Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

CEA Industries announced Tuesday it had purchased another 38,888 BNB worth around $33 million, maintaining its position as the world's largest corporate BNB treasury.

In July, the Nasdaq-listed company announced that it was shifting its primary focus from nicotine vapes to building a BNB treasury, changing its ticker symbol from VAPE to BNC. It recently closed a $500 million private placement to support its treasury strategy, led by 10X Capital and Changpeng Zhao's YZi Labs.

The latest acquisition builds on the $160 million worth of BNB the firm bought last month, bringing CEA Industries' total holdings to 388,888 BNB, valued at approximately $330 million.

The firm targets acquiring 1% of the total BNB supply by the end of 2025, which, if achieved, would put its holdings at roughly 1.4 million BNB, worth around $1.2 billion at current prices, according to The Block's BNB price page.

"We see BNB as the most compelling digital asset with massive, under-recognized potential," CEA Industries CEO David Namdar said. "Our mission couldn't be clearer: every purchase amplifies our conviction, deepens our exposure, and accelerates us toward our bold target of owning 1% of the entire BNB supply."

BNB reached an all-time high of approximately $900 on Aug. 22, subsequently falling 6.2% to $844.25 amid the broader crypto market correction. BNB Chain is the largest blockchain ecosystem by daily active users and decentralized trading volume, with over $12 billion in total value locked.

CEA Industries argues that its single-asset focus on BNB distinguishes it from diversified treasuries, enabling it to capture network effects, generate on-chain yield, and align with the ecosystem’s long-term growth. If its full treasury plan is executed — including up to $750 million from warrant proceeds — the company’s BNB holdings could exceed $1.25 billion, ranking among the largest digital asset treasuries worldwide.

The trend of corporate crypto accumulation has recently expanded beyond Bitcoin and Ethereum, with companies establishing treasuries based on altcoins such as Solana, Litecoin, XRP, and BNB. Other firms, including B Strategy, Nano Labs, and Windtree, also intend to build BNB treasuries.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Yunfeng Financial Group, a Hong Kong-listed company with ties to Alibaba founder Jack Ma, acquired 10,000 ETH (worth about $44 million) in a move to deepen its Web3 expansion.

The purchase, disclosed in a voluntary announcement on Tuesday, was funded through internal cash reserves. The move follows a recent announcement by Yunfeng outlining its push into Web3, real world assets (RWA), digital currency and artificial intelligence.

According to the company, Ether (ETH) was chosen as a reserve asset to support RWA tokenization, technological innovation and the broader integration of finance with Web3 infrastructure.

“The Board believes that the ETH’s inclusion as the Company’s strategic reserve assets is consistent with the Group’s layout of expansion into frontier areas, including Web3, and provides key infrastructure support for Real World Assets (RWA) tokenization activities,” the company said.

Yunfeng to classify ETH as investment asset

ETH will be reflected as an investment asset on Yunfeng’s balance sheet. “The ETH are accounted for as investments in the financial statements of the Group,” per the announcement.

The company also noted that ETH holdings would help diversify its asset base and reduce reliance on traditional fiat currencies. Yunfeng also plans to explore Ethereum's potential application in insurance operations and new business scenarios tailored to decentralized finance.

Yunfeng Financial is a Hong Kong-listed financial technology group that provides investment and financing services, including brokerage, asset management, insurance, and financial technology solutions. Jack Ma is a key associate of Yunfeng Financial.

Ether Machine raises $654 million in ETH

On Tuesday, The Ether Machine revealed that it has raised $654 million in private financing, securing 150,000 ETH from longtime Ethereum advocate Jeffrey Berns, who will join the company’s board.

The raise supports a strategy to build a large ETH treasury ahead of its planned Nasdaq listing later this year. The Ether Machine now holds over 345,000 ETH and is on track to go public with more than 495,000 ETH.

BitMine Immersion Technologies, led by Fundstrat’s Tom Lee, added more than 150,000 ETH to its treasury, bringing its total holdings to nearly 1.87 million ETH, valued at around $8.1 billion.

A massive 201,435% liquidation imbalance hit the Bitcoin derivatives market on Tuesday, as per CoinGlass. Ironically, this occurred just as Michael Saylor confirmed another multibillion-dollar expansion of Strategy holdings. The software firm revealed that it had purchased 4,048 BTC for $449 million, averaging $110,981 per Bitcoin.

However, rather than cheering the market, this announcement coincided with a sell-off, pushing the price of the main cryptocurrency below $109,000 and rattling leveraged positions across multiple exchanges at once.

In an hour after the announcement, $4.21 million worth of Bitcoin longs were liquidated, compared to only $2,090 on the short side — that’s where the imbalance was hiding in plain sight.CoinGlass">

It’s not an isolated event, though, as over the 24-hour period, more than $393.9 million in leveraged positions were liquidated, with long contracts taking the bigger hit at $292 million versus $101.8 million in shorts.

Whose margin call was most painful?

Binance saw the largest liquidation of the day: an position worth nearly $9.8 million. The pressure extended well beyond Bitcoin itself, pulling altcoin markets into the storm.

Saylor’s company now holds 636,505 BTC at an average cost of $73,765 per coin, with the total stack valued at $46.95 billion. It’s still a 25.7% gain on paper for Saylor & Co.

A bottom line may be that despite massive spot accumulation from the likes of Saylor, the current price action of Bitcoin may be dictated more by derivatives positioning than corporate buying. And imbalance figures prove that point today.

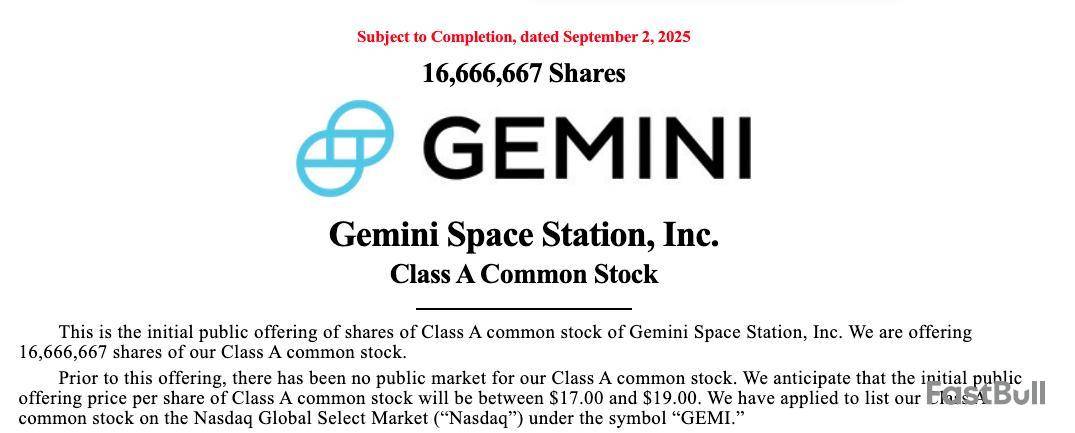

Crypto exchange Gemini has filed plans for a U.S. initial public offering that could raise up to $317 million and value the firm at about $2.22 billion. The offering marks a significant step for the Winklevoss twins’ company as crypto businesses test renewed appetite in public markets.

Gemini Moves Toward Nasdaq Listing

In an SEC filing, Gemini Space Station, Inc. said it intends to list its Class A common stock on the Nasdaq Global Select Market under the ticker “GEMI.” The firm will offer 16.67 million shares priced between $17 and $19 each. Underwriters will also have a 30-day option to buy about 2.5 million additional shares.

Goldman Sachs, Citigroup, Morgan Stanley, and Cantor are leading the underwriting syndicate, which is joined by a group of other investment banks.

In filings with the Securities and Exchange Commission, Gemini reported $142.2 million in revenue for 2024, compared with $98.1 million the previous year. While smaller than Coinbase, the results point to higher trading activity during last year’s rally in bitcoin and other digital assets.

Significance for the Winklevoss Twins

Founded in 2014 by Cameron and Tyler Winklevoss, Gemini has positioned itself as a regulated exchange for U.S. investors. However, the company has faced challenges, including a dispute with bankrupt lender Genesis that drew regulatory scrutiny, but continues to pursue growth in a competitive market.

The IPO comes as crypto firms return to U.S. public markets, following listings by Circle, eToro, and Bullish. Gemini’s mid-sized scale could attract investors betting on wider adoption of digital assets, though the company cautioned that the deal depends on market conditions and may not proceed as planned.

Read more: After Circle’s IPO, Crypto Exchange Gemini Takes Next Step Toward Listing With SEC Filing

Gemini’s IPO plans follow recent regulatory resolutions. Earlier this year, the U.S. Securities and Exchange Commission closed its investigation into the company. The exchange also settled a $5 million lawsuit with the Commodity Futures Trading Commission, clearing significant obstacles to its public market debut.

"The question for investors regarding Gemini revolves around the business mix and moat of trading versus custody, how they differentiate on trust and growth, and what they do that Coinbase can't copy by Tuesday," said Michael Ashley Schulman, partner and chief investment officer at Running Point Capital, quoted by Reuters.

Key takeaways:

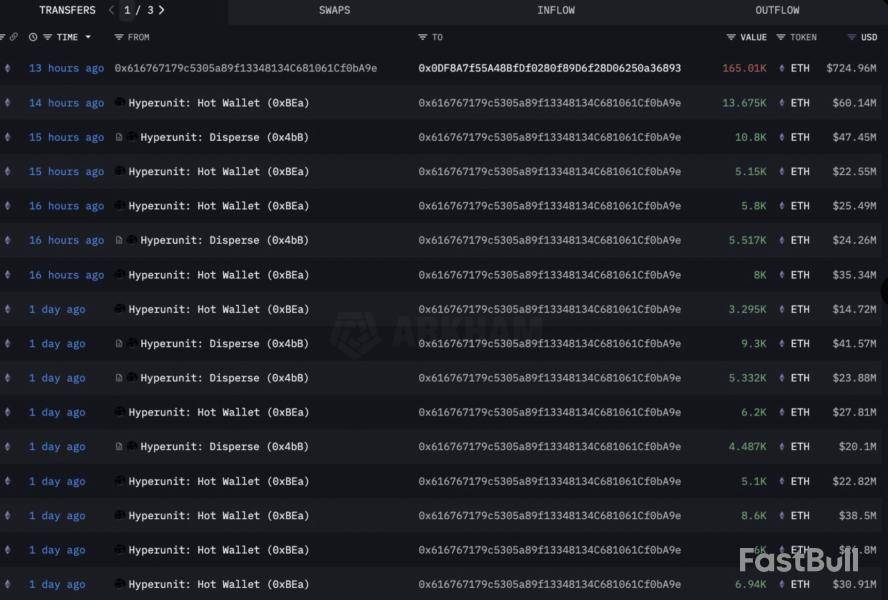

Ethereum whales bought 260,000 ETH in the last 24 hours, signaling accumulation.

Whales, BitMine and ETFs add billions of dollars in ETH, reinforcing bullish demand.

Price technicals favor the bulls with targets between $5,000 and $6,000.

Despite the price drawdown, whales keep buying hundreds of thousands of ETH, igniting hopes of Ether’s possible return to all-time highs.

Ethereum whales buy the dip

Responding to the market correction over the last week, Ether whales took advantage of the drop to $4,200.

Data from Santiment shows that whale addresses holding between 10,000 and 100,000 ETH rose by 4% between Aug. 24 and Tuesday. Moreover, these big investors have accumulated about 260,000 ETH worth $1.14 billion in the past 24 hours.

This underscores the confidence these large investors have in the future prospects of ETH, despite its latest price correction.

As Cointelegraph reported, Bitcoin (BTC) whales rotating billions of dollars into Ether is a continuing trend.

On Monday, a whale holding $5 billion worth of BTC bought and staked $1.08 billion of ETH via Hyperunit, data resource Arkham Intelligence revealed in a post on X, adding:

These moves coincide with BitMine’s continued push into Ethereum. Over the past week, the company added $354.6 million in Ether, pushing its total holdings to 1.71 million ETH (valued at about $8 billion), making it the largest corporate holder of ETH and the second-largest crypto treasury behind Strategy.

Bitmine BMNR@BitMNRAug 25, 2025🧵

1/5

BitMine disclosed latest crypto holdings. As of August 24th at 5:30pm ET:

- 1,713,899 $ETH,

- 192 Bitcoin ($BTC) and

- unencumbered cash of $562 million

- fully diluted shares outstanding 221,515,180

= BMNR NAV per share $39.84

Total NAV $8.8 billion.

BitMine is #2… pic.twitter.com/PjN7nry3bf

Global Ethereum investment products attracted more than $1.4 billion in inflows last week, while spot Ethereum ETFs saw $1.4 billion in inflows between Aug. 25 and Friday.

This strengthens the narrative that Wall Street views the recent ETH price drawdown as a good entry opportunity.

Can ETH price recover to $5,000?

Data from Cointelegraph Markets Pro and TradingView shows ETH trading inside a symmetrical triangle in the four-hour time frame, as shown in the chart below.

The price must close above the triangle’s upper trendline at $4,440 to confirm a bullish breakout. Note that this is where the 50-period simple moving average (SMA) and the 100 SMA converge.

Above this level, the price faces resistance between $4,800 and a $4,950 all-time high, which, if broken, can climb quickly to the measured target of $5,249.

Such a move would bring the total gains to 20% from the current level.

Popular analyst CryptoGoos says Ether’s macro structure remains strong, with the altcoin’s breakout from a falling wedge still in play on the weekly chart.

The measured target of the falling wedge was $6,100, as shown in the chart below.

“Don’t sell your $ETH too early!” the analyst told followers in an X post on Tuesday.

Other metrics also suggest that Ethereum’s bull cycle is not over, with several technical setups projecting that ETH’s price could climb toward $10,000-$20,000 in the coming months.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Ethereum’s (ETH) momentum has stalled, with the token tumbling from its August record of $4,950 to under $4,300. The decline reflects investors shifting focus to securing profits after the recent rally, as the overall sentiment appears to have extended into September.

But ETH’s bearish setup may not be what it seems, and traders fearing the altcoin’s September breakdown may regret it.Greatest Bear Trap

Ethereum may be on the verge of what some analysts call the “biggest bear trap” this month.

In his latest post on X, crypto trader and analyst Johnny Woo warned that Ether could appear bearish in September by forming a head-and-shoulders pattern, which happens to be a classic signal of potential downside.

However, if invalidated, this setup could flip sentiment in October, known in crypto circles as “Uptober,” forcing sidelined traders to buy back in at higher levels. Such pattern-driven reversals have occurred before, and have now fueled speculation about Ethereum’s next decisive move.

Woo also went on to highlight the critical support zone for Ethereum, as he noted that the $3,800 to $4,100 range is an area to watch closely. According to the analyst, this level has become increasingly significant for traders. If the altcoin manages to hold above this level, it couldstrengthenbullish sentiment, while a breakdown might open the door for further downside pressure.Bullish Setup

Crypto trader Hardy also expressed strong bullish sentiment on Ethereum, and tweeted that the asset looks “ready to PUUMP” with an imminent breakout ahead. He suggested that, based on its previous price action, Ethereum could deliver a “double pump” move.

Meanwhile, another popular market watcher, Axel BitBlaze, said that ETH’s setup looks primed for another breakout. He highlighted a cup-and-handle formation alongside two powerful pumps, each retracing before fueling further upside. With the market now on pause, BitBlaze believes that a potential third move could be the most aggressive yet, possibly catapulting ETH above the $5,000 mark.

Gemini, a crypto exchange founded by Cameron and Tyler Winklevoss, has announced the launch of an initial public offering (IPO) of 16.67 million shares of Class A common stock.

Gemini Space Station officially filed a Form S-1 for IPO on Tuesday, planning to sell the shares priced between $17 and $19 per share, to raise up to $317 million.

Subject to completion, the filing comes weeks after the company filed with the US Securities and Exchange Commission to list its Class A common stock on the Nasdaq Global Select Market under the ticker GEMI on Aug. 16.

With the IPO, Gemini exchange is seeking a valuation of up to $2.22 billion, according to a report by Reuters.

Goldman Sachs, Citigroup among lead bookrunners

Gemini’s IPO involves participation from prominent financial institutions, including Goldman Sachs, Citigroup, Morgan Stanley and Cantor, who are acting as lead bookrunners.

Additional bookrunners include Evercore ISI, Mizuho, Truist Securities, Cohen & Company Capital Markets, Keefe, Bruyette & Woods, A Stifel Company, Needham & Company and Rosenblatt.

Additionally, Academy Securities, AmeriVet Securities, and Roberts & Ryan are acting as co-managers.

Gemini and the selling stockholders have granted the underwriters an option for a period of 30 days from the filing date to buy up to an additional 2,396,348 and 103,652 shares of Class A common stock at the IPO price, less the underwriting discounts and commissions.

“We will not receive any proceeds from the sale of shares by the selling stockholders upon such exercise,” it said.

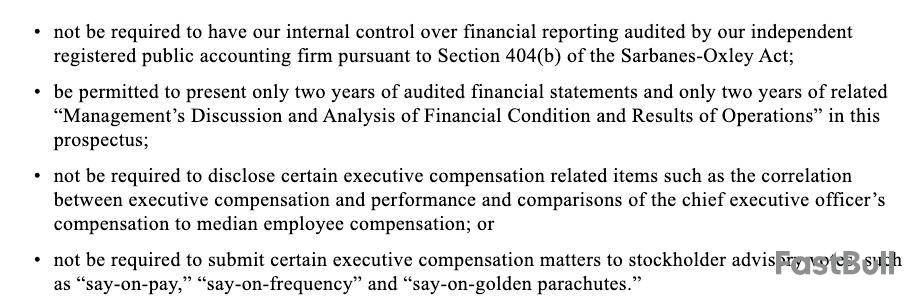

Emerging growth company

In the filing, Gemini stressed that it files for an IPO as an “emerging growth company,” which, according to the US federal securities laws, makes it subject to reduced public company reporting requirements.

“We qualify as an ‘emerging growth company’ as defined in Section 2(a)(19) of the Securities Act of 1933,” Gemini wrote, adding:

As an emerging growth company with reduced reporting exemptions, Gemini disclosed that it had presented only two years of audited financial statements and omitted a compensation discussion, among other reliefs.

Gemini’s IPO filing came months after the company filed a confidential draft registration statement about its IPO in June, which allowed it to file for IPO before publicly disclosing sensitive information.

The confidential filing came the next day after Circle, the issuer of the second-largest stablecoin by market capitalization, USDC , debuted trading on the New York Stock Exchange on June 5.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up