Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Cardano price is showing strong signs of a breakout, with a technical analyst pointing to a massive 300% explosion on the horizon. If the current pattern holds, ADA could be gearing up for a major bullish impulse that could push prices as high as $2.65 within the next few months.

Master Ananda, a crypto analyst on TradingView has released a new chart report predicting that Cardano will experience a staggering 300% price surge in the next three months. The analyst’s firm bullish outlook for ADA stems from the formation of a Falling Wedge pattern on the cryptocurrency’s monthly chart.

Cardano Price Aims For 300% Rally

A Falling Wedge is a distinctive reversal chart pattern that suggests a potential bullish reversal after a period of decline. This pattern had been forming on the Cardano price chart since January 2025, characterized by a series of lower highs and lower lows, gradually tightening within the structure. Currently, the Cardano price has broken to the upside of the Falling Wedge, signaling a potential end to the cryptocurrency’s prolonged correction phase and the beginning of a new bullish phase.

Adding fuel to this optimistic outlook, Master Ananda revealed that ADA had formed a higher low on April 7, 2025, which aligns with the critical support zone near the $0.57-$0.60 range. The analyst views this move as a confirmation that Cardano may have reached a bottom, supported by a prior long lower wick in early February that highlighted significant buying pressure.

Based on Cardano’s current technical setup, Master Ananda forecasts that the cryptocurrency will see a 300%+ increase to $2.65. This bullish target aligns with the 2.618 Fibonacci Extension level on the price chart.

With Cardano currently trading at $0.7, the analyst anticipates a breakout through multiple key Fibonacci Extension levels, each serving as a future price target. The first major target lies at the 0.382 Fib, which aligns with the $0.81 level. From there, the Cardano price is expected to climb past the 0.5 Fib at $0.91, the 0.618 Fib at $1.01, and the 0.786 Fib at $1.14.

If momentum persists, ADA could then rally toward a high target of $1.3 before skyrocketing to the 1.618 Fib at $1.83. Once it successfully crosses this level, the cryptocurrency is expected to reach its final projected target of $2.65 in this analysis.

ADA Set For Long-Term Bullish Growth

According to Master Ananda’s analysis, ADA’s current price action is just the beginning of a mid-term bullish impulse that could extend well into Q3 2025. While short-term price swings are expected, the underlying structure of the Falling Wedge pattern suggests Cardano is entering a sustained growth phase.

Furthermore, the TradingView analyst has revealed that the projected move to $2.65 is not the top of the cycle but part of a much larger trend. He stresses that this long-term bullish growth will not happen overnight. However, as long as prices hold above the 0.236 Fibonacci support at $0.69, long positions are expected to remain secure.

The Federal Bureau of Investigation’s Internet Crime Complaint Center (IC3) has released its annual report detailing complaints and losses due to scams and fraud involving cryptocurrency in 2024.

According to the report released on April 23, the IC3 received more than 140,000 complaints referencing cryptocurrency in 2024, resulting in roughly $9.3 billion in losses. The bureau reported that individuals over the age of 60 had been the most affected by crypto-related fraud, with roughly 33,000 complaints and $2.8 billion in losses.

“Last year saw a new record for losses reported to IC3, totaling a staggering $16.6 billion,” said the report. “Fraud represented the bulk of reported losses in 2024, and ransomware was again the most pervasive threat to critical infrastructure, with complaints rising 9% from 2023," notes the report, adding that, as a group, those over the age of 60 suffered the most losses and submitted the most complaints.

The report added that the resultant losses had increased roughly 66% since 2023, from roughly $5.6 billion to $9.3 billion. The most significant percentage of losses occurred due to crypto investment schemes, while the largest number of complaints related to “sextortion” schemes, in which fraudsters manipulated photos and videos to create explicit content. Other scams included schemes involving the use of crypto ATMs or kiosks.

In February, the FBI reported its “Operation Level Up” had saved potential victims of crypto fraud roughly $285 million between January 2024 and January 2025. However, blockchain analytics firm Chainalysis speculated that 2025 could see the largest number of scams to date, given that generative AI is making the practice “more scalable and affordable for bad actors to conduct.”

Globally, Chainalysis estimated that there had been roughly $41 billion in illicit crypto volume in 2024, with roughly 25% of the funds involved with “hacking, extortion, trafficking, or scams.” Some of the most high-profile crimes included the $1.4 billion in crypto stolen from the Bybit exchange in March and North Korean hackers taking more than $1.3 billion.

Sovereign wealth funds and other institutions were accumulating Bitcoin during April 2025, while retail traders were exiting the markets via exchange-traded funds (ETFs) and spot markets, according to John D’Agostino, the head of strategy at Coinbase Institutional.

During a recent appearance on CNBC, the Coinbase executive likened Bitcoin to gold and said that many institutional buyers bought BTC as a hedge against currency inflation and macroeconomic uncertainty. The Coinbase executive said:

"When you do the work, there's a very short list of assets that mirror the characteristics of gold. Bitcoin is on that shortlist," the executive added.

Governments and financial institutions are increasingly adopting Bitcoin to protect purchasing power and the value of their treasuries in the face of macroeconomic shocks and geopolitical tensions.

Institutions adopting Bitcoin reserve strategies to combat inflation

Sovereign countries like El Salvador and Bhutan have adopted national Bitcoin reserves and actively purchase Bitcoin for their reserves.

Municipalities and state governments have also adopted pro-Bitcoin policies and proposed legislation to accumulate Bitcoin to protect the purchasing power of treasuries from depreciating fiat currencies.

Michael Saylor and Strategy, formerly known as MicroStrategy, popularized the corporate Bitcoin treasury concept now adopted by a growing list of companies, including MARA, MetaPlanet, and Semler Scientific.

The executive also transformed the business software and intelligence company into a Bitcoin holding firm, akin to a BTC hedge fund.

On April 20, Saylor announced that over 13,000 institutions have direct exposure to Strategy, while an estimated 55 million beneficiaries have indirect financial exposure to the company.

Bitcoin recently surpassed Google in market capitalization, making Bitcoin one of the top five assets in the world, ranking above Amazon and Silver and showcasing the supply-capped digital asset's meteoric growth since 2009.

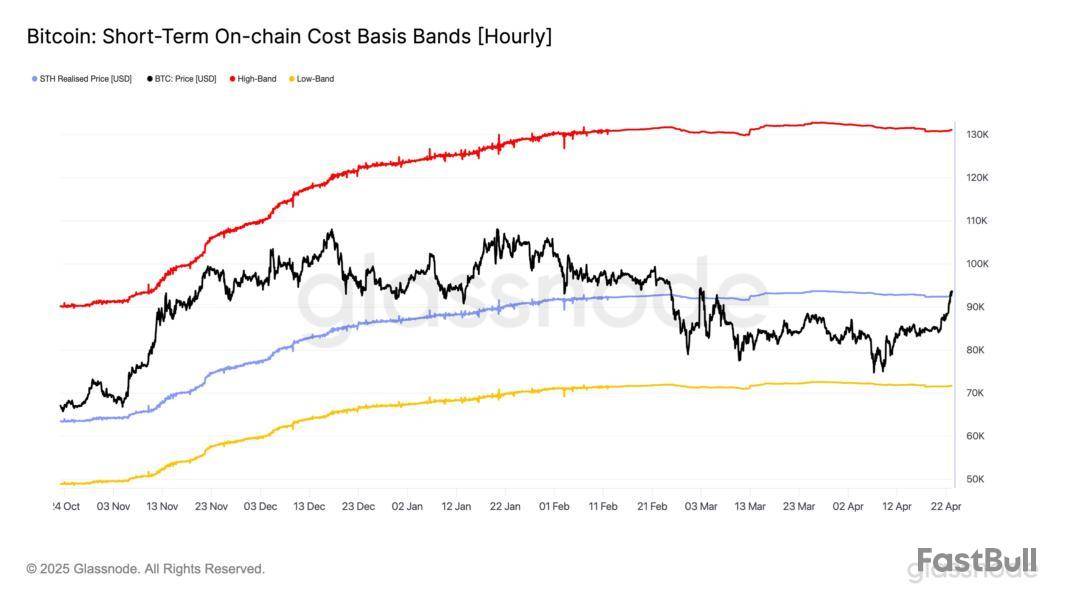

On-chain data shows the Bitcoin price has reclaimed the cost basis of the short-term holders, a level that has historically been psychologically important.

Bitcoin Is Now Back Above The Short-Term Holder Realized Price

In a new post on X, the on-chain analytics firm Glassnode has discussed the Realized Price of the Bitcoin short-term holders. The “Realized Price” here refers to an indicator that keeps track of the cost basis or acquisition level of the average investor in the BTC sector.

When the spot price of the cryptocurrency is trading above this metric, it means the holders as a whole are sitting on a net unrealized profit. On the other hand, it being under the indicator suggests the dominance of loss in the market.

In the context of the current topic, the Realized Price of only a specific part of the sector is of interest: the short-term holders (STHs). The STHs are made up of the BTC investors who purchased their coins within the past 155 days.

This cohort represents one of the two broad divisions of the userbase done on the basis of holding time, with the other group being known as the long-term holders (LTHs).

Statistically, the longer an investor holds onto their coins, the less likely they are to sell them at any point. As such, the LTHs include the resolute hands, while the STHs include the weak ones.

Now, here is a chart that shows how the Realized Price of the Bitcoin STHs has changed during the last few months:

As displayed in the above graph, the Bitcoin spot price fell below the STH Realized Price earlier in the year, suggesting these investors dipped into a state of net loss.

As mentioned earlier, the STHs include the fickle hands of the market. These investors often panic whenever retests related to their cost basis occur, so the cryptocurrency can feel some kind of reaction when it touches the STH Realized Price.

When this retest occurs from below (that is, when the STHs were in the red prior to the retest), the cohort might react by selling, if the sentiment among them is bearish. This panic exiting at the break-even can provide resistance to the asset. From the chart, it’s visible that Bitcoin witnessed this effect back in early March.

After staying under the line for a couple of months, though, it appears the asset has finally managed to break above the resistance with the latest price rally. If the asset now goes on to see a sustained move in this profit region, it could be a signal that confidence is back among the STHs.

Historically, these holders being bullish has meant that their cost basis has turned into a notable support level for the cryptocurrency.

BTC Price

Following a surge of almost 6% in the last 24 hours, Bitcoin has returned to the $93,600 mark.

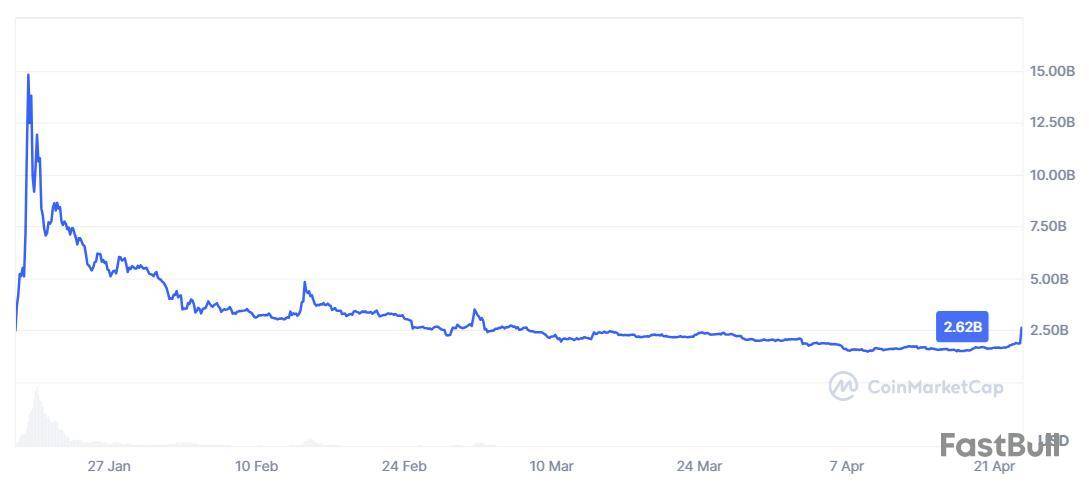

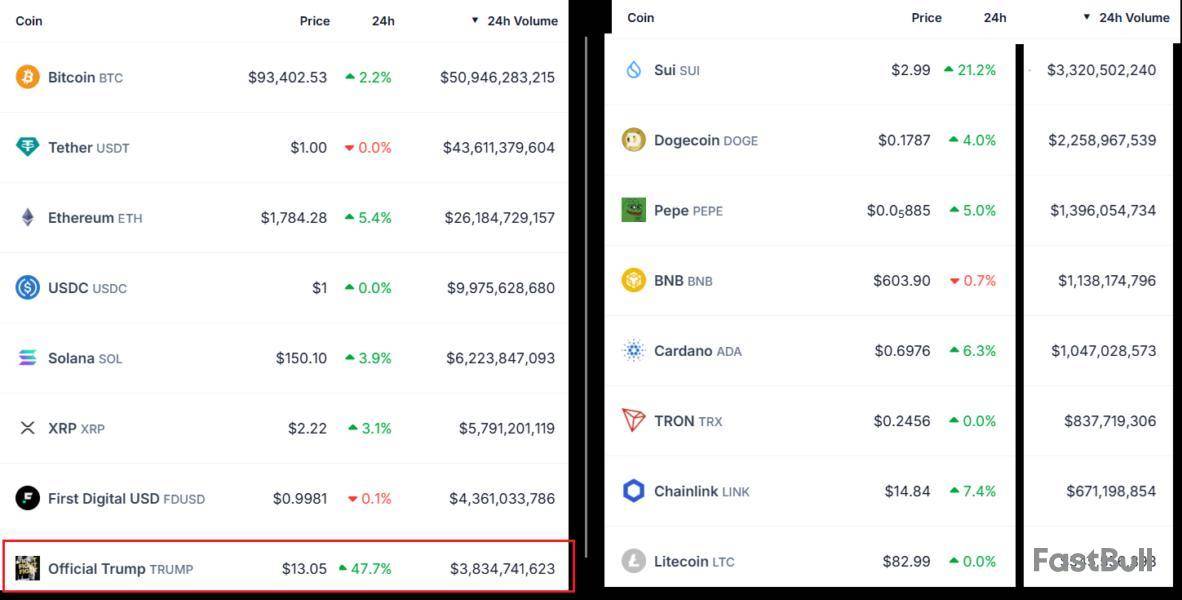

Official Trump (TRUMP) jumped 52% on April 23 after the announcement of an exclusive in-person dinner for the top tokenholders with US President Donald Trump. For some crypto advocates, this marks the end of the bear market, especially as Bitcoin bounced back above $93,000, but others raise suspicions on how sustainable the TRUMP memecoin rally really is.

From a purely performance perspective, the Official Trump (TRUMP) memecoin has been a disappointment. After soaring above $75 on launch day, its gains quickly disappeared as investors noticed the high concentration of tokens and the short-term vesting period.

At first sight, it is difficult to justify TRUMP’s current market capitalization of $2.6 billion, given that 80% of the supply was allocated to founders and entities controlled by Trump.

For comparison, well-established projects such as Arbitrum (ARB), Jupiter (JUP), and Maker (MKR) hold a capitalization below $1.6 billion. Those token valuations derive from buybacks using treasury reserves or direct benefits in staking and DeFi mechanisms. For instance, Arbitrum, a leading Ethereum layer-2 scaling solution, holds $2.4 billion in Total Value Locked (TVL).

Jupiter, the leading decentralized exchange (DEX) on Solana, boasts $2.3 billion in deposits and has accrued $76.6 million in fees over the past 30 days, according to DefiLlama data. Meanwhile, Sky (formerly Maker), the project behind the extremely successful DAI stablecoin, holds $5.9 billion TVL and $28.6 million in 30-day fees.

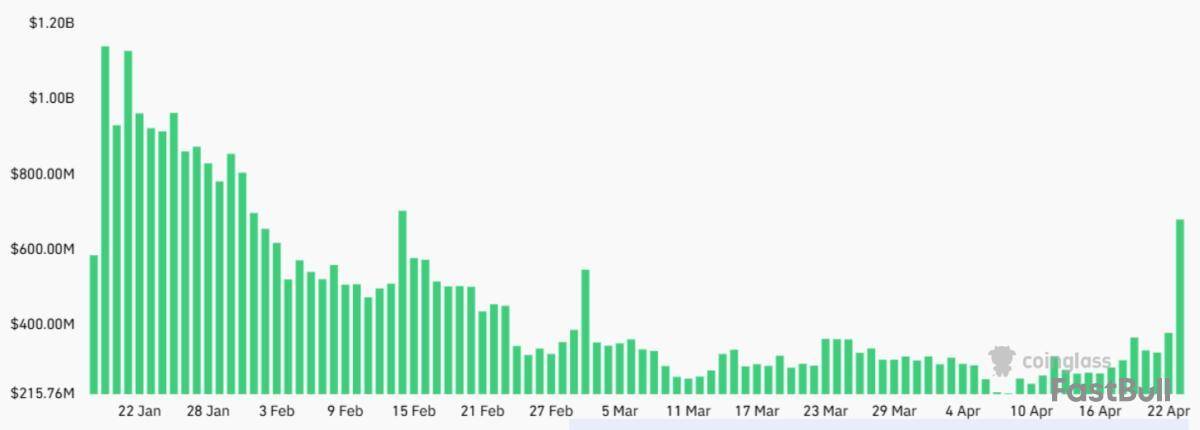

TRUMP still ranks in the top 10 for trading activity

Besides being listed on major exchanges, including Binance, Bybit, OKX, Coinbase, Upbit, and Kraken, and often promoted on social media by Trump, the memecoin holds an impressive share in derivatives markets. Notably, its futures open interest stands at $700 million, a top-10 overall.

Established projects with market capitalizations over $6 billion, such as Chainlink (LINK), Litecoin (LTC), and Polkadot (DOT) have smaller futures open interest than TRUMP. Still, while demand for futures markets allows larger traders to take part in the action, it does not necessarily imply optimism as longs (buyers) and shorts (sellers) are matched at all times.

Even though TRUMP is currently trading 84% below its all-time high, it remains a top-10 token in terms of volume. In fact, excluding the stablecoins, only 4 cryptocurrencies surpassed TRUMP’s impressive $3.84 billion 24-hour turnover, according to CoinGecko data.

Despite the huge trading activity, a single promotional event with US President Trump is unlikely to create lasting demand for the TRUMP memecoin, putting the current $13.50 price tag in check. Unless the project eases investors’ concerns about token unlocks, there is hardly a way to justify the 50% premium versus cryptocurrencies that offer utility and perspectives of growth.

It is worth noting that Shiba Inu (SHIB), another memecoin with no real utility, presently trades at a $8 billion market capitalization, hence one could easily argue that a token officially supported by the sitting US President is worth far more, paving the way for $30 or higher price targets for TRUMP.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

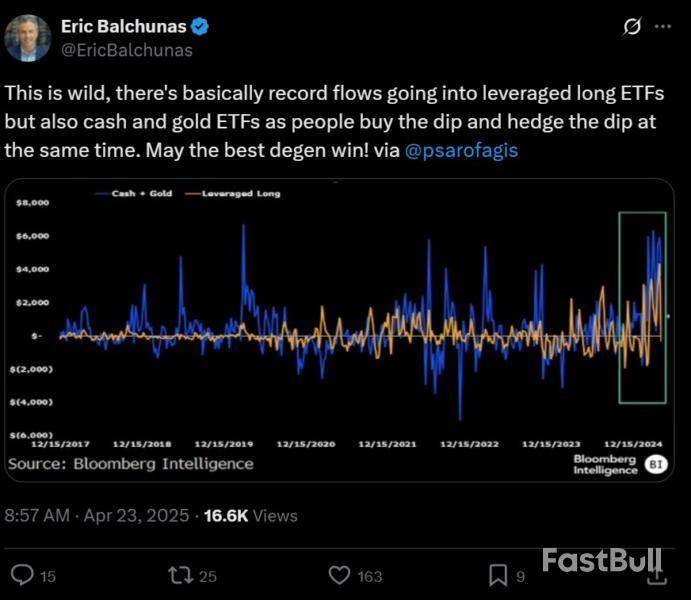

Traders are embracing diametrically opposed exchange-traded fund (ETF) strategies in a bid to navigate one of the most unpredictable financial markets in recent history, according to data from Bloomberg Intelligence.

The year-to-date has seen record inflows to ETFs providing leveraged long exposure to volatile assets such as stocks and cryptocurrencies, as well as funds holding risk-off assets such as cash and gold, the data shows.

“[T]here's basically record flows going into leveraged long ETFs but also cash and gold ETFs as people buy the dip and hedge the dip at the same time. May the best degen win!,” Bloomberg Intelligence analyst Eric Balchunas said in an April 23 post on the X platform.

Leveraged ETFs are funds that aim to multiply the daily performance of assets like stocks or crypto, often by two or three times.

In 2025, leveraged long ETFs attracted net inflows of roughly $6 billion, according to Bloomberg Intelligence. Meanwhile, inflows into cash and gold funds approached roughly $4 billion.

Digital gold?

The record fund flows come amid a spike in market turbulence after US President Donald Trump announced plans for sweeping tariffs on US imports on April 2.

Since then, the S&P 500, an index of large US stocks, has shed roughly 5% of its value, according to data from Google Finance. Bitcoin , meanwhile, has been comparatively resilient.

On April 22, the cryptocurrency’s spot price reclaimed $90,000 per coin for the first time in six weeks, with Bitcoin ETFs clocking nearly $1 billion in net inflows. The cryptocurrency trades above $93,000 as of April 23, according to data from Google Finance.

“Even in the wake of recent tariff announcements, BTC has shown some signs of resilience, holding steady or rebounding on days when traditional risk assets faltered,” Binance, the world’s largest cryptocurrency exchange, said in an April research report.

Bitcoin has often been referred to as “digital gold” but the cryptocurrency still has a weak correlation to the safe haven asset and trades more in line with equities, Binance said. Its correlation with gold has averaged around 0.12 over the past 90 days, versus 0.32 for equities.

“The key question is whether BTC can return to its long-term pattern of low correlation with equities,” noted the report, adding that gold is still a preferred safe-haven asset for most investors.

Meanwhile, cryptocurrency exchanges are profiting off of rising volatility by doubling down on financial derivatives, such as futures.

In April, net open interest in Bitcoin futures increased by upward of 30%, to approximately $28 billion, according to data from Coinalyze.

The Shiba Inu team has seen a major trend in its burn strategy, as data from its on-chain burn tracker, Shibburn, shows that the SHIB burn rate has surged massively by 1,328.82% over the last day.

On Tuesday, the crypto market kick-started a fresh bull run that saw major cryptocurrencies rebound above previous key resistance levels. While this has sparked renewed interest among investors, fuelling massive demand for SHIB, it has also seen SHIB record a notable four-digit increase in its burn rate in just one day.

As such, a total of 27,204,090 SHIB tokens have been sent to dead wallets, reducing the amount of SHIB in circulating supply. The team deploys this mechanism as a way to increase scarcity for SHIB and boost its market value.

SHIB burn up as price rockets

The tracking firm revealed multiple transactions issued to send SHIB to unspendable wallets, as the tokens were moved in varying batches. The most significant transactions involved massive transfers of 15,736,713 SHIB and 11,060,001 SHIB in a short period.Shibburn.com">

While this has been followed by multiple burn transactions involving large and small amounts of SHIB, over 410 trillion SHIB have been burned so far.

According to Shibburn data, the massive SHIB burn that happened today has brought the remaining tokens in circulation to 589,252,031,906,252, providing the chance for continued burning in the future.

The impact of this decisive action to burn as many Shiba Inu tokens as possible appears positive in the performance of the token in recent days. Data from CoinMarketCap shows that SHIB has surged by 2.37% to an impressive $0.00001354 over the last day.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up