Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

ChainGPT is bringing its AI tools and the $CGPT token to Solana. New technology like this can be good for both CGPT and Solana because it makes both chains more useful. Cross-chain swaps can increase trading volume and user activity. Partnership with big Solana projects could also bring more attention and push the price up. Still, if users do not like the new features, the price may not move much. The two-week launch could bring waves of news, so prices may change quickly. For details, see: source.

ChainGPT@Chain_GPTMay 12, 2025ChainGPT is expanding to @Solana!

We’re thrilled to bring ChainGPT’s AI infrastructure and applications to the Solana ecosystem, empowering $SOL developers, users, and projects with next-gen AI tools built for Web3. ️

What’s coming to Solana:

Crypto AI Hub: Now fully… pic.twitter.com/mc04iRZaDN

Redacted (RDAC) will be listed on Binance, the biggest crypto exchange. Listings on Binance often bring strong price movement because many new people can start to buy and sell the token. Also, there is an airdrop for users who reach the Alpha Points threshold, which can bring more interest and high volume. This could make the price go up fast, but also can bring wild changes if many sell after getting free tokens. It is important to watch the market when trading starts. Read more here: source.

Binance@binanceMay 12, 2025Binance Alpha will be the first platform to feature REDACTED (RDAC)! Trading will open on May 13th.

To celebrate the launch, users who meet the Alpha Points threshold will receive their airdrop within 10 minutes after trading starts. The eligibility threshold will be announced… pic.twitter.com/E8R5zOawTo

BaaSid (BAAS) will be listed on LBank, a known world crypto exchange. When a small token gets a new listing, more people notice and can trade it. This can quickly raise the price if there is buying demand. But LBank is not as big as Binance, so the effect may be smaller and short. It is important to note that some traders may sell after a price rise. Traders should be careful and watch for big price moves when the listing happens. Find out more at: source.

LBank Updates@LBankUpdatesMay 12, 2025New #listing

$BAAS (BaaSid) will be listed on LBank! @baa_sid

'BaaSid' is next generation security technology for “Data security & security authentication” based on De-centralized & Blockchain.

️ Details: https://t.co/RtGVWJLeF3 pic.twitter.com/pGQjqP0T9X

Let's see what news the past weekend has brought with a summary of U.Today's top three news stories.

Goldman Sachs bets on Bitcoin with $1.4 billion via BlackRock's ETF

According to the SEC filing, Goldman Sachs has substantially increased its involvement in the cryptocurrency market, becoming the largest institutional holder of BlackRock’s iShares Bitcoin Trust (IBIT) with 30.8 million shares valued at over $1.4 billion. This represents a 28% increase from its previous holdings of 24 million shares and positions Goldman Sachs ahead of other major investors, signaling strong confidence in Bitcoin ETFs. By the end of 2024, the bank's total crypto ETF holdings reached $2.05 billion, with about $1.3 billion in BlackRock’s Bitcoin ETF and $300 million in Fidelity’s. This reflects a huge 50% increase in their crypto ETF exposure compared to the $720 million total from the previous quarter.

516,120,000,000,000 Shiba Inu set to be hit: Potential scenarios

Shiba Inu is moving closer to a critical price range that could decide its next major move. Data provided by IntoTheBlock shows that nearly 516.12 trillion SHIB held by over 116,000 addresses are priced between $0.000016 and $0.000019. At press time, SHIB is trading at $0.00001619, up 1.24% over the past 24 hours and up almost 28% over the week, benefiting from a broader bullish trend in the crypto market. Traders are now closely monitoring the potential resistance around the $0.000016 to $0.000019 range due to possible selling pressure from those looking to break even on their investments. If SHIB breaks above this range convincingly, it may attract additional buying pressure, targeting the next level between $0.000019 and $0.000024. If SHIB fails to break out, a wave of profit-taking could drag prices down toward lower support levels between $0.000014 and $0.000016.

XRP's first major chart signal of 2025 emerges: What to expect

XRP is approaching a crucial moment that could influence its price trajectory, particularly the emergence of its first major chart cross of 2025. The asset's 50-day and 200-day Simple Moving Averages (SMA) converge, which could result in either a golden cross (if the 50-day SMA crosses above the 200-day SMA), or a death cross (if the 50-day SMA falls below the 200-day SMA). Analysts are closely monitoring this crossover, as the last golden cross in November 2024 preceded a notable bull run for XRP. Currently, XRP is changing hands at $2.56, up 8.85% over the past 24 hours, per CoinMarketCap. If the rise sustains, XRP may target $2.60 and $3 next. The asset is also benefiting from the positive news in the Ripple-SEC case settlement; $50 million will go to the SEC, while the remainder of the escrow funds (just over $75 million) will go back to Ripple.

This week, MicroStrategy announced another massive Bitcoin purchase at 13,390 BTC, which were acquired for $1.34 billion. This represents a firm continuation of Saylor’s recent trend of major Bitcoin buys.

The company recently received massive criticism for its potential instability, and the fundamental concerns are still present. Strategy’s BTC holdings are in excess of $50 billion, but it plans to issue more than $80 billion in new debt.

MicroStrategy Makes A Big Bitcoin Buy

Strategy (formerly MicroStrategy) is one of the world’s largest Bitcoin holders, and it’s looking increasingly vindicated in that decision.

The firm has purchased more than $1 billion in BTC on several occasions this year, although smaller acquisitions also punctuated the trend. Today, Michael Saylor revealed another big purchase, exuding high confidence:

“Strategy has acquired 13,390 BTC for ~$1.34 billion at ~$99,856 per bitcoin, and has achieved BTC Yield of 15.5% YTD 2025. As of 5/11/2025, we hodl 568,840 BTC acquired for ~$39.41 billion at ~$69,287 per bitcoin,” Saylor claimed via social media.

Over the last few weeks, negative trends have dogged his company. Persistent liquidation rumors surround Strategy, as it has been accumulating massive debt to buy Bitcoin.

Recently, it posted major losses in Q1 while simultaneously announcing $84 billion in new stock offerings. Surely, the community thought, this was a house of cards that might collapse soon.

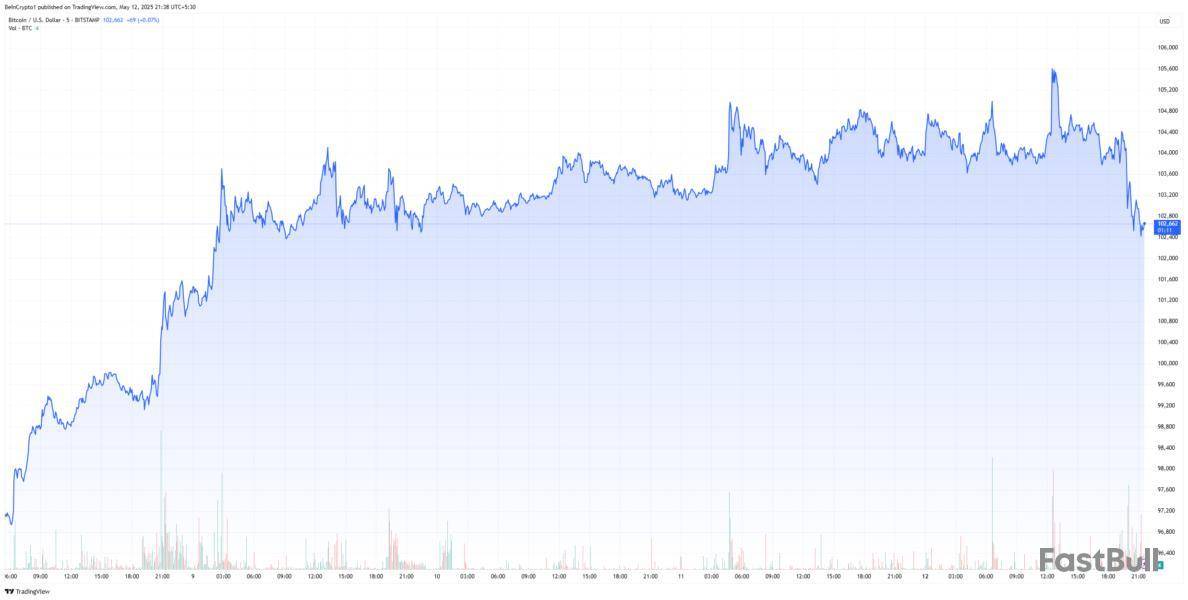

However, Bitcoin is soaring at the moment, and Strategy is peaking alongside it. Bitcoin reclaimed $100,000 after rumors of a breakthrough in US-China trade deals.

When Trump announced an apparent truce in the tariff showdown, BTC jumped to $105,000. This market environment has given Strategy some much-needed breathing room.

It’s difficult to be certain, but Bitcoin’s recovery may have influenced Strategy’s purchase size. One week ago, the firm only acquired $180 million in BTC, while this $1.34 billion commitment is one of its larger buys in 2025.

Strategy’s total BTC holdings are in excess of $50 billion right now, further signifying the scale of a $1 billion+ weekly purchase.

Still, the same negative fundamentals are all present. Strategy’s entire foundation rests on Bitcoin right now; its other business operations are not profitable.

Even if it holds $50 billion in BTC, the company cannot sell these assets, and further plans to issue $84 billion in new debt. When Bitcoin inevitably has another cyclical downturn, this could spell big trouble.

For now, however, it’s a good day for Michael Saylor. BTC is surging off bullish macroeconomic developments, and Strategy enjoys the benefits.

As usual, the size of Strategy’s acquisitions remains an important barometer of Bitcoin’s health and community confidence in the asset. Saylor’s next purchase will continue providing useful data.

FLOKI will host an AMA on X with RICE AI on May 13th at 14:00 UTC. The discussion will address the partnership between the two entities, the forthcoming RICE token launch on the TokenFi Launchpad, and the development of a Floki-branded AI companion robot.

FLOKI Info

FLOKI is a meme cryptocurrency, much like Dogecoin and Shiba Inu. It was created in 2021 and named after the dog of Elon Musk, the CEO of Tesla and SpaceX, who has a significant influence over cryptocurrency markets. The token is part of a broader ecosystem that includes an NFT marketplace and a game. As with all meme tokens, FLOKI's value is largely driven by community sentiment and social media trends. Investors should exercise caution and thoroughly research before investing in these types of digital assets, as they can be highly volatile.

Kadena will host an AMA on X with Satoshi Club on May 13th at 15:00 UTC. The session is expected to provide forthcoming updates and insights regarding the project.

KDA Info

Kadena is a public blockchain platform that provides a secure, scalable, and user-friendly environment for developing and launching distributed applications (dApps).

One of the unique features of Kadena is its utilization of a new form of Proof-of-Work (PoW) in its consensus protocol. This protocol, called "Chainweb," is designed to achieve high throughput and scalability while maintaining security and decentralization.

The Kadena token (KDA) is a digital currency that is used to pay for computation on the Kadena public chain. Similar to ETH on Ethereum, KDA on Kadena is the token in which miners are compensated for mining blocks on the network and is the transaction fee that users pay in order to have their transactions included in a block.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up