Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

ADA found support at $0.70 and appears determined to reverse the downtrend.

Key Support levels: $0.64, $0.70

Key Resistance levels: $0.77, $0.901. Buyers Return at Key Support

Once the price landed on the 70 cents support, buyers returned. At the time of this post, ADA is at 75 cents and has good momentum to test the resistance at $0.77. If bull break that level, then ADA has a clear path to go back towards 90 cents.2. Bullish Momentum Picking Up

In the past five days, ADA closed four daily candles in green. While the volume is still low, this is a promising reversal that could allow for an attempt at a breakout. The momentum indicators are also giving first signs of curving back up which supports a possible reversal here.3. Daily RSI Above 50

As bulls return, the daily RSI has moved above 50 points hinting at a positive bias. If the RSI can stay above 50, then ADA had a good chance of moving beyond its current resistance at 77 cents. That could build sufficient momentum to even test the 90 cents level later on.

Solana memecoin launchpad Pump.fun has launched Glass Full Foundation, a new initiative to support various projects within its ecosystem.

"GFF will inject significant liquidity into ecosystem tokens to support our most diehard cults," Pump wrote in its announcement on social media platform X.

In crypto, a foundation usually refers to a legal entity—often a nonprofit or similar organization—set up to oversee and guide the development of a project.

The social media post stated that GFF has already started its initial support for several projects with plans to deploy more capital. The foundation will facilitate Pump's mission to expand the Solana ecosystem, the announcement added.

"The Foundation will help our mission of growing the Solana ecosystem exponentially," the project said. However, the announcement did not disclose the source of the foundation's capital or the criteria for which projects will receive liquidity.

Last month, Pump launched its native token as part of an initial coin offering, which raised $600 million in just 12 minutes. In the following week, the memecoin launchpad initiated a multimillion‑dollar buyback of its token, according to onchain analysts.

The platform has recently faced stronger competition from another Solana memecoin launchpad LetsBonk.fun, which is integrated with Raydium and backed by the Bonk memecoin community.

Pump.fun's platform revenue has experienced a decline since its peak during the memecoin craze. Daily revenue plummeted from over $7 million in January to lows of around $200,000 earlier this month.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

After the protracted legal battle between Ripple and the US Securities and Exchange Commission ended, an expert is optimistic that BlackRock, one of the world’s top asset managers, may soon file for an XRP exchange-traded fund (ETF).

The conclusion of one of the cryptocurrency industry’s most significant regulatory disputes has also sparked a positive surge in XRP’s price and improved the odds of the ETF approval.

Will BlackRock File for an XRP ETF?

BeInCrypto reported that both parties dismissed their appeals on August 7. Now, industry experts are turning their attention to the implications for XRP’s future.

“I’ll own it if I’m wrong. IMO, makes *zero* sense for them to ignore crypto assets beyond BTC and ETH,” he said.

Geraci further emphasized that for BlackRock to focus solely on Bitcoin and Ethereum would imply that the company believes the two largest cryptocurrencies are the only ones with value.

However, Bloomberg’s senior ETF analyst, Eric Balchunas, disagreed with Geraci’s view.

“I just think they are happy w the two. Law of diminish returns from here on out. But again I’ve nothing to go on but my own spidey sense here,” he replied.

While views on BlackRock’s potential involvement with XRP may differ, an ETF application from the asset manager could be highly beneficial for XRP. BlackRock manages the leading Bitcoin and Ethereum ETFs, the iShares Bitcoin Trust (IBIT) and the iShares Ethereum Trust (ETHA). It has established itself as a key player in the cryptocurrency space.

BlackRock’s support for XRP could bring credibility and institutional backing to the digital asset, potentially increasing investor confidence and market adoption. Nevertheless, while BlackRock’s involvement would undoubtedly be positive for XRP, it’s important to note that the asset is not without other filings.

Major asset managers, including Bitwise, 21Shares, Canary Capital, Grayscale, Franklin Templeton, ProShares, WisdomTree, and others, have already filed to launch XRP ETFs. This indicates a growing interest in the asset.

End of Ripple-SEC Case Pushes XRP Price and ETF Approval Odds Up

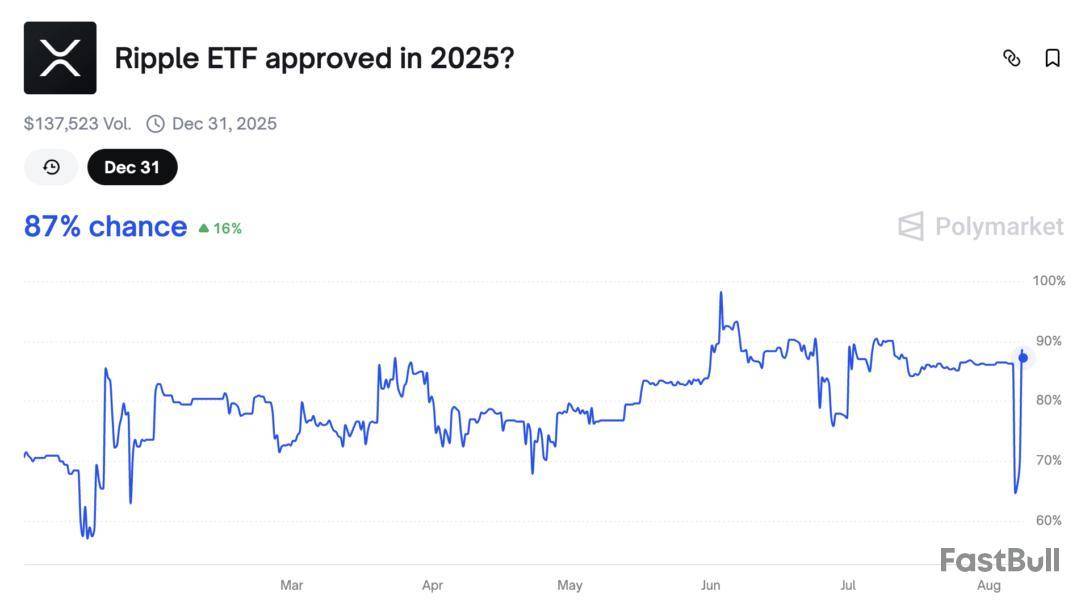

While BlackRock may or may not file for an XRP ETF, the Ripple-SEC development has certainly increased the odds of one being approved by the end of the year. According to the latest data from Polymarket, traders have assigned a 87% probability of an XRP ETF being approved by December 2025.

The number is notable especially since the odds fell as low as 62% after SEC Commissioner Caroline Crenshaw voted against approving several crypto ETFs.

“Interesting, trades reporting how Polymarket odds of XRP ETF approval went down to 62% after the votes were disclosed, showing Crenshaw voting no, but a) she’s gonna vote no on EVERYTHING and b) it’s meaningless, she’s outnumbered = we haven’t changed our odds, still at 95%,” Balchunas stated.

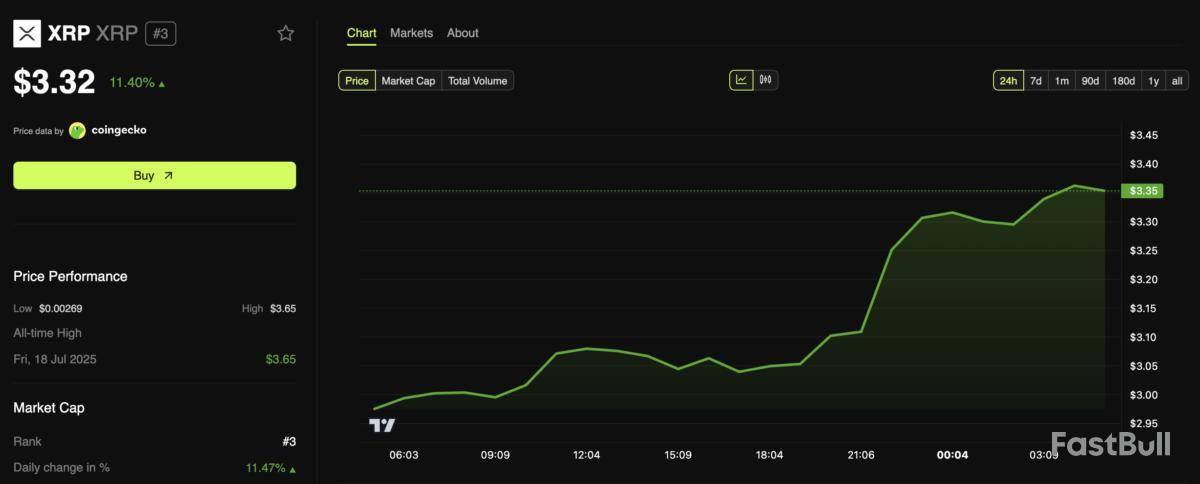

Besides the approval odds, XRP’s price also saw a notable uptick. The altcoin’s value has appreciated 11.4% over the past day, marking the highest gains among the top 10 coins.

According to BeInCrypto Markets data, XRP’s trading price stood at $3.32 at the time of writing.

This Friday, we examine Ethereum, Ripple, Cardano, Solana, and Hyperliquid in greater detail.Ethereum (ETH)

Ethereum is fast approaching the key psychological level at $4,000. This comes after a good week where the price increased by 6%. This is the first time since 2024 when ETH is about to test this resistance.

It would be surprising to see Ethereum break $4,000 and move higher without any sellers making there presence known. Therefore, expect a lot of volatility as the price inches closer to this level. If the cryptocurrency moves above it, then that could signal that the sellers have already retreated to $4,800, the current ATH.

Looking ahead, this cryptocurrency has shown a lot of strength since end of April when this major uptrend started. With buy volume picking up, ETH has a good shot at breaking $4,000 in the nearby future.Ripple (XRP)

XRP had a great week after its price increased by over 12%. This allowed it to expand and move higher from the $3 support level. Buyers came in strong in the past three days and managed to take XRP to the $3.4 resistance.

The momentum indicators are turning positive on the daily timeframe, with the MACD about to do a bullish cross. If confirmed, the price will have the path set towards the current ATH at $3.6 which will also act as a resistance.

Looking ahead, XRP is well positioned to make new highs, especially if the overall altcoin market heats up since Ethereum is also close to breaking $4,000. This will likely see a lot of money return to altcoins as euphoria takes over.Cardano (ADA)

Cardano holders have reasons to be optimistic after the price closed the week with a 8% gain and managed to pass the resistance at $0.77. ADA is now moving fast towards $0.80. This uptrend could continue until 90 cents where sellers may return.

With buyers coming back in the past three days, ADA has made good progress at reversing the losses from the downtrend that dominated the chart in the second half of July. Another impulse up could see the price approach $0.90 in the coming week.

Looking ahead, Cardano is well positioned to move higher thanks to the ongoing bullish momentum that is intensifying. There is a high chance that a second attempt at the $0.90 key resistance may be successful.Solana (SOL)

Solana continues to lag behind other market leaders like ETH or XRP, managing only a 3% increase in the past week. Nevertheless, the price reversed from the support at $155 and managed to make good progress towards the current resistance at $185.

At a macro level, SOL is found in a clear uptrend with higher highs and higher lows. This is positive and may see this cryptocurrency try to reach a price above $200 again. Hopefully, buyers will be strong enough this time to hold Solana above that key level.

Looking ahead, buyers are well positioned to make sustained gains in August and volume could pick up in the future to amplify the current uptrend.Hype (HYPE)

On the weekly chart, HYPE is flat, basically returning to the same price of last week. This comes after sellers managed to take its price to $35, but luckily buyers stepped in there to reverse that move in full in the past 24 hours.

This reversal is a first signal that HYPE’s correction, that started in mid-July, may be over. Buyers have a real chance to capitalize on the positive market sentiment and take the price closer to the ATH at $50. So far, they made good progress by pushing it to $40.

Looking ahead, as long as this cryptocurrency holds above $40, buyers have the upper hand and a good chance at making sustained gains in the following days. Their biggest challenge is the resistance at $50 which saw the price struggle there in the past.

The odds of an early Bitcoin investor buying the cryptocurrency when it was worth cents and keeping those holdings until today to make them a billionaire are extremely low, says a crypto trader.

The trader, known as Techdev, shot down the notion that many traders could’ve held onto Bitcoin (BTC) from its early days in an X post on Tuesday, which has been viewed nearly 3.5 million times on the platform.

Most people wouldn’t have the conviction to hold

“‘If I put $100 into Bitcoin in 2010, I’d have $2.8 billion now.’ No.” they wrote.

The post listed Bitcoin’s brutal corrections over the past 15 years, saying that only someone with significant conviction could have held on to a Bitcoin investment while watching it rise from $1.7 million, only to then fall to $170,000, to then gain $110 million, only to see it crash again to $18 million.

Although the argument has been made before, Techdev’s post triggered reactions across the crypto industry just weeks after Bitcoin reached an all-time high of $123,100 on July 14.

Over the past 13 years, Bitcoin has recorded a compound annual growth rate of 102.79%, according to Curvo data.

While many people claim they would be retired today if they had invested in Bitcoin early, numerous crypto executives agreed with Techdev’s view on the reality being that most would not have had the discipline to hold long-term.

Those who do are known as having “diamond hands,” a crypto slang term for investors with strong risk tolerance who hold through high volatility.

Holding Bitcoin long term “easier said than done”

Crypto entrepreneur Anthony Pompliano echoed a similar sentiment. “Everyone thinks they would have held Bitcoin from pennies to billions of dollars,” he said in an X post. “Easier said than done.”

Many of the commenters on Techdev’s post recalled spending what would now be thousands or even millions worth of Bitcoin on various purchases or losing access to old Bitcoin wallets.

Nibiru Chain head of ecosystem Erick Pinos said an investor has to “make a choice every day, every hour, not to sell, for years.”

Other users argued that many of today’s Bitcoin billionaires were those who bought early and forgot about their holdings, only returning to their wallets once the asset began gaining wider adoption.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Nearly $5 billion worth of Bitcoin and Ethereum options expire today, a major milestone that could test market stability amid persistently low volatility.

With traders divided on the next move and volatility strategies in sharp focus, all eyes are on key support levels and whether this expiry will shake the market out of its slumber.

Bitcoin, Ethereum Options Expiry Looms With $4.96 Billion at Stake

According to data from Deribit, Bitcoin leads with option contracts worth $4.09 billion set to expire. The max pain point, representing the level at which the most options expire worthless and dealers experience the least loss, is $116,000.

The total open interest (OI) for these expiring Bitcoin options is 34,954 contracts and a put-to-call ratio (PCR) of 1.46.

This PCR suggests a slightly bearish lean, with more puts (Sale options) than calls (Purchase contracts) in play.

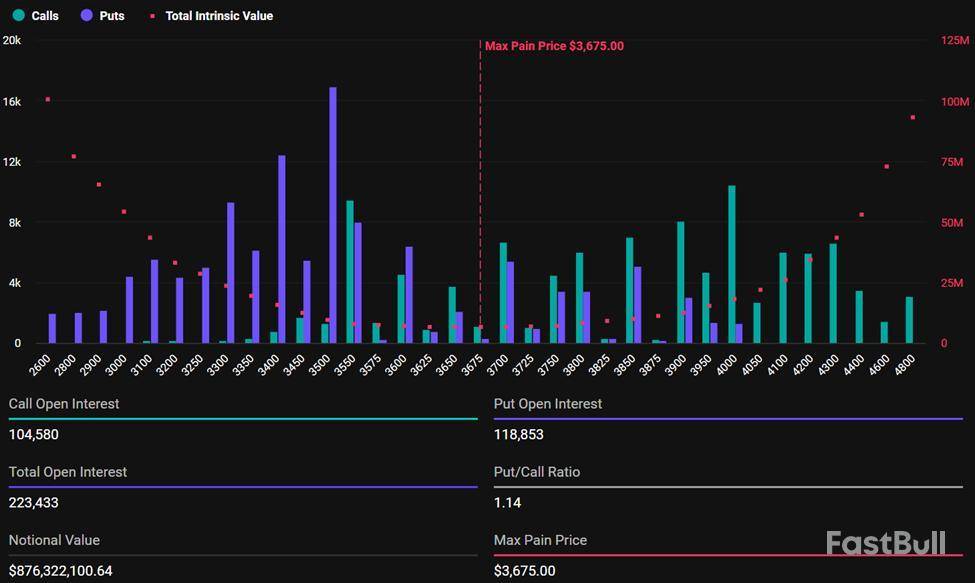

For Ethereum, the figures are more modest but still significant. At 8:00 UTC on Deribit, $876 million in Ethereum options will expire today, with 223,433 contracts outstanding.

The max pain level, $3,675, is aligned with the notional value of $876.3 million, and the PCR of 1.14 indicates a more neutral sentiment than Bitcoin.

Deribit analysts highlighted the current open interest (OI) distribution, noting a large cluster of put positions below spot and call positions stacked above.

“OI distribution hints at puts clustered below spot, calls stacked higher. Do you think the expiry could shake things up?” Deribit analysts posed.

However, this skew may act as a gravitational force keeping prices range-bound, but only until expiry, which happens today, at 8:00 UTC on Deribit.

Low Volatility Dominates Market Sentiment

Options analysts at Greeks.live note a mixed sentiment across the market, with many traders adapting to a low-volatility environment.

Despite concerns around 32% implied volatility (IV), traders aggressively sell puts, especially around the BTC 112,000 strike for end-of-week expiration. This suggests most are betting on price stability or mild upside, ideal conditions for harvesting premiums.

“Traders are actively selling puts at 112,000 strike rice for end-of-week expiration despite 32% implied volatility concerns,” said analysts at Greeks.live.

They also point to strong confidence in premium selling strategies, indicating that successful trades generate profits as the underlying moves favorably.

Further, the BTC 5-minute EMA100 is a key technical battleground, with the analysts highlighting it as both resistance and support in recent sessions. With the Bitcoin price now below this moving average, it typically indicates short-term bearish momentum.

This could trigger defensive action from Put sellers. With large open interest near the $112,000 strike, traders may attempt to push prices higher to avoid losses. The move could increase volatility around today’s $5 billion options expiry.

Could expiry bring a volatility spike? That is the open question. With such a large volume of contracts coming off the board, there is always a risk of sudden repositioning, especially if BTC or ETH break technical thresholds.

However, with the bulk of traders positioned as volatility sellers, the consensus is still tilted toward muted action.

Still, once these positions are unwound, the post-expiry environment could open up fresh directional opportunities, especially if macro catalysts emerge or liquidity shifts.

Meanwhile, as traders play defense, harvesting what they can in a week of compressed volatility, it is imperative to note that things could change anytime.

Tron (TRX) has recorded notable price gains over the past month, rising by nearly 20% in the past 30 days. Currently trading at around $0.3392, the asset has also posted a 1.5% gain in the past 24 hours.

These developments occur amid growing on-chain activity, particularly driven by the increased use of the TRON network for Tether (USDT) transactions, positioning the blockchain as a major player in the stablecoin infrastructure space.

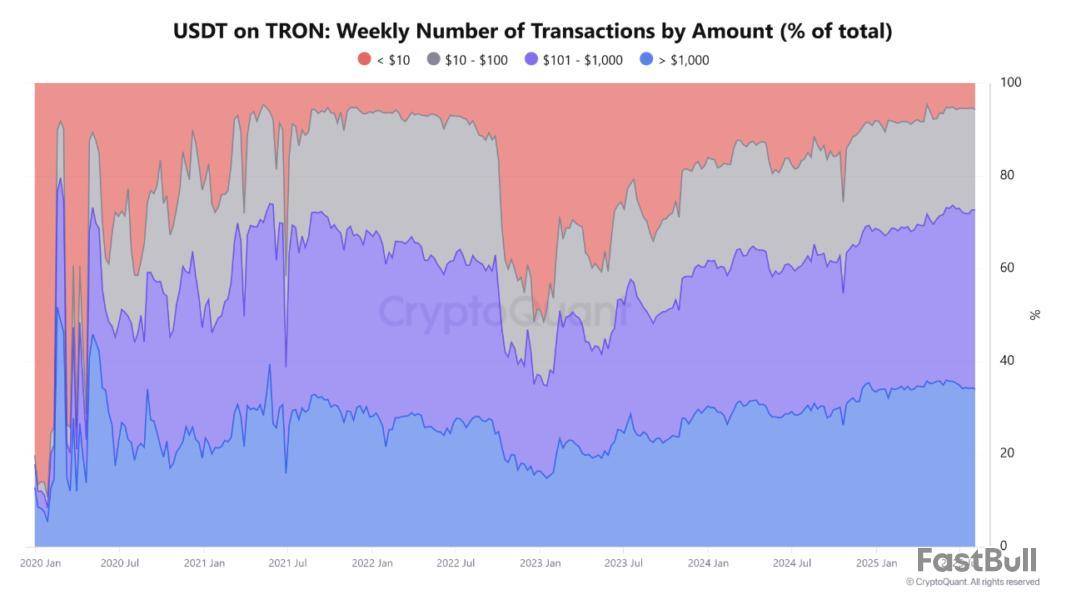

One of the key observations has been the network’s sharp rise in USDT transaction volume. According to CryptoQuant contributor Arab Chain, TRON processed over 8.29 million USDT transactions in the week ending August 3, 2025.

This figure not only indicates heightened activity but also reveals the diversity of transaction sizes across the network. Transfers between $101 and $1,000 made up the largest proportion at 38.66%, with significant activity also observed in transactions exceeding $1,000.

TRON’s Dual Adoption: Retail and Institutional Activity on the Rise

Arab Chain emphasized that this distribution highlights TRON’s appeal across different user groups. The presence of mid-sized transactions suggests usage by freelancers, online vendors, and remittance users.

In contrast, the substantial number of larger transactions implies participation by institutional traders, high-net-worth individuals, and potentially corporate entities.

The analyst also noted a decline in transactions below $10, suggesting a reduced reliance on micro-payments or testing activity and a pivot toward practical use cases.

The growing use of TRON for real-world settlement purposes is reinforced by its infrastructure, which supports low-cost, high-volume stablecoin transactions. Unlike networks that cater predominantly to large institutional transfers, TRON’s environment facilitates both high-frequency and high-value transfers.

Arab Chain stated that this makes TRON a core component in enabling digital commerce, payroll systems, and cross-border payments.

Meanwhile, CryptoQuant analyst Burak Kesmeci linked TRX’s recent momentum to regulatory developments in the United States. On July 18, 2025, the US Congress passed the GENIUS Act, marking the first formal federal regulatory framework for payment stablecoins.

Kesmeci noted that this legislation provides a clearer legal foundation for dollar-backed digital assets by establishing guidelines for anti-money laundering (AML), consumer protection, and financial stability.

Post-GENIUS Act: TRON Expands USDT Dominance

Following the passage of the GENIUS Act, TRON moved swiftly to expand its footprint. According to Kesmeci, approximately $1 billion worth of new USDT was minted on the TRON network shortly after the bill became law.

This increased TRX’s share of the total circulating USDT supply to over 83 billion out of 163 billion, accounting for approximately 51% of all USDT in circulation. The analyst suggested that this reinforces TRON’s position as the leading blockchain for stablecoin transfers.

The GENIUS Act may catalyze stablecoin adoption in the US, with TRON expected to benefit due to its efficiency in handling stablecoin transactions.

As more institutions and users seek reliable, low-fee solutions for digital payments, TRON’s role in the growing ecosystem of tokenized dollars might just continue to expand.

Featured image created with DALL-E, Chart from TradingView

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up