Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ethereum has been enjoying renewed momentum in 2025. With rising institutional inflows and the sustained interest around spot ETF approvals, the second-largest cryptocurrency continues to prove itself as a cornerstone of decentralized finance. Its network upgrades and strong market cap have kept it at the forefront of crypto innovation. But while Ethereum maintains its dominance, a new name is making waves from the grassroots up: Mutuum Finance (MUTM).

Mutuum Finance (MUTM) is still in presale, yet it has already raised around $10.85 million and attracted more than 12,250 holders at a presale price of just $0.03 per token. What sets it apart from traditional protocols is not only its entry point but also its powerful earning mechanics and the infrastructure being built for long-term decentralized growth. For investors who want strong upside potential from a lower base, Mutuum Finance (MUTM) will offer more than just speculative gains—it will deliver real DeFi utility.

DeFi Lending Reimagined—Built for Yield, Built for Access

Mutuum Finance (MUTM) will function as a decentralized, non-custodial liquidity protocol that allows users to lend and borrow various crypto assets using two models: Peer-to-Contract (P2C) and Peer-to-Peer (P2P). In the P2C model, users will deposit assets like Ethereum , USDC, USDT, Solana , Binance Coin , Bitcoin , or Avalanche into smart contract-based liquidity pools. These deposits will automatically earn interest as they get borrowed by others. As pool usage rises, interest rates will increase dynamically, attracting more lenders and creating a high-yield cycle tied to real demand.

The P2P model will give lenders full control, allowing them to negotiate terms directly with borrowers. Users will be able to lend even less commonly supported assets like Pepe , Dogecoin , or Shiba Inu —tokens that are often ignored by centralized platforms. This flexibility will appeal to active users who want more personalized control and higher reward strategies.

Once an asset is deposited into the pool, users will receive mtTokens—tokenized representations of their deposit and interest accrual. These mtTokens will serve as yield-bearing instruments and can be staked to earn passive income from protocol profits. As usage expands, users who lock their mtTokens in designated contracts will receive MUTM token dividends bought in the open market from market revenue. This creates a rewarding loop for early believers.

Layer-2 integration will also give the platform an edge. Lower transaction fees and faster execution times will ensure that Mutuum Finance (MUTM) functions efficiently even during market congestion. The protocol’s CertiK audit, with a Token Scan Score of 80.00 and a Skynet Score of 72.38, will add an extra layer of confidence for users exploring new DeFi options.

Stablecoin Utility and MUTM Token Value—Driving Real Ecosystem Demand

Another major development is the upcoming launch of Mutuum’s decentralized stablecoin. It will maintain a $1 peg and will be minted only when a user borrows against on-chain collateral, such as ETH. This stablecoin will be automatically burned when loans are repaid or liquidated. Unlike traditional models that rely on fiat or centralized reserves, this one will use algorithmic governance to manage supply and interest rates.

Interest rates for borrowing this stablecoin will not be decided by market speculation. Instead, governance will adjust the rates to help stabilize the peg. This system will allow the stablecoin to become a foundational utility layer within the Mutuum ecosystem. Only approved issuers will be allowed to mint this stablecoin, with individual allocation caps to ensure responsible usage.BINANCE:ETHUSDT Isn’t the Only Smart Play" class="wp-image-435807" style="width:530px;height:auto" />

https://ads.mutuum.com/hvhiuThe MUTM token itself will be the centerpiece of the entire protocol. With a supply of 4 billion tokens, MUTM will be used to distribute passive dividends, and incentivize users who stake mtTokens. Most importantly, its long-term value will be tied directly to protocol activity—every time someone borrows, lends, or interacts with liquidity pools, value will flow through to token holders.

MUTM Is Built to Last—Presale Progress, Ecosystem Momentum, and Beta Launch Plans

According to the current roadmap, Mutuum Finance (MUTM) is preparing to launch a beta version of its lending and borrowing platform by the time the token goes live. This will mark a key milestone in usability and provide early adopters with a hands-on experience of the system in action. The project is also running a $100K giveaway, where ten winners will be awarded with $10,000 worth of MUTM tokens each—rewarding those who supported the project early in its journey.

All deposits will be handled through secure, non-custodial smart contracts. Users will always retain control of their funds and can redeem their mtTokens anytime, assuming sufficient liquidity is available. Interest rates will shift dynamically in P2C lending, while in P2P, users will set their own terms. This dual approach will ensure flexibility and adaptability to various market conditions.

For those looking to borrow instead of sell, Mutuum will allow access to liquidity without losing exposure to long-term holdings. Whether someone wants to borrow against ETH to invest in other opportunities or manage short-term costs, this strategy will allow them to keep control of their assets while still participating in the broader DeFi market.

Through an intelligent combination of dynamic interest systems, passive income rewards, algorithmic stablecoin mechanics, and real yield opportunities, the project is projecting a complete financial ecosystem for the decentralized future. With presale still active and the price fixed at $0.03, there is a narrow window before the next price jump begins. Those who act now will secure a stronger position in what could become one of the most talked-about DeFi protocols of the year.

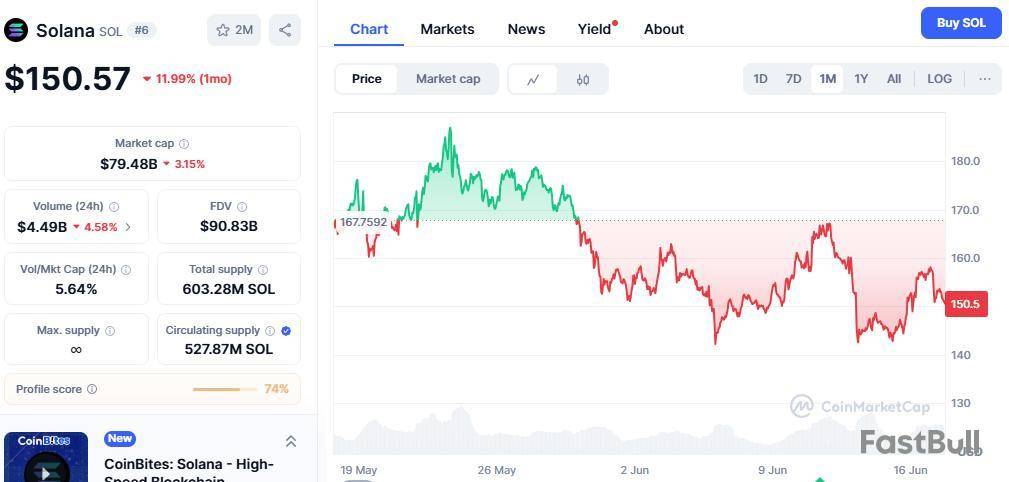

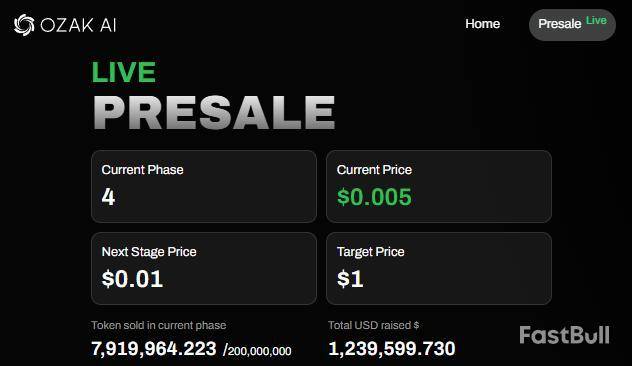

Two crypto names are presently shooting investor interest—Solana and Ozak AI. While Solana is a well-mounted layer-1 blockchain gaining momentum with institutional adoption and DeFi activity, Ozak AI is a growing celebrity within the world of artificial intelligence and decentralized analytics.

Both projects have bold goals for 2025—Solana eyeing $300, and Ozak AI aiming for a large 200x surge from $0.005 to $1. But the paths they comply with, and the possibilities they present, are fundamentally different.

Solana: Speed, Adoption, and Technical Rebound

Solana has demonstrated itself to be one of the fastest and most scalable blockchains, capable of processing thousands of transactions in keeping with second with extremely-low expenses. Its growing surroundings consist of decentralized exchanges, NFT systems, or even traditional finance integrations. With backing from the principal price range and a robust developer network, Solana is placed to play a key role within the next crypto bull run.

The SOL price has been rebounding steadily, and many analysts assume a retest of its all-time high around $260. The cutting-edge chart suggests bullish signs and symptoms after surviving the 2022 downturn, with key resistance stages at $185, $230, and $300, at the same time as help ranges are visible at $145, $120, and $98. If Solana breaks above the $230 range, momentum ought to push it quickly closer to the $300 mark by 2025, particularly if the broader marketplace turns bullish.

Youtube embed:

Next 500X AI Altcoin

Ozak AI: Predictive Analytics Meets Blockchain Innovation

On the other hand, Ozak AI is not another blockchain—it’s an advanced AI-native analytics platform that blends machine learning with decentralized infrastructure. By integrating components such as:

Ozak AI is building a powerful ecosystem for financial forecasting and decision-making. Currently in Stage 4 of its presale at $0.005, Ozak AI has already raised over $1.2 million and has been listed on CoinMarketCap and CoinGecko. The team’s vision of democratizing predictive analytics in crypto and traditional finance is gaining traction. A successful launch and listing could propel the token toward its ambitious $1 target, potentially offering early investors 200x returns—a growth path rarely seen in the post-ICO era.

Ozak AI vs Solana: Which One Is the Better Bet?

Solana and Ozak AI represent two ends of the investment spectrum. Solana is more established, less risky, and already has significant market penetration. A move from $150 to $300 would offer a 2x return, which is excellent for a top-10 coin with strong fundamentals.

Ozak AI, however, represents the high-risk, high-reward category. With a small market cap, cutting-edge utility, and the AI narrative in its favor, the token has the potential to multiply many times over if it gains adoption and delivers on its promises.

Ultimately, Solana is the safer growth bet, but Ozak AI could be the moonshot that defines the next altcoin season. Wise investors may consider a diversified approach—balancing the reliability of Solana with the explosive potential of Ozak AI.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

Amid the market performance, BNB is attempting to reclaim the $650 level. Some analysts believe that a breakout toward the $700 barrier might occur next, which could lead to a bigger move to new highs.

BNB Breakout To Retest $700

On Friday, BNB dropped to the $640 support after failing to hold the mid-zone of its local price range. The cryptocurrency has been trading within the $630-$690 price range following its reclaim of the $600 barrier last month.

During the May breakout, BNB neared the crucial $700 resistance level, hitting a four-month high of $697. This key level propelled the altcoin’s price toward its $788 all-time high (ATH) after being broken in late 2024 and was lost during the early 2025 pullbacks.

Now, the cryptocurrency is eyeing a reclaim of this area as support to continue its price recovery. Analyst Carl Runefelt from The Moon Show noted that BNB displays a one-month descending triangle pattern on the daily timeframe, with price compressing between the support and resistance levels.

According to the chart, the formation’s support sits around the $635 level, while the descending resistance sits around the $650 area. To Runefelt, a bullish breakout from this pattern could propel the token 10% toward the $700 resistance.

Notably, reclaiming and confirming this key area as support could also send BNB’s price toward another crucial horizontal level.

Analyst Crypto Batman recently highlighted that BNB is forming a multi-month ascending triangle, “holding strong” near the ascending trendline after continuing to bounce from the $635-$640 support zone.

To the market watcher, “Even with market uncertainty, BNB structure is clean after respecting the trendline and bouncing off major support, now eyeing a breakout above $700,” which could be part of a bigger move toward the $800 level.

Is A Move To $800 Coming?

Crypto Batman also noted that the cryptocurrency could be following the same price action as last year. He asserted that the altcoin’s price “loves testing key zones before liftoff,” adding that it is displaying the same base form as it did in Q3 2024.

Last year, the token formed a three-month base around the $460-$470 area, which led to an “explosive” run over the next few months. This year, BNB formed a similar base near the $550 level, and it’s “showing strength again.”

To the analyst, “If the pattern repeats, then patience will give us profits.” Additionally, he pointed out that despite the early April retraces, BNB held its macro range, trading above the range lows and multi-time-tested support.

The cryptocurrency is now consolidating near the mid-zone, which could propel the price to a retest of the macro range highs around the $729 mark. He explained that “If we see a breakout above the $729 resistance, it could open the path toward a 50% move to the upside.”

The analyst affirmed that BNB’s structure remains bullish as long as the cryptocurrency holds the $490-$500 levels, adding that the $600 mark is also a strong support.

As of this writing, BNB is trading at $641, a 2.9% decline in the weekly timeframe.

The crypto market is down 3% today, bringing the total market cap to $3 trillion. Bitcoin has dropped to $103,000, down 1.1%. Major altcoins like Ethereum, Solana, and XRP are also down by up to 3%, while memecoins such as Dogecoin, Litecoin, and others continue to slide.

Top analyst Crypto Capo had recently issued a strong warning saying, “We haven’t seen anything yet.” He warns that altcoins are already dropping hard, even though Bitcoin is still above $100K.

Memecoin To Be Hit The Hardest!

He identifies two key support levels for Bitcoin: first at $93,000 and then the main support zone between $60K and $ 70 K. This would be a 35-45% decline from the current prices. In a full-blown capitulation or a Black Swan scenario, the analyst says Ethereum could drop 45-55% and reach the $1000-$1200 range. Altcoins are expected to drop 50-70% on average, while memecoins could be hit the hardest. They could crash by up to 60-80%, as per the analyst.

He expects the real drop to begin once Bitcoin breaks the $100,000 level. That is when bearish momentum could accelerate sharply. He also shared a few examples of altcoins already collapsing before Bitcoin's drawdown.

Charts Point to Memecoin Meltdown

Crypto Capo’s charts show memecoins are on the edge of major breakdowns. FARTCOIN is at risk of dropping 61% to the first support zone around $0.38, and possibly 82% drop to $0.17 if it falls further.

RETARDIO is stuck below resistance and showing weakness. Despite several bounces, it’s stuck in a lower range, showing signs of exhaustion. PEPE has triggered a bearish Head and Shoulders pattern, with an expected 70% drop ahead.

Slow Bleed Continues

CryptoQuant data also shows that altcoins are still deep in a slump. Altcoin Sherpa notes that the top gainers like Fartcoin, SPX, and are pulling back the hardest, while the rest of the market is in a slow, steady bleed. He also expects coins like POPCAT to continue drifting lower, with no major liquidations or panic selling so far. Most altcoins look weak, and the analyst sees no strong buy signals at the moment. https://twitter.com/AltcoinSherpa/status/1936238773135950124

Calm Before the Altcoin Storm?

Analyst Michaël van de Poppe says altcoins have been flat for the past three months, simply retesting lows. He believes that this quiet phase is just the calm before the storm, with the biggest altcoin bull run still ahead.

Meme-coin crazes pop up every few months, and hopeful traders keep trying to turn pocket change into life-changing cash. Right now, that $100 buy-in looks eye-catching on Little Pepe (LILPEPE) and Bonk , two tokens buzzing with breakout chatter.

Little Pepe (LILPEPE): The Meme Coin With Infrastructure Ambition

Stage 2 Presale Details

Many meme coins blow up on nothing but excitement and posts that fade by lunchtime. Little Pepe, though, is nailing down real tech by launching its own Layer 2 chain, one that settles blocks almost on the fly, charges zero trading tax, slams bot abuse, and hands creators a complete toolbox. In other words, LILPEPE packs a mission, not just a mascot.

Why Early Buyers Should be Hyped:

Fold these pieces together and you get a classic meme-stage recipe: low price, clear listing target, loud community, and a product that works instead of winks. It's the same cocktail that sent SHIB and PEPE to wild heights, but, for once, someone wrote a playbook first.https://littlepepe.com/?utm_source=Coinpedia&utm_medium=Coinpedia2006

Bonk : Solana’s Meme Veteran Primed for Next Chapterhttps://littlepepe.com/?utm_source=Coinpedia&utm_medium=Coinpedia2006

On-Chain Snapshot

Why It Still Matters

BONK definitely isn't drifting without a plan—the token rides on raw momentum, solid trading rules, and the sheer power of its community. Should analysts guess right and Solana bounces back, Bonk would tag along for a big payday.

Side-by-Side Comparison

Conclusion: Fresh Bets, Big Potential

Little Pepe keeps popping up in chats that feel, well, a tad different. You drop a hundred bucks now and score the presale price, possibly locking in tens of thousands of tokens. Folks are already daydreaming about 2x or 3x when it hits a public exchange. What grabs attention is the chain itself: a Layer 2 playground built for meme coins that promises lightning-fast trades, swaps without the tax bite, and space for later meme launches.

The roadmap reads like an inside joke gone public, starting with Pregnancy and finishing who knows where with Dominance. Toss in a hard cap on tokens and a plan for the crowd to steer the ship, and you've got a classic high-risk, high-reward setup that some investors can't resist. Bonk feels more like old news that keeps surprising you. It's been Solana's poster-child meme coin for long enough to rack up a big following and score real-world deals, from betting apps to wallets you use every day.

Traders watch the charts and whisper that a fresh bull market could throw its price into the 5x-or-maybe-10x zone. Add landing spots on giants like Binance and Coinbase, and Bonk trades the sketchy label for at least a little bit of credibility. Volatile still? Absolutely. Worth holding in case? Many think so. In conclusion, these tokens are great bets, but Bonk pales in comparison to Little Pepe in terms of their potential to transform $100 into a life-changing sum.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up