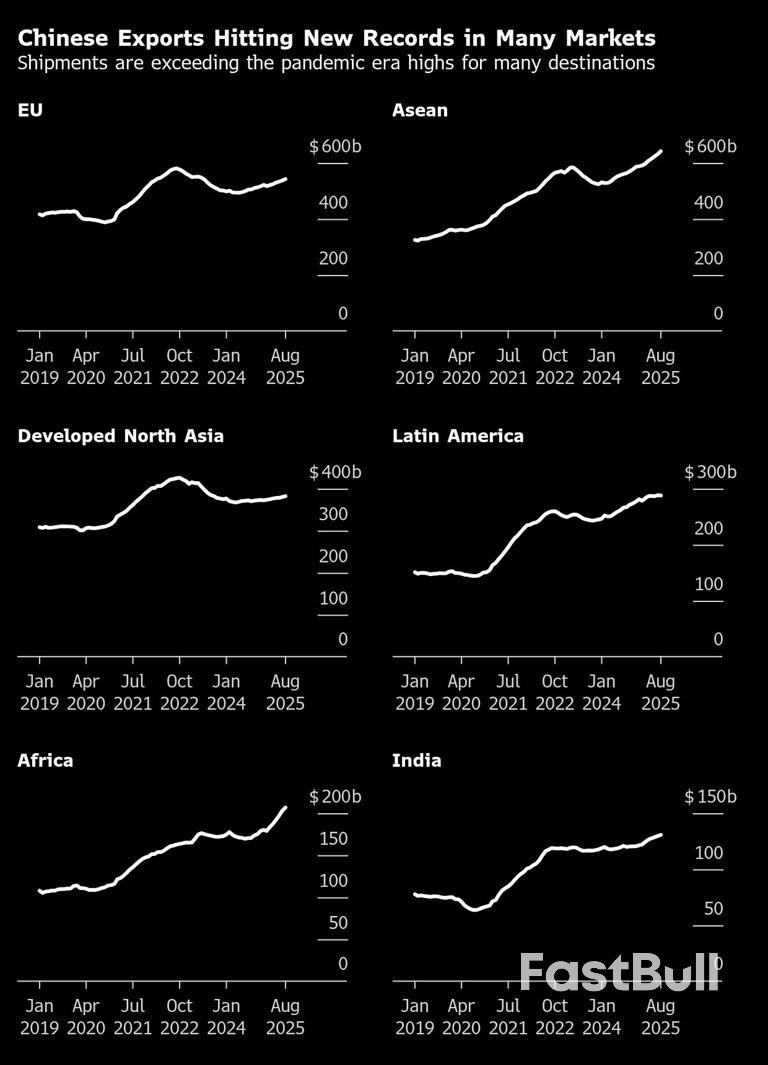

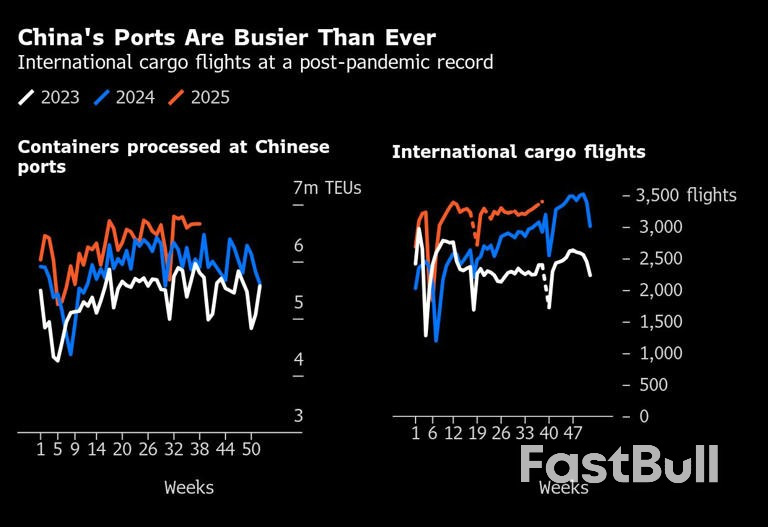

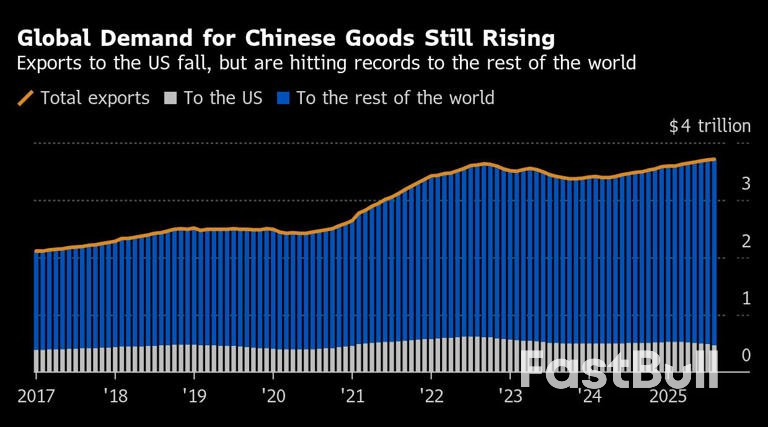

China’s exports surged despite U.S. tariffs, pushing a \$1.2T surplus as sales to India, Africa, and Southeast Asia hit records. Most nations avoid retaliation, giving Beijing room to expand.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up